At the end of February, despite a noticeable reduction in lumber

manufacturing since Q4 2022, supply was ample enough that prices dropped

significantly. A fresh round of harsh winter weather, including in southern

California, brought a stop to any construction activity that might still

have been going on.

Noting the recent waffling of price levels, wary customers sat on their

hands and delayed buying anything more than absolutely necessary. This in

hopes that prices might fall further. For their part, producers and

wholesalers kept their minds on the looming spring building season. There

remain many unknowns to play out as this year rolls on. If the past three

years have demonstrated anything, it’s that the previous normal annual cycle

of home building, thus lumber price trends, have not been as apparent as

they were historically.

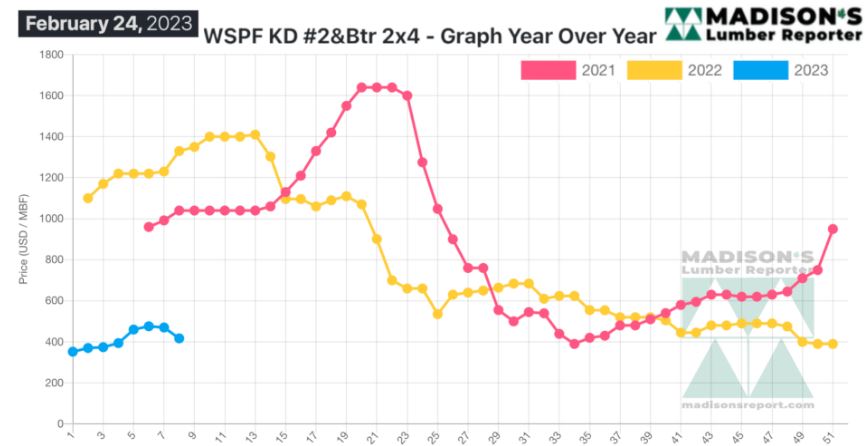

In the week ending February 24, the price of Western Spruce-Pine-Fir 2×4 #2&Btr

KD (RL) was US$417 mfbm, which is down by $53, or 11 per cent, from the

previous week when it was $470. That week’s price is up by $45, or 12 per

cent, from one month ago when it was $373.

Construction markets consuming only dribs and drabs of framing components,

thus downstream business remained subdued.

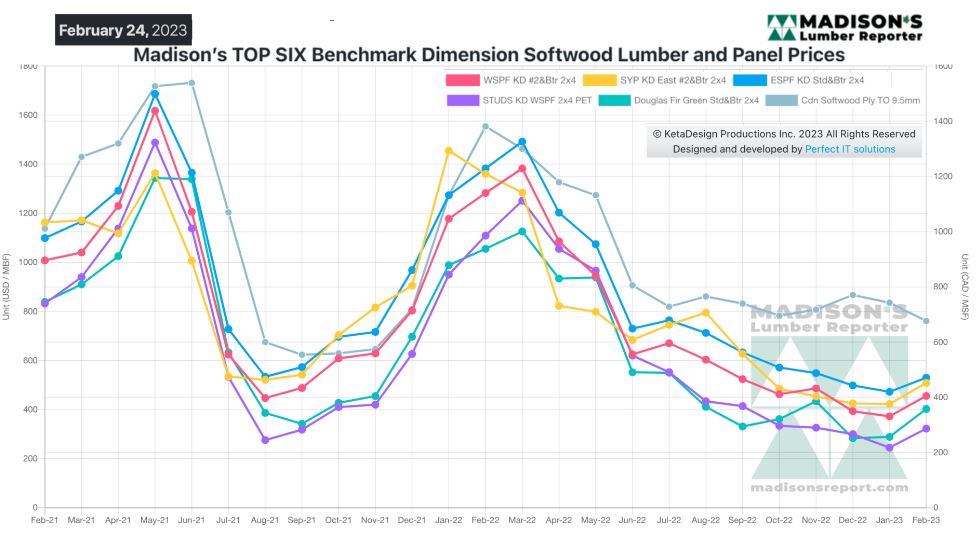

"North American lumber demand was restrained overall, with prices of many

key commodity prices tumbling amid persistently weak demand." — Madison's

Lumber Reporter

Suppliers of Western S-P-F commodities in the United States reported a

restrained tone among buyers. Negativity on the futures board gave customers

further pause, relegating the bulk of business to the distribution network.

Even secondary suppliers, however, were underworked; as the only sales they

saw came in highly mixed truckloads from cautious buyers looking to fill the

odd hole in their inventories. Warehousing and storage rates have risen

dramatically compared to pre-COVID levels, causing wholesalers and

distributers to bemoan the heightened cost of carrying wood. Mid-March

sawmill order files were widely reported.

A prevalent downward trend emerged in Western S-P-F trading. Sawmills made

significant adjustments to their asking prices, particularly on standard-

and high-grade dimension items. Buyers continued to sit on the sidelines,

waiting for wood already ordered to arrive or working through their own

ample inventories. Conifex announced plans to temporarily curtail operations

at its Mackenzie, B.C., sawmill. Unsustainable inventory levels caused by

rail transportation issues in Interior B.C. apparently necessitated the

move, which will reduce that mill’s production capacity by an estimated 7

million board feet.

“Demand for Western S-P-F studs went quiet according to suppliers in

Western Canada. Buyers continued to work through purchases made in mid- or

late-January. Downstream takeaway was nearly nil as winter weather returned

to much of the North American continent. Sawmills maintained order files

around three weeks out. Asking prices were lowered on bread-and-butter

trims, with little to no effect on sales activity. What meagre business

transpired was confined almost entirely to LTL transactions at the secondary

level.” — Madison’s Lumber Reporter

Compared to the same week last year, when it was US$1,330 mfbm, the price of

Western Spruce-Pine-Fir 2×4 #2&Btr KD (RL) for the week ending February 24,

was down by $913, or 69 per cent. Compared to two years ago when it was

$1,040, that week’s price is down by $623, or 60 per cent.

More Reports: