Introduction

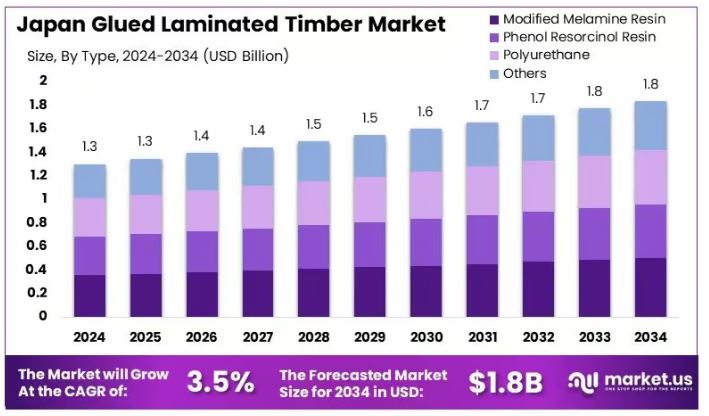

The Japan Glued Laminated Timber Market is projected to reach

approximately USD 1.8 billion by 2034, up from USD 1.3 billion

in 2024, reflecting a compound annual growth rate (CAGR) of 3.5%

during the forecast period from 2025 to 2034.

The Japan Glued Laminated Timber (Glulam) Market is a vital

segment within the country¡¯s engineered wood industry, driven by

the rising demand for sustainable and high-performance

construction materials. Glued Laminated Timber (Glulam) refers

to a structural wood product manufactured by bonding multiple

layers of dimensioned timber with durable adhesives, offering

superior strength, stability, and design flexibility compared to

traditional lumber.

The Japan Glulam market is experiencing steady growth, fueled by

increasing adoption in residential, commercial, and

infrastructure projects due to its environmental advantages,

earthquake-resistant properties, and enhanced load-bearing

capacity. The Japanese government¡¯s commitment to promoting

wooden construction, particularly in public buildings, aligns

with the broader trend of reducing carbon footprints and

enhancing urban sustainability.

Additionally, the demand for Glulam is supported by stringent

building regulations emphasizing earthquake resilience, as

Glulam structures offer high strength-to-weight ratios and

flexibility, making them suitable for seismic-prone areas.

Furthermore, rising urbanization and the shift towards

prefabricated and modular construction methods are augmenting

the demand for engineered wood solutions, including Glulam. Key

growth opportunities exist in the increasing preference for

eco-friendly building materials, government incentives for

timber-based construction, and the expansion of cross-laminated

timber (CLT) applications.

However, challenges such as raw material price fluctuations and

competition from alternative construction materials remain

factors to monitor. Overall, Japan¡¯s Glued Laminated Timber

market is poised for sustained growth, supported by evolving

construction practices, sustainability initiatives, and the need

for resilient building materials in a region prone to natural

disasters.

Key Takeaways

¡¡

-

The Japan Glued Laminated Timber

Market was valued at USD

1.3 billion in 2024 and is projected to reach USD

1.8 billion by 2034, growing at a CAGR

of 3.5%.

-

Modified Melamine Resin led the segment in 2024

with a 27.3%

share, attributed to its durability

and strong adhesive properties.

-

Straight Glulam Beams dominated with 38.2%

share, driven by their preference

for structural applications in construction.

-

Framing

Grade accounted for 34.3% of

the market due to its strength

and suitability for residential buildings.

-

Horizontal Lamination led with 43.2%

share, providing structural

stability and flexibility.

-

Commercial Construction accounted for 34.4%,

supported by the rising

demand for sustainable building materials.

Emerging Trends

Key Takeaways

-

Sustainable Construction Practices: There

is a growing emphasis on environmentally friendly building

materials, leading to increased adoption of glulam due to

its renewable nature and lower carbon footprint compared to

traditional materials.

-

Technological Advancements: Innovations

in manufacturing processes have enhanced the quality and

versatility of glulam products, making them more competitive

with traditional materials.

-

Government Initiatives: Policies

promoting the use of wood in public buildings have

encouraged the adoption of glulam, aligning with

sustainability goals.

-

Urbanization and Infrastructure

Development: Rapid

urbanization has led to a demand for materials that offer

both structural integrity and aesthetic value, positioning

glulam as a favorable option.

-

Seismic Performance: Japan¡¯s

focus on earthquake-resistant construction has highlighted

glulam¡¯s flexibility and strength, making it suitable for

seismic applications.

Top Use Cases

-

Residential Construction: Glulam

is extensively used in housing projects, offering strength

and aesthetic appeal.

-

Commercial Buildings: Its

ability to span large spaces without internal supports makes

it ideal for commercial applications.

-

Public Infrastructure: Glulam

is utilized in public structures such as schools and

community centers, benefiting from its durability and design

flexibility.

-

Bridges: The

material¡¯s strength-to-weight ratio makes it suitable for

bridge construction, providing both functionality and visual

appeal.

-

Renovation Projects: Glulam

is favored in renovations for its adaptability and ease of

integration with existing structures.

Major Challenges

-

Price Sensitivity: Economic

factors have led to increased demand for cost-effective

materials, challenging glulam¡¯s market position.

-

Competition from Alternative

Materials: Traditional

materials like steel and concrete continue to dominate

certain sectors, limiting glulam¡¯s adoption.

-

Supply Chain Constraints: Dependence

on imported raw materials can lead to supply disruptions and

increased costs.

-

Regulatory Hurdles: Building

codes not fully accommodating glulam can impede its broader

application.

-

Market Awareness: Limited

understanding of glulam¡¯s benefits among stakeholders can

slow its adoption in new projects.

Top Opportunities

-

Sustainable Construction Demand: Growing

environmental awareness presents opportunities for glulam as

an eco-friendly material.

-

Technological Integration: Advancements

in manufacturing can lead to innovative glulam applications,

enhancing its market appeal.

-

Urban Development Projects: Urbanization

trends create demand for materials like glulam that offer

both structural integrity and aesthetic value.

-

Government Support: Policies

favoring wood-based construction can boost glulam¡¯s adoption

in public projects.

-

Educational Initiatives: Increasing

awareness and training about glulam¡¯s benefits can expand

its use across various construction sectors.

Conclusion

The Japan Glued Laminated Timber (Glulam) market is set for

steady expansion, driven by rising demand for sustainable

construction materials, government policies promoting

timber-based structures, and technological advancements

enhancing product performance. The market benefits from Glulam¡¯s

structural strength, design flexibility, and

earthquake-resistant properties, making it a preferred choice

for residential, commercial, and infrastructure projects.

Increased urbanization and the adoption of prefabricated

construction further boost its application. However, challenges

such as competition from alternative materials, price

fluctuations, and regulatory constraints persist. Despite these

hurdles, the market remains poised for growth, supported by

sustainability trends, innovative manufacturing processes, and

increasing awareness of engineered wood¡¯s benefits in modern

construction.

Source: news.market.us

|