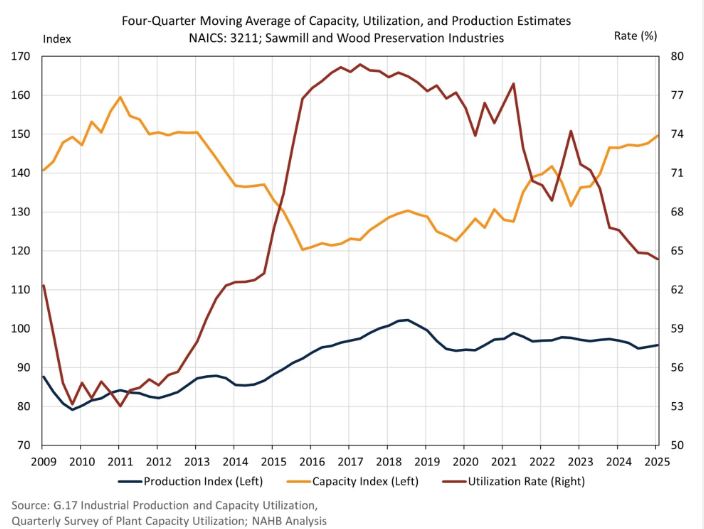

With tariffs on Canadian lumber, there has been a greater push

for U.S. sawmills to boost their lumber production. However,

according to the National Association of Home Builders,

utilization rates of U.S. sawmills are falling, meaning mills

technically have the capacity to make more lumber but aren’t

doing so. Among the reasons: many mills have reduced employment

over the years and don’t have enough workers to produce at

higher levels. Additionally, high prices and a more recent lack

of foreign competition have removed much of the incentive to

boost domestic production of lumber in favor of profitability.

In the first quarter of 2025, sawmill and wood preservation

firms continued to report lower capacity utilization coupled

with stagnant production. The utilization rate, a ratio of

actual production and potential production, was 64.4% in the

first quarter on a four-quarter moving average basis. The

utilization rate has continued to drop since 2017, as capacity

(or the capability to produce) has increased, but production has

remained lower than in 2018.

Based on the data above, sawmill capacity has increased from

2015 but remains lower than peak levels in 2011. Most of the

recent capacity gains took place in 2023, followed by little

gain over the course of 2024. As evident above, there is ample

room to increase production of domestic lumber, but current

production levels remain much unchanged over the past several

years. Looking at the Producer Price Index, lumber prices remain

higher than 2024. At current pricing levels, producers may see

no benefit of increasing output, as it would push prices lower

since demand has fallen from the start of the year. Notably,

even when prices were historically high in 2021 and 2022,

producers were unable to increase their production significantly

during these periods, potentially due to supply chain

disruptions.

Source:

eyeonhousing.org