|

1.

CENTRAL AND WEST AFRICA

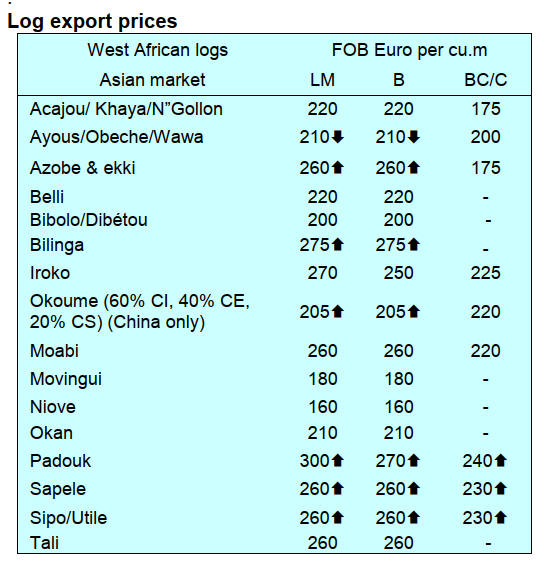

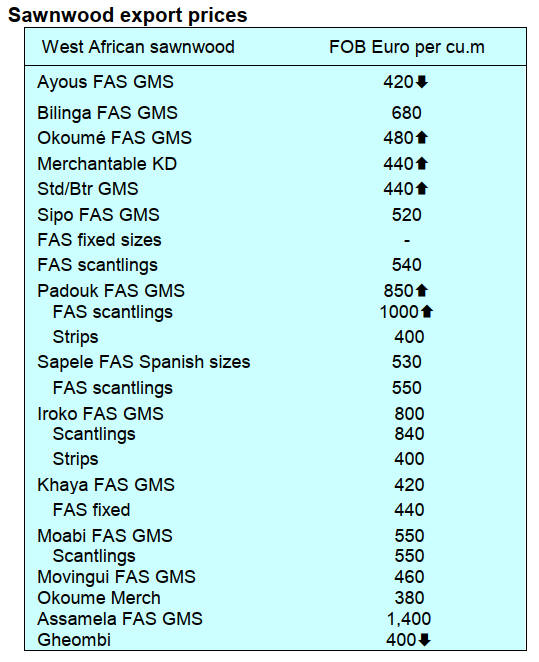

Mounting pressure from CITES paperwork

There has been some upward movement in FOB prices in

Gabon, Cameroon and the Republic of Congo.

The main concern expressed by both exporters and some

importers is the mounting pressure from CITES paperwork

in Europe. Some are saying European authorities are slow

to process documents and this is delaying some shipments

and causing export stocks to rise.

As global demand is still muted many sawmills in the

region have cut production. Okoume veneer producers are

also feeling the effect of the decline in demand. Some

have switched to single shift operations while others have

temporarily closed.

It is reported that sawnwood flows to Asian markets are

holdin-up with the Philippines and Vietnam being the

active importers. Demand in the Middle East countries is

said to be steady but unspectacular. Across Europe trade is

subdued in all species except azobé which continues to

move consistently into the Dutch and Belgian heavy

construction markets.

Regional round up

Gabon

Owendo Port is said to be operating well and the

availability of containers is adequate. Vessel turn-around

is said to be good. The planned carbon‑offset levy on

every freight tonne is still under review so shipping lines

are not faced with the issue of implementing this as yet.

Exports of padouk, khaya and doussie have dropped

sharply say exporters, because authorities in the EU are

slow to process CITES documents.

It has been reported the proposed land tax increases are on

hold. After missing the 25 March deadline to settle

current taxes many concessionaires have asked for

staggered payments and extensions are being granted case

by case.

General Brice Oligui Nguema has won the presidential

election in Gabon. General Nguema won with more than

90% of the votes according to the Interior Ministry.

Cameroon

For the next two months the forecast is for mainly dry

weather conditions so most producers expect smooth

trucking to Douala and Kribi Ports. Camrail continues to

run without major disruption providing a reliable route for

sawn timber from the interior.

Operators report Chinese demand for redwoods has faded

forcing many mills to reduce production. It is suggested

that roughly half of the Chinese owned mills are now idle.

Overall, the flow of orders is very slow with importers in

Europe buying only for immediate demand so as not to

increase stocks.

In Europe, importers complain that processing CITES

documents is slow dampening trade in padouk, khaya and

doussie. Buyers in the Middle East countries are still

interested in Iroko, Sapelli and redwoods.

Congo

No change in output has been reported during the second

half of April. Northern concessions are still in the dry

window but some plywood and veneer plants, mainly

Chinese and Malaysian owned, have moved to single shift

operations because of weak demand.

Domestic haulage routes are said to be serviceable. A

common problem is fuel rationing which occasionally

disrupts transport plans. Log flows to Douala Port (Kribi

for some operators) remain sporadic because of tight

trucking capacity and high fuel costs.

Pointe Noire is again experiencing congestion with

berthing opportunities sliding by up to five

days. Container supply is said to be adequate.

Order books have not improved since the previous

update. EU buyers are avoiding CITES‑listed species until

permit processing becomes more efficient. Buyers for the

Chinese market are purchasing only limited volumes. The

Philippines and Vietnam continue modest purchases

chiefly of okoume and tali.

No new forestry directives have been issued but the

finance ministry is said to be insisting that land tax arrears

be cleared before new harvesting coupes (AAC) are

approved.

Through the eyes of industry

The latest GTI report lists the challenges identified by the

private sector in the Republic of Congo and Gabon.

https://www.itto-

ggsc.org/static/upload/file/20250418/1744957176173218.

pdf

2.

GHANA

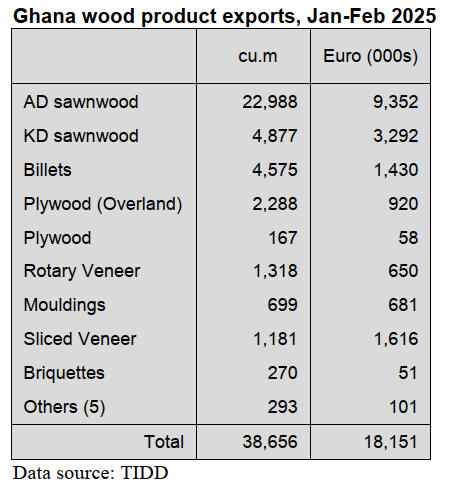

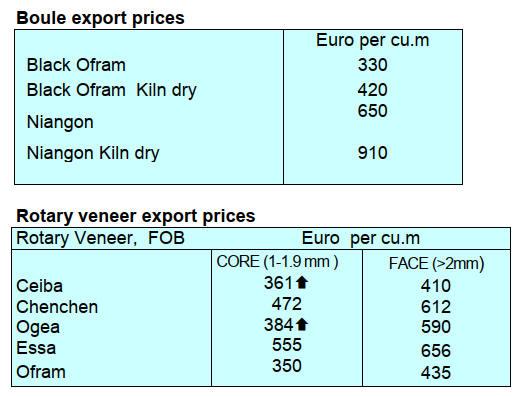

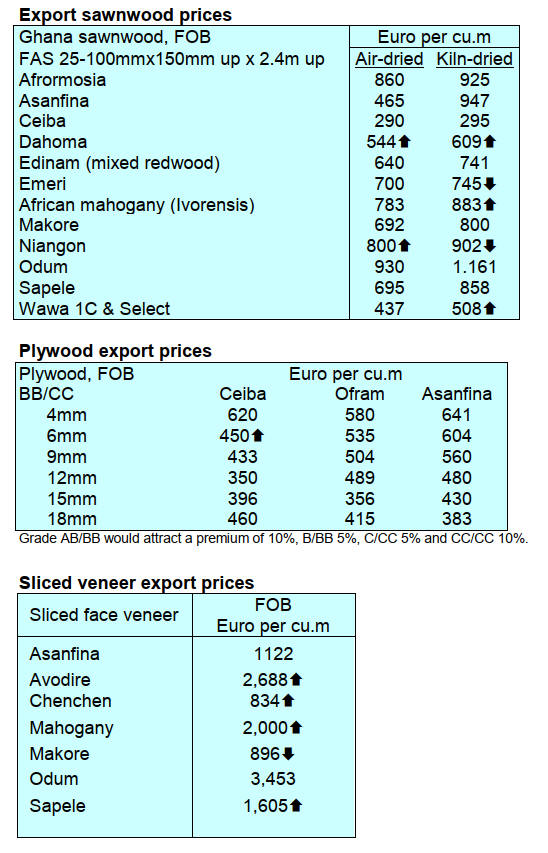

Volume and value of wood product exports fall

According to the Timber Industry Development Division

(TIDD) of the Forestry Commission (FC) Ghana’s wood

product exports for the first two-months of 2025 recorded

decreases of 5% in volume and 4% in value compared to

the previous year.

The country earned Eur18.15 million from the export of

38,656 cu.m of wood products for the period in 2025

against figures recorded for the same period in 2024 which

were Eur18.83 million from 40,709 cu.m.

The low volume of exports for the period under review

compared to the same period in 2024 could be attributed to

the poor performance of plywood (-93%), briquettes

(-40%), plywood to the regional market (-28%),

mouldings (-21%), kiln dried sawnwood (-18%), rotary

veneer (-14%) and five other wood products (-38%).

The main exporters of sliced veneer saw a growth of 64%

in volume and 87% in value in the first two months of

2025 compared to the same period in 2024. The main

destinations for this product were Europe (65%), Asia

(18%), Africa (13%) and the US (4%).

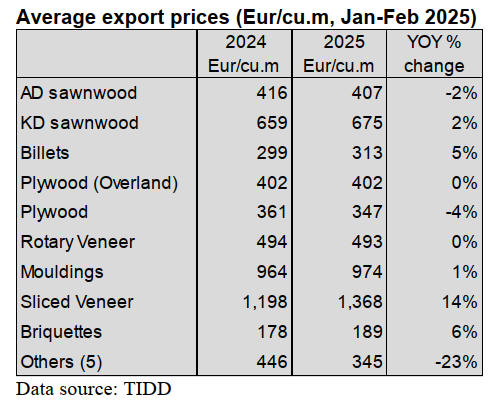

The TIDD data also showed the average unit prices of

wood products exported during the period. Teak, wawa,

denya, ceiba and gmelina were the top species exported.

Sliced veneer, which accounted for 3% of the total export

volume, registered an increase of 14% in average price

while air-dried sawnwood, accounting for 59% of exports,

saw a 2% average price decrease for the period under

review.

Review of Plantation Development Fund

The Minister for Lands and Natural Resources, Emmanuel

Armah-Kofi Buah, has engaged the Forest Plantation

Development Fund (FPDF) Board to assess their

operational activities and discuss ways to enhance their

mandate in line with the government’s agenda.

At a meeting with management and staff the Minister

commended the Fund Board Secretariat for their efforts in

promoting forest plantation development. He emphasised

the importance of aligning activities with the

government’s broader environmental objectives to

improve the nation’s forest cover.

The FPDF provides financial support for private forest

plantation development and offers research and technical

advice to individuals engaged in commercial plantation

forestry.

Briefing the Minister on the Board’s operations the

Technical Officer within the Secretariat, Jason Nunoo,

highlighted pressing issues of the FPDF that require urgent

attention and offered recommendations to ensure its

sustainability.

Speaking to the media the Deputy Minister for Lands and

Natural Resources, Yusif Sulemana, emphasised the

concerns raised by the Secretariat. He assured their

concerns would be addressed by a new Board once

constituted. He also stressed the need to amend the

governing Act 623 to review the FPDF Board’s mandate

and formally establish it as an agency under the Ministry.

Meanwhile, the FPDFB Board currently owes seedling

producers GH¢4 million. Payments are to be made after a

new Board is reconstituted to look into the details of the

arrears.

See: https://mlnr.gov.gh/strengthening-ghanas-green-future-

minister-reviews-forest-plantation-development-fund-operations/

Businesses assured of efficiency at ports

The Ghana Ports and Harbours Authority (GPHA) and the

Ghana Shippers’ Authority (GSA) have assured businesses

of enhanced efficiency and attractive protocols at Ghana’s

Ports to reduce their cost of doing business.

The new heads of these institutions made this commitment

during their partnership meeting aimed at collaborating

with both the local and transit customers to discuss issues

of mutual interest while their fostering socio-economic

growth in line with the government’s economic agenda.

This collaboration forms part of broader efforts to make

Ghana’s ports more competitive within the sub-region,

facilitate trade and contribute to national economic

development.

The Chief Executive of GSA, Professor Ransford

Gyampo, stressed the importance of identifying

operational bottlenecks and implementing sustainable

solutions to mitigate delays, noting that inefficiencies

often lead to additional costs for importers which are

ultimately passed on to consumers.

On his part the Director General of the GPHA, Brigadier

General Paul Seidu Tanye-Kulono, reiterated his earlier

appeal to the Minister of Transport for the removal of

Value Added Tax (VAT) and COVID-19-related taxes on

transit and trans-shipped goods.

See: https://citinewsroom.com/2025/03/gpha-gsa-reaffirm-

commitment-to-reduce-port-business-cost/

Power and water charge raised

The Public Utilities Regulatory Commission (PURC) has

announced a 14.75% increase in electricity charges and a

4.02% increase in water tariffs across all customer

categories to take effect 3 May 2025.

According to the PURC the revised tariffs form part of its

Quarterly Tariff Review Mechanism based on changes in

four key variables in the past quarters, namely, the

Cedi/US$ exchange rate, inflation, the electricity

generation mix and the cost of fuel (mainly natural gas)

used in power production. It stated inflation and exchange

rates as the main drivers of tariff increases.

The Commission also cited the need to recover the

outstanding GHS976 million in revenue arrears

accumulated over the last three quarters of 2024 as a major

contributing factor to the increases.

In a statement signed by the new Executive Secretary, Dr.

Shafic Suleman, the PURC emphasised that it opted to

recover only half of the outstanding arrears now to

minimise the impact on consumers. Dr. Suleman described

the decision as part of a "careful balancing act" to maintain

utility solvency without overburdening consumers given

the prevailing economic difficulties.

See: https://citinewsroom.com/2025/04/electricity-tariff-up-14-

75-water-4-02-effective-may-3/

Inflation fell in March

According to the latest CPI report by the Ghana Statistical

Service (GSS), the year-on-year inflation rate for March

2025 eased slightly to 22.4%, down from 23.1 percent

recorded in February 2025. However, the recent rise in

utility charges will have a direct impact on the Consumer

Price Index (CPI).

See:

https://statsghana.gov.gh/gssmain/storage/img/marqueeupdater/B

ulletin_%20CPI%20March%202025.pdf

Through the eyes of industry

The latest GTI report lists the challenges identified by the

private sector in Ghana.

https://www.itto-

ggsc.org/static/upload/file/20250418/1744957176173218.

pdf

3. MALAYSIA

ASEAN-Australia-New Zealand Free Trade Area

upgrade

The upgrade of the ASEAN-Australia-New Zealand Free

Trade Area (AANZFTA) in April strengthens Malaysia’s

economic resilience in an increasingly competitive

regional market which has a combined gross domestic

product exceeding US$5.6 trillion and a population of

more than 700 million.

The latest Agreement offers an opportunity to reduce

transaction costs, support the digitalisation of trade,

strengthen supply chain resilience and trade and

investment. The AANZFTA has been a vital part of

Malaysia’s regional trade strategy since its entry into force

in 2010.

See:

http://theborneopost.pressreader.com/article/282312505925782

Pivot towards conservation

Sarawak is now shifting its focus from timber extraction to

forest conservation and developing environment-based

revenue streams, said Sarawak Forestry Department

Director, Hamden Mohammad.

He said this shift was crucial as Sarawak moves to

transform its forestry sector through more sustainable and

technology-driven methods in line with the Post Covid-19

Development Strategy 2030.

“More than 50 years ago timber was the State’s main

source of income. However, we are now prioritising forest

conservation and looking for new ways such as carbon

trading and payment for services that do not affect the

existing ecosystem,” he said.

Training for log scalers and log pond supervisors

A total of 34 participants comprising log scalers, log pond

supervisors and timber industry stakeholders participated

in a three-day Log Scaling Course in Sibu organised by

the Sarawak Forest Department (SFD) and STA Training

Sdn Bhd (STAT, a training arm of the Sarawak Timber

Association.

The course provided critical aspects of log scaling,

covering measurement techniques, log tagging, identifying

species, recording log details into log specification form

and submitting applications to SFD for royalty assessment,

as well as other log movement activities along the

Sarawak Timber Chain of Custody in accordance with the

Forests Ordinance 2015 and associated requirements.

During the training, the trainers imparted participants with

necessary knowledge and skills on log scaling in both

classroom settings and valuable on-site hands-on practice.

Participants were taught accurate measurement of log

dimensions, including volume calculation for various log

dimensions such as hollow, bent and other defects. This is

critical in commercial trading as well as royalty payments

to the government.

See:

http://theborneopost.pressreader.com/article/281599541356969

Research on evidence-based forest governance

A technical committee from the Sarawak Forest

Department (FDS) recently met at the National Institute

for Environmental Studies (NIES) in Tsukuba, Japan. The

meeting marked a step forward in the bilateral

collaboration between the Department and NIES to

advance research for evidence-based forest governance.

The committee brought together experts in forestry,

geospatial science, environmental legislation, forest

engineering and research technology.

The primary objective of the collaboration was to assess

research findings and data presented by NIES researchers

to guide Sarawak’s policy decisions in line with the

Sarawak Premier’s vision of a green economy. The

Japanese researchers presented papers on a wide range of

topics, including advanced forest monitoring technologies

and sustainable management practices.

In 2024, NIES conducted several capacity-building

programmes for Sarawak civil servants and industry

stakeholders and these included training on tree DNA

analysis and Light Detection and Ranging (LiDAR)

technology, a powerful tool for forest mapping and

modelling.

See:

http://theborneopost.pressreader.com/article/281565181616278

Reappointed chairman for Malaysian Timber Council

Sarawak Timber Industry Development Corporation

(STIDC) General Manager, Zainal Abidin Abdullah, has

been reappointed as Malaysian Timber Council (MTC)

chairman for 2025/27.

This will be his second term as the Council’s chairman,

according to a press release. In response to the

appointment Zainal Abidin expressed optimism about the

future of the timber and wood industry emphasising a

renewed focus on strategic leadership to drive sustainable

growth and innovation.

“My expectation is to work closely with all stakeholders to

enhance industry standards, promote responsible forest

management and expand market access both domestically

and internationally,” he said.

He also stressed the importance of collaboration across the

value chain to increase competitiveness and ensure that the

industry contributes significantly to the economy while

maintaining environmental and social responsibilities.

FRIM committed to spearheading tropical forestry

research and innovation

As it approaches its 40th anniversary this October, the

Forest Research Institute Malaysia (FRIM) remains

committed to spearheading tropical forestry research and

innovation based on natural resources.

FRIM Director-General, Datuk D.r Ismail Parlan, said this

year’s anniversary is not only a celebration of past

achievements but also a symbol of FRIM’s resolve to

move forward with a global vision and aspirations for

environmental sustainability. “This 40th anniversary

reflects FRIM’s legacy and its future direction as a

credible, sustainable and internationally recognised

institution,” he told the press.

He noted that the institute— formerly known as the Forest

Research Institute (FRI) established in 1926 and renamed

FRIM on Oct 1, 1985—has received various accolades and

awards in recognition of its contributions to research,

development, commercialisation and innovation.

See:

http://theborneopost.pressreader.com/article/281917368907778

and

https://info.frim.gov.my/infocenter/fin/file/MY_899_20250410_

N_BPK_HOME_PG10_fe9e90.pdf

Discussions on measures to withstand tariff storm

The text should read “In 2024 Malaysia's exports to the United

States were RM 198.65 billion out of total exports of RM 1,508

billion.”

Through the eyes of industry

The latest GTI report lists the challenges identified by the

private sector in Malaysia.

See: https://www.itto-

ggsc.org/static/upload/file/20250418/1744957176173218.pdf

4.

INDONESIA

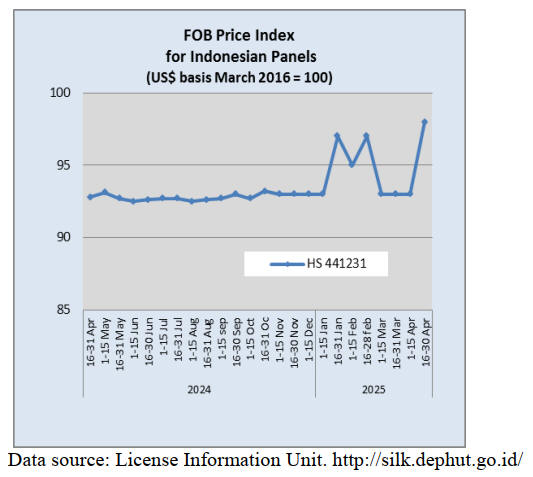

Encouraging first quarter exports

According to data from the Ministry of Forestry analysed

by the Indonesian Forestry Entrepreneurs Association

(APHI), the value of wood products exports in the first

quarter 2025 increased 8% compared to the first quarter

2024.

The wood products that contributed most to exports were

paper products US$1.05 billion followed by pulp

(US$890.9 million), wood panels (US$567 million) and

furniture (US$423.5 million). Indonesian wood product

exports to China in the first quarter were recorded at

US$830.4 million, up 9% year on year.

Exports of Indonesian wood products to the US rose 20%

while exports to the European Union and the UK were

recorded at US$336.12 million, up 18% year on year.

However, exports to Japan were recorded at US$2$.3

million, down 24%. A decline in exports to Korea was

largely influenced by a decline in demand for wood chips.

See: https://forestinsights.id/tren-menanjak-kinerja-ekspor-

produk-kayu-indonesia-triwulan-pertama-2025-modal-hadapi-

perang-tarif/#

Minister confirms commitment to sustainable forest

management

Minister of Forestry, Raja Juli Antoni, has reaffirmed the

government’s commitment to sustainable forest

management which aligns with enhancing community

welfare. The Minister stated the Ministry is reviewing

regulations to enhance forest management. The goal is to

encourage productivity while ensuring the protection of

the surrounding environment.

Additionally, the Minister highlighted the Forest

Utilisation Business Permit (PBPH) as an example of how

productivity can align with efforts to maintain

environmental sustainability. The Minister has said that

one of the priorities is establishing strong collaboration to

expand the potential of forest areas with sustainable use

and explained that this potential can be expanded through

the implementation of multi-business forestry which is

expected to boost the local economy.

He said that a working team has been formed to accelerate

the implementation of the multi-business forestry model.

To ensure the programme can run successfully the

Ministry requires support from its partners, especially in

improving capacity, widening market access, innovation

and investment. In addition, the Minister is prioritising

acceleration of official recognition of customary forests.

"This is an important part of our commitment to social

forestry and the rights of customary communities," he

said.

He explained, the Multi-Business Forestry (MUK) Task

Force aims to promote a more diverse and sustainable

forestry business model. Suryo Adiwibowo, a

representative of the MUK Task Force, stated that over

600 indigenous communities have received official

recognition to date. However, challenges with verification

and limited resources continue to pose obstacles.

He proposed the creation of a national database for

indigenous peoples and emphasised the need to strengthen

indigenous committees at the regional level as a means to

accelerate progress.

Additionally, it is important to clarify and enhance the

roles and responsibilities of local indigenous committees

in order to align the duties of the Director General of

Social Forestry within the Ministry of Forestry with those

of local governments and NGOs.

See: https://www.antaranews.com/berita/4777789/menhut-

tegaskan-komitmen-pemerintah-dalam-pengelolaan-hutan-lestari

and

https://www.msn.com/id-id/masyarakat-budaya-dan-

sejarah/masalah-sosial/menhut-kebut-proses-pengakuan-hutan-

adat-di-indonesia/ar-AA1CVkVp?ocid=BingNewsVerp

Kadin to transform the forestry business model

beyond wood

The Indonesian Chamber of Commerce and Industry

(Kadin) has reaffirmed its commitment to sustainably and

inclusively in transforming forestry businesses. Shinta W.

Kamdani, Deputy Chairperson for the Coordinator of

Human Development, Culture and Sustainable

Development at Kadin, emphasised that Multi-Business

Forestry (MUK) represents a crucial shift in the forestry

business model which has primarily relied on timber.

"This transformation is not an easy process. For more than

50 years the forestry business has depended solely on

wood. Now, we must build a new business model.

However, we believe that, through collaboration and

innovation, we can meet this challenge," Shinta stated

during a Roundtable Dialogue with UK officials at the

British Embassy.

In related news, Kadin, through the Regenerative Forest

Business Hub (Kadin RFBH) in collaboration with the

British Embassy, has introduced and promoted the

implementation of the Biodiversity Credit scheme as part

of the transformation towards a green economy.

Kamdani said biodiversity conservation must be an

integral part of economic development.

The Biodiversity Credit scheme provides businesses with

an opportunity to contribute to environmental conservation

in a meaningful way. Dominic Jermey, British

Ambassador to Indonesia, highlighted that the UK and

France initiated the International Advisory Panel on

Biodiversity Credit in 2023. He noted that Indonesia's

efforts to develop biodiversity credit scheme represent a

vital step in the global agenda for nature conservation and

the transition to sustainable economic growth.

See: https://www.idxchannel.com/economics/kadin-siap-

tranformasi-bisnis-kehutanan-tak-hanya-fokus-pada-kayu/2

and

https://www.inews.id/finance/bisnis/gandeng-kedubes-inggris-

kadin-dukung-implementasi-biodiversity-credit-dan-multi-usaha-

kehutanan

Ban on commercial timber extraction in Mangrove

forests

The government has announced that permits will no longer

be issued for timber extraction in mangrove ecosystems.

Permits will now be prioritised for environmental services.

Ristianto Pribadi, Director of Mangrove Rehabilitation

stated that environmental services in mangrove

ecosystems could include the utilisation of Non-Timber

Forest Products (NTFP) and ecotourism.

Ristianto stated that 84,000 hectares of mangroves have

been rehabilitated in the past five years. The government

has set a target to rehabilitate 600,000 hectares of

mangroves by 2024. Ristianto stated that the forestry

sector was a high priority for past the government.

See: https://www.antaranews.com/berita/4774849/kemenhut-

tidak-ada-lagi-izin-penebangan-kayu-di-kawasan-mangrove

and

https://lestari.kompas.com/read/2025/04/16/171500786/kemenhu

t--84.000-hektare-mangrove-direhabilitasi-selama-5-tahun-

terakhir-.

Incentives offered to to US companies

It has been reported that the Indonesian government

intends to offer facilities and incentives to US companies

operating in the country to smooth the ongoing

negotiations over the new import tariffs. ". The

government plans to form a deregulation team dedicated to

simplifying rules and regulations to make business

operations easier for investors.

See: https://en.antaranews.com/news/352169/indonesia-plans-

business-incentives-to-advance-us-tariff-talks

Attempts to fast track Indonesia-European Union (IEU-

CEPA) agreement

The government is seeking a quick completion of the

Indonesia-European Union Comprehensive Partnership

Agreement (IEU-CEPA) to address the impact of US

reciprocal tariffs, according to chairperson of the National

Economic Council (DEN), Luhut Binsar Pandjaitan.

He said this while receiving a visit from a delegation of

the Committee on International Trade (INTA) of the

European Parliament led by Bernd Lange. The European

Union aims to collaborate more closely with Indonesia,

said Lange. He cited the current uncertain and

geopolitically complex global situation.

Lange elaborated that the European Union aims to foster

sustainable growth to generate more employment

opportunities while safeguarding existing jobs within

Indonesia. Lange expressed hope that the cooperation

between the European Union and Indonesia will soon

materialise through a trade agreement.

See: https://en.tempo.co/read/1998002/eu-and-indonesia-forge-

closer-ties-amid-global-instability

and

https://en.antaranews.com/news/351857/ri-pushes-ieu-cepa-talks-

completion-amid-us-tariffs

5.

MYANMAR

Quake impacts economic and social vulnerabilities

The recent 7.7 magnitude earthquake and the US tariff

policy have impacted various sectors of Myanmar’s fragile

economy. These new pressures are now intertwined

further escalating the country’s economic and social

vulnerabilities.

US import tariffs - limited immediate impact

The US has imposed a 44% tariff on imports from

Myanmar but most exports from Myanmar are under

sanctions in the US. As Myanmar is still grappling with

post-earthquake devastation and civil conflict analysts

suggest that the tariff’s immediate economic impact will

be limited. After decades of exposure to sanctions,

Myanmar’s economy has developed a form of “sanctions

immunity”.

See: https://www.orfonline.org/expert-speak/between-quakes-

and-conflicts-china-india-and-myanmar-s-shaky-corridors

Post-earthquake assessment: rising debt and conflict

risks

The 28 March earthquake devastated Myanmar’s Sagaing

Region near Mandalay, affecting 17 million people across

57 townships and critically impacting 9 million. As of

early April, 3,471 deaths and 4,671 injuries were reported,

with 214 people missing.

The United States Geological Survey (USGS) estimates

that the earthquake caused damages exceeding US$10

billion, approximately 70% of Myanmar’s GDP.

Emergency declarations were issued across six regions,

and international aid was mobilised with China pledging

the largest package of US$14 million, followed by

contributions from India, the UK, the US and Singapore.

UN agencies allocated emergency aid.

It has been suggested that the disaster has jeopardised

major Chinese investments in Myanmar under the China-

Myanmar Economic Corridor (CMEC) including the

Letpadaung copper mine, Tagaung nickel project and the

oil and gas pipelines. Projects such as the Muse-

Mandalay-Kyaukphyu railway and Alpha Cement plant in

Madaya also face potential delays.

India’s strategic India-Myanmar-Thailand Trilateral

Highway (IMT-TH) suffered significant damage with key

structures such as the Ava Bridge being destroyed.

Meanwhile, Myanmar’s external debt, standing at

US$12.1 billion in 2024, is set to increase as

reconstruction needs grow. Rising reconstruction

borrowing could deepen the country’s financial

vulnerabilities.

See: https://www.orfonline.org/expert-speak/between-quakes-

and-conflicts-china-india-and-myanmar-s-shaky-corridors

UNICEF's dire warning

In a press release UNICEF has issued a stark warning that

millions of children are at grave risk following Myanmar’s

deadliest earthquake in decades. The earthquake and

aftershocks caused widespread destruction across central

Myanmar Homes, schools, hospitals and infrastructure

were heavily damaged across Mandalay, Nay Pyi Taw,

Sagaing, Bago and Shan regions.

UNICEF says “Myanmar is one of the most complex

humanitarian emergencies globally. Even before the

earthquake, over 6.5 million children were in need of

assistance, with one in three displaced people a child. Yet,

the humanitarian response remains critically underfunded,

with less than 10 per cent of the 2025 Humanitarian

Action for Children appeal received to date”.

UNICEF is calling for urgent funding to scale up the

delivery of life-saving support to children and families

affected by the earthquake including clean water, medical

care, protection, psychosocial support, and emergency

education.

See: https://www.unicef.org/press-releases/millions-children-

grave-risk-following-myanmars-deadliest-earthquake-decades

6.

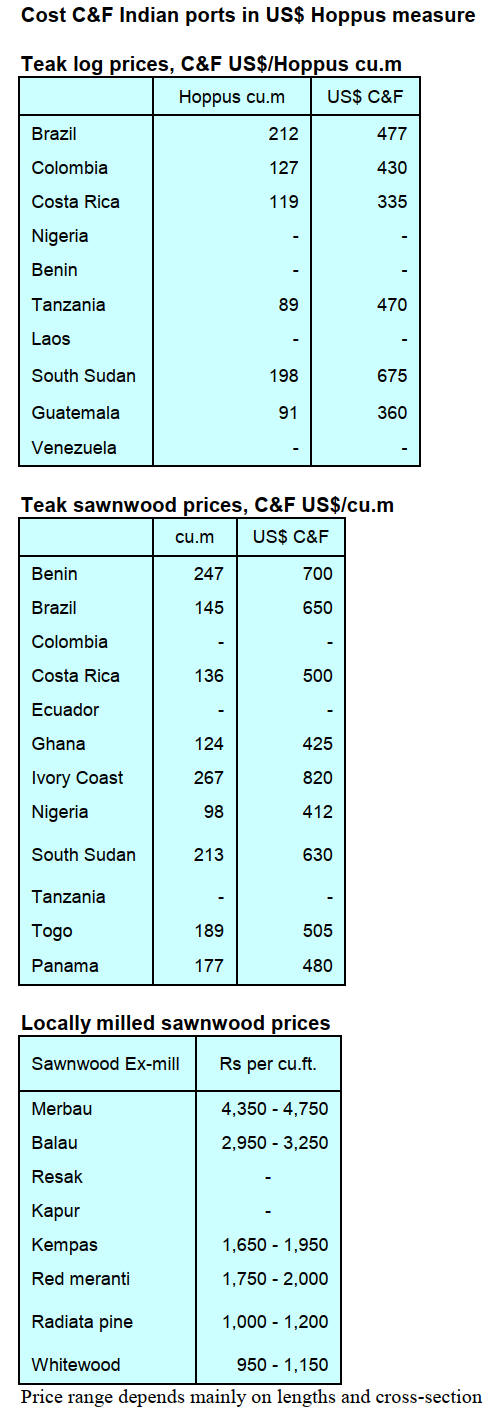

INDIA

Imports of panels -

almost zero

The correspondent writes “the market is slow but

stable. Imports of panel products such as plywood, MDF,

particleboard and decorative panels have almost stopped

as exporters have not yet been assessed as meeting the

recent Quality Control Order (OCO) with only a few mills

in Nepal and one in Thailand and one company in

Malaysia have secured a licence. Several 100 applications

are still pending from overseas manufacturer-suppliers and

there is a lot of distress among importers“.

Over the past decade the Central government has

mandated higher standards for production and imports of a

wide range of products such items. The recent mandatory

QCO for wood products is one of the latest.

QCOs, notified by government departments in

consultation with the Bureau of Indian Standards (BIS),

are compulsory in nature unlike the numerous other

standards prescribed by the BIS. Though the government

has said QCOs have been imposed to ensure the quality of

products, protection of human, animal and plant health,

and prevention of deceptive practices, the domestic

industry speaks of the burden the measures entail.

The QCO for wood panels applies to both domestic

production and imports and has been identified as likely to

increase production costs. India’s overseas trade partners

view the recent QCO as a trade barrier.

QCOs are covered under the Technical Barriers to Trade

(TBT) agreement at the WTO which aims to ensure that

technical regulations, standards and conformity

assessment procedures are non-discriminatory and do not

create unnecessary obstacles to trade. The TBT Agreement

strongly encourages members to base their measures on

international standards to create a predictable trading

environment.

See: https://www.rediff.com/business/report/quality-control-

orders-what-does-this-mean-for-domestic-

industry/20240425.htm

PlyReporter, the Indian panel sector trade journal, has said

the domestic manufacturing industry has largely

welcomed the QCO implementation as step forward in

standardising made-in-India products to promote export

oriented industries. PlyReporter idenifies some problems

for small-scale plywood manufacturers which are not in a

position to upgrade production to meet the new standards

desite the grace period granted to small companies

As of April it is reported only around 35% of the small

plywood manufactuerers have secured a license. The other

65% of the around 3,300 mills are awaitng processing of

their applications. Also, says PlyReporter, there are many

particleboard and MDF manufacurers preparing the

required documentation.

See: https://www.plyreporter.com/magazine-March-2025

Training, capacity building and worker certification in

construction and real estate sectors

The Confederation of Real Estate Developers Association

of India (CREDAI) recently signed a MoU with the

National Skill Development Corporation (NSDC) and the

Quality Council of India (QCI) to establish a collaborative

framework for skill training, capacity building and worker

certification in the construction and real estate sector.

Under the partnership all parties pledge to enhance

workforce development in the real estate sector through a

structured focus on skill development, capacity building

and sustainable employment.

The collaboration aims to deliver industry-aligned training

programs with quality assurance through certification,

support Recognition of Prior Learning (RPL) to validate

existing skills and drive workforce integration by

promoting job placements and modern construction

practices including green building techniques.

The MoU was signed at an event introducing Mr. Shekhar

G. Patel as the new president of CREDAI for the term

2025-27.

A move to net-zero buildings

During the ceremony CREDAI launched a report prepared

in collaboration with Colliers titled ‘Sustainability in Real

Estate: Towards a Greener Skyline’. The report highlights

India’s path to green growth and development and a shift

towards net-zero buildings.

According to the report, 66% of India’s Grade A office

stock is now green certified with cities like Hyderabad

leading at 75% penetration. The industrial and logistics

sector is also embracing sustainability. The report further

underscores a massive retrofitting opportunity for aging

office spaces.

With 80% of future office demand expected in green

spaces and rising consumer preference for eco-friendly

homes, India’s real estate sector is poised to drive the

nation’s 2070 net-zero target through innovation, policy

alignment and stakeholder collaboration, said the CREDAI

president.

See: https://www.credai.org/media/view-details/571

and

https://www.colliers.com/en-in/research/sustainability-in-real-

estate-report

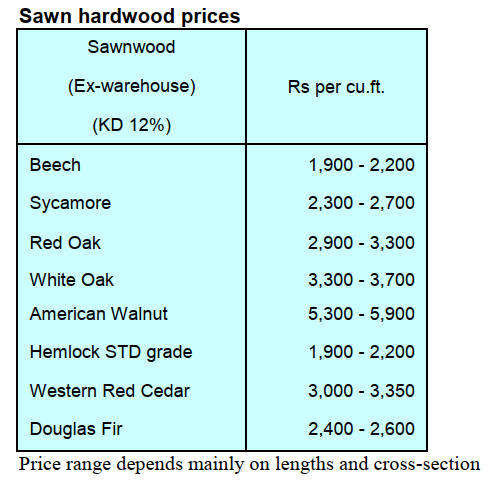

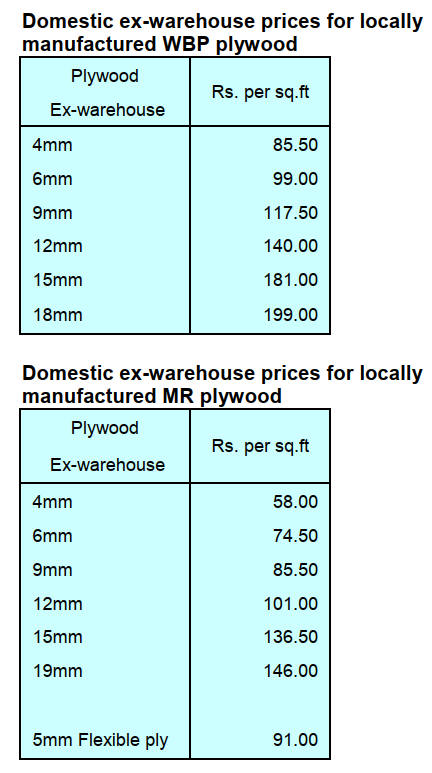

Plywood

The recently announced price increases have now been

introduced.

7.

VIETNAM

Wood and Wood Product (W&WP) trade

highlights

Statistics from the Customs Department show that in

March W&WP exports reached US$1.47 billion, up 44%

compared to February 2025 and up 13% compared to

March 2024.

WP exports earned US$1.01 billion, up 52% compared

to

February 2025 and up 14% compared to March 2024.

In the first 3 months of 2025 W&WP exports earned about

US$3.9 billion, up 11% over the same period in 2024.

In March W&WP exports to the Spain were valued

US$9.3 million, up 80% compared to March 2024. In the

first 3 months of 2025 W&WP exports to Spain stood at

US$21.8 million, up 8% over the same period in 2024.

In the first quarter of 2025 exports of kitchen furniture

amounted to US$100 million, down 11% compared to

March 2024. In the first 3 months of 2025 exports of

kitchen furniture were US$281 million, down 3% over the

same period in 2024.

Raw wood imports from China in March were about

100,000 cu.m, worth US$30.0 million, up 13% in volume

and 7% in value compared to February 2025 bringing the

total import of raw wood from China in the first 3 months

of 2025 to 314,195 cu.m, worth US$92.48 million, up

90% in volume and 46% in value over the same period in

2024.

Exports of bedroom and dining room furniture in March

fetched US$250 million, up 12% compared to March

2024. In the first 3 months of 2025 exports of bedroom

and dining room furniture were valued at US$639.2

million, up 7% over the same period in 2024.

Vietnam's W&WP imports in March 2025 reached

US$261.8 million, up 26% compared to February 2025

and up 35% compared to March 2024. In the first 3

months of 2025 imports of W&WP reached US$667.7

million, up 25% over the same period in 2024.

The imports of raw wood (log and lumber) from the US in

March 2025 totalled 75,000 cu.m at a value of US$30.0

million, an increase of 24% in volume and 20% in value

compared to February 2025 and an increase of 10% in

volume and 1% in value over the same period in 2024.

In the first quarter of 2025 imports of raw wood from the

US reached 197,740 cu.m, with a value of US$78.67

million, up 39% in volume and 28% in value over the

same period in 2024.

Viet Nam’s wood industry is setting its sights on reaching

an ambitious export target of US$18 billion in 2025

Setting sights on US$18 billion exports

Growing international regulations on legally sourced

agricultural and forestry products are presenting new

challenges.

To stay competitive and mitigate trade risks, Vietnamese

exporters are being urged to improve supply chain

governance, embrace green production standards and

invest in sustainable development.

According to trade analysts policy shifts in major markets

such as the US and the EU can reshape the landscape for

wood and timber product exports. The US is expected to

implement stricter trade protection measures in 2025,

adding pressure on Vietnamese exporters who currently

send over 50% of their wood-related exports to the

American market.

As Vietnam stands as the US’s fourth-largest export

market in ASEAN and its eighth-largest global trading

partner, the stakes are high. Concerns are growing over the

risk of punitive tariffs or trade barriers if exporters cannot

meet strict traceability requirements.

In the EU the recently extended EU Deforestation

Regulation (EUDR) poses a similar challenge. Now

scheduled to come into effect at the end of 2025 for large

companies and mid-2026 for small and medium-sized

enterprises, the regulation aims to eliminate import of

products linked to deforestation.

Beyond individual markets the potential for broader trade

disputes or disruptions to global supply chains could

further impact Vietnam’s wood product exports. This

makes agility and preparedness a top priority for industry

stakeholders.

The Vietnam Timber and Forest Product Association

(VIFOREST) has identified both opportunities and

challenges ahead. It noted that global trends favour

sustainable materials in construction and interior design

creating new prospects for Vietnamese wood exporters

that can meet eco-conscious demand.

According to Tran Quang Bao, Director General of the

Forestry and Forest Protection Department under the

Ministry of Agriculture and Rural Development,

strengthening raw material areas is key to achieving long-

term sustainability.

This includes expanding large timber plantations and

forests certified by FSC or PEFC standards. In the short

term, pilot programmes to assign traceability codes to

forest areas in Northern provinces are underway and

expected to be rolled out nationwide.

These traceability codes are seen as a cornerstone for

developing a legal timber supply chain that aligns with

international requirements.

They also support Vietnam’s efforts to quantify carbon

sequestration potential, contributing to climate goals. Ngo

Sy Hoai, Vice Chairman and Secretary General of

VIFOREST, emphasised that competitiveness is vital to

survive in the current environment.

He noted that both the government and private sector are

stepping up efforts to promote sustainable forest

certification and adopt advanced traceability technologies.

Exporters are encouraged to invest in digital supply chain

management, improve product design and branding and

adopt environmentally compliant production processes.

Ensuring legal origins, meeting design preferences and

offering competitive pricing will be essential to

maintaining and growing market share.

Close cooperation between businesses, industry

associations and government agencies is seen as essential

to navigating the evolving regulatory landscape. One of

the key tools in this regard is the verification of product

origin which helps prevent trade fraud and supports

compliance with importing countries’ rules.

Legal capacity building, risk management improvements

and adherence to international environmental standards are

also needed to strengthen Vietnam’s position in global

timber trade.

See: https://en.vietnamplus.vn/vietnams-forestry-sector-ramps-

up-competitiveness-to-meet-export-targets-post313257.vnp

Vietnam’s wood exports surge but face mounting

headwinds

Vietnam’s wood industry is now bracing for a tariff storm

as the United States is set to impose a 46% reciprocal tariff

on Vietnamese goods.

The United States remained Vietnam’s largest export

market for wood and wood products making up 53% of

total exports. Japan and China followed, accounting for

13% and 11%, respectively.

Despite this robust performance the wood sector continues

to grapple with considerable challenges.

A large proportion of Vietnam’s wood businesses are

small and medium-sized enterprises (SMEs), many of

them family-run operations. These firms are particularly

vulnerable to market fluctuations and often struggle with

the modernisation of production and processing

technologies.

Supply-side constraints also persist. Vietnam lacks a stable

domestic supply of large-diameter wood forcing

companies to rely heavily on imports. This dependency

not only inflates production costs but also diminishes the

competitiveness of Vietnamese wood products in global

markets.

Additionally, while demand remains steady in core export

destinations, Vietnam’s wood exports remain overly

concentrated in a few key markets posing long-term risks.

US tariffs threaten industry outlook

Ngo Si Hoai, Vice President and Secretary-General of

Vietnam Timber and Forest Product Association (Viforest)

has recently addressed the mounting challenges and urged

businesses to prepare for market headwinds.

Among the most pressing concerns is the US

government’s decision to impose a 46% reciprocal tariff

on Vietnamese imports. This move would directly impact

Vietnam’s agricultural and wood product exports to the

US, Vietnam’s most valuable export market for

agricultural, forestry and seafood products.

The stakes are especially high for the wood sector which

generated the largest trade surplus among Vietnam’s

agricultural exports to the US. Over the past four years,

US imports of Vietnamese wood products have

consistently ranged from US$7–9 billion annually,

accounting for over 50% of Vietnam’s total wood product

exports. In contrast, Vietnam imports (mostly logs and

lumbers) were only around US$300-350 million.

The sudden announcement of a 46% tariff - nearly double

the 25% that was previously anticipated - has shocked the

industry.

Broader strategy needed beyond the US

One of the key strategies being pursued by Vietnam’s

agriculture ministry is to prove the complementary, not

competitive, nature of US and Vietnamese agricultural

products, including wood. This argument is central to

ongoing trade negotiations.

At a recent meeting with the US Ambassador, Vietnam’s

Minister of Agriculture and Environment, Do Duc Duy,

emphasised that the two countries' agricultural exports are

mutually supportive and should not be seen as adversarial.

He also affirmed Vietnam’s openness to importing more

U.S. agricultural goods.

To that end, Viforest in coordination with local trade

associations, exporters and relevant ministries, is

preparing to participate in upcoming hearings. Their goal:

to demonstrate that Vietnam-U.S. wood trade is mutually

beneficial and poses no threat to the U.S. domestic

industry.

Still, Hoai cautioned that diplomacy alone may not suffice:

“We need to do more than just talk. The key now is for

Vietnamese agencies and enterprises to consider

increasing imports of U.S. wood products in order to

rebalance trade and underscore the benefits of

cooperation.”

Beyond immediate responses to U.S. tariff threats, Hoai

urges businesses to diversify their export markets.

Another critical area is raw material sourcing. To build a

strong and competitive wood industry capable of meeting

international demand, businesses must invest in

sustainable, legal timber supplies with forest management

certification. This is essential not only for increasing

export orders but also for meeting the country’s broader

sustainability goals, said Hoai.

See: https://wtocenter.vn/chuyen-de/27554-vietnams-wood-

exports-surge-in-early-2025-but-face-mounting-headwinds

Increasing imports of US timber to boost processing

and re-exports

China’s suspension of log and sawn timber imports from

the United States valued at around US$2 billion annually

is seen as an opportunity for Viet Nam’s wood.

In 2024, Viet Nam imported US$316.36 million worth of

timber from the US, a 33% increase over 2023

representing 11% of the country’s total timber import

value. The three main products included sawnwood, logs

and veneer.

The Vice Chairman and Secretary General of the Vietnam

Timber and Forest Products Association (VIFORES) Ngô

Sỹ Hoài emphasised that US timber consistently meets

legality standards required in major export markets EU.

Viet Nam is the second-largest supplier of wooden

furniture to the US accounting for around 40% of total

wooden furniture imports.

Currently, domestic timber production cannot meet the

industry’s needs leaving Viet Nam heavily reliant on

imports. Of the country’s US$2.81 billion worth of wood

and wood product imports in 2024, raw timber (HS code

44) accounted for 85%. Logs and sawnwood remain the

core products.

Despite trade uncertainties, many wood businesses remain

resilient and hopeful about the Government’s ongoing

negotiations. It is reported that Viet Nam will waive

import duties on timber shipments from the US.

In the long term, VIFORES has proposed that the

Government continue supporting businesses through fiscal

and monetary policies previously applied during the

COVID-19 period including tax deferrals, rent reductions

and debt restructuring to help the industry navigate current

challenges.

See:https://vietnamnews.vn/economy/1695612/viet-nam-aims-to-

increase-imports-of-us-timber-to-boost-wood-processing-and-re-

exports.html

8. BRAZIL

Native timbers - a sustainable solution

for civil

construction

At the Civil Construction Fair (FEICON) 2025, a leading

construction industry trade fair in Latin America the forest

sector, Mato Grosso highlighted the potential of native

timber species as a sustainable and technically viable

alternative for civil construction.

Represented by the Center of Timber Producing and

Exporting Industries of the State of Mato Grosso (CIPEM)

the sector advocated the repositioning of wood from

natural forests as a sustainable material suitable for a wide

range of building types, from structural components to

finishing which, says CIPEM, would deliver significant

benefits for the decarbonising the construction industry.

CIPEM also highlighted the potential for using wood from

natural forests in social housing projects, advocating its

inclusion in public policies and housing finance

mechanisms.

Currently, Caixa Econômica Federal, the main federal

financial institution supporting low-income housing in

Brazil, does not finance wooden houses. The first step to

change this mindset would be legislation.

Backed by sustainable forest management practices,

traceability and internationally recognised quality

standards, wood from natural forests of Mato Grosso State

was presented as a modern, ecological and economically

viable solution for the future of civil construction in

Brazil.

See: https://www.remade.com.br/noticias/20637/madeira-nativa-

de-mato-grosso-se-destaca-como-solucao-sustentavel-para-a-

construcao-civil

New populations of Brazilwood identified

Recent research has significantly advanced the

understanding of Paubrasilia echinata (Brazilwood), the

iconic species of Brazil. A researcher from the Rio de

Janeiro Botanical Garden discovered 12 new populations

of the species in natural forests, bringing the total to 17 in

the state of Rio de Janeiro alone. It is as if Brazilwood,

once considered nearly extinct, has been rediscovery.

Although scientists are still working toward a complete

understanding of the species effective strategies for its

preservation are already known, the creation of protected

areas/conservation units being one such measure.

Previous studies had already identified morphological

variations among different Brazilwood populations,

grouped into three main lineages known as "arruda

"laranja" and "café" each occurring in specific areas of the

Atlantic Forest in the states of Rio de Janeiro, Bahia and

Espírito Santo, respectively.

Private and agroforestry projects feature Brazilwood in

"cabruca" systems in the state of Bahia and have

demonstrated the potential of the species. A study by the

Federal University of Espírito Santo focuses on planted

Brazilwood trees aiming to identify the most suitable

specimens for harvesting.

IBAMA (Brazilian Institute of Environment and

Renewable Natural Resources) has stated that it will

decide in the coming months whether to propose the

inclusion of Brazilwood in Appendix I of CITES

(Convention on International Trade in Endangered Species

of Wild Fauna and Flora).

This would completely ban the international use of

Brazilwood and prevent musicians traveling with violin

bows or any other musical instruments made from this

wood.

Currently, Brazilwood is listed in Appendix II, which

allows trade if it can be proven that the wood was legally

harvested. Biologist Haroldo Lima, from the Rio de

Janeiro Botanical Garden, highlighted the importance of

regularising existing stockpiles (as has been done abroad)

and providing security for farmers who plant and own

plantation of Brazilwood.

See:

https://globorural.globo.com/agricultura/noticia/2025/04/pesquis

as-ajudam-o-pais-a-redescobrir-o-ameacado-pau-brasil.ghtml

and

https://revistagloborural.pressreader.com/globo-rural/

Export update

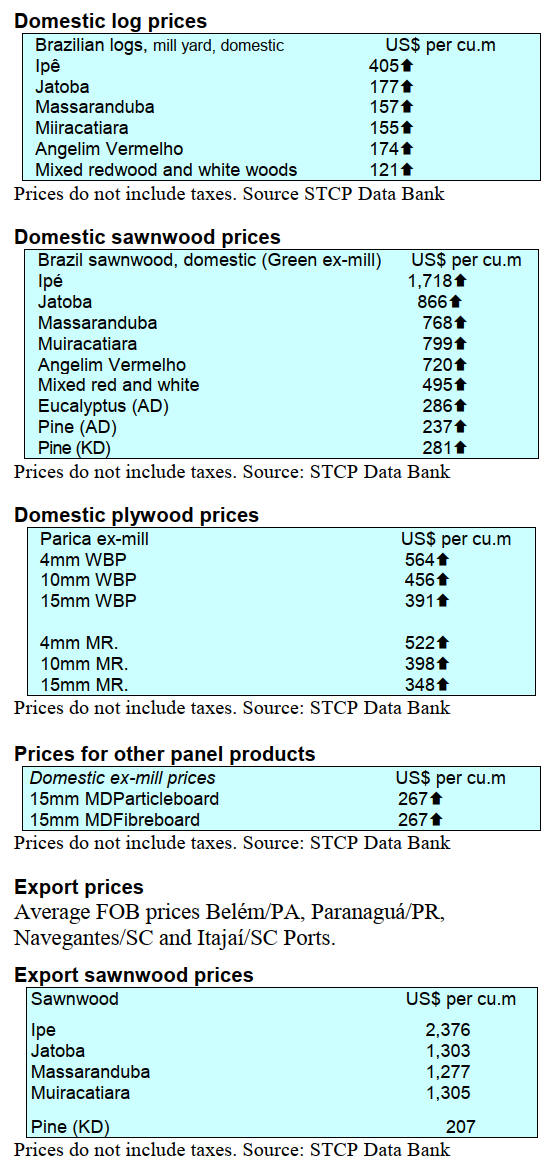

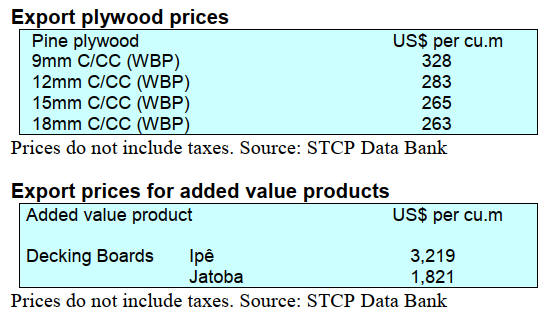

In March 2025 Brazilian exports of wood-based products

(except pulp and paper) increased 18% in value compared

to March 2024, from US$286.7 million to US$339.4

million.

Pine sawnwood exports increased 45% in value between

March 2024 (US$43.7 million) and March 2025 (US$63.4

million). In volume, exports increased 40% over the same

period, from 188,400 cu.m to 263,100 cu.m.

Tropical sawnwood exports increased 44% in volume,

from 16,500 cu.m in March 2024 to 23,700 cu.m in March

2025. In value, exports increased 25% from US$7.6

million to US$9.5 million over the same period.

Pine plywood exports increased 35% in value in March

2025 compared to March 2024 from US$68.9 million to

US$93.0 million. In volume, exports increased 43% over

the same period from 208,800 cu.m to 298,700 cu.m.

As for tropical plywood, exports increased in volume 42%

and in value 25% from 1,900 cu.m and US$1.2 million in

March 2024 to 2,700 cu.m and US$1.5 million in March

2025 respectively.

As for wooden furniture the exported value increased from

US$45.5 million in March 2024 to US$54.4 million in

March 2025, an increase of 20%.

Climate Fund supports degraded Amazon restoration

The Brazilian Development Bank (BNDES) has approved

the first reforestation initiative under the National Climate

Change Fund (New Climate Fund) aimed at forest

restoration with a total value of R$100 million.

Of this total, R$80 million is from the Climate Fund with

another R$20 million from the BNDES Finem credit line.

The funds will be allocated to Mombak, a startup

specialised in carbon removal which will invest to reforest

degraded areas in the Amazon. The project focuses on

biodiversity recovery and large-scale carbon sequestration.

The initiative aims to generate high-integrity carbon

credits and foster the local economy by generating jobs

and boosting the reforestation value chain.

The targeted area includes part of the Restoration Arc, a

region considered priority for forest restoration efforts and

will contribute to Brazil´s goal of restoring 6 million

hectares by 2030. The Climate Fund, a key instrument of

Brazil’s National Climate Change Policy and was

restructured by the federal government and is linked to the

Ministry of the Environment and Climate Change (MMA).

See: https://forestnews.com.br/bndes-fundo-clima-desembolsa-r-

100-milhoes-para-restauracao-florestal-com-mombak/

Through the eyes of industry

The latest GTI report lists the challenges identified by the

private sector in Brazil.

https://www.itto-

ggsc.org/static/upload/file/20250418/1744957176173218.pdf

9. PERU

Exports exceeded US$8.5

million but crashed 31%

The Center for Global Economy and Business Research of

CIEN-ADEX Exporters Association has reported export

shipments of wood products totalled US$8.5 million in the

first two months of 2025 representing a decrease of 31%

compared to the same month in 2024 (US$12.4 million).

According tothe ADEX Data Trade Trade Intelligence

System the products were sawnwood (US$4.1 million),

firewood and charcoal (US$1.7 million), semi-

manufactured products (US$1.1 million), construction

products (US$626,000) and furniture and parts

(US$483,000).

The main destination was the Dominican Republic with

shipments totalling US$2.0 million, a 32% increase

compared to the previous year. Vietnam followed with

US$1.8 million, an increase of 118% compared to 2024,

Mexico with US$1.4 million, an increase of 10%, the

United States with US$1.1 million, a decrease of 20% and

China at US$455,000, a decrease of 78%.

Tools to measure illegal logging - a study led by

OSINFOR

With the aim of strengthening the fight against illegal

logging and providing key data to combat illegal logging

the Presidency of the Council of Ministers (PCM)

commissioned the Forest and Wildlife Resources

Supervisory Agency (OSINFOR) to conduct a study

"Estimating and Improving the Legality of Timber in

Peru" to measure the rate of illegal logging in the country.

This year, this work will be carried out in coordination

with the National Forest and Wildlife Service (SERFOR)

and regional forestry authorities.

During the launch ceremony Mabel Gálvez, representative

of the Secretariat of Decentralisation of the PCM,

highlighted the importance of this study. “It is essential

that OSINFOR continue this work as results will allow us

to understand the impact of illegal logging, design new

strategies and boost the supply of legal forest products

thus increasing the competitiveness of the sector”, she

stated.

For his part, the Head of OSINFOR, Williams Arellano

Olano, emphasised the value of this new approach saying

“it allows us to precisely identify the areas where illegality

is increasing or decreasing. This information is key to

making better decisions and confronting this scourge more

effectively.” .

Arellano also highlighted the coordinated work with ten

regional governments, SERFOR and other entities such as

the Superintendency of Banking and Insurance and the

Pension Fund Administrators (SBS) which are

contributing to the study.

See: https://www.gob.pe/institucion/osinfor/noticias/1146395-

peru-afina-herramientas-para-medir-la-tala-ilegal-de-madera-

con-estudio-liderado-por-el-osinfor

OSINFOR and the Army seek to work together for

forests

In a joint effort to contribute to the conservation of forests

and mitigate the effects of climate change the Forest and

Wildlife Resources Oversight Agency (OSINFOR) and the

Environmental Management Sub-directorate of the

Peruvian Army are promoting an inter-institutional

agreement to intensify surveillance in hard-to-reach areas

and develop capacities to promote the sustainable use of

natural resources.

During an initial meeting the Head of OSINFOR,

Williams Arellano Olano and the Deputy Director of

Environmental Management Support, Lieutenant Colonel,

E.P. Nelson Yvan Meza Romero, recognised the need to

sign an agreement to strengthen surveillance and control

of Peruvian forests located in OSINFOR and Army

intervention zones as well as to conduct joint operations to

combat illegal activities that affect forest and wildlife

resources which put at risk the benefits forests provide to

communities and the environment.

See: https://www.gob.pe/institucion/osinfor/noticias/1158445-

osinfor-y-el-ejercito-buscan-trabajar-juntos-por-los-bosques

|