The European building material industry is beginning to rebound

after experiencing a significant decline. We think this recovery

will persist as the housing market steadily improves. US import

tariffs on EU products are expected to have a minimal impact on

most European building material suppliers

Further recovery expected in the building material industry

We anticipate a further revival of the building material

industry in 2025, encompassing concrete, cement, and bricks. The

sector faced significant challenges in 2022 and 2023 due to a

decline in demand for new houses, the primary market for

building material companies producing these products.

However, house prices of existing homes have started to increase

in many European countries. This is a positive indicator for new

developments, as the prices of newly built and existing homes

typically follow each other closely; they cannot diverge too

much since new and existing houses are substitutes for

consumers. Therefore, new building developments will lead to

increased demand for building materials.

In most European countries, building material suppliers'

production levels plummeted in 2022 and 2023. Volumes were down

by almost 15% in Spain and by around 25% in Belgium and Germany

at the beginning of last year. Yet, we also observed the first

signs of a recovery in 2024. Poland and the Netherlands are

experiencing the largest comebacks. These countries have seen

the biggest uptick, at 16% and 12%, respectively. In Germany,

production is still at a very low level but has started to

increase slowly as well.

It is only in France and Austria where volumes have decreased

further. In a European Commission business survey, building

material companies in these two countries are the most

pessimistic about the development of further production in

February 2025.

We believe that volumes in the building material sector will

slowly further improve in 2025. In many urban European areas,

there is a structural high demand for new houses. As mentioned

earlier, house prices are improving and this makes the business

case for new house developments and consequently the demand for

building materials stronger. Nevertheless, higher interest rates

could slow down the pace of this process.

Prices of concrete, cement and bricks stable

Building material prices, such as concrete, are very stable and

have almost not moved during the last two years. You might

expect a price decline here as demand has significantly slowed,

but the prices of concrete, cement and brick remain sticky.

Building materials such as concrete and cement are heavy and

voluminous. This is why they're often traded on relatively small

local markets, resulting in less competition. This gives the

suppliers of these products a bit of market power, which usually

results in both higher prices and lower price volatility. They

do not have to pass on price reductions of raw materials or

energy costs directly because of the relatively limited

competition. As a result, the output prices of these products

rise ¨C and fall ¨C at a slower rate compared to building

materials such as steel, which are traded in more competitive

markets.

The graph above also shows that the steel price follows a

bumpier road. US tariffs on metals could also result in trade

diversion from other origins, which could directly affect local

EU metal prices.

Timber more expensive, plastics cheaper

The prices of many building materials are relatively steady. The

cost of timber has slowly increased and prices were 7% higher in

January 2025 compared to the same month a year earlier,

following a decline of 4% in 2023. Plastic prices have remained

more or less the same compared to two years ago.

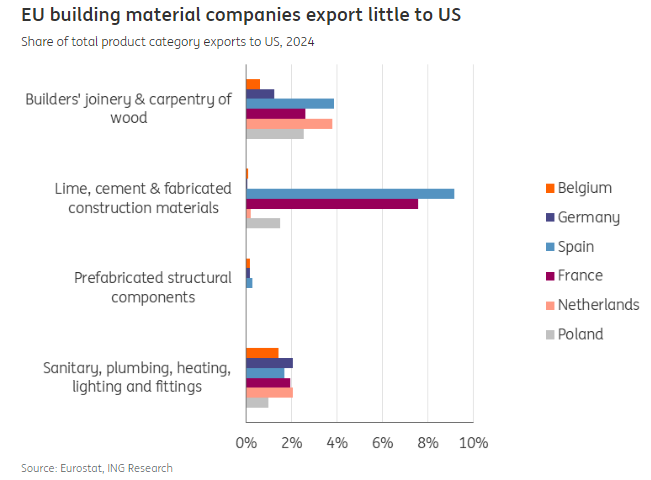

US import tariffs won¡¯t harm the EU building material sector

of concrete, bricks & cement

Many building materials, such as concrete, bricks, and cement,

are heavy and thus costly to transport, resulting in limited

exports from the EU to the US. For most building material

categories from EU countries, less than 3-4% is exported to the

US. Only France and Spain have a higher share of their exports

to the US for lime, cement, and fabricated construction

materials. However, the exported volumes remain low. For

example, French building material suppliers exported only €55m

worth to the US in 2024.

Source:

think.ing.com