Japan

Wood Products Prices

Dollar Exchange Rates of 25th

Mar

2025

Japan Yen 150.58

Reports From Japan

US tariff policy could

upend recovery in Japan

The Bank of Japan’s (BoJ) resolve to closely monitor the

possible impact of U.S. tariffs on Japan’s economy

prompted it to keep interest rates unchanged at 0.5% at its

most recent meeting. Analysts are split over when the

central bank’s next raise will be.

At a press conference following the bank’s Monetary

Policy Meeting, BoJ Governor, Kazuo Ueda, indicated the

effects of the high tariff policy of the U.S. administration

on Japan’s economy and consumer prices would need to

be carefully assessed.

The U.S. administration has proposed additional tariffs on

automobiles imported from all nations and regions. If this

plan goes ahead the business performance of Japanese

automakers could suffer and the Japanese economy could

come under downward pressure. Ueda said the higher U.S.

duties could also affect the Japanese economy through

their impact on the global economy or more directly

through supply chains.

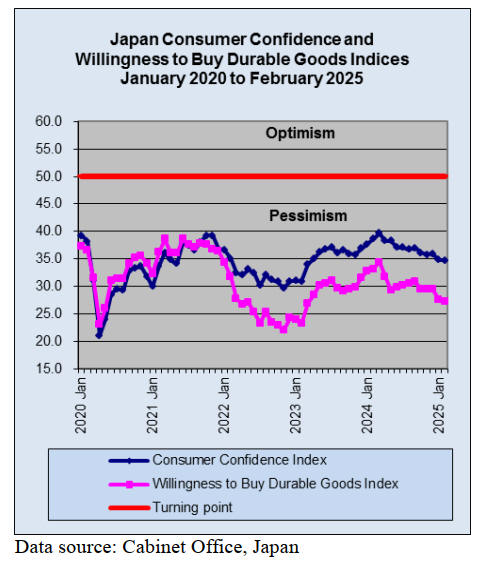

Ueda also pointed out that “some data” suggested the

uncertainty was starting to affect consumer sentiment in

the United States. The governor indicated the bank would

analyse the risks to Japanese economic activity, including

the psychological impact on companies and household

spending.

See:https://japannews.yomiuri.co.jp/business/economy/20250320

-244355/

Another rate rise will get Japan back on track

The recent downward pressure on the yen has eased

slightly as Japan's policy rate has risen above that of

Switzerland's for the first time in two years. Many market

watchers expect the interest rate spread between Japan and

Switzerland to only grow further as the BoJ continues to

raise rates.

During a news conference following a two-day monetary

policy meeting that ended with the BoJ board deciding to

keep the un-collateralised overnight call rate unchanged

Governor Ueda left open the option for a rate hike in May

mentioning the risk of an upward swing in inflation and

vowing to "avoid falling behind the curve."

Economists were unanimous in projecting back-to-back

rate increases as unlikely from a BoJ intent on playing it

safe since roiling the markets last year with a surprise rate

increase.

The governor indicated the Bank would analyse the risks

to Japanese economic activity including the psychological

impact on Japanese companies and household finances.

Business confidence among Japanese manufacturers

– negative in March

In March business confidence among Japanese

manufacturers turned negative for the first time in three

months reflecting concerns over U.S. tariffs and a sluggish

Chinese economy according to a Reuters Tankan survey.

The manufacturers’ sentiment index fell the lowest level

since December. The non-manufacturer index also

weakened, as rising labour and transport costs weighed on

sentiment. Reuters Tankan is a monthly survey that seeks

to track the Bank of Japan's tankan quarterly survey.

See: https://www.forexlive.com/news/japan-business-sentiment-

weakens-in-march-amid-tariff-and-china-concerns-20250318/

China still a favourite with Japanese companies

According to the latest survey released by the Japanese

Chamber of Commerce and Industry in China more than

half of the Japanese companies operating in China and

surveyed said that they plan to either increase or maintain

their investment because China is their primary market.

The positive sentiment was driven by multiple factors

including growing demand and rising orders. Additionally,

other changes have fueled Japanese businesses' confidence

in the Chinese market such as an improved business

environment, a visa-free policy for Japanese citizens and

other government stimuli, including trade-in policies to

spur consumption.

See: https://www.globaltimes.cn/page/202502/1328323.shtml

Operations in the US an option but there are risks

According to a Nikkei survey nearly 50% of major

Japanese companies look to expand U.S. operations as the

US administration increases efforts to draw foreign

investment, though many remain worried about the

uncertainty surrounding his tariff plans.

Of the 144 companies that provided responses, 28% said

they plan to expand in the US with another 21%

considering doing so while others with no presence there

now aim to enter the market. None of those surveyed

intend to scale back US operations.

See: https://asia.nikkei.com/Business/Business-trends/Half-of-

top-Japan-business-leaders-eye-U.S.-expansion-survey

Households savings dropping fast

According to the BoJ Japanese households reduced their

savings at the fastest pace on record in the last quarter of

2024 as they struggled to cope with the rising cost of

living. Holdings of cash slipped to yen 105.3 trillion in the

three months ended in December, down 3.4% from a year

earlier in the biggest drop in the data going back to 1998.

The decline mostly likely reflects the wider adoption of

cashless consumption as well as a decline in nominal

consumer spending due to inflation, a reversal after the

pile of cash grew during the COVID-19 pandemic, the BoJ

said at a briefing.

The decline in cash comes as economists have been

watching to see if households change their behavior

regarding so-called mattress money, or funds kept at

home. A government report showed that in March Japan’s

inflation rose at a faster pace than expected, staying well

above BoJ’s 2% target.

See:

https://www.japantimes.co.jp/business/2025/03/21/economy/japa

n-households-slash-cash/

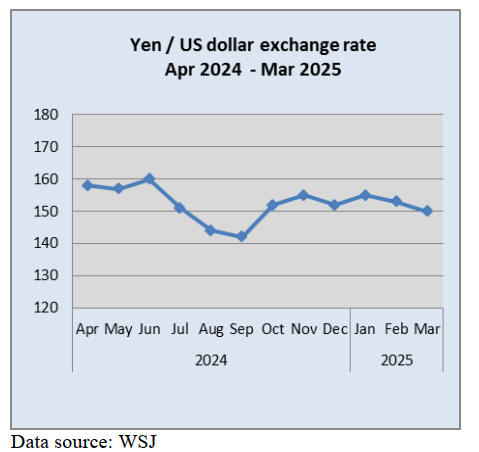

Yen exchange rate rattled by statements from the US

The yen strengthened against the dollar recently reaching

148 at one point but analysts expect the Japanese currency

to eventually weaken in light of the uncertain U.S.

economic outlook and divergence of Japan-U.S. monetary

policies.

The latest yen rally was sparked by comments from the

US that countries such as Japan and China were “driving

down their currencies which is unfair to the U.S.”.

Japanese real estate attracts overseas investment

An Asia-based investment fund has indicated it is

considering investing about US$7 billion in Japanese real

estate over the next three years aiming to buy property

being sold by Japanese companies and to invest in data

centres.

See: https://asia.nikkei.com/Business/Markets/Property/Asia-

fund-PAG-to-invest-7bn-in-Japan-real-estate-over-3-years

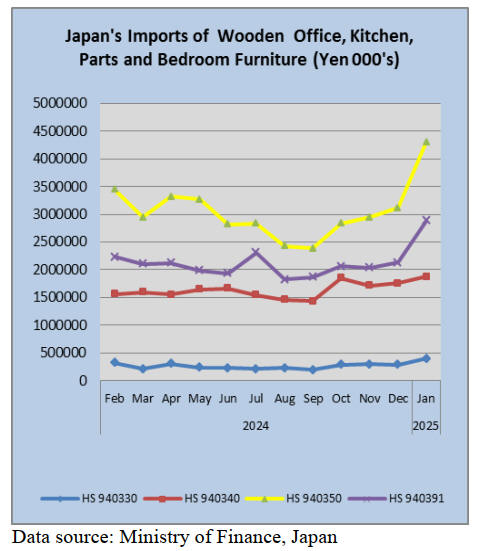

Import update

Yen value of furniture imports

Beginning in the third quarter of 2024 and extending to

January 2025 there has been a steady upward trend in the

value of furniture imports.

While some of the upswing can be explained by the

weaker yen making imports more expensive a review of

the quantity of imports as reported by Japanese Customs

reveals an steady increase in the quantity of wooden

furniture arriving in Japan.

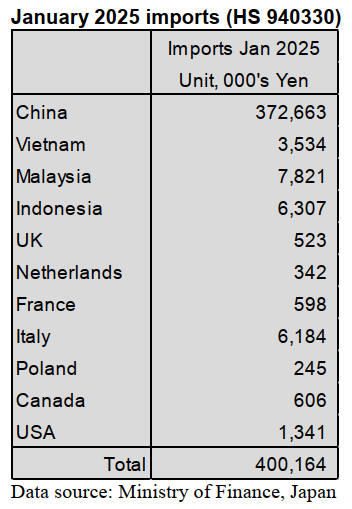

January 2025 wooden office furniture imports (HS

940330)

In January 2025 as was the case in December 2024

shippers in China accounted for 93% of Japan’s imports of

wooden office furniture (HS 940330). The only other

shipper of note in January was Malaysia, which increased

market share to 2% (1.5% in December 2024). The third

and fourth ranked shippers in terms of value were

Indonesia and Italy.

Year on year, the value of Japan’s imports of wooden

office furniture in January was little changed but month on

month there was a huge 40% rise in the value of arrivals.

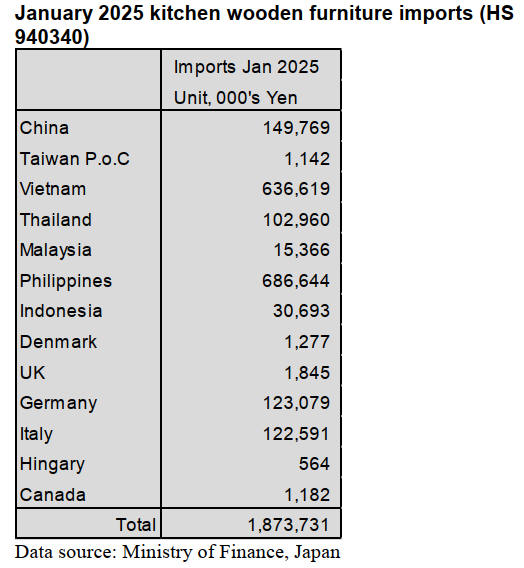

January 2025 wooden kitchen furniture imports (HS

940340)

In January 2025 the combined value of shipments of

wooden kitchen furniture (HS 940340) from the

Philippines and Vietnam accounted for over 70% of

Japan’s imports of HS 940340.

The Philippines and Vietnam each accounted for around

35%. of total imports of wooden kitchen furniture in

January this year. The other shippers of note in January

were China (8%) and Germany and Italy, with a combined

share of around 7%.

The year on year value of Japan’s wooden kitchen

furniture imports rose 42% in January further extending an

upward trend. Compared to the value of imports in

December a 38% rise was recorded in January.

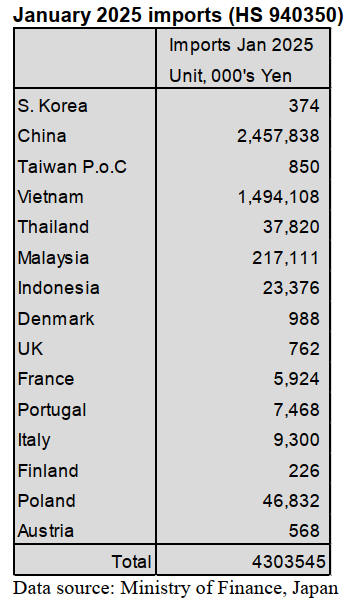

January 2025 wooden bedroom furniture imports (HS

940350)

The top two shippers of wooden bedroom furniture (HS

940350) to Japan in January were China (57%) and

Vietnam (35%). Malaysia and Poland were the other

shippers of note in January with Malaysia, seeing a 6%

share of January imports (up from 3% in December).

Compared to December 2024 there was a 24% increase in

the value of imports in January and a 35% rise compared

to the value reported for January 2024. Over the past four

months there has been a steady upward trend in the value

of wooden bedroom furniture imports to Japan.

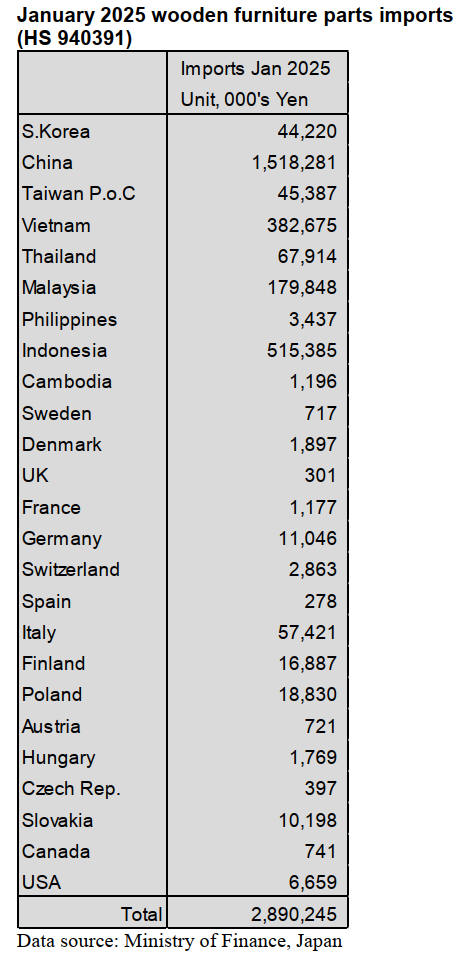

Shippers in China, Indonesia, Vietnam and Malaysia,

as in

previous months, accounted for around 90% of Japan’s

imports of wooden furniture parts (HS 940391) in January

2025.

Of the total value of imports, 57% was delivered from

China, almost the same value as in December 2024; 18%

from Indonesia, a slight rise month on month; 13% from

Vietnam and 6% from Malaysia, a slight drop month on

month.

Compared to the value of January 2024 imports there was

a sharp rise of 31% in the value ofJanuary 2025 imports

and a 35% increase compared to December 2024

Trade news from the Japan Lumber Reports (JLR)

The Japan Lumber Reports (JLR), a subscription trade

journal published every two weeks in English, is

generously allowing the ITTO Tropical Timber Market

Report to reproduce news on the Japanese market

precisely as it appears in the JLR.

For the JLR report please see:

https://jfpj.jp/japan_lumber_reports/

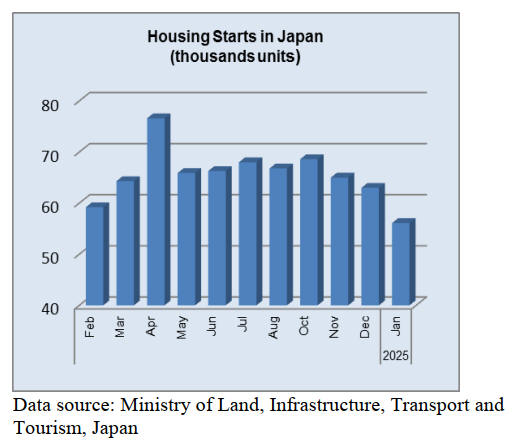

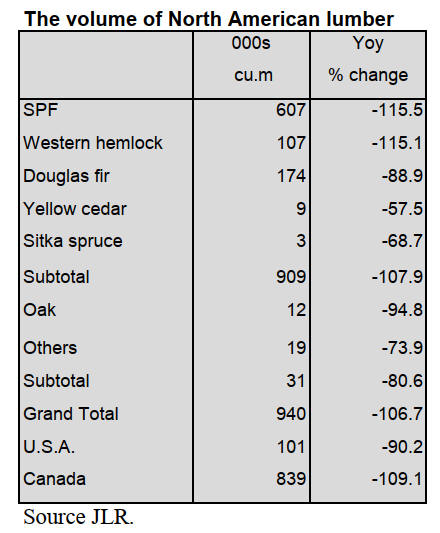

North American lumber import in 2024

Volume of North American log in 2024 is 1,476,240

cbms, 14.2 % less than 2023. This is straight two years for

not exceeding 2,000,000 cbms.

Volume of North American lumber is 939,000 cbms and

this is also straight two years for not exceeding 1,000,000

cbms. However, volume of SPF and Western Hemlock is

over 15 % more than last year so total volume is 6.7 %

more than 2023. Since Chugoku Lumber Co., Ltd. had a

fire at its plant, the company could not purchase a certain

amount of Doulgas fir logs. Also, there had been an

influence of low demand in Japan. Logs for major

Japanese lumber manufacturers from the US is 6.7 % less

and from Canada is nearly 30 % less than the previous

year.

As for North American lumber, volume of SPF is better

than last year because it was as a reaction to the inventory

control in 2023. Additionally, the starts of 2 x 4 in 2024

are 95,095 units, 4.7 % more than 2023 so the inquiries

rose.

The reason for a decrease in Douglas fir lumber is that

precutting plants hesitated to purchase the lumber due to

low demand for houses.

European softwood lumber import in 2024

Volume of softwood lumber from Europe in 2024 is

2,196,000 cbms, 32.9 % more than 2023. The volume in

2023 was under 2,000,000 cbms.

Softwood lumber supply increased even though the new

starts was 3.4 % less than the previous year. Especially, it

was an oversupply of whitewood stud at the second half of

2024. However, whitewood studs and whitewood lamina

were less popular than redwood studs and redwood lamina

because there had been an influence of the woodshock and

demand for whitewood studs or lamina shrank.

The log price will keep high this 2025 because the price of

whitewood log in Europe skyrocketed due to a shortage.

Planed or filed stud in 2024 is 779,682 cbms, 26.7 % more

than 2023. Lamina is 1,409,620 cbms, 36.9 % more than

last year. Tongue and groove is 7,345 cbms, 1.1 % more

than the previous year.

Pine lumber is 942,932 cbms, 38.9 % up. Fir, spruce and

other lumber are 466,688 cbms, 33.0 % up.

Softwood lumber from Romania, Czech and several

countries in Central Europe increases widely. On the other

hand, softwood lumber from Ukraine and Switzerland

decreases. The average import price of lamina in 2024 is

44,862 yen, 5.7 % more and of stud is 61,811 yen, 1.0 %

less than last year.

Plywood

Domestic plywood manufacturers raised the price of

softwood plywood in January and February, 2025. 12 mm

3 x 6 structural softwood plywood is 980 – 1,000 yen,

delivered per sheet. However, the plywood manufacturers

will raise the price by 1,100 yen, delivered per sheet, in

March, 2025 due to low profits.

Movement of domestic softwood plywood has been dull

since February, 2025 because the demand is low as usual.

The precutting plants say that a number of orders for a

house is poor. There are not enough plywood and logs at

several plants and the due date will be delayed. The

plywood production in February, 2025 is low due to less

working days.

Imported 12 mm South Sea plywood would be tight in this

spring because there had been heavy rains and floods

during the end of January to the beginning of February,

2025 in Sarawak, Malaysia. Plywood plants in this area

stopped operations and there were not enough logs.

The price of 12 mm plywood has been raised by $10 – 20,

C&F per cbm from the previous negotiation.

12 mm 3 x 6 painted plywood for concrete form is $590 –

600, C&F per cbm. Plywood form is $500 – 510, C&F per

cbm. Structural plywood is $510 – 520, C&F per cbm. 2.4

mm 3 x 6 plywood is $970, C&F per cbm. 3.7 mm 3 x 6

plywood is around $880, C&F per cbm. 5.2 mm 3 x 6

plywood is $850, C&F per cbm.

In Japan, the price of 12 mm plywood is 30 – 40 yen,

delivered per sheet, more than last month.

12 mm 3 x 6 painted plywood for concrete form is around

1,850 yen, delivered per sheet. Plywood form is 1,550 yen,

delivered per sheet. Structural plywood is 1,550 yen,

delivered per sheet. 2.5 mm plywood is 750 yen, delivered

per sheet. 4 mm plywood is 930 yen, delivered per sheet.

5.5 mm plywood is 1,100 yen, delivered per sheet.

Domestic lumber and logs

The production of lumber cannot keep up with the

inquiries at precutting plants. The prices of cedar studs,

cedar ceiling joists, 90 mm cypress squares or sills and

taruki have been increasing. As a result, there are not a lot

of lumber delivered from Kyushu region in Kanto region.

The precutting plants have been struggling with deficit

because the working days are less and they have to lower

the price of lumber for house builders. This is the reason

that the precutting plants changed to purchase domestic

lumber instead of imported lumber. Since distributors

forecasted that logs would be in short, they ordered a lot of

lumber to lumber manufacturers.

The price of KD 105 mm cedar post is 58,000 – 60,000

yen, delivered per cbm and this is 3,000 yen more than

January, 2025.

The prices of cedar and cypress logs are high because

there are not enough logs due to the heavy snow. Cypress

log for sill is 26,000 yen, delivered per cbm, in Okayama

Prefecture.

It is 25,000 yen, delivered per cbm in Kyushu region, is

24,600 yen, delivered per cbm in Shikoku region and is

24,500 yen, delivered per cbm in Tochigi Prefecture.

These prices are about 3,000 yen more than the previous

year.

The price of cedar log in Tochigi Prefecture is 17,000 yen,

delivered per cbm and this is the highest price in Japan.

This is 1,000 yen more than last year.

Supply of lumber is tight and the price of lumber is raised

in several places but the actual demand is low so it is

concerned that demand for domestic logs would drop. It is

important to see how the price of logs change after this

April.

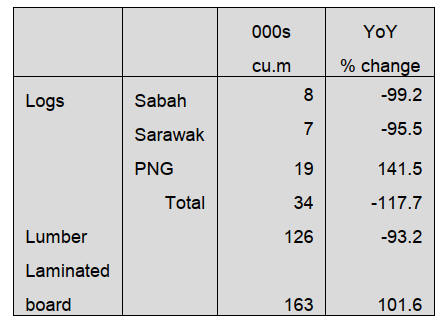

Imported South Sea logs and lumber in 2024

Import of South Sea logs in 2024 is 36,186 cbms, 17.7 %

more than 2023. South Sea logs from Papua New Guinea

supposed to arrive to Japan at the second half of 2023 but

the South Sea logs arrived to Japan at the first half of 2024

so the volume of South Sea log from Papua New Guinea

increased widely in 2024. South Sea lumber is 6.8 % less

than 2023 and laminated boards are 1.6 % more than last

year.

The price of South Sea log in South Asia is still high but

some Japanese consumers purchase other kind of log

instead of South Sea log.

South Sea lumber from Indonesia is 46,164 cbms, 2.7 %

less and from Malaysia is 31,848 cbms, 8.4 % less than the

previous year. The reasons are low demand for houses in

Japan, high-priced lumber in South Asia and the weak yen.

|