Since October 2022, quite a few sawmill operators have taken downtime and

curtailments. This is normal for the time of year, as usually lumber demand

slows in winter and regular maintenance needs to take place, as well as

employee vacation time. Over the past few months there has been perhaps a

bit more than the usual reduction of lumber manufacturing volumes, as

companies chose to be intentionally proactive against prices falling even

further than they already were into the end of last year.

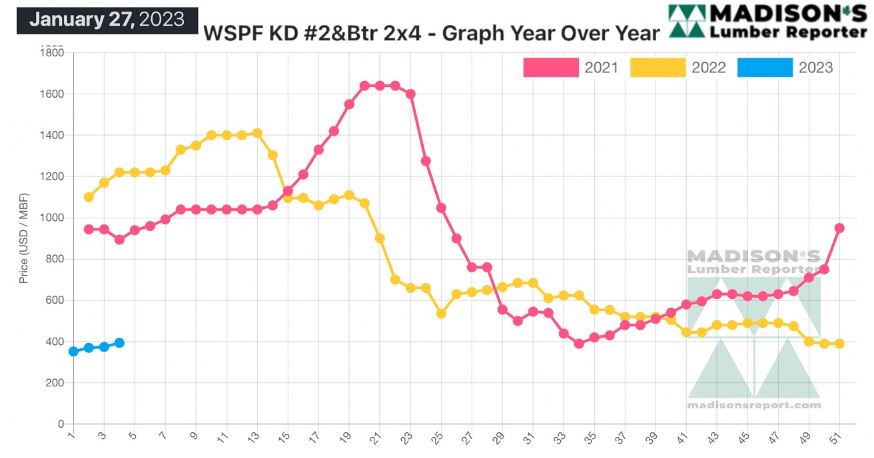

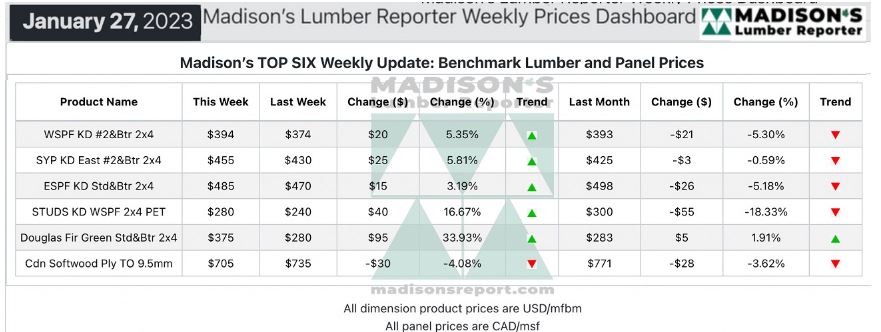

In the week ending January 27, 2023, the price of benchmark softwood lumber

item Western Spruce-Pine-Fir 2x4 #2&Btr KD (RL) was US$394 mfbm, which is up

by +$20 or +5%, from the previous week when it was US$374 mfbm, said weekly

forest products industry price guide newsletter Madison’s Lumber

Reporter.This is up by +$1, or 0%, from one month ago when it was $393.

“Field inventories remained pretty thin according to suppliers, with most

buyers still reluctant to secure early coverage in advance of the spring

building season.

“More sawmill shutdown and curtailment announcements sent ripples through

the lumber market; sales of panels continued to struggle.”

More shutdown and curtailment announcements from Western Canadian producers

generated a wave of demand for Western S-P-F commodities. A palpable

contingent of buyers in the United States was busy scrambling for pressing

inventory needs after they heard the news. Sawmill order files were largely

into the week of February 13th, with prompt availability getting scarcer by

the day.

Canadian purveyors of Western S-P-F lumber described an improving feel to

the market. Attendees of the previous week’s Western Retail Lumber

Association Building and Hardware Showcase in Winnipeg, Manitoba, Canada,

noted a positive tone among suppliers and buyers who met at the conference.

There was an increasing perception that downside risk was evaporating as

sawmill asking prices continued to firm up and order files stretched into

the two- to three-week range on many items. Mill sales lists got thinner

with each passing day, consistent with ongoing curtailments among major

producers.

Producers of Western S-P-F studs in British Columbia and Alberta reported a

solid market. Limited supply was outstripped by burgeoning demand generated

largely by sweeping curtailment announcements among large Western producers.

Prompt offerings dwindled rapidly, with order files in many cases stretching

into mid- to late-February. Some buyers remained on the sidelines and

unwilling to commit just yet, while many others were spurred into action by

the turbulent supply situation.

“Producers of Western S-P-F studs in B.C. and Alberta reported a solid

market. Limited supply was outstripped by burgeoning demand generated

largely by sweeping curtailment announcements among large Western producers.

Prompt offerings dwindled rapidly, with order files in many cases stretching

into mid- to late-February. Some buyers remained on the sidelines and

unwilling to commit just yet, while many others were spurred into action by

the turbulent supply situation.” — Madison’s Lumber Reporter

Compared to the same week last year, when it was US$1,220 mfbm, the price of

Western Spruce-Pine-Fir 2x4 #2&Btr KD (RL) for the week ending January 27,

2023 was down by -$826, or -68%. Compared to two years ago when it was $894,

that week’s price is down by -$500, or -56%.

More Reports: