|

1.

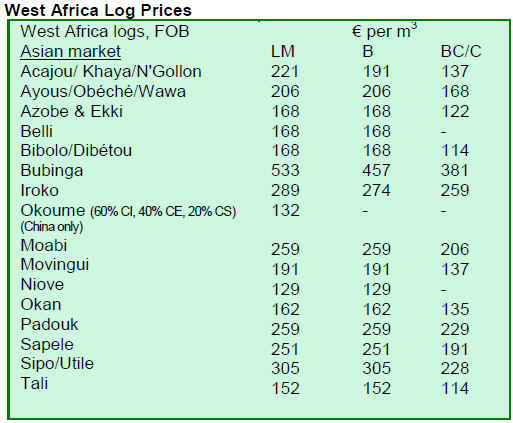

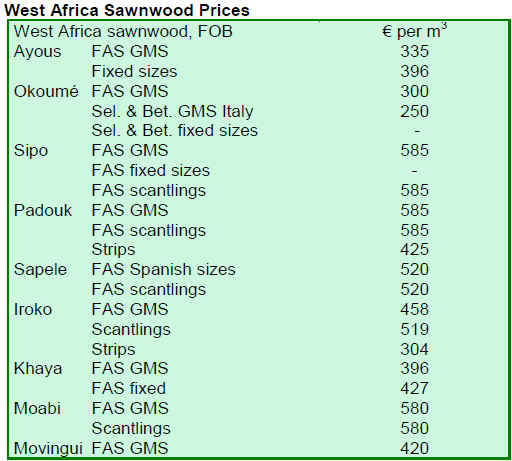

CENTRAL/ WEST AFRICA

Prices unchanged due to slow trading

There are no price changes to report during the first two

weeks of November. Trade has been very slow but

basically was in balance because production and stock

levels have been kept very low. The rainy season in Gabon

and Cameroon has been hampering logging and as a

consequence sawmill production was limited. China has

continued to buy, and while India has been less active,

trade was still being conducted. Prices for the favored

species have not moved, and Vietnam has proved to be a

more active buyer over the past few months for the lower

rated species. A few sales have been made to North

Africa but prices have been very high. Experts suggest that

some buyers may have been able to negotiate a slightly

lower price, while at the same time some producers may

be able to apply a price premium for higher quality or

special size specifications. These price differences were

unlikely to be more than a very few dollars up or down

and were not affecting the general stability of prices as

producers have stopped cutting any species for which

there is no interest from buyers.

In general, European importers have been reducing stocks

to a bare minimum. In the UK, companies in secondary

and tertiary processing such as windows and doors have

experienced marked slowdown in demand, and some small

and medium-sized businesses have been forced to close or

have reduced staff and production. One larger company

(Palgrave Brown) has gone into administration and

forecasts for 2009 for European housing and construction

business are not positive for West African exporters.

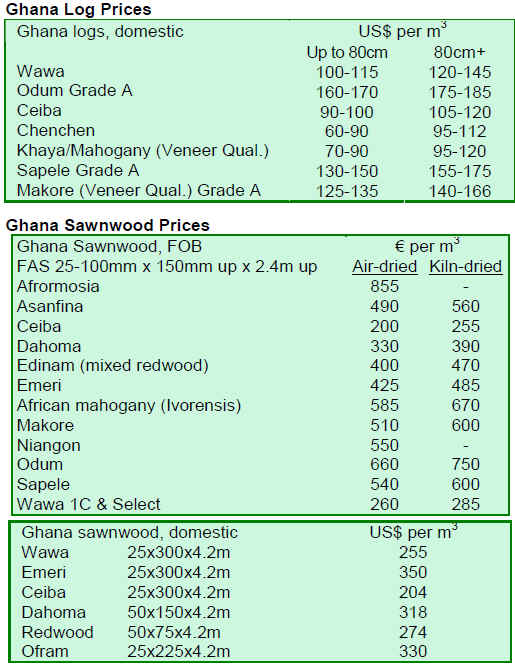

2. GHANA

TIDD export permits rise 7% in second quarter

The Timber Industry Development Division (TIDD) of the

Forestry Commission (FC) of Ghana vetted, processed and

issued 2,319 permits to exporters during the second

quarter of 2008 to ship various timber and wood products

through the Takoradi and Tema ports. This figure, which

includes overland exports to neighboring countries,

showed a 7% rise when compared to first quarter 2008

figures. A total of 1,022 export permits were issued for

kiln-dried and air-dried lumber registered the highest

number of export applications during the period. This

represented 44% of the total export permits issued. This

was followed by plywood (16.6%), mouldings (10.6%)

and sliced veneer (9.2%), with eleven other products

registering the remaining 19.5%.

Three hundred and thirty-two (332) export permits were

granted to 21 companies to export lumber, plywood and

blockboard by road to Burkina Faso, Nigeria, Niger,

Senegal, Benin and Togo. Exporting companies receiving

permits included Ghana Primewood Products Ltd (GAP),

John Bitar & Company Ltd (JCM), Naja David Veneer &

Plywood Company Ltd (NDVP) and Samartex Timber &

Plywood Company Ltd (SAX). The total volume and

value of permits issued for overland exports during the

second quarter of 2008 were 34,218 m³ and EUR8.5

million respectively, showing increases of 19.4% and

7.4% when compared to the previous quarter.

Edinam and wawa were the most exported air-dried levied

species in lumber form. Edinam represented 50.9% of the

total volume and value of exports during the second

quarter. Wawa represented 40.7% by volume and 24.8%

by value in the same period. During the period under

review, six export permits were issued in Takoradi to Best

Glow Wood Ltd. for the shipment of rubberwood lumber

to Malaysia. This involved a volume of 714 m³ at a total

value of EUR58,638. One export permit was also issued in

Tema to the Kugyampy Company Ltd. for the shipment of

powdered mahogany barks to China ostensibly for

medicinal purposes. This shipment was five tons valued at

EUR2,380.

3.

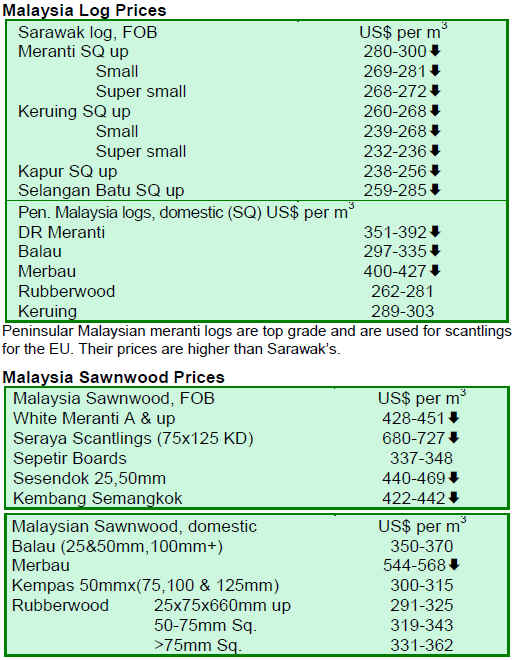

MALAYSIA

Malaysia expects timber exports to slow in 2008

Malaysia¡¯s Deputy Plantation Industries and Commodities

Minister, Senator A. Kohilan Pillay, recently indicated that

Malaysia may see declines of timber and timber products

in 2008 due to the global economic slowdown. Bernama

reported on the minister¡¯s statement, which said that the

Malaysian industry¡¯s outlook would depend on demand

from major importers such as Japan, Europe and the US.

He recalled previous statements, which indicated that

Malaysia would need to expand into Middle East markets

to boost exports of timber and timber products and offset

drops in exports to traditional markets. He noted that in

2007, total exports of timber and timber products

amounted to RM22.65 billion. Wooden furniture

accounted for 29.3% of the total value of exports while

plywood earned 27.7% of total revenue. During the period

January to August 2008, exports of timber and timber

products amounted to RM14.9 billion, noted Kohilan. He

indicated that the timber sector was 5% of Malaysia¡¯s

GDP and provided over 300,000 jobs nationally. At the

same time, Kohilan noted that Malaysia was considering

reducing its dependence on foreign labor from about 2.16

million persons to about 1.53 million in 2015.

4.

INDONESIA

Prince Charles urges government to stay committed to

forest preservation

Antara News reported on Prince Charles¡¯ recent visit to

Indonesia, where he called on the government to maintain

its commitment to preserving its forests. During his tour of

the Indonesian Rain Forest Ecosystem Restoration Park in

Bungku village, the Prince asked accompanying

Indonesian Forestry Minister MS Kaban to support PT

Restorasi Ekosystem Indonesia¡¯s (REKI) initiative to

develop the park. Relatedly, Jambi Governor Nurdin has

already asked the Forestry Minister to issue a license for

REKI¡¯s ecosystem forest restoration project. Minister

Kaban has responded to the requests and said he has

issued a licence for the management of Jambi¡¯s forest

restoration areas of up to 101,000 hectares.

Bank Indonesia expects lower growth in fourth quarter

Bank Indonesia (BI) Deputy Governor Hartadi A.

Sarwono said that fourth quarter growth would be around

5.9%, lower than the 6.4% reported for in the third quarter,

indicated The Jakarta Post. Saying that the global

economic crisis was beginning to have an impact on the

Indonesian economy, Hartadi noted that he expected

overall growth in 2008 to be between 6.1 and 6.2%, one

tenth lower than growth in 2007. Nevertheless, he said that

the Indonesian economy would find ¡®a new equilibrium¡¯ in

the wake of the US recession and expected the full impact

of slowing exports and imports to be felt in 2009. He also

indicated that when the Indonesian rupiah adjusts to the

effects of the global economic slowdown, BI would be

developing appropriate policy responses to have an

¡®orderly adjustment¡¯.

5.

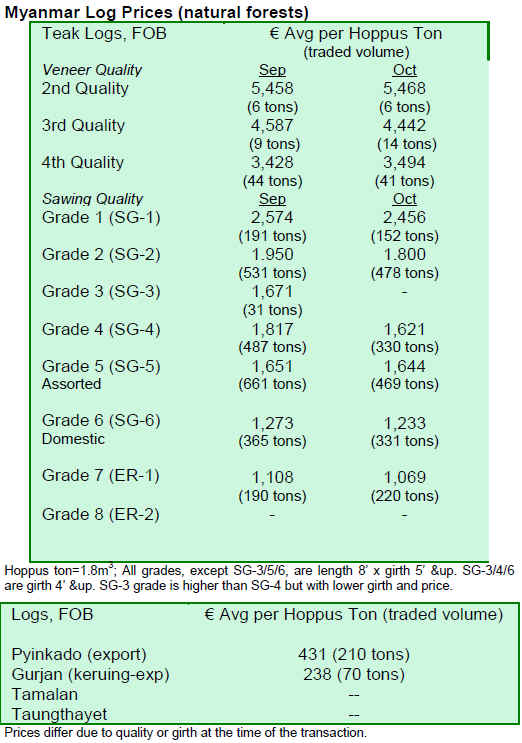

MYANMAR

MTE announces price freeze on timber

The Myanmar Timber Enterprise (MTE) has announced

that the current list price, which has been in effect since

August 2008, will apply until 31 March 2009. The

announcement, made on 10 November 2008, also suggests

that the MTE may adjust the allowable felling and supply

to ease buyers¡¯ current problems. Buyers are expecting to

see some quantity adjustments in the coming tenders.

Major importers, particularly India, China, Thailand and

Pakistan, have been facing difficulties with supply and

prices. It is expected that buyers and sellers will have to

make some concessions to address the current market

situation.

Reports from Myanmar indicate that the current economic

crisis has been causing some uncertainty among timber

dealers. India, which is a major consumer of teak, was said

to have fallen behind in purchases and shipments. Indian

buyers noted exchange rate problems and credit facilities

as some of the factors the factors affecting their purchases

and shipments. As it has been reported, the negative

economic effects of the credit crunch are being felt in

India as well.

The tender prices fell during the past few months.

Earnings from tender sales are less than 16% of MTE¡¯s

total annual exports. More than 80% of revenue for MTE

has been from direct sales (with fixed prices) during the

past three years.

Some analysts feel that selling higher quantities of teak to

meet annual revenue targets could backfire on both buyers

and sellers. Prior to the price freeze, some dealers had

argued that a sharp reduction in prices could have affected

buyers with heavy stock. Similar recommendations were

made in the past and often proved wrong, as teak from

natural forests is only a negligible fraction of the world¡¯s

timber trade. As such, demand always seems to be good.

Analysts were usually not able to consider all the variables

involved in predicting the effect of lowering prices on

demand.

November is the end of the felling season and the start of

the trucking season in Myanmar. Timber has started to

come down to Yangon depots in trucks and barges. As a

result, analysts suggest it is not practical to reduce supply

at this point in time, in order to recoup expenses.

6.

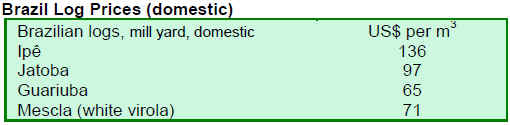

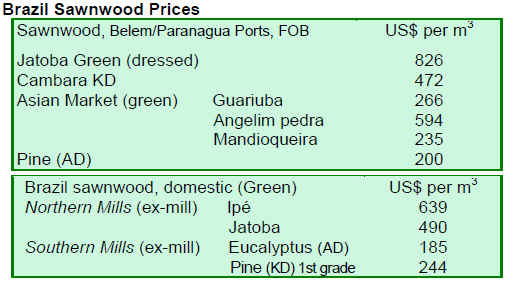

BRAZIL

Amazon Fund aims to raise USD21 billion by 2021

Despite the global economic crisis, countries and private

companies continue to make donations to the Amazon

Fund, noted Portal Cultura. The expectation is that by

2021, Brazil would raise about USD21 billion for projects

to combat deforestation in the Amazon. In addition to

funds already donated by Norway, Japan, South Korea and

Sweden have shown interest in making donations to the

Fund.

At the first meeting of an oversight committee for the

Amazon Fund, guidelines and priorities for the fund were

presented. Participants decided that projects meeting more

than one objective of the Fund would have priority. The

committee is composed of nine representatives from the

federal and state governments and six members of civil

society, to be appointed by the Brazilian Development

Bank (BNDES). The donors of the Amazon Fund are not

entitled to be members of the committee in order to ensure

Brazil¡¯s sovereignty over the management and protection

of the Amazon.

Projects to be supported by the Amazon Fund are expected

to include the following topics: management of public

forests and protected areas; environmental control,

monitoring and surveillance; sustainable forest

management; ecologic-economic zoning; land use and

land regulation; conservation of biodiversity and

sustainable biodiversity use; restoration of deforested

areas; and payment for environmental services. These

projects must be linked with the strategies of the Action

Plan for Prevention and Control of Deforestation in the

Amazon and with the goals of the Sustainable Amazon

Plan.

The Brazilian Minister of the Environment welcomes

payment for environmental services as an alternative

means to address sustainable development. According to

the Minister, there are aspects that cannot be resolved by

the police or IBAMA. Therefore, alternatives to

sustainable development are needed. The objective of the

Amazon Fund is to finance sustainable forest-based

activities in order to curb illegal activities.

Brazilian timber industry on alert

Interact Comunicaçao Empresarial reported that the lack

of credit for exports, the fluctuation of the US dollar and

instability of international markets has placed the Brazilian

forest sector on alert. The sector represents 3.4% of the

Gross Domestic Product and generates more than 8.6

million jobs. Exporters are hesitant to close deals due to a

strong daily fluctuation of the Brazilian real. According to

reports from Brazil, foreign buyers have demanded

discounts on price to compensate the expected variation in

the exchange rate.

The mechanically-processed timber products industry has

faced difficulties since 2005, when rising costs caused

exports to fall and competitors such as China emerged in

the international market. This had a negative effect on

Brazil¡¯s market, including a drop in job creation.

Parana, a traditional exporting state of pine plywood,

recorded a 4.73% drop in exports in July 2008 when

compared to the same period of 2007, according to the

Federation of Industries of the State of Parana (FIEP).

With domestic housing construction having grown in the

past two years, analysts suggest that companies producing

wood finishing for civil construction have and in the future

will likely see significant sales in the Brazilian market. In

addition, the global economic crisis is not expected to

affect low-income housing construction, as it relies on

special governmental credit lines.

Brazilian furniture sector shares concerns about

global economic crisis

Agencia Sebrae de Not¨ªcias/Abim¨®vel reported on the

concerns of the Brazilian furniture sector about the effects

of the global economic crisis. In recent weeks, prices of

raw materials for furniture production have been

increasing and other prices of products essential to the

sector, such as paints and varnishes, have been rising or

were expected to rise in the coming weeks.

The global economic slowdown is a concern for the

furniture sector because of the uncertainty for Brazilian

furniture producers and the impact of the crisis on the

production chain, which affects 16,500 companies.

Most of the sector is composed of micro and small-sized

companies. The sector generates 232,000 direct and

460,000 indirect jobs in Brazil. In recent years, furniture

producers have made efforts to work with certified wood

from management plans authorized by the Brazilian

Institute for the Environment and Renewable Natural

Resources (IBAMA) and other environmental agencies.

The forecast of the Brazilian Association of Furniture

Companies (ABIMOVEL) for 2008 suggests a 10%

increase in sales to the domestic market. Analysts expect

an increase of 5% in exports this year. The main importer

of Brazilian furniture is the US, responsible for more than

half of furniture exports. In 2008, sales to the US have so

far decreased around 30%.

The majority of furniture production is oriented to the

domestic market, but in the past four months, sales have

been slowing down. Sales in the first quarter of 2008 were

favorable in the domestic market, but in the second quarter

they began to drop, both for high-cost and popular

furniture.

7.

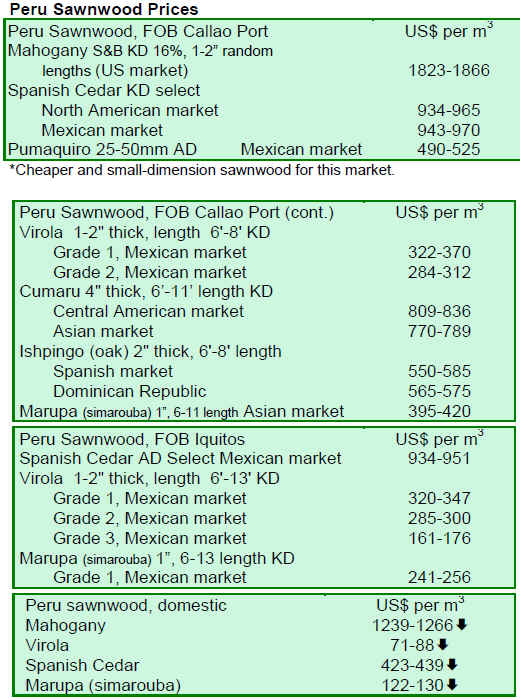

PERU

Peru exchanges over USD25 million in debt for forest

protection

The US Department of the Treasury has recently

announced an over USD25 million debt-for-nature swap

with the Government of Peru under the Tropical Forest

Conservation Act. The initiative builds on previous debtfor-

nature agreements with Peru and aims to dedicate the

new funds to finance projects for the conservation,

protection and restoration of Peru¡¯s forests over a seven

year period. The new agreement is the fourteenth such

agreement under the Tropical Forest Conservation Act,

which is expected to raise a total amount of USD188

million to protect tropical forests.

Peru and Brazil dispute over Amazon logging

Various news reports have detailed recent disputes

between Brazil and Peru over uprooted Indian tribes that

have been forced to migrate as a result of logging in the

Amazon Forest. Reuters noted the inter-tribal conflicts

may drag both Brazil and Peru into disputes over their

responsibilities in the events. Two human rights

organizations working in the area, Survival International

and the Indigenous Committee for the Protection of

Uncontacted Tribes those in Initial Contact in Amazonia,

the Chaco and Eastern Paraguay (CIPIACI), have said the

Peruvian authorities have not been addressing the issue,

especially in the Ucayali region. Peru has denied the

claims over its responsibility in the conflicts. Nevertheless,

deforestation in Peru is recognized as a problem, even

though deforestation continues both in Brazil and Peru.

National Wood Convention draws Mexican businesses

The Fourth National Wood Convention, jointly organized

by ADEX and the Regional Government of Loreto and

supported by the ITTO, was held at end September 2008

and drew over 300 participants from businesses,

governments, traders and academic experts. Mexican

businesses took a keen interest in the event, with the

Mexican Import and Export Association of Forest

Products (IMEXFOR) signing a Memorandum of

Understanding with the Exporters¡¯ Association of Peru

(ADEX) and the Regional Government of Loreto to

strengthen cooperation between the two countries. The

National Wood Convention also hosted 5 other side events

about forest management and development and the

international wood market.

8. BOLIVIA

9. MEXICO

Forest certification on the rise in Mexico

In Mexico, the Federal Government through the National

Forest Agency (CONAFOR) grants economic supports to

pay for certification. The ProTree 2008 program, for

example, includes a specific subcategory of support for

Forest Certification. The objective of certification is to

ensure that forests are managed according to a series of

principles for environmental conservation, social justice

and economic viability, when considering standards of

international recognition.

Durango has a large amount of certified forest in Mexico,

under the Rainforest Alliance Mexico¡¯s SmartWood

program. Enrique Vega Fernandez of Rainforest Alliance

recently explained the processes of certification and chain

of custody. He noted that the processes involved, from

evaluation to certification, could take about three months

on average (up to 6 months in extreme cases) and depends

on the following: size of the operation; traveling distance

to the area; complexity; and existence of serious conflicts.

He explained that the certificate granted for forest

management or chain of custody remains active for five

years, but annual audits are conducted to determine

adherence to management standards. Where remedial

actions are not taken to address deficiencies in forest

management, a suspension or cancellation of the

certificate is possible. In Mexico, the Foundation for

Forest Life A.C. (Fundaci¨®n Vida para el Bosque A.C.)

has carried out initiatives for forest certification programs

and Rainforest Alliance Mexico, Alliance for Forests A.C.

are the two associations accredited by the Forest

Stewardship Council to conduct evaluations.

10.

GUYANA

Plywood exports recover in third quarter

Export volumes of plywood in the third quarter of 2008

have recovered from the first two quarters, showing

progressively greater export volumes. Plywood accounted

for as much as 41% of all wood exported. As of end

September 2008, plywood exports by volume were 9%

greater than that of the previous quarter and 14% over the

first quarter¡¯s total. The leading market for this product

continues to be the US, consuming 54.4% of all plywood

exported from January to September 2008. Consumption

of Guyana¡¯s plywood in this market increased in the third

quarter by 31.4% and 16.4% over its first and second

quarter consumption, respectively.

Other improvements exports were recorded for logs, with

third quarter volumes accounting for 34% of all log

exports, ending September 2008. This was attributable to

the much larger increase in demand for Guyana¡¯s logs

from India. Log exports to India in the third quarter

accounted for 53.8% of total export volume for the three

quarters. Total export of logs are, however, still lower than

2007 by both value and volume.

Moreover, loans and cash advances to businesses in the

forest sector have shown marked increases in January to

August 2008 when compared to same period of 2007. A

robust 14.8% increase in investment recorded in the sector

reflects a continued interest in Guyana¡¯s timber products

both locally and internationally. The increase in loans and

advances by commercial banks to the sector were reported

in documents from the Central Bank of Guyana.

Chainsaw milling project addresses community forest

work

In May 2008, Guyana commenced work on a project that

focuses on chainsaw milling in Guyana and Ghana to

address this area at the local community level. This work

is being undertaken as part of a project financed by the

European Union and implemented by Tropenbos

International (TBI). The Ghana Forestry Commission and

the Forestry Research Institute of Ghana are the local

partners on the ground in Ghana and Iwokrama

International Centre for Rainforest Conservation and the

Forestry Training Centre Inc. (FTCI) are the implementing

partners in Guyana.

The project¡¯s activities include an overview of chainsaw

milling practices through research at national level,

dialogue at the local, regional and international levels and

capacity building for sustainable forest management at the

community level. On a wider scale, the project will

contribute to the: reduction of poverty and promotion of

livelihoods in forest dependent communities; reduction of

the illegal logging; and the conservation and sustainable

management of tropical forests.

To date, there has been much progress in project activities,

including the completion of draft reports on three research

themes on chainsaw logging. These are: an assessment of

the impacts of chainsaw milling in Guyana; the

institutional policy and legal framework and drivers of

chainsaw milling in Guyana; and a diagnosis of chainsaw

milling in Guyana.

At this early stage, there have been several exchanges

between Guyana and Ghana on the substance of the

project, with a workshop hosted in Ghana in May¨CJune

2008, to address, among other areas, techniques of

implementing the landscape approach and multistakeholder

dialogues. Another meeting recently hosted in

Guyana in November 2008, which was attended by

Representatives of Tropenbos International, Ghana¡¯s

Forestry Commission and various participants from

Guyana. It is hoped that this project will result in the

creation of a higher level of understanding and stakeholder

dialogue in the area of chainsaw milling in Guyana.

GFC holds Forestry Open Day

On 27 October 2008, the Guyana Forestry Commission

held an open day tour of the Forestry Training Center

Inc¡¯s (FTCI) location at Manaka on the Essequibo River.

The tour was designed for special invitees, including the

Minister of Agriculture with responsibility for forestry,

Mr. Robert Persaud, the media and other key stakeholders,

to gain a first hand look at what is being done to develop

sustainable forest management through Reduced Impact

Logging (RIL) practices and other schemes.

Forestry Training Centre Inc. personnel gave a practical

demonstration of RIL at work, while outlining some

aspects of other training modules, including the operation

of forestry equipment and skid trail planning.

The session was successful in the sharing of experiences

with key stakeholders of the forest sector, the aspects of

training offered by the Center. Many persons have taken

advantage of these sessions, which has led FTCI to expand

training facilities to the regional level.

|