US Dollar Exchange Rates of

25th

Mar

2025

China Yuan 7.27

Report from China

Rise in fibreboard exports to Vietnam

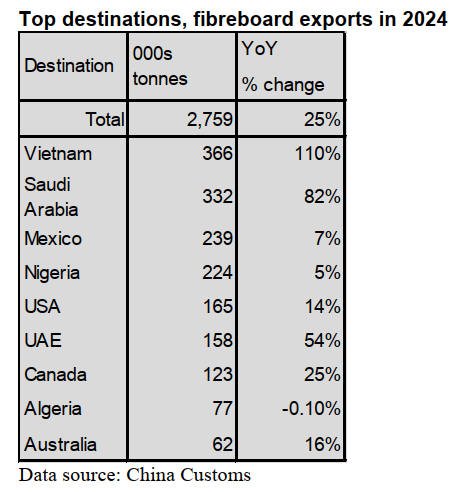

According to China Customs fibreboard exports to

Vietnam, the largest market in 2024, more than doubled to

366,000 tonnes year on year. China’s fibreboard exports to

Saudi Arabia, as the second largest destination in 2024

rose 82% year on year to 332,000 tonnes.

For other markets export growth rates in 2024 varied

leading to an overall increase in export tonnages of 25%

compared to a year earlier. China’s fibreboard exports to

the USA in 2024 rose 14% over 2023 level. China’s 2024

fibreboard exports to Algeria alone fell year on year.

Rise in fibreboard imports

According to China Customs, in 2024 fibreboard imports

were 53,500 tonnes valued at US$47 million, up 4% in

volume but down 5% in value year on year.

New Zealand and Thailand were the two top suppliers of

China’s fibreboard imports in 2024. Imports from New

Zealand and Thailand rose 15% and 12% to 16,800 tonnes

and 92,000 tonnes respectively compared to 2023 levels.

China’s fibreboard imports from Romania and Australia in

2024 surged over 100% and 300% respectively year on

year. In contrast, China’s fibreboard imports from

Germany and Spain in 2024 fell 28% and 25% compared

to 2023 levels.

Rise in wooden furniture exports in 2024

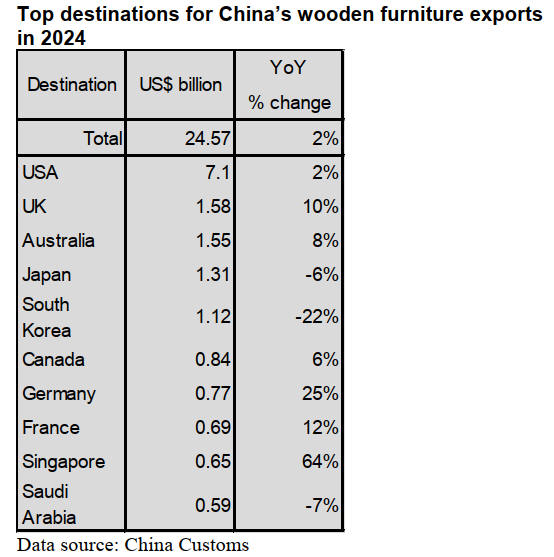

China Customs has reported wooden furniture exports in

2024 rose 2% to US$24.57 billion year on year. The USA

was the largest market for China’s wooden furniture

exports. Nearly 30% of China’s wooden furniture was

exported to the USA in 2024.

China’s wooden furniture is exported to more than 200

countries. The value of China’s furniture exports to the top

5 countries, the U.S., the UK, Australia, Japan and South

Korea earned more than US$12 billion and accounted for

just 52% of the national total in 2024.

China’s wooden furniture exports to the UK and Australia

in 2024 rose 10% and 8% respectively year on year. In

contrast, China’s wooden furniture exports to Japan and

South Korea in 2024 dropped 6% and 22% respectively

year on year.

Decline in wooden furniture imports

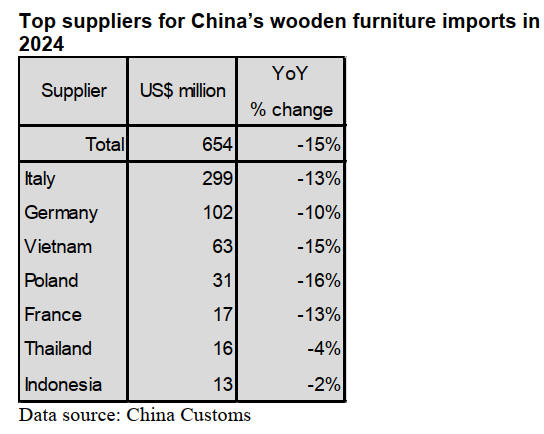

China’s wooden furniture imports in 2024 fell 15% to

US$654 million year on year. Italy, Germany and

Vietnam were the top 3 suppliers of China’s wooden

furniture imports. 71% of China’s wooden furniture were

imported from the 3 countries but fell 13%, 10% and 15%

to US$299 million, US$102 million and US$63 million

respectively in 2024.

The main reason for the large decline in China's wooden

furniture imports in 2024 was because domestic demand

for furniture had fallen sharply due to the downturn in

China's real estate sector.

Decline in fibreboard production capacity in 2024

According to the statistics from the Academy of Industry

Development and Planning under the National Forestry

and Grassland Administration and the China Forestry

Products Industry Association (CFPIA), both the number

of enterprises and production capacity of China’s

fibreboard industry continued to decline in 2024.

However, the average single-line production capacity

continued to rise in 2024.

By the end of 2024, the 240 fibreboard production

enterprises had 265 production lines and factories were

distributed across 20 provinces with a total annual

production capacity of 41.83 million cubic metres, down

9% year-on-year, a sharp decline over the past four

consecutive years.

Six fibreboard production lines were built in 2024 and put

into operation adding an additional production capacity of

820,000 cubic meters per year.

GTI report for February 2025

To boost domestic demand and promote high-standard

production, China has adjusted import tariff rates for

certain goods in 2025. Among them, tariffs on some

imported wood products—including veneer, wood

flooring, fiberboard, plywood, wooden doors, wooden

formwork, wooden pallets, wooden tools, cork and cork

products, etc have been revised. Most wood products

continue to enjoy a provisional tax rate of 0% maintaining

the policy implemented in 2024.

Data from China's National Forestry and Grassland

Administration shows that the total output value of

China’s forestry industry reached 10.17 trillion yuan in

2024 marking a year-on-year growth of 9.6%.

A key driver behind the growth is timber production in the

country which reached 137 million cubic metres in 2024,

representing an 8% increase compared to 2023.

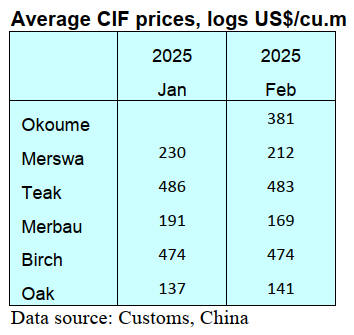

Recently, many shipping companies announced a new

round of price increases for certain routes in March adding

cost pressures on Chinese wood importers. In response,

some enterprises plan to mitigate these challenges by

diversifying transportation methods and expanding their

procurement sources.

In February 2025, the GTI-China index registered 44.1%,

an increase of 4.6 percentage points from the previous

month and has been below the critical value (50%) for 4

consecutive months indicating that the business prosperity

of the timber enterprises represented by the GTI-China

index shrank from the previous month, however, the pace

of contraction eased.

In February China's traditional Spring Festival holiday

slowed down production and operations in the timber

sector. However, as the holiday impact was diminishing

enterprises were relatively optimistic about the overall

trend of the timber market over the next six months.

As for the twelve sub-indexes, the indices for delivery

time and market expectation were above the critical value

of 50%, the indices for imports and purchase price were at

the critical value, while the remaining eight indices

(production, new orders, export orders, existing orders,

inventory of finished products, purchase quantity,

inventory of main raw materials and employment) were all

below the critical value.

Compared to the previous month, the indicess for

production, new orders, export orders, existing orders,

inventory of finished products, purchase quantity, import,

inventory of main raw materials, employees, delivery time

and market expectation increased by 1.1-11.7 percentage

points and the index for purchase price declined by 0.5

percentage point.

|