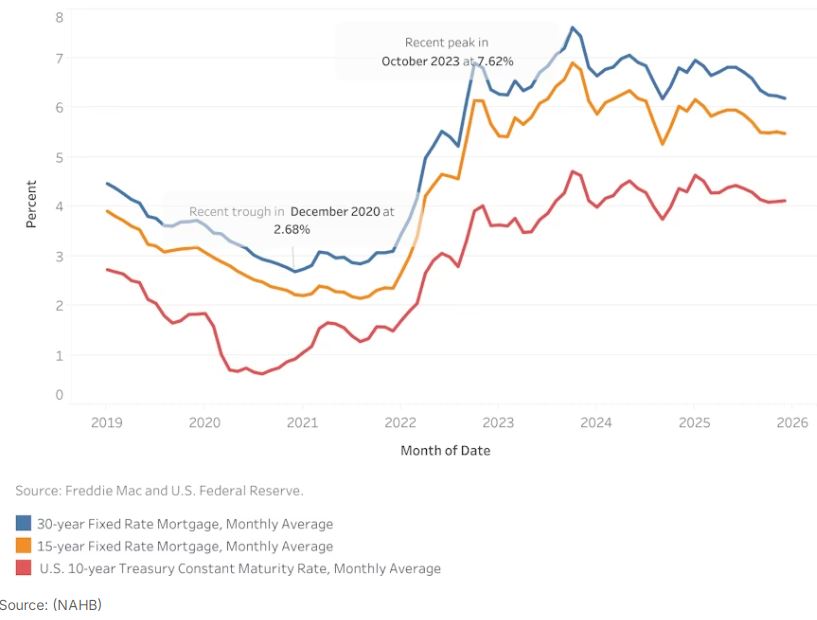

NAHB expects the 30-year mortgage rate to average 6.17% in

2026 and to reach 6% by 2027.

Long-term mortgage rates have been declining since mid- 2025 and

ended the year at their lowest level since September 2024.

According to Freddie Mac, the 30-year fixed-rate mortgage

averaged 6.19% in December, 5 basis points (bps) lower than

November. Meanwhile, the 15-year rate declined 3 bps to 5.48%.

Compared to a year ago, the 30-year rate is lower by about half

a percentage point, or 53 basis points (bps). The 15-year rate

is also lower by 45 bps.

The 10-year Treasury yield, a key benchmark for long-term

borrowing, averaged 4.12% in December – a modest increase of 2

bps from the previous month. Given forward-looking markets, the

10-year Treasury yield declined during the week preceding the

Federal Reserve’s third rate cut of the year. However, compared

to the prior month, yields ended slightly higher, rising 2 bps,

as labor market data released shortly thereafter pointed to

slowing job gains and rising unemployment rate.

Falling lower mortgage rates have started to translate into

gains as existing home sales edged up slightly in November.

However, this increase remains limited as mortgage rates above

6% are still considered elevated. Nonetheless, as financing

costs continue decline, more households are likely to reenter

the housing market. An NAHB analysis shows that a 25 bps

reduction in the 30-year mortgage rate, from 6.25% to 6.00%,

could bring approximately 1.1 million additional households back

into the buyer pool.

NAHB expects the 30-year mortgage rate to average 6.17% in 2026

and to reach 6% by 2027.

Source:

lbmjournal.com