Key takeaways:

-

Our 2026 North American lumber market outlook predicts that

demand for wood products will stabilize, supported by

falling interest rates and renewed home improvement

activity.

-

We expect overall consumption for wood products in the North

American market to remain flat.

-

According to our North American lumber forecast, we expect

softwood lumber capacity to decline by over 1.3 billion

board feet (BBF) due to ongoing mill closures in British

Columbia and the US South.

-

Market trends suggest that lumber duties may fall to 15-20%,

while reduced Brazilian panel imports and continued tariffs

are likely to drive modest price increases across most wood

product categories.

Another challenging year is in the books for the North American

wood products industry. To recap, demand disappointed as

affordability challenges festered with inflation and interest

rates remaining sticky. Compounding this, uncertainty surged

with the onset of a trade war and a prolonged government

shutdown. Mill asset closures continued in response to sustained

weakness, though not at the same clip we saw in 2024. Confidence

across the building materials and broader forest products

complex is probably the lowest we have seen since the Global

Financial Crisis.

Forecasting in this policy-driven environment has been

challenging to say the least. And while the dust seems to be

settling on many fronts, much remains in question given ongoing

trade negotiations, elevated recession concerns, a push by the

current administration to reignite home building, and pronounced

pessimism in the lumber and panel markets.

So, what does our wood products team at Fastmarkets expect for

the North American wood products market in 2026? Below are five

key predictions that we believe will drive the market this year.

1. Demand will stabilize across most wood products

One of our key forecast misses in last year’s “Predictions”

piece was the call for a demand turnaround in North American

wood products that did not materialize. While interest rates

continued to fall as predicted and the US did avoid a recession

despite much speculation, affordability challenges paired with

the explosion of uncertainty due to the trade war amplified the

drags on home buying and construction activity.

The good news is some of this trade related uncertainty should

subside in 2026 as more trade deals are inked and the

administration walks back some of the most onerous tariffs, as

we saw on December 31 with the postponement of further increases

on furniture, cabinets and vanities.

Interest rates, while descending at a slower pace than we

expected, should continue to fall as inflation cools and the

Federal Reserve pivots further to address labor market

uncertainty. The first half of the year should also get a fiscal

boost from Congress passing the One Big Beautiful Bill (OBBB)

last year as substantial tax refunds hit household bank

accounts. Just recently, the White House also announced a plan

to purchase mortgage back securities to help push mortgage rates

lower. Other plans to support builders seem in the cards as

well.

Residential construction, which accounts for about 70-80% of

wood products demand in North America, should see some modest,

albeit unspectacular, improvements under these macroeconomic

conditions. Even marginal improvements in affordability should

at least help stabilize the crucial single-family market, which

saw an estimated drop in starts of 8-10% last year. Although

slowing off its current pace, we also anticipate more

multifamily projects will pencil out as rates continue to ease

and upzoning efforts in many jurisdictions across the country

help drive more affordable housing construction.

Finally, home improvement activity, which based on our

Fastmarkets Repair & Remodeling Index has shown signs of

reacceleration, should continue to gain momentum as real

disposable income remains steady and drops in short-term

interest rates stimulate more HELOCs to drive home improvement

projects. Pent-up project demand is also substantial in the

space, and should be unlocked by more certainty on inflation and

the jobs front later this year.

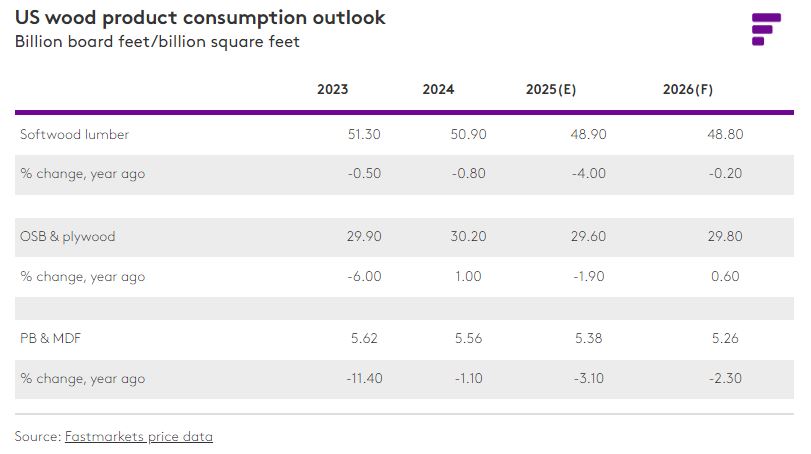

Demand will vary by product, but we expect wood products

consumption in the US to remain flat in 2026, with structural

panel markets performing the strongest, while nonstructural

panels will experience greater weakness as those products are

still feeling the downshift in home completions and domestic

furniture and cabinet production. While downside risk to the

outlook exists, Fastmarkets believes the significant losses from

last year should pause again in 2026 as the wood products market

transitions to a reacceleration phase later in the year that

sets up solid growth in 2027. However, in the meantime, demand

will still remain challenging as near-term headwinds continue to

be pronounced.

2. Softwood lumber capacity losses will accelerate to over 1

BBF

Shuttering of industry capacity has been an ongoing theme in

the softwood lumber market for the past several years. Average

annualized operable capacity in 2024 and our preliminary

estimates for 2025 show a similar drop in operable capacity

(-0.7 billion board feet (BBF)). While losses since 2017 have

focused on the struggling British Columbia market, we have seen

a pronounced surge in southern yellow pine (SYP) closures in the

US South in response to weak market conditions and historic

discounts for SYP compared with competing species.

Of course, industry rationalization reflects a number of

factors, including declining demand since 2021, compressed

margins from prices correcting back to pre-pandemic levels for

many key items and pronounced stress in Canada from longer-term

structural fiber challenges in BC, steadily rising lumber duties

on Canadian supply and now 10% tariffs stacked on top of that.

------

------

------

>>>

For the full information

Source:

fastmarkets.com