|

1.

CENTRAL/ WEST AFRICA

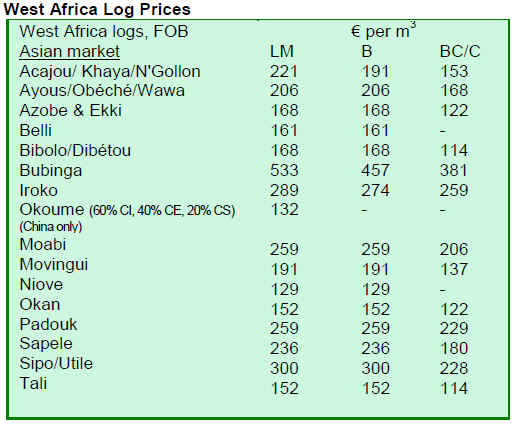

Business inactive as Europe breaks for holidays

Trade continues very subdued in West Africa, with

European buyers out of the market as the Christmas and

New Year¡¯s holiday period approaches. The European

manufacturing sector has already been hard hit by the

economic downturn. Those producing doors, door sets,

windows and roof trusses have been badly affected and

consumption of both hardwood and softwood has fallen to

very low levels. Importers and merchants say that demand

has been weak and that stock reduction continued to be the

main focus.

The impact of slow business on West African exporters

has been minimized by the curtailment in production.

However, the effects of this have now begun to cause

concern in government forestry and financial departments

as tax revenues in forest operations, production activities

and export taxes have been far lower than expected, while

unemployment in the timber sector has become a serious

problem. Producers in turn complain that taxes have been

too high given their current financial situation.

Exports of logs to the Asian region have been fairly active

for the reduced number of exporters able to offer prompt

shipments in moderate volumes.

For sawn lumber, there has been little relief in sight. Prices

for sapele and some other lumber species have fallen

marginally, though firm orders were very few and, with

low production volumes, producers were not disposed to

accept low offers. Lead times for new orders for special

sizes have said to be extended and prices for specials have

at times been above those for regular specifications.

2. GHANA

Ghana¡¯s timber exports rise by volume and value

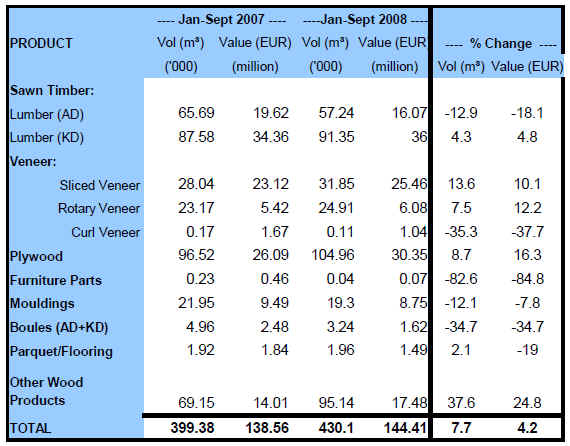

Ghana¡¯s total exports of timber and wood products for the

first nine months of 2008 increased to 430,100m³, a 7.7%

rise when compared to the same period in 2007. The

corresponding total revenue for the first three quarters also

increased 4.2% to EUR144.42 million in 2008, up from

EUR135.55 million in 2007.

The gain resulted from higher volumes recorded for sliced

veneer (13.6%), plywood (8.7%), rotary veneer (7.5%)

and kiln-dried lumber (4.3%). Decreases in volume were

recorded for furniture parts (82.6%), curl veneer (35.5%),

boules (34.7%) and air-dried lumber (12.9%) as shown in

Table 1 below:

Table 1: Ghana¡¯s Timber Export Statistics, January-September 2007-

2008 (Note: 1- lumber (AD) includes lumber overland; 2-sliced veneer

includes layons; 3- plywood includes overland)

Plywood (24.4%), kiln-dried lumber (21.2%), air-dried

lumber (13.3%), sliced veneer (7.4%) and rotary veneer

(5.8%) altogether accounted for 72.2% of the total volume

exports during the period, with twelve other products

accounting for 27.8%.

Plywood exports, including overland exports, during the

period recorded an 8.7% increase in volume over that of

the previous year to reach 104,960 m³. The corresponding

revenue was EUR30.35 million, showing a 16.3% rise in

2008 compared to the same period in 2007. The three

leading exporters were Naja David Veneer & Plywood,

John Bitar & Co. Ltd. and Asuo Bomosadu Timbers,

which contributed 70.0% of total volume exported. The

main species were ceiba, chenchen and mahogany, and the

leading importing countries were Nigeria, Burkina Faso,

Niger and Togo.

Kiln-dried lumber rose from 34,360 m³ in 2007 to 36,000

m³ in 2008 during the first three quarters registering

increases of 4.3% and 4.8% in volume and value,

respectively. Of the 96 exporters, the two leading

companies were Ayum Forest Products Ltd. (12.0%) and

Samartex Timber and Plywood (9.9%). When compared to

2007, air-dried lumber exports suffered a decline of 12.9%

in volume with a corresponding 18.1% decrease in

revenue for the period January ¨C September 2008.

Sliced veneer export rose 13.6% to record 25,460 m³ for

2008 against 23.12% registered for 2007 during the same

period. The main leading exporters were Logs and Lumber

Co. Ltd. and John Bitar Co. Ltd., which together

accounted for 49.2% of total export volume with revenues

of EUR11.2 million.

Total rotary veneer exports for the first three quarters were

EUR24,910 m³, a 7.5% gain over 2007 figures. The

corresponding revenue for the same period also rose from

EUR5.42 million in 2007 to EUR6.08 million in 2008.

Tertiary products accounted for EUR10.86 million of the

EUR144.42 million earned in 2008 as against Euro 12.27

million from the total revenue of EUR138.55 million of

wood export for the same period in 2007. Secondary

products for the January ¨C September 2008 period were

also EUR133.56 million as compared to EUR126.28

million in 2007.

Ghana¡¯s trade was notably directed to the European Union

(EU), which accounted for 45.04% and 33.25% of the total

export volume and value, respectively, for the period

under consideration. The key markets in the EU included

France, Germany, the UK, Belgium, Spain, Ireland and

Holland.

The US accounted for 9.01% and 12.66% of the total

export volume and value, respectively, in contrast to the

period compared 10.23% and 13.33% in 2007. The US

market maintained its dominance as the largest destination

market for Ghana¡¯s lumber (KD) and rotary veneer

exports.

The ECOWAS market (mainly Senegal, Nigeria, Niger,

Gambia, Mali, Benin, Burkina Faso and Togo) also

absorbed EUR30.35 million (96.54%) of Africa¡¯s

EUR31.44 million wood imports from Ghana during the

period. Plywood and lumber (air-dried) continued to

interest the Nigeria, Niger, Burkina Faso and Senegalese

markets.

The emerging markets in Asia and the Far East - India,

Malaysia, Taiwan, China, Singapore and Thailand -

altogether contributed EUR23.07 million (15.97%) to

Ghana¡¯s total of wood export value during January ¨C

September 2008. India continues to be the leading

importer of teak lumber (AD).

The Middle East countries, notably Saudi Arabia,

Lebanon, United Arab Emirates and Israel, together

represented EUR7.88 million (5.46%) of the total export

value for the period.

3.

MALAYSIA

Sarawak merchants seek favorable production trends from China

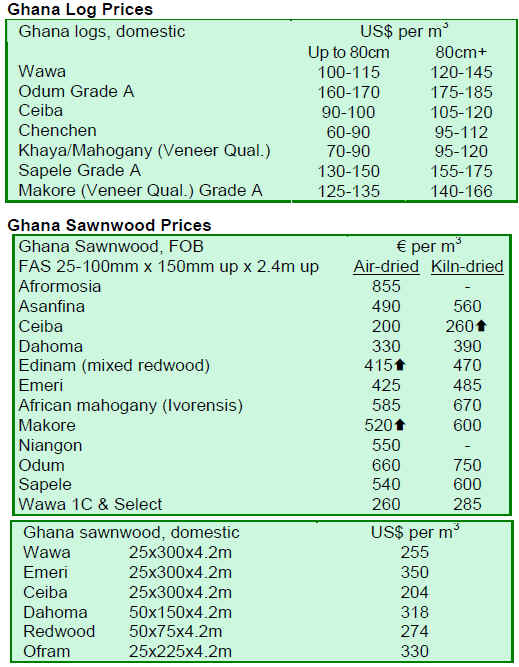

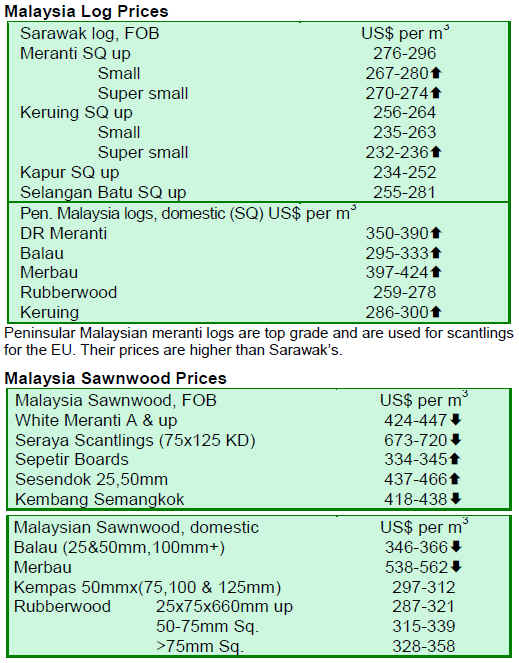

Log prices in Malaysia began to stabilize, particularly in

West Malaysia, where the year-end monsoon has caused

widespread flooding and landslides, making it difficult and

dangerous for the harvesting of logs. Timber merchants in

Sarawak are hopeful that China will increase its imports of

logs from the east Malaysian state at the end of the winter

season. Wood Resources International recently reported

that China¡¯s timber production has substantially increased

over the first seven months of 2008, although production

was expected to be down during most of the fourth quarter

of 2008. Timber merchants from Sarawak have also faced

enormous competition from New Zealand, which has

increased its export of radiata pine logs to China during

third quarter 2008, up about 58% from third quarter 2007

levels. Nevertheless, traders in Sarawak are hopeful

production trends in China will turnaround in 2009 and

offer promising opportunities.

Malaysia furniture makers take interest in Saudi Arabian markets

Furniture manufacturers continued to take interest in the

Kingdom of Saudi Arabia. According to a report by Jones

Lang LaSalle, a leading international real estate

investment and advisory firm, the Saudi Arabian real

estate market is expected to grow substantially over the

next four years. The country has had over five years of

continued economic growth, with GDP increasing on

average 15% annually since 2002.

Despite this news, sawnwood processors and wooden

furniture manufacturers were facing sharp challenges,

reported the Khaleej Times, as raw material supply

continued to tighten and the Gulf Cooperation Council

(GCC) countries¡¯ real estate and construction industries

began to slow down. Banks in the GCC, especially Dubai

and Kuwait were also tightening lending rules and policies

as crude oil prices fell below USD50 per barrel.

4.

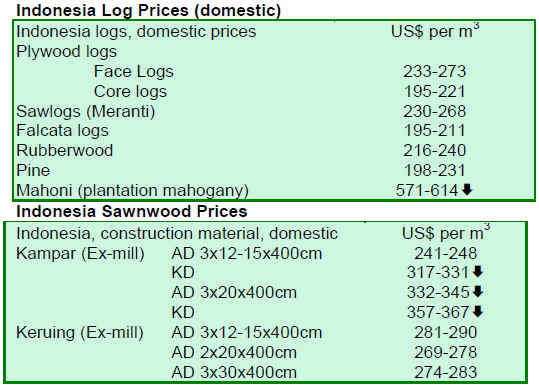

INDONESIA

Indonesia responds to US government guidelines on certification

The Indonesian government acted quickly and positively

to set up a team of officials from various ministries to

address certification of the country¡¯s timber products for

the US market, reported The Jakarta Post. The Trade

Defense Director of the Indonesian Trade Ministry, Mr.

Martua Sihombing, commented that the team will be

composed of officials from the forestry, trade, agriculture,

finance, foreign affairs, and industry ministries and

representatives from the various timber trade associations.

The team has been given the task to determine and identify

procedures and constraints outlined under the US Lacey

Act, which establishes new guidelines for certified timber

products entering the US market. By July 2009, all timber

products entering the US market must be certified by

entities approved by the US government. Indonesia¡¯s

initial position will be known by 3 February 2009.

Sustainable Forest Management (SFM), Verification of

Legal Origin (VLO) and the Chain of Custody (CoC)

process will be addressed to meet the new guidelines. An

exporter can choose to utilize any of the three certificates

when exporting to the US. Indonesian Pulp and Paper

Association (APKI) chairman, Mr. Mohammad Mansyur,

said the Indonesian pulp and paper industry was ready to

comply with the required US regulations. Indonesian

Furniture and Handicraft Association (Asmindo)

chairman, Mr. Ambar Tjahjono, added that certification

was understandably necessary for wood products to

compete successfully in the global market. Indonesia¡¯s

global exports of wood products stand at USD2.48 billion

for the first 10 month of this year, down 3.9% from

USD2.58 billion for the same period in 2007, according to

the Indonesian Central Statistics Agency.

HSBC to scale back lending for forestry schemes in Indonesian and Malaysia

Reuters and The Guardian (UK) newspaper reported that

environmental concerns have caused HSBC, a major

British banking group, to scale down lending for forestry

schemes in Indonesia. HSBC will sever ties with a third of

forestry clients in Malaysia and Indonesia, including

clients involved in palm oil, soy and timber by end 2009,

according to Mr. Francis Sullivan, the bank¡¯s advisor on

the environment. HSBC is planning to terminate 30% of

client relationships in the forest land and forest products

sector in ¡®high-risk¡¯ countries, including Malaysia and

Indonesia, due to non-compliance with HSBC¡¯s forestry

policy.

5.

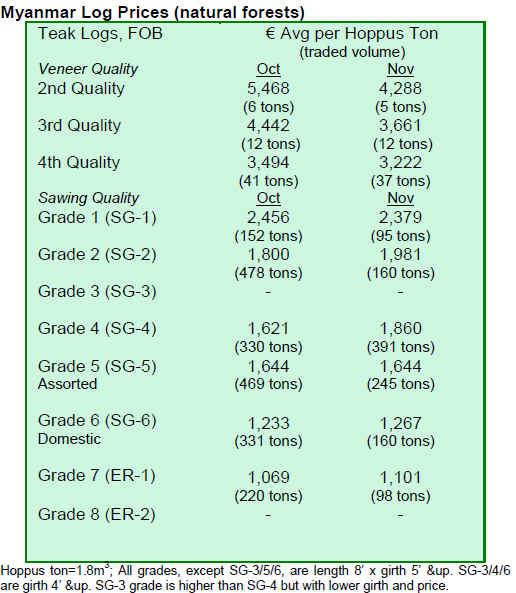

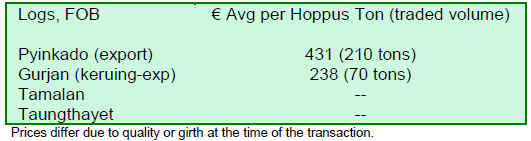

MYANMAR

Prices hold steady as orders fall

The market situation for Myanmar teak and other non-teak

hardwoods has not improved over the last fortnight. Some

Indian buyers are shipping small quantities of teak and

gurjan, but in comparison to ground stock in Yangon, the

shipments have been minimal.

As reported in a previous TTM report (TTMR 13:21),

buyers hoped that the Myanmar Timber Enterprise (MTE)

might reduce its list price. Many buyers believe that the

six month average prices and the September 2008 list

prices may have aggravated the situation. While in its 60

year history, MTE has not needed to reduce prices it has

set, this may change due to the current effect of prices on

traders. Some buyers do not expect the situation to

turnaround soon. Analysts believe that MTE may need to

rethink its pricing strategy to alleviate the plight of buyers

and stockists (both foreign and domestic).

Local sawmills in Yangon are reported to be facing

difficulties due to high raw material prices and falling

orders. Exports of sawn timber are also down. One

representative from the industry noted that even if prices

of raw materials are adjusted, it would still be difficult to

run the sawmills, as there are no new orders from abroad.

The only possible way that MTE may be able to avert

future problems is to reduce felling in the current

harvesting season, thereby reducing supply. Analysts

admitted that it was not easy to anticipate this potential

move by the MTE.

The prices below are from November¡¯s tender sales. The

December tender will be held around 22 December.

6.

BRAZIL

São Paulo promotes wood from legal sources

According to Cadmadeira/Di¨¢rioNet, the Secretariat of

Environment of the state of São Paulo recently launched

the State Registrar of Companies (CADMADEIRA)

commercializing forest products and by-products from

natural forests in São Paulo state. The registry, which was

launched in December, is voluntary, but according to the

Secretariat of Environment, only companies registered in

CADMADEIRA will be able to participate in the state

bidding process for wood supplies as of July 2009.

The Environment Secretariat has also designed a seal to

show forest products or by-products are from sustainable,

certified sources. This informs consumers about

companies that sell forest products and by-products in a

responsible manner, providing consumers with options to

buy wood from legal sources. To receive the seal, a

company should voluntarily adhere to CADMADEIRA

and will be subject to surveillance, certification and

evaluation before receiving the seal. The seal also certifies

that the company¡¯s tax situation is in conformity with

appropriate regulations and has no pending tax disputes.

The National Forum of Forest-Based Activities worked

decisively to establish CADMADEIRA. The decree that

created the organization also sets out the establishment of

a technical chamber for forestry matters to improve the

control system and promote forestry activities in the state

of São Paulo.

Wood waste shows income generation potential

During the last International Fair of the Amazon (FIAM),

the National Institute of Amazonian Research (INPA)

presented its project designed to create technologies for

the utilization of wood waste from sawmills and forest

management projects, reported Ag¨ºncia de Not¨ªcias da

Amazônia.

For example, with the technology developed at INPA,

sawmill waste, has been used in the art of marquetry,

which is a collage of different types of wood. The

technique of marquetry has been already used in the city

of Cruzeiro do Sul, in the state of Acre, where the

Yawanaw¨¢ Indians also have been manufacturing furniture

and wood handicrafts for decoration.

A researcher of INPA studied techniques of marquetry for

the manufacturing of products that are expected to bring

greater development to the region. According to INPA,

this marquetry wood work project benefits the company

that produces the artifacts, creates jobs in the region and

offers new business opportunities.

INPA studied the industrialization of lesser-known tree

species in the Amazon to implement the project and

conducted technological research on the quality of tree

species. At present, many people believe that only species

such as cedar and mahogany can be commercialized,

increasing the demand for these species, which end up

being overexploited.

The project has been supported by the Foundation for

Research Support of the State of Amazonas (FAPEAM)

and the National Funding Agency for Studies and Projects

(FINEP).

Storm affects Santa Catarina furniture industry

The furniture companies of São Bento do Sul and Rio

Negrinho municipalities, Brazil's main exporters, are

already facing difficulties meeting international delivery

deadlines after the recent flooding in Santa Catarina state.

Itaja¨ª Port, where 4% of Brazilian exports are shipped, was

closed as a result of the storm. Portal Moveleiro reported

that the storm, which hit the state at the end of November,

has caused economic problems along the entire supply

chain of timber and furniture. Santa Catarina is the leading

Brazilian exporter of furniture, with exports worth

USD378 million in 2007, or 32.8% of total Brazilian

furniture exports, according to the Federation of Industries

of Santa Catarina State (FIESC). Entrepreneurs are now

subjected to higher costs, complex logistics, renegotiation

of delivery dates with international customers, and risk

losing customers for breach of contract.

Since no furniture shipments were being made through the

Port of Itaja¨ª, product costs will be higher, as products will

need to be rerouted through the ports of São Francisco do

Sul (SC) and Paranagu¨¢ (PR). The costs of shipping

through these ports are now twice as high as shipping

through Itaja¨ª. Customers have not been accepting

renegotiation of contracts because they believe it is the

state¡¯s problem.

According to the Secretary of the Ministry of Foreign

Trade and Development (MDIC), Brazil's exports dropped

USD370 million by value in November 2008 because of

the severe damage at the Port of Itaja¨ª. For the Union of

Construction and Furniture Industries of São Bento do Sul

(Sindusmobil), logistical problems will add costs at year

end, since prices of contracts are already fixed. There are

no new contract negotiations scheduled for the moment.

Economic losses for the furniture industry in Santa

Catarina state is expected to be severe.

Africa may be potential market for Brazilian wood products

The Brazilian timber industry is actively seeking

alternatives to traditional North American and European

markets. According to the Brazilian Association of

Mechanically-Processed Timber Industry (ABIMCI),

economic growth of some African countries with growth

rates above 10% a year and countries with demand for

civil construction products such as South Africa, Angola,

Morocco and Egypt may represent potential markets for

the Brazilian solid wood industry.

Despite the small per capita consumption of these

countries, the population of the region is large and

economic growth has been accelerating, with their imports

above the world average. It is estimated that imports of

forest products by African countries may grow in the

coming years at rates higher than 8% a year. Imports of

wood products from Brazil by African countries are

diverse and focus on plywood, coniferous sawnwood,

wood panels and value-added products such as furniture.

Several African countries are both producers and exporters

of tropical timber, but do not produce much value-added

products; the majority of exports are logs and sawnwood.

In addition to obtaining a specialized market for furniture

products, another advantage in exporting to these countries

is the fact that there are no limitations with regard to nontariff

barriers.

Besides Africa, other developing countries represent

market alternatives for Brazilian companies. These include

markets in China, India, Taiwan and Vietnam, the United

Arab Emirates, Qatar and Saudi Arabia. In many of these

emerging countries, Brazil is already present, but there are

still opportunities to be explored.

7.

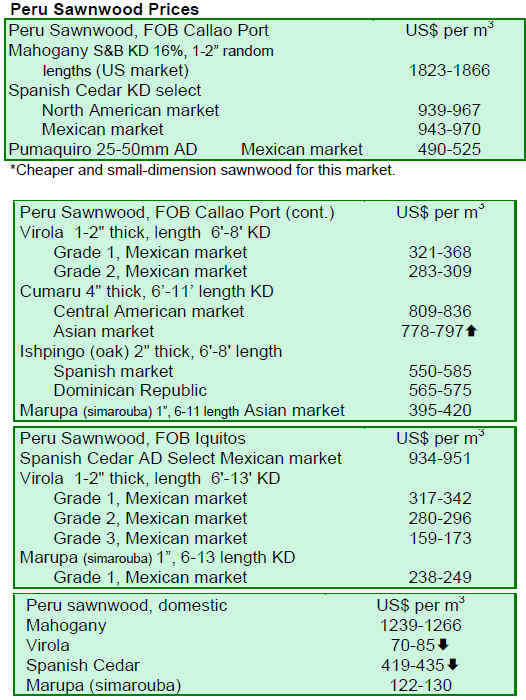

PERU

Peru¡¯s Environment Minister to raise funds for forest conservation

Peru¡¯s Minister of Environment, Antonio Brack, has

begun a journey to various European countries to raise

funds for environmental conservation. According to

Brack, Germany has already contributed EUR4 million to

the Ministry of Environment in Peru for rainforest

conservation. Some European countries have also

expressed interest in collaborating with Peru on

environmental conservation, he said. He added that he

would seek funds from countries in Asia, saying that he

had already established partnerships in Japan to conserve

and develop forests.

Brack explained that Peru, through the Ministry of

Environment, was making an international proposal to

preserve 54 million hectares of tropical forests. He noted

that the proposal would include protected Indian lands and

that carbon credits generated from this land would be sold

in the international carbon market. This way, he noted,

deforestation would not take place and biodiversity and

Indian culture would be preserved.

Peru has a number of projects addressing carbon

offsetting, which could be offered to different countries.

Minister Brack noted that Peru could collect over

USD5,800 million in the next few years if the 106

businesses carrying out environment projects with carbon

benefits are completed successfully.

Wood exports grow 9.6% in first three quarters of 2008

Wood exports from January to October 2008 were

USD194.20 million, up from USD177.25 million during

the same period in 2007. While this represents a 9.6%

growth in the value of exports, the growth has slowed in

2008 when compared to previous years, since exports to

main destination markets (Mexico, US and China) have

fallen. For instance, the total value of exports has dropped

in the Loreto region due to the lower imports from

Mexico.

From January to October 2008, exports were concentrated

in three main markets representing 84% of total exports of

the wood sector. Mexico represented 36% of these

exports, while China represented 28% and the US 20%. Of

total exports, sawnwood was the highest exported product.

Emerging markets for Peru¡¯s products were the Dominican

Republic, Italy and Hong Kong.

8. BOLIVIA

9. MEXICO

Mexico and Italy agree on bioenergy projects

The National Forest Agency (CONAFOR) and the

Ministry of Environment and Territory of Italy are

working together to reduce greenhouse gases and mitigate

climate change by generating bioenergy while preventing

forest degradation. The two countries signed a

Memorandum of Understanding in November 2008, and

Mexico has already started a national energy progamme,

which includes a programme to save firewood and reduce

the incidence of respiratory disease. In 2008, 185 million

Mexican pesos will be invested for the installation of

120,000 stoves in the country. Another component of the

program will promote commercial forest plantations for

the generation of biogas and bioethanol. Mexico and Italy

will promote technical and scientific cooperation for the

prevention of forest degradation and sustainable forestry

and exchange experiences on bioenergy generation to

promote sustainable development.

10.

GUYANA

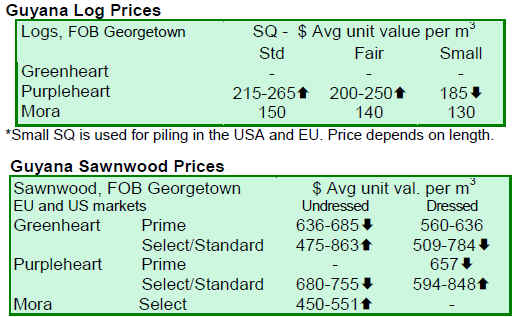

Guyana¡¯s value added products continue record

growth

A year-to-date analysis of the volume and value of

shingles exported when compared to the same period of

2007 revealed gains of 16% by volume and an overall rise

of 57% by value. This robust growth by value is mainly

attributable to the higher price paid for shingles in the

Latin American/Caribbean markets and larger demand for

Guyana¡¯s shingles. Volumes of exports to these regions

have increased by 5.6% and 40% by value over the first 11

months of 2007. The average price received for shingles in

the Latin American/Caribbean market was 33% higher

than in other markets. Other main markets for Guyana¡¯s

shingles were in the African region, which has also shown

rises in the volume and value of shingle imports over 2007

levels. Prices of shingles to the region on average

increased 10% over prices in 2007. Despite lower volumes

of shingle exports to the North American market in 2008,

the value of these products were 12% greater than in 2007

and average prices jumped 69%.

In another added value product class, exports of kabukalli

doors showed marked improvements for the period

January to November 2008 by both volume and value

when compared to the same period of 2007. Increases of

30% by volume and 38% by value were recorded over the

review period. This was closely followed by

improvements in exports of locust doors, with gains of

65% by volume.

The highest volume of shingles exports has been seen over

the past fortnight, when compared to all other periods this

year. As projected in the last fortnight, log exports

continued to rise by both volume and value. Prices for logs

recorded average increases of 35% over the previous

fortnight¡¯s average. Sawnwood exports were also higher

over the last fortnight, 85% by volume and 80% by value.

The smaller improvement in value can be attributed to the

larger export volumes of less popular and commercial

timber species.

Guyana launches avoided deforestation model

On 5 December 2008, the Government of Guyana

launched a technical report, which will form the basis of

international support on avoided deforestation and for

climate change mitigation and adaptation. The document

recognizes the economic impact of deforestation across the

globe and uses a model to estimate economic losses from

deforestation to Guyana and the world. The report

concludes that while Guyana may benefit from short-term

gains from quick harvesting of its forest resources, a more

appropriate long-term strategy to align national and global

interests is necessary.

The President of Guyana, when presenting the model, said

funds generated from the market-based model on avoided

deforestation could help Guyana shift to using clean

energy technologies, which would supply low-carbon

electricity to the country. The President noted that targeted

funds could also provide an unprecedented amount of

assistance to forest communities and develop the economy

by expanding eco-tourism and other schemes and support

diversification of the economy. Other benefits identified

for Guyana under such an incentive scheme include

investing heavily in public development and upgrading the

sea defence and irrigation systems along coastal areas.

GFC and USAID host forum on US Lacey Act

The Guyana Forestry Commission and USAID Guyana

hosted a forum on the US Lacey Act on 11 December

2008. The forum was attended by stakeholders, including

both primary and added value producers, and exporters,

many of whom export to the United States.

At the meeting, representatives from the US Forest Service

presented the background and context of the recently

amended Lacey Act, the changes and new requirements

which are contained in the legislation, an outline of the

products that will be affected, the handling of violations

and upcoming developments regarding the implementation

of the Act. Several key areas within these general

discussion points were examined, including exclusions and

exemptions under the Act.

Several recommendations were made at the forum,

including: having access to a check list of requirements to

comply with the new provisions; the need for a core set of

documentation required for these provisions; and the

recognition of national level legislation in determining

legality of forest products harvested and traded. Guyana,

through the GFC, has identified trade relations with

international partners as a priority area for 2009, with

emphasis being given to the requirements of key markets,

including the US and EU markets.

At the forum, Guyana also discussed a legal verification

system it has developed. The system is expected to be

implemented in 2009.

|