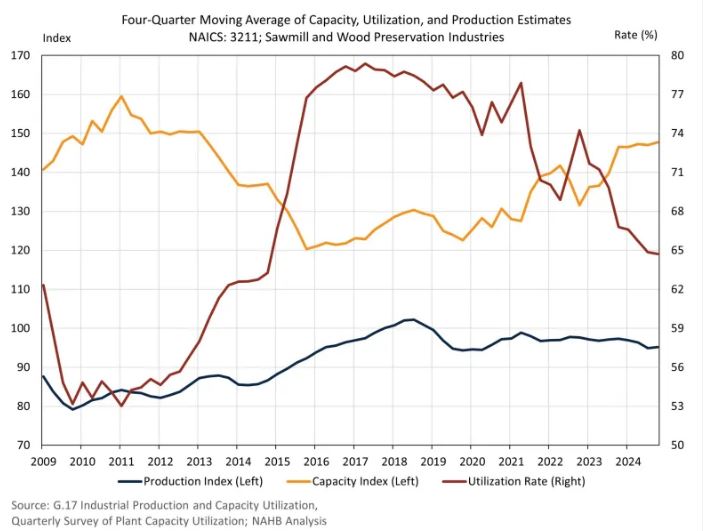

U.S. sawmill and wood preservation firms maintained steady

production and capacity levels throughout 2024, but capacity

utilization rates declined to 65% in the fourth quarter on a

four-quarter moving average basis. This decline reflects a

continuing trend since 2017, where production capability has

expanded, but real output remains lower than 2018, according to

the National Association of Homebuilders (NAHB) analysis.

Capacity utilization rates, calculated as the ratio of actual

production to full production potential, illustrate a growing

gap between these two figures. The lower utilization rate stems

from factors such as material shortages, order limitations, and

labor constraints.

The NAHB estimated current U.S. sawmill production capacity by

combining data from the Federal Reserve¡¯s production index and

the Census Bureau¡¯s utilization rate. With U.S. firms operating

below potential, imports continue to fill gaps in supply,

particularly for softwood lumber.

Since U.S. firms do not produce at their full potential, imports

help to supplement domestic supply, especially in the softwood

lumber market. According to Census international trade data,

existing tariffs on Canadian softwood lumber have not reduced

the need for imports to meet domestic consumption but have made

the U.S. more reliant on non-North American lumber, resulting in

unnecessarily complex supply chains. The current AD/CVD Canadian

softwood lumber tariff rate stands at 14.5% and is expected to

double under the administrative review process by the Department

of Commerce. Potential tariffs on lumber, such as the ongoing

232 investigation and 25% on all Canadian goods, could push

tariffs rates on Canadian softwood lumber above 50% later this

year. Higher tariffs on softwood lumber mean higher costs for

builders who use lumber as a key input to construction. Given

the current housing unaffordability crisis, any additional costs

will continue push homeownership and affordable housing further

out of reach for households in the U.S.

Source: NAHB