Japan

Wood Products Prices

Dollar Exchange Rates of 25th

Apr

2025

Japan Yen 144.22

Reports From Japan

Preliminary Japan/US

trade deal could soon be signed

The tariffs proposed by the US have raised concerns for

Japan's export-reliant economy especially as the US

proposes high import duties on cars, steel and aluminum.

A baseline 10% levy remains in place despite a 90-day

reprieve for "reciprocal" tariffs. The US is determined to

reduce the trade deficit with Japan and has targeted cars

and agricultural products.

Economic Revitalisation Minister, Akazawa Ryosei, was

appointed Minister in charge of trade talks. In the last

week of April Japan added 10 new members to its task

force for tariff negotiations drawing people from the

transport, agricultural and other ministries.

According to press reports in the US, a preliminary trade

deal could soon be signed with Japan although this could

be more like an outline for further negotiation rather than a

finalised agreement. The media report the two sides

remain far apart on some issues and it could take time for

an agreement.

Prime Minister Ishiba said that Japan has emphasised the

importance of free trade in bilateral tariff negotiations with

the United States while also highlighting Japanese

company investments in the United States.

There was serious concern that the US may demand action

to strengthen the yen but the US Treasury Secretary is

reported as saying the US has no currency targets in mind

when negotiating with Japan. However, he indirectly

discouraged Japan from foreign exchange interventions to

weaken the currency.

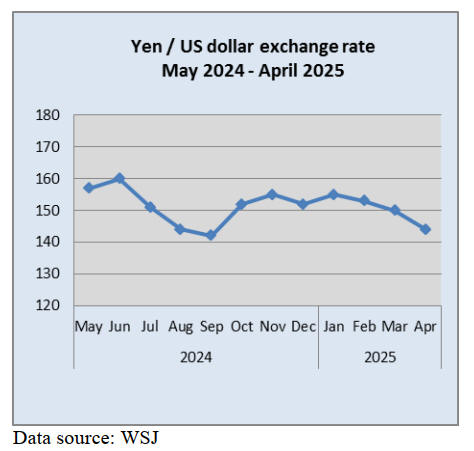

The yen remains low, an advantage for exporters, but the

currency has appreciated for three consecutive weeks

against the dollar as the uncertainty surrounding the global

trade war bolsters safe haven assets.

See: https://asia.nikkei.com/Economy/Trade-war/Trump-

tariffs/Bessent-US-will-not-pursue-currency-target-in-Japan-

trade-talks

and

https://www.japantimes.co.jp/business/2025/04/21/japan-

bullish-against-dollar/

and

https://mainichi.jp/english/articles/20250423/p2g/00m/0na

/044000c

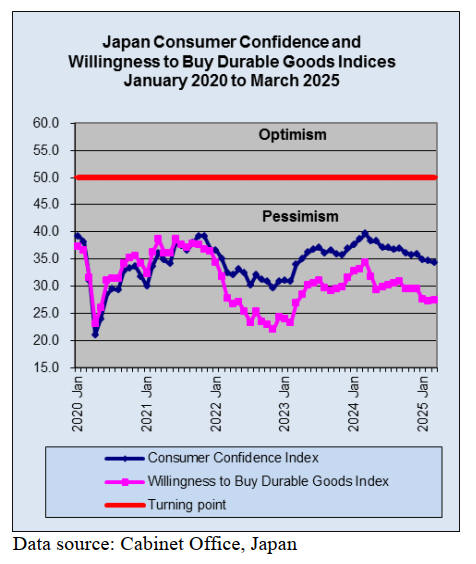

Government considering measures to boost domestic

spending

Japan is urgently discussing economic stimulus measures

to address the potential fallout from US tariffs. The

government is considering measures to boost domestic

spending and shore up corporate balance sheets. Five areas

of focus were outlined in the emergency stimulus package:

strengthening the consultation framework for affected

businesses, assisting companies with their cash flows,

ensuring employment retention, stimulating consumption

and enhancing industrial competitiveness.

In a ministerial meeting on tariff responses Prime Minister

Shigeru Ishiba instructed ministers to get ahead of

potential problems and ensure effective implementation of

the policies.

See:

https://www.japantimes.co.jp/business/2025/04/25/economy/tarif

f-stimulus-

upped/?utm_source=pianodnu&utm_medium=email&utm_camp

aign=72&tpcc=dnu&pnespid=6.dikpue6paw.6iz9qajtoug5hwor3

nthbush0qhuxkv9s6zyx.qsgsh0p3jhjwbjb.w5q

Opposition party wants consumption tax on food

suspended

The largest opposition party in Japan announced it wants

the consumption tax rate on food items to be scrapped for

a year. This comes ahead of a crucial parliamentary

election this summer.

The country is bracing for the prospect of persistant

inflation and a hit from higher US tariffs driving debate on

how best to help households with the surging inflation.

Prime Minister Shigeru Ishiba, however, has so far ruled

out changing the consumption tax rate.

"People today are struggling. We need to face reality,"

Constitutional Democratic Party of Japan chief Yoshihiko

Noda said at a press conference. "We should be prepared

for what the Prime Minister has described as a 'national

crisis,' said Noda. Japan's consumption tax was raised

from 8 percent in 2019, but the rate on food and drinks is

still 8 percent.

See: https://www.asahi.com/ajw/articles/15726120

Buying yen as a safe alternative

US policy announcements have caused investors to sell

US dollars and buy yen as a safer alternative. This

strengthened the yen to 140 to the dollar briefly at the end

of April.

The US has claimed that Japan's currency is undervalued

with some in the US administration calling for a Plaza

Accord 2.0, a reference to the 1985 Plaza Accord, an

agreement between the US and a number of other

countries that led to a dramatic strengthening of the yen.

Japan insists that the value of the currency should be

decided by the markets and that governments should not

interfere.

Japan-US tariff talks avoide currency issues

After rising to its strongest level in months the yen

weakened against the US dollar in the second half of April

after Japan-US tariff talks avoided currency issues but

traders remain on guard for pressure from Washington.

The Japanese currency appreciated to 140 yen against the

dollar but retreated when Ryosei Akazawa, Japan's

Minister for Economic and Fiscal Policy, said

afterward that currencies had not been discussed.

After lifting borrowing costs three times since March of

last year the BoJ now faces unprecedented US tariff

measures which pose a threat to Japan’s economy.

See:

https://www.japantimes.co.jp/business/2025/04/28/economy/boj-

to-pause-on-rate-hike/

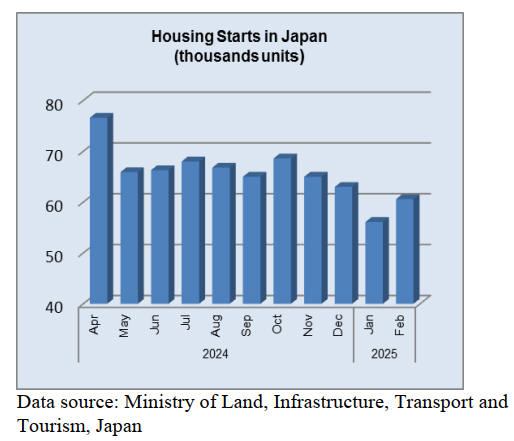

Average price of a new condominium at four year high

The average price of a new condominium exceeded yen

100 million (US$709,000) for the second straight year in

fiscal 2024 according to the Real Estate Economic

Institute. That was up 11% from the previous year hitting a

record high for the fourth consecutive year The continual

increases were put down to increases in land prices,

construction materials and labour expenses.

Tadashi Matsuda, a Senior Researcher, warned that

concerns about possible economic stagnation in light of

US tariff policy could affect consumer sentiment. The

average unit price of new condos in Kanagawa, Saitama

and Chiba grew 7.5%, also a record high.

See: https://www3.nhk.or.jp/nhkworld/en/news/20250421_20/

Likely pause in BoJ policy of ‘normalisation’

The Bank of Japan (BoJ) is widely expected to pause its

policy normalisation when it meets 1-2 May without

shifting its stance on gradually raising interest rates when

the outlook clears.

The BoJ is expected to keep the benchmark rate at 0.5%

according to all 54 economists surveyed. BoJ watchers

will scrutinise policymakers’ quarterly economic

projections for any hint on the extent of the pause.

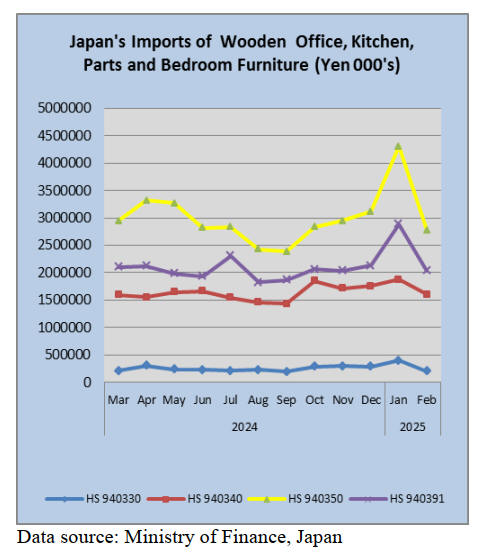

Import update

Yen value of furniture imports

January saw the value of imports of each of the four

categories of wooden furniture tracked rise to year on year

highs but in February there was a major correction with

the value of all four categories falling.

In February the yen exchange rate against the US dollar

was around 150/US dollar suggesting the correction was

not the result of any appreciation of the yen which is now

being observed.

As could be expected there was a sharp reduction of

wooden furniture arrivals from China as factories there

close for the New Year celebrations. The decline in

arrivals from Vietnam was also influenced by factory

closures for the Tet holiday.

Because China and Vietnam account for a large part of

Japan’s wooden furniture imports the decline in their

shipments drove down overall import values.

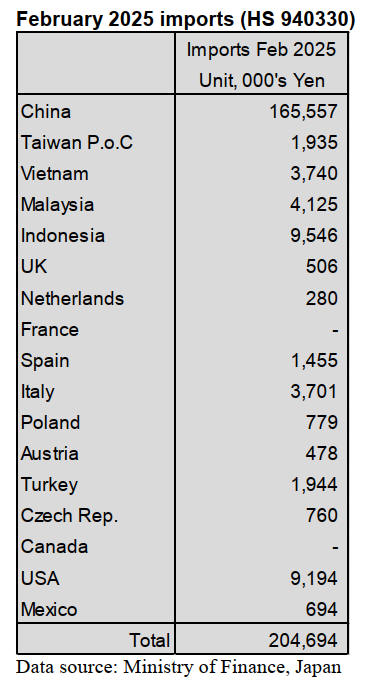

February wooden office furniture imports (HS 940330)

In February shippers in China accounted for 81% of

Japan’s imports of wooden office furniture (HS940330),

down from the 93% in January. The other main shippers in

February were Indonesia (5%) and the US (4%). Arrivals

of wooden office furniture from Malaysia in February

were down month on month.

Year on year, the value of Japan’s imports of wooden

office furniture in February down and compared to

January there was a sharp reduction.

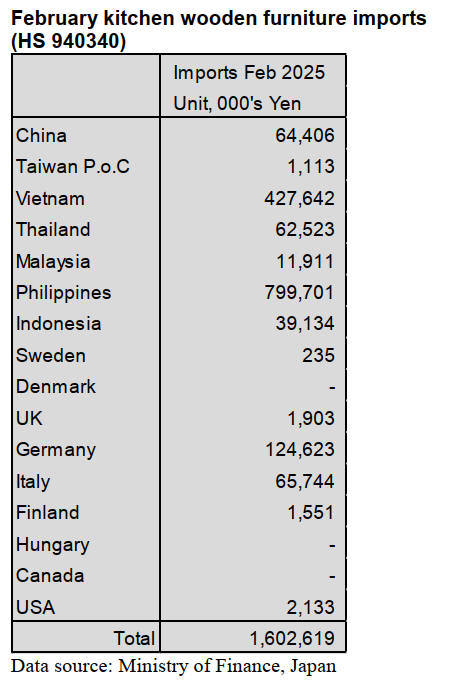

February wooden kitchen furniture imports (HS

940340)

The year on year value of Japan’s wooden kitchen

furniture imports was slightly higher in February but

compared to January the value of imports fell around 15%.

In February 2025 the combined value of shipments of

wooden kitchen furniture (HS940340) from the

Philippines and Vietnam accounted for over 77% of

Japan’s imports of HS940340.

Shippers in the Philippines accounted for around 49% of

total imports of wooden kitchen furniture in February but

shipments from Vietnam dropped to just 28% of total

imports of HS940340. The other shippers of note in

February were Germany and Italy.

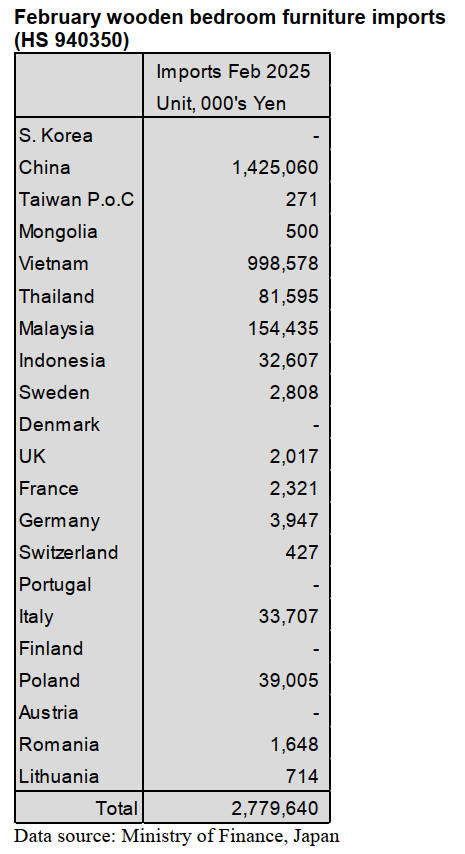

February wooden bedroom furniture imports

(HS940350)

The top two shippers of wooden bedroom furniture

(HS940350) to Japan in February were China (51%) and

Vietnam (36%). Malaysia and Thailand were the other

shippers of note in January with Malaysia, seeing a 5%

share of February imports, about the same level as in

January.

Compared to February 2024 there was an almost 20%

decline in the value of imports in February this year and a

massive 36% downward correction compared to the value

reported for January this year. Over the past four months

there was a steady upward trend in the value of wooden

bedroom furniture imports to Japan but this trend ended in

February but with shipments from China and Vietnam

being impacted by New Year celebrations, March may see

a reversal.

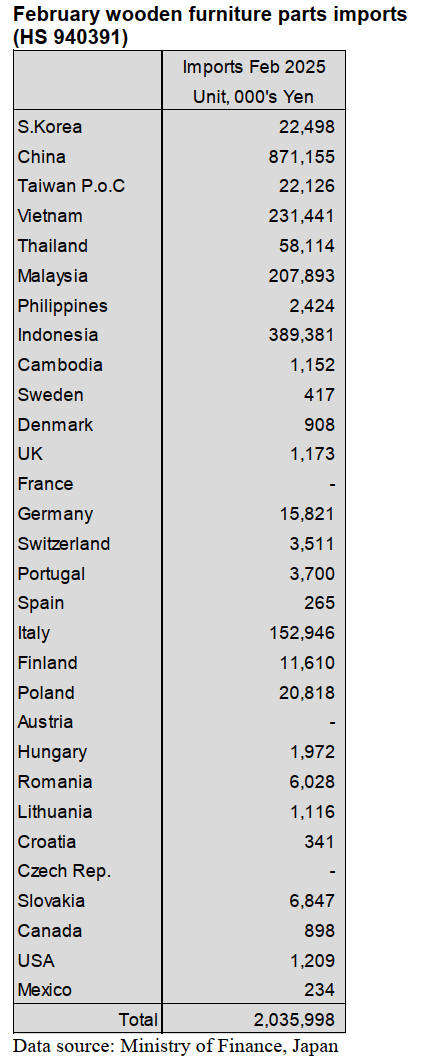

February wooden furniture parts imports (HS

940391)

Shippers in China, Indonesia, Vietnam and Malaysia, as in

previous months, accounted for most of Japan’s imports of

wooden furniture parts (HS940391) in February but the

total value of imports from these shippers was down

compared to a month earlier.

Of the total value of imports43% was delivered from

China, down from January; 19% from Indonesia,

unchanged from a month earlier; 11% from Vietnam and

10% from Malaysia, a significant increase. Compared to

the value of February 2024 imports there was decline of

9% in the value of February 2025 imports and a 29%

decline compared to January.

Trade news from the Japan Lumber Reports (JLR)

The Japan Lumber Reports (JLR), a subscription trade

journal published every two weeks in English, is

generously allowing the ITTO Tropical Timber Market

Report to reproduce news on the Japanese market

precisely as it appears in the JLR.

For the JLR report please see:

https://jfpj.jp/japan_lumber_reports/

No tariffs on wood products

The US President announced reciprocal tariffs on April

2nd, 2025. However, the reciprocal tariff is not on wood

products.

President Trump gave the order of tariffs for improve the

status of the United States and protect workers. He also

will impose a basic tariff of 10 % on all countries and will

add tax rates by countries or regions.

Japan’s tariff is 24. Vietnam’s tariff is 46 %. China’s tariff

is 34 %. India’s tariff is 26 %. South Korea’s tariff is 25

%. EU’s tariff is 20 %. However, wood products are not

subject to tariffs.

Additional tariff rates for Chin aare raised to 20 % from 10

% to avoid the flow of illegal drugs on March 3rd, 2025.

Then, China stopped importing American logs on March

4th, 2025. Timber trade tensions are brewing between the

U.S. and China.

Oji established corporate forest fund with New Forests

Oji Holdings Corporation in Tokyo, Japan established a

corporate forest investment fund, the “Future Forest

Innovation Fund” with New Forests Pty Limited in New

South Wales, Australia on 26th March, 2025.

The company aims to expand overseas forest plantation

areas to achieve the Oji Group’s environmental goals for

2030. Oji’s stake in Future Forest Innovation Fund is 99 %

and New Forests’ stake is 1 %.

The company aims to acquire approximately 70,000

hectares of forest plantation areas in South Asia, North

America, Central and South America and Africa thorough

this fund, with the goal of net absorption of 1.5 million

tons of CO2 in a year by 2030.

By leveraging New Forests’ sustainable forest

management expertise developed over the past 20 years,

advanced information analysis systems and sophisticated

use of geospatial data, the company aims to enhance the

productivity of the acquired plantations and conserve the

biodiversity of surrounding natural forests, thereby

improving the sustainable added value of the forests.

The fund will focus on investment activities and forestry

management activities, which Oji’s policy and intension of

forestry management. The fund’s forest assets would be

Oji’s business results.

Severe disaster

Japanese government announced that the Cabinet decided

to designate the forest fire in Ofunato city, Iwate

Prefecture as a severe disaster on 25th March, 2025. The

forest fire occurred on 19th February, 2025.

Related ordinances were also passed at a cabinet meeting

on the same day. The government will support Forest

Disaster Recovery Project to cut down and remove

damaged trees and afforest the areas.

The government published and implement about this at the

end of March, 2025.

Since the Act on Special Measures for Disaster Relief

against Severe Disasters came into effect, there have been

three forest fires that have been the subject of the law,

making this the fourth.

Domestic plywood

Plywood manufacturers keep raising the price. 12 mm 3 x

6 structural softwood plywood is 1,030 – 1,050 yen,

delivered per sheet in March, 2025. is 30 – 50 yen more

than February 2025 Movement of domestic plywood in

March, 2025 was worse than the movement in

February,2025.

Some plywood manufacturers could not raise the price by

1,100 yen, delivered per sheet, which they were going to

raise the price in March, 2025. Major plywood

manufacturers in Japan will raise the price by 50 yen in

April, 2025. The price would be 1,150 yen, delivered per

sheet.

The price has been raised for four months in a row. The

reasons are that the manufactures did not have enough

profits and the costs of logs, adhesives, and labors rose.

In Sarawak, Malaysia, there are not enough logs due to the

influence of a heavy rain in February 2025. Some plywood

plants in Sarawak which manufacture structural plywood

and painted plywood for concrete form had a decrease in

production in March. The delivery to Japan is delayed.

Movement of South Sea plywood in Japan is sluggish but

the inventory is very low due to less arrival volume.

Therefore, the price did not decrease even though the

trading companies had a financial closing period in March.

Rather, the Japanese importers tried to raise the plywood

price.

Structural plywood is around 1,550 yen, delivered per

sheet. 2.5 mm plywood is around 780 yen, delivered per

sheet and this is 30 yen more than last month. 4 mm

plywood is around 930 yen, delivered per sheet. 5.5 mm

Plywood is around 1,100 yen, delivered per sheet. In

South East Asia, 12 mm 3 x 6 painted plywood for

concrete form is US$590 - 600, C&F per cbm. Form

plywood is US$500 - 510, C&F per cbm.

Structural plywood is US$510 - 520, C&F per cbm. 2.4

mm 3 x 6 plywood is US$970, C&F per cbm. 3.7 mm 3 x

6 plywood is US$880, C&F per cbm. 5.2 mm 3 x 6

plywood is US$850, C&F per cbm.

Increased use of domestic lumber

There is an increase in using domestic lumber for 2 x 4

construction method. According to the survey of demand

and supply of domestic lumber in 2023, production of

structural lumber for 2 x 4 construction method at JAS

certificated plants is 89,435 cbms, 7.4 5 more than 2022.

A growth rate in 2023 became dull compared to the

growth rate in 2022. It was 9.2 % increased in 2022.

The survey was held to 63 housing companies, 26

component companies and 23 lumber companies. The

production of domestic lumber increased for 3 years

continuously. The estimated production of 2024 would be

100,200 cbms. The housing companies, which had

answered to the survey, would have more new starts in

2024 than 2023.

80 % of production is cedar lumber but cypress lumber in

2023 increased by 6.1 %, 4.3 points more than the

previous year. 4 x 4 or 4 x 6 cypress lumber is 6.7 %, 4.9

points more than last year. It is presumed that cypress

lumber as sills has increased. Production of Sakhalin fir

lumber dropped in 2023 but Sakhalin fir lumber would

increase in 2024. Production of 2 x 6 lumber is 23.4 %, 0.9

point more than last year. It would also rise in 2024. 2 x 6

lumber is used at outer walls as high thermal insulation

products. A ratio of using finger joints is 30 % and it

would be important to use more finger joints for

improving the yield.

The results of estimated CO2 emissions from the use of

domestic timber were also compiled. It was calculated and

compared emissions when using imported and domestic

timber for a housing model with the same design.

As a result, the use of domestic timber is approximately

0.64 tons less than that of North American timber and 1.60

tons less than European lumber. However, domestic

lumber’s CO2 emissions are a lot during the

manufacturing process.

The reason is that renewable energy, such as biomass

power generation, are consumed at lumber plants in

Europe and North America. It would be important to

reduce CO2 emissions at the manufacturing process and to

contribute decarburization.

|