As is historically usual for this season, demand — and therefore prices — of

most softwood lumber items dropped during the US Thanksgiving holiday week.

This time of year is normally marked by slowing construction activity thus

lower demand for dimension lumber. Of course, the past two years have not

been normal. As forest industry players look to the end of the year, the big

question is; what is going to happen in 2023? Expectations are that supply

and demand are in better balance now than they have been since early 2021,

which gives both sellers and customers the ability to find where the new

price level will be. In these new market conditions, “new normal”, the

current price of benchmark item Western Spruce-Pine-Fir KD 2×4 #2&Btr is

hovering at just below cost-of-production for most of the large-volume

operators in British Columbia. As we head into the true slow-down at year

end, all eyes are on where the new price bottom will be.

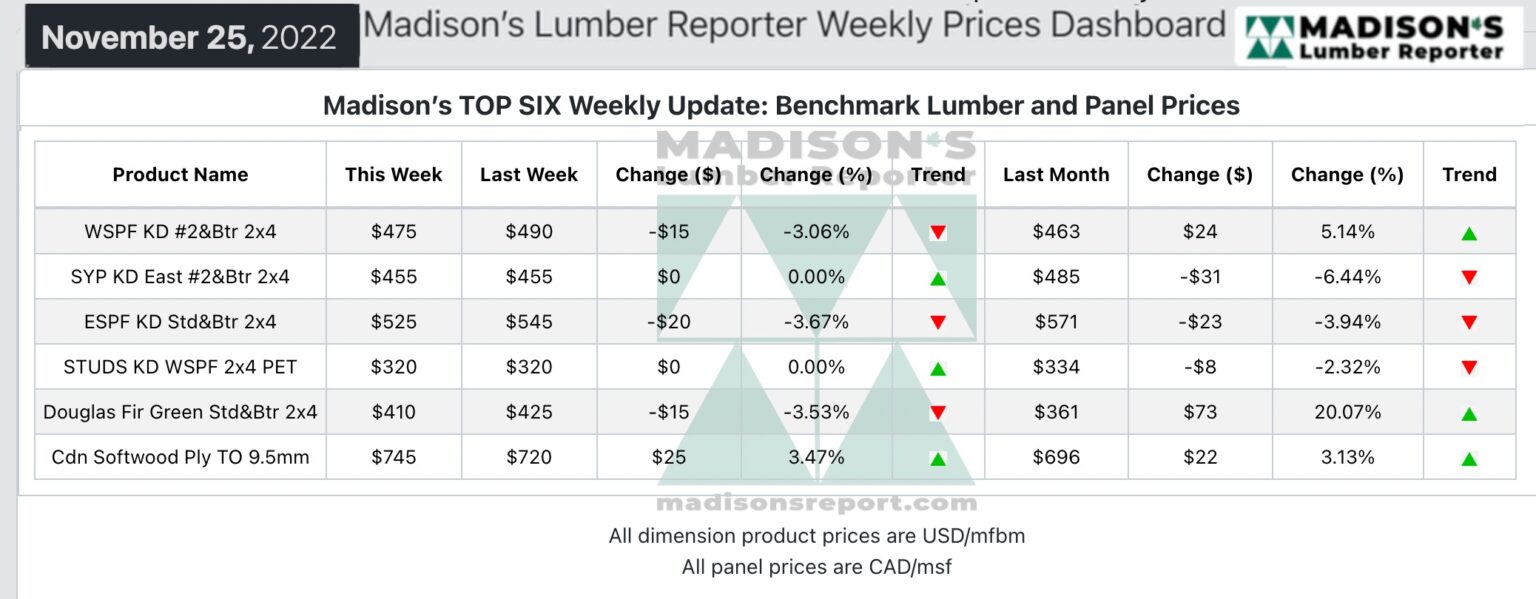

In the week ending November 25, 2022, the price of benchmark softwood lumber

item Western Spruce-Pine-Fir 2×4 #2&Btr KD (RL) was US$475 mfbm, which is

down by -$15 or -3%, said weekly forest products industry price guide

newsletter Madison’s Lumber Reporter. This is up by +$13, or +3%, from one

month ago when it was $463.

Deepening winter weather had the effect of slowing consumption, production,

and transportation, all to relatively concurrent degrees such that no one

variable in the supply-demand equation was overstressed.

“The American Thanksgiving holiday predictably dampened lumber market

activity, particularly from midweek-on.” – Madison’s Lumber Reporter

Buyers of Western S-P-F lumber in the United States were somewhat active to

start the week as they short-covered in advance of American Thanksgiving.

Sales activity petered out from there, with the market going dead quiet by

midweek. Both primary and secondary suppliers reported an unsurprising

dearth of inquiry later in the week, while order files at sawmills remained

in the two- to three-week range. Transportation issues began to appear as

winter weather took hold in many regions, and there was much speculation

about job action in the rail sector.

Canadian suppliers of Western S-P-F lumber saw inquiry and takeaway drop off

precipitously as the week wore on. No one was surprised, as the American

Thanksgiving holiday weekend is almost always accompanied by a dip in

demand. Apparently sawmills at both the regional and national levels were

getting more amenable to counter offers with each passing day, with many

reporting an ongoing challenge in finding trading levels where they could

establish any consistent flow to business. Order files ranged from prompt

availability at more local mills to three weeks out at some of the larger

producers.

“

Limited overall supply of Southern Yellow Pine commodities was balanced

out by a drop in demand. Many players used the Thanksgiving holiday as an

opportunity to step back and assess their current inventory positions.

Prices hovered around the previous week’s levels as sawmills felt no

pressure to chase the market or boost their numbers. Order files remained

two-to three-weeks out. Suppliers were confident that more demand will come

from the multifamily and mixed commercial sectors once players are back at

their desks after the holiday weekend. ” – Madison’s Lumber Reporter

Compared to the same week last year, when it was US$634 mfbm, the price of

Western Spruce-Pine-Fir 2×4 #2&Btr KD (RL) for the week ending November 25,

2022 was down by -$170, or -26%. Compared to two years ago when it was $620,

that week’s price is down by -$145, or -23%.

More Reports: