|

Report from

Europe

Recovery in European furniture production stalls in

2025

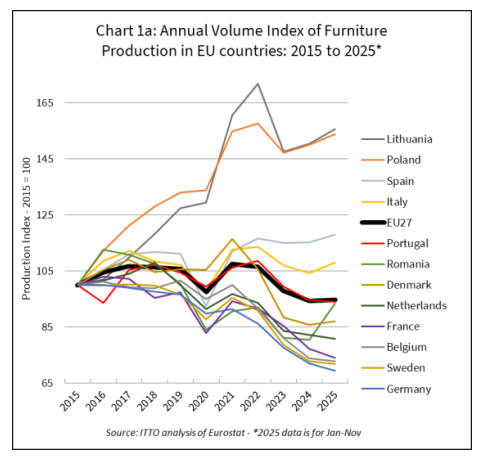

Signs of recovery in EU27 furniture production during the

opening months of 2025, petered out in the second half of

the year. Eurostat data indicates that seasonally adjusted

furniture production in the EU27 during the January to

November period of 2025 was up by only around 0.5%

compared to the previous year.

Production in 2025 remained stubbornly below that

recorded during the previous record downturn in 2020 at

the height of the COVID-pandemic.

Overall production in the EU27 was dragged down during

2025 by particularly sluggish performance in several large

producing countries in Western Europe including

Germany, Sweden, Belgium, France and the Netherlands.

But the downturn in these countries was offset by strongly

rebounding production in Lithuania, Poland, Spain, Italy,

and Romania. Production in Portugal and Denmark

remained at the same level as the previous year. (Chart

1a).

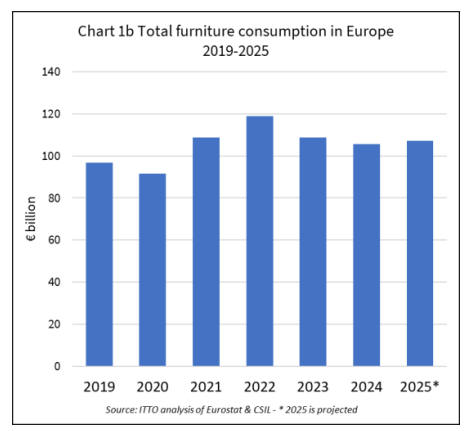

Drawing on Eurostat data and commentary in World

Furniture Online (www.worldfurnitureonline.com) by the

Italy-based market research organisation CSIL, it is

estimated that total furniture consumption in Europe

increased by around 1.5% to €107 billion in 2025. This

follows on from a 3% fall in 2024 and even sharper 8%

decline in 2023 (Chart 1b).

The marginal rise in European furniture consumption last

year was due in part to an 0.5% increase in domestic

production and in part to an increase in Europe’s furniture

trade deficit. While exports of furniture products to

countries outside the region were static last year, there was

a rise in imports, particularly from China.

The volatile global market situation created by rapid and

unpredictable changes to U.S. tariffs has been generally

detrimental to the European furniture industry. In addition

to the direct impact on EU furniture exports to the U.S., it

has led to an increased proportion of furniture produced in

other parts of the world previously destined for that market

to be shifted elsewhere. This effect has been compounded

by the recent downturn in the Chinese real estate market.

Overall, CSIL’s forecast of June 2025, that furniture

demand in Europe would “remain almost stagnant in

2025” has been borne out by events. More positively, the

upside factors mentioned by CSIL in mid-2025 that could

support a stronger recovery remain valid. These include a

slow improvement in macroeconomic indicators, an

expected easing of inflation and interest rates, and

potential wage growth. These factors could boost

consumer confidence and encourage greater spending on

furniture during 2026.

In a volatile global trading environment, the European

furniture industry also benefits from its huge captive

internal market and essentially insular nature. The industry

is characterised by an exceptionally high level of business-

to-business trade concentration and integration within the

region. Unlike in the U.S. where a large share of furniture

production has been relocated to China, Southeast Asia

and Mexico, 80% of current demand in Europe continues

to be met by manufacturers located in the region.

Even a large proportionate increase in imports from China

and other parts of the world barely impacts on overall

consumption, such is the market domination of Europe’s

domestic producers.

The direct business benefits of proximity to the market,

particularly to facilitate rapid adjustment to changing

fashions and other market trends, and for quick returns and

turnaround times, tend to reinforce the market dominance

of domestic manufacturers. So too does Europe’s strong

focus on environmental issues in the furniture sector,

particularly around circularity and deforestation-free

material origin.

Europe’s furniture imports likely to feel effects of

EUDR

When EUDR finally enters into force, expected now from

the beginning of 2027, the EUDR obligations will be

particularly challenging to meet for EU imports of

composite products manufactured primarily by SMEs and

which derive a high proportion of material from

smallholders or material waste streams. These are all

defining features of the international furniture

manufacturing sector.

The European Commission (EC) is currently in the

process of reviewing EUDR with a view to proposing

additional simplifications and is due to report before the

end of April 2026. In practice that means the EC will need

to receive input before the end of February.

European furniture exports remain flat while imports

rose rapidly

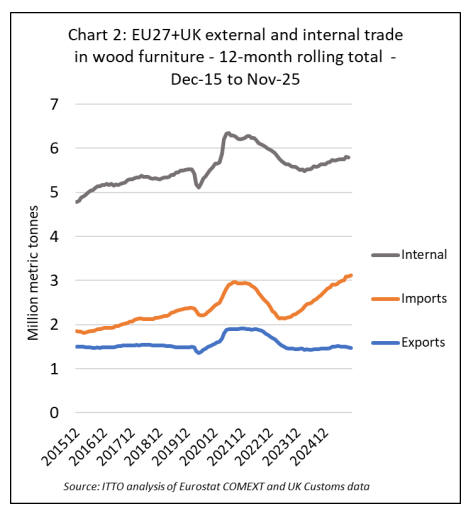

The latest Eurostat and UK trade data (Chart 2) shows that

European exports of wooden furniture to countries outside

the region, after rising and then falling rapidly between

2021 and 2022, remained stable between 2023 and 2025 at

an annualised level of just below 1.5 million tonnes.

In contrast, European imports of wooden furniture from

other parts of the world began to increase in the second

half of 2023, a trend maintained throughout 2024 and

2025.

Imports from outside the region in the 12 months ending

November 2025, at 3.1 million tonnes, exceeded those at

the height of the boom in European spending on furniture

in 2021 and early 2022 which occurred during and

immediately after the COVID pandemic.

Internal European trade in wooden furniture, which was

slowing in 2023 and the opening months of 2024, began to

rise in May 2024 and the gradual upward trend was

maintained throughout 2025.

This may reflect both the slow recovery in underlying

consumption in Europe and a continuing shift in

manufacturing locations within the region, particularly

into Poland and Lithuania and away from some traditional

manufacturing centres, such as in Germany, France and

the UK.

China drives rise in European furniture imports

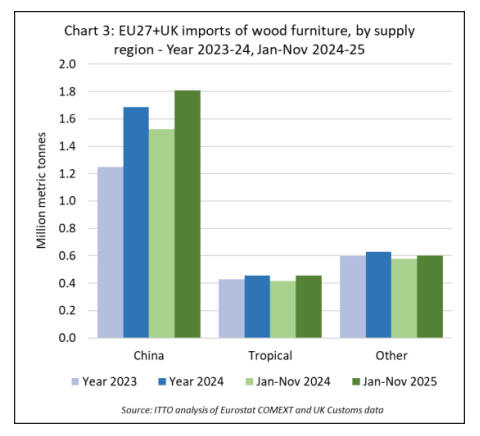

Closer analysis of the data reveals that the recent growth

in wooden furniture imports into the EU27+UK has been

driven almost entirely by China. Imports into Europe from

China, after rising 5% in 2023, increased by more 35% to

1.68 million tonnes in 2024 and were up 19% to 1.81

million tonnes in the first eleven months of 2025 (Chart 3).

EU27+UK wooden furniture imports from tropical

countries, after falling by 23% in 2023, were up 6% to

454,000 tonnes in 2024. The pace of tropical wooden

furniture imports picked up in 2025, rising 9% to 456,000

tonnes in the January to November period last year.

Imports from all other countries (mainly non-EU European

countries and Turkey), after decreasing 8% to 600,000

tonnes in 2023, rebounded by 5% to 630,000 tonnes in

2024 and had already reached 600,000 tonnes by the end

of November in 2025, 4% more than the same period in

2024.

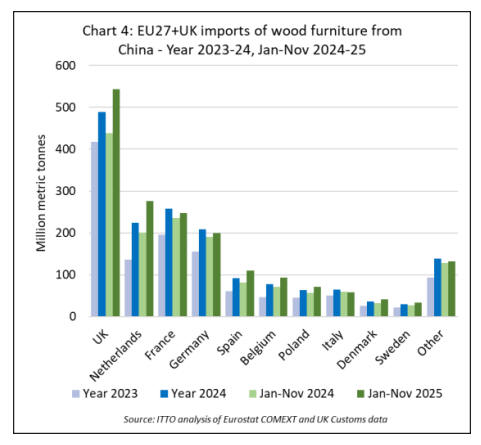

Wooden furniture imports from China have increased both

into the UK, the largest single wooden furniture importing

country in Europe, and into most EU countries (Chart 4).

UK imports from China increased 17% to 488,200 tonnes

in 2024 and were up another 24% to 542,600 tonnes in the

first eleven months of 2025.

EU imports of wooden furniture from China increased

44% to 1,196,400 tonnes in 2024 and increased another

17% to 1,264,300 tonnes during the January to November

period last year.

Imports of wooden furniture from China have risen into

nearly all EU countries, but the gains have been

particularly dramatic in the Netherlands, Spain and

Belgium where they increased by more than 50% in 2024

and gained more than 30% in the first eleven months of

2025.

Vietnam more prominent in European furniture imports

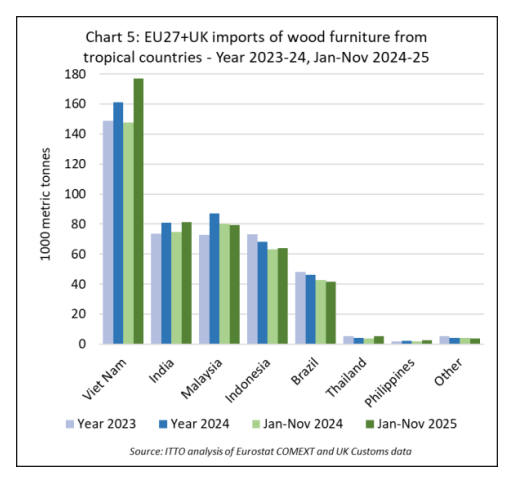

Following a steep decline in 2023, European imports of

wooden furniture from the three largest tropical supplying

countries, Vietnam, Malaysia and India recovered some

lost ground in 2024. In 2025, European imports from

Vietnam accelerated,but slowed from India and declined

slightly from Malaysia (Chart 5).

After 11 months in 2025, EU27+UK imports were up 20%

to 177,000 tonnes from Vietnam, up 9% from India to

81,000 tonnes, but down 1% from Malaysia to 79,000

tonnes.

European imports of wooden furniture from Indonesia,

after declining 7% in 2024, made some slight gains in the

first eleven months of 2025, up 2% to 64,000 tonnes.

However, imports from Brazil fell 3% to 42,000 tonnes

during the January to November period last year following

a 5% fall in 2024.

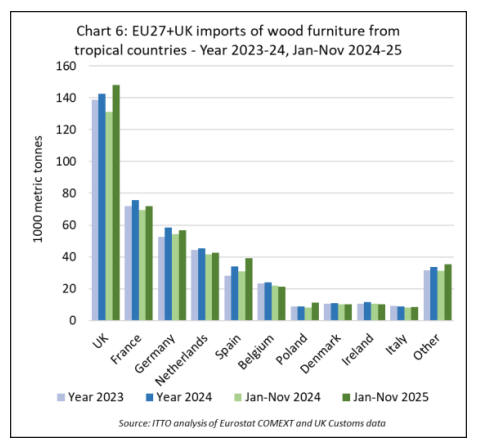

After most European destinations for tropical wooden

furniture recorded a large downturn in 2023, there was a

recovery in all the main markets in 2024 and 2025 (Chart

5 above).

During the first eleven months of 2025, imports of tropical

wooden furniture increased in the UK (+13% to 147,900

tonnes), France (+3% to 71,800 tonnes), Germany (+4% to

56,700 tonnes), Netherlands (+2% to 42,500 tonnes), and

Spain (+27% to 39,300 tonnes).

Imports into smaller European import markets were more

variable, declining to Belgium (-3% to 21,400 tonnes) and

Ireland (-1% to 10,400 tonnes), but rising to Poland (+36%

to 11,200 tonnes), Denmark (+2% to 10,400 tonnes), and

Italy (+5% to 8,700 tonnes).

Projected 3% decline in global wooden furniture trade

in 2025

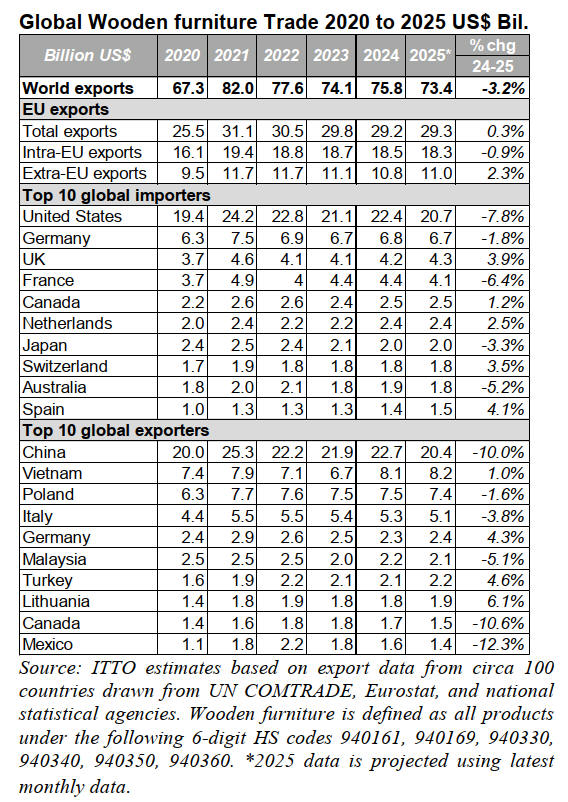

Preliminary assessment of trade data suggests that the total

value of global trade in wooden furniture declined by

around 3% last year to US$73.4 billion. This followed a

2% rise the previous year. 2025 represented a reversal

compared to the previous year in more ways than one.

In 2024, while there was robust growth in the global

wooden furniture trade, the overall level of trade was

dragged down by a downturn in the EU. In 2025, EU trade

held up reasonably well, but there was a dramatic

downturn in trade flows elsewhere in the world driven

mainly by political events in the United States.

In 2025, it is projected that US imports of wooden

furniture fell by nearly 8% to US$20.7 billion. China,

Canada and Mexico were hit particularly hard on the

export side, all key targets of the Trump Administration’s

tariff policy during the year. Projected wooden furniture

exports from China declined 10% to US$20.4 billion last

year, exports from Canada were down 11% to U$1.5

billion and exports from Mexico were down 12% to

US$1.4 billion.

There were mixed fortunes for the leading tropical

exporters of wooden furniture last year. Vietnam’s

wooden furniture exports rode the tariff storm reasonably

well last year, projected to have increased by 1% to

US$8.2 billion.

However, projected exports from Malaysia were down

5% to US$2.1 billion, while exports from Indonesia were

down 6% to US$1.4 billion, exports from India were down

8% to US$810 million, and exports from Brazil were

down 0.5% to US$650 million.

Global furniture trade trends identified in CSIL

association survey

While a 3% downturn in global wooden furniture trade last

year is a setback for a sector that had just begun to recover

from the volatility of the pandemic years, there is some

consolation in the fact that trade did not decline further. As

noted by CSIL in World Furniture Online

(www.worldfurnitureonline.com), the tariff shock turned

out to be smaller than initially expected during 2025.

Households and businesses front-loaded consumption and

investment in anticipation of higher tariffs, giving a

temporary boost to global activity early in the year. Trade

flows began to reroute toward third countries during 2025.

Nevertheless, CSIL note that prospects for 2026 remain

uncertain in the absence of clear and durable agreements

among trading partners. To gain additional insights into

emerging industry dynamics at a global level, CSIL

undertook a survey of furniture sector associations in 2025

with the following conclusions:

A large majority (73%) of surveyed associations

agreed that “leveraging digital tools for

marketing, sales and trade facilitation” is a key

opportunity.

63% identified “developing niche or high-value

products to meet international demand” as

another key opportunity.

Associations identified lower export volumes and

declining price competitiveness as the key

challenges in 2025.

South America and Africa, as export destinations,

were identified as exceptions. Reduced exports to

these regions were less of a concern, although

rising export costs were noted.

Tariffs introduced in 2025 primarily affected

trade with the US, although broader uncertainty

impacted nearly all regions.

To cope with this uncertainty, 65% of

respondents reported that member companies are

exploring new or emerging markets, particularly

in the Middle East, Africa, South America, and

India.

Looking ahead to 2026, respondents expect tariffs

to continue to rise in the United States, and more

non-tariff barriers to be introduced in both North

America and Europe.

Non-tariff barriers are seen by respondents as a

particularly pressing concern by respondents.

Reflecting this, 57% of respondents flagged

“higher compliance costs” as an extremely

relevant challenge.

Despite these hurdles, several positive factors

were identified as potentially supporting export

performance in 2026. New and ongoing trade

agreements, such as the EU-Mercosur deal,

Vietnam’s FTAs and others, could open new

markets and improve conditions.

Finally, growing global demand for sustainable

and certified products is seen as a positive trend,

encouraging eco-friendly and innovative

furniture.

|