Japan

Wood Products Prices

Dollar Exchange Rates of 10th

May

2025

Japan Yen 145.38

Reports From Japan

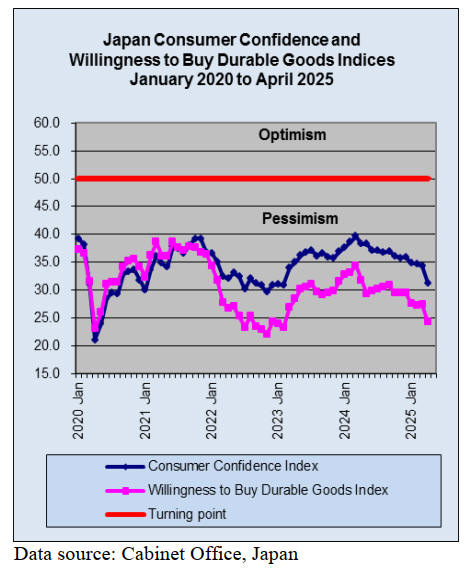

Weak private consumption and disrupted external

demand up-ends growth

In advance of the official government data most analysts

believe Japan's economy contracted in the first quarter of

2025 due to weak private consumption and disrupted

external demand. Eight out of 11 private-sector research

institutes projected the economy shrank in the first quarter

of this year. If this is the case it would undo three quarters

of growth in 2024.

Three research firms believe private consumption fell due

to higher living costs. Private consumption accounts for

more than half of Japan's GDP. Most researchers say

Japan's GDP was hit by the global economic slowdown.

This reduced earnings from exports at the same time the

cost of imports increased.

On a more positive note, most analysts assess that capital

investment expanded in the first quarter. Analysts point

out GDP was not directly impacted by US tariffs.

If there is actually a decline in GDP this would cast a

shadow over the Bank of Japan’s plans to steadily

continue with policy normalisation. It also highlights

weaknesses in Japan’s economy which could be weakened

further by stringent tariffs in the US.

See: https://www3.nhk.or.jp/nhkworld/en/news/20250512_B2/

Record current account surplus

Japan posted a record current account surplus of US$208

billion in fiscal 2024 marking a high for the second

consecutive year. The success was driven by huge returns

on foreign investments. In the year ended March

government data shows the surplus in the current account

balance, a gauge of international trade, grew 16% year on

year, an all-time high.

The yen averaged 152.48 against the U.S. dollar in

fiscal

2024, 5.5% weaker than the year before with the Japanese

currency's depreciation inflating the value of returns from

foreign investments by domestic companies and overseas

dividend income. Among other key components, imports

climbed 4% and exports rose 4% helped by shipments of

semiconductor-making equipment, electronics parts and

vehicles.

See:

https://mainichi.jp/english/articles/20250512/p2g/00m/0bu/0200

00c

Profits dip – weak sale in US and China

The combined net profit of Japan's manufacturers for the

financial year ended March 31 declined 2% year on year,

the first decline in two years. The downturn was largely

due to automakers which struggled with weak sales in the

US and China. Steelmakers had to contend with cheap

Chinese imports. Automakers' net profit fell by more than

20%.

See:https://asia.nikkei.com/Economy/Japan-manufacturers-log-

1st-profit-decline-in-2-years

Cut in consumption tax discussed as prices surge

Several opposition parties in Japan are arguing for a

consumption tax cut to aid consumers amid soaring prices.

Some are calling for a one-off cut on only food. Others are

suggesting the government make up for any shortfall in tax

revenue that arises from a lower rate by issuing debt. The

ruling Liberal Democratic Party has, so far, resisted calls

for a tax cut and is emphasing its role as the only party that

is able to take responsibility for ensuring the country's

financial stability.

Discussions on the consumption tax have traditionally

been risky for political parties but consumers are facing

mounting price increases and the tax issue is likely to be

the main issue during campaigning for the July Upper

House election.

See: https://japannews.yomiuri.co.jp/editorial/yomiuri-

editorial/20250513-254062/

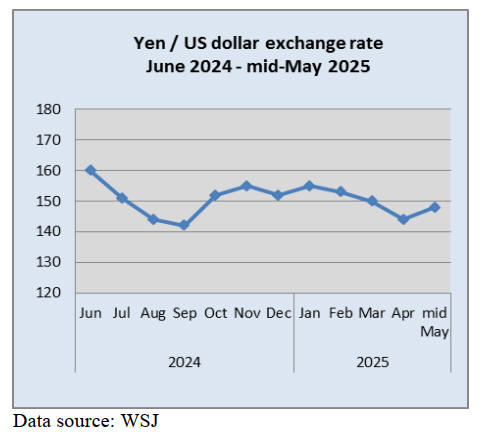

Yen volatility returns

For a while, because of the turmoil created in the Global

economy, the yen once again became the safe-haven as

money poured in. The US tariff strategy seriously

undermined confidence in dollar assets and early this year

the Japanese yen strengthened by around 10% on the

dollar.

Volatility in currency markets returned as news emerged

that China and the US had reached a tentative initial

agreement driving the dollar higher and the yen lower. In

mid-May the yen was back to around 148 to the US dollar.

See:https://asiatimes.com/2025/05/how-trump-made-

japans-yen-great-again/

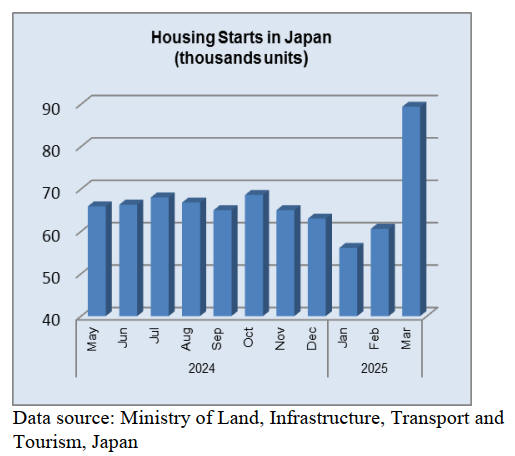

Not enough carpenters

Carpenters with experience in house building have joined

the ranks of Japanese industries suffering a shortage of

trained professionals. The result of this is that a custom

designed home has become very expensive.

According to the national census the carpenter workforce

has, over the past 40 years, dwindled to a third of its

former size and this is behind the rising housing costs of

new homes and long waiting times for home renovations.

The government census found the number of carpenters

peaked at 930,000 in 1980. By 2020 it had fallen below

300,000 with projections indicating a possible drop to

150,000 by 2035.

Government statistics show new housing starts declined by

35% over a 15-year period ending in fiscal 2020. The

carpentry workforce shrank even faster with a 45% drop.

See: https://www.asahi.com/ajw/articles/15709629

Revision of JAS dimension lumber and other wood

products

The Ministry of Agriculture, Forestry and Fisheries

(MAFF) has invited public comments on three different

proposed Japan Agricultural Standard (JAS) revisions.

One proposed revision is for “JAS 600: Dimension

Lumber and Finger Jointed Dimension Lumber” for 2×4

construction methods, which includes changes in species

groups for design values. The other proposed revisions are

for JAS wood pellet fuel and JAS labeling requirements.

See:

https://apps.fas.usda.gov/newgainapi/api/Report/DownloadRepor

tByFileName?fileName=Revision%20for%20JAS%20Dimensio

n%20Lumber%20and%20Other%20Wood%20Products_Tokyo_

Japan_JA2025-0023

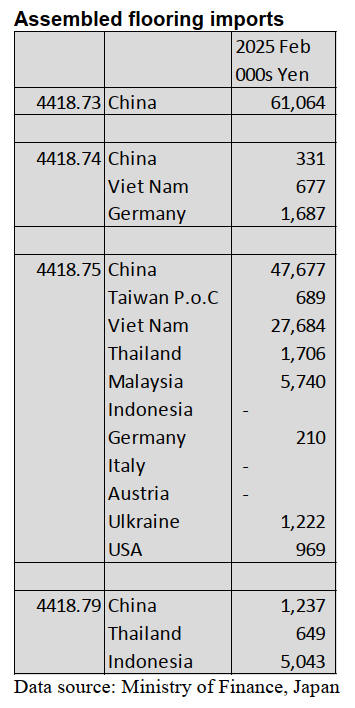

Import update

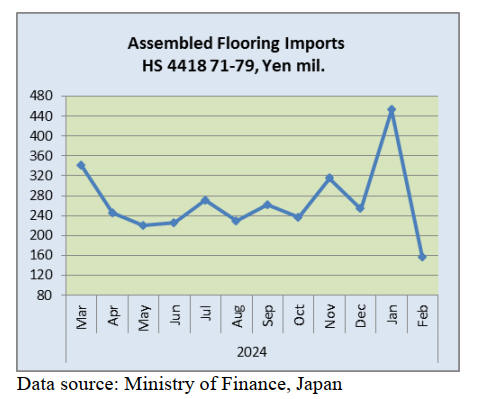

Assembled wooden flooring imports

The value of February 2025 imports of assembled wooden

flooring HS441871-79 was over 60% less than in January.

It is assumed that, as most assembled wooden flooring is

shipped from manufacturers in China, the surge in January

imports was in because Japanese importers wanted to

secure supplies before businesses in China closed for their

New Year holidays.

The sharp drop in the value of February import brought

the average of January and February imports back in-line

with the value of previous monthly import values.

The main category of assembled flooring imports in

February 2025 was HS441875, accounting for 55% (62%

in January) of the total value of assembled flooring

imports. Of HS441875 imports, 56% was provided by

shippers in China and 33% by shippers in Vietnam. The

other main sources of assembled flooring (HS441875) in

January were Malaysia and Thailand.

The second largest category in terms of value in February

2025 was HS441873 (39% of the total in February) all of

which was shipped from China. The third and fourth

largest categories in value terms were HS441879 (4%) and

HS441874 (4%).

Plywood imports

Construction activity slows in January because of the

influence of the bad weather in many regions and due to

the New Year holidays as these factors influence plywood

imports. In February plywood imports picked up rising

around 30% compared to the volume imported the

previous month.

Malaysia and Indonesia were the top suppliers in February

2025 however arrivals from both countries were down

month on month and compare to February 2024. In

February 2025 the other main shippers, Vietnam and

China recorded a decline in the volume of shipments. The

decline was particularly noticeable for China reflecting

mill closures for the Chinese New Year.

As in previous months, of the various categories of

plywood imported in January 2025 HS441231 was the

largest (81% of total imports) followed by HS441233

(4%). Malaysia and Indonesia accounted for most of the

HS441231 arrivals in December.

Small volumes of HS441239 and HS441234 arrived in

Japan during February from a wide range of suppliers.

Trade news from the Japan Lumber Reports (JLR)

The Japan Lumber Reports (JLR), a subscription trade journal

published every two weeks in English, is generously allowing the

ITTO Tropical Timber Market Report to reproduce news on the

Japanese market precisely as it appears in the JLR.

For the JLR report please see:

https://jfpj.jp/japan_lumber_reports/

Export of wood products from Japan to U.S

Starting on 5 April the U.S. government imposed an

additional 10% tariff on top of the existing tariffs,

applying uniformly to all countries. Also, starting on the

9th April, reciprocal tariffs will be imposed on 57

countries and regions. For Japan, the tariff will increase by

24% on top of the existing rate, which would influence the

car industry.

On the other hand, wood products were designated as an

exempt item from additional tariffs and reciprocal tariffs,

along with pharmaceuticals and semiconductors.

The tariff exemption applies to logs, lumber, plywood and

wood chips. The applicable items include structural

laminated lumber, CLT, wooden fitting and wooden

tableware, parquetry work and decorative wooden boxes.

The export value of wood products to the U.S. from Japan

was 5.6 billion yen in 2024.

The primary use is fencing materials around residential

areas. However, if the lumber is imported without

processing and classified under HS code 4407, it will be

exempt from the additional tariffs imposed by the recent

presidential order.

However, these exempt items may be subject to changes in

measures depending on the results of the investigation

under Section 232 of the Trade Expansion Act related to

lumber.

On the 9th April, 2025, U.S. President Trump announced a

90-day suspension of reciprocal tariff measures for certain

countries and regions. As a result, the 24% tariff imposed

on Japan has been temporarily suspended.

On the other hand, the additional 10% tariff on existing

tariffs, imposed on all countries since the 5th April, will

remain in effect.

North American logs

The precutting companies do not have a lot of orders in

this month and the movement of American lumber is

sluggish. Since supply of Douglas fir small lumber or

square lumber has been reduced by a Douglas fir lumber

manufacturer and the arrival volume of imported lumber

has been decreasing since the latter half of last year, the

lumber is in short supply.

A major Douglas fir lumber manufacturer in Japan raised

the price of lumber due to high production cost. It was

easy to raise the price because the price of European

laminated redwood square, which is competing with KD

Douglas fir squares, is high.

Canadian Douglas fir log prices for plywood remained flat

compared to the previous month. Inquiries to long

plywood is also weak as same as lumber. As a result,

production at domestic plywood manufacturers is low.

However, Canada will not lower the price.

South Sea logs and products

The supply and demand balance for hardwood products

has tended to remain stable at a low level, with low supply

and weak demand. With overall domestic demand

stagnating, there was even less work available in March as

it was the end of the fiscal year.

When the yen temporarily appreciated to the mid-140 yen

range against the dollar, domestic distributors made orders

some items which were running low on stock. As the yen

weakened again, inquiries rapidly decreased.

Russian sellers won’t change the current prices. Although

demand for South Sea lumber or laminated boards is

weak, local manufacturers show no signs of lowering

prices due to high production costs.

Demand and supply of South Sea logs are balanced. Logs

from Papua New Guinea and Malaysia will be delivered to

Japan at the end of this May. The impact of US tariff

policy has not been felt on South Sea logs.

Forest bathing is beneficial for preventive medicine

One of research groups at Tokyo Medical Center of

National Hospital Organization has scientifically

demonstrated that forest bathing contributes to improved

mental health. The effects of forest bathing have been

studied for some time but this research group and others

have conducted rigorous clinical studies to systematically

validate its benefits. The utilisation of forest environments

is expected to play a significant role in future preventive

medicine.

Research has consistently shown that walking in a forest

environment activates the parasympathetic nervous system

leading to physiological relaxation. These studies suggest

that forest bathing may help reduce anxiety and

depression. However, there are still few studies that

employ chemically rigorous research designs and the

effects on mucosal immunity, an essential component in

infection defense, have not been thoroughly examined.

Therefore, the research group conducted a randomised

controlled trial comparing the effects of forest bathing and

urban walking in healthy men aged 40 to 70.

As a result, the research group found that secretory

immunoglobulin A increased in the forest bathing group.

In conclusion, forest bathing has been shown to enhance

immune function and contribute to the prevention of

various infections, including those caused by viruses.

Future research needs to examine the extent to which

habitual forest bathing contributes to disease prevention

and health maintenance. Also, future research needs to

investigate in detail which elements of forest bathing have

positive effects on health. It is expected that forest bathing

will increasingly contribute to health promotion for a

larger number of people.

The research findings were published on January 26 in

“Scientific Reports”, a journal under the UK-based Nature

Publishing Group.

|