Japan

Wood Products Prices

Dollar Exchange Rates of 10th

January

2026

Japan Yen 158.46

Reports From Japan

Rising interest rates contribute to higher

debt-serving

costs

The government recently approved a record yen 122.3

trillion (approx. US$783 billion) budget that includes the

issuing of yen29.6 trillion worth of government bonds to

cover the revenue shortfall. The total is yen 7.1 trillion

more than the current fiscal year’s initial budget, which

was prepared by the previous goverment.

Government debt-related costs, covering both principal

redemption and interest payments, are yen 31.3 trillion, the

most ever. Higher interest rates have contributed to the

higher debt-serving costs. On the revenue side, the

government projects a record tax haul of yen83.7 trillion

as high inflation is expected to continue boosting

corporate earnings.

Government support for semiconductors and artificial

intelligence received a significant boost with the Ministry

of Economy, Trade and Industry nearly quadrupling its

commitment to companies and institutions active in the

manufacturing of relevant products and development of

relevant technologies.

See: https://www.nippon.com/en/japan-data/h02652/

and

https://www.japantimes.co.jp/business/2025/12/26/economy/taka

ichi-2026-budget/

Inflation eases slightly

The rate of inflation in Tokyo (taken as a baseline for the

entire country) has slowed more than expected as

pressures from food and energy prices faded triggering

yen weakness on forecasts the Bank of Japan (BoJ) may

delay the timing of its next interest rate increase.

Consumer prices (excluding fresh food) rose 2.3% in

December from a year earlier, slowing from 2.8% in the

previous month according to the Ministry of Internal

Affairs and Communications. The overall inflation gauge

also slowed sharply to 2% from 2.7% in the same period

last year.

The yen weakened to a low of almost 157 per US dollar

after the inflation report was released.

See: https://x.com/japantimes/status/2004388075552506242

2026, the year of the ‘Fire Horse’ - symbol of

transformation and inflection

In its 2026 Japan Economic Outlook ‘Steady

Fundamentals, Policy Risks Ahead’,Goldman Sachs

explores prospects for the Japanese economy. Steady

growth is forecast to continue in 2026 led by domestic

demand. We expect the Japanese economy to continue its

steady growth and expand 0.8% in 2026.

The report says “while external demand is expected to

decelerate slightly due to factors such as Japan-China

diplomatic tensions, we expect solid consumption and

capex, supported by the structural shift to a labour

shortage economy with continued high wage growth”.

Future growth will depend on interest rates developments.

Last month the Bank of Japan (BoJ) raised its policy rate

to around 0.75%, the highest level in 30 years.

2026 is the rare Year of the Fire Horse in the Chinese

zodiac and BoJ Governor Ueda Kazuo referred to the Fire

Horse symbol of transformation and inflection points. He

noted that wages and prices are likely to continue to rise

gradually and he confirmed the BoJ would consider

further rate hikes if needed.

"We will continue to raise the interest rate and adjust the

degree of monetary easing, depending on whether the

economy improves or not," Ueda said.

See:

https://www.gspublishing.com/content/research/en/reports/2026/

01/06/eefdf592-d197-40da-a74b-dd316dbea9ee.html

and

See: https://www3.nhk.or.jp/nhkworld/en/news/backstories/4516/

Lingering economic uncertainties despite government

efforts

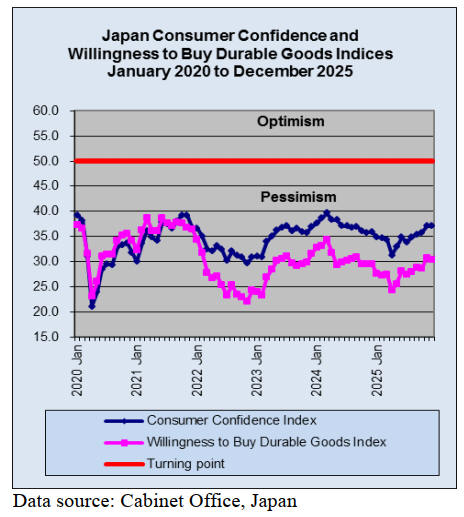

Japan's Consumer Confidence Index over the past decade

shows a general trend of fluctuation but staying below the

neutral 50 mark, reflecting lingering economic

uncertainties despite government efforts.

The index dipped significantly during COVID-19 (April

2020) but recovered, reaching multi-month highs in late

2025 before slightly pulling back indicating cautious

consumer sentiment driven by shifts in income,

employment and durable goods buying intentions. Since

mid 2025 there has been aun upward trend in the

confidence index and the index for willingness to buy

durable goods.

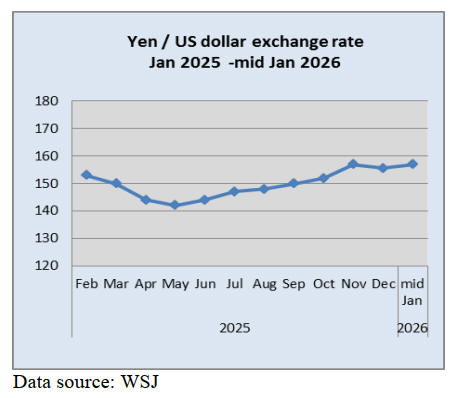

Yen close to historical lows at the end of 2025

Fitch Ratings expects the Japanese yen to appreciate

moderately in 2026, but for it to remain historically weak.

In contrast, strategists at JPMorgan Chase & Co., BNP

Paribas SA and other firms see the yen weakening to 160

per dollar or beyond by the end of 2026 driven by wide

US-Japan yield gaps, negative real rates and persistent

capital outflows.

The yen was close to historical lows at the end of 2025

after a roller-coaster year. The yen appreciated in the first

four months of last year in common with other currencies

as the US dollar weakened but then it steadily depreciated

by about 13% from the middle of April to year-end.

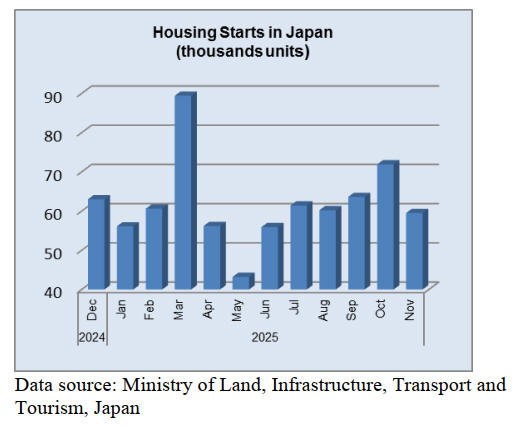

40% of wood demand is tied to construction

Japan's wood consumption is strongly and directly

influenced by housing starts as the residential housing

sector is the largest end-use market for lumber in the

country. Approximately 40-43% of the nation's wood

demand is tied to construction with about 80% of low-rise

residential buildings being wooden structures.

Japan is a construction timber-deficit country and requires

substantial imports to meet its domestic demand. North

America is the primary source for softwood logs and

sawnwood with Canada often holding the largest share

followed by the US. Fluctuations in domestic housing

starts, therefore, also influence the volume and origin of

imported wood products

Speculation continues to real estate drive prices

higher

For years, property prices in urban areas barely changed,

then in 2023 the market awoke as investment money

started pouring into the real estate sector. In many cases

buyers were quickly reselling for profit, a practice that

continues to drive prices higher and pushing house-hunters

toward the second hand homes. The Tokyo municipal

government has developed plans to secure affordable

homes for young people.

In a related article, The Mainichi says Tokyo's Chiyoda

Ward Government has requested the real estate industry to

prohibit the resale of properties for five years after

purchase.

The Kobe Municipal Government is considering imposing

a "vacancy tax" on owners of unoccupied residences, with

high-rise condominiums in mind. However, excessive

government intervention could disrupt market functions

and infringe on property owners' rights.

See: https://www3.nhk.or.jp/nhkworld/en/shows/4002990/

and

https://mainichi.jp/english/articles/20250922/p2a/00m/0op/00700

0c

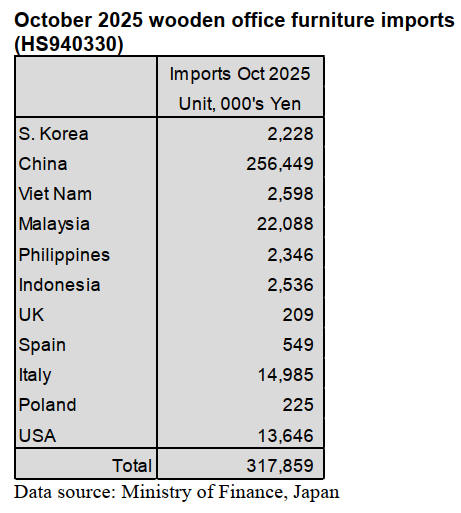

Wooden furniture imports

Online shopping now accounts for nearly a third of interior

Household item sales, a major shift in purchasing

behavior. To remain competitive manufacturers are adding

features like wireless chargers and focusing on multi-

functional pieces, especially for indoor use.

The weak yen continues to raise import costs pressuring

smaller manufacturers and leading to interest in domestic

wood substitution.

October 2025 wooden office furniture imports

(HS940330)

In October three suppliers accounted for over 90% of

imports of wooden office furniture: China (81%),

Malaysia (7%) and Italy (5%). October shipments of

HS940330 from Malaysia were up significantly compared

to the value shipped in September and Malaysia took the

second spot in terms of value. The other significant source

of wooden office furniture in October was the US.

Year on year, the value of Japan’s imports of wooden

office furniture (HS940330) in October rose around 10%

and compared to the value of September arrivals there was

an over 50% increase in the value of arrivals.

October 2025 wooden kitchen furniture imports

(HS940340)

As in previous months the value of October imports of

wooden kitchen furniture (HS940340) were dominated by

shippers in the Philippines (55% of imports) and Viet Nam

(29% of imports). The value of October imports from both

the Philippines and Viet Nam extended the recovery from

the August downturn with the value of imports for each

supplier rising around 20%.

The value of September arrivals of HS940340 from China

(5% of the total) was around the same level as in

September.

Year on year, the value of October wooden kitchen

furniture imports were little changed from a month earlier

but compared to the value of September arrivals there was

a 13% rise in October.

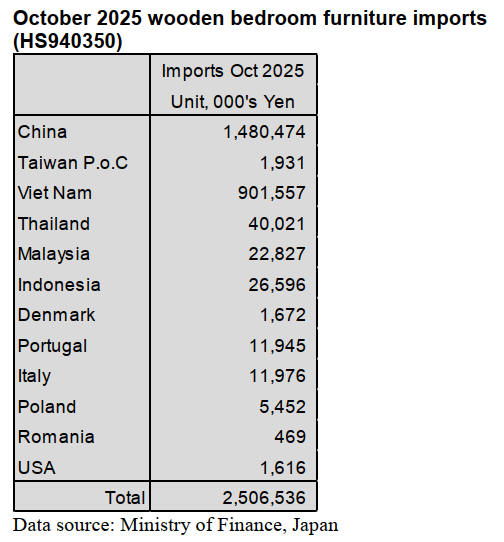

October 2025 wooden bedroom furniture imports

(HS940350)

After the volatile trend in the value of imports in the early

part of 2025, imports steadied in the third quarter of 2025.

September saw a slight dip in the value of imports

compare to a month earlier but this was reversed in

October as the value of imports rose.

The top two shippers of HS940350 to Japan in October

remained China, 59% (63% in September) and Viet Nam

36% (29% in September).

The other top source of October imports of wooden

bedroom furniture was Thailand (2% of the total for

HS940350). Italy was a major supplier in September but in

October the value of imports dropped, at the same time the

value of imports from Portugal rose significantly.

Year on year there was a decline in the value of October

imports but compared to a month earlier October 2025

imports rose slightly.

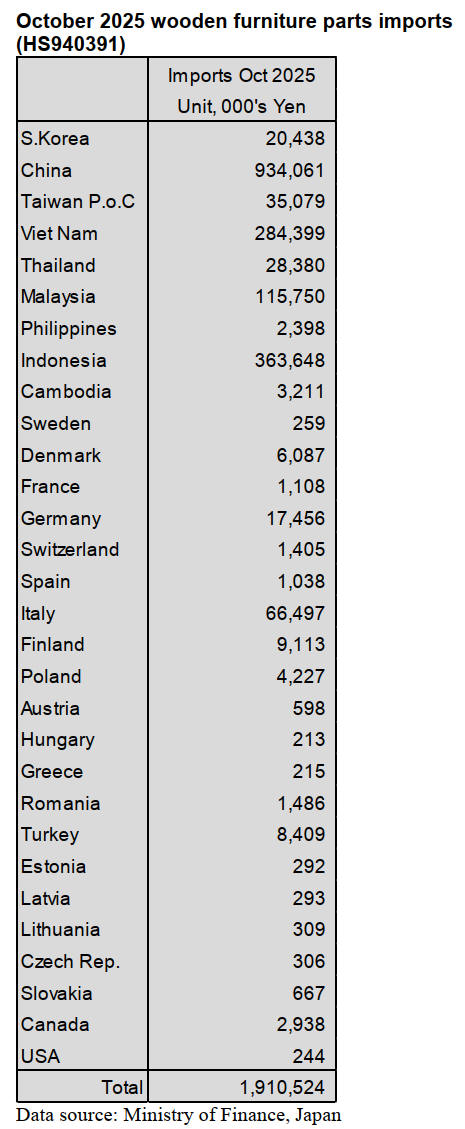

October 2025 wooden furniture parts imports (HS

940391)

The value of wooden furniture parts imported into Japan

up to October 2025 remained remarkably consistent except

for the peak in January. As in previous months shippers in

China and Indonesia dominated October imports with Viet

Nam contributing just 15% of the value of October

arrivals.

Of the total value of HS940391 imports in October 49%

was delivered from China (47% in September), 19% from

Indonesia (21% in September) and 15% from Viet Nam

(14% in September). Malaysia, once again, secured a 6%

share of the value of October imports.

Of the value of Imports of HS940391 from shippers

in

Europe (6% of the October total) more than half was from

Italy.

Year on year the value of October imports of HS940391

was down around 6% and there was an 8% decline in

value compared to September.

Trade news from the Japan Lumber Reports (JLR)

The Japan Lumber Reports (JLR), a subscription trade

journal published every two weeks in English, is

generously allowing the ITTO Tropical Timber Market

Report to reproduce news on the Japanese market

precisely as it appears in the JLR. For the JLR report

please see: https://jfpj.jp/japan_lumber_reports/

Yamaha teams up with Indian sawmill

Yamaha Corporation has signed a cooperation agreement

with Overseas Traders, an Indian sawmilling company

supplying Indian rosewood, to promote sustainable forest

conservation and management of the species.

Over the next three years, Yamaha will work with local

research institutes and government agencies on initiatives

such as rosewood reforestation and studies on material

utilization efficiency for acoustic and electric guitars,

aiming to develop a sustainable forest conservation model.

Indian rosewood, used for the sides and backs of guitars, is

mainly harvested from state-owned forests in southern

India, but the lack of natural regeneration within these

forests has become a pressing issue.

Responding to rising inventories, higher costs, and weak

prices

The Södra Group has decided to temporarily reduce

production by 20% at its Värö and Mönsterås mills by the

end of the year.

The company has already implemented production

adjustments this year, including temporary suspensions,

but as inventories at several mills currently exceed

planned levels and the imbalance of rising production

costs—such as higher log prices—not being passed on to

product prices persists, it will carry out production cuts in

response.

The company operates six sawmills in Sweden and one in

Finland, a total of seven, making it a major supplier in

Northern Europe. It is a major supplier of whitewood 2x4

lumber to the Japanese market.

Of the two mills where a 20% production cut has been

decided, the Värö mill has obtained JAS certification and

handles supply to Japan.

In its second quarter results this year, the company

reported that its performance deteriorated due to sharp

exchange rate fluctuations, geopolitical risks, and

persistently high raw material prices.

To strengthen its long-term position, the company has also

begun implementing competitiveness measures based on a

reduction of 200 employees across both operational and

administrative divisions.

South Sea logs and products

Due to rising prices and higher labor costs, there is no

room for price reductions in tropical hardwood products;

on the contrary, some items are even seeing moves to

explore price increases.

Producers are inclined to pursue more active sales as

market conditions outside Japan have also deteriorated.

However, with various production costs rising or

remaining high, significant price reductions are extremely

difficult.

Moreover, in the case of shipments to Japan, the continued

depreciation of the yen could force substantial price cuts in

order to align with local market levels.

Given these difficulties, sellers have no choice but to

proceed cautiously. In the domestic market, with no

prospect of the yen’s weakness being resolved in the short

term, expectations for price cuts from producers are

fading, and buyers are limiting procurement to the

minimum necessary for immediate work. As for tropical

hardwood logs, major arrivals were largely completed by

October, and demand has been covered through around

March of the new year.

North American logs

Concerns have been raised that rising domestic log prices

in the U.S. may push up prices for Japan as well, but the

December shipment price of U.S. Douglas fir logs bound

for Japan was settled at around USD 970 per 1,000 board

feet (FAS, Scribner scale) for IS-grade.

Import costs are about ¥2,000 higher than the previous

month, and ocean freight rates are rising toward the year-

end. The Japan-bound price of Canadian logs is USD

1,260 per 1,000 board feet (C&F, Scribner scale) for

Douglas fir IS-grade, and USD 1,300 per 1,000 board feet

(C&F, Scribner

scale) for SS-grade. Canadian hemlock logs are priced at

around USD 1,100 (C&F, per 1,000 board feet, Scribner

scale), about USD 50 higher than those from Alaska, but

still considered inexpensive for the Asian market.

|