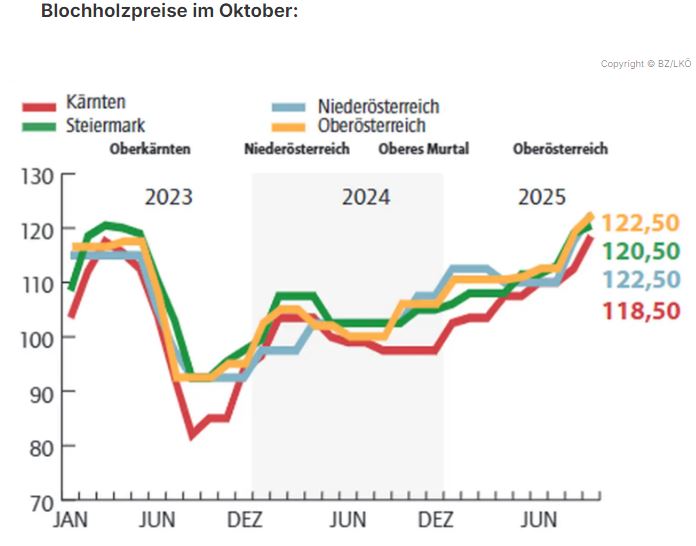

The weather has led to less damaged timber. The supply of

needle saw logs is therefore still low at present, which is

leading to rising prices amid brisk demand. This is according to

the latest LK market report.

Austria's economy is expected to grow slightly by 0.3 percent in

2025, largely driven by private consumption. The construction

industry is stabilizing and companies are becoming more

optimistic. At the same time, Austria has so far been spared

from windthrow and bark beetle infestation is declining sharply

due to weather conditions. The supply of coniferous sawlogs is

therefore still rather low at present. Demand, on the other

hand, is extremely brisk and the sites are operating at full

capacity.

Due to low stock levels, sawn timber production has had to be

scaled back slightly in some areas of southern Austria. Prices

have continued to rise and start at €115 per FMO for the leading

spruce, A/B, 2b range. White pine follows spruce in terms of

demand and has also seen a regional price increase. Pine (A, B,

C, 2a+) is selling for 70 euros per FMO and above. Larch

continues to be in high demand at an unchanged high level (A, B,

C, 3a+ from 120 euros per FMO).

Restrained demand for industrial wood

The positive development in softwood sawlogs is offset by

restrained demand for industrial roundwood. The paper and board

industry locations are very well stocked. Supply and demand are

mostly in balance. In Lower Austria, forest stocks are beginning

to build up slightly, but for the most part, transport and

takeover are still proceeding according to plan. Prices for

pulpwood and fiberwood have remained low for some time. The

situation for panel wood varies. While prices in Lower Austria

have been adjusted downwards, an increase in prices has been

observed in Salzburg. Demand for red beech fiberwood remains

subdued, with prices unchanged.

Energy wood: Hopes for the heating season

The situation for energy wood remains tense. Heating plants are

very well stocked, and additional quantities outside of

long-term contracts are difficult to market, especially

lower-quality quantities. However, the start of the heating

season offers hope for relief. The first signs of this can be

seen in Carinthia, where the oversupply of energy roundwood

appears to be gradually decreasing.

All prices quoted refer to transactions in the period from

September to early October 2025 and are net prices. In the

timber business, it is always important to check whether the

delivery note, list of dimensions, and invoice or credit note

correspond to the quantities and qualities actually delivered.

Any discrepancies should be reported immediately.

Source:

LK Österreich