How could softwood lumber prices be affected by

developments in the US residential construction market in 2024?

In this deep dive outlook, Fastmarkets¡¯ senior economist Dustin

Jalbert outlines his predictions for the year ahead

Another year is behind us, with no shortage of discussion topics

when reflecting on the US residential construction and wood

products markets in 2023. In many ways, the year played out how

our team expected as we laid out in last year¡¯s ¡°Predictions¡±

piece.

Here is how our predictions played out throughout 2023:

-

Housing and lumber demand took a significant hit

-

Lumber prices scraped along the top of the cash cost curve

around $400 per thousand board feet (MBF)

-

About 1.3 billion board feet (BBF) of closures were

announced for British Columbia

-

And inflation is now rapidly cooling toward the Federal

Reserve¡¯s target.

But things have played out in unexpected ways as well. For one,

the single-family market rebounded more rapidly than anticipated

in the second half of the year. The US labor market also

remained far more resilient to the Fed¡¯s salvo of rate hikes and

the winddown of fiscal stimulus than most forecasts ¨C including

our team ¨C were calling for.

By popular demand, we¡¯ve decided to follow up on last year¡¯s

¡°Predictions¡± piece with another for 2024. As we frequently

remind our readers, the future is uncertain and market

conditions can change rapidly. Nevertheless, here are

Fastmarkets¡¯ key calls for the 2024 housing and lumber market.

Prediction 1: Unemployment will remain historically low in

2024 as the US economy dodges a recession

Prediction 2: Single-family housing starts will grow by over

1 million units in 2024

Prediction 3: Repair and remodeling volumes will continue to

flatline through 2024

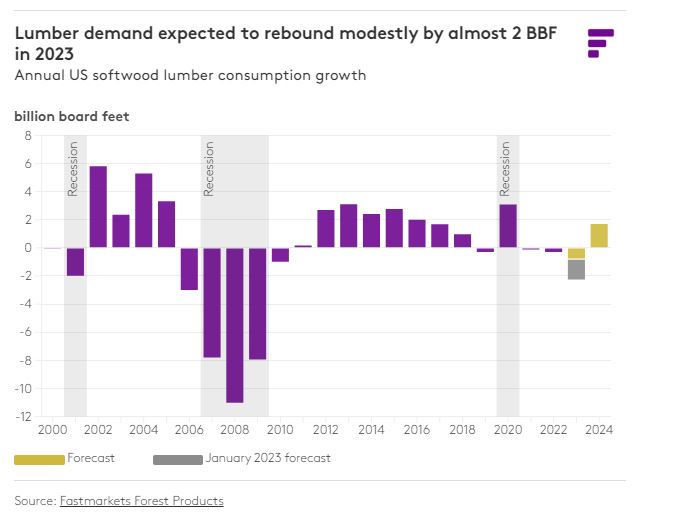

Prediction 4: Lumber consumption will grow by 1.7 BBF in 2024

As we stated last year, it¡¯s no surprise that our view of the

housing market largely dictates the demand outlook for lumber

and other wood products. New residential construction and R&R

combined account for roughly 70-80% of US wood products demand.

For full transparency, readers will be reminded that our call

for lumber consumption last year was for a drop of about 2.2 BBF.

We still have several months of industry data to be delivered

before we can fully evaluate 2023 demand levels, but compared

with our January 2023 forecast, consumption will likely have

surprised to the upside by more than 1 BBF. This is largely due

to the much more aggressive incentive measures taken by builders

that we mentioned earlier, which helped soften the blow in

consumption for the year.

From a volume perspective, a year slated for solid growth in

single-family housing and flattish R&R demand suggests a

volume-positive year for most wood product categories. Even with

the further declines in multifamily that we are calling for in

Prediction 2, it¡¯s important to remember that single-family

homes use roughly three times more lumber per start than a

typical multifamily start ¡ª due to more floor space, a higher

share of stick framed, etc. Single-family starts are also

currently about double those of multifamily. There are other

considerations also, such as shrinking home sizes and material

substitutions, but even accounting for these factors, the arrow

points up on softwood lumber demand in 2024.

Fastmarkets¡¯ call for US softwood lumber consumption to advance

by 1.7 BBF (3.4%) is by no means a gangbuster year of growth. In

fact, it is very much in line with typical volume gains for the

industry over the last decade or so. However, consumption

reversing course after falling about 0.8 BBF (1.6%) in 2023

based on our latest estimates will be a welcome change for

building material dealers, wholesalers and mills alike.

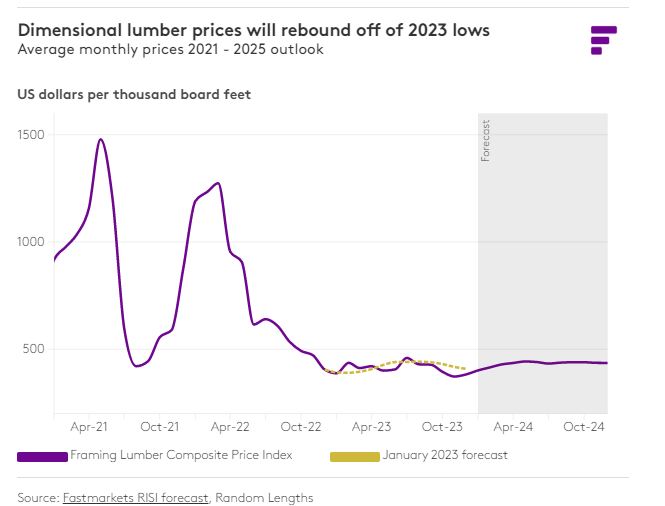

Prediction 5: Lumber prices will bottom in 2023, setting up

for modest appreciation into 2024

As we emphasized in last year¡¯s ¡°Predictions¡± piece and in our

recent editions of the Lumber Commentary, there¡¯s reason to

believe month-to-month price volatility will remain elevated

compared with the sleepy days prior to 2018.

However, market participants will need to accept that the

volatility in the market witnessed from the spring of 2020 and

through 2022 is behind us now. This was a black swan event,

largely stemming from both demand and supply shocks directly

tied to the pandemic that are now subsiding. Mill staffing and

production has now recovered fully, the surge in demand from the

R&R and single-family boom have corrected, and transportation

and distribution are facing a fraction of the disruptions we saw

in 2021 and 2022. We are now in a normal demand-supply

equilibrium, which suggests the price-surge environment we saw

for two years is over. This correction was clear in 2023, when

the Random Lengths Framing Lumber Composite Price (FLCP)

averaged $411 per MBF for the year, which we will proudly note

was within $8 per MBF of our January 2023 forecast.

So, what is the good news for mill operators and traders in

2024? The demand rebound we anticipate in 2024 sets the industry

up for tightening operating rates, which should carry prices

higher. While supply continues to expand as southern yellow pine

(SYP) capacity ramps up in the US South, closures and

constrained log supply in the rest of North America will keep

capacity gains modest, trending at a modest 1-2% in most years.

This should provide the opportunity for demand growth to

overshoot supply growth in 2024.

We predict Western SPF 2&Btr 2¡Á4 will average $427 per MBF in

2024 and the FLCP will average $432 per MBF, which translates to

mid- to high-single-digit growth in prices year over year.

Prices at current levels are also not sustainable for a

significant swath of the North American industry, namely

dimensional lumber producers in British Columbia who are coping

with variables breakeven levels in the low $400s per MBF for

lumber delivered to the US (and notably still facing antidumping

and countervailing duties). The salvo of closures we predicted

and saw in 2023 reflects the challenging market environment for

high-cost mills in North America.

As lumber prices gain upward momentum, temporarily curtailed

sawmill capacity will come in from the sidelines. This will keep

supply and demand in balance and temper the magnitude of the

price increases. Competing sources of supply from offshore,

particularly from Central and Northern Europe, which has gained

share over the years, will also keep the market in check. While

the year-over-year gains in dimension lumber prices will be

modest, a year of net price appreciation will still be a welcome

development for much of the wood products supply chain.

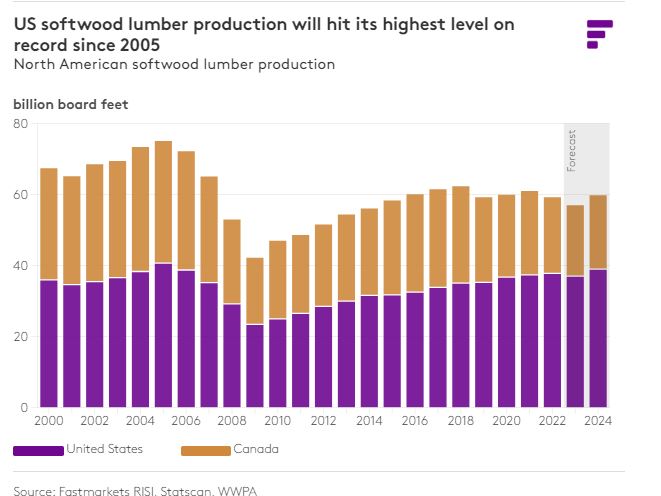

Prediction 6: US softwood lumber production will hit its

highest level since 2005

Finally, what about the supply side of the lumber market? After

a year of significant capacity rationalization, what should we

expect in 2024? Our key prediction is that US sawmill production

will hit its highest level since peaking in 2005, marking the

second-highest level on record.

While 2023 was a challenging environment for mill operators,

many sawmills in the US have been able to limp along through

this market as Canadian operators took the brunt of the pain,

with many of them cash-negative at prevailing dimensional lumber

prices. This also explains the wave of Canadian closures we

predicted and ultimately saw in 2023. SYP production, which

accounts for about 38% of North American softwood lumber output,

also has the added tailwind of very low delivered fiber costs.

Most producers in the US South with modern, state-of-the-art

sawmill operations are still cash-positive. We¡¯ve also seen SYP

capacity investment trending close to 1 BBF a year in recent

years, which in most years was more than sufficient to counter

capacity losses, particularly those in British Columbia.

The growing US share of the North American lumber market has

been a secular trend driven ultimately by lower fiber costs in

the rapidly growing US South but also accelerated by duties and

managed trade for Canadian sawmills as well as the long-term

consequences of the mountain pine beetle kill in British

Columbia. This is a noteworthy development considering that

historically, Canada has accounted for anywhere between a

quarter to a third of US softwood lumber consumption.

The story of secular decline in BC production tends to dominate

the narrative in the lumber industry, but the rise of the US

lumber industry after a decade of pain stemming from the capital

destruction brought on by the housing crash in 2008-10 remains

an important part of the supply story. For commodities like

lumber, the low-cost supplier tends to prevail over the long

run. We are seeing this happen in real-time as SYP continues to

fill the supply void, just as home construction and lumber

demand is primed for a recovery in demand in 2024.

Want to learn more about the lumber market, prices, or

forecasts? Check out our dedicated

page for timber/lumber,

other wood

products,

or speak

to our team about

accessing our news, analysis, forecasts and more.

Source:

fastmarkets.com