As March began, softwood traders continued to face an uncertain

market with demand only showing signs of a marginal increase

over the previous 2 months, still lagging behind most peoples¡¯

expectations. The forward market showed a modest improvement,

but as always, it was product-specific rather than across all

softwood groups, and the main ongoing casualty was still C24.

As the staple product in importers¡¯ and merchants¡¯ yards for

many years, graded carcassing has taken up large areas of

stocking space. With the number of sizes and lengths needed to

service the market, carcassing has tied up a high level of

financial investment and cash, yet it remains stuck as a low

profit product. Suffering from perhaps the most erratic section

of the market, it has brought some businesses to their knees due

to stock write downs through a perpetual series of extreme peaks

and troughs in both demand and price.

In the current climate, credit insurers are adopting a very

cautious approach to the limits granted in the timber

merchanting sector. During the past year, a number of

well-established merchants have either lost money (and still are

losing money) or have failed altogether, and this has affected

confidence to the point where insured limits have been withdrawn

altogether.

As March progresses, raw material shortages and increased log

costs are starting to bite, and regardless of demand, prices are

rising and recovering from the very low levels that prevailed in

Q4 of last year. Regular increments are now being heralded by

producers that will come into play on a monthly basis.

Last autumn, Baltic processors found the market unworkable, as

increases in log costs far outweighed the levels of return they

could expect from UK buyers. As mentioned in previous reports,

many of the producers switched away from building specifications

in favour of wood fuel, pallet wood and agricultural fencing.

Even today at many ports, it is still evident that the trade in

Latvian C24 and batten material has been substituted by rounded

posts and general landscaping products.

Now a similar situation has arisen in Sweden in terms of raw

material costs and supply. To balance supply and demand, mills

in the south have suspended production for varying periods

rather than just reducing shifts as they have done in the past.

These decisions have been made by the Swedes to avoid

loss-making, and by their efforts to control output, they have

help trigger increased prices along the supply chain.

March is the first month to witness any meaningful price

increases since last summer, but once again, merchants express

concerns that prices could go into reverse gear, so it is vital

for the industry that shippers try to ensure a level of

stability is maintained.

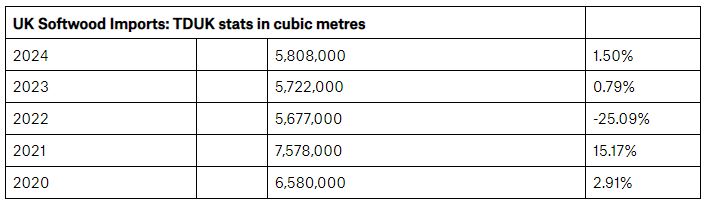

The volume of UK softwood imports for last year rose by

approximately 86,000m3 (+1.5%)* according to Timber Development

UK (TDUK) and the sterling value moved in parallel, indicating

that the average price index was unchanged from 2023. Within the

figures it was noted that Sweden¡¯s exports to the UK had eased

downwards while Latvia made a gain.

At the year-end, Sweden remained in first position with 47%

of the UK market (2,729,000m3), Latvia second with 17%, followed

by Finland at 12%, with Germany and the Irish Republic at 8%

each.

A brief snapshot of the joinery and quality grades, shows that

there has been a gradual reduction in the average diameter of

harvested Nordic/Scandinavian redwood logs. This has resulted in

a higher portion of centre-cut material reducing the volume of

sideboards in both unsorted and fifth grades.

With shortages of whitewood logs in some areas of Sweden,

volumes of kiln dried redwood have been switched towards treated

carcassing. Redwood enables merchants and importers to achieve

both UC3 & 4 treatment performance levels, something which they

are unable to do with spruce due to its lower porosity which

inhibits the penetration of preservatives.

Looking to the future, off-site timber frame construction,

cassette floors and engineered wood structural beams are all

growing in demand, while solid wood joist designs are being

specified less, particularly for new housing developments.

The housing market is a hot topic, not just in the timber trade,

but also across the national media where a consensus among

housebuilders highlights the fact that the current push for

planning reform seems to be only focused on the major developer.

Apparently, there are around 2,500 registered small to

medium-sized builders capable of erecting sites of between 10-20

houses, and they are reporting that they are struggling more

than ever to get planning approval. These developers are more

likely to use solid wood joists as opposed to multiple house

sets designed in I-joists and LVL and are therefore an important

outlet for solid softwood joist consumption.

To meet the government¡¯s target of 1.5 million new homes during

their term in office, the collective voice of the housebuilding

industry is warning that all sizes of building companies must

receive active assistance to overcome red tape, and they all

need to be involved if the initiative is to stand a chance of

succeeding.

Source: ttjonline.com