Ongoing harsh winter weather and ample supply of lumber inventories in the

field served to keep prices stable in North America. It seemed that only the

sawmill downtime and curtailment announcements of recent weeks – and months

– kept lumber prices from falling lower. The balancing act of keeping

manufacturing volumes in line with demand was made even more murky than

usual by adequate supply, especially at resellers. Wholesalers and reloads

in particular had sufficient wood available to satisfy customer inquiries.

As such, actual sawmill sales were limited thus prices remained flat.

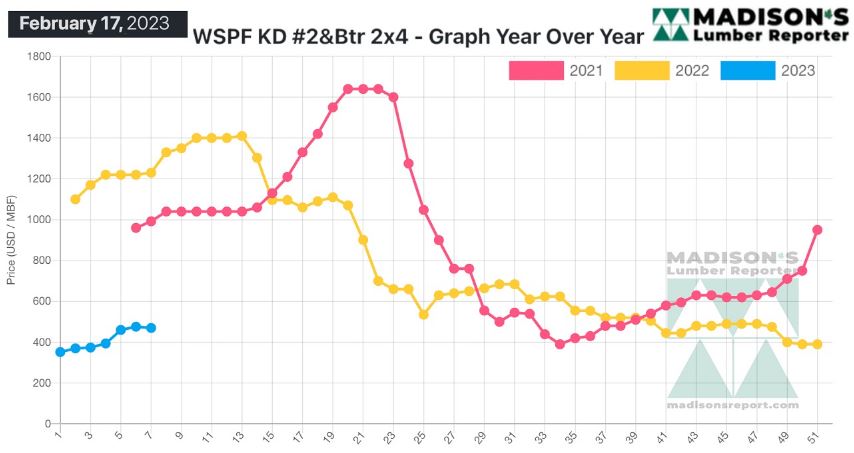

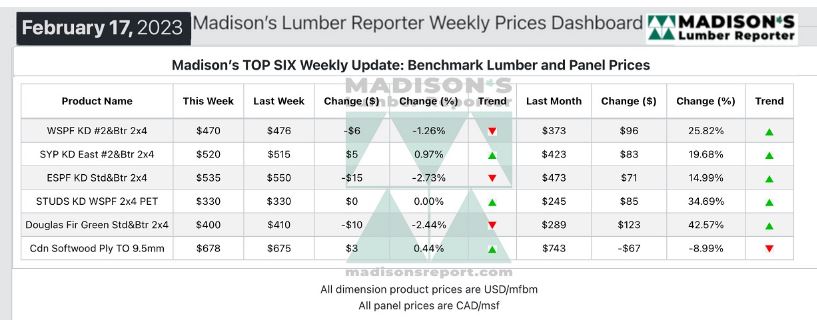

In the week ending February 17, 2023, the price of benchmark softwood lumber

item Western Spruce-Pine-Fir 2x4 #2&Btr KD (RL) was US$470 mfbm, which is

down by -$6 or -1%, from the previous week when it was US$476 mfbm, said

weekly forest products industry price guide newsletter Madison’s Lumber

Reporter.This is up by +$98, or +26%, from one month ago when it was $373.

The distribution network got a little frantic in an effort to shed excess

material, apparently selling well-below replacement levels to clean up their

inventories.

While lumber mills maintained robust order files for the most part, the

solid wood commodities market experienced no significant changes in either

pricing or demand.

In mid-February, demand for Western S-P-F commodities was lacklustre. Buyers

retreated to the sidelines, having covered their most pressing needs during

late-January and early-February. Even with large volumes of overall supply

taken out of the equation by sweeping closures and curtailments among WSPF

producers, overbought position of many customers showed just how quickly

winter inventory needs can still be met or exceeded. Meanwhile, sawmill

order files were no further out than the first week of March.

Players reported a promising start to Western S-P-F trading, following an

uncertain end to the previous week. Buyers were patient with their

purchases, calling sawmills and secondaries multiple times to find their

preferred mixes and tallies. They were often disappointed; as producers’

offer lists were thin and wholesalers didn’t have much better selections.

Field inventory levels were apparently satisfactory however, evidenced by

diminishing customer activity as the week wore on. Producers leaned on order

files into early-March.

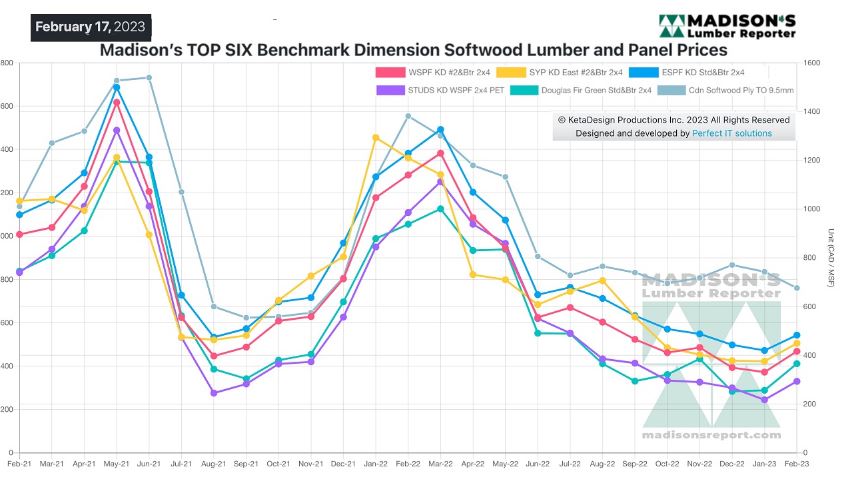

In contrast to the flatness in the rest of the Hemlock/Fir complex, prices

of green Douglas-fir commodities took a tumble. At least, that was the case

in dimension, while studs were unchanged from the previous week’s levels.

Buyers were quiet again, leading producers to bring some numbers closer in

line with other Hem/Fir categories. Those price corrections did little to

cajole customers however, with sales activity only worsening as the weekend

approached. Sawmill order files were into the week of March 6th.

Compared to the same week last year, when it was US$1,230 mfbm, the price of

Western Spruce-Pine-Fir 2x4 #2&Btr KD (RL) for the week ending February 17,

2023 this price was down by -$760, or -62%. Compared to two years ago when

it was $992, that week’s price is down by -$522, or -53%.

More Reports: