As Mid-April Arrived It Seemed Like The Recent Practice Of Customers

Holding Off Buying Volumes Of Wood, Making Purchases For Immediate Needs

Only, Was Becoming An Entrenched Habit.

As Mid-April Arrived It Seemed Like The Recent Practice Of Customers

Holding Off Buying Volumes Of Wood, Making Purchases For Immediate Needs

Only, Was Becoming An Entrenched Habit.

Historically at this time of year the seasonal stocking up of lumber

inventory would be well underway. However, given the late end to winter and

recent harsh weather across the continent, construction activity at jobsites

has been slow to get going. In addition, the uncertainty of larger economic

conditions — from interest rates to housing starts — continues to keep

lumber buyers cautious.

The overriding sentiment currently is of hesitance to stock up on inventory.

Seasoned players warn this could become a problem, should building activity

pick up suddenly, as the entire supply chain is very low on lumber supply.

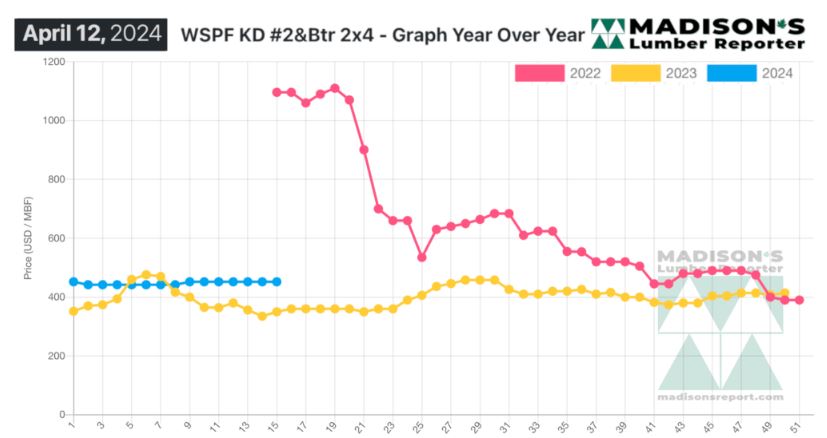

As the extreme volatility and unprecedented high prices are

firmly in the past, the year-over-year trend for price changes is once again

able to provide insight into what is happening currently — if not into what

is to come this year.

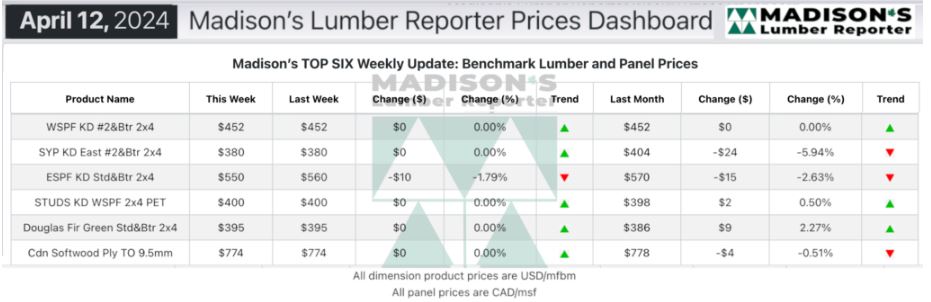

Remaining steady at US$452 mfbm, that benchmark WSPF 2×4 price is now up by

+$102, or +29% compared to the same week last year.

In the week ending April 12, 2024, the price of Western Spruce-Pine-Fir 2×4

#2&Btr KD (RL) was US$452 mfbm, which is flat from the previous week when it

was $452.

There was a pause in demand as buyers waited to see if prices might erode.

Players reported a two-tiered pricing structure opening up between sawmills

and the distributors, as wholesalers with unfavourable contract positions

and/or inventory levels got conspicuously aggressive with their numbers to

entice buyers.

KEY TAKE-AWAYS:

Most lumber sales continued to lag on sluggish inquiry.

Small counter-offers were considered.

Retailers bought at higher volumes; similarly the large builders took

advantage of persistently low prices.

The total amount of supply circulating in the market was slim.

Builder yards needed to replenish their plywood and OSB inventories, thus

nonchalantly increased their order volumes.

Studs mills order files were into later April.

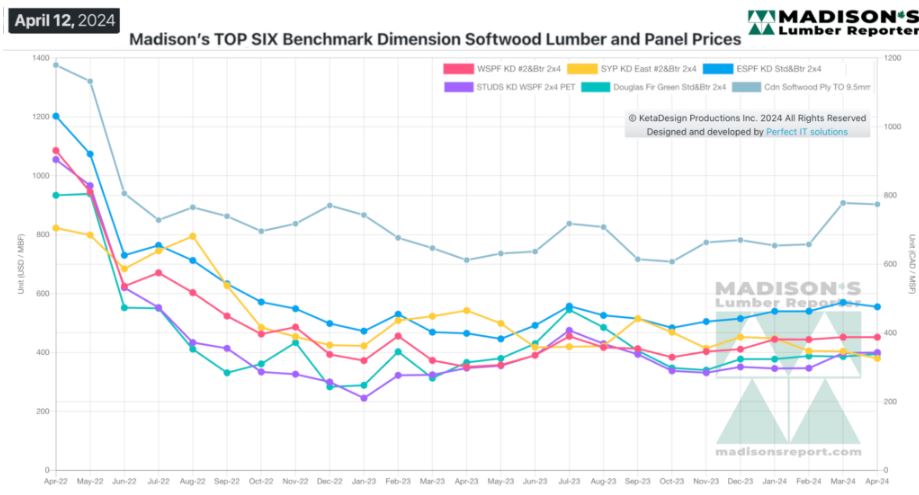

MADISON’S BENCHMARK TOP-SIX SOFTWOOD LUMBER AND PANEL PRICES: MONTHLY

AVERAGES

Compared To The Same Week Last Year, When It Was Us$350 Mfbm, The Price

Of Western Spruce-Pine-Fir 2×4 #2&Btr Kd (Rl) For The Week Ending April 12,

2024 Was Up By +$102, Or +29%.

Compared To Two Years Ago When It Was $1,096, That Week’S Price Is Down By

-$644, Or -59%.

More Reports: