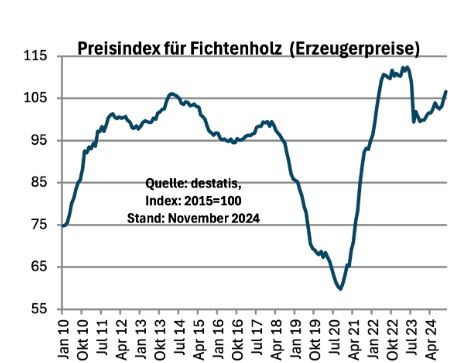

Prices for roundwood rise

Prices for roundwood rise in February. This applies to spruce

but also to pine. Sales of construction timber continue to be

difficult - and will remain so. However, other factors are also

driving up (round) timber prices.

Due to the lower beetle infestation in many regions, demand

is often higher than the current timber supply. Prices for

spruce sawlogs in particular continued to rise in February,

according to forest owner associations following the conclusion

of new contracts.

For spruce, prices of 105 to 115 euros per cubic metre (plus

VAT) are quoted on average for fixed length and long timber for

quality B/C in strength class 2b+. Individual buyers pay an

additional bonus for required length mouldings.

For beetle wood, 15 euros less is usually paid and the discount

for D-wood is 25 euros per cubic metre. This means that prices

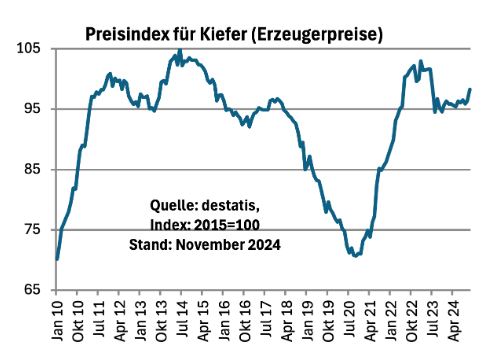

have risen by 5 to 10 euros this year. Pine sawlogs are also

benefiting from the robust demand and prices are also rising.

The reason for this is the continuing low availability of

high-quality round timber.

Forest owners' associations explain the price increase with the

very low quantities of damaged timber compared to previous

years. Added to this is apparently the recent resurgence in

exports to the USA - which is boosting demand and driving up

prices, according to timber traders and sawmills.

Exports play an important role in the development of timber

prices in Germany. The introduction of additional 25 per cent

tariffs on Canadian softwood lumber could further improve sales

opportunities for German exporters. However, a European trade

war with the USA could quickly block this sales channel again.

Industrial wood and energy wood are not (yet) benefiting

The current good export opportunities can at least partially

offset the weak sales of sawn timber on the domestic market.

Nevertheless, the poor state of the construction industry in

Germany has so far prevented a recovery in sawn timber prices.

Pine sawlogs are also benefiting from robust demand and

prices are also rising. This is due to the persistently low

availability of high-quality round timber.

The sawmill industry therefore continues to have problems

selling sawn timber in large quantities on the domestic market.

As the outlook for the construction industry in Germany is not

expected to improve according to current forecasts and the

economic outlook for 2025 is very weak overall, no significant

recovery in demand for construction timber and therefore sawn

timber prices is expected. Unless supply is further reduced by

strong exports and a low volume of damaged timber.

The paper, pulp and panel industry continues to be well stocked

with softwood industrial timber and production volumes have also

been reduced recently. Industrial timber prices were therefore

lowered at the beginning of the year. However, the already

reduced prices have largely been able to maintain their current

level. Forest owners' associations are also expecting continuous

sales in the coming months, which should at least support

prices.

The market situation is similar for energy wood, where prices

fell in autumn last year but are now largely holding their own.

The sales situation for wood chips is apparently difficult in

some regions.

Source:

agrarheute.com