A combination of the normal seasonal slowdown in demand, due to construction

activity reducing during winter, and plenty of supply throughout the

marketplace brought steady-to-lower lumber prices. As the holiday season

quickly approached, producers across the continent took extended downtime.

This not only for the usual seasonal curtailments and maintenance, but also

in response to quite weak demand. At this point of the year no one wants to

build inventory, whether sawmill or wholesaler. While the phones at sales

desks still rang, supply remained ample enough that sellers could barely

hold off reducing prices further.

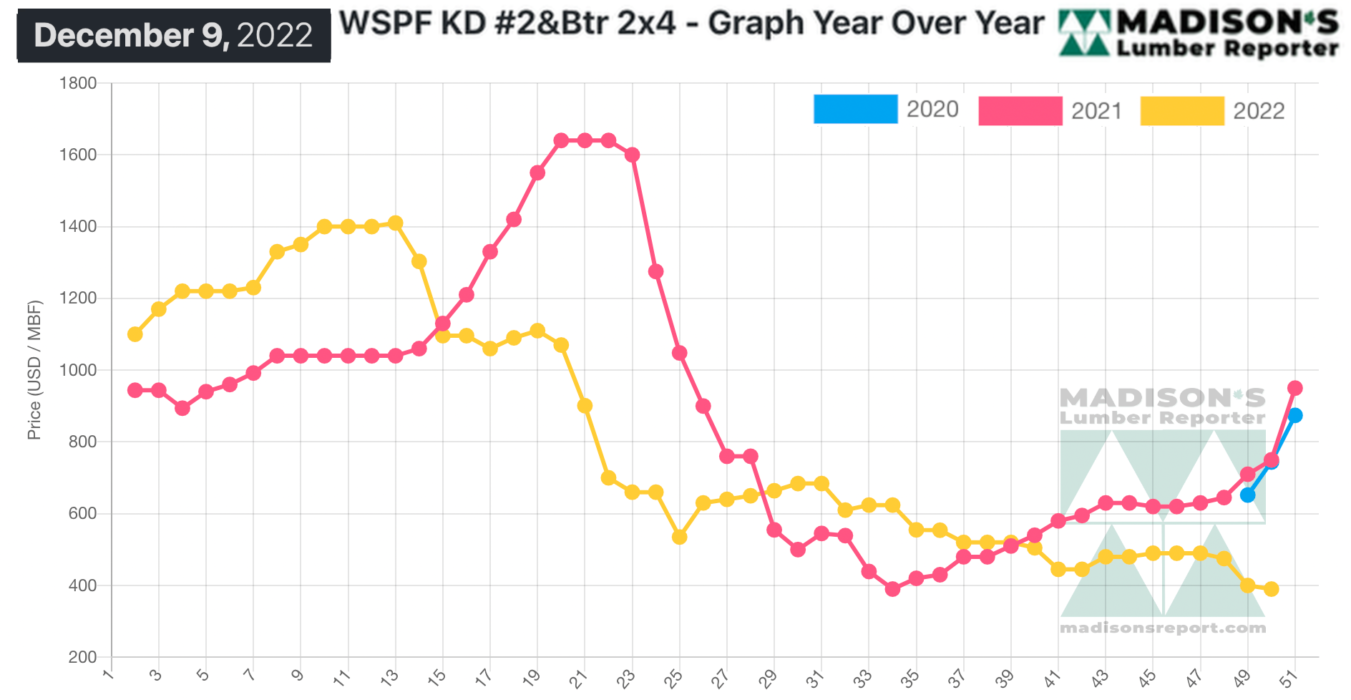

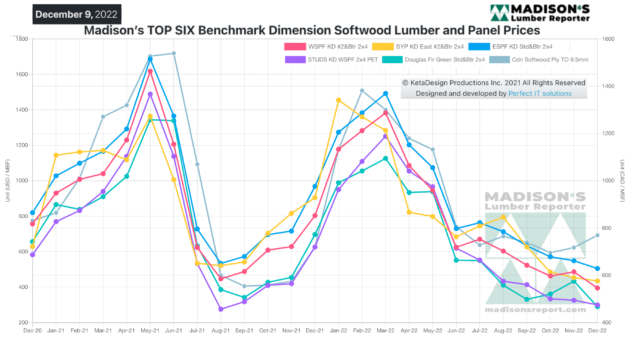

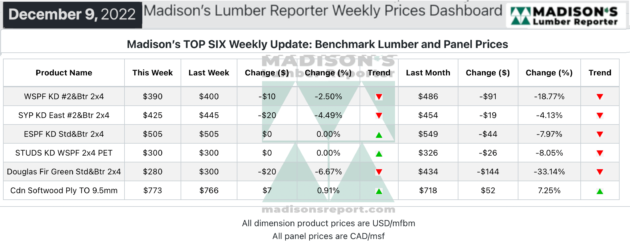

In the week ending December 9, the price of benchmark softwood lumber item

Western Spruce-Pine-Fir 2×4 #2&Btr KD (RL) was US$390 mfbm, which is down by

$10 or 3.o per cent, from the previous week when it was US$400 mfbm. This is

down by $96, or 20 per cent, from one month ago when it was $486.

Producer asking prices were mostly flat from the previous week, with narrows

correcting another few points. Interest in stud trims was again beyond

lacklustre.

“As year-end approached, players felt that demand was winding down

overall.” — Madison’s Lumber Reporter

Traders of Western S-P-F lumber and studs in the U.S. reported moderate

sales early in the week after demand was stirred up by curtailment

announcements from major Canadian producers. The hubbub died down after

midweek however, as buyers turned their focus back to cautiously filling out

their inventories or holding steady in advance of year-end. For their part,

sawmills felt downward pressure easing as December 19th production schedules

took them into their holiday maintenance and/or shutdown periods.

Canadian purveyors of Western S-P-F lumber reported lackadaisical demand

overall, even with lumber futures popping amid a bump of business early in

the week. That jot of buyer activity came after Canfor announced it will

temporarily curtail Canadian production due to weak market conditions.

Sawmills in BC and Alberta will be affected starting December 19th, reducing

the company’s output by approximately 150 million board feet through

December and January. The associated reduction in overall supply appeared to

be balanced out by persistently weak demand due to ongoing negativity in

broad economic terms including inflation, fuel prices, and housing metrics.

Buyers remained reticent to cover more than immediate needs, sticking to LTL

orders through the distribution network to carefully manage inventory levels

ahead of year-end.

“Sales of Eastern S-P-F tailed off late the previous week, with prices on

standard grade commodities meandering downward while low grade numbers were

firm by comparison. That rambling pace of business bled into the current

week, with traders reporting good, but selective, demand. Sawmills showed

less availability as the week wore on, as many were already in the process

of ramping down production due to unreliable market conditions and

decreasing buyer activity consistent with the winter season. Plenty of

dealer yards were also battening down the hatches, giving motivated buyers

less options to cover their immediate needs. Narrow dimension items were the

only commodities accumulating to any degree, with cheap quotes and

fluctuating price points muddying the waters as suppliers tried to rid

themselves of excess inventory. ” — Madison’s Lumber Reporter

Compared to the same week last year, when it was US$750 mfbm, the price of

Western Spruce-Pine-Fir 2×4 #2&Btr KD (RL) for the week ending December 9,

was down by $360, or 48 per cent. Compared to two years ago when it was

$744, that week’s price is down by $354, or 48 per cent.

More Reports: