|

Report

from

Europe, the UK

and

Russia

Export demand for Italian furniture proves resilient

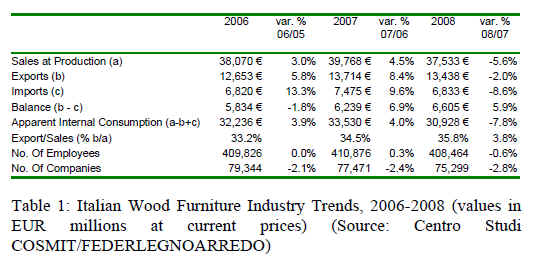

The Italian furniture sector held up reasonably well to the

end of 2008 considering the scale of the economic

downturn. Preliminary 2008 end-year figures suggest that

Italian sales of wood furniture fell by 5.6% in 2008

compared to the previous year. Much of the decline in

sales was due to a fall in the overall level of Italian

domestic furniture consumption. The value of Italian wood

furniture exports fell by only 2%. The likelihood is that the

Italian furniture sector extended its share of the global

wood furniture sector in 2008. The latest available

international data indicates that the share of Italian

furniture on the global market in 2007 reached 9.1%,

rising from 8.9% in 2006.

After the sharp upturn in overseas sales during 2006 and

2007, a 2% drop in exports is by no means a positive

result. However, it is an indication that Italian furniture

products remain highly competitive in international

markets. During 2008, there was a severe downturn in

Italian furniture exports to two markets worst hit by the

credit crunch, the UK (-13%) and the US (-22%), together

with Germany (-5%) and Spain (-14%). However, these

losses were offset by strong gains in exports to Russia

(+17%), the United Arab Emirates (+37%), and Greece

(+4%). Exports to France and Austria remained stable.

Two factors had a bearing on the drop in Italy¡¯s domestic

furniture consumption in 2008. On the one hand, there was

a severe loss of consumer confidence during 2008 and, on

the other, there was a significant slump in the real estate

and rental markets even before the construction industry

was hit by a sharp fall in demand.

But overall, Rosario Messina, President of the Italian

wood furniture association Federlegno Arredo, believes

the figures are a reason for optimism. ¡®This is a crisis that

is being imported, quite unlike those in the past which

were all linked largely to a gap in our country¡¯s

competitiveness and in part to our business system. We are

stronger now: we have had time to absorb the competitive

shock generated by embracing the Euro and spot exchange

rates that were far from favorable to Italian exports. We

have taken stock of an increasingly global market and of

the difficulties inherent in true internationalization. Much

still remains to be done, but businesses have responded

well....the fact that Italian companies suffered to a lesser

extent than others on the international markets is largely

attributable to the quality of our products¡¯.

Italian furniture companies have certainly been hit by the

crises and small artisan businesses in particular have

registered an overall decline of 2.6% in numbers.

However, employment figures have been holding up.

According to Rosario Messina there are very definite

reasons for this: ¡®at times like these family-run businesses

[which dominate the Italian furniture industry] are in a

position to tighten their belts and focus on medium-term

objectives. There are many cases in which families have

fallen back on their own reserves during a credit crunch or

a lack of liquidity and, equally, family-run businesses

offer greater flexibility in terms of choice when times are

hard. When entrepreneurs identify with their own

businesses, they are less likely to make staff cuts, tending

to view these as a last resort. This in turn avoids setting a

vicious circle of consumer uncertainty and cutbacks in

motion, which then rebounds on the businesses

themselves¡¯.

These comments might provide some crumbs of comfort

to timber importers in Italy, but it is also clear that the

benefits of the furniture sector¡¯s apparent resilience have

yet to filter through to the wood trade. Trade data suggests

that the Italian wood sector suffered more severely than

the furniture sector during the latter months of 2008. This

was due in part to widespread destocking by furniture and

joinery manufacturers in response to the uncertain

economic conditions and also to a sharp downturn in

construction sector activity. According to Federlegno

Arredo, Italian wood industry sales fell by 7.5% (an

overall total of approximately 15 billion Euros) in 2008

compared to the previous year, mainly due to a decline in

Italy¡¯s internal wood consumption which plummeted by

9.1%.

Salone del Mobile furniture show reflects market resilience

The Salone del Mobile in Milan is perhaps the most

significant furniture show in the world where a huge

number of exhibitors jostle for attention, many employing

the services of some of the world¡¯s top designers. In terms

of sheer volume of production, Italy was recently

overtaken by China as the world¡¯s largest furniture

manufacturing country. However the Italian furniture

sector generally, and the Salone show in particular,

continues to have a huge impact on furniture fashion

trends in all areas of the world.

A key part of the Italian furniture sector resilience during

the global downturn has been a heavy emphasis on design

and marketing. Underlining the determination of the

Italian furniture sector to stay on top, or perhaps a

reflection of greater desperation to generate demand

during the economic downturn, this year¡¯s Salone show

boasted a huge increase in the numbers of exhibitors

compared to last year. The show, which ended on 27

April, hosted 2,723 exhibitors (of whom 911 were non-

Italians) and covered an exhibition area of 202,350 square

meters. In 2008, there were 1,068 Italian and 230 foreign

exhibitors and the overall exhibition area stood at 152,207

square meters.

The key question doing the rounds of insiders in the runup

to the Salone show was this: ¡®How will manufacturers

and designers respond to the crisis that has the world

economy in its grip?¡¯ The show¡¯s publicists, based on their

own survey of products on display, felt that the economic

downturn had contributed to two contrasting trends in

Italian furniture design. They note that ¡®some designers

and firms have striven for greater pragmatism, a more

balanced relationship between object and cost and a

greater focus on consumer demand. Others have sought

refuge in escapism. An important element of this trend has

been to link furniture design to the world of nature¡¯.

The first approach is believed to have led to an

¡®unexpected return to minimal¡¯, scaling down the

decorative explosion of the last few years. There is greater

emphasis on timeless objects that are built to last rather

than paying lip service to passing fashions. There is an

emphasis on ¡®gracious¡¯, non-aggressive designs that can

¡®stray¡¯ from one room of the house to the next.

Many of the wood furniture items on show adhered to the

minimalist ideal. The Dutch furniture company Arco was

displaying a table manufactured 100% in wood with no

metal or other elements. The simplicity of the design

combined with use of real wood veneers and avoidance of

other potentially expensive materials meant the product

was extremely cost efficient. Another example is the Eno

chair in black oak designed by Mikko Lakkonen for Covo.

Other exemplars of the minimalist look in wood were the

Italian FEG company, the Swiss Mobimex, and the Italian

Mathias company.

There was a strong preference in these modern minimalist

designs either for very dark brown, often black woods, or

for whitened woods. Walnut was used most extensively to

achieve the darker colors. Wenge was occasionally seen,

although much more typically oak was stained to achieve

the black look. Ash was often painted for the white look.

Another common theme was to combine a minimalist

design with a more exotic finish. A simple chair or table

may be manufactured in a heavily grained even stripey

wood, or in plywood cross-cut to produce an interesting

look. A particularly good example was the Gem 743 table

designed by Gianni Astolfi and Sergio Mian for the

Mathias company in ziricote (Cordia dodecandra), a

tropical hardwood from Central America.

The second trend towards ¡®escapism¡¯ and ¡®naturalism¡¯ had

even clearer implications for the use of wood, particularly

tropical. According to the show publicists, this trend has

contributed to the strong emergence of outdoor furniture

(often with a dual ¡®outdoor/indoor¡¯ function). They note

that ¡®outdoor collections are multiplying; costlier materials

and finer designs are being employed¡¯.

It was evident from the show that while tropical wood is

benefiting to some extent from this trend, it now has to

share the outdoor furniture sector with a huge range of

other materials. Gone are the days when teak was

dominant, a reflection both of a fashion for mixed

materials and the increasing difficulties of obtaining high

quality large dimension teak. Much of the outdoor

furniture on display at the Salone show was manufactured

from plastic, steel, aluminium and fabric.

Alternative woods were also being used for exterior

furniture. The Belgian company Tribu was promoting a

new line of garden furniture made of painted acacia wood.

Schonhuber Franchi now combines teak with aluminium

and is also promoting a line of aluminium/palissandro

products. Fornasarig was displaying outdoor furniture by

Japanese designers Shinibu and Setsu in treated oak

chosen primarily for its ability to produce curvatious

designs. Gloster, while maintaining their strong loyality to

teak, were introducing a new design which combines the

tropical wood with copious quantities of soft material for a

more comfortable look.

The concepts of ¡®escapism¡¯ and ¡®nature¡¯ were also major

influences in the indoor furniture sector. While designers

were interpreting these themes in a huge variety of ways,

certain threads tended to be repeated, such as the

widespread use of natural fibers and reclaimed materials,

and of non-geometric ¡®rough¡¯, ¡®ethnic¡¯ and ¡®rural¡¯ designs.

The Italian Riva company were particularly firm adherents

to the ¡®natural¡¯ concept. Their stand was dominated by a

huge timber board 12 meters in length and 2 meters wide

carved from a New Zealand kauri tree (agathis australis).

The theme of the stand was ¡®eco-design¡¯, Riva having

brought together around 20 of the world¡¯s top furniture

designers to create unique furniture, all in real wood. The

company claims to use only sustainably managed woods ¨C

although interestingly there was no reference to any

specific sustainable forestry standard or labeling system

such as FSC or PEFC (in fact no-one seemed to be visibly

promoting either of these labels at the show). Instead, Riva

emphasizes its heavy reliance on American hardwoods.

All the products on display were manufactured in

American black walnut.

Generally, tropical timbers were not strongly featured in

the visual elements of indoor furniture displayed at the

show. The only exception was Indian rosewood (Dalbergia

latifolia) used widely in veneer form to produce a highly

exotic and glossy striped finish on more classic furniture

lines. There was a little teak favored for the darker brown

grainy look which is currently in fashion. In line with the

¡®natural¡¯ and ¡®rustic¡¯ themes, there were also a few

companies displaying furniture in reclaimed teak. Tropical

redwoods appear to be very much out of fashion in the

European furniture sector. But closer examination of some

furniture items revealed a bit of tropical wood under the

skin. For example, mahogany was occasionally being used

for frames in high quality classic furniture lines where it is

valued for its strength and stability.

¡¡

|