|

Report from

Europe

Another all-time low for UK tropical wood and wood

furniture imports in 2024

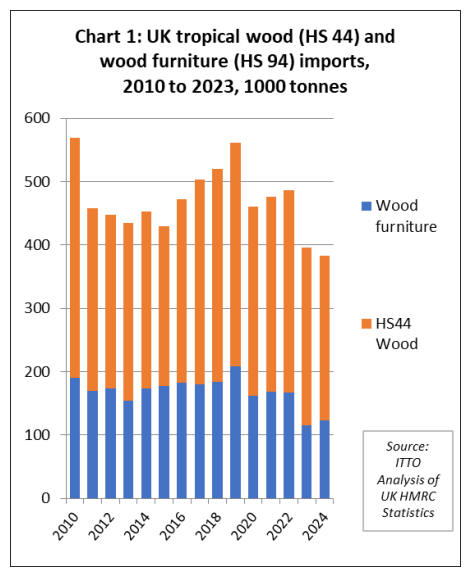

In 2024, the UK imported 383,200 tonnes of tropical wood

and wood furniture products with a total value of US$994

million, respectively 3% less and 6% more than the

previous year. In tonnage terms this was the lowest on

record and, in retrospect, may be seen as a continuation of

a long-term downward trend that started as far back as the

2008 financial crisis (Chart 1).

Import quantity last year was around half the level of

tropical wood imports into the UK typical two decades

ago. There was an upturn in UK tropical wood product

imports in 2015-2019, and another rebound in 2020-2022,

but these trends were driven respectively by a big increase

in imports of plywood faced with tropical hardwoods from

China, and then by the short-lived post-COVID boom.

Although UK imports of wood furniture and joinery

products rebounded in 2024 after a very sharp decline in

2023, imports of tropical plywood, sawnwood, and

mouldings continued to slide last year.

UK imports of tropical wood and wood furniture in the

fourth quarter of 2023 were 101,280 tonnes, a reasonable

performance in the context of the wider market slowdown,

this being 14% up on the previous quarter and 15% greater

than the same quarter in 2023. That provides some

encouragement that the market may have hit bottom

already.

Underlying the historically low levels of import in 2024 is

the weakness of the UK economy. According to the Office

of National Statistics, UK gross domestic product (GDP)

is estimated to have grown by 0.9% in 2024, while GDP

per head fell by 0.1%.

Much of the growth last year was concentrated in the first

six months. GDP expanded by just 0.1% in Q4 2024,

following no growth in the previous quarter. In February,

the Bank of England predicted that the UK economy will

grow by just 0.75% in 2025, down from its previous

estimate of 1.5%.

The UK Construction Products Association (CPA) Winter

Forecast issued in January predicts 2.1% growth in the UK

building sector this year. This is a significant improvement

following two challenging years with construction output

falling by 6.8% in 2023 and by another 2.9% in 2024.

The declines particularly affected the two largest sectors –

private housing new build and repair, maintenance and

improvement. However, the CPA’s forecast recovery for

this year is a downward revision compared to 2.5% growth

expected in their Autumn 2024 Forecast. The CPA now

expects slower economic growth this year, higher inflation

for longer, and fewer interest rate cuts than in their

previous forecast.

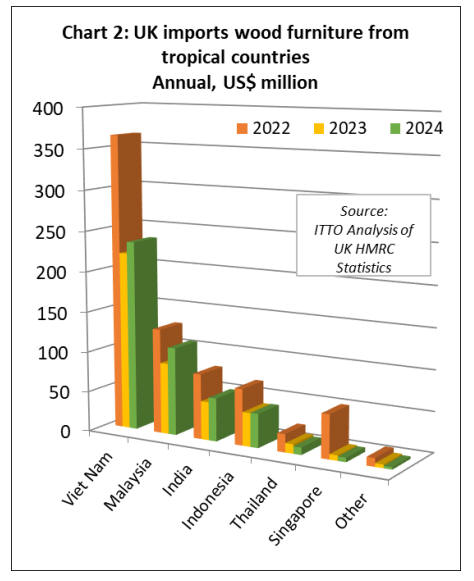

UK import value of wooden furniture from tropical

countries rebounded in 2024

After a 43% decline in UK imports of wood furniture from

tropical countries in 2023, imports rebounded by 9% to

US$457 million in 2024. In quantity terms, wood furniture

imports were 122,400 tonnes in 2024, 6% more than in

2023.

Tropical wood furniture imports in 2024 increased for all

leading supply countries to the UK including Vietnam

(+7% to US$235 million), Malaysia (+23% to US$109

million), India (+13% to US$53 million), and Indonesia

(+1% to US$42 million). However, imports declined from

Thailand (-22% to US$9 million), and Singapore (-18% to

US$5.4 million). UK wood furniture imports were

negligible from all other tropical countries in 2024 (Chart

2).

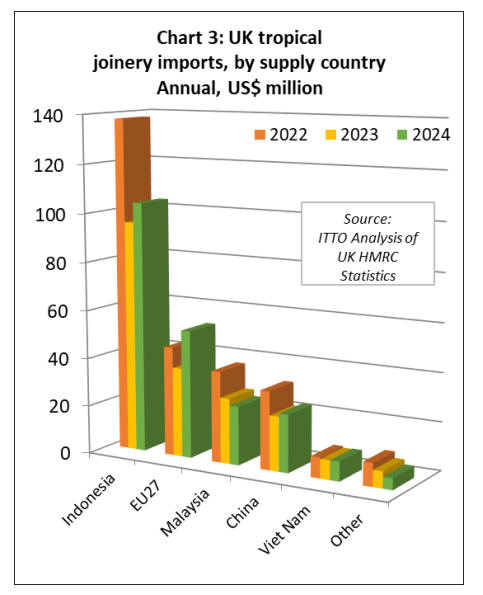

UK import value of tropical wood joinery increases

11% in 2024

Total UK import value of tropical joinery products

increased 11% to US$218 million in 2024 and import

quantity increased 6% to 74,100 tonnes. The biggest

rebound was in UK imports of tropical wood joinery

products from the EU, up 43% to US$53 million during

the year.

UK import value of joinery products from Indonesia

(mainly doors) was US$104 million in 2024, up 9% on the

previous year but still well short of US$138 achieved in

2022. Imports from Malaysia (mainly laminated products

for kitchen and window applications) fell 10% to US$24

million in 2024, continuing the slide that set in the

previous year.

UK import value of tropical wood joinery products from

China, nearly all doors, was US$24 million in 2024, 6%

more than the previous year. UK import value of joinery

products from Vietnam increased 2% to US$8.1 million

during the year (Chart 3).

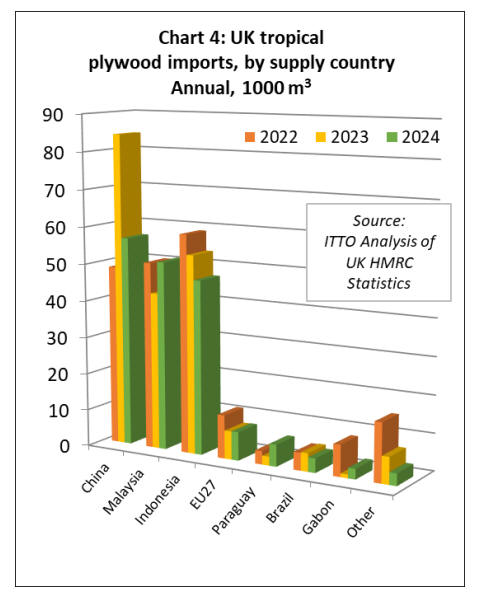

UK imports of tropical hardwood plywood from China

fall sharply

In 2024, the UK imported 178,400 cu.m of tropical

hardwood plywood, 12% less than the previous year.

Import value fell less sharply, by 5% to US$113 million.

The increase in the unit value of tropical plywood imports

into the UK last year was due to a sharp decline in imports

of lower-value plywood with an outer layer of tropical

hardwood from China. Direct imports of higher-value

tropical hardwood plywood from tropical countries were

more stable last year (Chart 4).

The UK imported 56,700 cu.m of plywood with an outer

layer of tropical hardwood from China in 2024, 34% less

than the previous year. UK imports of tropical hardwood

plywood direct from tropical countries increased 2% to

114,000 cu.m in 2024.

Imports were up 20% to 51,000 cu.m from Malaysia, up

145% to 5,900 cu.m from Paraguay, and up 181% to 2,800

cu.m from Gabon. These gains offset a decline of 12% to

47,100 cu.m from Indonesia and 21% to 3,900 cu.m from

Brazil. UK imports of tropical hardwood plywood from

EU countries were 7,700 cu.m in 2024, 1% more than the

previous year.

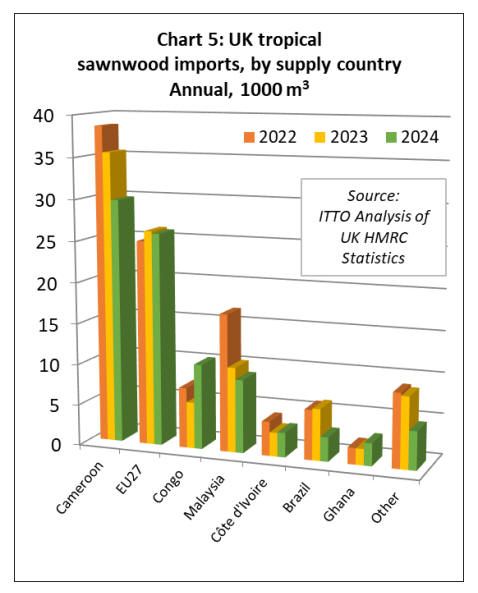

Rising share of tropical sawnwood imports into the UK

from the EU

UK imports of tropical sawnwood were 88,380 cu.m in

2024, 9% less than the previous year. Import value fell 4%

to US$107 million during the year. The UK imported

25,900 cu.m of tropical sawnwood from EU countries in

2024, down 1% compared to the previous year but

accounting for a higher share (29% compared to 27%) of

all UK imports of tropical sawnwood during the year

(Chart 5).

The UK’s high dependence on indirect imports of tropical

sawnwood from the EU is partly due to a shortage of kiln

drying space in African supply countries combined with

lack of any hardwood kiln drying capacity in the UK.

A large share (34% in 2024) of sawnwood sourced directly

from the tropics by UK importers comes from Cameroon,

but the Republic of Congo (RoC) increased share in the

UK market last year.

UK imports of tropical sawnwood from Cameroon were

29,800 cu.m in 2024, 16% less than the previous year,

while imports from RoC increased 84% to 10,370 cu.m.

Imports from Cote d’Ivoire and Ghana also increased in

2024, respectively by 4% to 3000 cu.m and by 40% to

2,750 cu.m. However, imports from Malaysia fell by 14%

to 8,900 cu.m in 2024 and imports from Brazil were down

53% to 2,950 cu.m.

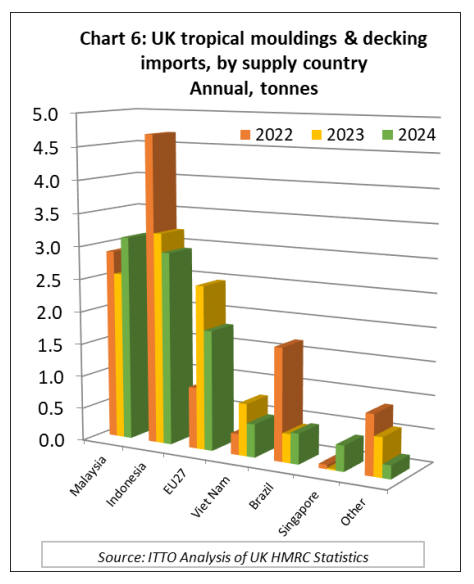

UK imports of tropical hardwood mouldings/decking fell

7% to 9,400 tonnes in 2024. Import value was down 5% to

US$26.6 million.

Although UK imports of this commodity from Malaysia

increased by 22% to 3,100 tonnes in 2024, this was offset

by falling imports from Indonesia (-9% to 2,900 tonnes)

and Vietnam (-36% to 500 tonnes). Imports from EU

countries also fell, by 27% to 1,800 tonnes. Imports from

Brazil were static at 500 tonnes (Chart 6).

China boosted share of UK wood product imports in

2024

The UK market for tropical wood and wood furniture

products last year performed marginally better than the

wider UK market for wood and wood furniture products.

In real terms (accounting for inflation), total UK import

value of these products remained static at US$10.6 billion

in 2024, while the value of tropical product imports

increased by 3%. The share of tropical wood and wood

furniture products in total UK imports increased slightly

from 9.3% to 9.5% last year. However, it was still down

on the 11.4% share achieved in 2022.

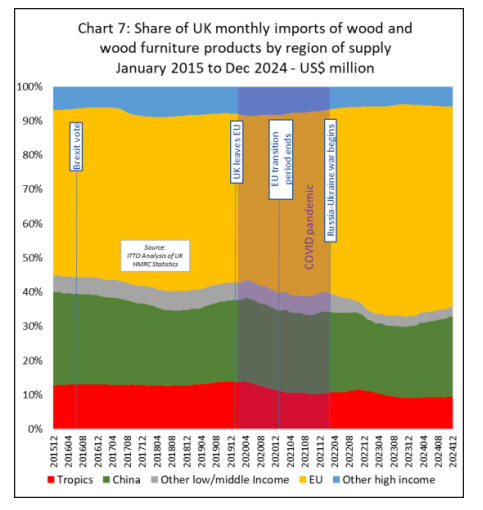

Considering longer term trends, the recent development of

the UK market for tropical wood and wood furniture

products is disappointing. Following the UK’s withdrawal

from the EU, an event that occurred five years ago, there

was speculation that higher transaction costs in EU-UK

trade might encourage more purchasing of wood products

from further afield, including in the emerging

manufacturing sectors of tropical countries.

What happened in practice was that UK imports from the

EU, both in absolute terms and in share, confounded

expectations by increasing during the immediate post-

Brexit period. The COVID pandemic was a factor during

this period, the huge increase in shipping costs and

disruption to production in Asia encouraging the UK to

import more from the EU. The war in Ukraine tended to

deepen this trend as supplies from Russia and Ukraine

dried up. During the period 2019 to 2023, the EU’s share

in total UK imports of wood and wood furniture products

increased from 49% to 62% (Chart 7).

In 2024, a new trend emerged as the UK finally began to

import a larger share of wood and wood furniture products

from outside the EU. However, the only real beneficiary of

this trend so far has been China.

China’s share of UK imports increased from 21% to 24%

last year, mainly at the expense of the EU whose share fell

from 62% to 58%. This trend may well continue as

China’s manufacturers seek to increase exports to

countries other than the U.S., in the face of rising tariffs,

and the EU where EUDR is creating new challenges for

Chinese manufacturers.

|