|

1.

CENTRAL/ WEST AFRICA

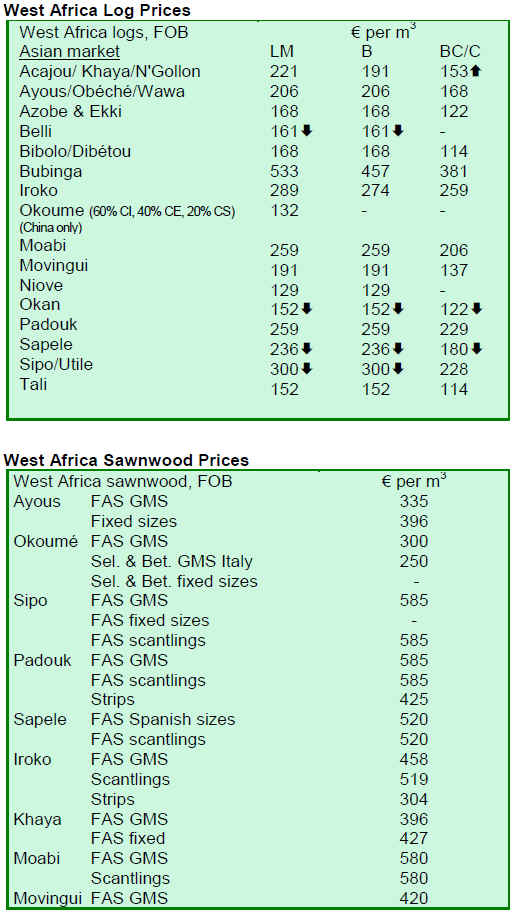

Trade sluggish in West Africa as European market

quietens

The overall market situation has changed very little, with

trade sluggish and European buyers mostly out of the

market for the time being. There were very few small price

increases and a weakness for less favored timbers.

Sapele prices have not recovered and European buyers

have said it has been very difficult to determine current

prices for imports or for whatever landed stocks are still

available. As reported mid-month, production in West

Africa was low and there were no signs of major

producers re-starting any shut down logging or processing

activities.

Producers and exporters in the Asian region have been

holding their prices steady and have not made any real

price concessions. This has helped West African exporters

reaffirm the position that cutting prices will not stimulate

increased buying from importers who are concentrating on

downsizing their activities to match the much reduced

consumer demand.

2. GHANA

Plantation Fund Management Committee inaugurated

The Forestry Commission (FC) and the Ghana Timber

Millers Organization (GTMO) have launched a sevenmember

Plantation Fund Management Committee to

generate funds for the development and finance of forest

plantations. The Committee will be responsible for

establishing its own rules of procedure, on-going forest

plantation development initiatives and ensuring plantation

forests are sustainability managed.

The Committee will be chaired by Mr. Samuel Afari-

Darty, with Msrs. Matthew Ababio, Alhassan Attah,

Robert Nyarko, Ernest Apraku, Kwaku Sampeney and

Kwaku Awauh Agyeman as members. The Committee

was inaugurated during a ceremony opened by the

Minister for Lands, Forestry and Mines, Mrs. Esther

Obeng-Dapaah, who said the Committee had become

necessary as a result of the recent high demand for

plantation timber and the increasing need for raw materials

to sustain the timber industry.

At the ceremony, it was recalled that in September 2001,

President J. A. Kufuor launched the National Forestry

Plantation Development Programme, which aimed to

establish 20,000 hectares of industrial forest plantations

annually.

WITC develops sawdust powered smoke dryer

The Wood Industries Training Center (WITC) of the

Timber Industry Development Division (TIDD) in Kumasi

has developed a smoke dryer facility that uses sawdust

instead of electricity to dry wood products. The facility is

suitable for small and medium scale enterprises (SMEs)

and marketed as affordable and easy to use. It was recently

showcased at the Ghana International Furniture and

Woodworking Industry Exhibition (GIFEX) 2008 in Accra

and is intended to reduce the costs of SMEs in a nonpolluting

and user friendly manner.

The WITC is known for its technical training activities in

the wood industry, with a primary focus on capacity

building, human resource development and institutional

strengthening. Specifically focused on supporting services

involved in downstream wood processing, the WITC has

earned a reputation over the last 12 years of being a center

of excellence for training and consultancy in the timber

industry as well as other timber-related sectors. The

Public Relations Officer of the WITC, Mr. George

Zowonu, hinted that the Center would soon change its

name to the Timber Technology Center.

In other developments, the Forest Research Institute of

Ghana (FORIG) has made significant breakthroughs in

processing coconut and palm tree waste into usable wood

for the manufacturing of various products such as tables,

chairs, cupboards and beds, a research scientist at the

Institute noted during the GIFEX 2008.

3.

MALAYSIA

SFC focuses on plantation timber projects

The Star reported that The Sarawak Forestry Corporation

(SFC) is increasing production of genetically improved

seeds to meet the heightened demand for plantation timber

products in Sarawak. Mr. Len Talif Salleh, SFC Managing

Director, indicated that the state government set a target to

establish one million hectares of planted forests by the

year 2020. Plantation forests have been seen as an

alternative and sustainable source of timber that will

relieve pressure on natural forests.

Mangroves to expand under Ninth Malaysia Plan

Bernama reported on developments geared to expand the

range of mangrove forests in Sarawak. Mangrove forests

are reported to play an important role in Sarawak¡¯s

economy and occupy 60% of 740 km coastline along the

shores and estuaries of Kuching, Sri Aman and Limbang.

The Sarawak Timber Industry Development Corporation

(STIDC) has also indicated that more than 2,000 hectares

have been identified under the Ninth Malaysia Plan as

areas where mangrove and other suitable tree species will

be planted. Tree planting awareness programmes are also

expected to be conducted under the Plan. Since 2006, over

300,000 mangrove trees of various species have been

planted in Malaysia.

EU extends EUR8 million in project finance to Malaysia

According to Business Times, the EU is providing

Malaysia nearly EUR8 million in project finance for

agriculture, environment and human capital development

in 2009. In addition, the EU is working with the European

Investment Bank to allocate another EUR1 billion for

projects in Asia. Mr. Vincent Piket, the EU Ambassador to

Malaysia, recently commented that the finance could be

linked to Malaysia¡¯s five economic corridors or could

focus on other priority sectors.

Additionally, he said the negotiation of the Forest Law

Enforcement Governance and Trade (FLEGT) Voluntary

Partnership Agreement between Malaysia and the EU was

expected to be concluded by March 2009. It is expected

that, after the signing of the VPA, Malaysia would be

given ¡®preferential access¡¯ to the EU market.

4.

INDONESIA

Significant layoffs affect Indonesia¡¯s timber sector

The Jakarta Post indicated that Riau Andalan Pulp and

Paper (Riaupulp) would be dismissing around half of its

total workforce, around 2,000 workers, in an effort to avert

financial disaster in the midst of the sector¡¯s raw material

shortage. Riaupulp Director Rudi Fajar said that the

shortage of raw materials for the pulp and paper industry

had been an issue for the past two years and were

inadequate to meet production needs. He noted that this

had been exacerbated by the current economic crisis. He

indicated that other cost saving measures had been taken,

including the reduction of fuel and electricity use, but

none had been effective in staving off the crisis. Rudi said

that only about half of normal production levels (3,000

tons v. 6,000 tons) had been sustained on a daily basis. He

expressed hoped that the government would reduce some

of the bureaucratic red tape on licensing procedures and

clarify the definition of illegal logging to help resolve the

raw material crisis.

West Sumatra regencies to benefit from sales of carbon credits

In cooperation with the Australian-based Carbon Strategic

Global (CSG), ten regencies of West Sumatra will be

compensated from the sale of their carbon credits. The

credits were generated by regencies that owned oxygenproducing,

protected forests. The plan will cover 865,560

hectares and one city in the Western Sumatran province.

The proposal was generated after CSG offered

compensation worth around USD750 million from sales of

the carbon offsets generated by the forest-owning regions

to emissions producing countries.

5.

MYANMAR

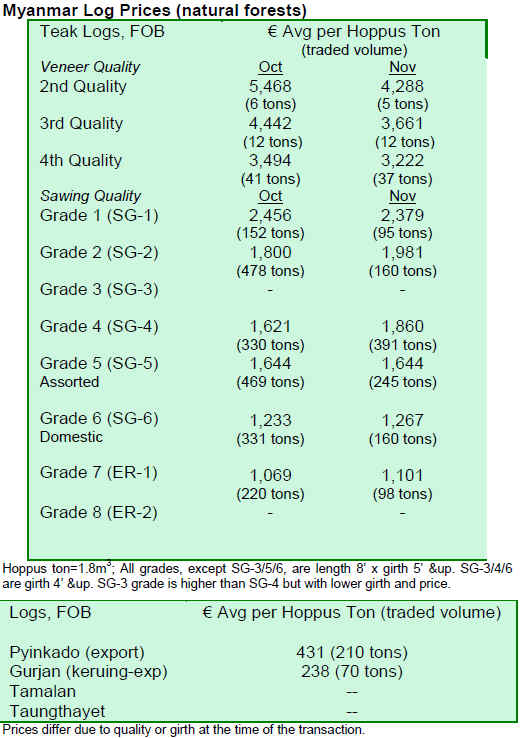

MTE slashes quantity of teak logs for sale

The Myanmar Timber Enterprise (MTE) has reduced the

quantity of logs in its November tender sales. The total

quantity of teak logs was 1,274 tons, compared to the

2,506 tons sold in August 2008, 2,525 tons in September

2008 and 2,041 tons in October 2008. This means the

MTE offered only about 50% of the amount sold in each

of the months of August and September. Nevertheless,

selling a smaller quantity of logs was helpful to maintain

the previous months¡¯ price levels. Additionally, the teak

logs sold this month were from prime source areas and

some major buyers supported reducing the amount of logs

sold to stabilize prices, particularly for sawing grades.

6.

BRAZIL

Uncertainty clouds 2009 outlook for furniture industry

According to Revista Amanhã, The Brazilian Association

of Furniture Companies (ABIMOVEL) has forecast a

difficult scenario for the first semester of 2009 as prices

are expected to fall. However, in the second half of the

year, a recovery is foreseen.

Despite ABIMOVEL¡¯s optimistic outlook, other

associations predict a more pessimistic scenario for the

furniture industry, with increasing input costs reducing the

profit margins of exporters. Unlike the prediction of

ABIMOVEL, the overall picture that Bento Gonçalves

Association of Furniture Companies (Sindmoveis)

foresees for 2009 is not promising. According to

Sindmoveis, growth for the furniture industry may be zero

in 2009. For the next year, the Association suggests that

companies should remain cautious about their budgets and

planning.

Controlling expenditures has been the major challenge for

the furniture industry. However, it is important that

companies invest in business management and personnel

training to sustain their businesses. In order to minimize

the effects of the global crisis, the Brazilian government

has already promised to help the sector by increasing

available credit lines. Sindmoveis believes that the dire

situation faced by the industry can be reversed with the

increase in public spending.

Timber companies face delays in securing transport

permits

According to S¨® Not¨ªcias, timber companies in the state of

Mato Grosso will initiate a lawsuit against the state

government if no action is taken in the short-term to end

the delay in issuing timber transportation permits.

Companies that are forced to delay the delivery of

products to customers in various states, and consequently

payment for services, have been seriously impacted.

Timber sales, including exports, have been harmed

because of problems in the Forest Products Trade and

Transportation System (Sisflora), an online service linked

to CCSEMA (the Registry of Forest Products Consumers)

that assists and monitors timber trade and transportation.

The delay in the issuance of such transport documents

slows down the sales and timber deliveries to customers.

The damage to date has not yet been estimated, but it is

significant.

The transport issuance process involves two institutes,

SEMA (the State Secretary of Environment) and INDEA

(the Mato Grosso Agriculture and Livestock Defense

Institute). If SEMA and INDEA fail to comply with

established procedures, timber transportation stops. The

delay in the issuance process has been generally due to the

insufficient number of public servants and the small

institutional structures. If the problems are not solved after

the expected intervention, the timber sector may initiate

lawsuits to obtain compensation for the damage caused by

the delays.

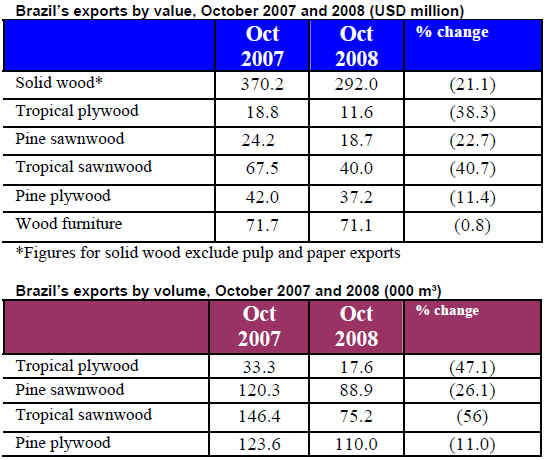

Brazil¡¯s October 2008 exports slip further

Brazil¡¯s wood products exports (except pulp and paper)

dropped further from September 2008 levels. Exports fell

21% from USD370.2 million in October 2007 to USD292

million in October 2008. The charts below show the

volume and value of Brazil¡¯s exports for October 2008

compared to the same month a year earlier:

Furniture producers eye Middle East markets

A group of 36 major furniture manufacturers in Brazil will

exhibit their products at the Index Dubai 2008 trade show

in late November 2008, reported Empreenadedor UOL.

This is the largest furniture fair in the Middle East and one

of the major furniture exhibitions in the world. The goal of

the event will enable businesses and traders to look for

new opportunities and open new markets for Brazilian

furniture. The Brazilian participation was spurred by a

project developed by the Brazilian Association of

Furniture Companies (ABIMÓVEL) in partnership with

the Brazilian Trade and Investment Promotion Agency

(APEX-Brazil).

The event will host the largest amount of the Brazilian

furniture industry participants to date. According to

ABIMÓVEL, the market for Brazilian furniture is growing

every year. It will be an opportunity to diversify target

markets for Brazilian exports and reduce its dependence

on the US market, which may continue to reduce its

imports of Brazilian furniture in the future.

Even with the housing crisis in the US, it is still the largest

single importer of Brazilian furniture. With the

depreciation of the Brazilian currency since September

2008, the furniture industry has revised its export growth

projections from 5% to 2.5% in 2008 compared to 2007,

when exports reached USD 1.1 billion.

Solidwood exports face worsening prospects

Gazeta Marcantil/Celulose Online reported that the

solidwood industry in Brazil is being crippled by the

impact of the United States housing crisis since early this

year. Official statistics indicate that exports of solidwood

products may show their worst result since 2004. The

outlook for 2009 is not optimistic because some mills have

been already closed or industrial production of some

companies has decreased dramatically.

The shrinkage of US imports has occurred since 2006. The

US share in Brazilian solidwood products exports, which

reached 42% in 2006, decreased to 30% in 2007, and in

2008 is expected to fall to 24%. In 2009, a further market

adjustment will likely occur. Many companies may phase

out their production, but capitalized mills investing in new

technology are expected to grow.

According to the Brazilian Silviculture Society (SBS), log

production from planted forests in Brazil was 156 million

m³ in 2007, and 50 million m³ from natural forests. The

total revenue of the forest sector, including charcoal and

pulp, was USD37 billion, out of which USD8 billion was

from exports. Log production was expected to be repeated

in 2008 and there was no clear forecast for 2009.

The difficulties in exporting faced by the forest sector

have been observed at least for three years due to the sharp

depreciation of the US currency. To some extent, the

domestic sales to the civil construction industry have

helped counterbalance shrinking exports.

7.

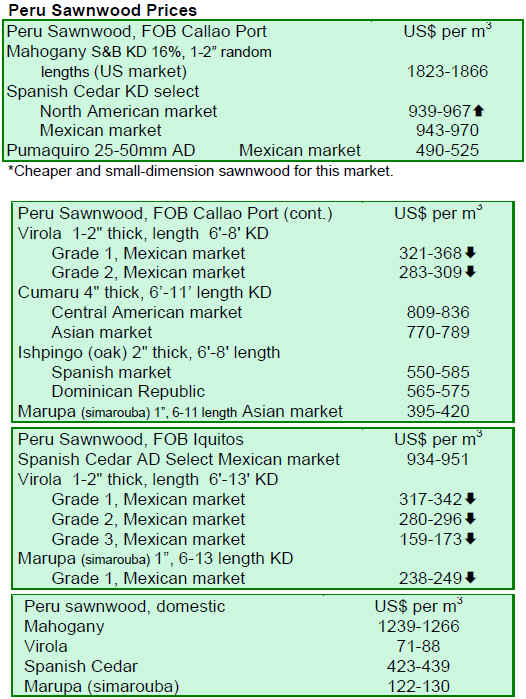

PERU

Regional authorities urge Congress to reject forest law

The authorities of Loreto, Ucayali and Amazona rejected

the current version of Decree 1090, new legislation which

addresses forests, and asked Congress to delay passing the

law in order to amend it. They argued that the law does not

protect forested areas or assist with decentralization

efforts. The Regional President of Loreto noted that the

law should be revised to take into consideration human

rights or it will fail. Speaking to participants at the

National University of the Peruvian Amazon in Iquitos, he

said that the law must be delayed to propose a new

alternative law to reflect the ¡®real position of society¡¯.

Forest management to be decentralized to the regions

Media reports indicate that the Ministry of Agriculture

will decentralize Peru¡¯s forest management beginning

December 2008. Minister Carlos Leyton said the first

regional government to participate in the transfer of

authority would be San Martin, since it already has in

place the instruments to guarantee sound forest

management at the regional level. He noted that San

Martin was ready to assume authority for forest

management since the regional government already had a

forest plan and an ecological and economic zoning plan in

place, which allow the government to determine the exact

amount of forest concessions to be given. Other regions

being considered for the new decentralization scheme

include Loreto, Ucayali, Amazonas and Madre de Dios,

depending on existing conditions and legal instruments

existing in the region to provide management oversight.

The responsibility for forest management currently is

under the authority of the National Institute of Natural

Resources (INRENA).

APEC highlights importance of small and medium

industries

More than 2,000 participants from the Latin American

region and 21 Heads of State successfully concluded the

meeting of the Asia Pacific Economic Cooperation

(APEC). Issues such as the global financial crisis and the

role of women and youth in economics were addressed in

this year¡¯s conference. Additionally, one of the key items

on the agenda addressed small and medium industry issues

(PYMES) under the APEC Business Council, and a CEO

Summit was also convened.

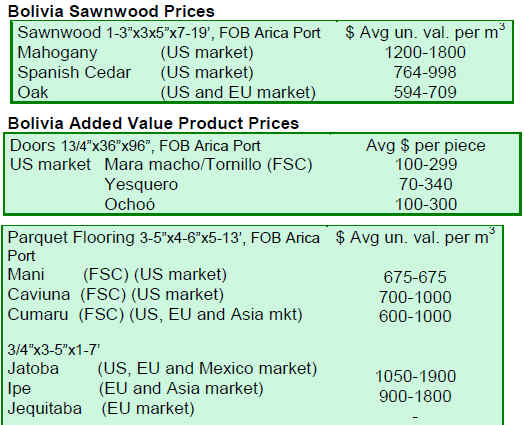

8. BOLIVIA

9. MEXICO

Mexico takes lead in community forest development

World Bank representative Robert Davis recently helped

launch the third stage of the Community Forestry Project

(PROCYMAF II). The project, he said, would reach out to

nearly 500 communities in Mexico covering around 3

million hectares of forests, with nearly 1 million of

certified forests included in this area. Mario Aguilar

Hernandez, the Manager of Community Forestry for the

National Forest Agency, said his institution through

PROCYMAF and ProTree, would further address

community forest work to reach nearly 80% of all forest

communities in the country. Since over 80% of the forest

area in Mexico is the property of communities and forest

common rural communities, the situation presents a

challenge for the sustainable development and

conservation of Mexico¡¯s natural resources.

10.

GUYANA

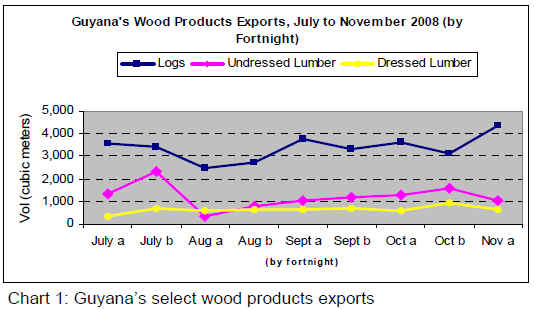

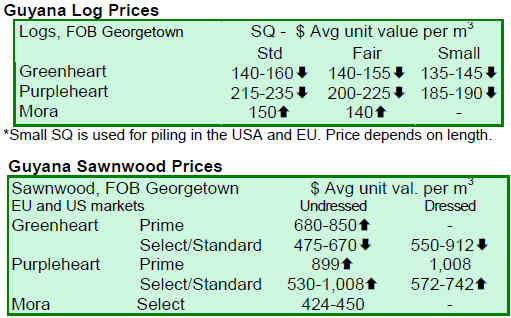

Guyana¡¯s timber products exports show rising trend

for logs

As the year-end approaches, there has been an increase in

both domestic and export prices for most products until

November 2008. Specifically, log prices have increased

for prime commercial species as well as lesser used

species.

Log prices jumped 11.5% over the average for 2007, while

sawnwood prices rose 8%, with the higher increase seen in

dressed sawnwood (11%) in 2008. The higher prices for

dressed sawn lumber drove up supply, and exporters in

Guyana have responded positively to this favorable market

condition.

Roundwood (piles, posts and poles) prices have shown the

greatest rise of all products exported over the ten month

period, with a 13% increase over average prices in 2007.

This was closely followed by plywood, which showed a

12.4% increase for the period.

With the impending log export policy that will take effect

on 1 January 2009, a spike in log exports has been seen in

this fortnight. It is expected that exports will continue for

the rest of 2008. Additionally, as the sawnwood market

remains resilient for Guyana¡¯s dressed and undressed

products, there is an indication that this will result in even

higher sawnwood exports both by value and volume in

2009.

The figure below illustrates the trend in export volumes of

the top revenue earning products (logs and lumber) for the

past four and a half months:

Guyana works with Canada on saw doctoring project

Guyana has collaborated with the Canadian Cooperation

Fund (CCF) in the implementation of a project aimed to

address the level of efficiency and quality of forest

products in Guyana. With the increasing call for higher

quality products in the international market, there has been

added emphasis on raising the level of efficiency of

processing in Guyana. Conversion efficiency for the subsector,

a key area that requires improvement, is being

specifically addressed under this project.

The project is being implemented in three phases with the

initial assessment having been completed on 21 November

2008. The recommendations from the assessment report

will inform the execution of the other phases of the

project, which involve providing training to the sector on

saw doctoring at the individual and regional levels. The

project is set to be completed by May 2009 with enhanced

saw doctoring skills developed by the sawmilling industry,

higher recovery rates at sawmills, and a higher quality

finished products being exported for export.

|