Key takeaways

-- Economic uncertainty has clouded the pallet market outlook,

as July’s job report revealed weaker-than-expected job growth

-- The elimination of the de minimis tariff exemption for

low-value shipments is expected to improve pallet demand

-- Anticipated interest rate cuts will have a knock-on effect on

housing affordability, stimulating the construction sector which

in turn impacts lumber prices

-- Higher softwood lumber prices could lead to increased demand

for hardwood pallets

How has economic uncertainty impacted pallet demand in the

US?

In our most recent commentary, which we finished writing up on

July 31st, we alluded towards the end that despite a few months

of uncertainty and turmoil, the US economy had weathered much of

the storm. Higher input costs hadn’t yet been fully passed onto

consumers, hiring was holding up, and now that much of the

tariff uncertainty seemed to be behind us – this Economic Policy

Uncertainty chart for trade policy gives some sense of that

notion – we could look forward to stronger customer demand, and

in turn, pallet demand.

Unfortunately, that cautiously optimistic outlook was blunted

the following day by some dire numbers in the July jobs report,

so in this viewpoint we’ll be examining the outlook for the US

pallet market through this slightly altered lens.

July’s nonfarm payroll report showed just 73,000 jobs were

added, well below the 115,000 consensus forecast, and the two

prior months were revised down by a staggering 258,000 jobs

combined. Meanwhile, core personal consumption expenditure

inflation – the Fed’s preferred inflation gauge as it strips out

the more volatile food and energy components – remained stuck at

2.8%, above the Fed’s 2% target. This combination of persistent

inflation and a softening labor market has revived murmurs of

stagflation risks.

While unemployment remains relatively low at 4.2%, the labor

force participation rate has now declined for three straight

months, hitting its lowest level since late 2022. Critically for

the market, short-term Treasury yields fell sharply after the

jobs report, indicating that they expect Federal Reserve

interest rates to fall, and CME FedWatch now shows a 93% chance

(at the time of writing) of a 25 basis point rate cut at the

Fed’s next meeting, up from just 40% prior to the release.

What policy changes encouraging pallet usage?

Yet even as the macro picture clouds, there are glimmers of

opportunity for the pallet industry.

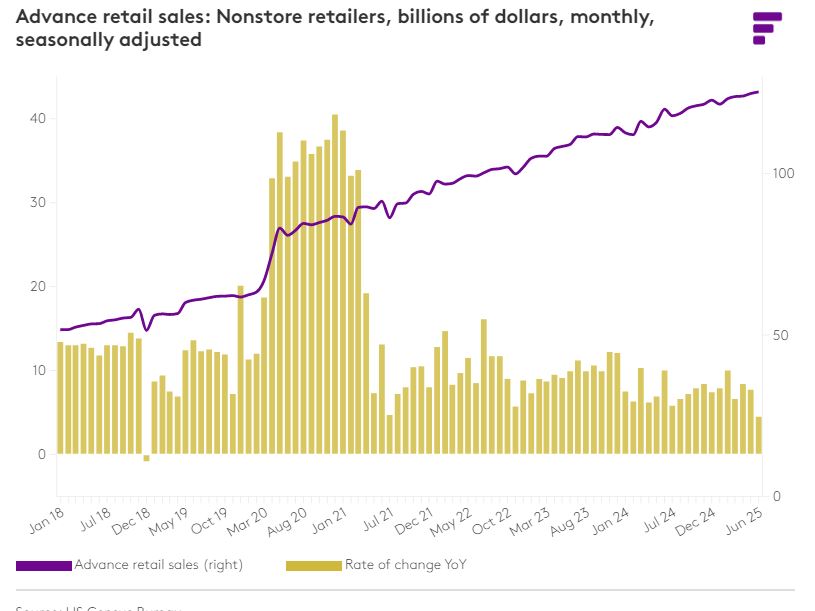

Non-store retail sales remain resilient, continuing to expand at

an impressive rate despite the broader deceleration. While

growth rates understandably tailed off slightly in the last

couple of months, it’s still putting up incredibly strong

figures over the last 5 years. This trend, coupled with recent

developments around the de minimis tariff exemption, has the

potential to reshape US import logistics in favor of pallet

usage. With Trump’s executive order eliminating the de minimis

exemption for low-value commercial shipments effective August

29, 2025, and full enforcement by mid-2026, we may soon see a

structural shift away from small-parcel imports toward bulkier,

palletized container shipments as exporters from Asia (the main

beneficiaries of this exemption) look for ways to save costs on

shipping.

For pallet demand, this is a meaningful pivot. As parcel air

freight gives way to containerized ocean freight, warehouse

throughput increases and palletized supply chains gain traction.

Especially as direct-to-consumer brands pivot to avoid new

tariff burdens, bulk shipping will likely boost demand for

pallets used in cross-border intermodal freight and warehousing.

While this policy shift is a potential tailwind, the broader

economy’s weakening signals also warrant attention. With

goods-producing sectors shedding 37,000 jobs over the past three

months, there are clear signs that industrial activity is

cooling. A portion of the blame for this can be attributed to

the uncertainty around tariff permanence discouraging capital

investment in domestic manufacturing, with firms wary of

committing to US production capacity that could be undercut by

future policy reversals.

How have tariffs impacted the US pallet market?

Moreover, the levels that tariffs have been placed at haven’t

had their intended effects, and in some cases, hurt domestic

producers. Currently, a finished car imported from Japan faces a

15% tariff. In contrast, building that same car in the US would

incur far steeper costs: a 50% tariff on steel, aluminum, and

copper; 55% on Chinese components like batteries and rare

earths; 25% on electronics from South Korea; 25% on parts from

Mexico; and 35% on components from Canada, and all of this on

top of higher US labor costs.

In effect, tariffs have been set at a level that discourages

domestic production without fully deterring imports. That

imbalance will ultimately filter through to consumers in the

form of higher prices, adding pressure to inflation and

complicating the path forward for interest rates.

As interest rate cuts grow more likely, housing affordability

could begin to improve, reviving demand in residential

construction. This would be a positive medium-term catalyst for

pallet producers that would see higher demand and higher prices

from the knock-on effects of more residential construction, as

the prices of low-grade lumber used to build pallets always

follow the price used for framing lumber, something we discussed

in more detail in our June newsletter.

The impact on lumber prices

We’ve put together some analysis compiling Fastmarkets data,

alongside Virginia Tech estimates for historic pallet

production, to give a sense of how this would affect the pallet

industry.

In 2024, US pallet producers used about 8.45 BBF of softwood

lumber. Given that last year 24% of total softwood was imported

from Canada – and recognizing that the more lucrative framing

lumber will see a higher amount imported, as it has a higher

value proposition than the low-grade lumber used for pallets –

we’re assuming a figure of 10% of low-grade lumber used for

pallets comes from Canada, leaving the US with a shortfall of

0.845 BBF.

For the reasons given above, we would see immediate upward price

pressure once Canadian supply tightens.

This does, however, raise the prospect of hardwood regaining

some market share. Since the duties focus exclusively on

softwood, higher softwood prices could prompt some pallet buyers

to switch to the more expensive, yet far more durable, hardwood

pallets once softwood loses its relative price advantage.

As shown in the graph above, as pallet usage has grown, softwood

has become the dominant material used in pallet manufacturing

due to its abundance and cost-effectiveness. Hardwood mills were

hit hard, and many saw closures, after the Chinese property

market collapsed as that was its biggest end-use market. This

Canadian softwood lumber supply shock does certainly leave the

door open for the hardwood pallet to regain some market share.

In conclusion, supply and demand indicators are certainly

pointing to higher prices towards the end of 2025 and into 2026,

after what’s been a largely uneventful 2 and a half years for

this sector. If you’d like to stay abreast of movements in the

pallet market to avoid shocks to your supply chain, sign up for

our pallet commentary here.

Source:

fastmarkets.com