|

1.

CENTRAL AND WEST AFRICA

Cameroon – reports of a tax incentive in its 2026

finance law to encourage SFM

The Cameroon timber sector differs significantly from that

in Gabon experience. The country is considered by

operators to be expensive to operate in but benefits from a

high population and a workforce that is inventive,

motivated and willing to work.

Several companies operate extremely large forest areas,

ranging from 200- 600,000 hectares, a scale that would be

impossible in Gabon, where the legal maximum per UFA

is 200,000 hectares.

Cameroon has introduced a tax incentive in its 2026

finance law to encourage sustainable forest management

aimed at reducing illegal activities. As of 1 January 2026 a

reduction of between 25% and 35% will apply to the

annual forestry fee paid to the State by logging companies

Finance Minister, Louis Paul Motazé, said in a circular on

budget execution.

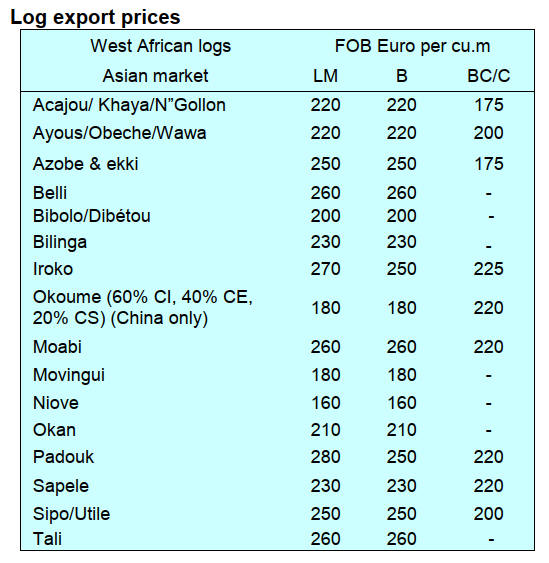

Prices for most timbers in Cameroon are rising. For Azobé

strict cutting limits are in place. Thickness is restricted to

15 cm while production of 20 cm thickness requires

special authorisation. However, unusually large

dimensions of Afzelia (40 × 40 cm and 50 × 50 cm) were

observed for export to Vietnam. This was explained

locally as a “special species only for Vietnam.”

Vietnam became the second-largest market for Cameroon

timbers after China. From 2016 to 2019 Cameroon logs

accounted for about 25% of Vietnam’s tropical log

imports according to a recent article.

See: https://www.ecofinagency.com/news-agriculture/1001-

51822-cameroon-cuts-forestry-taxes-to-promote-sustainable-

logging

Over recent weeks no rainfall was recorded. According to

local foresters rainfall levels were lower than last year

with heavy but short and late rains. Cameroon is now

entering its six-month dry season which should improve

forest access and transport conditions.

A major operational limitation remains the trucking

regulation that restricts log trucks to a maximum of 25

cu.m per load. As a result, trucks often carry only two or

three logs per journey, increasing transport costs and

reducing efficiency.

Gabon – reports suggest export duties raised

2026 began with several major focus area’s affecting

forestry operations and exports. These include the

introduction of EUTR compliance, carbon regulations, log

bans, and new CITES measures. In addition, the Finance

Law 2026 has now been passed and introduces higher

customs export duties for transformed timber products.

Unconfirmed reports suggest export duties effective 1

January 2026 are as follows: First transformation products

such as sawn timber and peeled veneer are taxed at 15%

(previously 7.5%). Second transformation products such

as plywood and kiln-dried timber are taxed at 10%

(previously 5%). Third transformation products such as

furniture and finished goods remain taxed at 3.5%.

These increases come at a time when international markets

are weak, placing strong pressure on margins and pricing.

No major policy or operational challenges have been

reported, however, heavy rains continue in eastern Gabon

causing delays in trucking operations to Libreville Port

(Owendo). These weather-related disruptions remain the

main logistical constraint for timber transport.

The domestic media has reported Gabon’s President Brice

Clotaire Nguema has announced the establishment of a

new government line up. The Minister of Water and

Forests, Environment and Climate, in charge of Human-

Wildlife Conflict is Maurice Allogho Ntossui.

See: https://www.ecofinagency.com/news/0301-51747-gabon-

unveils-new-government-cabinet-expands-to-31-members

Upcountry areas continue to experience light rainfall.

Harvesting remains at a low level due to weak market

demand in Asia and Europe. The main harvested species

continue to be Okoume, Okan, Azobé and redwoods.

Transport remains affected by the previous rainy period,

particularly in the south and east of the country where

trucking times can still reach two to three days. However,

road conditions are improving steadily due to ongoing

rehabilitation works.

Log supply and industrial operations

The GSEZ log park in the Nkok Special Economic Zone

has been rebuilding Okoume stocks following the

conclusion of investigations by the government Task

Force. Current log stocks at GSEZ are estimated at

approximately 3,000 cu.m, consisting mainly of Bosse,

Sapelli, Padouk, some Azobé and Okan and limited

volumes of Okoume.

Peeling mills in Nkok are currently operating one shift.

India and China remain steady buyers although overall,

Chinese demand for Gabonese sawnwood remains very

weak.

Road rehabilitation is progressing under a four-year

government programme covering 3,000 km of concrete

and tarmac roads, financed by the Islamic Bank and the

African Development Bank (BAD). Central regions

including Lastourville, Lopé, Makokou, Okondja and

Makoukou are now benefiting from improved all-weather

laterite roads. Transport time from Makokou and Okondja

to Owendo Port has been reduced to one to two days.

A second railway corridor is again under study linking the

Belinga mining site to the planned Mayumba deep-water

port. This project is being reactivated under joint

Chinese/Australian management.

A further iron and manganese port between Port-Gentil

and Mayumba is also under study.

Port operations in Owendo remain stable. Container

availability is sufficient. Ships are waiting a few days

before berthing but port operations are otherwise

functioning normally.

Electricity supply remains unstable. Power cuts continued

into the New Year with multiple outages per day.

Although additional Turkish power ships are planned

reliability remains a major concern for industrial

operators.

Market demand and trade flows

China remains the weakest market for Gabonese sawmills.

Philippines demand is said to be declining. Vietnam

remains strong for Tali, Padouk and Niove. The Middle

East market is improving as Brazilian softwood prices

have started to increase.

Brazil remains Gabon’s main competitive threat at present.

A large automated sawmill in Brazil is producing

approximately 5,000 cu.m of sawn pine with only 40

employees and offering prices around €210–220 per cu.m

CIF Middle East. This pricing has severely impacted

Okoume demand. However, recent information suggests

Brazilian prices are now rising.

European demand remains weak with orders limited to

supply-on-demand due to high stock levels.

Republic of the Congo

Rainfall has declined across the country allowing

harvesting activities to continue under more stable

conditions. However, production remains below capacity

due to weak international markets.

The main commercial species remain Sapelli, Ayous,

Iroko, Padouk, Azobé and Okoumé in the northern

regions. Harvesting activity has slowed due to weak

Chinese demand. Sawmills are increasingly turning toward

European markets creating a risk of oversupply similar to

the situation previously experienced with Padouk.

The Philippines has reduced demand for Okoumé while

Vietnam remains active for Tali, Padouk and Niové.

Demand in Middle East countries for Okoumé sawnwood

remains weak. European demand is limited with operators

cautious about oversupplying red species.

The Republic of the Congo is a large and logistically

complex country. For many northern operators transport to

Douala Port in Cameroon is preferred over Pointe-Noire in

the south, which is approximately 1,400 km away.

Transport from northern Congo and the Central African

Republic to Douala continues to face challenges due to the

lack of surfaced roads over the 1,200 km route from

Bangui to Douala.

Conditions in the Likouala region are improving,

supported by reduced rainfall and ongoing repairs to

laterite roads. Timber from this region is increasingly

shipped by container through Kribi Port in Cameroon

while logs continue to move through Douala.

Reports suggest sawmills currently hold log stocks

sufficient for approximately two to three months of

operation. However, production remains cautious due to

subdued demand and uncertainty in export markets.

Operators observe that the forestry administration remains

well organised and maintains strict control over forest

operations and exports. Congo continues to enforce CITES

regulations and applies EUTR requirements for exports to

Europe. Only southern Congo produces Okoumé, which is

largely absent in northern Congo and Cameroon. Northern

Congo production is dominated by Sapelli, Sipo and other

red species.

The Republic of the Congo enters 2026 with improving

weather conditions and stable forest operations but

production remains constrained by weak demand from

China and subdued European markets. Logistics remain

challenging due to long transport distances although

conditions are slowly improving in key production

regions.

2.

GHANA

Parliament bans mining in forest reserves

Parliament has reinstated a full ban on mining in forest

reserves as part of broad environmental reforms aimed at

safeguarding water resources, reversing deforestation and

strengthening protection against illegal mining.

The Environmental Protection (Mining in Forest Reserves)

Revocation Instrument 2025 which nullifies L.I. 2462 was

put before parliament by the Acting Minister for

Environment, Science and Technology and Minister for

Lands and Natural Resources in October 2025.

According to the Ministry of Environment, Science and

Technology (MEST) the repeal of the June 2022

Environmental Protection (Mining in Forest Reserves)

Regulations became law effective in December 2025 after

the mandatory 21-day constitutional period. The decision

marks a decisive shift in Ghana’s environmental policy

framework restoring blanket protection for forest reserves.

Environmental civil society organisations and public

interest groups, including A Rocha Ghana, OXFAM and

the Christian Council hailed the Government for the

revocation of Legislative Instrument (L.I.) 2462,

describing it as a major victory for forest protection and

environmental governance.

They argued that L.I 2462 undermined sustainable forest

management, contradicted the Forest Development Master

Plan (2016–2036) and conflicted with Ghana’s

international commitments under the Paris Agreement and

Convention on Biological Diversity.

While praising the move they criticised the long delay in

revoking the law which faced months of widespread

criticism and urged the Legislature to avoid politicising

the fight against galamsey. They also called on

government for a review of Act 703 to explicitly ban

mining in reserves.

Awula Serwaa of Eco Conscious Citizen stressed that

repealing the law alone is insufficient, urging government

to adequately resource the Forestry Commission to enforce

protection. Data shows that over 50 of the country’s 288

reserves came under mining pressure leaving 80%

vulnerable even after a 2025 amendment.

See: https://gna.org.gh/2025/12/ghana-revokes-controversial-

mining-law-paving-way-for-forest-conservation/

and

https://www.myjoyonline.com/csos-commend-govt-for-

revoking-l-i-2462-call-for-stronger-forest-protection-measures/

Primary products accounted for 66% of wood exports

ending October 2025

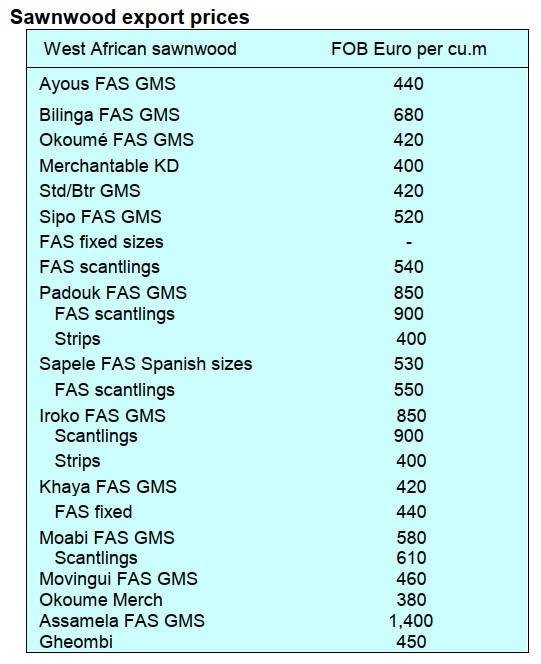

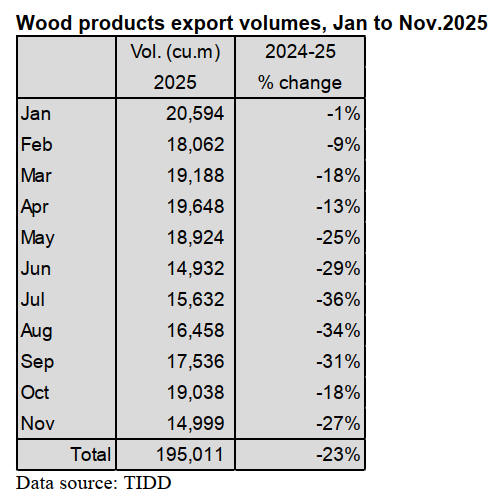

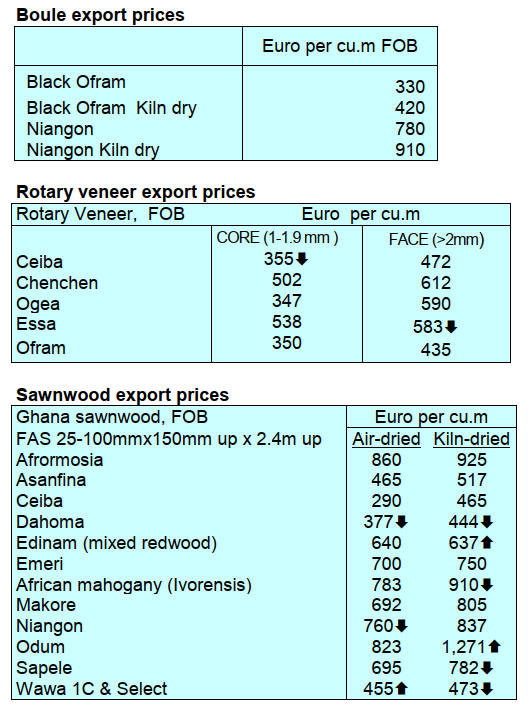

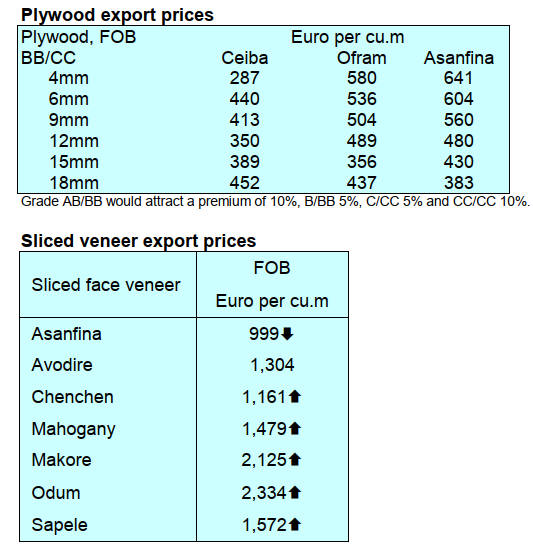

Ghana’s timber and wood product exports in November

2025 generated Eur7.03 million from a volume of 14,999

cu.m, reflecting declines of 25% in value and 27% in

volume compared with November 2024.

From January–November 2025 cumulative exports totalled

Eur89.39 million from 195,011 cu.m, marking declines of

21% in value and 23% in volume compared with the same

period in 2024. Despite reduced trade, the average unit

price rose slightly by around 2%, from €450 to €458 per

cu.m.

Primary products contributed 53% of the export value

while secondary and tertiary products accounted for 42%

and 5%, respectively. Asia remained Ghana’s largest

market (52%), followed by Europe (25%), Africa (10%),

America (10%) and the Middle East (3%) with Oceania

showing modest growth (0.1%).

The data showed that fifty-six exporters traded. Shipments

comprised 13 product types across 45 species reaching 36

countries and 82 buyers.

Top products were sawnwood (Air Dried/Kiln Dried),

Plywood (Overland/Overseas) and billets, with Teak,

Wawa, Denya, Cedrela and Ceiba as leading species.

India, Vietnam, USA, Germany and Togo were the main

market destinations for Ghana’s wood products.

According to the Indian High Commissioner, Manish

Gupta, bilateral trade between Ghana and India, which

includes wood products, has surpassed US$3 billion

annually with ambitions to double this within five years

under Ghana’s 24-Hour Economy Initiative.

Strengthening forest governance

The Forestry Commission (FC) has reinforced its

leadership in sustainable forest governance with the

signing of a new Memorandum of Understanding (MoU)

between the Governments of Ghana and the United

Kingdom.

The Agreement marks a significant milestone in deepening

collaboration on forest legality, climate resilience and

responsible forest management, reaffirming the

Commission’s central role in driving reforms that protect

forest resources while promoting sustainable trade and

livelihoods.

The event brought together the leadership of the Forestry

Commission (FC), representatives of the UK Government,

stakeholders from the private sector, civil society

organisations and development partners underscoring the

shared commitment of both countries to protecting forest

resources and promoting responsible forest-based trade.

The renewed UK support under the MoU, is aimed at

strengthening governance and enforcement and advancing

sustainable financing mechanisms, including the

exploration of payments for ecosystem services.

The Chief Executive of FC, Dr Hugh C.A. Brown,

highlighted the long-standing partnership between Ghana

and the United Kingdom which spans more than two

decades of collaboration in forest law enforcement,

governance and trade.

Christian Rogg, British High Commissioner to Ghana,

described the signing of the MoU as a significant

milestone in the evolving partnership between Ghana and

the United Kingdom.

See: https://mlnr.gov.gh/forestry-commission-strengthens-forest-

governance-through-renewed-uk-ghana-partnership/

Economic recovery gaining momentum

Ghana’s economic recovery gained momentum in late

2025 with the International Monetary Fund approving a

US$380 million disbursement under the Extended Credit

Facility, part of a US$3 billion bailout package. The

decision followed the Fifth Review of Ghana’s programme

performance and reflects progress in restoring stability and

investor confidence.

The country’s inflation dropped sharply to 5.4% in

December 2025, down from 24% a year earlier marking

twelve consecutive months of disinflation. The Ghana cedi

achieved a historic 32% appreciation against the US dollar

last year, its first annual gain in over three decades.

While fiscal discipline was reinforced by the early

settlement of a US$709 million Eurobond, bringing total

repayments to US$1.4 billion for the year. This reaffirms

Ghana’s credibility as a sovereign borrower and

underscores Government’s commitment to restoring

investor confidence through transparent, predictable and

disciplined debt-service practices.

In related news, the Bank of Ghana reduced its policy rate

to 18% urging banks to expand credit to SMEs to spur

economic growth. Looking ahead, the Governor of the

Bank of Ghana, Johnson Asiama, announced plans to roll

out a National Remittance Strategy and Remittance

Roadshow initiative with the Ministry of Finance in 2026

to boost foreign exchange inflows.

See: https://theheraldghana.com/imf-approves-380m-for-ghana-

after-latest-programme-review/

and

https://statsghana.gov.gh/gssmain/storage/img/marqueeupdater/D

ecember%202025CPI-Bulletin.pdf

and

https://www.mofep.gov.gh/news-and-events/2025-12-

31/%20government-of-ghana-settles-us709-million-eurobond-

obligation

3. MALAYSIA

Delayed tariff hike offers limited relief

The decision by the United States to delay higher tariffs on

selected furniture products offers limited relief to

Malaysian manufacturers amid rising domestic costs and

weak demand especially in the US, say exporters.

The US has postponed planned tariff increases on

upholstered furniture, kitchen cabinets and vanities,

keeping the current 25% rate in place. Tariffs on certain

upholstered wooden products were previously set to rise to

30% 1 January, while duties on kitchen cabinets and

vanities were due to increase to 50%.

In April last year, the United States announced sweeping -

tariffs on imports from nearly all countries around the

world, including Malaysia. Malaysian exports were

initially subjected to a 25% tariff but an Executive Order

signed by the US President in August 2025 reduced these

to 19%. However, new 25% tariffs which affected kitchen

cabinets and upholstered furniture were imposed in

September and took effect in October.

Malaysian Furniture Council president, Desmond Tan

Boon Hai, said the change does not significantly improve

Malaysia’s competitiveness as the same tariff rate was

imposed on many other countries. For some local

manufacturers, Tan said, the extension of the 25% tariff

would have only a modest impact as it mainly affects

kitchen cabinets, vanities and upholstered furniture.

Tan added the industry hopes the government can

renegotiate tariffs on Malaysian-made furniture with

Washington though such efforts ultimately depend on a

bilateral agreement. On domestic challenges he said the

government could provide more immediate support by

reviewing policies that have significantly raised operating

costs for furniture makers.

“These include the expansion of the sales and service tax

(SST), mandatory EPF contributions (a national retirement

fund) for foreign workers, minimum wage adjustments,

recalibrated petrol and electricity tariffs and the multi-tier

levy on foreign workers due to take effect this year,” he

said.

Tan warned that the multi-tier levy, introduced to

encourage the hiring of local workers by making foreign

labour more expensive may not achieve its intended

outcome. “The reality is that the industry may not be able

to afford the new levy while locals continue to shun jobs

in timber sector,” he said, warning that prolonged pressure

could put the wider furniture, timber and export industries

at risk. He urged the government to consider exemptions

from costly policies and provide fast-track financial

assistance to companies badly affected.

“These measures would give firms time to adjust,

including expanding their design offerings, improving

their manufacturing processes, and speeding up delivery

times to remain competitive globally,” he said.

Kuala Lumpur and Selangor Furniture Association

honorary president, Matthew Law, said weak US

consumer demand continues to impact the industry. “The

residential sector shows no improvement” he said.

See: https://www.thestar.com.my/news/nation/2026/01/03/little-

joy-for-local-furniture-players

Sabah Guidelines for plantations

The Sabah Forestry Department has released three new

publications aimed at enhancing forest plantation

development and strengthening the management of tree

genetic resources in the State. The publications are titled

‘Guidelines for Selecting Candidate Plus Trees (CPT) for

Forest Plantation Species’,’ Photo Collection of Candidate

Plus Trees (CPT) of Local Forest Plantation Species in

Sabah’ and ‘Photo Collection of Candidate Plus Trees

(CPT) of Exotic Forest Plantation Species in Sabah’.

Chief Conservator of Forests, Frederick Kugan, said the

forest plantation industry remains an essential pillar of

Sabah’s timber sector providing a sustainable supply of

raw materials while driving economic growth and

improving community well-being.

“The selection of Candidate Plus Trees (CPT) is a vital

scientific approach in tree breeding programmes. This

method evaluates superior characteristics such as growth

performance, stem form, disease resistance and fruit

production to ensure high genetic quality of planting

materials,” he said.

The publications serve as comprehensive references for

researchers, estate managers and stakeholders,

underscoring the department’s commitment to

strengthening tree genetic resource development through

sustainable and impactful strategies.

See: https://www.dailyexpress.com.my/news/273521/undefined/

Technology-driven methods to address forest crimes

Sarawak is ramping up its forest enforcement framework

through more strategic, integrated and technology-driven

methods to address increasingly complex forest crimes,

said Sarawak Forest Department Director, Hamden

Mohamad.

He said conventional approaches are no longer sufficient

as the nature of forestry offences has evolved significantly

over the past decade. “The world is changing rapidly and

the enforcement challenges of today are not the same as

those of a decade ago.

Hamden said enforcement officers must progressively

shift from relying solely on physical patrols to

incorporating technology, data analytics and intelligence-

led operations. These enhancements include the use of

drones and satellite imagery for wide-area monitoring,

Geographic Information Systems, digital mapping, data

analysis and crime intelligence, real-time detection

systems as well as smart cameras and forest forensics

technology.

The Sarawak Forest Department and the Enforcement

Leadership Management University (Elmu) signed a

memorandum of understanding to strengthen the capacity

of enforcement officers statewide and bolster forest

protection. Hamden said the collaboration will allow

officers to undergo training and further studies at Elmu.

“We will also look into establishing a training scheme for

the university to assist enforcement personnel, not only in

Sarawak but also throughout Malaysia,” he said.

He added that continuous upskilling is essential as officers

must keep pace with current legislation, new enforcement

techniques and evolving technologies to safeguard the

state’s forest heritage.

See: https://www.theborneopost.com/2025/12/12/sarawak-

boosts-forest-protection-with-drones-satellite-monitoring-and-

data-analytics/

Ensuring industry’s survival and long-term alignment

with global sustainability expectations

The Sabah Timber Industries Association (STIA) has

called on the State Government to introduce measures

which are deemed necessary to ensure the industry’s

survival and long-term alignment with global

sustainability expectations. The measures are:

Enhance investment incentives to attract both

local and foreign investors into modern,

technology-driven wood-based manufacturing.

Accelerate industrial tree plantation development

and expansion to reduce dependence on natural

forests and to secure long-term raw material

supply.

Introduce targeted financing schemes and

incentives to support industry upgrading and

sustainability compliance.

Strengthen cross-agency cooperation to

streamline approvals and reduce red tape and

regulatory processes for plantation and

downstream industry development, while

promoting digitalisation systems across

government agencies to enhance inter-agency

coordination and ensure a faster, more efficient

delivery system in Sabah.

Support skills development programmes to

prepare young Sabahan workers for a modernised

timber ecosystem.

See: https://www.dailyexpress.com.my/news/272251/sabah-

timber-industries-association-urges-urgent-measures-to-stabilise-

industry/

4.

INDONESIA

Processed Wood

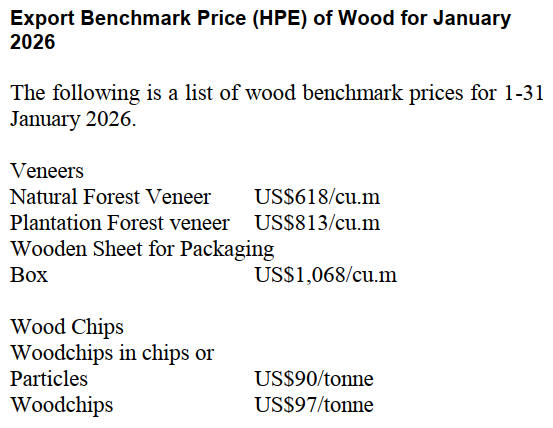

Processed wood products which are leveled on all four

sides so that the surface becomes even and smooth with

the provisions of a cross-sectional area of 1,000 sq.mm to

4,000 sq.mm (ex 4407.11.00 to ex 4407.99.90)

Processed wood products which are leveled on all four

sides so that the surface becomes even and smooth of

Merbau wood with the provisions of a cross-sectional area

of 4,000 sq.mm to 10,000 sq.mm (ex 4407.11.00 to ex

407.99.90) US$1,500/cu.m.

See: https://jdih.kemendag.go.id/peraturan/keputusan-menteri-

perdagangan-republik-indonesia-nomor-2139-tahun-2025-

tentang-harga-patokan-ekspor-dan-harga-referensi-atas-produk-

pertanian-dan-kehutanan-yang-dikenakan-bea-keluar-dan-tarif-

layanan-badan-layanan-umum

Review of national forest governance

President Prabowo Subianto instructed the Minister of

Forestry, Raja Juli Antoni, to conduct a review of national

forest governance as part of broader structural reforms in

the forestry sector. The directive follows a series of

ecological disasters in several regions which the

government believes are linked to weak governance.

The Ministry of Forestry has proposed establishing a

Regional Forestry Office Head in each province to reduce

the wide gap in control between the ministry and its

technical units which it is believed contributed to not

identifying problems that led to severe flooding. The

minister said this new structure would strengthen policy

implementation at the local level.

See: https://www.metrotvnews.com/read/kWDCze4w-prabowo-

perintahkan-menhut-evaluasi-total-tata-kelola-hutan-nasional

Forest permits covering over 1 million hectares

revoked

The government has revoked 22 forest-use permits

covering a total of more than 1 million hectares

nationwide according to Forestry Minister, Raja Juli

Antoni. The decision follows a directive from the

President and is part of the government’s broader effort to

maitain order in the forestry sector. With this latest action,

the government has now addressed around 1.5 million

hectares of problematic forest land.

The government is also taking legal steps through the

Forest Area Order Task Force, particularly in Aceh, North

Sumatra and West Sumatra targeting cases linked to illegal

logging.

See: https://en.antaranews.com/news/396613/indonesia-revokes-

22-forest-permits-covering-over-1-million-hectares

and

https://hijau.bisnis.com/read/20251215/651/1936900/pemerintah-

cabut-22-izin-pemanfaatan-hutan-seluas-lebih-dari-1-juta-hektare

Chamber of Commerce proposes furniture industry

incentives

The Indonesian Chamber of Commerce and Industry

(Kadin) met with Finance Minister, Purbaya Yudhi

Sadewa, to discuss deregulation and incentives for the

national furniture industry.

Kadin Chairperson, Anindya Novyan Bakrie, highlighted

that while the global furniture market is worth around

US$300 billion Indonesia contributes only about US$2.5

billion. Although the industry’s growth remains healthy he

noted that Indonesia’s trade surplus is shrinking due to

rising imports. The proposed incentives include access to

financing with more competitive interest rates and support

for resource-based industrialisation, such as for the rattan

sector.

Anindya also stressed the need to diversify export markets

as nearly 60% of Indonesia’s furniture exporters still rely

on the United States while there is potential for expansion

to Canada and the European Union.

HIMKI Chairperson, Ahmad Sobur, urged the government

to provide financial support pointing out that exporters

currently access loans at around 6% interest through the

Indonesian Export Financing Institution (LPEI). In

response, Finance Minister Purbaya said the government

would review LPEI’s internal condition before expanding

incentive support for the furniture industry through the

institution.

See: https://en.tempo.co/read/2074881/kadin-indonesia-pushes-

furniture-industry-incentives-in-meeting-with-finance-

minister?tracking_page_direct

and

https://en.antaranews.com/news/397513/indonesia-allocates-rp2-

trillion-to-boost-textile-furniture-exports

and

https://www.cnnindonesia.com/ekonomi/20251219192114-92-

1308816/purbaya-siap-dukung-pelaku-industri-furnitur-ri

Furniture and craft industries anticipate a rebound in

export demand

Indonesia’s furniture and handicraft industry is optimistic

about an export market rebound in 2026 supported by

expectations of global monetary policy easing and

improving consumer sentiment.

Industry leaders anticipate that growth will be led by

value-added, sustainable and design-driven products

following a relatively stable and consolidative

performance in 2025. While prospects are improving the

recovery is expected to unfold gradually and selectively

across markets.

Despite the positive outlook, the industry continues to face

internal challenges such as high financing costs, efficiency

pressures, inconsistent raw material supplies and rising

compliance costs linked to sustainability certifications,

particularly for MSMEs.

External risks include volatile logistics costs, intense

competition from Vietnam and China and stricter trade

policies including the EU’s deforestation regulation and

US tariffs. To address these challenges, HIMKI is

prioritising a green industry strategy focused on

sustainability, productivity, product differentiation and

stronger branding while emphasising the need for

supportive government policies to maintain

competitiveness.

See: https://www.msn.com/id-id/berita/other/pelaku-industri-

mebel-dan-kerajinan-optimistis-pasar-ekspor-pulih-di-tahun-

2026/ar-AA1SThiv?ocid=BingNewsVerp

and

https://www.antaranews.com/berita/5325943/himki-yakini-2026-

penuh-peluang-bagi-industri-furnitur-kerajinan

Opportunities for performance-based REDD+ financing

in regions

Indonesia’s Ministry of Forestry has created opportunities

for performance-based financing for the implementation of

the REDD+ scheme at the regional level emphasising the

importance of strong collaboration between the central and

regional governments.

Forestry Minister, Raja Juli Antoni, highlighted that

national success in reducing emissions depends heavily on

forest management performance in the regions.

One key financing mechanism is the ART-TREES scheme

which applies a jurisdictional, performance-based

approach while maintaining environmental integrity and

international accountability.

The ministry praised regional leaders for their

commitment to forest and environmental protection. The

ministry encourages regional governments to further

strengthen forest conservation, reduce deforestation and

degradation, improve data and monitoring systems and

ensure fair and sustainable participation of indigenous

peoples and local communities.

According to an October 2025 report, Indonesia’s REDD+

implementation has successfully reduced emissions in the

forestry and land-use sector and gained international

recognition through Result-Based Payments totaling

US$499.8 million, with US$340.7 million already

disbursed. This includes US$103.8 million in support from

the Green Climate Fund through UNDP.

See:https://www.antaranews.com/berita/5327518/kemenhut-

buka-peluang-pendanaan-redd-berbasis-kinerja-di-daerah

and

https://www.kehutanan.go.id/news/kemenhut-buka-peluang-

pendanaan-redd-berbasis-kinerja-bagi-daerah

FTA with EAEU signed, Indonesia eyes wider Eurasian

market access

Indonesia has signed a free trade agreement (FTA) with

the Eurasian Economic Union (EAEU) to reduce trade

tariffs and expand access for Indonesian products to non-

traditional Eurasian markets. The agreement was signed

on December 21, 2025, at the EAEU Summit in Saint

Petersburg, Russia, with Trade Minister Budi Santoso

representing Indonesia.

The FTA is expected to help Indonesia penetrate a market

of around 180 million people with a combined GDP of

US$2.56 trillion while supporting the country’s strategy to

diversify export destinations and attract new investment,

particularly in manufacturing and agriculture.

The pact consists of 15 chapters covering market access,

trade facilitation and economic cooperation and includes

the EAEU’s commitment to apply preferential tariffs on

90.5% of tariff lines for Indonesian products. This is

projected to boost exports of palm oil and its derivatives,

textiles, footwear, fishery products, natural rubber,

furniture and electronics.

In return, Indonesia offers EAEU members access to its

large and growing domestic market of 281.6 million

people and a GDP of US$1.4 trillion, marking the

Agreement as a strategic step toward deeper and balanced

economic partnership.

See: https://en.antaranews.com/news/397396/indonesia-seals-fta-

with-eaeu-eyes-wider-eurasian-market-access

Indonesia accelerates tariff negotiations

with US

Indonesia is accelerating its trade and tariff negotiations

with the United States aiming to finalise an agreement in

early 2026. The US is Indonesia’s second-largest trading

partner with trade valued at US$28.14 billion from

January to November 2025, following China at US$58.24

billion.

A negotiating team is scheduled to travel to the US for

drafting an agreement expected to be signed by President

Prabowo Subianto and US President by the end of

January.

Coordinating Minister for Economic Affairs, Airlangga

Hartarto, confirmed that all major issues have been agreed

in principle. Under the Agreement Indonesia will expand

market access for US products, reduce non-tariff barriers

and enhance cooperation in digital technology and national

security. In exchange, the US will grant tariff exemptions

for key Indonesian exports, including palm oil, cocoa,

coffee and tea.

See: https://kalsel.antaranews.com/berita/499061/indonesia-

speeds-up-tariff-negotiations-with-us

5.

MYANMAR

6.

INDIA

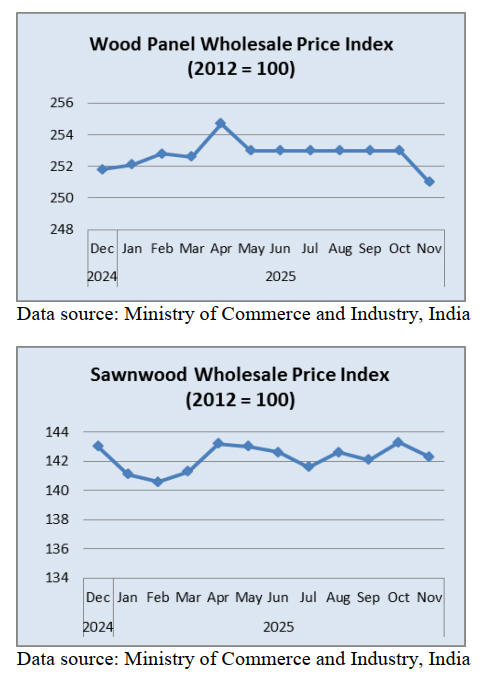

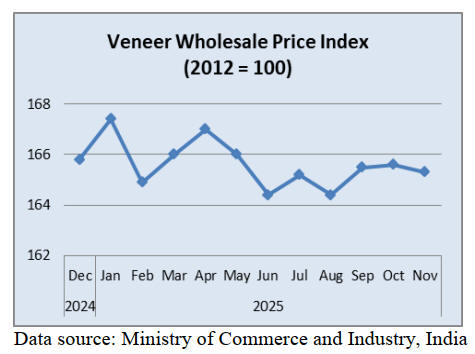

Price indices for wood products tilt lower

The annual rate of inflation based on the all India

Wholesale Price Index (WPI) was -0.32% for November

2025 (over November 2024). The negative rate of inflation

in November 2025 was primarily due to decreased prices

for food articles, mineral oils, crude petroleum and natural

gas, manufacture of basic metals and electricity.

The index for this major group decreased by (-) 0.07%

from 145.1 for October 2025 to 145.0 in November 2025.

Out of the 22 NIC two-digit groups for manufactured

products 14 groups witnessed a decrease in prices, 7

groups witnessed an increase in prices and 1 group

witnessed no change in price.

Some of the important groups that showed month on

month decreased prices were manufacture of fabricated

metal products (except machinery and equipment) food

products, other non-metallic mineral products, computer,

electronic and optical products and chemicals and

chemical products. There was a marked decline in the

index for wood panels and sawnwood in November

compared to a month earlier.

Some of the groups that witnessed an increase in prices

were other manufacturing; machinery and equipment,

textiles, electrical equipment and wearing apparel.

See: https://eaindustry.nic.in/

and

file:///C:/Users/Owner/Documents/2026-

MIS/Jan%20a%202026/cmonthly.pdf

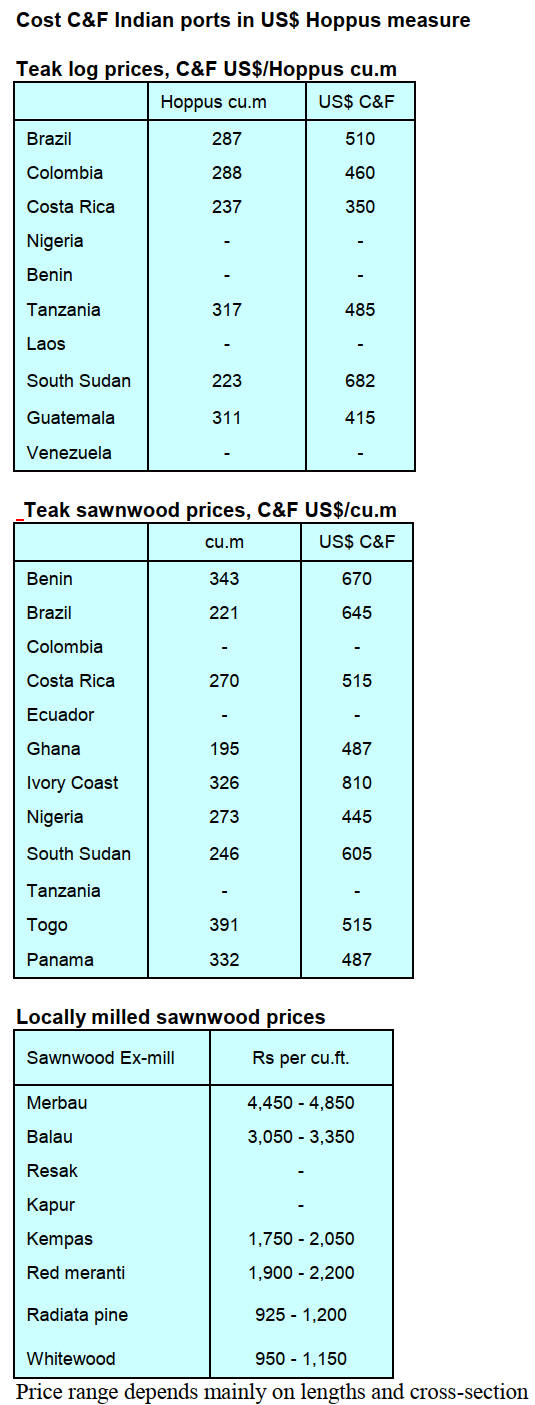

Core veneer supply from Vietnam and Nepal

PlyReporter indicates that core veneer supply from

Vietnam and Nepal has improved significantly for Indian

plywood manufacturers, offering relief from domestic raw

material shortages and high timber costs, with Vietnam

becoming a major supplier of cost-effective

eucalyptus/acacia core veneer and Nepal supplying more

finished plywood, though quality and pricing remain key

factors for Indian buyers.

The number of core veneer containers from Vietnam

increased 25% in October 2025 compared to a month

earlier and was distributed to mills in Gujarat, Rajasthan

and Tamil Nadu. Core veneer importers view that over the

next few months quantity would improve.

Plywood mills located close to the ports in Gujarat, Tamil

Nadu have mostly shifted production using imported core

veneer and logs. Kandla, Vishakhapatnam, Cochin Ports

have received sizeable volumes of logs from Brazil,

Argentina, Uruguay and Australia for core veneer.

There is a report of an increasing number of containers of

core veneers from Nepal to Indian plywood mills in Uttar

Pradesh, Bihar and Jharkhand.

See: https://www.plyreporter.com/article/153812/increasing-

core-veneer-import-from-nepal-vietnam

Decision on commercial plantations in forests attracts

criticism

According to the Downtoearth website

(https://www.downtoearth.org.in/) the central government

has amended forest conservation rules to allow private

entities to undertake commercial plantations in forest areas

without paying long-standing environmental levies, a

move that has raised concerns among former forest

officials, environmentalists and tribal rights groups.

The amendment was triggered by India’s growing

dependence on imports of paper and paperboard, which

have nearly doubled over the past five years.

The change, notified by the Union Ministry of

Environment, Forests and Climate Change allows assisted

natural regeneration, afforestation and plantations carried

out by government or non-government entities to be

treated as “forestry activities”.

As a result such projects will no longer require payment of

Net Present Value (NPV) and the creation of

compensatory afforestation plots.

Downtoearth says “NPV is a one-time charge levied on

users diverting forest land, based on a scientific

calculation of the value of ecosystem goods and services

such as clean air, water, and biodiversity. The value is

compensated through artificial regeneration, protection

and the prevention of pests and diseases, among other

activities. Such plantations will now be considered as

forestry activity.

The amendment has been made under the Van

(Sanrakshan Evam Samvardhan) Adhiniyam, 2023,

formerly the Forest Conservation Act, through changes to

the consolidated guidelines originally notified on

November 29, 2023. The revised provision was approved

by theMministry on 2 January 2026”.

See: https://www.downtoearth.org.in/forests/union-government-

removes-financial-and-ecological-obligations-on-private-

plantations-in-forest-areas#google_vignette

and

https://www.newslaundry.com/2026/01/07/disastrous-modi-govt-

allows-commercial-plantations-in-forests-drops-safeguards

India - promising real estate investment opportunities

India is emerging as one of Asia Pacific’s most promising

real estate investment opportunities as fresh capital

platforms, deeper institutional participation and broader

asset-class expansion reshape the market.

Japanese property developers like Mitsui Fudosan and

Sumitomo Realty are significantly increasing investment

in India‘s booming real estate market and are expanding

beyond traditional segments into logistics and data centres

according to Reuters.

Other Japanese developers in the Indian market include

Daibiru Corp, which started with investments in office

deals in two cities last year. Japanese investors are not the

only ones seeking gains in the Indian property market. US

investment firm Blackstone is India‘s biggest commercial

landlord and roughly half of its US$50 billion in Indian

assets are in real estate.

The Economic Times article suggests foreign investors are

deploying large amounts of capital into Indian real estate“

because India offers a rare combination of high growth

potential, rising demand across residential, commercial

and logistics segments and real-asset stability all wrapped

in a maturing but still under-penetrated real-estate

market“.

See:

https://economictimes.indiatimes.com/industry/services/property-

/-cstruction/why-are-foreigners-betting-big-on-indian-real-

estate/articleshow/125690210.cms?from=mdr

and

https://realestateasia.com/commercial-other/in-focus/how-global-

capital-pivoting-apac-real-estate

7.

VIETNAM

Viet Nam's W&WP exports - US$16.5 billion

in 11

months

A conference to address difficulties, remove trade barriers

and expand the market for wood and forest product

exports was held in November. The Forestry and Forest

Protection Department under the Ministry of Agriculture

and Environment, in coordination with the Ho Chi Minh

City Department of Agriculture and Environment and the

Handicraft and Wood Industry Association of Ho Chi

Minh City (HAWA), hosted this event.

The Deputy Director of the Department of Forestry and

Forest Protection, Nguyen Van Dien, stated that although

exports over 11 months reached US$16.5 billion, growth

is below expectations at only 5.4% below the projected

6%. The main reasons are challenges in exporting to key

markets, technical barriers related to legal wood origin,

transparency requirements and ongoing pressures on

businesses.

Domestic production also faces difficulties due to

extreme

weather which disrupted raw material supply thus

reducing processing output.

Mr. Ho Truc Thanh, Deputy Director of the Ho Chi

Minh

City Department of Agriculture and Environment, noted

that the City currently has over 5,120 enterprises

participating in the wood processing chain and is

promoting green transformation and digitalisation to meet

international standards.

Meanwhile, Deputy Director of the Trade Remedies

Authority under the Ministry of Industry and Trade,

Truong Thuy Linh, reported that by October 2025 Viet

Namese goods faced 297 trade remedy investigations with

the U.S. leading at 77 cases. Authorities recommend that

businesses fully comply with investigation requests,

maintain transparent documentation and proactively

diversify markets.

The conference concluded that the wood industry is

at a

critical stage and requires close coordination between

regulatory agencies and enterprises to sustain export

growth in the coming period.

See:https://en.sggp.org.vn/Viet Nams-wood-exports-

reach-us165-billion-in-11-months-post121945.html

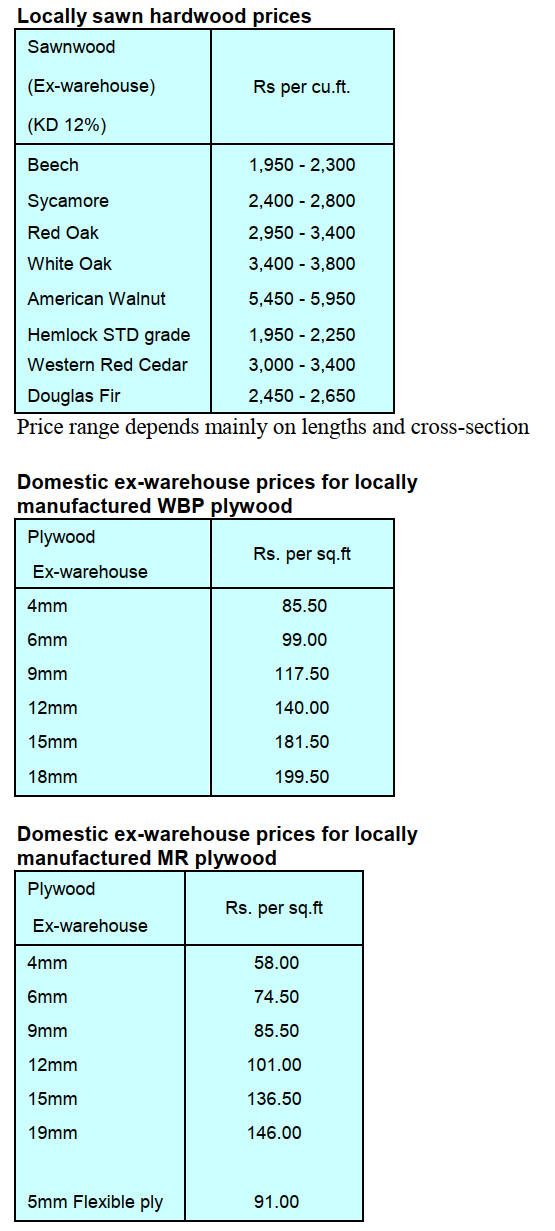

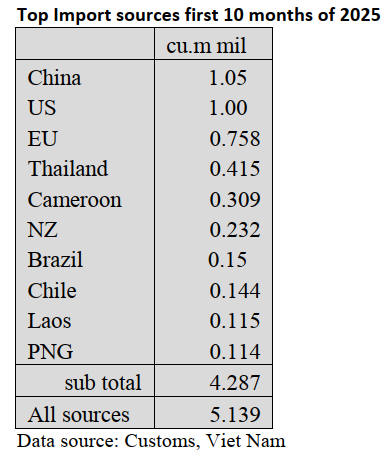

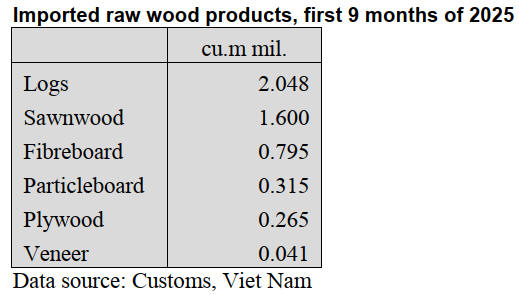

W&WP imports first 11 months 2025

As of 11/15/2025 W&WP imports were valued US$2.76

billion, up 15% over the same period in 2024.

According to preliminary statistics, imports of raw

wood

(sawnwood and logs) in October 2025 reached 530,600

cu.m, worth US$164.5 million, down 5% in volume and

5% in value compared to September 2025 but compared to

October 2024 imports were up 4% in volume and 5% in

value.

In the first 10 months of 2025, raw wood imports were

5.67 million cu.m, worth US$1.79 billion, up 23% in

volume and 20% in value over the same period in 2024.

Import prices

In the first 9 months of 2025 the average import price of

raw wood to Viet Nam stood at US$316.7 US$/cu.m,

down 3% over the same period in 2024.

The import price of raw wood from China decreased by

23% over the same period in 2024 to US$304.8 per cu.m;

from the US the price decreased by 3% to US$419.2 per

cu.m; from the EU the average price increased by 0.5%

over the same period in 2024.

W&WP imports from the United States in the first 10

months of 2025

W&WP imports from the US in the first 10 months of

2025 reached US$489.74 million, up 82% over the same

period in 2024 and accounted for nearly 19% of the total

10-month W&WP imports.

In the first 9 months of the year the US held the position as

the second largest supplier of raw wood to Viet Nam with

an import volume of 1.0 million cu.m, worth US$420.5

million, up 94% in volume and 88% in value over the

same period in 2024 and accounted for 19.5% of total

imports in the first 9 months of 2025.

It is forecast that for 2025 imports of raw wood from the

US will total 1.3 million cu.m, at a value of US$543

million.

Trade highlights

W&WP exports to the Dutch market in October 2025

earned US$8.8 million, down 23% compared to October

2024. In the first 10 months of 2025 W&WP exports to the

Dutch market totalled US$82.9 million, up 33% over the

same period in 2024. W&WP exports to the Spanish

market in October 2025 were valued US$4.8 million, up

5% compared to October 2024. In the first 10 months of

2025 W&WP exports to the Spanish market totalled

US$60.1 million, up 25% over the same period in 2024.

Viet Nam's W&WP imports in October 2025 were valued

US$248.4 million, down 6% compared to September

2025, however, compared to October 2024, imports

increased by almost 6%. In the first 10 months of 2025

W&WP imports reached US$2.62 billion, up 16% over the

same period in 2024.

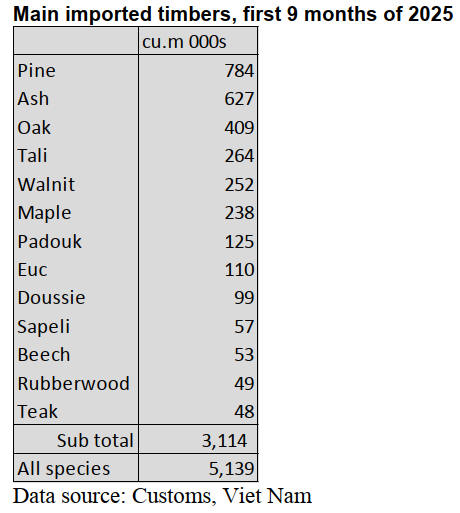

Viet Nam's pine timber imports in October 2025 were

89,900 cu.m, worth US$16.4 million, down 7% in volume

and 6% in value compared to September 2025. Compared

to October 2024 imports were down 13% in volume and

31% in value.

In the first 10 months of 2025, imports of pine

timber

amounted to 874,000 cu.m, worth US$172.3 million, up

6% in volume and down 7% in value over the same period

in 2024.

In the first 9 months of 2025 wood imports from

Cameroon reached 309,090 cu.m, with a value of

US$121.33 million, up 109% in volume and 3% in value

over the same period in 2024.

Sustainable softwood trends stand out at

VietNamWood 2025

In November the 16th International Exhibition on

Machinery and Equipment for the Wood Processing

Industry in Viet Nam (VietnamWood 2025) opened at the

Saigon Exhibition and Convention Center (SECC)

attracting more than 320 domestic and foreign units and

enterprises to participate.

With a scale of 13,500 sq.m and gathering more than

320

enterprises from 28 countries, VietnamWood affirmed its

position as one of the leading events in the wood

processing sector in Viet Nam specialising in machinery,

technology and consumables. The exhibition attracts a

large number of domestic and foreign manufacturers.

At VietnamWood 2025, Canada Wood Viet Nam had an

impressive display space with a variety of interior

applications from Canadian wood. The special highlight of

the booth was the wood colour palette with shades from

light to dark helping visitors easily visualise the practical

application of Canadian wood. In addition, the company’s

technical experts were present at the booth to provide

direct consultation and introduce the Canadian Wood

Experience Program – an initiative that provides free

wood samples, as well as in-depth technical support to

help factories in Viet Nam verify quality, optimise

production and expand supply sources.

According to the General Department of Viet Nam

Customs and the Viet Nam Wood and Furniture Export

Report 2024 – 2025, Viet Nam’s wood and wood products

exports reached US$16.25 billion in 2024, up 20% over

the previous year.

In 2025 the industry aims to increase this figure to

US$18

billion and is shifting its focus towards sustainability, legal

origin and supply chain transparency.

See: https://baotintuc.vn/kinh-te/xu-huong-go-mem-ben-vung-

noi-bat-tai-Viet Namwood-2025-20251119194112259.htm

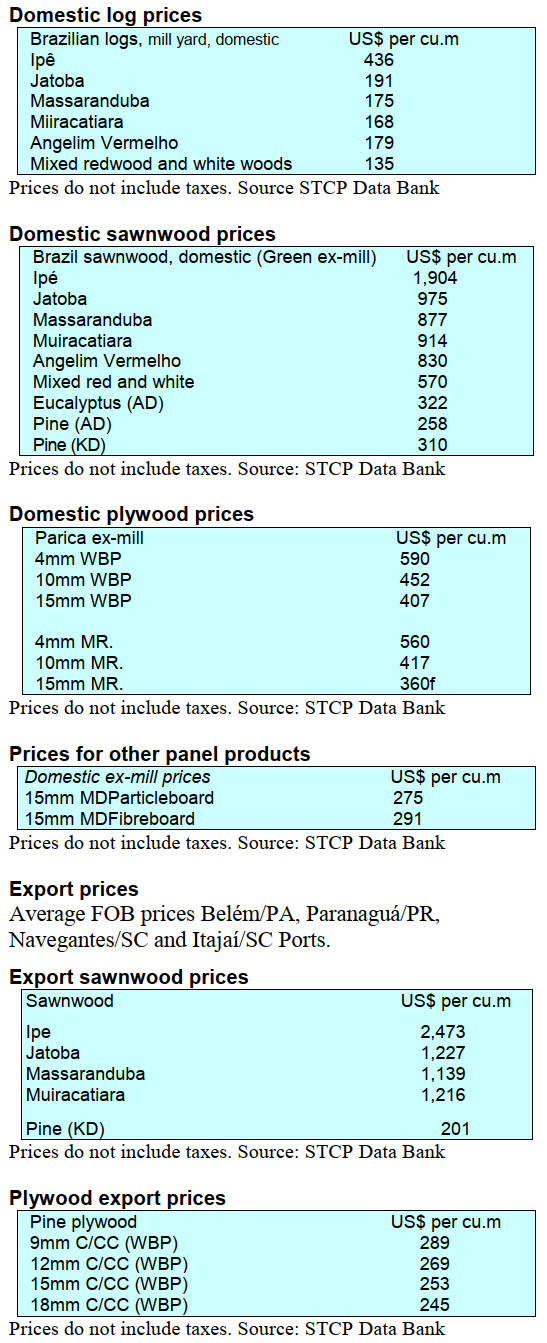

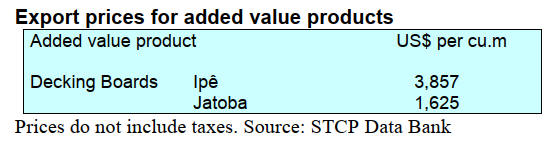

8. BRAZIL

Despite tough conditions wood products

sector

demonstrats high level of resilience

2025 was a period of intense tension for the Brazilian

forest sector marked by an abrupt shift in the challenges

throughout the year.

After a promising start, supported by expectations of

productive expansion, new investments and stability in

international trade, the sector was directly affected by an

increase in tariffs imposed by the United States, initially at

10% in April and subsequently raised to 50% in August.

As a result, the tariff reduced export competitiveness

leading to trade imbalances and significant socioeconomic

impacts such as temporary shutdowns of operations, the

adoption of forced vacations, layoffs and projections of up

to 10,000 job losses. These impacts particularly affected

States where forest-based activities are a significant

component of the economy, such as Paraná State.

Despite the tough conditions, the wood products sector

demonstrated a high level of resilience. The State of

Paraná maintained its position as the second-largest

contributor nationwide in terms of forest production value.

Paraná also concentrates approximately 1.17 million

hectares of planted forests comprising 710,836 hectares of

pine, 438,721 hectares of eucalyptus, and 6,486 hectares

of araucaria.

At the same time, international recognition of the role of

forests as a driver of sustainable development, together

with advances in innovation, the bioeconomy and the use

of wood as a strategic material helped consolidate a long-

term vision grounded in competitiveness, legal certainty

and sustainable socioeconomic development.

2026 is viewed with responsibility and confidence marked

by the 120th anniversary of the introduction of pine in

Brazil, a symbol of the development of forest production

chains and an invitation to reflect on the past and the

future paths of the sector.

See: https://apreflorestas.com.br/noticias/2025-um-ano-que-

colocou-a-prova-a-resiliencia-do-setor-florestal/

Timber hub in the State of Amazonas

The timber sector in the State of Amazonas was the

fastest-growing segment within the Manaus Industrial Pole

(PIM) in 2025, with a major increase in revenue through

September.

According to the Manaus Free Trade Zone

Superintendency (Suframa), this performance nearly offset

the accumulated losses of 48% recorded over the previous

two years and in relative terms outpaced the growth of

other industrial sectors. The Federation of Industries of the

State of Amazonas (Fieam) has said despite the positive

result revenue remains below the levels reached in 2021

and 2022 when the sector recorded BRL64.1 million and

BRL70.3 million, respectively.

Nevertheless, the current growth signals a recovery in

activity with all industries in the timber hub being certified

and complying with strict environmental standards,

essential requirements for access to incentives under the

Manaus Free Trade Zone.

The hub currently employs 758 direct workers and focuses

its production on processed items, sawnwood as well as

components for the civil construction sector.

The Civil Construction Industry Union of Amazonas

(Sinduscon-AM) attributes the expansion of the sector

directly to the strengthening of the State’s construction

industry which grew by around 43% over the past 12

months. This expansion increased demand for certified

timber and strengthened integration between the forest-

based value chain and the real estate sector.

The timber value chain is increasingly integrated with civil

construction particularly among companies investing in

technology and chain-of-custody certification. Raw

material is sourced primarily from legally approved forest

management areas in the Amazonas State, notably in

Itacoatiara, Manicoré and Maués municipalities, as well as

from suppliers in Pará and other States holding

environmental authorisation.

However, significant structural challenges persist

including high logistics costs, dependence on river and

road transportation and the need to expand land tenure and

environmental regularisation, factors considered critical to

ensuring competitiveness and legal compliance across the

entire timber production chain in the state.

See: https://www.portaldocaubi.com.br/polo-madeireiro-do-

amazonas-cresce-387-e-lidera-expansao-da-industria-em-2025

Mato Grosso SFM model presented as an international

reference

During the recnt International Tropical Timber Council

(ITTC-61) held in October 2025 in Panama the Center of

Timber Producers and Exporters Industries of the State of

Mato Grosso (Cipem) presented the Mato Grosso State

sustainable forest management model as an international

reference for the responsible production of tropical timber.

Representing the Brazilian forest sector, Cipem

highlighted Brazil’s capacity to reconcile environmental

conservation, the rational use of forest resources and

income generation as well as emphasising the strategic

role of timber as a renewable, low-carbon material,

particularly in the context of decarbonising the

construction sector.

During a panel dedicated to Latin America, Cipem

underscored Brazil’s leadership in sustainable forest

production noting that approximately 19 million hectares

of forest plantations are located in the country with

increasing diversification of industrial applications such as

pulp and paper, wood-based panels, furniture and

construction.

It was also highlighted that Brazilian forest-based exports

reached US$17 billion in 2024, with projections of

US$25-35 billion in the coming years. To reach this

potential, however, significant investments are required,

estimated at US$220 billion in infrastructure, logistics and

industrial capacity.

Finally, Cipem emphasied the importance of sustainable

forest management as a key instrument to ensure

international competitiveness, the long-term responsible

supply of tropical timber and the maintenance of standing

forests, balancing environmental conservation, job

creation and socioeconomic development.

See: https://cipem.org.br/cipem-apresenta-modelo-mato-

grossense-de-manejo-florestal-em-evento-no-panama/

Brazilian furniture industry redirects exports

The Brazilian furniture industry has been implementing

strategic adjustments in its export markets following the

imposition of tariffs of up to 50% by the United States. On

a year-to-date basis the sector shows a positive

performance (+4.4% compared to 2024) but there has been

a slowdown reflecting logistical and commercial

adjustments in response to reduced competitiveness in the

US market.

Although the US remains the main export destination

accounting for 25% of total exports year to date, this

represents a decline from the 29% recorded in 2024. The

reduction in shipments to the US has encouraged market

diversification with Uruguay increasing its imports to

11%, Chile maintaining 7% and Argentina rising to 6%

more than three times the share observed in the previous

year (2%).

Alongside this geographic reorientation of exports the

sector has intensified international promotion efforts,

focusing on Latin America, Europe, Asia and the Middle

East supported by initiatives from Abimóvel and

ApexBrasil (the Brazilian Trade and Investment

Promotion Agency). On the regulatory front, however,

uncertainties persist in the US as the removal of the

additional tariff benefited only agricultural products while

barriers and high costs for industrial goods (including

furniture and processed wood) remain in place.

These factors continue to constrain furniture exports to the

sector’s main market. As a result, the outlook for furniture

exports will depend on progress in tariff negotiations, the

consolidation of alternative markets.

See: https://emobile.com.br/site/industria/industria-moveleira-

ajusta-rotas-de-exportacao-diante-de-tarifas-dos-eua/

9. PERU

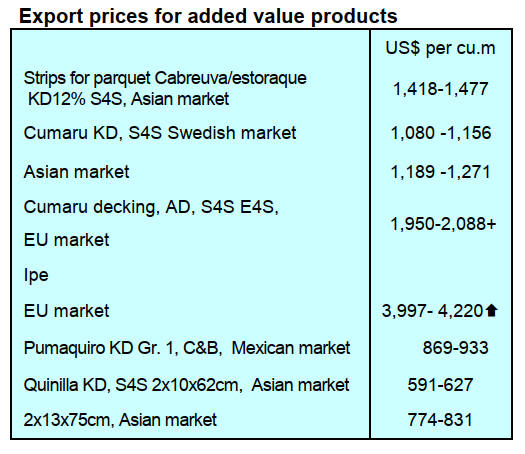

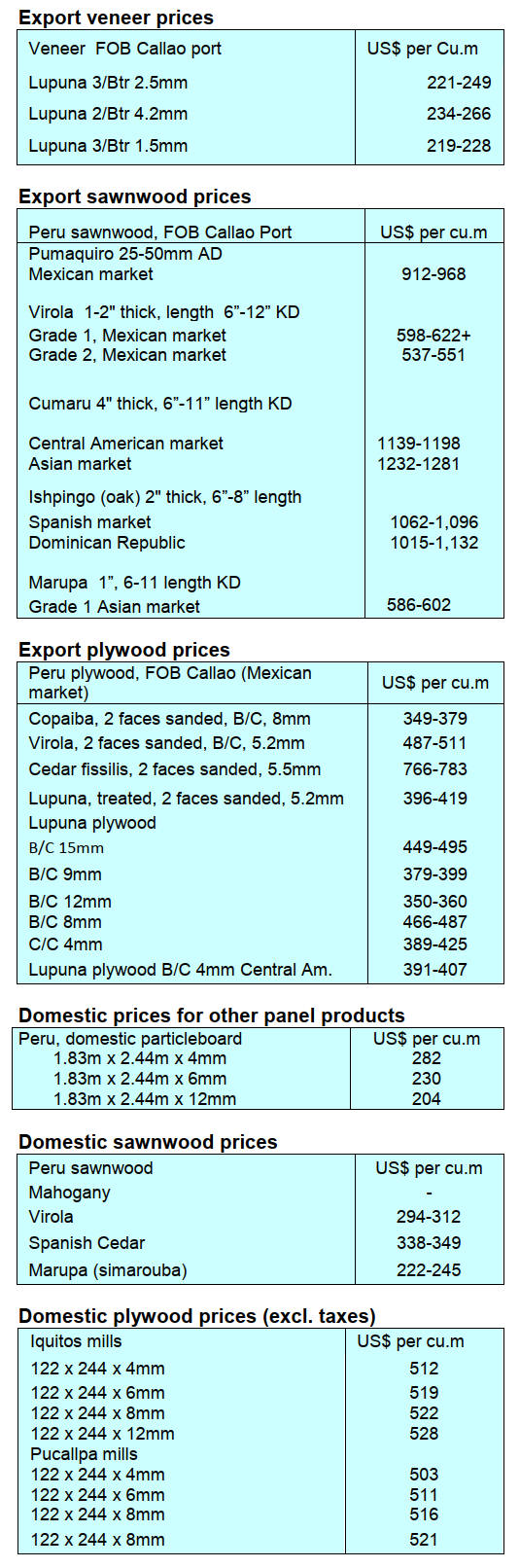

Exports exceeded US$57.6 million through October

2025

Shipments of wood products for finishing and construction

totalled US$57.6 million during the first eight months of

2025 reflecting a 21% decrease compared to the same

period in 2024 (US$72.7 million) according to the Center

for Research on Global Economics and Business of the

Association of Exporters (CIEN-ADEX).

According to data from the ADEX Data Trade Business

Intelligence System, exports included sawn timber

(US$19.8 million), semi-finished products (US$21.1

million), firewood and charcoal (US$5.0 million),

furniture and furniture parts (US$3.8 million) and

construction products (US$3.6 million).

The leading destination was the Dominican Republic, with

exports totalling US$9.0 million, a 1% increase compared

to the previous year. The US followed with US$8.8

million, a decrease of 22% compared to 2024; France with

US$8.5 million, a decrease of 30%; China with US$5.9

million, a decrease of 39% and Mexico rounding out the

top five with sales of US$5.6 million, a decrease of 36%.

FSC certification concentrated in Madre de Dios,

Loreto and Ucayali

As of 30 November 2025, according to information

provided by FSC Peru, the country has 964,2377 hectares

of FSC-certified forest. There are 96 initiatives from the

private sector, eleven of which are related to forest

management and 83 to chain of custody (CoC). The

regions of the country with the largest certified areas are,

in the following order: Madre de Dios, Loreto, and

Ucayali.

SERFOR recorded production of 2 million cubic meters

in 2025

To strengthen efforts to promote the proper use of the

Forest Transport Guide (GTF) for 2025 the National

Forest and Wildlife Service (SERFOR) registered the

production of over 2 million cubic metres of timber,

including information on its origin and traceability in the

Control Module of SERFOR's National Forest and

Wildlife Information System (SNIFFS).

This confirms the importance of the GTF in promoting the

competitiveness of forest products in national and

international trade. Information resources were developed

explaining the responsible use of the GTF as well as the

administrative and criminal consequences of its improper

or fraudulent use.

Through the SNIFFS Control Module, 80,145 digital

GTFs were issued in 21 Departments of the country.

According to the records 38,470 correspond to products

from Enabling Titles, 35,814 were issued by Primary

Processing Centres and 5,861 correspond to plantation

products.

See:

https://www.gob.pe/institucion/serfor/noticias/1314702-

serfor-registro-mas-de-2-millones-de-metros-cubicos-de-

productos-forestales-en-lo-que-va-del-ano-2025

Legal origin of 500,000 cubic metres certified in 2025

The Supervisory Agency for Forest Resources and

Wildlife (OSINFOR) certified the legal origin of

504,292.06 cu.m of timber harvested in Peruvian forests

during 2025. These results were achieved through the

monitoring of 1,024,095 hectares of forests with forestry

permits or concessions, known as enabling titles.

Through 840 monitoring actions in Amazonian, dry and

high Andean forests OSINFOR verified the sustainable

harvesting of 110,659 authorised trees and the existence of

32,027 standing seed trees essential for the natural

regeneration of these ecosystems.

Among the species with the highest number of monitored

individuals are shihuahuaco (Dipteryx micrantha) with

8,472 trees, tornillo (Cedrelinga cateniformis) with 8,167,

bolaina (Guazuma crinita) with 7,347 and capinuri

(Maquira coriacea) with 4,561 individuals.

Furthermore, during the monitoring process, which

included field supervision and monitoring using satellite

technologies and artificial intelligence, OSINFOR

detected the unauthorised extraction of 63,050 cu.m of

timber.

See: https://www.gob.pe/institucion/osinfor/noticias/1329815-

peru-acredito-el-origen-legal-de-mas-de-500-000-metros-

cubicos-de-madera-durante-el-2025

|