As more cold and snow descended yet again across North America, construction

activity remained stalled thus lumber sales were similarly slow. Those

purchases which were made were generally for just-in-time buying or

immediate needs; almost no one was stocking up on inventory yet for this

looming spring building season. For their part, sawmills could only hold off

increasing production volumes to keep supply in line with ongoing muted

demand. Stocking wholesalers tried to play the inventory-advantage game,

only to end up selling small volumes at below current replacement costs. All

eyes were on the weather, as expectations were for a burst of building to

come as soon as the weather improves.

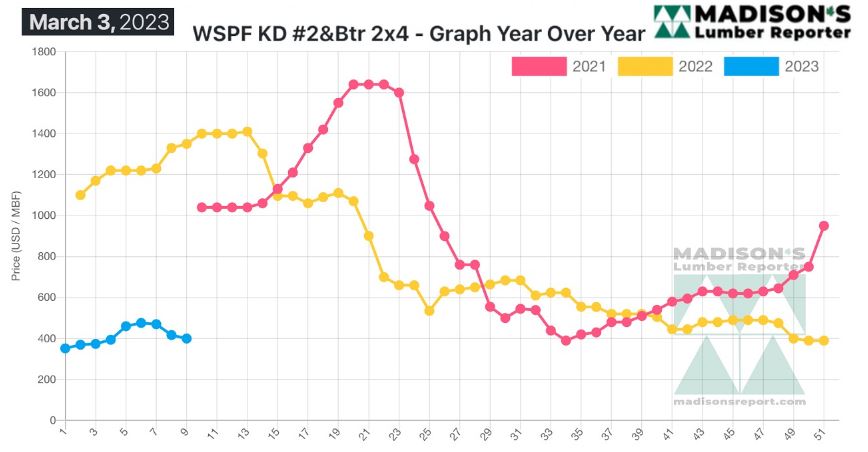

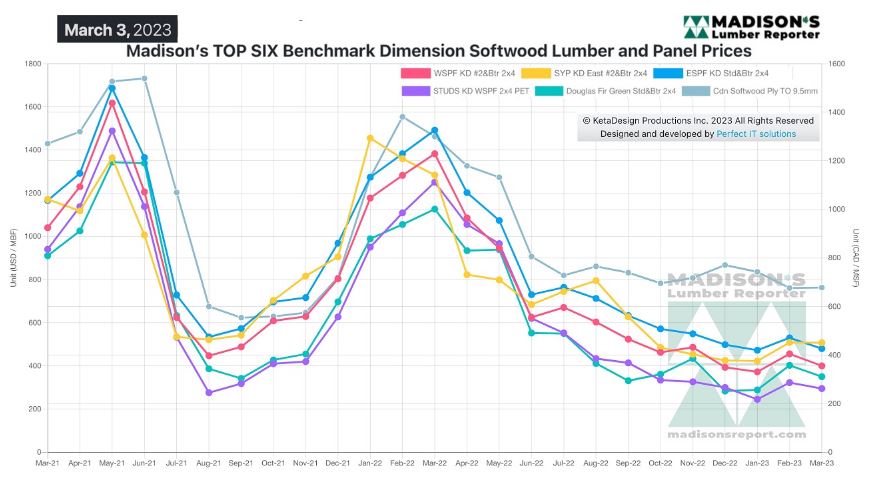

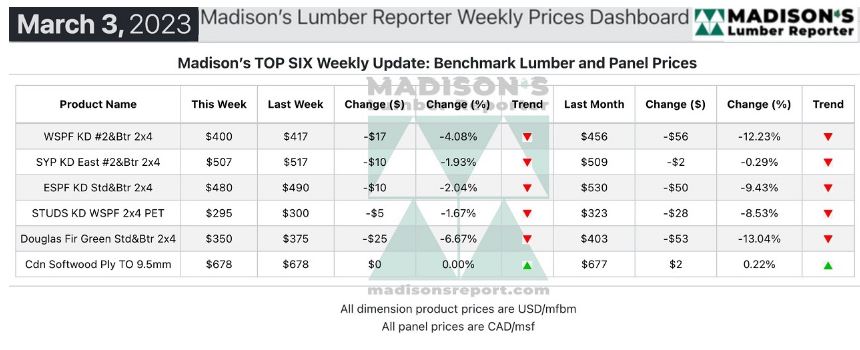

In the week ending March 3, the price of benchmark softwood lumber item

Western Spruce-Pine-Fir 2×4 #2&Btr KD (RL) was US$400 mfbm, which is down by

$17 or four per cent, from the previous week when it was US$417 mfbm. This

is down by $56, or 12 per cent, from one month ago when it was $456.

Secondary suppliers did replenish some of their stock, while downstream

buyers jumped in to cover only their short-term needs with small volume

purchases.

"Slow demand for panels was a carbon copy of the previous week, while a

two-tiered market developed in lumber and studs' sales." — Madison’s Lumber

Reporter

Following the previous week’s deep price cuts at the sawmill level, sales of

Western S-P-F in the U.S. perked up a bit at the beginning of March.

Overall, the market felt healthier according to players, but it wasn’t

gangbusters yet. Better takeaway allowed mills to push their order files

into the second or third week of March, with production of nine-foot studs

the furthest out due to ongoing tight supply. Customers remained reluctant

to begin spring buying for many reasons; chief among them sustained winter

weather and the troubling economic outlook.

Traders of Western S-P-F lumber in Western Canada reported an uneven pace to

business. Some customers found their preferred numbers and secured

short-term coverage, while others continued to hold off from buying to see

if there will be more downside to pricing. Double-digit price corrections

swept across nearly every dimension item, with High- and Low-Grade

categories hit the hardest. Ongoing winter weather in many regions helped

buyers keep to the sidelines. Availability among both primary and secondary

suppliers was ample again, while sawmill order files were anywhere from

prompt to two weeks out.

Eastern S-P-F trading was decent at the start of March, with primary and

secondary suppliers reporting good takeaway amid a more optimistic tone.

That trend was reinforced as the week wore on, with sawmills stabilizing

their numbers noticeably from the weaker levels observed on Monday. Sales

volumes grew as a midweek push came from buyers who felt a bit of pressure

to secure short-term coverage. Business tapered off to a slow burn later in

the week according to suppliers. Producers were able to nudge their order

files out to mid- or late-March, while secondaries competed with each other

for limited orders then ended up selling below replacement levels.

"Buyers were squarely focussed on small volumes of the most

readily-available and cheapest wood possible." — Madison’s Lumber Reporter

Compared to the same week last year, when it was US$1,330 mfbm, the price of

Western Spruce-Pine-Fir 2×4 #2&Btr KD (RL) for the week ending March 3, this

price was down by -$930, or 70 per cent. Compared to two years ago when it

was $1,040, that week’s price is down by $640, or 62 per cent.

More Reports: