|

1.

CENTRAL AND WEST AFRICA

EU demand quiet and subdued

Demand for tropical timber in the European Union (EU) is

currently quiet and subdued, a trend consistent over recent

years. This general quietness follows a period of volatility

and strong demand in early 2022 which was subsequently

impacted by economic headwinds and geopolitical issues

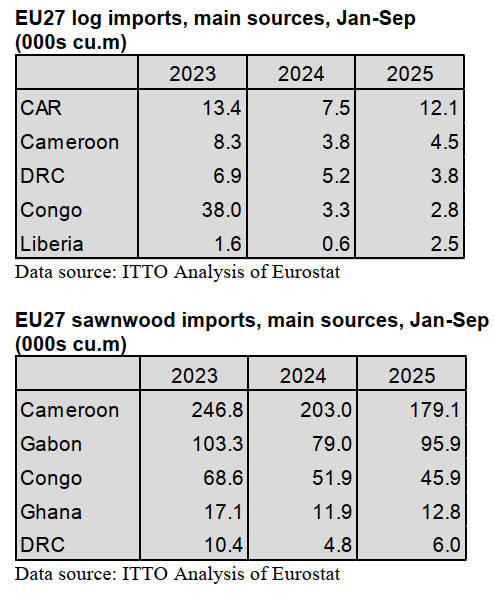

African sawnwood imports into the EU 27 were down in

the first nine months of 2025 compared to 2024. The

EU27 imported 32,500 cu.m of tropical logs from all

sources in the first nine months of 2025 respectively 21%

and 12% more than the same period in 2024.

Regional round-up

Gabon

December marks the peak of the rain season with heavy

daily rainfall across inland regions. These conditions

continue to restrict movement and slow harvesting

operations but given the subdued international demand

industries are content to maintain moderate output levels.

The GSEZ log park at Nkok was reportedly short of

Okoume logs, though the situation is now improving as

the main supplier has secured Task Force approval to

resume operations. Mills requiring peeler and saw logs

have been relying on GSEZ stocks which currently include

approximately 1,500 cu.m of mixed red species (Bosse,

Sapelli, Padouk, limited Azobe and Okan) but still very

little Okoume.

The Task Force was initially very aggressive in its

inspections and enforcement but has become more

accommodating due to widespread complaints and layoffs.

All companies that were told by the Task Force to suspend

activities are now back in operation,

Government pressure on industries to reduce expatriate

labour is causing concern for those companies that rely

heavily on foreign technicians. The policy is now being

softened, permitting an estimated 10% expatriate

workforce allowing companies to rehire essential foreign

expertise.

Electricity disruptions remain a significant operational

burden. Despite the presence of two Turkish power ships

and a third vessel expected to raise total output. Libreville

and surrounding areas continue to experience 2–3 power

cuts per day each lasting 1–2 hours. On 11 December parts

of Libreville faced a full-day blackout.

Operations at Owendo Port remain functional with normal

traffic flows to and from the terminals. However, vessels

often have to wait to berth due to congestion.

Millers in Gabon have welcomed a recent improvement in

the number of orders from Middle East buyers but say the

volumes are not large. Enquiries from Europe remain low

as buyers limit purchasing strictly on an immediate needs-

only basis. No change has been reported on demand from

China.

The government is pursuing a new Finance Law for 2026

proposing an increase in Customs export duties on

processed timber from 8.6% to 12.5% (effective 1 January

2026). This has not yet been signed into law but operators

are already warning clients of potential price increases.

Concerns are being expressed that an increase in duties

will put operators in the country at a disadvantage in

international markets.

Cameroon

Harvesting activities continue but at a reduced pace

despite the unusually favourable weather for this time of

year. Operators reported that, unlike last year when heavy

rains persisted well into mid-January, rainfall has been

lighter and less disruptive this year.

Many Chinese-operated mills remain closed due to both

forestry and financial controls introduced by the

government in recent months. This has contributed to a

general slowdown in overall sawnwood production. In the

quiet market environment many mills are operating single

shifts.

Trucking operations have largely returned to normal,

supported by functioning rail connections and the

reopening of key road segments. Laterite roads remain

under rain barriers, meaning traffic is restricted during wet

conditions.

The strategically important Sangmelima road has been

fully repaired. This route is particularly relevant for North

Congo operators who transport sawnwood to Kribi Port.

Log shipments are regularly arriving in Douala Port,

including from Congo and the CAR.

Sawnwood stocks in Douala are said to be approximately

4,000 cu.m across all species. Some exporters apparently

prefer to hold stocks locally rather than ship to Europe

during the winter due to seasonal slowdowns and port

congestion.

Exporters in Cameroon are experiencing increased

scrutiny under the European Timber Regulation with EU

authorities tightening controls and requiring sound proof

of legality. The sentiment among operators in Cameroon is

that demand in major markets remains subdued with slow

demand in Europe, low demand in China and stable

demand in Middle Eastern countries. Operators remain

cautious and are focusing on maintaining basic operations

rather than investing or expanding.

Analysts observe that the operating environment in

Cameroon is markedly different to that in Gabon. The

country benefits from a large and active labour force

generally described as inventive. Most timber companies

are managed by Lebanese operators with the notable

exception of SFIL (Décolvenaere), a Belgian-owned

company appreciated for its operational efficiency.

However, operators say administrative transparency in

forestry operations remains an issue. Forest management

through the coupe de vente, coupe communautaire and

private concession (UFA) systems complicates overall

transparency. Some companies in Cameroon are said to

have very large concession areas (over 500,000 ha in

Gabon 200,000 ha. is the maximum permitted.

Republic of the Congo

Rain is gradually slowing across the country and

harvesting continues at a reduced level largely because of

weak markets in Asia and Europe. Many operators

continue directing their output toward Douala as this is

shorter and more practical compared to Pointe Noire

which is approximately 1,400 km from the northern

production zones.

Timber from the northern regions and from the Central

African Republic continues to move toward Douala

despite the absence of tarmac roads over the roughly 1,200

km route between Bangui and Douala.

In the Likouala region, transport conditions are improving

with easing rains, allowing increased flow of timber

toward Kribi (containers) and Douala (logs).

No major issues are reported concerning spare parts

imports or other production inputs. No significant new

fees or toll changes have been reported. In Pointe Noire,

container availability is stable and no major shortages

have been observed. Dispatch remains normal, with no

specific disturbances beyond the general slowdown in

export activity driven by weak international demand.

Attention throughout the country is shifting towards the

upcoming national elections next year creating a general

atmosphere of caution among operators and investors.

2.

GHANA

TUC calls on government to absorb part of the new

tariff increases

The Trade Union Congress (TUC) has called on the

government to absorb part of the recently announced

Public Utilities Regulatory Commission (PURC) tariff

increases. The Union’s Vice Chairperson, Dr. Ken

Tweneboa Kodua, made this statement following an

emergency meeting of a TUC steering committee held to

determine the next steps after the PURC press release on

the tariff increases.

According to Dr. Kodua the TUC is advocating for a

process that reviews the operational costs of the utility

companies to determine which PURC variables and

expenses should go to the State and which should

legitimately fall to consumers.

The Vice Chairperson said this approach would bring

some level of fairness to households and businesses which

are already under economic pressure. He indicated that the

consumer must have the ability to pay and emphasised that

the Union’s concerns relate to fairness and due process,

not opposition to tariff adjustments when they are

justified.

Ghanaian workers recently secured a 9% wage increase

from January 2026 but just last week the PURC

announced 15% rise in water charges and a 9% increase

for electricity which the TUC anticipates would wipe out

the wage gain.

Meanwhile, the Food and Beverages Association of Ghana

(FABAG) has also criticised the PURC tariff increases

describing the changes as economically harmful,

unjustified and major blow to Ghana’s economy.

In past development, the Association of Ghana Industries

(AGI) and the Ghana Union of Traders Association

(GUTA) have jointly sounded the alarm, warning PURC

tariff increases could undermine the success of the

government’s flagship 24-hour economy policy.

The variables PURC considered during its quarterly

reviews include inflation, the exchange rate, fuel costs and

the energy mix.

According to the latest Ghana Statistical Service (GSS)

Consumer Price Index (CPI) report Ghana’s inflation rate

dropped for the eleventh consecutive month, easing to

6.3% in November 2025 from 8.0% in October 2025.

See: https://ghanatuc.com/

and

https://www.graphic.com.gh/news/general-news/tuc-demands-

government-subsidy-to-cushion-ghanaians-from-new-tariff-

hikes.html

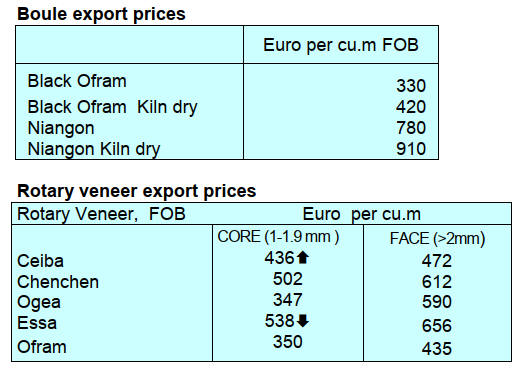

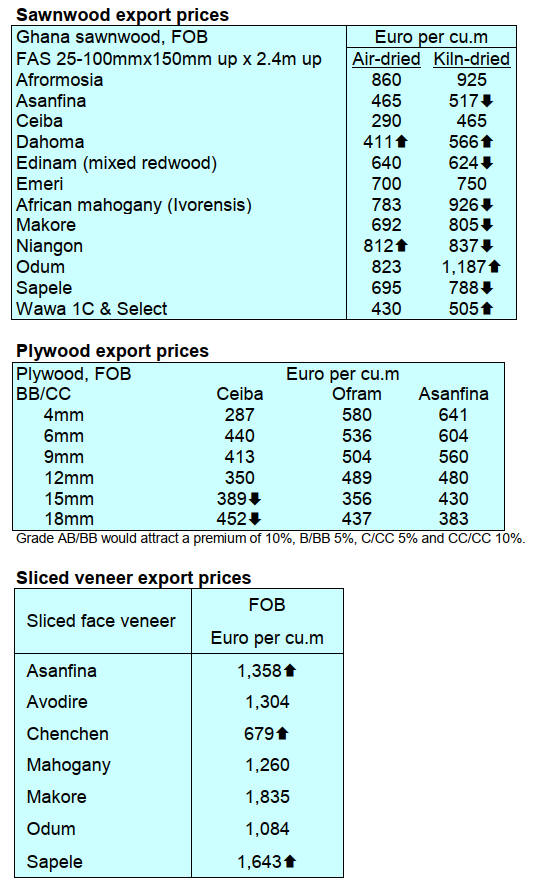

Primary products account for most wood products

exports

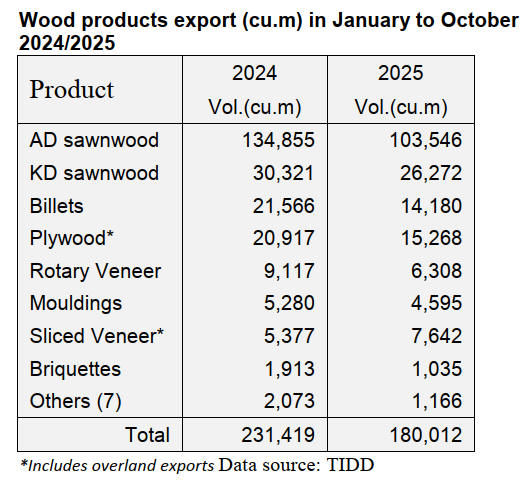

According to data published by the Timber Industry

Development Division (TIDD) of the Forestry

Commission (FC) Ghana earned Eur2.37million from the

export of 180,012 cu.m wood product exports during the

period January to October 2025 as against Eur103.93

million from 231,419 cu.m in the same period in 2024.

The year on year growth for the period showed a decrease

of 20% in value and a decrease of 22% in volume with the

details are tabulated below.

A total of eighteen different products were exported

during the period, of which air-dried sawnwood, kiln-dried

sawnwood, billets and plywood contributed the largest

share, accounting for 88% of the total export volume in

2025 dropping from almost 90% in the same period in

2024.

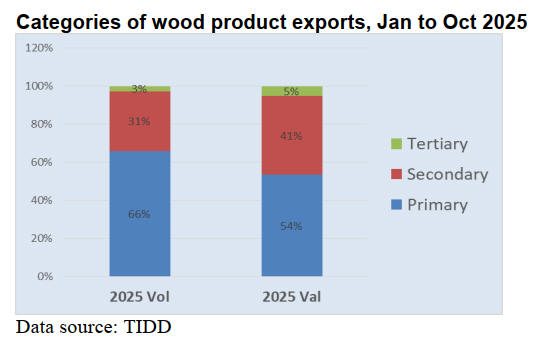

The demand for primary products which included kindling

and poles accounted for 118,701cu.m worth Eur44.08

million of the total exports in 2025. Exports of secondary

and tertiary wood products earned Eur34.14 million and

Eur4.14 million respectively.

There were more than 100 exporting companies during the

10-months period with the first top five accounting for

53% of the total export volume.

Kindling and poles (primary products category) recorded

volume increases in the first 10 months of 2025. The

kindling products were shipped to Saudi Arabia, UK,

Ireland and Greece while the poles went to Senegal.

CSOs scorecard on extractive sector promises

The Alliance of Civil Society Organisations (CSOs)

working on extractive governance, forestry, the

environment and anti-corruption measures has rated the

government’s performance in fulfilling its extractive

sector manifesto promises as satisfactory.

It noted that at the current rate of implementation 25% the

government is on track to achieve full delivery of its

commitments within four years.

These findings were presented in the Alliance’s latest

CSOs Assessment Scorecard on Government

Performance, which covers Mining, Petroleum,

Climate/Energy Transition, Forests and the Environment

and Anti-Corruption.

However, the Alliance urged the government to intensify

efforts toward its anti-corruption commitments, warning

that delays could hinder successful implementation and

leave behind key promises by 2028.

See: https://ghanaiantimes.com.gh/govt-on-track-to-meet-

extractive-sector-promises-csos-scorecard/

BII supports MSMEs with loan facility

British International Investment (BII), the UK’s

development finance institution, has extended a US$20

million loan facility to First National Bank Ghana (FNBG)

to expand financing opportunities for micro, small, and

medium-sized enterprises (MSMEs) across the country.

The signed agreement is expected to deepen support for

businesses that form the backbone of Ghana’s economy.

MSMEs account for over 90% of all enterprises in the

country contributing 60% to the GDP and provide 80% of

jobs yet many struggle to access long-term and affordable

capital.

The Chief Executive of First National Bank, Warren

Adams, described the five-year loan as a timely

intervention that will allow the Bank to scale up lending to

small businesses navigating economic uncertainties,

particularly in the commerce sector.

See: https://www.myjoyonline.com/bii-provides-20m-boost-to-

first-national-bank-to-strengthen-msme-financing-in-ghana/

and

https://www.gov.uk/government/news/bii-backs-msmes-with-

20m-loan-to-first-national-bank

3. MALAYSIA

Sabah timber industries call for support to remain

competitive

The Sabah Timber Industries Association (STIA) has

called on the State Government to strengthen support for

the timber sector amid rising structural challenges and

mounting pressure to remain competitive and sustainable.

STIA president, Tan Peng Juan, said the industry is at a

critical crossroads. “Industry players are concerned that

without decisive action the timber sector, which supports

thousands of livelihoods and contributes significantly to

the national economy, may struggle to sustain itself in the

years ahead”.

He emphasised that Sabah’s timber industry remains a

vital economic contributor generating employment,

supporting rural communities and producing significant

export revenue. “In 2024, Sabah’s forest product exports

generated RM1.13 bil, underscoring the sector’s continued

relevance”

The road ahead for industrial tree plantations will not be

easy and the industry cannot overcome the challenges

without strong and sustained government support, he said.

Another major concern is the industry’s changing

workforce landscape. “There are critical labour gaps in

both upstream and in specialised downstream areas,” he

said, noting that the sector still relies heavily on foreign

workers. Tan added that the industry urgently needs major

investments in both upstream and downstream segments to

introduce new technology and automation that can offset

workforce challenges.

In a related development the Sabah Forestry Department

has announced the publication of three new books related

to forest plantation development, Guidelines for Selecting

Candidate Plus Trees (CPT) for Forest Plantation Species,

Photo Collection of Candidate Plus Trees (CPT) of Local

Forest Plantation Species in Sabah and Photo Collection of

Candidate Plus Trees (CPT) of Exotic Forest Plantation

Species in Sabah.

These publications mark another significant step in

strengthening the management of tree genetic resources to

support the advancement of the state’s forest plantation

sector.

See:

http://theborneopost.pressreader.com/article/281539412280432

and

http://theborneopost.pressreader.com/article/281590951887984

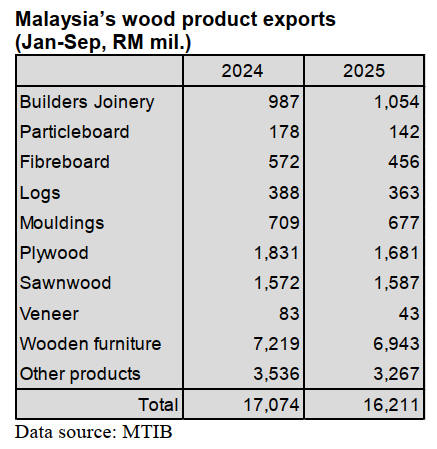

Sarawak wood pellet exports up 60%

Sarawak’s timber industry recorded exports valued at

RM1.87 bil as of the third quarter of 2025 according to

Deputy Minister of Natural Resources and Urban

Development, Len Talif Salleh. He highlighted the growth

in the timber sector compared to the same period last year

pointing out that logs contributed RM310 mil., an increase

of 3% compared to the same period in 2024 while wood

pellet exports also rose 60% to RM97 mil., up from RM60

mil. during the same period in 2024.

He added that Japan remained the top importer with a

value of RM1.17 bil, followed by India (RM 299 mil),

Middle East countries (RM 105 mil), Taiwan P.o.C (RM

77 mil) and the Philippines (RM 65 mil).

On sustainable environmental management, Len Talif said

up to the third quarter of this year the Natural Resources

and Environment Board (NREB) had received 61

Environmental Impact Assessment (EIA) reports and 15

Environmental Management Plans (EMP). “Of these, 46

EIA reports and 15 EMPs have been approved, while 15

EIA reports are still at various stages of assessment.”

For context, EIA is a legal requirement and a key

instrument to ensure sustainable development in Sarawak.

To ensure compliance with EIA approval terms and

conditions, Len said the NREB had conducted 918 post-

EIA monitoring activities and received 1,857

Environmental Monitoring Reports (EMR) between

January and October 2025.“Monitoring results identified

87 cases of non-compliance, for which notices were

issued. During the same period, 14 investigation papers

were opened, while eight cases were compounded,

amounting to RM 150,000.”

In response, Len Talif said the NREB is enhancing the

standard operating procedures for post-EIA monitoring

and the Guidelines for EMR Submission and Evaluation to

strengthen monitoring and compliance processes.

See:

https://theborneopost.pressreader.com/article/281659671348184

Customary rights and carbon

Owners of Native Customary Rights (NCR) land that has

been gazetted can apply for a Forest Carbon Study Permit

to participate in carbon credit and reforestation initiatives

in Sarawak. According to Deputy Minister for Natural

Resources and Urban Development this initiative forms

part of the state’s efforts to reduce carbon emissions

through Nature-based Solutions (NbS).

“In Sarawak, this initiative has been strengthened through

the enactment of the Environment (Reduction of

Greenhouse Gases Emission) Ordinance 2023 and the

Forests (Forest Carbon Activity) Rules 2022. These

regulations require all carbon projects to comply with

internationally recognised carbon standards including

Verra and the Gold Standard to ensure integrity,

transparency and effective implementation,” he said.

Following the introduction of the Ordinance and its

regulations, Len Talif said several initiatives had been

implemented, including nine Forest Carbon Study Permits

covering 231,983 ha of forested land with seven new

applications currently under consideration.

In addition, a Forest Carbon Licence covering 25,675

hectares had been issued and a memorandum of

understanding (MoU) between Sarawak Forestry

Corporation (SFC) and Mubadala Energy, Abu Dhabi, on

NbS and blue carbon potential was signed last year.

See:

http://theborneopost.pressreader.com/article/281586656898821

Launch of an e-Removal Pass System

The Sabah Forestry Department launched the e-Removal

Pass System, a new digital platform designed to strengthen

the management, monitoring and transparency of the

State’s forest produce transfer process, particularly for

logs.

Chief Conservator of Forests, Frederick Kugan, said the

new system replaces the existing manual process with a

fully digital method enabling all applications, approvals

and monitoring of Removal Passes to be conducted online.

He said the system was developed to, provide more

accurate and auditable reporting and ensure complete

traceability. He noted that the development of the e-

Removal Pass System aligns with the State Government’s

aspirations under the 12th Malaysia Plan (RMK-12),

which emphasises digital technology adoption, enhanced

integrity and sustainable forest management.

See: https://www.dailyexpress.com.my/news/271745/forestry-

department-launches-e-removal-pass-system/

4.

INDONESIA

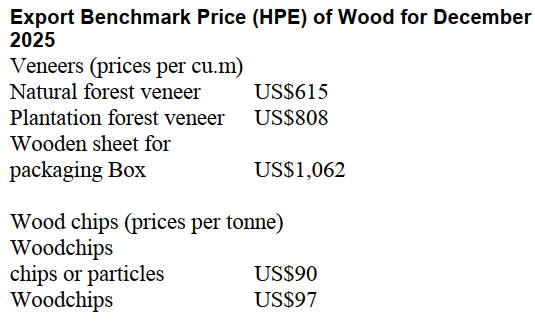

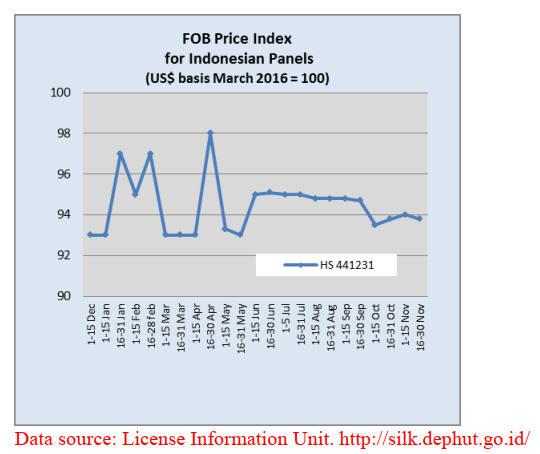

Processed wood (prices per cu.m)

Processed wood products which are leveled on all four

sides so that the surface becomes even and smooth with

the provisions of a cross-sectional area of 1,000 sq.mm to

4,000 sq.mm (ex 4407.11.00 to ex 4407.99.90)

Processed wood products which are levelled on all four

sides so that the surface becomes even and smooth of

Merbau wood with the provisions of a cross-sectional area

of 4,000 sq.mm to 10,000 sq.mm (ex 4407.11.00 to ex

4407.99.90) = US$1,500/cu.m

See: https://jdih.kemendag.go.id/peraturan/keputusan-menteri-

perdagangan-republik-indonesia-nomor-2241-tahun-2025-

tentang-harga-patokan-ekspor-dan-harga-referensi-atas-produk-

pertanian-dan-kehutanan-yang-dikenakan-bea-keluar-dan-tarif-

layanan-badan-umum

Forest product exports have stagnated

The Ministry of Forestry has reported that forest product

exports remain flat at around US$12 billion annually

despite expectations of 3% yearly growth. Laksmi

Wijayanti, Director General of Sustainable Forest

Management, noted that the stagnation is influenced not

only by production challenges but also by negative public

narratives surrounding forestry policies.

Issues such as carbon, forest rehabilitation and

international trade politics often dominate public attention

affecting perceptions of the sector. She emphasised that

Indonesia already has strong sustainability regulations

including the Timber Legality and Sustainability

Assurance Program (SVLK).

To stimulate growth the ministry is now focusing on

downstream processing and increasing the value added to

of forest products. Current major exports include timber,

pulp and paper but the government aims to shift from

exporting mostly semi-processed materials to producing

premium-quality goods.

Laksmi stated that efforts will expand beyond timber to

promote non-timber forest products as well, ensuring that

Indonesia’s forest-based commodities can compete in

higher-value international markets.

In related news, it has been reported that the contribution

of the forestry sector to national economic growth in 2025

experienced a noticeable decline compared to previous

years. The Minister of Forestry, Raja Juli Antonnei,

reported that the sector’s contribution to GDP reached

Rp97.22 trillion, down from Rp129.57 trillion in 2024 and

Rp130.12 trillion in 2023. Data trends show steady growth

from 2020 to 2023, followed by a significant drop in 2025,

highlighting a slowdown in the sector’s overall economic

impact.

Investment in the forestry sector also fell sharply with

upstream forestry investment declining to Rp13.6 trillion

in 2025 from Rp34.7 trillion in 2024 while downstream

investment in industrialisation reached Rp 36.6 trillion.

Non-tax state revenue from forestry also decreased to

Rp6.53 trillion from Rp8.12 trillion in 2024. However, the

furniture industry, as a labour-intensive downstream

sector, delivers significant added value to the national

economy.

In the third quarter of 2025 the industry contributed 0.92%

to the non-oil and gas GDP while the export performance

remained slightly better than the previous year. The United

States continues to be the main export destination

accounting for more than half of Indonesia’s furniture

exports. The handicraft sector also showed solid growth,

supported by the country’s rich natural resources and

creative craftsmanship.

Indonesia’s furniture and craft industry, which employs

more than 2.1 million workers and supports millions of

SMEs, is facing growing pressure from global competition

and increasingly strict international regulations.

In response, the Indonesian Furniture and Craft Industry

Association (HIMKI) has urgied the government to

strengthen industry protection, improve product

traceability and reinforce the “Made in Indonesia” brand.

HIMKI Chairman Abdul Sobur highlighted the heavy

compliance burden posed by measures such as the EUDR

and called for differentiated requirements and stronger

government support to ensure local businesses remain

competitive.

To safeguard the sector, HIMKI recommends creating a

national traceability and single-documentation system,

offering financing and certification assistance and

harmonising timber regulations to reduce bureaucratic

overlap.

The Association is also pushing for preferential export

tariffs, strict enforcement of anti-dumping measures and

action against the influx of cheap imported products.

Despite current challenges Sobur expressed confidence in

the industry’s future, citing Indonesia’s unique cultural

creativity as a lasting competitive advantage.

See: https://katadata.co.id/ekonomi-hijau/ekonomi-

sirkular/69253136c82f3/kontribusi-sektor-kehutanan-terhadap-

pertumbuhan-ekonomi-ri-turun

and

https://lestari.kompas.com/read/2025/11/25/134035086/ekspor-

produk-hasil-hutan-stagnan-kemenhut-genjot-hilirisasi.

and

https://wartaekonomi.co.id/read591149/industri-furnitur-beri-

nilai-tambah-tinggi-bagi-perekonomian-ri

and

https://rri.co.id/en/business/2022154/indonesia-urges-stronger-

protection-for-furniture-industry

Strengthening forest-certification to meet evolving

global regulations

Indonesia is intensifying efforts to strengthen the global

competitiveness of its forest products by enhancing policy

synergies with internationally recognised certification.

Officials emphasised that, while Indonesia has strong

regulatory frameworks and sustainable forest management

practices, reputational challenges persist making credible,

data-driven, communication increasingly important.

A newly signed MoU between the Ministry’s Directorate

General of Sustainable Forest Management, the

Association of Indonesia Forest Concession Holders

(APHI) and the Indonesian Forestry Certification

Cooperation (IFCC) aims to promote both mandatory

certification and the voluntary IFCC/PEFC scheme as

tools to demonstrate traceability and responsible resource

management.

The IFCC highlighted the growing relevance of

international standards as Indonesia prepares for stricter

global regulations such as the EU Deforestation

Regulation (EUDR).

See: https://mediaindonesia.com/humaniora/834212/indonesia-

perkuat-sinergi-sertifikasi-hutan-demi-hadapi-persepsi-negatif-

global

and

https://forestinsights.id/indonesia-perkuat-sinergi-sertifikasi-

hutan-untuk-hadapi-regulasi-global-dan-eudr/

Companies continue readiness for EUDR despite delay

Indonesian forestry businesses are preparing to comply

with the European Union Deforestation Regulation

(EUDR), even though its introduction has been delayed by

one year. APHI Chairman Soewarso said the

postponement provides valuable time for companies to

study the requirements and improve their systems to meet

the regulation’s strict sustainability and traceability

standards.

To support this effort APHI is collaborating with the

Indonesian Forestry Certification Cooperation (IFCC) to

expand the adoption of PEFC certification which can help

Indonesian forestry products gain wider acceptance in the

European market. Currently, only 93 of APHI’s more than

400 members hold such certification but the number

continues to grow.

See:

https://lestari.kompas.com/read/2025/11/25/160318886/pengusah

a-siap-siap-meski-penerapan-deforestasi-eudr-ditunda-setahun.

Papua ships processed wood products to China

Papua Governor, Matius Fakhiri, was present when 10

containers of processed wood were shipped from Jayapura

to Shanghai marking the fifth batch of exports this year.

According to the Papua Trade and Industry Office these

exports represent significant progress in strengthening the

regional economy and boosting value-added production

within the province’s wood-processing sector.

The Governor praised industry players for maintaining

legal compliance, practicing sustainable resource

management and fostering strong partnerships with

Indigenous communities.

See: https://rri.co.id/papua/daerah/1998283/gubernur-fakhiri-

lepas-ekspor-kayu-olahan-ke-china

Accurate of statistics will support food security

strategy

The Ministry of Forestry highlighted the need for accurate,

standardised and integrated forestry data as a foundation

for optimising and sustainably managing forests. During a

multi-sector dialogue on One-Data Governance officials

emphasised that unified forestry data is essential for

shaping food security strategies, including agroforestry

development, strengthening non-timber forest products

and identifying potential areas for social forestry.

The initiative aims to enhance policy planning and ensure

that forestry-based food security programs are supported

by reliable and comprehensive information.

Strengthening data interoperability, aligning metadata with

the One Data Indonesia policy and enhancing data-sharing

mechanisms were identified as key priorities.

The Ministry committed to accelerating field verification

and integrating geospatial data into the national forestry

information system expressing optimism that robust

unified data governance will reinforce national food

security while promoting sustainable forest management.

See: https://news.detik.com/berita/d-8227986/kemenhut-perkuat-

akurasi-data-kehutanan-untuk-strategi-ketahanan-pangan.

IEU-CEPA could lift exports to EU by over 50%

Indonesia’s Coordinating Ministry for Economic Affairs

anticipates the Indonesia–European Union Comprehensive

Economic Partnership Agreement (IEU-CEPA) could

increase the country’s exports to the EU by over 50%.

Secretary, Susiwijono Moegiarso, highlighted the

significant impact while the Minister of Trade, Budi

Santoso, noted that ratification is targeted for January

2026 paving the way for the agreement’s implementation.

The ministry views IEU-CEPA as a strategic tool to help

Indonesia achieve its goal of eight percent economic

growth by 2029.

The agreement will provide wider market access for

Indonesian products in the EU and offer several

advantages, including tariff reductions for most exports.

See: https://en.antaranews.com/news/394841/indonesia-says-ieu-

cepa-to-lift-exports-to-eu-by-over-50-percent

5.

MYANMAR

Forest legality framework faces prolonged

uncertainty

Myanmar’s forest legality and sustainability framework,

developed over a decade with international technical

support, is facing prolonged uncertainty amid ongoing

instability despite the fact that large-scale timber

harvesting has been minimal in recent years according to

forestry sector observers.

The challenge now lies less in current forest operations but

in the handling of existing timber stocks whose legal

documentation is no longer readily accepted in

international markets.

Between roughly 2011 and 2021 the Forest Department,

together with the Myanmar Timber Enterprise (MTE) and

the Myanmar Forest Certification Committee (MFCC)

established key technical pillars required for legal timber

trade. These included the development of the Myanmar

Timber Legality Assurance System (MTLAS), formally

launched in 2018, which provided a nationally defined

benchmark for “legal timber.”

In parallel, the Myanmar Forest Certification Scheme

(MFCS) was developed and MFCC became a member of

the Programme for the Endorsement of Forest

Certification (PEFC) in 2019 signaling moves to

alignment with internationally recognised sustainable

forest management principles.

However, there was a significant setback when the

Endorsement process of MFCS was suspended by PEFC

in 2021.

Transparency tools such as the Chain of Custody (CoC)

Dossier documented step-by-step verification points from

harvesting authorisation and marking systems to transport

and sale enabling operators to meet international due-

diligence expectations. These efforts were reinforced by

conservation-oriented measures including logging

moratoriums, reductions in the Annual Allowable Cut

(AAC) and the promulgation of a updated Forest Law in

2018.

Collectively, these initiatives positioned Myanmar to

progressively engage with international legality

frameworks including the possibility of future dialogue

under the EU FLEGT process. The suspension of EITI-

related processes and the reduced operational engagement

of civil society organisations have significantly weakened

the transparency framework that previously supported

independent oversight and public confidence in the forest

sector.

Since early 2021 forest harvesting activities have been

extremely limited and in many areas effectively

suspended. As a result, current legality concerns are not

primarily linked to new extraction but rather to existing

stocks of logs and processed timber harvested prior to or

around that period.

The MTE and the Forest Department continue to hold

complete and structured documentation including Delivery

Orders, Harvesting Permits, Marking Records and Sales

Contracts that would normally support legality

verification. However, due to evolving external constraints

these documents no longer provide practical support for

market access despite remaining technically valid within

the national system.

This situation has resulted in a growing disconnect

between documented legality and market recognition

leaving legally documented timber effectively

immobilised in yards, mills and storage facilities.

While core forestry institutions and procedures remain in

place their operational effectiveness has been constrained,

particularly in relation to data updating, field monitoring,

and long-term planning. Forest management plans and

AAC-related monitoring, which depend on continuous

field engagement, have not progressed as originally

designed.

Importantly, this does not represent a collapse of technical

systems but rather a pause and accumulation of unresolved

legality questions, especially regarding the temporal

linkage between harvest dates, stock records and future

market claims.

Analysts conclude that the conflict has done more than

pause reform. It has created a long-term legality crisis that

could burden Myanmar’s timber trade for decades forcing

the sector to rebuild its governance and assurance systems

almost entirely from scratch.

Analysts emphasise that Myanmar’s challenge is

therefore not the absence of legality systems, but

the temporary loss of international credibility in those

systems. Addressing this gap through technical dialogue,

transparency measures and confidence-building

mechanisms will be essential to restoring long-term

market access for Myanmar’s timber sector.

World Bank forecast moderate signs of recovery

Myanmar’s economy is showing moderate signs of

recovery despite major setbacks as a result of the March

2025 earthquake and ongoing conflict according to the

World Bank in its latest Myanmar Economic Monitor.

The report notes modest improvements in business activity

and currency stability as firms operated at higher capacity

in October and the kyat strengthened after last year’s steep

decline. Inflation has eased slightly, although prices

remain high and continue to strain households. Freight

transport volumes have also increased reflecting partial

easing of supply disruptions.

However, growth remains constrained by weak domestic

demand, labour shortages, frequent power outages and

limited reconstruction financing combined with the

persistent insecurity from the civil conflict.

The World Bank projects a 2.0% contraction in real

GDP for the fiscal year ending March 2026, an

improvement from earlier estimates of -2.5%. Looking

ahead it forecasts a moderate rebound of about 3% in

FY2026/27 largely driven by post-quake reconstruction

and targeted support for affected communities.

Inflation is expected to stay above 20% and fiscal

pressures are likely to persist, with the deficit forecast at

around 5% of GDP.

The agrifood sector continues to be a resilient contributor

to economic activity and employment, even as frequent

shocks such as flooding and earthquake effects linger.

See: https://www.devdiscourse.com/article/business/3724346-

world-bank-reports-modest-recovery-for-myanmar-despite-

conflict-and-quake-impacts?utm_source=chatgpt.com

and

https://www.worldbank.org/en/news/press-

release/2025/12/08/myanmar-s-economy-shows-moderate-signs-

of-recovery-amid-earthquake-and-conflict-impacts

6.

INDIA

Trees Outside Forests provide 85% of

industrial wood

demand

Timber production from government managed forests has

steadily declined from 10 million cubic metres in the

1970s to 4 million in the 1990, 3 million in 2017, 1.75

million in 2019 and 1.56 million in 2020. It is against this

backdrop that the significance of Trees Outside Forests

has grown.

TOF are found in diverse formations in the rural and urban

land-scapes from small woodlots, block plantations, strip

plantations, along roads, canals and bunds and scattered

trees on farmlands, homesteads and community land.

TOFs plays a significant role in the livelihood of people in

the country both economically and evironmentally. They

make critical contributions to sustainable agriculture, food

security and diversification of household economies.

The Forest Survey of India (FSI) has broadly divided TOF

into two categories. TOF (Rural) and TOF (Urban). Block

plantations of one ha. or more are categorised as under

forest cover while block plantations of less than one ha.

and scattered trees are counted as tree cover.

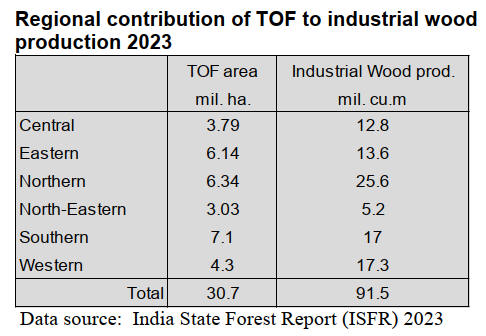

According to the India State Forest Report (ISFR) 2023

the total extent of area under TOF in India is estimated at

30.7 million hectares of which 12.8 million hectares are

under agroforestry constituting about 42% of the TOF.

According to ISFR-2023, between 2013 and 2023 the area

under TOF in India increased by 3.7 million hectares, a

14% rise, while agroforestry alone expanded by 2.1

million hectares marking a 20% increase. The overall

increase in TOF area has been significant in Maharashtra,

Karnataka and Odisha. In Gujarat the decline of 120,000

ha of TOF area during this period is a matter of concern.

ISFRs have been consistently reporting the potential

industrial wood production from TOF in their biennial

assessments. These reports show a steady upward trend

from 69 million cu.m in 2011 to 91.5 million cu.m in

2023. This marks an increase of 22.5 million cu.m and

accounts for approximately 85% of India’s industrial wood

demand.

The highest industrial wood production is recorded in the

Northern region (25.6 million cu.m) attributed to high soil

fertility, progressive farming practices and widespread

adoption of clonal forestry.

Conversely, the North-Eastern region reports the lowest

production (5.2 million cu.m) mainly due to shifting

cultivation practices.

Interestingly, the Western and Southern regions show

comparable wood production levels despite the Southern

region having significantly larger TOF area. This disparity

may be explained by this region’s focus on tree

conservation a higher proportion of urbanised areas,

prevalence of longer rotation crops, harsher climatic

conditions and relatively lower soil fertility.

According to ISFR 2023 the top three States in terms of

industrial wood production from TOF are Maharashtra,

Uttar Pradesh and Madhya Pradesh.

Agroforestry is primarily practiced for commercial

purposes and thus constitutes the major source of

industrial wood. However, due to small landholding sizes

most farmers grow only small-diameter timber.

Consequently medium and larger diameter timber is often

imported to meet domestic requirement. India remains a

net importer of wood and wood-based products with

imports valued at around US$9 billion.

To promote TOF the Ministry of Environment, Forest and

Climate Change (MoEFCC) along with various State

Forest Departments (SFD) has undertaken several

initiatives. State Forest Departments have implemented

various plantation schemes on Panchayat/Community

land, farmland across the country. The private sector has

contributed by promoting commercial tree crops to meet

their raw material needs.

A key component of vision ‘Viksit Bharat@2047’

involves doubling wood production by enhancing the

productivity of commercial tree crops and expanding the

area under TOF as this will support the growth of wood-

based industries and help meet the country’s increasing

demand for timber and wood products. ThePply Insight

article outlines recommendations for the Central and State

government.

In related news, a renewed call for stronger community-

driven forest governance was the focus at a National Book

Trust book launch attended by the Dalai Lama. The

book,”Forest Resources in India: Integrative Governance

and Community Participation for Sustainable Future”

examines how India can strengthen sustainable forest

management at a time of rising pressure on natural

resourcessay the authors,Sushil Kumar Singla, Rakesh B

Sinha and Krishan Kumar Raina.

The authors say that India’s forest future depends on

governance models that actively involve women, tribal

communities and local institutions, noting that traditional

conservation practices remain relevant to modern

environmental challenges.

See: https://plyinsight.com/beyond-forest-boundaries-significant-

role-of-trees-outside-forest/

and

https://www.indiatodayne.in/lifestyle/story/dalai-lama-unveils-

national-book-trust-title-on-future-of-indias-forest-governance-

1313258-2025-12-05

Indian rupee weakening while economy strengthens

These seemingly diametrically opposite economic

observations are puzzling timber importers.

In early December it was reported that the economy

recorded a six-quarter high growth of 8% in the third

quarter, a result that exceeded the expectations of most

economists. At the same time the Indian Rupee dropped to

an all-time low against the US dollar-breaching the Rs90

at one point. Economists have pointed out that the drivers

of GDP are widely different from the forces that drive the

value of a currency saying tariffs imposed by the US are a

force behind the depreciating Indian rupee.

Reserve Bank of India Governor, Sanjay Malhotra ,

dismissed concerns of the falling rupee value stating this

was just a side effect of tariffs. He believes when India

and US finalise their trade deal the pressure on the

currency will be relived.

In related news, the RBI recently cut its policy rate by 25

basis points to 5.25%.The monetary policy committee

delivered a unanimous reduction, citing “weakness in

some key economic indicators,” even as headline inflation

has eased significantly.

Anubhuti Sahay, Head of India Economics Research at

Standard Chartered Bank said the rate cut is timely given

that the economy is doing well but the outlook remains

uncertain. She added that the rate cut is even more

significant given the rupee’s weakness.

See: https://www.indiatoday.in/business/story/indian-economy-

gdp-growing-why-is-rupee-falling-currency-crisis-explained-

2830631-2025-12-04

and

https://www.cnbc.com/2025/12/05/india-cuts-rates-to-as-

expected-as-central-bank-rbi-warns-of-further-reductions.html

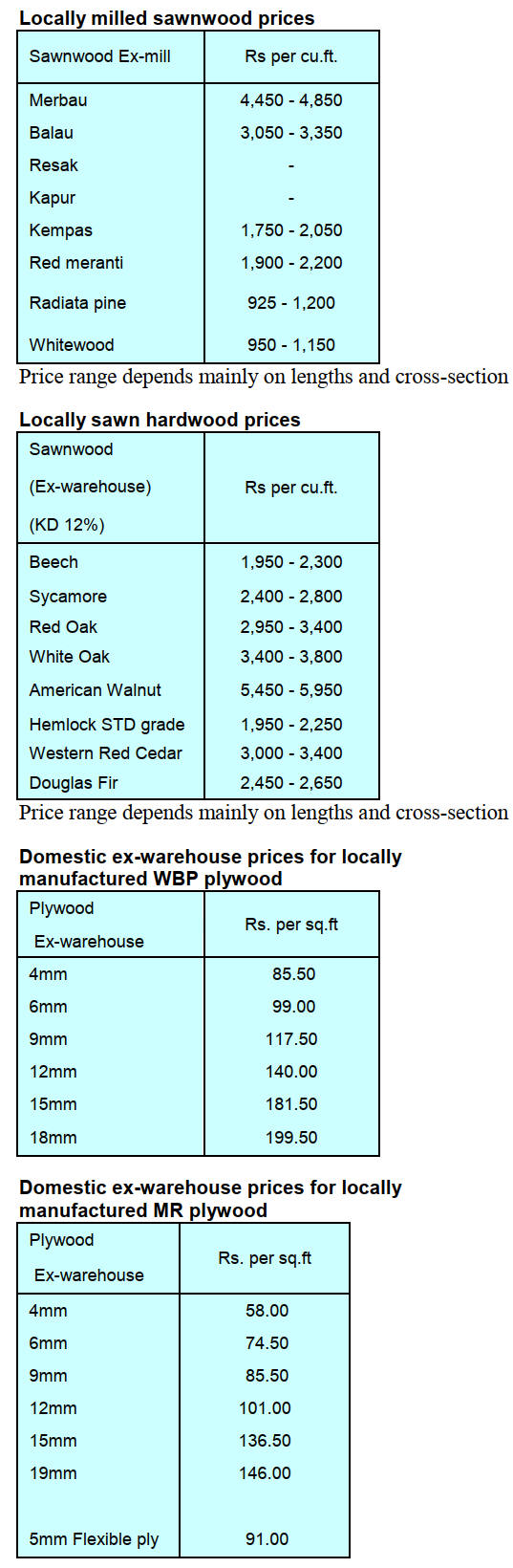

Turbulent times

The correspondent writes “demand is reasonably good but

costs are going up in the panel industry mainly because of

the Rupee exchange rate as well as rising phenol prices.

Overall, 2025 has been a rollercoaster ride. Firstly, BIS

implementation in January, then the US tariffs issue and

thirdly the extended monsoon and finally the Rupee

exchange rate at an all-time low. However, the good thing

is that India is a promising market and our domestic

consumption is high hence we can sail thru this turbulent

time”.

7.

VIETNAM

Wood and Wood Product (W&P) trade

highlights

According to the Viet Nam Customs Office W&WP

exports in November 2025 reached US$1.55 billion, up

5% compared to November 2024. The WP export share

was US$1.06 billion, up 3% compared to November 2024.

In the first 11 months of 2025 W&WP exports were

recorded at US$15.6 billion up 6% over the same period in

2024 of which WP exports earned US$10.67 billion, up

5% over the same period in 2024.

Viet Nam’s W&WP imports in November 2025 were at

483,200 cu.m, worth US$154.6 million, down 3% in

volume and 2.5% in value compared to October 2025.

Compared to November 2024 there was an increase of 3%

in volume and 3% in value. In the first 11 months of 2025

imports accumulated at 6.12 million cu.m, worth US$1.94

billion, up 21% in volume and 18% in value over the same

period in 2024.

Viet Nam's NTFP exports in October 2025 fetched

US$74.59 million, up 12% compared to September 2025

and 22% over the same period in 2024. In the first 10

months of 2025, NTFP exports generated US$ 715.18

million, up 9% over the same period in 2024.

The W&WP exports to the US in November 2025 earned

US$819 million, down 1% compared to November 2024.

In the first 11 months of 2025 W&WP exports to the US

are expected to reach US$ US$8.6 billion, up almost 6%

over the same period in 2024.

The exports of bedroom and dining room furniture in

November 2025 earned US$202 million, down 15%

compared to November 2024. In the first 11 months of

2025 exports of living room and dining room furniture are

estimated at US$2.3 billion, down 5% over the same

period in 2024.

According to preliminary statistics, Viet Nam's imports of

wood and wood products in November 2025 will reach

US$290.0 million, up 17% compared to October 2025.

Compared to November 2024 an increase of 26% was

observed. In the first 11 months of 2025 imports of wood

products have been estimated at US$2.91 billion, up 16%

in value compared to 2024.

Digital transformation challenges even billion-dollar

firms in Viet Nam

Despite high revenues, many Vietnamese wood product

manufacturers admit to confusion and setbacks when

embracing digital transformation.

Representatives of wood manufacturing and processing

enterprises have voiced concern and offered proposals

aimed at enhancing the role of the Viet Nam Timber and

Forest Products Association (Viforest) in supporting

business connectivity, trade promotion and policy

advocacy.

During the 5th Congress (2025–2030) of Viforest held

on

1 December in Ho Chi Minh City leading figures in the

industry shared their experiences and frustrations in

adapting to new market demands, particularly around

digitisation and governance.

Le Duc Nghia, Chairman of the Board of Directors at An

Cuong Wood JSC, emphasised the importance of direct

engagement among businesses. He believes such forums

offer clearer perspectives on the industry and help

companies identify solutions for sustainable growth.

According to Nghia, domestic wood companies benefit

from a highly skilled labour force and are capable of

producing goods competitive with foreign brands. Yet, he

admits that managerial capacity remains a major

challenge.

“Digitisation has helped An Cuong streamline operations

and gain full process control over the past five years,” he

stated.

At the congress, Vu Quang Huy, CEO of Tekcom JSC,

noted his company sales are around US$100 million

annually but has found the wood product and plywood

industries are evolving rapidly and face mounting

pressures from tariffs, origin traceability, and transparency

standards.

Huy highlighted several systemic challenges: rising input

costs amid falling product prices, legal risks tied to

sourcing, and supply chain disruptions as more firms

resort to importing raw materials themselves.

To navigate these issues, Huy proposed three key

strategies: increasing transparency in sourcing, promoting

collaboration and specialisation, and transforming supply

and value chains.

Sharing deep concerns about the future of woodworking as

a craft, Nguyen Thi En, Standing Vice President of the

Van Diem Craft Village Association, stated that traditional

woodworking villages are facing immense pressures in

today’s market.

According to En, traditional handicrafts, once celebrated

for their cultural value, are being squeezed out by mass-

produced goods and shifting consumer tastes.

Moreover, many traditional designs no longer match

modern consumer needs, limiting access to younger

audiences and high-end markets. Although artisanal

products receive praise in Europe, craft villages still

struggle to meet international standards.

En also pointed to digital transformation and e-commerce

as major challenges. Most workshop households still

operate independently, lack digital marketing strategies

and have limited adaptability to rapid market changes and

higher digitisation demands.

For long-term sustainability, En believes craft villages

must be restructured into larger models that allow

collaborative production to boost competitiveness.

“Authorities and Viforest need to strengthen support in

trade promotion, product design innovation and digital

training for producers. Only by preserving traditional

values while adapting to modern needs can woodworking

villages truly thrive,” she said.

Deputy Minister of Agriculture and Environment Nguyen

Quoc Tri, speaking at the congress, praised Viforest’s

contributions to wood processing and exports.

To help businesses meet stricter standards - especially

regarding legal timber, product origin and carbon

emissions - he urged the association to adopt new

mindsets, reform operations, and accelerate the

implementation of key plans.

For the 2025–2030 term the Deputy Minister outlined core

goals for Viforest: to continue helping businesses

overcome challenges, actively participate in policymaking,

expand markets and promote the development of high-

value products. He emphasised the need for a transparent,

eco-friendly production model that meets the growing

expectations of international markets and called on

Viforest to strengthen its role in building a legal wood

supply chain.

See: https://vietnamnet.vn/en/digital-transformation-puzzles-

billion-dollar-wood-firms-in-vietnam-2472051.html

Timber sector seeks solutions to VAT refunds

The Viet Nam Timber and Forest Products Association

(VIFOREST) has alerted the authorities that billions of

VND in delayed VAT refunds are leaving Viet Nam's

timber enterprises short of capital for reinvestment,

stalling production and directly threatening the livelihoods

of millions of people across the country.

VIFOREST has petitioned the Ministry of Finance and

relevant agencies to eliminate VAT on primary wood

products and recognise them as agricultural outputs

exempt from VAT. It has also called for consistent

application of Decree 209/2013/ND-CP, which clearly

stipulates that ordinarily processed plantation timber

should not be subject to VAT.

According to the Association, this proposal would allow

processing and exporting firms to avoid burdensome

deductions and refund procedures, reducing compliance

costs and freeing up working capital. “Our goal is to ease

administrative bottlenecks, mitigate legal risks, and

prevent losses to the state budget from invoice fraud,”

VIFOREST stated in its report.

The move, it argued, would also protect the incomes of

millions of rural household engaged in afforestation.The

sector's achievements underscore what is at stake.

Viet Nam today maintains more than 4.6 million hectares

of planted forests, producing an annual harvest of 35-40

million cubic metres of timber, sufficient to meet 75–80

per cent of processing demand.

Exports of wood products is forecast to reach US$16.9

billion in 2025, ranking sixth among Viet Nam's export

categories. The industry provides direct jobs for over

500,000 workers and sustains millions of smallholder tree

growers.

These numbers point to an acute liquidity challenge.

Preliminary figures from VIFOREST indicate that timber

enterprises are still waiting for VAT refunds worth around

VND6.1 trillion ($250 million). The delay is linked to

current procedures that require refunds to be processed

only after thorough review.

On paper, the system is meant to secure the state budget.

In practice, it has stalled refund approvals for compliant

businesses. “Many companies have complete and

legitimate dossiers, yet they are still asked to provide

additional clarifications over and over again,” noted Cao

Xuan Thanh, chief of office at VIFOREST. He stressed

that refund processing often exceeded the statutory

deadline, causing serious cash flow disruption.

Thanh pointed out that the requirement to trace raw

material origins back to individual households is

especially unrealistic.

“A single export shipment may be sourced from dozens of

growers across multiple provinces,” he explained. “The

verification process becomes unworkable, and that is

where enterprises get stuck.”

The consequences are immediate. Exporters are forced

to

advance 10%t VAT on input materials while awaiting

refunds, eroding their capacity to rotate capital.

This hits small- and medium-sized firms the hardest. With

industry-wide profit margins averaging only 5-7 per cent,

the sector loses an estimated VND500-600 billion ($20-25

million) annually due to refund

Nguyen Liem, Vice Chairman of VIFOREST, added that

product classification is another barrier. He observed that

plantation timber after harvest, such as logs, sawn timber,

peeled veneer or woodchips has not been clearly

recognised as “primary processed” goods. “Because of this

ambiguity, exporters accumulate large VAT credits that

cannot be refunded on time,” he said.

Liem further noted that both enterprises and small traders

are still obliged to declare and pay VAT even on

minimally processed timber, increasing costs and

paperwork. In his words, “These procedures consume

enormous time and resources, but the refunds remain out

of reach. This has paralyzed business cash flows and put

many companies at risk.”

These obstacles are driving a troubling shift. Some

companies now prefer to import timber rather than

purchase from domestic plantations to avoid VAT refund

complications. This undermines demand for local wood,

stripping millions of farmers of stable income and is a dis-

incentive for reforestation. Thanh cautioned that the

government might ultimately face the paradox of bailing

out commercial plantation forests, a scenario entirely at

odds with Viet Nam's sustainable forestry goals.

VIFOREST's message is clear: resolving VAT refund

issues is not merely about tax administration. It is about

preserving national reputation, protecting farmers'

livelihoods, and securing the industry's competitiveness in

a global market increasingly focused on sustainability. “If

these obstructions are not lifted, we risk losing both

domestic and international trust,” Thanh emphasised.

In its petition, the Association stresses that timely VAT

reform will immediately free up liquidity, reduce exposure

to legal risks, and enhance compliance with international

traceability standards.

See: https://vir.com.vn/timber-sector-seeks-solutions-to-vat-

refunds-138610.html

Wood, forestry sectors targets US$25 billion exports

For the 2025–2030 term, Viforest aims to reinforce its role

as a hub for innovation, build long-term development

plans and expand cooperation with ministries and

international partners to support the sector’s green

transition.

According to Viforest’s report the sector maintained solid

expansion over the past five years despite global trade

fluctuations. Export revenue from wood and wood

products rose from US$10.33 billion to US$16.2 billion

and is forecast to exceed US$18 billion in 2025.

These results were attributed to strong coordination among

enterprises, forest growers and state agencies, along with

Viforest’s role in assisting firms with technical

regulations, market information and trade-remedy

responses. The gradual strengthening of the legal timber

supply chain has also helped the industry meet stricter

requirements in major markets.

However, Viforest noted that the sector continues to face

structural challenges, including rising political and trade

competition, origin fraud risks and tariff pressure.

Limited management capacity and weak information

coordination in some enterprises have slowed their

reaction to market changes. Increasingly demanding

standards on green production and emission reduction,

particularly under the EU’s new deforestation regulation

(EUDR) pose added difficulties for small and medium-

sized firms. For the 2025–2030 Viforest aims to reinforce

its role as a hub for innovation, build long-term

development plans and expand cooperation with ministries

and international partners to support the sector’s green

transition.

The Association identified five priorities, helping

enterprises expand markets, strengthening branding,

developing high-value products, promoting deeper

processing and improving system-wide coordination and

trade promotion.

The congress elected a 31-member Executive Committee

for the new term, with Nguyen Quoc Khanh, Chairman of

AA Corporation, chosen as Viforest President. He said the

sector aims not only to expand export scale but also to

increase added value, bringing greater benefits to forest

growers.

To achieve the export target of US$25 billion by 2030, he

emphasised three directions: enhancing competitiveness

through stronger linkages; building a national brand for

Vietnamese wooden products; and diversifying markets,

product lines and distribution channels. He stressed the

need for a resilient supply chain, improved production

capacity, investment in green manufacturing and a data

system aligned with international standards.

Viforest also encouraged enterprises to increase their

presence at major global trade fairs, deepen connections

with foreign partners and make better use of Viet Nam’s

overseas trade offices. Domestically, upgrading

specialised exhibitions would help position Viet Nam as a

key destination for international buyers./.

See: https://en.vietnamplus.vn/wood-forestry-sector-targets-25-

billion-usd-in-exports-post334173.vnp

8. BRAZIL

Forest concessions an instrument for

restoration,

conservation and carbon

During COP30 in Belém the Brazilian Forest Service

(SFB) moderated the Panel “Forest Concessions:

Conservation, Restoration and Carbon” and highlighted

the strategic role of forest concessions as public policy

instruments which can combine conservation, ecological

restoration, carbon credit generation and socioeconomic

development.

The discussion brought together representatives from

Petrobras, Brazil NBS Alliance, National Bank for

Economic and Social Development (BNDES) and

Mombak, which emphasised the need to align public

policy, financial instruments and private initiatives to

expand nature-based solutions (NBS) in the Amazon.

The SFB opened the session noting that the climate agenda

goes beyond reducing deforestation and requires restoring

degraded areas and reorganising the use of public forests

with legal security and socio-environmental safeguards.

In this context the concept of a ‘new generation’ of forest

concessions focused on restoration and carbon was

presented and illustrated by the Bom Futuro National

Forest Concession located in the Amazon.

This is the first federal model dedicated to restoring

degraded areas through carbon credit generated funds and

commercial production.

According to SFB this initiative raises the standard of

forest concessions by combining large-scale restoration,

carbon revenues and direct benefits for local communities

and this reinforces Brazil’s contribution to global climate

goals.

The Panel consolidated the view that a forest concession

structure and the sustainable use of public forests provide

predictability for investors and promote biodiversity-based

development connecting conservation, restoration and the

low-carbon economy into an integrated agenda for a

sustainable Amazon.

See: https://www.gov.br/florestal/pt-

br/assuntos/noticias/2025/novembro/concessoes-florestais-

aproximam-conservacao-restauracao-e-carbono-na-amazonia-

durante-a-cop30

Partnership to boosts native species silviculture

The Chico Mendes Institute for Biodiversity Conservation

(ICMBio) and the Brazil Climate, Forests and Agriculture

Coalition have formalised a Technical Cooperation

Agreement aimed at expanding native timber species

silviculture at a national scale with an emphasis on

enhancing the value of Protected Areas (Unidades de

Conservação - UCs) and integrating these areas into the

productive sector.

The initiative establishes structured actions including

mapping degraded areas, installing demonstration plots in

Federal Protected Areas and providing technical training

for ecological restoration and native species management.

The agreement also includes assessing environmental

liabilities within protected areas to guide recovery projects

and the sustainable use of the territory.

According to the National Center for Biodiversity

Conservation (CBC) the partnership addresses the

challenge of connecting Protected Areas, currently

surrounded by degraded landscapes, to sustainable

production practices thus strengthening interactions with

agribusiness.

The strategy includes initiating native timber species

plantations in National Forests and expanding them to

surrounding rural properties. The partnership has also

contributed to advancing the National Plan for Native

Vegetation Recovery (Planaveg).

See: https://www.maisfloresta.com.br/icmbio-e-coalizao-brasil-

firmam-parceria-para-ampliar-silvicultura-de-nativas-no-pais/

Postponement of EUDR

The European Parliament has approved a broad package of

amendments to the European Union Regulation on

Deforestation-Free Products (EUDR) confirming its

second implementation postponement and redefining the

roles, responsibilities and obligations of operators along

the supply chain.

The changes introduce new categories of operators (micro

and small primary and downstream operators) and

simplify due diligence obligations for micro and small

operators while downstream operators further along the

chain are largely exempt from the regulation´s main

requirements.

The amendments aim to reduce the burden on the EUDR

information system, lower administrative costs and

making compliance more proportionate without altering

the core objectives of the regulation.

The Parliament also instructed the Commission to propose

further adjustments by 30 April 2026 maintaining the

focus on geolocation of production areas, proof of legality

and verification of deforestation-free origin. For Brazil,

the postponement represents an opportunity to strengthen

internal organisation and ensure continued access to the

European market. Technical compliance remains essential

to ensure access and turn the additional time into a

competitive advantage.

See: https://www.maisfloresta.com.br/o-eudr-foi-adiado-o-que-

realmente-muda-para-quem-exporta/

Mato Grosso - a model for sustainable forest

management

The Secretaria de Comunicação Social (SECOM-MT) has

indicated the Mato Grosso State Secretariat for the

Environment (Sema-MT) has consolidated an advanced

forest management model based on strict control,

monitoring and traceability of timber from natural forests.

This, says SECOM-MT, has made the State a national

reference and led to its invitation to present the initiative at

the 5th edition of the event “Sustainable Timber: The

Future of the Market,” at a Federation of Industries event

in the State of Bahia.

The Mato Grosso system integrates forest cover

monitoring, enforcement actions and the System for the

Commercialisation and Transport of Forest Products

(Sisflora) which ensure the traceability of each tree

harvested under forest management plans thus

guaranteeing environmental compliance and transparency

throughout the supply chain.

In managed forest areas tree harvesting is conducted

selectively, respecting each tree’s life cycle. Trees that

have fulfilled their ecological role are strategically

harvested minimising the environmental impact and

allowing the regeneration of younger trees.

During the event State authorities emphasised that

sustainable forest management is strategic for keeping the

forest standing, increasing the supply of legal timber,

strengthening the bioeconomy and monetising ecosystem

services thus contributing to job creation, income

generation and regional development.

See: https://www.secom.mt.gov.br/w/modelo-implementado-em-

mt-para-garantir-produ%C3%A7%C3%A3o-regular-de-madeira-

nativa-%C3%A9-refer%C3%AAncia-em-n%C3%ADvel-

nacional#f9331d53-89f6-4e10-b532-d85982a3be84

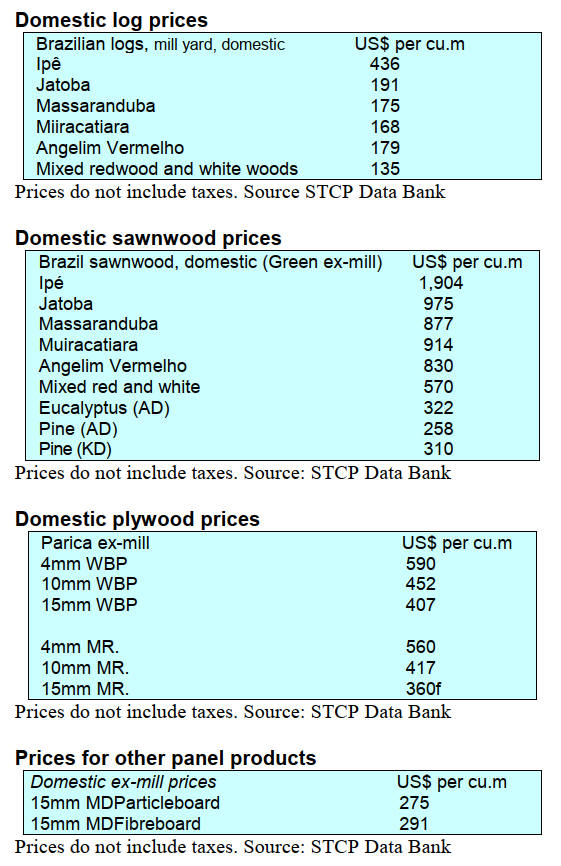

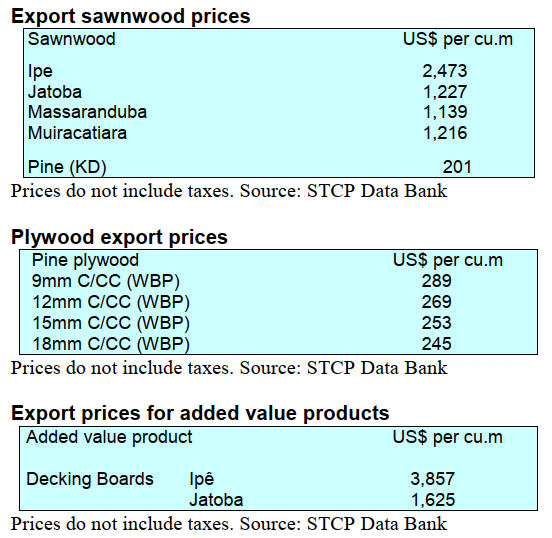

Export prices

Average FOB prices Belém/PA, Paranaguá/PR,

Navegantes/SC and Itajaí/SC Ports.

9. PERU

Timber harvested under permits predominantly legal

At the IX Latin American Forestry Congress OSINFOR

presented the results of its 2023 assessment of illegal

logging revealing that 88% of the timber extracted under

permits is legal. The report confirms that sustainable

management continues to deliver an opportunity to

conserve forests and promote development in Peru.

Currently, more than 7 million hectares of the country's

forests are managed under management plans. "In these

areas, legality is strengthened. The greatest risk lies in

unmanaged territories where forest loss is concentrated,"

stated Williams Arellano Olano the Head of OSINFOR.

The study also demonstrated sustained progress. Illegality

under permits decreased from 80% in 2015 to 12% in

2023 a result of the monitoring, training and technology

implementation efforts undertaken by OSINFOR.

See: https://www.gob.pe/institucion/osinfor/noticias/1293751-el-

88-de-la-madera-de-los-titulos-habilitantes-es-legal

Madre de Dios, Loreto and Ucayali – centres for FSC

certification in Peru

Peru has 1,022,175 hectares of forest certified by FSC

according to information provided by FSC Peru. There are

98 initiatives from the private sector, twelve of which are

related to forest management and 86 to chain of custody

(CoC). The regions of the country with the largest certified

areas are: Madre de Dios with 52%, Loreto with 35% and

Ucayali with 13%.

Strengthen forest regeneration and conservation

The Yamino native community, a Kakataibo indigenous

group recognised for its sound management of timber

resources, is the site of the study “A Look Towards

Conservation: Potential of Seed Trees in Native

Communities and Forest Concessions of the Ucayali

Region.”

This initiative is led by the Supervisory Agency for Forest

Resources and Wildlife (OSINFOR), the National

Agrarian University of the Jungle (UNAS) and the

Association for Research and Integral Development

(AIDER) with the goal of contributing to forest

conservation.

To understand the forest's natural regeneration capacity

and identify the productive potential of the seeds, the

technical team entered the community's forest

management area to evaluate the seed trees declared in its

management plan and collect information on species such

as ana caspi, mashonaste, copaiba, and cachimbo.

The results of the fieldwork will be used in the preparation

of a book that will highlight the role of seed trees in the

conservation and natural regeneration of forests.

See: https://www.gob.pe/institucion/osinfor/noticias/1244472-

ucayali-impulsa-estudio-de-arboles-semilleros-para-fortalecer-la-

regeneracion-y-conservacion-de-los-bosques

Pilot study to accurately identify timber species

With the aim of strengthening the traceability of timber

resources and ensuring their legal origin the Supervisory

Agency for Forest Resources and Wildlife (OSINFOR)

and the Technological Institute of Production, through the

CITEmadera y del Mueble (Wood and Furniture

Technology Center) and the CITE Forestal Maynas

(Maynas Forestry Technology Center) collected botanical

and wood samples of fifteen forest species as part of the

first pilot collection project carried out in Loreto.

Samples will allow researchers to analyse their cellular

structure, pore patterns and growth rings, essential

information for accurately identifying each tree species.

See :https://www.gob.pe/institucion/osinfor/noticias/1304312-

loreto-inicia-estudio-piloto-para-identificar-con-precision-

especies-maderables

|