Japan’s government has been pushing policies

that favor green building and promote the use of domestically

sourced timber. As construction trends shift, imports of

softwood sawlogs continue their decades-long decline, but as

volumes dwindle North America’s market share increases.

Historical Import Volumes

Japan’s annual softwood log import volumes peaked at almost 18

million m3 in 1987, and between 1986 and 1990 Japan imported

upwards of 16 million m3/year. By the end of 2017, annual

softwood log import volumes barely exceeded 3 million m3.

Source: ResourceWise

Japan’s softwood log imports are almost entirely sawlogs. One

factor in the import decline has been a decline in traditional

Japanese construction, particularly single-family homes, amid

demographic changes, which has reduced demand for lumber and

plywood. Japan has the world's fastest-ageing population; more

than 29% of its 125 million population is 65 or older. Japan’s

total housing starts between 2003 and 2023 declined by almost

30%, and in the same period, wooden housing starts fell by 13%.

The Rise of Engineered Wood Products

Another trend that has influenced log imports is the increasing

use of engineered wood products (EWPs). Laminated veneer lumber

(LVL) and glued laminated timber (glulam) have become

increasingly popular for residential and commercial construction

and Japan has domestic production of EWPs. Rising interest in

tall mass timber buildings and recent legislation to support the

use of wood in construction is likely to bolster the market for

EWPs.

The Japanese government has also been encouraging the use of the

country’s own forests. In 2023, Japan Lumber Journal reported

that Daito Trust Construction Co. Ltd. had started construction

in Iwate Prefecture on apartments made of all domestic lumber.

About 80% of the buildings supplied by the Daito Group are wood

structures built using 2x4 framing and CLT (cross-laminated

timber) construction techniques.

In 2023, Japan’s annual softwood sawlog imports fell to a little

more than 1.9 million m3 from 3.1 million m3 in 2017, according

to WMP data. Japan’s imports from January through November 2024

show a year-over-year decline of 14%.

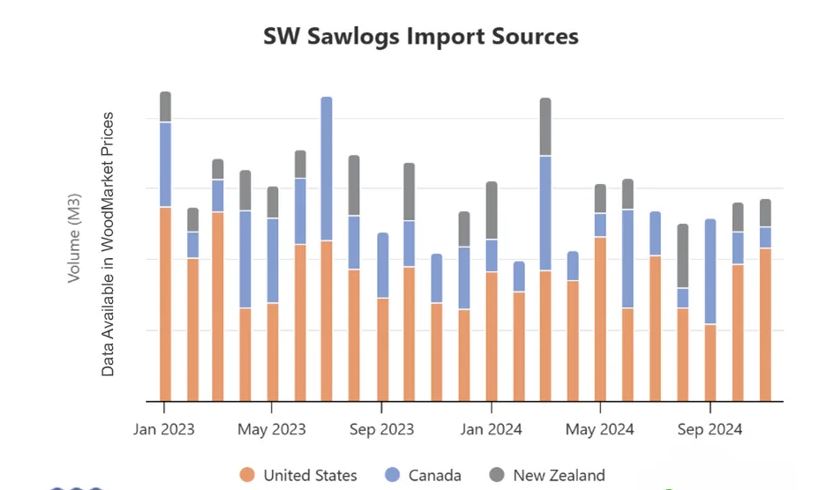

For dominant suppliers such as the US and Canada, market share

in Japan has risen even as softwood log export volumes have

trended downwards. In 2017, the US accounted for 52% of Japan’s

softwood sawlog imports, and Canada about 31%. In 2024 through

November, combined US and Canadian exports to Japan accounted

for 86% of Japan’s imports.

Source:

resourcewise.com