|

1.

CENTRAL AND WEST AFRICA

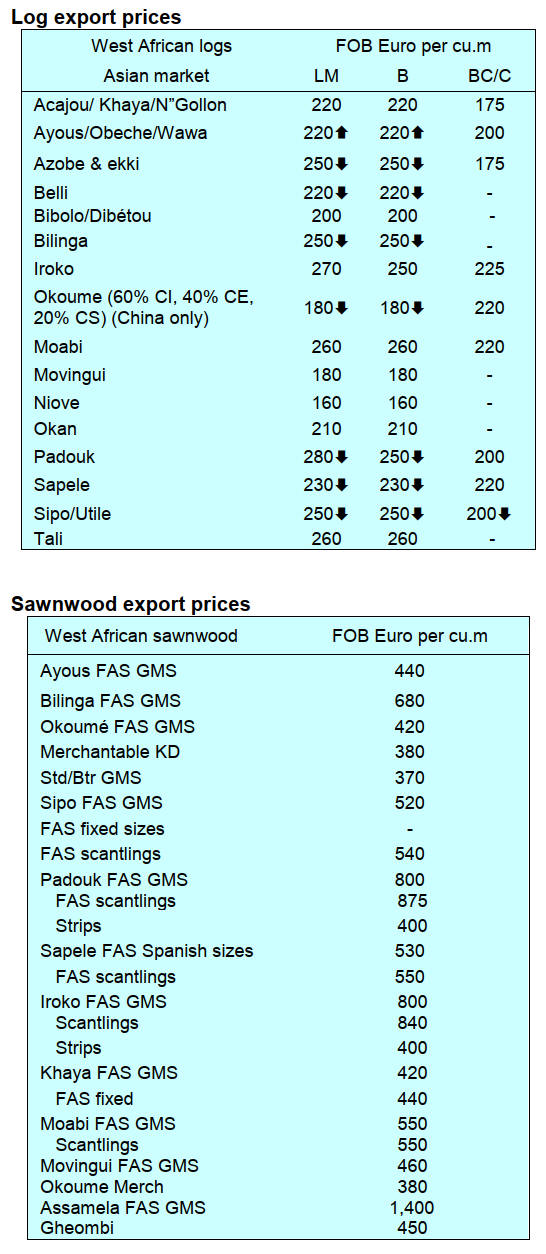

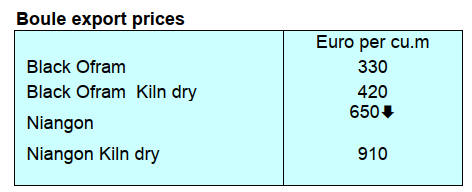

Demand trends – producer views

The Middle East market is showing improved timber

demand helping to reduce stocks. Nevertheless, future

prospects remain uncertain because there are no major

construction projects reported in Dubai or neighbouring

countries.

Demand in the Philippines for Okoume, Dabema and

contracts for Iroko remain robust.

The Vietnamese market also appears stable with no signs

of diminished demand.

No improvement is evident in the Chinese market. Large

inventories of unsold apartments are a concern as is the

decline in disposable income among the working

population.

It has been reported that timber stocks in In Zhangjiagang

Port are sufficient for up to two years at current levels of

sales illustrating the severity of the market slowdown.

Regional round-up

Gabon

The new forestry code with around 800 articles is under

development but local observers say adoption is unlikely

until after the presidential election in April.

Most parts of the country have had uninterrupted

electricity supply thanks to the newly installed Turkish

power ships.

Up-country transport remains slow and trucks from the

mid and southern regions can take two to three days to

reach Libreville.

Harvesting activities remain virtually the same as in the

previous update as heavy rains in up-country regions

continue to hinder operations. Ongoing roadwork along

National Highway 3 near Ndjolé has been slow resulting

in transport delays of two to three days for timber coming

from the central and southern parts of the country to

Libreville.

Rail capacity available for timber has expanded since the

decline in manganese shipments to China. It is reported

that the railway operator, SETRAG, is seeking financial

aid to repair damaged track segments and bridges. Plans

for a second rail line from the Belinga iron mining site

have come to a standstill.

Container availability at Gabonese Ports is reported as

adequate with most vessels experiencing a turn-around of

just a few days. However, exporters are concerned about

the higher port charges and an increase in export duties.

Producers in Gabon report overall market conditions

remain steady, albeit with the same challenges of sluggish

demand and tight local compliance rules.

Cameroon

Conditions are extremely dry in the Mid and South, with

Yaoundé struggling to provide adequate water supplies.

Production is gradually increasing under CFAD (the

Forestry Concession compliance framework) which could

help producers in meeting EUTR requirements.

Container stocks at Cameroon Ports are said to be

adequate. Timber exports through Douala Port have

declined partially due to CFAD enforcement along with

cooling market demand. Observers report lower

throughput of logs from the northern Congo through Kribi

Port as Congo is now in the rain season.

There are no reported changes in truck routes from forest

to mill or log depot and production appears unchanged.

While order volumes are described as “stable to low,”

Azobe logs and timber continue to find some buyers in

Holland but shipments of redwoods and Ayous have

slowed.

Demand in China for redwoods, Ovangkol and Okan is

low, mirroring the broader global market downturn.

Meanwhile, Middle Eastern interest in Iroko, Sapelli and

redwoods has improved slightly say producers. Overall,

the timber industry continues to rely on small volume

orders with mills keeping moderate log inventories of

about three months.

Although no new policy decisions have been announced

government controls are intensifying. Trucks carrying

timber arriving at Douala or Kribi must present verifiable

forestry and tax documentation.

Republic of Congo

No major forest policy developments have been reported .

Pointe-Noire Port faces up to five days of vessel backlog.

The country faces financial challenges despite steady oil

exports but reduced revenue from timber exports.

Sawmills are reported to have sufficient log stocks but

only orders for the next one to two months. This especially

applies to the redwoods.

Mill operations face no new challenges and the availability

of spare parts for logging machinery is good indicating no

immediate supply bottlenecks. Overall production is stable

though market demand is soft.

No new government policy changes have been announced

and the regulatory framework remains steady.

Through the eyes of industry

The latest GTI report lists the challenges identified by the

private sector in the Republic of Congo and Gabon.

See: https://www.itto-

ggsc.org/static/upload/file/20250318/1742261179154976.pdf

2.

GHANA

January wood products exports steady

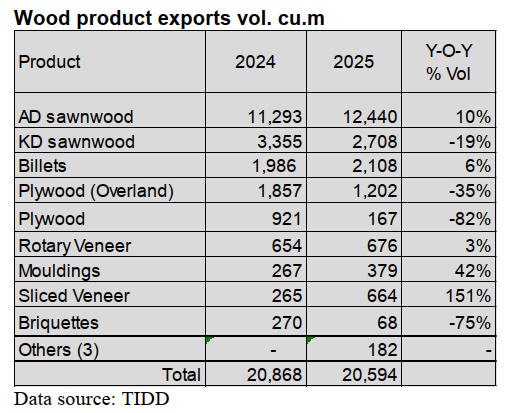

According to the Timber Industry Development (TIDD)

timber and wood export report for January 2025 the

country exported twelve different wood products with a

total volume of 20,594cu.m.

When compared to the same period in the previous year

this volume fell marginally by 1%. However, export

earnings registered an increase to Eur9.74 million in

January 2025 compared to Eur9.65 million in 2024.

The export performance in January was characterised by

increased exports of sliced veneer (plus 151%), mouldings

(plus 42%) air-dried sawnwood (plus 10%), billets (plus

6%) and rotary veneer plus 3%).

The leading export wood products to the regional market

were air-dried sawnwood (12,440 cu.m), kiln-dried

sawnwood (2,708 cu.m), billets (2,108 cu.m) and plywood

(1,202 cu.m). Together, these accounted for close to 90%

(18,458cu.m) of the total export volume for the period.

Sliced veneer exports generated increased revenue growth

to Eur852,000 in January 2025 from Eur368,000 for the

same period in 2024. Italy accounted for 57% of the export

volume for this product, China 13% and eight other

countries including Denmark, Morrocco, Vietnam and the

USA accounting for the remaining volume.

Air-dried sawnwood exports also increased in January

2025 to 12,440 cu.m (Eur 5.10million) in from 11,293

cu.m (Eur 4.73million) recorded in January 2024

registering 10% and 8% growth in volume and value

respectively.

Teak accounted for 85% of the total export volume of the

wood product. Exports of teak were mainly to the India

(10,57 cu.m) and Vietnam (1,049 cu.m) which together

accounted for 93% of the total volume.

Teak, wawa, ceiba, denya and Cedrela were some of the

other species exported.

Revitalising Ghana’s forestry sector

The Minister for Lands and Natural Resources, Emmanuel

Armah-Kofi Buah, met with a delegation from the World

Bank Ghana led by Country Director, Robert Taliercio

O’Brien. The meeting focused on potential investments

aimed at revitalising Ghana’s forestry sector.

The Minister expressed the government’s readiness to

continue its partnership with the World Bank and

particularly to pursue further investments in the forest

economy.

He highlighted the government’s transformative policies

and structures aimed at improving the forestry sub-sector.

He said, this is an initiative designed to create jobs for the

unemployed youth to embark on the country’s

reafforestation efforts, restore degraded land and protect

the nation’s forest cover.

According to Mr. Buah, these efforts are part of a broader

strategy to enhance sustainable forest management

practices and promote environmental conservation. The

Country Director of the Bank, on his part expressed the

World Bank’s commitment to support Ghana’s forest

economy, on agroforestry issues, restoring depleted forest

covers among others for sustainable growth.

According to a 2024 report by the World Bank,

deforestation and forest degradation cost Ghana an

estimated 2.5% of annual Gross Domestic Product.

See: https://www.gbcghanaonline.com/news/world-bank-

delegation-meets-lands-minister-to-discuss-forestry-

investments/2025/

Fast-track courts to punish illegal miners

As the battle against the illegal miners in the country’s

forest reservescontinues the Minister for Lands and

Natural Resources has hinted at setting up of a dedicated

Fast-Track Courts. Such courts would help swiftly handle

and prosecute persons involved in illegal mining and

environmental degradation. According to the Minister the

current legal process is too slow, which does not deter

offenders.

Speaking to the media, the Minister expressed concern

about the unethical practices of these illegal mining

activities across the country’s forest reserves. He therefore

called for urgent measures to protect Ghana’s forests and

water bodies.

The Minister indicated that, while his ministry is

responsible for policies on land and natural resource

management, enforcement lies with other agencies and he

called for their support. He has therefore initiated

discussions on the idea of the establishment of a Fast

Track Court with the highest levels of government,

including the Attorney General and Chief Justice.

He revealed that data he recently presented to Parliament

showed that 44 of Ghana’s 288 forest reserves have

already been seriously degraded. Nine of the affected

reserves have been classified as “red zones” because of the

level of damage they have suffered.

Meanwhile the Legislative Instrument (L.I.) 2462 seeking

to strip the President of the power to grant licenses for

mining in forest reserves has officially been laid before

Parliament.

If passed, the new legislation would revoke the President’s

authority to grant mining licenses in forest reserves, a

move widely seen as a critical step in tackling illegal

small-scale mining, commonly known as galamsey.

In a related development, the Chief Executive Officer

(CEO) of the Forestry Commission, Dr Hugh Brown, has

also called for the setting up of a special unit in the Ghana

Armed Forces (GAF) for the protection of the country’s

forest reserves against illegal miners.

See: https://www.myjoyonline.com/lands-minister-demands-fast-

track-court-to-punish-illegal-miners/

and

https://www.myjoyonline.com/ghana-has-lost-44-of-forest-

reserves-due-to-illegal-mining-and-logging-activities-lands-

minister/

and

https://www.myjoyonline.com/forest-mining-l-i-2462-to-remove-

presidential-power-in-granting-licenses-laid-in-parliament/

Ghana’s export competitiveness declining

The African Centre for Economic Transformation (ACET)

has said Ghana’s export competitiveness has weakened

over the last two decades and is still declining. In its

Country Economic Transformation Outlook (CETO)

report for Ghana ACET mentioned that the country’s

exports remain concentrated on moderate and low

complexity products, reflecting limited diversification and

export sophistication.

According to the report, weak value addition and minimal

processing have hindered technology upgrading, slowing

industrial progress. About 94% of the country’s current

exports have low technological content which has not

changed significantly over the last 30 years. Consequently,

the need to expand and deepen non-traditional exports and

higher value products is crucial for competitiveness and

economic resilience.

Although there have been some shifts in export markets,

with increased exports to other African countries –

particularly within ECOWAS – Ghana still faces

challenges in expanding beyond its traditional export

destinations, says the report.

Timber and wood products are one of Ghana’s export

commodities shipped to five major market destinations

globally. These are categorised into Primary Products,

Secondary Wood Products and Tertiary Wood Products.

Statistics show that, the country’s wood product exports

are largely primary and secondary, accounting for over

90%.

See: https://thebftonline.com/2025/03/19/editorial-export-

competitiveness-wanes/

Through the eyes of industry

The latest GTI report lists the challenges identified by the

private sector in the Ghana.

See: https://www.itto-

ggsc.org/static/upload/file/20250318/1742261179154976.pdf

3. MALAYSIA

Growth to be sustained by domestic consumption

The Malaysian central bank (Bank Negara Malaysia

BNM) has forecast Malaysia’s economy to grow between

4.5 and 5.5% in 2025 driven by sustained domestic

demand despite heightened external uncertainties that

could slow export growth.

Inflation is projected to trend higher but remain

manageable amid easing global costs and the absence of

excessive demand pressures.

Malaysia’s economy grew by 5.1% in 2024 with a

moderate inflation of 1.8% while the Ringgit ended 2.7%

higher against the US dollar.

See:

https://www.malaymail.com/news/malaysia/2025/03/24/malaysia

s-economy-to-grow-45-55pc-in-2025-inflation-manageable-says-

bank-negara/170678

Long-Term visit pass for foreign businesses

From 1 April 2025 the Malaysian Immigration Department

will introduce a Long-Term Social Visit Pass for Foreign

Businesses and Investors aiming to streamline the entry

process for foreign investors and facilitate long-term stays.

Also known as the Investor Pass, it aims to facilitate the

entry for those committed to invest in Malaysia.

See: https://www.humanresourcesonline.net/malaysia-s-new-

investor-pass-to-facilitate-long-term-stay-for-foreign-investors-

effective-1-april-2025

CITES listing of Shorea timbers

In an article in the Malaysian Sun newspaper, Wong Kar

Wai the Timber Exporters’ Association of Malaysia

(TEAM) Treasurer, is reported as saying the proposed

classification under the Convention on International Trade

in Endangered Species of Wild Fauna and Flora (CITES)

of extensively traded Malaysian timber species in will

result in disruption of timber exports.

The Sun reports that, in a letter to members, TEAM

president, Chua Song Fong, noted that the European

Commission and the US have proposed the inclusion of

Shorea species (such as Balau, Red Meranti, Yellow

Meranti and White Meranti) and Apitong (keruing) in a

CITES appendix. If approved, he said, the listing would

result in strict trade restrictions on these timber species

significantly impacting the domestic industry.

A vote on inclusion of Shorea is scheduled for the CITES

CoP20 Conference in Uzbekistan to be held in Uzbekistan.

See: https://thesun.my/business-news/malaysia-s-timber-

industry-faces-threats-on-two-fronts-us-tariffs-and-cites-

JK13807097#google_vignette

Carbon credit system for forestry sector

Malaysia is developing a national carbon credit system for

the forestry sector termed the Forest Carbon Offset (FCO)

mechanism to promote transparent carbon trading.

Natural Resources and Environmental Sustainability

Minister, Nik Nazmi Nik Ahmad, said: "The ministry has

introduced the REDD+ financial framework. This

initiative offers financial support to state governments for

activities focused on forest conservation and ecosystem

sustainability, particularly to mitigate climate change”.

A key component of the REDD+ financial framework is

the FCO mechanism. It serves as the primary mechanism

for generating carbon credits in the forestry sector for

domestic and international markets.

The aim is to create a domestic carbon credit system

aligned with international standards, including Verra and

the Gold Standard, while ensuring competitive fees. The

system is being developed with inputs from stakeholders.

The goal is to instill confidence in the MyHIJAU label,

ensuring that certified products are sustainable and not a

form of greenwashing.

MyHIJAU is a government initiative under the Malaysian

Green Technology and Climate Change Corporation.

See:

https://www.nst.com.my/news/nation/2025/02/1179772/m

alaysia-develops-carbon-credit-system-forestry-sector

Compliance-based carbon markets

By implementing Article 6 of the Paris Agreement

Malaysia seeks to become a leader in compliance-based

carbon markets aligning economic growth with emissions

reductions. As ASEAN Chair in 2025, Malaysia aims to

amplify the region’s collective voice on climate action,

emphasising inclusivity and sustainability.

At COP30 in Belem, Brazil (Nov 10 to Nov 21, 2025), we

will present the ASEAN Joint Statement on Climate

Change, advocating for regional solidarity, sustainable

development, and financial support. Malaysia will also

advance the development of the South-East Asia Alliance

negotiation bloc (Group SEA) to strengthen Asean’s

influence in global climate negotiations.

See:

https://www.thestar.com.my/opinion/letters/2025/03/14/committ

ed-to-advancing-climate-action-globally

Blue carbon project

Sarawak’s inaugural Blue Carbon Project in the Paloh and

Serdeng areas of Tanjung Manis will restore and preserve

10,232 hectares of mangrove forest ecosystems.

According to the Sarawak Timber Industry Development

Corporation (STIDC) Sustainable Resource Management

Division Assistant General Manager, Hamzah Morshidi,

the project development design will be submitted to the

Forest Department for issuance of carbon permit, which

will enable the carbon to be marketed in the area within

two years after replanting.

With the help of the consultants, he added, we will

develop more structured development for the coastal area

in the future. STIDC and Worldview Climate Solutions

signed a Memorandum of Agreement to mark the

launching of the project in November last year.

See: https://www.theborneopost.com/2025/03/20/sarawak-

launches-first-blue-carbon-project-in-tanjung-manis-to-restore-

10232-ha-of-mangroves/

Through the eyes of industry

The latest GTI report lists the challenges identified by the

private sector in Malaysia.

See: https://www.itto-

ggsc.org/static/upload/file/20250318/1742261179154976.pdf

4.

INDONESIA

Full repatriation of revenue from natural

resource

exports

The government has mandated that exporters retain 100%

of their export earnings from natural resources in the

Indonesian financial system for a minimum of one year.

This regulation took effect on 1 March. It has been

estimated that approximately US$80 billion will be

repatriated this year.

The regulation applies to various business entities

including companies receiving credit or loans from state-

owned banks, those holding Business Use Permits (HGU),

companies managing industrial forest plantations (HTI)

and all other export-oriented enterprises.

Coordinating Minister of Economic Affairs, Airlangga

Hartarto, stated that the government will provide a range

of incentives to exporters, including those related to the

banking sector, such as arrangements for cash collateral.

"The banking sector will provide cash collateral facilities

and the use of cash collateral will not be included in the

Maximum Credit Limit nor reduce the gearing ratio" said

Airlangga.

See: https://en.tempo.co/read/1989542/todays-top-3-news-10-

best-night-markets-in-bangkok-top-spots-for-shopping-and-

street-food?tracking_page_direct

Opportunities for furniture in Mexico

The Ministry of Trade, through the Indonesian Trade

Promotion Center (ITPC) in Mexico City, hosted a

business pitching meeting for micro, small and medium

enterprises active in the furniture sector. The event was

supported by Bank Syariah Indonesia.

The Head of ITPC Mexico City, Sunny Andrian, said that

Mexico has a rapidly growing tourism industry which

drives growth in construction of hotels, resorts, restaurants

and spas presenting opportunities for the export of

Indonesian furniture products.

Indonesian furniture products face strong competition

from both domestic and international companies. Mexico

is a significant player in the global furniture industry

primarily serving the United States market.

Mexico imposes relatively high tariffs on imported

furniture products. In addition to competition from local

manufacturers, Indonesia would also have to compete with

products from Vietnam and Malaysia. These countries

benefit from exemptions on import duties due to the

Comprehensive and Progressive Agreement for the

Transpacific Partnership (CPTPP) trade agreement making

their products more competitive.

"Since Indonesia and Mexico do not have a trade

agreement it's important to examine which products are

competitive and have unique characteristics," Sunny

stated.

See: https://www.antaranews.com/berita/4728761/itpc-buka-

peluang-produk-furnitur-indonesia-ke-pasar-meksiko

and

https://validnews.id/ekonomi/itpc-mexico-city-sebut-jaringan-

hotel-meksiko-minati-produk-furnitur-ri

Opportunity for RI in Chinese factory relocations

Deputy Minister of Industry, Faisol Riza, has said that

Indonesia has the potential to take advantage of the

momentum of factory relocations from China to ASEAN

countries.

Regarding the news that China's plan to relocate 630 of its

furniture factories to Vietnam, Riza said that Indonesia

could take advantage of this momentum to attract

investors from China to establish factories in Indonesia.

The Chinese factory relocation is said to be due to the

protectionism policy in the United States (US) but said

Raza, Vietnam has a large trade surplus with America and

is likely to face tariffs so he advised Chinese entrepreneurs

to re-evaluate their relocation and consider Indonesia.

Earlier, Riza confirmed that several Chinese entrepreneurs

were interested in relocating their factories to the Kendal

Special Economic Zone (SEZ) in Central Java.

See: https://en.antaranews.com/news/348897/opportunity-for-ri-

in-chinese-factory-relocations-govt

Discussion on trade pact continues

It is reported in the domestic press that Indonesia and the

European Union are still trying to reach a consensus on

import licensing in their free trade agreement talks.

Indonesia and the EU have been negotiating a

comprehensive economic partnership agreement (CEPA)

since July 2016.

See: https://jakartaglobe.id/business/indonesia-eu-still-cant-

agree-on-trade-pacts-import-permit

Environmental organisations advocate revision of the

Forestry Law

Several environmental organisations are optimistic that the

Indonesian House of Representatives' plan to revise Law

No. 41 of 1999 on Forestry will bring about significant

improvements in forestry governance. Muhamad

Burhanudin, coordinator of the Indonesian Conservation

Dialogue Forum (FDKI) stated that Law No. 41 of 1999

has served as the foundation for Indonesian forest

governance for over two decades.

"However, with the advancement of time and the growing

pressure on forest resources, it is essential to update this

regulation to address current challenges," he stated during

a discussion organised by the KEHATI Foundation in

collaboration with FDKI.

He specifically highlighted several issues including

deforestation and land conversion which contribute to

greenhouse gas (GHG) emissions and drive climate

change.

Forest Watch Indonesia (FWI) Campaigner Anggi Putra

Prayoga highlighted the incompatibility in current forestry

conditions and challenges. He discussed the impacts of

climate change, deforestation, forest degradation and the

rise in agrarian conflicts, particularly to Law 41 of 1999.

See: https://www.antaranews.com/berita/4719545/organisasi-

lingkungan-harapkan-revisi-uu-kehutanan-yang-holistik

and

https://www.liputan6.com/regional/read/5966624/yayasan-

kehati-dan-fdki-dorong-revisi-ruu-kehutanan-yang-holistik-dan-

partisipatif

Forest fires contributed to deforestation in 2024

In a press conference, Agus Budi Santosa, Director of

Forest Resources Inventory and Monitoring at the Ministry

of Forestry, reported that in 2024 the forest cover area in

Indonesia was 95.5 million hectares.

However, the country experienced a deforestation loss of

175,400 hectares. Agus stated, "the primary cause of this

deforestation was forest and land fires." He also noted that

illegal logging continues to be a significant factor

contributing to the reduction of forest cover in the country.

According to data from the Ministry of Forestry's SiPongi

monitoring system the extent of forest and land fires in

Indonesia in 2024 was recorded at 376,805 hectares.

See: https://www.antaranews.com/berita/4732709/kemenhut-

kebakaran-hutan-jadi-salah-satu-faktor-deforestasi-pada-2024

Social forestry programme to unlock additional areas

for farmers

The government has identified seven million hectares of

land as potential sites for the social forestry programme

which is expected to support efforts to strengthen food

security.

"We have plans for the social forestry programme, an

initiative designated as a national strategic programme"

Minister of Forestry, Raja Juli Antoni, stated in a press

release. "Farmers already have access to 8.3 million

hectares and four million hectares remain available for

use," Antoni added.

The Minister clarified that the newly announced areas

include the remaining 4 million hectares previously

identified, along with newly assessed land. Antoni further

emphasised the government's commitment to encouraging

local farmers to make optimal use of forested areas to

contribute to Indonesia's food and energy self-sufficiency

goals.

To-date, management access has been granted for

approximately 8.3 million hectares across Indonesia,

benefiting around 11,000 forest farmer groups through

five different schemes: Community Forests (Hkm),

Village Forests, Community Plantation Forests,

Customary Forests and Forestry Partnerships.

The economic impact of the activities carried out by these

forest farmer groups is significant, as reflected in the

Economic Transaction Value (NTE) generated from the

sale of forest product commodities by these groups.

See: https://en.antaranews.com/news/348629/social-forestry-

program-to-unlock-7-million-hectares-for-farmers-govt

and

https://www.agrofarm.co.id/2025/03/nilai-transaksi-ekonomi-

dari-perhutanan-sosial-tahun-2024-capai-rp-15-triliun/

5.

MYANMAR

Election announcement

Speaking at the annual Armed Forces Day parade in

Naypyidaw, Senior General Min Aung Hlaing, pledged to

hold a free and fair election in December and vowed to

transfer power to the winning party, urging armed

opposition groups to renounce violence and pursue

dialogue.

See: https://www.reuters.com/world/asia-pacific/myanmar-junta-

chief-announces-election-december-2025-or-january-2026-2025-

03-08/

2024 in review

Myanmar’s economy faced significant challenges in 2024.

Economic activity was constrained by elevated conflict,

increased macroeconomic volatility and a challenging

business environment. In addition to its ongoing impacts

on household livelihoods and agricultural production,

conflict continued to disrupt land border trade with China

and Thailand, as well as domestic supply chains.

Myanmar’s economy continues to face a range of

constraints including trade and logistics disruptions,

rapidly rising prices and shortages of a range of key inputs

including labour, electricity and imported inputs. Conflict

has led to substantial displacement among affected

populations, disrupted the transport of goods within the

country and disrupted cross-border trade.

The activation of the conscription law has reportedly

prompted significant migration out of major urban areas

toward rural border areas and to Thailand, with some firms

reporting labour shortages as a result.

Continued exchange rate depreciation and constrained

access to import licenses has resulted in higher prices and

ongoing shortages of imported inputs. Electricity outages

have worsened further as gas-powered supply falters, with

firms forced to use expensive diesel-powered generators to

substitute for grid-based power.

The economic outlook remains very weak, implying little

respite for Myanmar’s households over the near to

medium term.

See: https://documents.worldbank.org/en/publication/documents-

reports/documentdetail/099061124195517221/p5006631cca5960

7d182041fae76ab566cc

Impact of food aid cut

The United Nations World Food Programme (WFP) has

warned that more than one million people in Myanmar

will be cut off from WFP’s lifesaving food assistance

starting in April due to critical funding shortfalls. These

cuts come just as increased conflict, displacement and

access restrictions are already sharply driving up food aid

needs.

Without immediate new funding WFP will only be able to

assist 35,000 of the most vulnerable people,

including children under the age of five, pregnant and

breastfeeding women and people living with disabilities.

“The impending cuts will have a devastating impact on the

most vulnerable communities across the country, many of

whom depend entirely on WFP’s support to survive,” said

Michael Dunford, WFP’s Representative and Country

Director in Myanmar.

“WFP remains steadfast in its commitment to support the

people of Myanmar but more immediate funding is crucial

to continue reaching those in need.”

The cuts will also impact almost 100,000 internally

displaced people in central Rakhine who will have no

access to food without WFP assistance, including

Rohingya communities in camps.

WFP urgently needs US$60 million to maintain its life-

saving food assistance to the people of Myanmar this year.

“WFP is calling on all partners to identify additional

funding to meet the needs in Myanmar as the situation

across the country continues to deteriorate,” said Dunford.

See: https://www.wfp.org/news/wfp-warns-one-million-

myanmar-be-cut-food-aid-amid-funding-shortfall

Central Bank intervenes to stabilise currency

According to DVB online news, the Central Bank of

Myanmar (CBM) has stepped up efforts to stabilise the

exchange rate by selling an average of US$2.2 million

daily to select fuel and edible oil importers.

In March alone, the CBM injected over US$57 million

into the market and announced on 17 March an additional

US$33 million will be allocated to fund imports.

Since October 2024, exporters have been required to

convert foreign currency earnings at a fixed rate of MMK

3,600 per dollar, well below market value. This policy has

exacerbated financial strain on factories, making it

difficult to raise wages amid rising inflation.

Labour rights groups say that workers’ real wages

have

declined by at least 43% since 2018, pushing many below

the poverty line.

See- https://burmese.dvb.no/post/695538

6.

INDIA

Tier 2 and 3 cities

shaping India’s real estate future

The Confederation of Real Estate Developers’

Associations of India (CREDAI) recently concluded its

6th “New India Summit” at Nashik, Maharashtra

underscoring the pivotal role of Tier 2 and Tier 3 cities in

India’s real estate evolution. Themed “Viksit Bharat –

Unlocking Potential of Emerging Cities” the summit

brought together key policymakers, industry leaders and

stakeholders to chart a roadmap for inclusive urban

development.

The event marked the launch of a report ‘Overview of

Residential Real Estate Market in 60 Major Cities of

India’, a collaborative study with Liases Foras a leading

real estate research firm.

The report highlights a significant surge in the role of Tier

2 and 3 cities in shaping India’s real estate future revealing

that 44% of the 3,294 acres of land acquired by developers

in 2024 were concentrated in these emerging hubs.

Housing sales in 2024 reached 681,138 units across 60

cities, recording an impressive 23% year-on-year increase.

With the real estate sector now valued at Rupee 22.5

trillion and contributing 7.2% to India’s GDP, Tier 2 and 3

cities are becoming growth engines offering both

affordability and investment returns.

While the main cities continue to dominate luxury and

premium housing sales the rise of Tier 2 and 3 cities has

introduced a more balanced market dynamic where mid-

range and affordable properties play a crucial role in

driving demand.

Many of these cities are evolving into academic, logistics

and industrial hubs further fuelling housing requirements,

says the report.

Manoj Gaur, Chairman of CREDAI, said “Tier 2 and 3

cities are the cornerstone of India’s next phase of

urbanisation, driving inclusive growth and economic

diversification.

As highlighted in the report these cities now account for

nearly half of all land acquisitions by developers,

signalling a seismic shift in investment patterns.

Boman Irani, CREDAI president, said “India’s real estate

sector is undergoing a paradigm shift, with Tier 2 and 3

cities playing a central role in urban expansion. As these

cities become economic and industrial hubs, there is an

increasing demand for affordable and mid-segment

housing. Developers are recognising this shift, leading to a

surge in investments and new projects.

The insights from this report will help the industry

navigate the evolving market and ensure sustainable

growth across regions.”

See: https://www.constructionweekonline.in/events/credai-new-

india-summit

Agroforestry contributes massive volumes to wood-

based industries

The March issue of Plyinsight carries a story on the

contribution of farm forests to wood-based industries.

According to the India State of Forest Report (ISFR)-2023

India’s recorded forest area comprises 52 million hectares

of forest cover (FC) inside recorded forest areas and 30.7

million hectares under trees outside forests (TOF).

According to ISFR-2023 India’s tree cover area under

agroforestry was 1.27 million hectares in 2023. The

potential production of industrial wood from TOF, mainly

from agroforestry, has been estimated as 91.5 million cu.m

per year, an increase of 30% over the estimate of industrial

wood reported in ISFR-2017.

Andhra Pradesh and Telangana lead in commercial

agroforestry due to the promotion of clonal forests of

eucalyptus, casuarinas and subabul to meet the raw

material demand. Plyreporter says the Tamil Nadu

agricultural university played a major role in encouraging

the planting of neem, Melia dubia.

It has been reported that farmers of States of Uttar

Pradesh, Punjab and Haryana are cultivating eucalyptus

and poplar finding this more profitable than traditional

agricultural crops. As a result of agroforestry these states

produced substantial amounts of farm wood, fostering the

growth of the plywood industry.

Between 2013 and 2023 the area under agroforestry in

Uttar Pradesh increased by around 200,000 hectares while

the area is reported to have remained almost unchanged in

Punjab and Haryana states. These states are seeing

agricultural crop yields declining due to changes in the

watertable and have switched to cultivation of tree crops.

The (ISFR)-2023 has the following observations:

Agroforestry has significantly contributed to increasing

forest cover outside RFAs and tree cover in southern

India. Given the large coastal expanses of many of the

southern states this advantage can be further harnessed to

develop wood-based industries in the region.

In Northern States of Haryana, Punjab, Uttarakhand and

Uttar Pradesh commercial agroforestry has also

substantially increased forest cover outside RFAs and tree

cover on farmlands resulting in greater wood production

from farmlands and fostering the growth of wood-based

industries.

India’s forest and tree cover story is one of mixed result-

significant progress in TOF growth through agroforestry

contrasts with challenges in maintaining dense forest cover

within the RFAs. By embracing agroforestry India can

sustainably balance ecological and developmental needs,

says the (ISFR)-2023.

See: https://plyinsight.com/agroforestry-and-its-contribution-to-

indias-wood-based-industries/

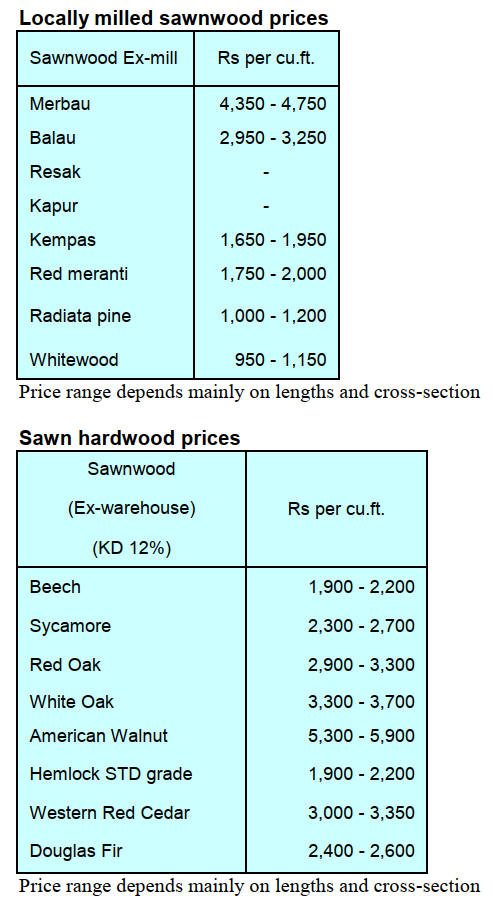

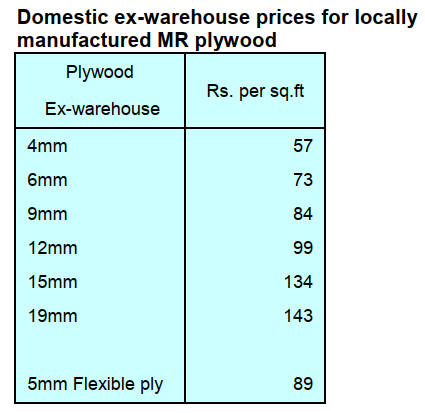

Price revisions proposed by the All Indian Manufacturers

Association have not been introduced because of the slow

market situation. Traders anticipate the new prices will be

effective in April.

Plywood

The recently announced price increases have not been

introduced as domestic demand is weak

7.

VIETNAM

Wood and Wood product (W&WP) trade

highlights

According to the statistics from Vietnam Office of

Customs W&WP exports to Japan in February 2025

reached US$158.2 million, up 50% compared to February

2024. In the first 2 months of 2025 W&WP exports to

Japan market amounted to US$323.4 million, up 21% over

the same period in 2024.

Vietnam’s W&WP exports to Canada in February 2025

were valued US$16.5 million, up 63% compared to

February 2024. In the first 2 months of 2025 W&WP

exports to Canada fetched US$43.7 million, up 22% over

the same period in 2024.

Vietnam's tali imports in February 2025 were 25,600

cu.m, worth US$9.0 million, up 5% in volume and 6% in

value compared to January 2025.

Compared to February 2024 imports increased by 173%

in

volume and 135% in value. In the first 2 months of 2025

tali imports totalled at 48,800 cu.m, worth US$17.1

million, up 14% in volume and 4% in value over the same

period in 2024.

Cameroon, the largest supplier of tali to Vietnam

In January 2025 Cameroon was the main supplier of tali to

Vietnam accounting for 83% of total imports which were

20,300 cu.m worth US$7.3 million, down 24% in volume

and down 27% in value compared to January 2024.

Vietnam’s imports of logs and sawnwood from ASEAN in

February 2025 amounted to 54,000 cu.m with a value of

US$16.0 million, down 0.3% in volume and down 0.8% in

value compared to January 2025 but an increase of 30% in

volume and 29% in value compared to February 2024.

In the first 2 months of 2025 imports of logs and

sawnwood from ASEAN reached 108,180 cu.m at a value

of US$32.13 million, down 18% in volume and down

15% in value over the same period in 2024.

Exports of wood and wood products to Japan

Due to the impact of the Lunar New Year holidays at the

end of January 2025 W&WP exports to Japan tended to

decrease.

However, exports of wood pellets, a top wood commodity

for Japan, increased in January 2025 and contributed to

maintaining the value of W&WP exports to Japan.

W&WP exports to Japan specifically in January

2025

were headed by wood pellets US$56.9 million, up 55%

compared to January 2024 and accounted for 34% of the

total W&WP exports to Japan. Next was wood chips

reaching US$53.3 million, down 12% compared to

January 2024; wooden furniture valued US$34.9 million,

down 20%; wood pallet and flooring contributed US$15.1

million, down 14%; handicraft furniture reached

US$245,000, a sharp year on year rise.

Wood pellets and wood chips are the 2 main

commodities

exported to Japan. According to statistics from the Japan

Customs Agency, in January 2025 Japan's imports of HS

code 4401 reached 1.6 million tonnes, worth 46.9 billion

yen (equivalent to US$316.9 million), up 13% in volume

and 14% in value compared to January 2024.

Of this, imports from Vietnam amounted to 870,900

tonnes, worth 24.6 billion yen (equivalent to US$165.9

million), up 66% in volume and 83% in value compared to

January 2024 and accounted for 54% of Japan's total

imports of wood chips and wood pellets.

Wooden furniture is also one of the items that Japan

has a

high demand. Japan is the 5th largest W&WP importer

and exports of furniture contributed to Vietnam’s W&WP

exports in 2025.

Vietnamese W&WP exporters who want to ship wooden

products to the Japanese market need to carefully study

Japanese tastes, invest in quality and strictly control the

production process to meet the strict standards of this

market. In addition, it is necessary to focus on quality,

appropriate design, meet technical standards and take

advantage of incentives from the CPTPP to improve

competitiveness.

Tali suppliers and tali price fluctuations

The average import price of tali in the first month of 2025

was US$349/cu.m, down 7% compared to January

2024.The price of tali imports from Cameroon decreased

by 4% compared to January 2024 to US$357/cu.m.

Tali imports from Nigeria contributed 1,600 cu.m total

imports and were valued at worth US$352,000d, up 78%

in volume and 21% in value compared to January 2024.

Tali imports from the Congo were ranked 3rd at 1,300

cu.m, worth US$514,000, down 44% in volume and 45%

in value compared to January 2024.

ASEAN furniture at VIFA ASEAN 2025

The 3rd Vietnam ASEAN International Furniture and

Home Accessories Fair, VIFA ASEAN 2025, will connect

Southeast Asia’s furniture industry to global buyers in Ho

Chi Minh City this August.

Building on the success of previous VIFA EXPO events

the 3rd Vietnam ASEAN International Furniture and

Home Accessories Fair (VIFA ASEAN 2025) is set to

take place from August 26 to 29, 2025 at the Saigon

Exhibition and Convention Center (SECC) in District 7,

Ho Chi Minh City.

This event is poised to become a significant bridge

connecting Southeast Asia's thriving furniture industry

with the global market.

Exhibitors at VIFA ASEAN 2025 will showcase a wide

range of products across four main categories: indoor

furniture, outdoor furniture, home décor - office wares -

handicrafts and machinery, hardware and tools. This

diversity offers a comprehensive platform for both

domestic and international stakeholders in the furniture

industry.

For more information, contact Lien Minh Company, the

event organiser, at 84 79 999 7657 or visit the website at

www.vifafair.com or www.vifaasean.com.

See:https://vietnamnet.vn/en/discover-the-best-of-asean-

furniture-at-vifa-asean-2025-2364134.html

Wood exporters wary on surging tariff pressures

Vietnamese wood businesses are closely monitoring

market developments to swiftly craft solutions in response

to volatile tariff policies on a global scale.

In a talk with VIR, Ngo Sy Hoai, Vice Chairman of the

Vietnam Timber and Forest Products Association

(Viforest), revealed that under normal conditions the goal

would be achievable. However, in the current context of

global trade turbulence it is hard to determine whether the

target will be realised.

The US President recently ordered an investigation under

Section 232 of the 1962 Trade Expansion Act regarding

wood and wood products. This could result in tariffs of up

to 25% on sawnwood and forest products from April.

The US accounts for over half of Vietnam’s wood exports,

primarily furniture, interior and exterior wood products,

carpentry and refined products with some plywood,

laminated boards.

Hoai noted, “In light of potential changes in policies

Vietnamese wood businesses are worried about the impact

on Vietnam’s wood product export performance.”

Viforest and businesses in the sector have been preparing

to participate in hearings if the US requests proof that the

trade relationship between Vietnam and the US in the

wood sector is mutually beneficial.

In this respect, Hoai argued, “We do not compete or

disrupt US production. Vietnam not only exports to the US

but is also the second-largest market in the world, after

China, for the consumption of US’ logs and sawn timber.

The imported wood volume is used to meet domestic

demand and it is also processed and exported to various

markets.

Many products using US wood are also exported back to

the US as such the trade is mutually beneficial, he said.

Sharing the difficulties of the wood industry, Do Ngoc

Hung, trade counsellor and head of the Vietnam Trade

Office in the US, noted, “The biggest challenge right now

is that Vietnam is not yet considered a fully market-

oriented economy which leads to disadvantages in US

anti-dumping and countervailing investigations.

Meanwhile, the US is also concerned about the trend of

shifting production and investment from some countries to

Vietnam to take advantage of labour cost benefits and the

competitive environment.”

Hung therefore suggested relevant ministries, industries

and business associations consider importing raw wood

materials from the US to reduce the trade deficit and to

avoid origin-related lawsuits. On the side of firms, caution

needs to be exercised regarding raw material imports from

countries that are subject to US tariffs. At the same time, it

is important to develop flexible production and business

plans, as countries subject to US tariffs may strengthen

trade protection measures, placing greater pressure on

Vietnam.

See: https://vir.com.vn/wood-exporters-wary-about-surging-

tariff-pressures-124396.html

Strategies to address tariff increases

Ngô Sỹ Hoài, Vice Chairman and General Secretary of the

Vietnam Timber and Forest Products Association

(Viforest), emphasised the importance of increasing log

and sawnwood imports from the U.S. “This ensures a legal

and transparent supply chain, strengthens compliance with

origin standards and facilitates exports to key markets like

the U.S. and Japan,” Hoài noted.

According to Võ Quang Hà, Chairman of Tavico,

Vietnam’s furniture market is valued at US$5 billion

annually yet remains underdeveloped. He suggests that

businesses should shift focus to the domestic market for

example supplying furniture for real estate developments

and expand traditional retail networks and e-commerce

channels. He added in the public sector manufacturers

could capitaliseg on government-funded projects. By

leveraging these opportunities, Vietnam’s furniture

industry can reduce dependency on exports and build a

more resilient domestic market.

Opportunities and prospects for Vietnam’s wood

industry

Despite the challenges Vietnam’s wooden furniture sector

remains optimistic about growth opportunities.

Ngô Sỹ Hoài, Vice Chairman of Voforest,

emphasised: “The U.S. cannot easily replace Vietnam as a

key supplier. Over the past 20 years we have built a strong

reputation for quality, design and compliance with

regulations. “The U.S. tariff policy may pose challenges to

Vietnam’s wooden furniture exports but businesses can

proactively adapt.

By adjusting tax policies, leveraging opportunities

to import legal wood and expanding the domestic market

the industry could maintain sustainable growth.

See: https://ssr-logistics.com/en/vietnams-wooden-furniture-

exports-us-tariff-challenges/

8. BRAZIL

Study suggests new approach to Amazon

forest

preservervation

A study conducted by ESALQ (Luiz de Queiroz College

of Agriculture) proposes new strategies to preserve the

genetic diversity of the Amazon rainforest. The research

suggests species-specific strategies are more effective than

the generalised approaches.

The study assessed the impact of logging based on the

Minimum Cutting Diameter (MCD) which defines the

lower size limit of trees that can be harvested. Researchers

also evaluated whether the trees remaining in the forest

after logging are close enough to ensure pollen exchange

and genetic diversity. The study proposed a new criterion

called Minimum Cutting Distance which considers the

proximity between the remaining trees.

The study was conducted in four forest management areas

in the Amazon totalling 48,876 hectares and suggests that

species and site-specific criteria are more effective than

general rules that use the same standard for all trees. The

results indicate that adopting ‘customised’ approaches can

contribute to sustainable forest management, ensuring

biodiversity conservation and the continuation of the

Amazon's ecosystem services.

The researchers advocate revising current logging

regulations to incorporate policies that balance production

and environmental conservation. The study highlighted

that maintaining adequate distances between trees

promotes cross-pollination thus increasing genetic

variability.

This genetic diversity is essential for the resilience of tree

populations against environmental changes. The proposed

Minimum Cutting Distance criterion is considered more

effective than the Minimum Cutting Diameter (MCD) as

established in Brazilian legislation, say the researchers.

See: https://www.remade.com.br/noticias/20578/estudo-da-esalq-

pode-mudar-forma-de-preservar-florestas-no-brasil

New Sustainable Forest Management Law in Roraima

State

The Legislative Assembly of Roraima (ALE-RR) has

approved Law nº 2.122/2025 which updates the

Sustainable Forest Management Plan (SFMP) to promote a

better balance between agricultural production and

environmental preservation. The new regulation provides

more flexibility to producers without compromising

ecological guidelines.

It allows for the modification of the Term of

Responsibility for Forest Management Maintenance in

specific cases of Legal Reserve reduction as outlined in

the Ecological-Economic Zoning of Roraima (ZEE-RR).

As a result, properties located in Productive Use Zones

can adjust their preserved areas to up to 50% of the total

area provided they comply with established environmental

criteria.

The new legislation establishes 2 May 2018 as the

reference date for forest inventories. Projects initiated

before this date require a new environmental assessment

while those initiated afterward will have their remaining

timber volume calculated through the Brazilian National

System for the Control of Origin of Forest Product

(SINAFLOR). The entire sustainable management process

will continue to be monitored by the State Foundation for

Environment and Water Resources (FEMARH).

Sustainable forest management has become an essential

tool for profitable and ecologically responsible agricultural

production, enabling the sustainable use of land by

integrating areas for use with the preservation of

biodiversity.

In the case of Legal Reserves which must maintain

between 20% and 80% of native vegetation the legislation

prohibits activities such as extensive cattle ranching and

monoculture planting. However, it allows the sustainable

subsistence farming of crops as long as at least 50% of the

area remains untouched.

Agroforestry systems, including the cultivation of Brazil

nuts, cupuaçu, guaraná and andiroba have already shown

positive results, promoting a balance between agricultural

production and the preservation of fauna. Alternative

crops like cashew and açaí are also being tested to

diversify the local economy.

With reduced bureaucracy and incentives for good

practices the new legislation strengthens Roraima's

commitment to sustainable development positioning the

state as a national reference in sustainable forest

management.

See: https://forestnews.com.br/roraima-avanca-no-manejo-

florestal-com-nova-lei-da-assembleia-legislativa/

Export update

In February 2025 Brazilian exports of wood products

(except pulp and paper) decreased 8.5% in value compared

to February 2024, from US$304.5 million to US$278.6

million.

Pine sawnwood exports increased 21% in value between

February 2024 (US$55.6 million) and February 2025

(US$67.5 million). In volume, exports increased 15% over

the same period, from 248,500 cu.m to 285,100 cu.m.

Tropical sawnwood exports decreased 0.5% in volume,

from 21,000 cu.m in February 2024 to 20,900 cu.m in

February 2025. In value, exports decreased 18% from

US$10.4 million to US$8.5 million over the same period.

Pine plywood exports increased 0.2% in value in February

2025 compared to February 2024, from US$57.5 million

to US$57.6 million. In volume, exports increased just over

3% over the same period, from 180,300 cu.m to 186,400

cu.m.

As for tropical plywood, exports increased in volume by

28% and in value by 30%, from 1,000 cu.m and US$1.8

million in February 2024 to 1,300 cu.m and US$2.3

million in February 2025.

The value of wooden furniture exports increased from

US$45.8 million in February 2024 to US$46.3 million in

February 2025, an increase of 1%.

Brazil advances creation of Tropical Forests Forever

Fund

Representatives from Brazil and other countries gathered

in London in early March to advance the development the

Tropical Forests Forever Fund (TFFF) whose objective is

to secure sustainable financing for the preservation of

tropical forests.

The fund intends to combine financial returns for investors

with the allocation of a portion of the profits to countries

that protect their forests. The financing model proposes

that 20% of the resources will be subsidised by the

governments of participating countries while the

remaining 80% will be raised from financial markets.

The TFFF aims to raise US$125 billion from international

sources at market interest rates, positioning itself as a low-

risk asset. This money will be invested in projects with

higher rates of return thus generating profits. Part of this

profit will be returned to investors while the balance will

go to countries that preserve their tropical forests in

proportion to the area conserved.

This model ensures that investors recover their resources

with a return aligned with regular market rates while also

contributing to environmental preservation and the

reduction of carbon emissions.

In addition to supporting conservation efforts the TFFF is

expected to stimulate demand for sustainable debt

instruments such as green and blue bonds. The fund will

not compete with the carbon credit market but act as a

complementary mechanism.

The TFFF has gained momentum, especially following a

technical partnership with the World Bank and the Interim

Advisory Committee countries, which include Germany,

Colombia, the United Arab Emirates, France, Norway, and

the United Kingdom. These countries have committed to

supporting the development of the financial mechanism to

provide financial compensation for tropical rainforests

conservation.

For both investor countries and private investors, the

model presents a more advantageous alternative to

traditional environmental donations, as invested resources

will be repaid within 30 to 40 years, with interest.

See: https://agenciagov.ebc.com.br/noticias/202503/em-londres-

brasil-avanca-na-construcao-do-fundo-florestas-tropicais-para-

sempre

Support for forest recovery project

The Brazilian Development Bank (BNDES) has expressed

its interest to the government of Pará State in evaluating

the Triunfo do Xingu Recovery Unit (URTX) project

located in the southern region of Pará State in the Amazon

Region which aims to restore more than 10,000 hectares

with native tree species.

The support may include financing for the institution

awarded a forest concession under the bidding process

(subject to technical and legal analysis). The project is

aligned with Brazil's environmental goals to restore 12

million hectares of native species by 2030.

As part of the State Native Vegetation Restoration Plan

(PRVN) the project involves grants for ecological

restoration with authorisation to generate and trade forest

carbon credits, credits for environmental services, timber

and non-timber products and forest services within the

URTX. The URTX is expected to restore 10,300 hectares

of native vegetation over the 40-year concession period.

See: https://forestnews.com.br/bndes-manifesta-interesse-em-

apoiar-projeto-de-recuperacao-florestal-no-sul-do-para/

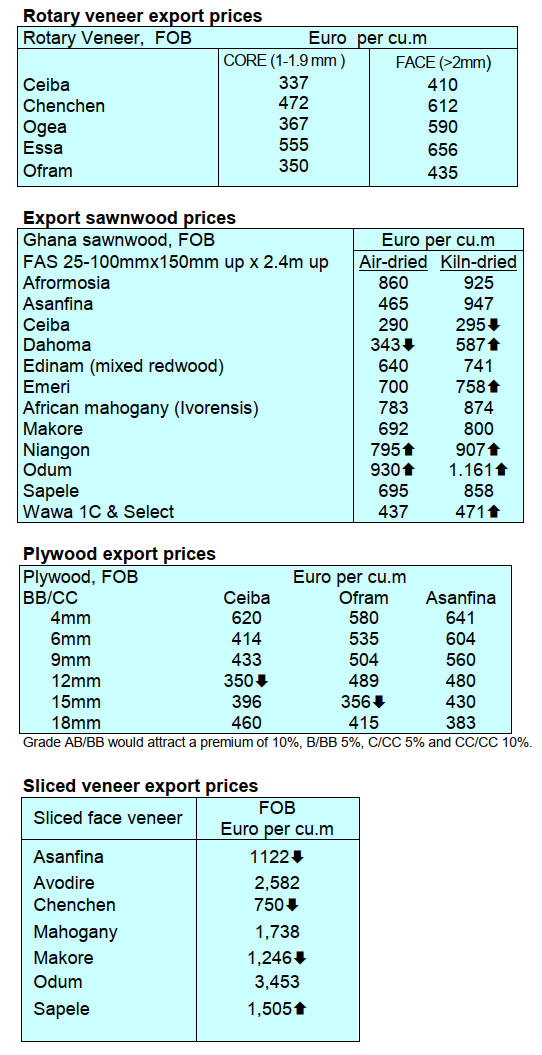

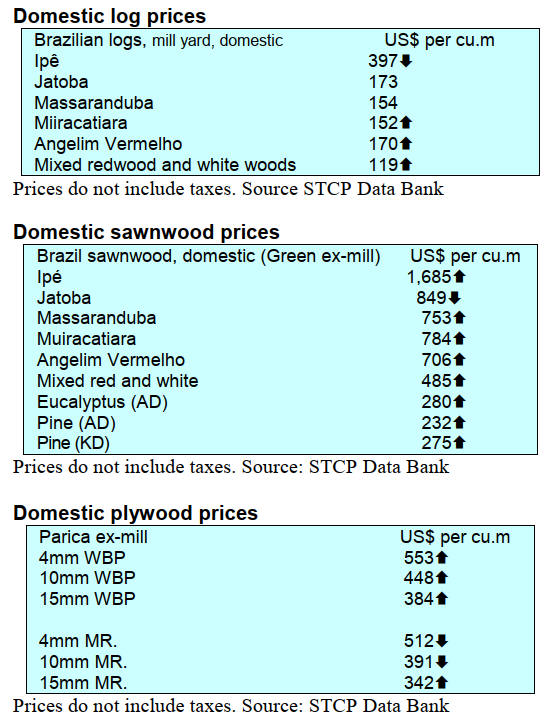

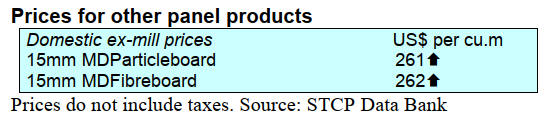

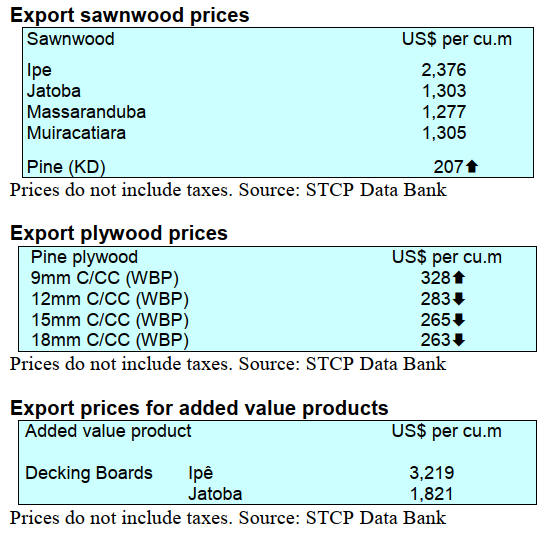

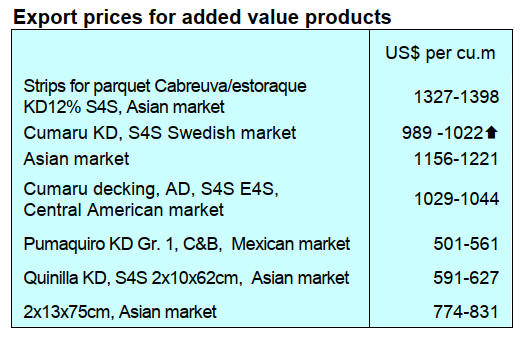

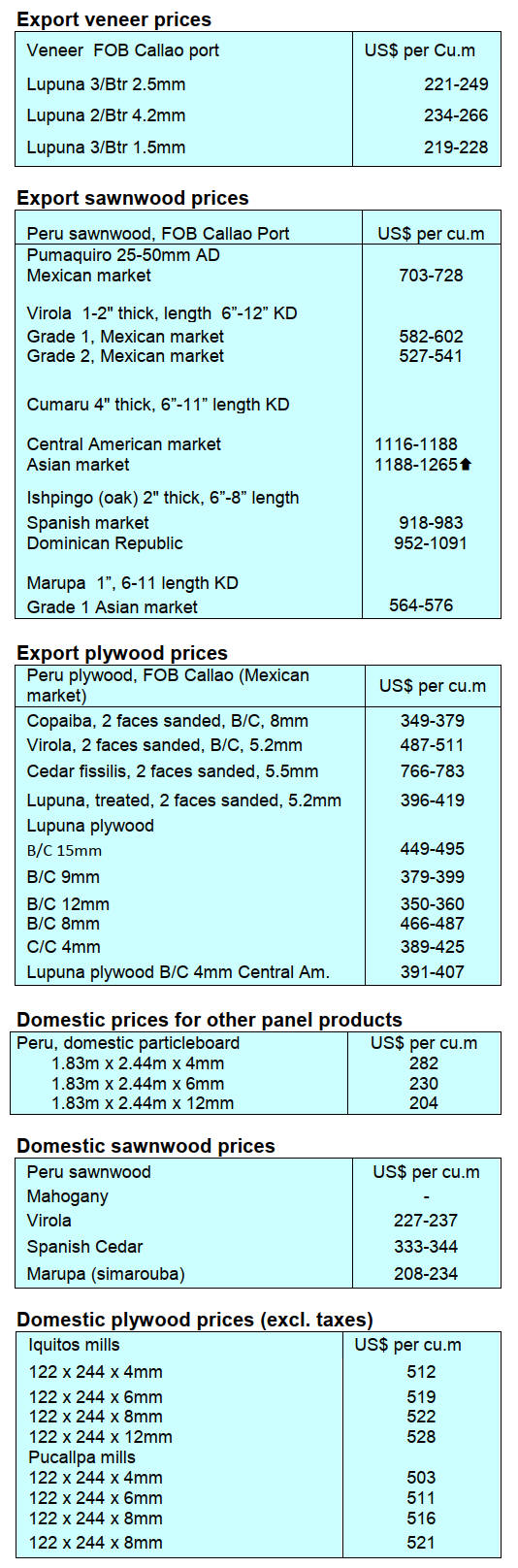

Export prices

Average FOB prices Belém/PA, Paranaguá/PR,

Navegantes/SC and Itajaí/SC Ports.

Through the eyes of industry

The latest GTI report lists the challenges identified by the

private sector in Brazil.

See: https://www.itto-

ggsc.org/static/upload/file/20250318/1742261179154976.pdf

9. PERU

Timber sector faces

structural challenges – exports

decline

Shipments of wood products reached US$1.6 million in

January 2025 representing a decrease of 43% compared to

January in 2024 (US$2.8 million) according to the Center

for Global Economics and Business Research of the

Exporters Association.

According to the president of the ADEX Wood and Wood

Industries Committee, Erik Fischer Llanos, the sustained

decline in the timber sector highlights the structural

challenges it faces. The Peruvian Amazon forest occupies

over 60% of the national territory yet the timber sector

contributes less than 1% to GDP. According to figures

from the ADEX Data Trade Trade Intelligence System

export items included other wood products (US$540,000)

and decking (US$426,000).

The leading destination for wood product exports was the

Dominican Republic with shipments abroad totalling

US$384,000. This was followed by Mexico

(US$383,000), China (US$234,000), France

(US$126,000) and the United States (US$112,000).

The top ten markets were completed by South Korea,

Belgium, South Africa, Slovenia and Denmark.

One million hectares of certified forests

According to the Forest Stewardship Council (FSC) Peru

has 1.1 million sustainably managed forests in Madre de

Dios, Loreto and Ucayali under FSC standards.

Certification of productive forests under these standards

ensures that their management maintains biological

diversity, protects the livelihoods of communities and the

rights of local workers and stimulates the local and

regional economy.

Nine Peruvian Departments for forest zoning

The National Forest and Wildlife Service (SERFOR) has

prioritised nine Peruvian Departments for the

implementation of the forest zoning process, a key tool for

sustainable forest management.

The following departments have been identified for this

phase: Cusco, Puno, Amazonas, Apurímac, Ayacucho,

Tumbes, Moquegua, Arequipa, and Tacna. This

prioritisation is based on the use of criteria related to the

presence of forests and the pressure on forest ecosystems.

This process promotes the development of the forestry and

wildlife sector, contributes to granting legal status to

productive activities so making goods and services more

competitive in national and international markets.

See: https://www.gob.pe/institucion/serfor/noticias/1134376-

serfor-prioriza-nueve-departamentos-del-peru-para-la-

zonificacion-forestal-en-este-2025

Junín Region propose plantation incentives

A SERFOR team evaluated the proposed Law on

Incentives for Commercial Forest Plantations, presented

by the Junín Forestry Technical Board.

This initiative aims to promote forest development in

collaboration with the State and private sector with a focus

on competitiveness for the benefit of rural communities.

SERFOR will provide legal and technical assistance to

promote this proposed law.

SERFOR achieves ISO 9001 certification

The National Forest and Wildlife Service (SERFOR) has

obtained international ISO 9001:2015 certification. This

recognition strengthens transparency and trust in the

issuance of export permits for specimens, products, and

byproducts of wild flora and fauna for commercial

purposes, including those regulated by the Convention on

International Trade in Endangered Species of Wild Fauna

and Flora (CITES).

This international certification guarantees a reliable and

efficient service as processes are aligned with international

standards ensuring greater transparency.

See: https://www.gob.pe/institucion/serfor/noticias/1129815-

serfor-logra-certificacion-internacional-iso-9001

Technology transfer for monitoring forest resources

The Forest and Wildlife Resources Oversight Agency

(OSINFOR) will begin a process of technology transfer

for monitoring and inspection for forest resources in

Madre de Dios. The methodologies include the use of

satellite images and an algorithm for detecting logging.

OSINFOR will also be responsible for forming a multi-

sectoral technical team to identify opportunities for

improvement in the implementation of the Enabling Title

process.

This working group will include representatives from the

National Forest and Wildlife Service (SERFOR) and the

Regional Forestry and Wildlife Management Bureau

(GRFFS).

See: https://www.gob.pe/institucion/osinfor/noticias/1134472-

osinfor-transferira-al-gobierno-regional-de-madre-de-dios-

tecnologia-para-supervision-y-fiscalizacion-de-los-recursos-

forestales

AI monitoring in Peruvian forests

OSINFOR is moving forward with the development of

version 2 of the selective logging detection algorithm

(ADETOP). This innovative update will be developed in

collaboration with the University of Sheffield under the

agreement signed between the two entities.

Using artificial intelligence the development and

implementation of a plugin is planned for the detection of

timber forest species, specifically those of the genera

Handroanthus and Dipteryx, which have been listed under

the Convention on International Trade in Endangered

Species of Wild Fauna and Flora (CITES).

This plugin will analyse the information collected by the

VTOL drones OSINFOR is acquiring which will expand

the area monitored per flight to 300 hectares, fifteen times

the current amount.

According to the work plan the implementation of new

technologies will be designed by July of this year to

continue improving OSINFOR's work.

See: https://www.gob.pe/institucion/osinfor/noticias/1132788-

osinfor-implementa-inteligencia-artificial-para-optimizar-

supervisiones-en-bosques-peruanos

|