|

Report from

Europe

European plywood imports rebound 14% in 2024

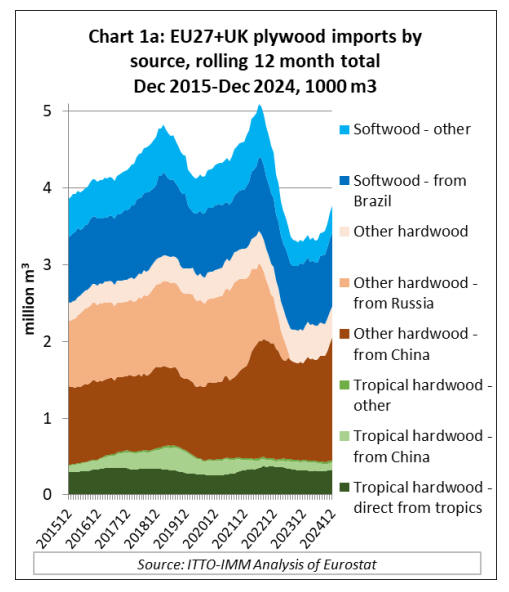

Total EU+UK imports of plywood from outside the region

in 2024 were 3.77 million cu.m, up 14% compared to the

previous year when imports were at the lowest level for 15

years. Import value increased by 8% to US$1.82b last

year.

While the rebound was significant, import quantity in

2024 was still the second lowest in a decade and well

below annual average imports of 4.25 million cu.m in the

years immediately before the covid pandemic. The rise in

2024 owed much to a sharp increase in imports during the

last quarter of the year, particularly in temperate hardwood

plywood from China (Chart 1a).

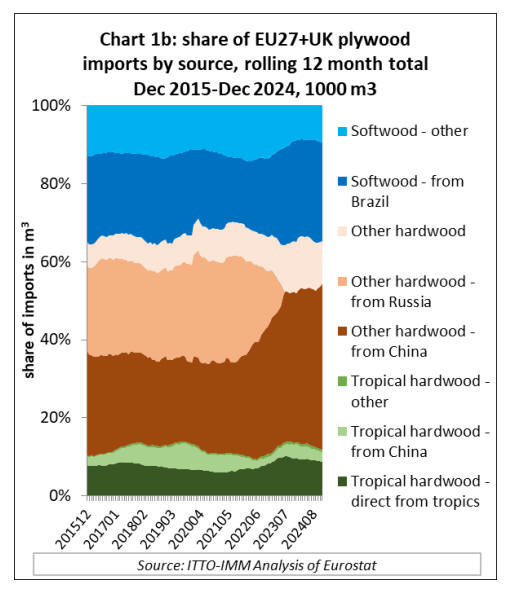

In terms of import market share in the EU+UK region, the

biggest shift last year was an increase in the share of

plywood faced with temperate hardwood from China,

largely at the expense of tropical hardwood plywood, both

direct from the tropics and from China (Chart 1b).

Sharp rise in European market share for Chinese

hardwood plywood

The share of temperate hardwood plywood from China in

total EU+UK import quantity increased from 38.1% in

2023 to 42.6% in 2024.

The import share of temperate hardwood plywood from

other countries fell from 13.2% in 2023 to 10.9% in 2024,

continuing a sharp declining trend which began in 2022

with the progressive tightening of European sanctions

against wood products originating in Russia and

Belorussia.

The share of tropical hardwood plywood in total EU+UK

imports fell from 13.7% in 2023 to 11.8% in 2024, with

the share of direct imports from the tropics down from

9.6% to 8.8% and import share from China down from

3.6% to 2.4%. The share of softwood plywood in total

EU+UK imports fell slightly from 34.9% to 34.6% with

Brazil maintaining its dominance of this market.

EU domestic plywood manufacturers have been unable to

significantly increase production in response to the supply

gap that opened following the sanctions on Russian and

Belorussian products.

Data from the European Panels Federation (EPF) indicates

that total EU plywood production fell 15% to 2.6 million

cu.m in 2023, the lowest ever recorded and only about half

the volume of nearly 5 million cu.m per annum prevailing

before the COVID pandemic.

EU plywood production figures for 2024 are not yet

available, but EPF projected last year that it was unlikely

to increase by more than 2%.

Weak construction sector leads to low plywood

consumption in Europe

On the import side, European importers were reporting no

significant problems in obtaining sufficient volume to

meet demand in 2024. Rather the historically low level of

imports during the year was driven by continuing slow

consumption. The Eurostat construction production index

fell by 1.3% between January and September last year,

although it did recover all the lost ground in the last

quarter.

Another factor impeding plywood imports last year was a

sharp hike in freight rates from Asia to Europe during the

middle of the year. This was partly attributed to attacks on

shipping in the Red Sea, leading to vessels having to avoid

the Suez Canal and take the long route around the tip of

Africa.

On the Shanghai to Rotterdam route, rates for 40-ft

contained increased from around $3000 at the start of May

to peak at over $8250 at the end of July, before falling

back to around US$4000 by the end of October. This year

they have fallen further and now stand at around

US$2300.

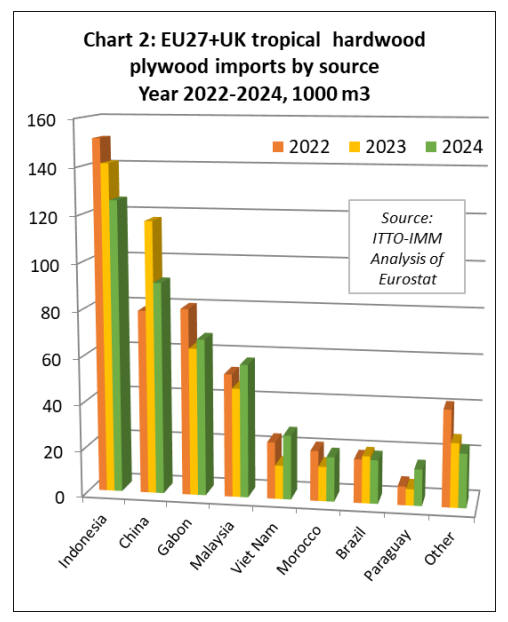

European imports of tropical hardwood plywood down

2% in 2024

Imports of plywood faced with tropical hardwood into the

EU+UK region last year totaled 446,900 cu.m in 2024, 2%

less than the previous year. In value terms imports

increased 3% to US$293m last year. Last year EU+UK

imports of tropical hardwood plywood direct from tropical

countries held up better than imports of tropical hardwood

plywood from China (Chart 2).

EU+UK imports of tropical hardwood faced plywood from

China, mainly destined for the UK, decreased 22% to

91,300 cu.m in 2024. However, EU+UK plywood imports

direct from tropical countries in 2024 were 330,400 cu.m,

4% more than the previous year.

There was a 6% increase in imports from Gabon to 67,600

cu.m, a strong 22% rebound in imports from Malaysia to

57,500 cu.m, and a 91% increase in imports from Vietnam

to 27,700 cu.m. Imports of okoume plywood from

Morocco were also up 29% to 19,300 cu.m, and

eucalyptus plywood imports from Paraguay increased by

122% to 15,700 cu.m.

These gains were partly offset by an 11% fall in tropical

hardwood plywood imports from Indonesia to 125,700

cu.m and a 7% decline from Brazil to 18,800 cu.m.

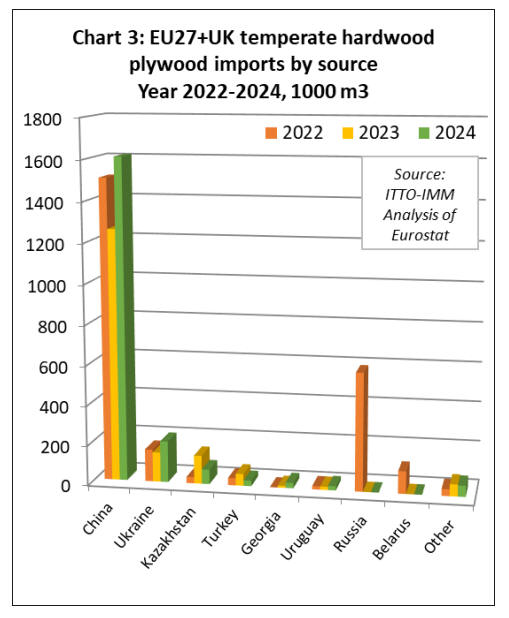

European imports of temperate hardwood plywood

increase 19% in 2024

EU+UK plywood imports of temperate hardwood

plywood increased 19% to 2,019,600 cu.m in 2024.

Imports of temperate hardwood plywood increased 10% in

value terms, to US$1.03b.

The gains were mainly due to imports from China and

Ukraine, which were 1,609,000 cu.m and 206,400 cu.m in

2024, respectively 28% and 39% more than in the

previous year. Imports of temperate hardwood plywood

from Kazakhstan were down 49% to 73,000 cu.m last

year, while those from Turkey fell 53% to 27,800 cu.m.

However, imports from Georgia increased 172% to 26,800

cu.m (Chart 3).

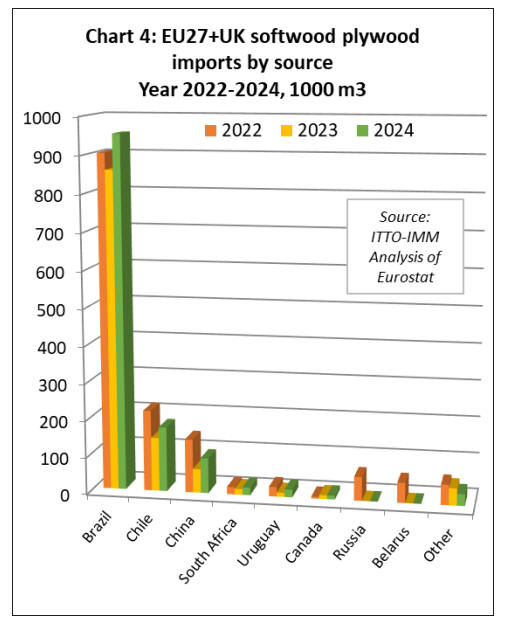

Rising European imports of softwood plywood from all

leading supply countries

The EU+UK region imported 1,306,900 cu.m of softwood

plywood in 2024, 13% more than the previous year.

Import value increased 9% to US$494m during the year.

Import quantity increased from all the main supply

countries including Brazil (+11% to 935,500 cu.m), Chile

(+20% to 174,900 cu.m), China (+47% to 95,200 cu.m),

South Africa (+33% to 20,800 cu.m), and Uruguay (+88%

to 20,600 cu.m).

EU anti-dumping measures targeting plywood imports

The decline in European imports of temperate hardwood

plywood from Kazakhstan and Turkey in 2024 followed

on from the extension of EU anti-dumping measures on

imports of birch plywood, previously applied to Russian

products, to imports from the two countries.

The European Commission announced the extension in

May last year following their investigation which

concluded that EU anti-dumping duties on imports of

birch plywood from Russia were being circumvented by

imports transshipped from Russia to Kazakhstan and

Turkey, or sent for final completion to these countries,

preceding shipment of the finished product to the EU.

In October 2024, the European Commission initiated an

additional anti-dumping investigation, this time

concerning imports of hardwood plywood from China.

That investigation is still on-going. As part of this

procedure, in December 2024 the EU introduced a law

requiring registration of all hardwood plywood imports

from China.

The measure is designed to ensure that all such imports

entering the EU are meticulously recorded by national

customs authorities. According to the law, the purpose of

registration is “to ensure that, if the investigation results in

findings leading to the imposition of anti-dumping duties,

those duties can, if the necessary conditions are fulfilled,

be levied retroactively on the registered imports”.

In March this year, the European Commission launched an

anti-dumping investigation into allegations by a

consortium of large European plywood producers that

Brazilian softwood plywood imports in the EU are being

sold at unfairly low prices.

As part of the probe, all Brazilian softwood plywood

imports must now be registered at EU borders to allow

customs authorities to retroactively impose additional

duties if the investigation confirms dumping practices.

US-EUface-off on tariffs

Following the US administration’s announcement to

impose US tariffs of 25% on all aluminium and steel

imports the EU launched a consultation in March on

possible retaliatory tariffs. A very large range of US forest

products were included in the initial list of products

pencilled in for retaliatory EU tariffs. Several EU forest

products trade and industry groups provided input into the

EU consultation asking that these products be removed

from the list to discourage any imminent trade war

between the US and EU from spilling over into the forest

products sector.

On 2 April, the US President issued an Executive Order

that imposed, starting 9 April, an additional ad valorem

duty on all US imports from all trading partners, with

some specific exceptions.

For the forest products sector, a notable exception is

everything up to and including 4413 in HS Chapter 44 -

that is biomass, chips, poles, logs, lumber, sleepers,

mouldings, veneer, plywood and densified wood.

These wood products are exempt from the 2 April

Executive Order because they are subject to an on-going

investigation under the terms of another Presidential

Executive Order issued on 1 March targeting lumber

products that may lead to alternative sector-specific tariffs

in the future.

The additional US duty on products not subject to an

exception was slated to start at 10% for all trade partners

with additional duties above this level imposed on trading

partners determined largely by the size of their trade

surplus in goods with the U.S. The duty on goods imports

from the EU was slated at 20%, while the UK would be

subject to the baseline 10% tariff.

The EU voted on 9 April on the first tranche of US

products to be subject to 25% retaliatory tariffs in response

to the earlier U.S. tariffs on steel and aluminium products.

While some U.S. hardwood products have been targeted

by the EU, the list is much reduced from the original

proposal sent out for consultation in March.

According to unofficial analysis by the American

Hardwood Export Council, products targeted for EU

retaliatory tariffs account for around 10% of the total value

of US hardwood primary products imports (logs, lumber,

veneer, plywood, mouldings) into the EU.

The EU retaliatory list excluded some of the largest U.S.

hardwood export items, notably all hardwood logs, all oak

lumber, lumber of “other” hardwood species (which

covers species such as walnut, tulipwood, and hickory),

and thin veneers. The products included were generally

less prominent in U.S. exports to the EU, such as ash,

cherry, and maple lumber.

Following the 9 April announcement of a 90-day delay to

the imposition of all US tariffs above the 10% baseline to

allow time for negotiations, the EU responded by

announcing that their package of retaliatory tariffs would

also be delayed. The EU tariffs on US hardwood products

are now scheduled to be imposed from 16 July.

Overall, the fact that both the US and EU have so far

refrained from imposing additional tariffs on their bilateral

trade in primary wood products has been seen by the wood

industry in the EU as a partial win in their efforts to avoid

the forest products sector being dragged into the wider

trade war.

It is only a partial win because a large proportion of

secondary and tertiary processed wood products, including

all wood furniture products, are still slated for retaliatory

tariffs by both the US and EU, respectively of 20% and

25%, in their bilateral trade. If no agreement can be

reached in on-going negotiations these tariffs will be

imposed in July.

Challenge to EU manufacturers from products diverted

away from the US

For the European forests products sector the direct impact

of additional tariffs on bilateral trade with the US, while

significant, may be less of an issue than the impact of the

new US tariffs on global supply chains and the wider

economy.

Total EU exports of forest products to the US, which

averaged US$9.37 bil. each year between 2022 and 2024,

accounted for 14% of the US$65 bil. total EU annual

exports of forest products outside the region during that

period.

A large proportion of EU products exports to the US

include added-value products such as wood furniture,

finished joinery, engineered wood and specialist paper

products that will be subject to the US 20% import tax if

no agreement is reached between the US and EU before

July. This would be a significant hit to overall EU forest

products exports but not an overwhelming challenge for

most manufacturers which are oriented more towards

supplying the large domestic market.

A bigger challenge may arise from the diversion of a large

proportion of products produced in other parts of the

world, previously destined for the US, towards the

European market. Last year, the US imported US$66 bil.

of forest products including US$22 bil. of wood (HS44),

US$22 bil. of wood furniture (HS94), US$18 bil. of paper

(HS48) and US$4 bil. of pulp (HS47).

Switching even a relatively small proportion of this

volume towards European markets could quickly

overwhelm domestic manufacturers already struggling

under pressure of relatively low consumption and high

costs of production.

This risk of diversion to Europe is heightened by US

plans, announced on 18 April, to impose port fees on

Chinese ships arriving at US ports. From mid-October,

Chinese ship-owners and operators will be charged US$50

per tonne of cargo with the fees increasing by US$30 a

tonne each year for the next three years.

This may increase the likelihood of the EU launching

further anti-subsidy and anti-dumping investigations and

implementing other policy measures to protect domestic

manufacturers in the forest products and other sectors in

the future.

On the other hand, as noted in a recent article on the

Politico website, “now that the United States…is

convulsing global markets and trade networks with its

barrage of duties - the European Union is being quick to

step up and cast itself as the heavyweight liberal trade bloc

that is open for business”. Swedish Trade Minister

Benjamin Dousa told Politico on the margins of a recent

meeting of EU trade ministers in Luxembourg that “there

is a sense of urgency among member states that we have to

open new trade routes, we have to sign new free trade

agreements.”

According to Politico, “Since being confirmed in

December, von der Leyen’s European Commission II,

which handles trade policy on behalf of the bloc’s 27

members, has been on a deal-making roll. Brussels has

concluded decades-long talks with the Mercosur bloc, as

well as with Mexico and Switzerland. It has also

relaunched negotiations with Malaysia and opened

discussions with the United Arab Emirates. Von der Leyen

has pledged to wrap up a hard-to-get FTA with India this

year and is eager to explore ‘closer cooperation’ with the

Comprehensive and Progressive Agreement for Trans-

Pacific Partnership (CPTPP)”.

These agreements are for the future, but for now some

early signs of trade diversion away from the US to the

European market are already emerging. An article by the

British Broadcasting Corporation (BBC) quotes Marco

Forgione, Director General of the Chartered Institute of

Export & International Trade, as suggesting that the tariffs

have already caused "significant build ups" of ships,

especially in the European Union, but also "significant

congestion" at UK ports.

"We've seen a lot of diversion of ships from China that

were due to head to the US, diverting and coming to the

UK and into the EU," Mr. Forgione is reported to have

said. In support of this, the BBC notes that in the first

three months of 2025 Chinese imports into the UK have

increased by about 15% and into the EU by about 12%.

The BBC article also refers to comments by Sea-

Intelligence, an independent analyst, that there may be an

“all-time high deployment of ocean shipping capacity on

the Asia to North Europe route

Other analysts note that tariffs are only one factor

contributing to current congestion at European ports. The

BBC quotes Sanne Manders, president of logistics firm

Flexport, as saying that strikes at ports in the Netherlands,

Germany and Belgium in the first three months of the year

are also playing a role. He also observed that while

shippers are looking for new markets, there may be well

be a surge of goods to the US to try to take advantage of

the 90-day window for goods from some countries.

Impact of tariffs on European economy may be small

The potential impact of the tariffs on the wider European

economy has been analysed by Bruegel, an independent

European thinktank. Bruegel note that the hit for the

European economy will depend on the actual tariff rate the

US settles on and on the EU’s response, both of which are

still uncertain. However, Bruegel also suggests that the

overall shock is small compared to other recent shocks

such as the covid pandemic and the energy crises that

followed Russia’s invasion of Ukraine.

Bruegel summarises the findings from five studies that

estimate the long-term impacts on Europe of various tariff

scenarios – including a trade deal with the US, unilateral

US tariffs and US tariffs plus retaliation. The average

assessed impact across all studies and scenarios is a 0.3%

contraction in EU-wide GDP. All scenarios bar one

calculated a drop between zero and 0.5 percent of GDP for

the EU.

The overall shock is constrained because of the relatively

limited exposure of the EU economy to trade with the US.

While 21% of total extra-EU exports go to the US, the EU

value added embedded in them represented only about

2.9% of EU GDP in 2021. However, some EU countries

are more exposed than others. The German economy could

be particularly severely affected if no agreement with the

US is reached, with an average estimated GDP contraction

of 0.4%.

See: https://www.bbc.co.uk/news/articles/cly517p1zgqo

and

https://www.bruegel.org/analysis/economic-impact-trumps-

tariffs-europe-initial-assessment

and

https://www.politico.eu/article/us-donald-trump-tariff-war-

empowering-eu-europe-free-trade-commission/

|