|

Report from

North America

Trade data rollout remains unpredictable

As US federal government agencies work to catch up on

releasing data held back during the 2025 government

shutdown some data reflecting the tropical timber trade is

now available while other data sources are yet to be

released.

For example, the US Census Bureau has not released a

monthly report on housing construction since its August

report released on 17 September. Nor has the Bureau yet

given any indication as to when it may resume issuing

reports.

Trade data reporting has been significantly more available

with the US Department of Agriculture recently releasing

both September and October data. While this period

coincides with the US issuing increased tariff rates for

upholstered furniture, kitchen cabinets and vanities the

numbers do not show any immediate correlations with the

tropical timber trade although imports were certainly more

volatile than normal during September and October.

This is in line with the overall US trade picture. Trade

patterns have whipsawed over the past year as supply

chains bend and flex around a blistering pace of policy

change. A year ago, as the US President was preparing to

take office on an economic agenda built largely around

tariffs the US trade deficit soared in part because domestic

companies raced to boost their inventories of foreign

goods before new duties arrived.

The latest data show the US trade deficit shrank

dramatically in October to its lowest level since 2009, an

unexpected twist in a year of volatile trade flows that have

been buffeted by the US administration’s steep tariffs.

See: https://www.msn.com/en-us/money/markets/us-trade-

deficit-unexpectedly-falls-to-lowest-level-since-2009/ar-

AA1TOLaS?ocid=hpmsn&cvid=695fd67a232c42c48aa4976f43f

dd236&ei=26

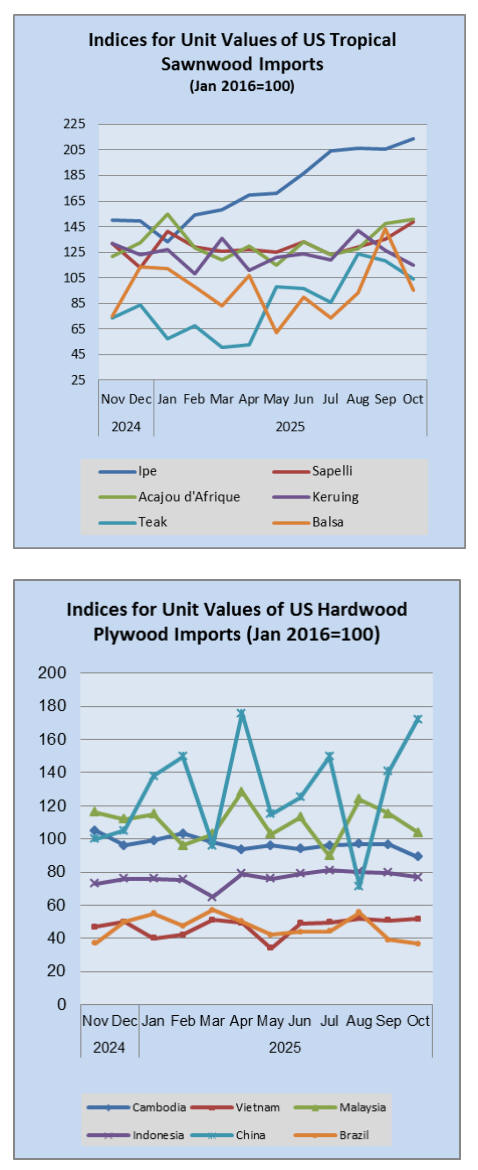

US imports of sawn tropical hardwood surge 25% in

October

US imports of sawn tropical hardwood surged 25% in

October after holding steady in September at an already

strong level. At 19,152 cubic metres this volume was 40%

higher than in October of 2024.

Imports from the top-trading partner Brazil increased by

50% while imports from Ecuador and Peru also made

healthy gains. Imports from Malaysia nearly doubled in

October. Total imports of sawn tropical hardwood were up

5% from October 2024.

In Canada, an 11% fall in October 2025 sawn tropical

hardwood imports followed two months of solid gains.

Imports showed an 18% increase in September following a

19% surge in August. Despite the October decline,

monthly imports were up 16% from the previous October.

Through October 2025 Canadian tropical hardwood

imports were down 1% from 2024.

US hardwood plywood imports jumped in September

US imports of hardwood plywood rose a healthy 6% in

September 2025 but cooled slightly in October, falling

2%. At 283,082 cubic metres, the October volume was

34% higher than in October 2024.

A 22% decrease in imports from top-supplier Vietnam

depressed October numbers as imports from nearly all

other top-suppliers rose. Imports from Russia recovered in

October after a steep September decline. Through October,

imports of hardwood plywood continued to greatly

outpace last year, rising 27% versus 2024.

See: https://apps.fas.usda.gov/gats/default.aspx

Veneer imports plunged, then recovered

US imports of tropical hardwood veneer made a near

complete recovery in October 2025, rising 95% to bounce

back from a plunge of 64% in September. Imports from

Cameroon, Italy and India which all fell more than 90% in

September, all returned in October to levels closer to their

average for the year.

While the month-to-month accounting has been volatile,

total imports of tropical hardwood veneer were up 14% in

2025 through October versus the previous year.

https://apps.fas.usda.gov/gats/default.aspx

See: https://apps.fas.usda.gov/gats/default.aspx

Moulding imports see another double-digit slide

US imports of hardwood mouldings fell more than 10%

for the second straight month in October 2025, decreasing

12% after a 13% dip in September. At US$13.1 million,

imports for the month were 11% lower than in October

2024.

Imports from Brazil fell 74% in September and another

55% in October to hit their lowest level in more than 10

years. Despite the drop, total imports were up 13% versus

2024 through October with year-to-date imports from

nearly all of the leading trading partners up more than

20%.

See: https://apps.fas.usda.gov/gats/default.aspx

Imports of hardwood flooring retreat

After a strong summer, US imports of hardwood flooring

retreated to a more normal level in autumn, falling 19% in

September 2025 but rising 6% in October. At US$6.1

million, October 2025 imports were 5% higher than in

October 2024.

Imports from Malaysia stayed well above 2024 levels,

rising 29% in October 2025 after a September dip. For the

year, imports from Malaysia are more than triple what

they were in 2024, while imports from all other leading

countries have fallen.

For example, imports from Brazil were down 44% up to

Octobe 2025 as imports fell to historically low levels in

September and October. Total imports of hardwood

flooring were down 4% through October 2025 versus

2024.

Imports of assembled flooring panels also stumbled,

falling 14% in October 2025 after a 2% September gain. A

9% October drop in imports from top-supplier, Cananda

and a 29% fall in imports from Indonesia spurred the loss.

Through October 2025, US imports of assembled flooring

panels were down 10% versus 2024.

See: https://apps.fas.usda.gov/gats/default.aspx

US wooden furniture imports continued to slump

US imports of wooden furniture continued to slump,

falling for a third consecutive month in October 2025. The

4% decrease in October follows month-to-month drops of

6% in September and August.

At US$1.44 billion, imports for October 2025 were 24%

below those of October 2024 and were below US$1.5

billion for the first time since March 2023.

Imports from Mexico rose 1% and imports from China

rose 7%, while imports declined from nearly every other

country. Total imports of wooden furniture were down 7%

versus 2024 through October 2025.

See:

https://usatrade.census.gov/data/Perspective60/Dim/dimen

sion.aspx

US delays scheduled tariff increases on furniture and

kitchen cabinets

Increased tariff rates for upholstered furniture, kitchen

cabinets and vanities have been delayed for a year

according to a White House directive.

The US was set to double its tariff rate on kitchen cabinets

and vanities produced outside the US to 50% starting1

January 2026. The import duty on upholstered furniture,

including sofas and armchairs, was set to rise to 30% from

25% on the first day of 2026.

According to the December White House announcement

the current 25% tariff on certain upholstered furniture,

kitchen cabinets and vanities, as imposed under the

September 2025 proclamation, will remain in effect.

While it welcomed the news that US tariffs would not be

raised the Canadian Kitchen Cabinet Association (CKCA)

called for the existing 25% tariffs to be removed entirely

and for coordinated action by both governments to restore

fair and balanced trade. “There is real relief across the

community of Canadian manufacturers and suppliers, but

relief is not resolution”, said Luke Elias, CKCA Vice-

President.

The CKCA also called on the Canadian government to

address the growing volume of imported kitchen cabinets

entering Canada at below fair market value which it says

has increased by 20% annually over the past five years.

See:

https://www.woodworkingnetwork.com/news/woodworking-

industry-news/trump-delays-scheduled-tariff-increases-furniture-

and-kitchen

and

https://www.whitehouse.gov/fact-sheets/2025/12/fact-sheet-

president-donald-j-trump-adjusts-imports-of-timber-lumber-and-

their-derivative-products-into-the-united-states/

US existing home sales edged up in November as

mortgage rates eased

US existing home sales increased a modest 0.5% in

November amid an easing in mortgage rates, but economic

uncertainty is keeping potential buyers on the sidelines. A

report from the National Association of Realtors on Friday

also showed the inventory of previously owned homes fell

from October to an eight-month low, limiting choices for

those looking to buy.

Though housing supply typically decreases heading into

winter, inventory growth has slowed on a year on year

basis, likely in response to sluggish demand. But limited

supply could prevent an outright decline in home prices.

Sales surged 4% in the Northeast, which accounts for a

small share of the housing market. They increased 1% in

the densely populated South, but fell 2% in the Midwest,

regarded as the most affordable region. Sales were

unchanged in the West.

Home sales declined 1% in November 2025 on a year on

year basis.

The interest rate on the popular 30-year fixed-rate

mortgage plunged from 7.04% in mid-January to 6.19% at

the end of November data from mortgage finance agency

Freddie Mac shows. It has, however, made no further

improvement since then.

See: https://www.nar.realtor/newsroom/nar-existing-home-sales-

report-shows-0-5-increase-in-november

and

https://www.reuters.com/world/us/us-existing-home-sales-

increase-moderately-november-2025-12-19/

|