|

Report

from Europe

and the UK

Putin postpones 80% log export duty by 9-12 months

According to the Associated Press, Russian President

Vladimir Putin has agreed to postpone implementation of

the Russian export duty of 80% on roundwood logs. The

announcement, which was made during a meeting with

Finnish Prime Minister Matti Vanhanen, indicated that the

rise in duty would be postponed for a nine to 12 month

period. The heightened duty was expected to jump from

25% to 80% at the start of January 2009, but will remain

set at 25% until further information is released. Japan

Lumber Reports has noted that even though the duty will

be maintained at 25%, it is still high enough to induce a

shift in the Japanese plywood and lumber industry to new

sources of raw materials or shut down since costs are still

too high and prices are not expected to drop in the near

future.

Economic data show deteriorating market conditions

Overall economic conditions in the EU have continued to

deteriorate. According to figures published on 14

November, which showed that the euro-area economy

shrank in the third quarter following a similar decline in

the three months to June, the region is now technically in

recession. This is the first time that GDP growth across the

area has fallen in successive quarters since the euro was

launched in 1999. Overall GDP in the euro-area has grown

by 0.7% this year, with all the growth concentrated in the

third quarter. Germany and Spain have performed slightly

better than the euro-area average; France has done a little

worse. Italy stands out as the worst performer ¨C its GDP is

down 0.9% on a year ago. Meanwhile unemployment has

jumped in Spain and Ireland, the two countries hardest hit

by the property bust and scarcity of mortgage credit. On

this measure Germany has performed reasonably well,

unemployment in the country having actually fallen

slightly this year.

In fact, of all the large European economies, Germany

now seems best placed to weather the storm. Compared to

companies in European countries, those in Germany are

relatively cash rich, less dependent on the banks and under

less pressure to prune budgets. And Germany¡¯s public

finances are in reasonable shape, the national budget was

close to balance last year, so the government has more

scope to boost growth through increased public spending

or tax reductions.

Meanwhile the UK economy is in a slump. A decline of

0.5% in the UK¡¯s GDP in the third quarter compared with

the second was a lot sharper than expected. And business

surveys are indicating that the final quarter of 2008 has got

off to a poor start. Manufacturing conditions in October

2008 stayed close to the previous month¡¯s record low, and

activity in construction and services plumbed new depths,

according to this week¡¯s purchasing managers¡¯ reports.

Together, these findings suggest that the decline in GDP in

the fourth quarter will be at least as steep as in the third. In

an effort to boost demand, on 6 November the UK¡¯s

central bank slashed the base interest rate by one-and-ahalf

percentage points, bringing it down from 4.5% to 3%,

the lowest since early 1955.

Little forward buying in the Benelux countries

The gloomy economic picture has had a profound impact

on the hardwood market. Agents supplying the large

importers in the Benelux countries report that there is very

little forward buying. Some importers are still carrying

excess landed stocks of key joinery species including

sapele and meranti. Only a few forward orders mainly for

higher quality items are trickling in from those buyers

concerned about the very long lead times. In the face of

slow demand, shippers have been winding down their

stocks now for some time, so availability of many items

for prompt shipment is now negligible. A representative of

one trading company dealing in a wide range of tropical

hardwoods noted that ¡®the supply pipeline is empty, we are

not overstocked at all. If you place forward orders for

African products today the lead time is 6 months¡¯.

UK market closes early for Christmas

In the UK, the weakness of sterling combined with

particularly gloomy economic data has meant that forward

buying has been particularly weak. One UK based agent

involved in the trade for 40 years comments ¡®I have seen

four recessions during this period, in the early 70s, 80s,

90s and now this one. But I¡¯ve never known a change as

rapid as this. We were having a good year until the end of

September, but everything stopped in the first week of

October when the banking crises came to a head. The

following week, sales briefly recovered to around 50% of

their earlier levels, but we¡¯ve seen a progressive decline

since then. Now the UK hardwood trade, at least with

respect to forward sales, has essentially shut down for

Christmas, the earliest shutdown I have ever known¡¯.

It will be little consolation to tropical suppliers that this

agent, when asked if any ¡®hardwood¡¯ products were selling

well in the UK at present, replied ¡®yes, Siberian larch!¡¯

While not technically a hardwood, Siberian Larch grows

so slowly in northern Russia that it produces an extremely

durable and hard timber. Siberian larch has become very

popular in the UK public sector, initially for cladding

where it competes directly with Western Red Cedar from

North America. But as architects have become more

familiar with the species, they have begun using it for a

wider range of joinery applications, such as flooring,

where it competes more directly with tropical hardwood.

A key advantage of the species for UK public sector

buyers is that it is readily available FSC certified. This

anecdote highlights both the increasing importance in the

UK of public sector buyers at a time when private sector

construction activity has shrunk and the rising significance

of forest certification to buyers in this sector.

In the UK, importers are still carrying heavy stocks in

standard commercial items. One large importer is reported

to be off-loading sapele and white oak ¨C the two most

popular hardwood species in the UK ¡ª at well below

replacement cost in order to generate cash flow. Other

importers have generally not joined in the fire sale, but

under such circumstances, there is very little interest in

forward buying.

UK market conditions for manufactured tropical hardwood

products seem little better. One contact that formerly sold

large volumes of tropical hardwood garden furniture from

the Far East to large UK high street retailers reports that he

has gone into receivership this month. ¡®Many retailers are

still sitting on large stocks of garden furniture from last

summer, sales having been hit hard by the appalling

summer. So absolutely nobody is buying for next season.

The market has collapsed. Problems have mounted for

shippers who until only three months ago were trying to

push through significant price rises in order to

accommodate rapid increases in costs, including rising

labor rates in China, high raw material and energy costs. I

was in China in the summer and large numbers of garden

furniture factories were on their knees back then. With few

sales coming through in the last three months and no

willingness on the part of buyers to accept price increases,

problems must have intensified since then¡¯.

The UK joinery manufacturing sector, traditionally a

significant user of tropical hardwood products, seems to be

fairing no better. Richard Lambert, the Chief Executive of

the British Woodworking Federation (BWF) suggests in a

recent TTJ article that there may be more joinery sector

redundancies and company closures in coming months

following the closure of the main site of the STP Group,

one of the largest UK door manufacturers. Lambert went

on to say: ¡®we¡¯ve had a steady flow of requests for advice

on redundancies, lay-offs and short time working over the

past couple of months¡¯ and noted that times were

particularly tough for those companies linked to the

residential construction sector.

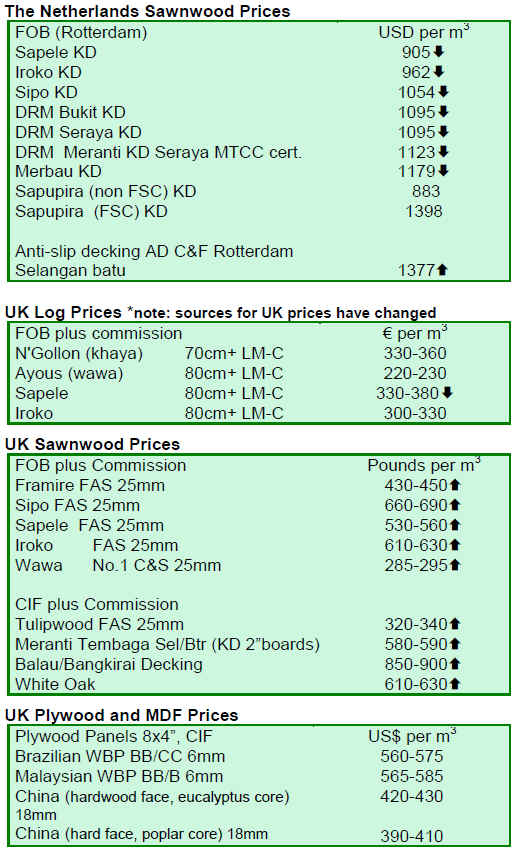

Cautionary note regarding indicative prices

Due to very low levels of trade over the last few weeks, it

has become increasingly difficult to collect indicative

prices for hardwood products traded in the EU. Shippers

are generally reducing forward prices across the board for

standard items, but since the vast majority of European

customers are currently very unwilling to buy forward at

any price, there is little or no price formation.

¡¡

|