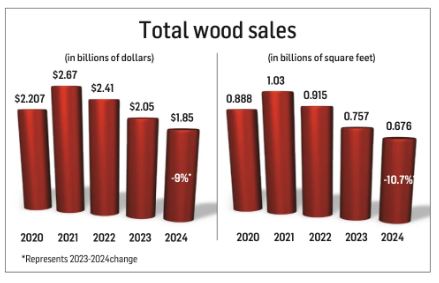

The dynamics that impacted the hardwood flooring category in

2023—i.e., intense competition from wood look-alike products

like SPC, WPC, LVT and laminate, as well as competition for raw

materials from end-use sectors other than wood

flooring—continued to challenge the wood category in 2024. In

the end, the hardwood segment again felt the impact, with sales

dipping below the $2 billion mark. FCNews research showed the

sales at the first point of distribution totaled $1.845 billion

in 2024, a 9% decrease from 2023. Volume took a hit as well,

falling 10.7% to 676 million square feet.

It’s been a while since the category generated numbers in that

vicinity or even lower. Back in 2009, the height of the Great

Recession, hardwood sales came in at $1.586 billion and volume

hit the 700 million-per-square-foot mark. And five years later,

in 2014, hardwood sales had improved to $1.94 billion in sales

and 770 million square feet. From 2015 through 2023, however,

the hardwood category rebounded, consistently generating sales

about $2 billion—until 2024.

Hardwood’s loss of market share is even more pronounced when

comparing the category’s performance relative to other hard

surfaces. Stripping out carpet, hardwood accounted for 12.6% of

total sales last year—coming in third place above laminate and

rubber, but trailing resilient and ceramic, respectively.

Volume-wise, hardwood accounted for nearly 7% of total hard

surface square footage sold at the first point of distribution

in 2024. By comparison, in 2015, hardwood accounted for nearly a

quarter of total hard surface sales (23.4%). But just five years

later, by 2019, hardwood’s share of total hard surfaces had

slipped to 19.5%.

“I think a lot of the decline in the wood flooring market last

year had to do with the drop-off in building and remodeling,

combined with higher interest rates,” said Milton Goodwin, vice

president, AHF Products. However, the higher end of the wood

flooring market seemed to hold its own. “In entry-level homes,

they’re not using wood,” he noted. “But people who are building

middle-to upper-end homes still want wood in there. In that

$500,000-$600,000-and-up range, we are seeing builders providing

wood as an option for the homebuyer.”

Other major hardwood flooring executives agree that the high

end was the category’s saving grace last year. “There’s always

going to be a customer for real hardwood,” said David Moore,

vice president of product management, Mohawk. “There’s always

going to be someone who says, ‘I want the real thing. I want to

have a party, have all my friends over, and tell them that this

is a real wood floor. And when I sell my home, I want to list

real wood floors on the documentation.’”

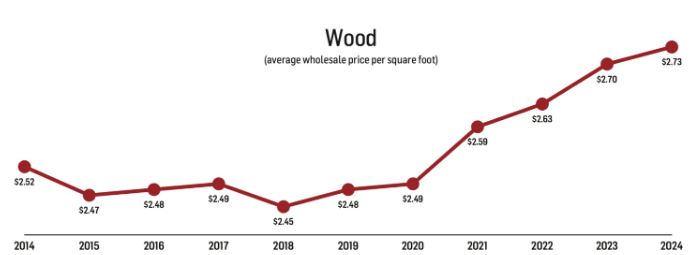

More importantly, wood still managed to maintain its

historically high-profile margins—mainly on the strength of

engineered products, which command a higher price tag compared

to traditional solids. FCNews research showed the average

wholesale price of hardwood flooring rose slightly to $2.73 per

square foot last year. In fact, it was the only category that

experienced an increase in average selling price.

Another encouraging sign for wood suppliers—looking at the glass

as “half full,” of course—is the rate of hardwood’s decline fell

from 15% and 17.3% in sales and volume, respectively, in 2023 to

9% and 10.7%, respectively, last year. It could be an

indication, proponents say, that wood is taking the first steps

in clawing back some of that lost market share. For example, the

improvements that hardwood suppliers have made to compete with

the LVP and high-performance laminate could finally be paying

dividends.

“We are seeing, especially in the high-end, positive activity in

the 3mm and 4mm veneer, sliced-faced products—the thicker 9/16-

and 5/8-inch wood floors,” Moore explained. “We’re also seeing a

little bit of a resurgence on the builder side as well as

builders look to compete in that mid-price point.”

Kyle McAllister, director of hardwood, Shaw Floors, concurred.

“When we look at the product mix in wood, you’re definitely

seeing movement toward the higher end,” he explained. “If you

were to look back six to eight years ago, there was a lot of

entry-level hardwood being sold. Now, with the growth of SPC and

WPC, you’ve seen that change. SPC ate up a lot of the share at

entry level of the market, which pushed wood growth to the

higher end.”

All this activity is reflected in the movement seen in terms

of wood flooring consumption last year. FCNews research shows

the residential replacement sector accounted for 66.4% of wood

flooring sales in 2024, up slightly from 65.4% the year prior.

Meanwhile, wood consumption in the new home construction sector

dipped slightly below 20%. Commercial wood consumption remained

relatively steady at roughly 11.6% of sales, based largely on

the strength of specified products going into restaurant,

hospitality and higher education settings like university

libraries. There was slightly less usage in corporate/office

applications for wood.

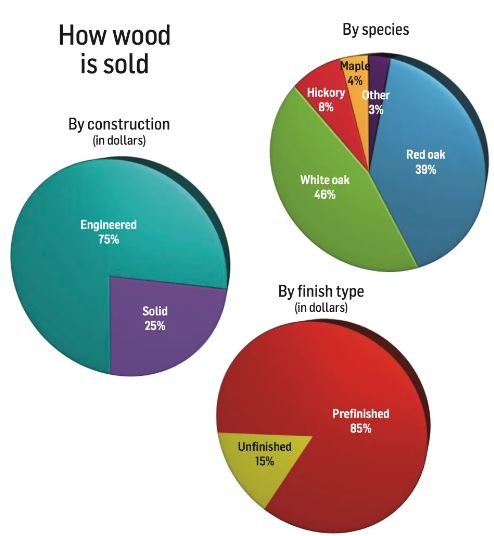

In terms of product type, prefinished wood flooring saw its

share of the market continue to rise in 2024. FCNews research

showed the prefinished portion of the domestic wood flooring

market accounted for roughly 85% of sales last year, up from

about 75% in 2023. In that same vein, engineered wood saw its

share of the total wood flooring pie grow from about 70% in 2023

to 75% last year. And with respect to species, white oak (much

of it sourced from Europe) and domestic red oak accounted for

the lion’s share of species sold last year.

Not much has changed, year over year, though, with respect to

wood flooring sales by channel. Specialty floor covering stores

represented about 41% of overall wood sales, up only slightly

from 2023’s 40%, while home centers’ share fell slightly from

35% in 2023 to about 32% last year. Large-format retailers like

Floor & Decor, which says it does not compete with the nation’s

major home center chains, actually reported an increase in its

hardwood flooring sales. All other flooring categories within

Floor & Decor declined last year, financial reports show.

Import influence

The year 2024 saw more domestic brands outsourcing wood flooring

production to other countries. In the years since the U.S.

flooring sector began seeing dramatic declines from

China—particularly engineered hardwood and laminate

products—Southeast Asia has emerged as a viable alternative.

Countries like Vietnam, Indonesia, Malaysia and Thailand, for

example, have seen their manufacturing industries grow steadily,

driven by competitive labor costs, a maturing supply chain

infrastructure and increasing foreign investment. FCNews

research shows shipments from Southeast Asian countries

accounted for nearly 50% of the wood flooring market last year,

while China’s share continues to drop.

For example, five years ago, shipments from China accounted for

nearly 60% of all hardwood flooring sold in the U.S. at the

first point of sale. In 2022 that number plummeted to 26% before

dropping 2 more percentage points in 2023. For 2024, that number

is hovering around 20% and falling fast. For perspective,

hardwood imports from Vietnam, Cambodia, Thailand, Malaysia and

others grew from roughly 9% in 2018 to 43% in 2022; 47% in 2023;

and 49.4% last year.

“We definitely saw hardwood production rise in Southeast Asia—a

region that has been the beneficiary of the decline in hardwood

production from China,” AHF Products’ Goodwin stated.

Importing from that part of the world is not without its

challenges, though. Southeast Asian suppliers must meet the

stringent regulatory and certification standards of the U.S.

market. U.S. laws such as the Lacey Act require that imported

wood products, including hardwood flooring, be legally harvested

and sourced. Violations can result in severe penalties,

including shipment seizure and bans. Additionally, suppliers

must comply with product testing and safety standards set by

organizations such as the Environmental Protection Agency (EPA),

the California Air Resources Board (CARB) and the U.S. Green

Building Council (USGBC). Products often need to be certified

for emissions, such as formaldehyde content in composite wood

flooring.

At the same time, Southeast Asian suppliers rely heavily on

maritime shipping to reach the U.S. market. Port congestion,

container shortages and unpredictable shipping schedules are not

unheard of. Even as the situation has improved since the days of

the pandemic, the industry remains vulnerable to bottlenecks and

rising freight costs.

Moreover, the long lead times involved in shipping from

Southeast Asia to the U.S.—typically ranging from four to eight

weeks—require precise inventory forecasting and demand planning.

That’s why the more savvy importers make it a point to ensure

ample stateside supply to avoid such issues.

“We have over 2 million square feet of inventory in two company

owned and staffed warehouses in Sutton, Mass., and Franklin,

N.J.,” said Bill Schollmeyer, who serves as vice president of

sales for R&J Flooring Supply, a Vietnamese-owned company.

Present state, future outlook

While hardwood flooring executives are encouraged by trends

showing a possible retreat from hardwood’s high, double-digit

sales losses, some challenges persist. Tariffs, for example,

stand to impact the category measurably, especially with more

wood manufacturers and distributors increasingly relying on

sourced programs. It’s also impacting our trading partners to

the north.

“Right now the big issue for us is the tariffs,” said Derick

Roy, sales director for Quebec-based Wickham Hardwood Flooring.

“The majority of our business is in the U.S., our best partners

are in the U.S., our best suppliers of lumber are in the U.S.,

so it does affect us tremendously.”

Even more frustrating for Canada-based suppliers like Wickham

ham is the “on again/off again” nature of the tariffs imposed by

the Trump Administration since he took office for the second

time. Proponents say the threat of tariffs—or the outright

imposition of tariffs with threats to raise them even

higher—provide a strong bargaining chip. The flip side of that

equation, however, is the uncertainty created by the start/stop

nature of the current tariff situation. This makes it difficult

for suppliers to manage costs and ensure product availability,

all while attempting to maintain competitive pricing in the

market.

Tariffs, while on the forefront of everyone’s minds, are not the

only issue hardwood suppliers need to contend with. Industry

executives are closely watching the housing market, a bellwether

sector for wood. The hope among many is that interest rates will

drop, causing home prices to come back down to earth. All of

which bodes well for wood floors.

Another factor is the ongoing competition for raw lumber—not

necessarily within the flooring arena but other market sectors.

For instance, competition for raw lumber materials from segments

such as wine-barrel manufacturing, furniture, paper/pulp

industries and the like. This phenomenon has intensified as

various industries continue to demand high-quality timber. This

competition has been exacerbated by the growing global demand

for timber, particularly from countries like China, where demand

for wood products has risen as the economy continues to expand.

“We’re not counting on somebody else to supply us our raw

materials,” AHF Products’ Goodwin said, citing the company’s

ownership of two local sawmills. “We also make our own plywood,

and we cut our own veneers. We do source some veneers, but a lot

of it is done in-house.”

Despite these challenges and others, wood flooring executives

remain cautiously optimistic. “We did start to see a pretty

significant rebound in the back half of the year though, and

it’s continued to grow throughout the first half of the year,”

Shaw Floors’ McAllister said. “As I look into the future, I feel

the industry will probably recover a little bit. I don’t see

major double-digit growth, but I’ve talked to a lot of customers

out there, a lot of sales reps and other manufacturers and

they’ve seen an uptick in their business. I cannot express

enough how excited I am about the future of the category. I’m

very pleased with the performance of the wood business right

now.”

Source:

fcnews.net