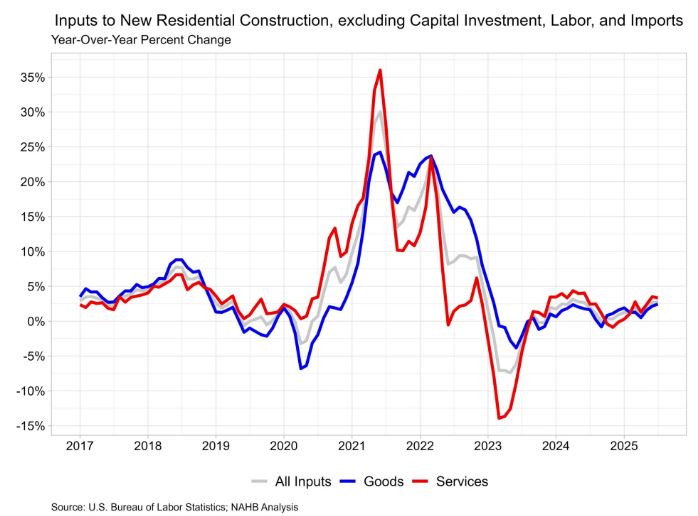

Prices for residential building materials rose again in July,

marking the largest year-over-year increase in over two years.

The underlying price growth trend remained the same, with

service prices continuing to grow at a faster pace than goods

prices. Similar to last month, parts for construction machinery

and metal molding/trim experienced significant price growth, as

both increased over 25% compared to last year.

Prices for inputs to new residential construction—excluding

capital investment, labor, and imports—rose 0.2% in July,

following a 0.8% increase in June. These figures are taken from

the most recent Producer Price Index (PPI) report published by

U.S. Bureau of Labor Statistics. The PPI measures prices that

domestic producers receive for their goods and services; this

differs from the Consumer Price Index which measures what

consumers pay and includes both domestic products as well as

imports.

The inputs to the new residential construction price index grew

2.8% from July of last year. The index can be broken into two

components—the goods component increased 2.4% over the year,

while services increased 3.3%. For comparison, the total final

demand index, which measures all goods and services across the

economy, increased 3.3% over the year, with final demand with

respect to goods up 1.9% and final demand for services up 4.0%.

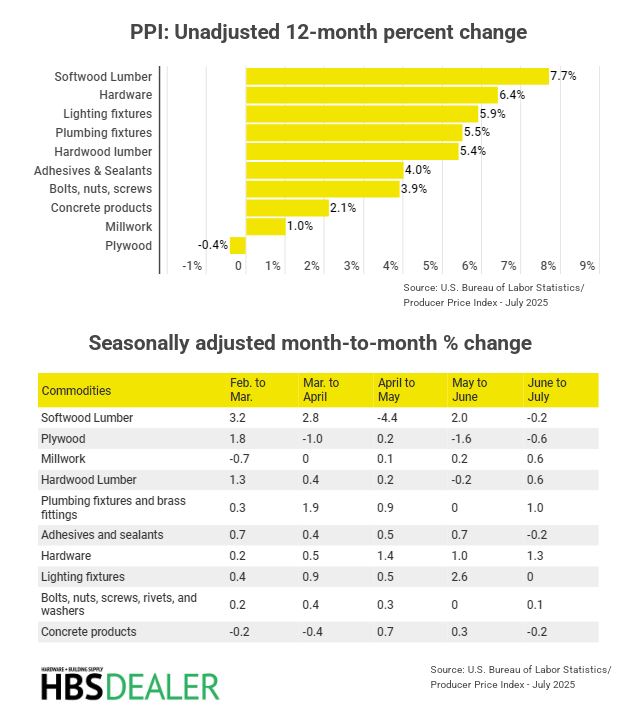

Here is the tally of 10 key commodities tracked by HBSDealer:

Construction inputs and building materials prices mostly

rose compared to last month, with a few exceptions including

plywood (-0.6%), softwood lumber (-0.2%), paint materials

(-0.5%), and cement and concrete products (both -0.2%).

Year-over-year, meanwhile, softwood lumber prices are up 7.7%,

and hardwood lumber is up 5.4%. Hardware prices, which rose 1.3%

month-over-month, are up 6.4% on a yearly basis.

According to Associated Builders and Contractors, construction

input prices increased 0.4% in July compared to the previous

month. Overall construction input prices are 2.2% higher than a

year ago, while nonresidential construction input prices are

2.6% higher.

ABC Chief Economist Anirban Basu: “Nonresidential input prices

have risen at a 5.8% annualized rate since January, and trade

policy will likely continue to put upward pressure on materials

prices over the next several months. Copper wire and cable

prices, for instance, surged 5% in July and are now up 12.2%

over the past year."

“The rapid increase in broader producer prices in July is just

as worrying as rising construction input costs,” Basu continued.

“With prices for final demand goods and services rising at the

fastest pace since March 2022, the Federal Reserve will have to

consider the prospect of resurgent inflation when deciding

whether or not to cut rates at its September meeting. The

construction industry is in desperate need of lower borrowing

costs, and higher rates for longer would continue to weigh on

construction spending.”

Source:

hbsdealer.com