US Dollar Exchange Rates of

25th

January

2026

China Yuan 6.95

Report from China

Decline in both volume and value of imported logs in

2025

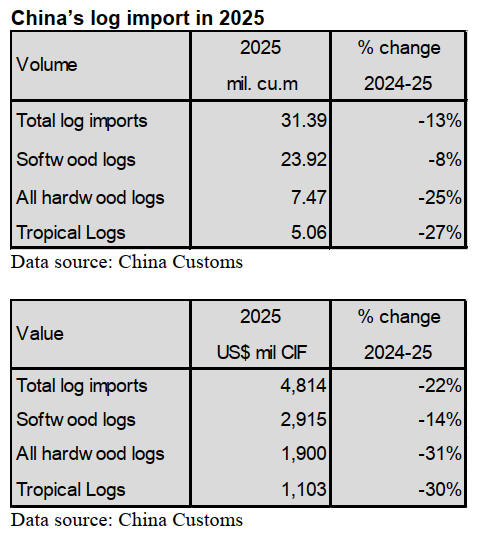

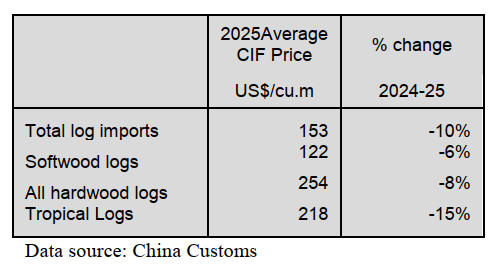

According to China Customs, log imports in 2025 totalled

31.39 million cubic metres valued at US$4.814 billion, a

large decline of 13% in volume and 22% in value year on

year. The average price for imported logs was US$153

(CIF) per cubic metre, down 10% on 2024 levels.

Of total log imports in 2025 softwood log imports fell 8%

to 23.92 million cubic metres, accounting for 76% of the

national total, up 4 percentage points from 2024 level. The

average price for imported softwood logs was US$122

(CIF) per cubic metre, down 6% on 2024 level.

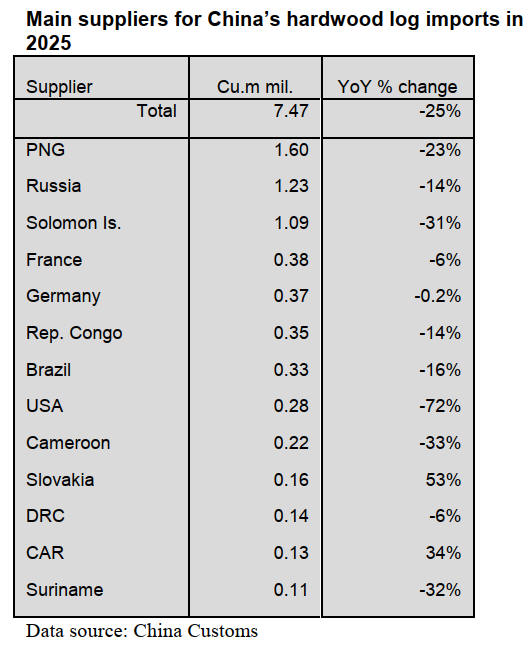

Hardwood log imports in 2025 fell 25% to 7.47 million

cubic metres (24% of the national total log imports).

The average price for imported hardwood logs in 2025

was US$254 (CIF) per cubic metre, down 8% on 2024.

Of total hardwood log imports, tropical log imports were

5.06 million cubic metres valued at US$1.103 billion,

down 27% in volume and down 30% in value from 2024

and accounted for 16% of the national total import volume

in 2025. The average price for tropical log imports in 2025

was US$218 (CIF) per cubic metre, down 15% on the

2024 level.

Radiata pine was the largest imported log species in terms

of volume in 2025. China’s radiata pine log imports rose

2% to 17.45 million cubic metre, accounting for 56% of

the national total log imports in 2025.

Over 90% of species in China’s imported logs are Radiata

pine, Spruce and fir, Douglas fir, Oak, Birch, Mongolia

Scots pine and Korean pine in 2025.

The volume of Spruce and fir, Douglas fir, Oak, Birch,

Mongolia Scots and Korean pine decreased 44%, 16%,

37%, 17%, 16%, 4%, 16% and 50% respectively year on

year in 2025.

The large decrease in China’s log imports was affected

that the global log supply chain experienced a severe

shock.

The uncertainty of international trade soared, with

geopolitical conflicts, repeated adjustments of tariffs and

weak demand in China combined with policy adjustments

and supply chain restructurings in some log-exporting

countries in 2025.

Domestic demand for logs continued to shrink. The real

estate industry is still in a deep downward trend resulting

in a sharp decline in wood product consumption, long-

term low prices of log spot markets, compressed profit

margins in the timber industry and low willingness of

timber traders to replenish inventories.

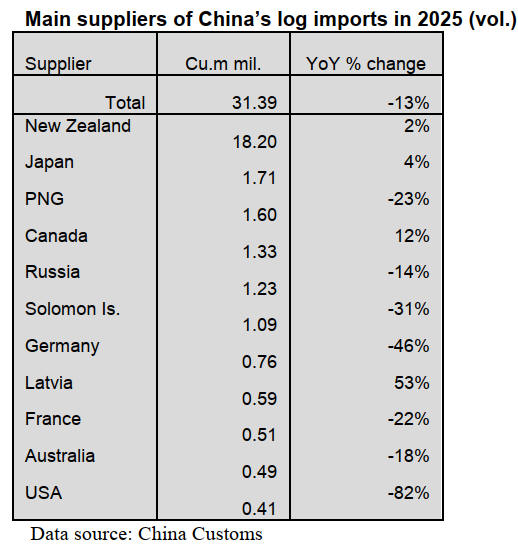

Rise in log imports from New Zealand

Despite a significant decrease in the total volume of

imported logs the volume of logs imported from New

Zealand increased by 2% year-on-year and the proportion

rose from 50% to 58% of the national total log imports in

2025.

China’s log imports from New Zealand totalled 18.20

million cubic metres in 2025, up 2% over the same period

of 2024.

In addition, China’s log imports from Japan, Canada and

Latvia rose 4%, 12% and 53% respectively in 2025. In

contrast, China’s log imports from the other main

suppliers fell sharply in 2025. Log exports from the US

saw the largest decline dropping 82% over 2024 levels.

The volume of logs imported from the US has

significantly decreased since China banned the import of

logs from the United States.

Instead, China has diversified its sources of log imports

and is now increasing the import of logs from other

countries, such as New Zealand, Japan, Canada and

Latvia. China’s log imports from all these countries grew

at different rates. China’s log imports from Latvia rose

53% year on year in 2025.

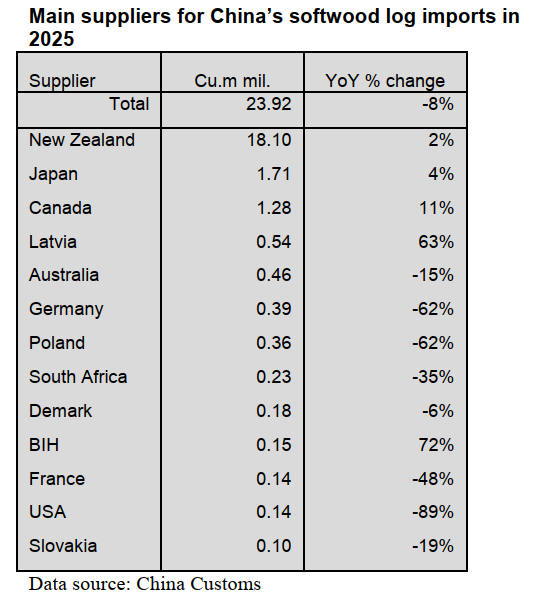

Decline in softwood log imports

According to China Customs, 2025 softwood log imports

fell 8% to 23.92 million cubic metres, accounting for 76%

of the national total, up 4 percentage points from 2024

level.

New Zealand, Japan, Canada, Latvia are the top four

countries in terms of China's imports of softwood logs and

China’s softwood imports from these countries rose 2%,

4%, 11% and 63% respectively resulting in increase in the

proportion of China’s softwood log imports.

This is the reason why the decline in the import volume of

softwood logs was smaller compared to the overall decline

in total log import volume. In addition, China’s softwood

log imports from Bosnia and Herzegovina (BIH) surged

72% year on year in 2025.

In contrast, China’s softwood log imports from the US fell

89% and from Germany and Poland both decreased 62%

year on year in 2025.

Hardwood log imports

According to China Customs, China’s hardwood log

imports fell 25% to 7.47 million cubic metres in 2025.

This was because China’s imports from the top three

shipping countries, PNG, Russia and the Solomon Is.

dropped significantly by 23%, 14% and 31% respectively

compared to 2024 levels.

In addition, China’s hardwood log imports from the

Republic of Congo, Brazil, US, Cameroon and Suriname

fell 14%, 16%, 72%, 13% and 32% respectively year on

year. In contrast, China’s hardwood log imports from

Slovakia and the CAR rose 53% and 34% respectively on

2024 level.

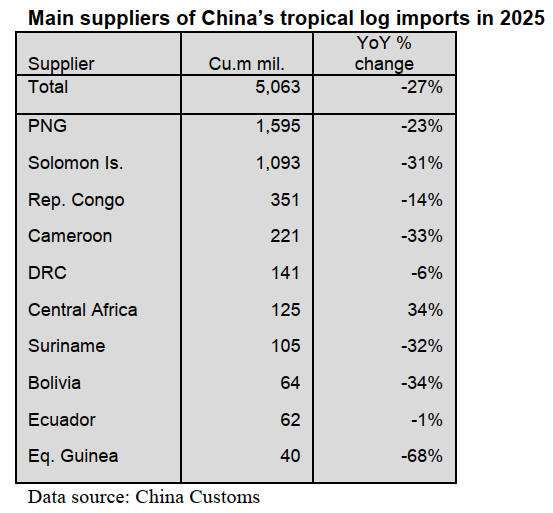

Decline in tropical log imports

According to China’s Customs, tropical log imports

totalled 5.063 million cubic metres in 2025, down 27%

over 2024 levels.

PNG still was the largest supplier of tropical log imports

in 2025 but China’s tropical log imports from PNG fell

23% to 1.595 million cubic meter on 2024 level. This was

the main reason behind the overall decrease in the tropical

log imports in 2025.

Some time ago the PNG government declared that logging

permits would only be granted to companies that process a

portion of logs domestically. It is anticipated that China’s

tropical log imports will continue to decline.

The Solomon Islands was the second largest supplier of

China’s tropical log imports in 2025 but log imports from

Solomon Islands dropped 31% to 1.093 million cubic

metres year on year. China’s tropical log imports from the

other main suppliers fell at different rates in 2025.

The main reason for the decrease in China’s tropical log

imports was because, internationally, the countries that

supply tropical timber have successively implemented

policies to prohibit or reduce the export of tropical logs.

Another reason is that the real estate and construction

industries in China have been experiencing sluggish

growth in recent years.

Additionally, as the awareness of protecting tropical

forests among Chinese people has increased, the domestic

demand for tropical timber in China has been decreasing

year by year.

GGSC report, December 2025

On 18 December China's Hainan Free Trade Port officially

launched island-wide special customs operations.

Following the implementation, the range of goods exempt

from import tariffs has expanded from 1,900 tariff lines to

approximately 6,600, covering 74% of all tariff lines and

nearly all timber raw materials.

While "zero-tariff" goods entering Chinese mainland from

Hainan are subject to relevant import duty payments,

goods processed in Hainan with a value-added rate of 30%

or higher are exempt from such taxes.

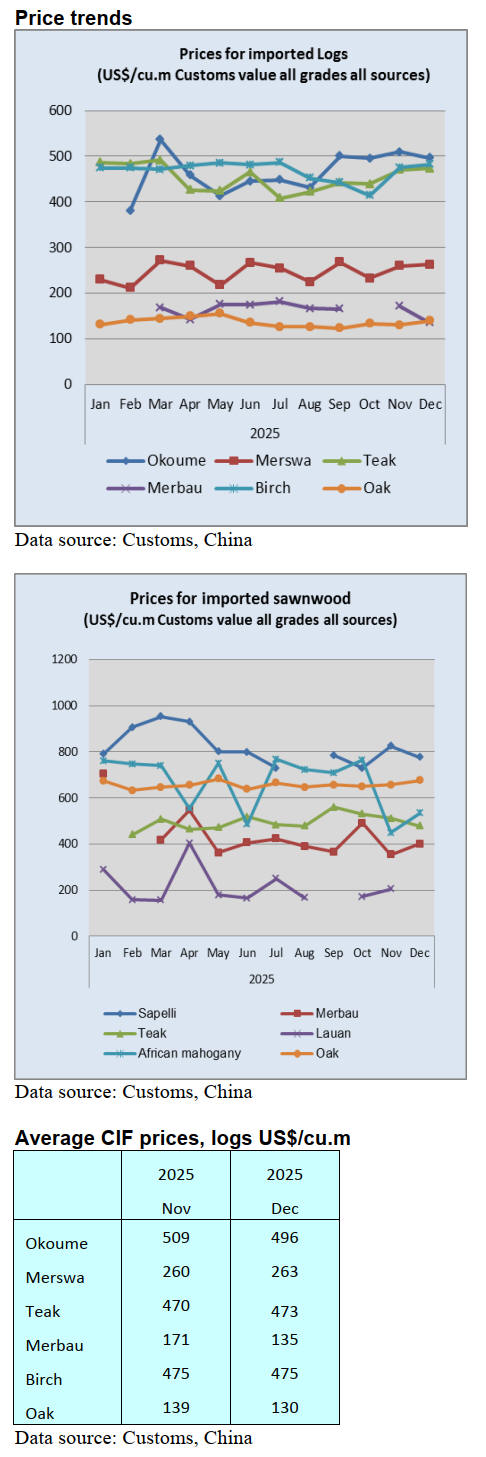

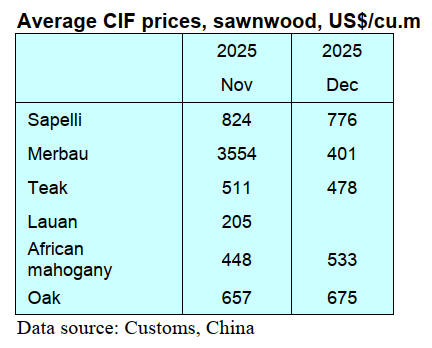

In November 2025, China’s total import value of logs and

sawnwood reached US$914 million, marking a 1.9% year-

on-year increase, with strong growth in imports from

Africa.

It is worth noting that import prices showed significant

fluctuations: the average unit price of log imports fell by

10.1% year-on-year, while that of sawnwood rose by

12.1%, indicating a five-month consecutive increase.

From 22-23 December the Chinese government held the

National Housing and Urban-Rural Development Work

Conference, at which it emphasised efforts to stabilise the

real estate market and mentioned that the rising proportion

of second-hand housing transactions would be a trend in

the coming period.

In December 2025 the GTI-China index registered 49.9%,

an increase of 0.3 percentage point from the previous

month and below the critical value (50%) for the third

consecutive month indicating that the business prosperity

of the timber enterprises represented by the GTI-China

index shrank from the previous month.

In December the total production volume of Chinese

enterprises increased slightly and supported by domestic

demand, the total volume of new orders also experienced

slight growth.

As for the twelve sub-indices, five indices (production,

new orders, purchase quantity, import and delivery time)

were above the 50% critical value while the remaining

seven indices were all below the critical value.

Compared to the previous month the indices for

production, existing orders, inventory of finished products,

purchase quantity, import, inventory of raw materials and

delivery time increased by 1.4-8.6 percentage points,

whereas the indices for new orders, export orders,

purchase price, employees and market expectation

declined by 1.0-20.5 percentage point(s).

Enterprises main challenges in December; Enterprises

struggled with insufficient orders. the costs of raw

materials rose. demand in the timber market was not

enough and there was intense competition in terms of

product prices. They suggested: break through

homogenised competition. broaden financing channels.

need the government policy support for timber enterprises.

And expand international markets to increase the volume

of orders.

See: https://www.itto-

ggsc.org/static/upload/file/20260119/1768790612819116.pdf

|