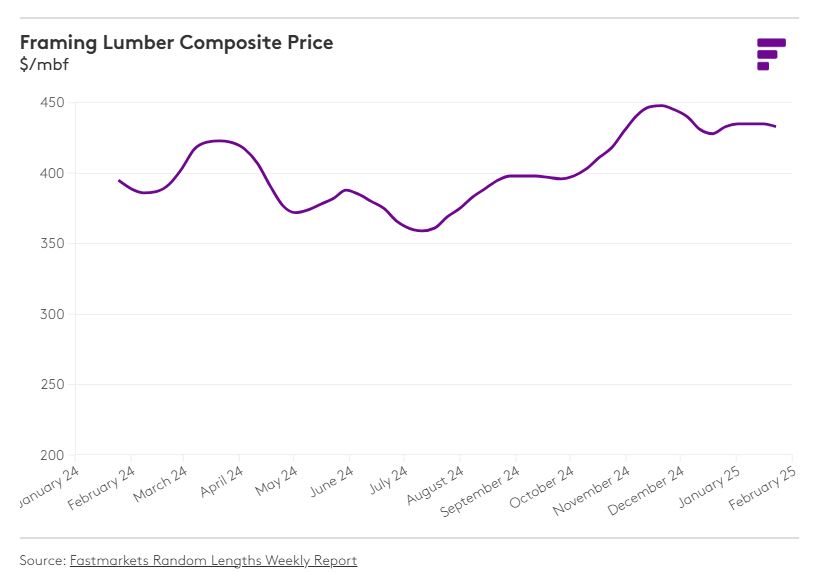

Trends in many framing lumber markets were unchanged amid

persistent uncertainty regarding tariffs and frigid temperatures

across much of the US.

The presidential inauguration and Martin Luther King Jr. holiday

on Monday served as further distractions. Western Canadian

producers sold cautiously while awaiting clarity on potential

tariffs. Buyers had few immediate needs and were content

operating with lean inventories despite the threat of

volatility. Prices were little changed in overall dull trading.

Lumber futures tracked a similar course in terms of interest,

but downside was evident as the large premium in the front month

eroded. The board fell each day week to date.

Meanwhile, subfreezing temperatures across the South and

historic snowstorms along the Gulf Coast brought Southern Pine

trading to a near standstill. Traders operated with widely

diverse views of whether President Trump’s threats of tariffs of

up to 25% on Canadian imports as early as February 1 will

actually become a reality.

The frigid conditions forced mills and treating plants to close

or run at sharply reduced rates. Insurance purchases ahead of

the potential tariffs were minimal to non-existent.

Concern about interest rates, and their potential impact on

housing demand, was an underlying theme prompting a cautious

approach to the market. In the Inland market, most traders

reported a quiet week. Mills with particular items to sell were

more open to counters. 2X12 remained under the most downward

price pressure.

In industrial lumber, Mldg&Btr remained susceptible to

discounts, some of them as much as triple digits. Meanwhile,

P.99 was sold at higher prices. Upper grades of shop held steady

despite limited sales.

Source: fastmarkets.com