|

Report from

North America

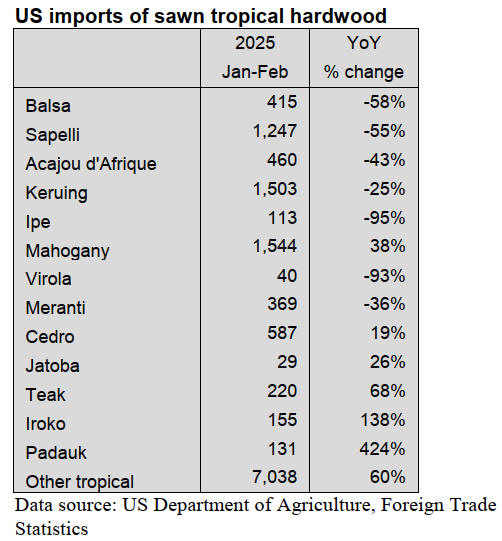

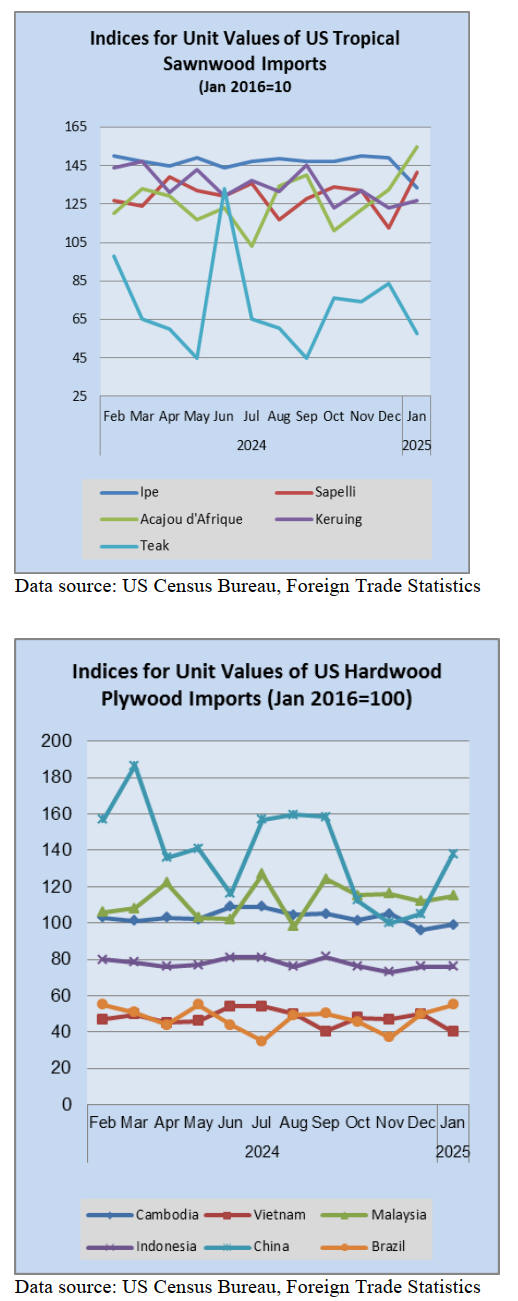

Imports of sawn tropical hardwood increased in

January

January imports of sawn tropical hardwood rose 12% over

the previous month as imports from Indonesia were their

strongest in more than 2 years. At 13,851 cubic metres, the

volume imported into the US in January was, however,

15% less than that of the previous January.

The month-to-month gain was due chiefly to a near

quadrupling of imports from Indonesia, which accounted

for almost a third of all imports for the month. Imports

from most other top traders decreased, including

significant drops in imports from Ghana (down 59%),

Brazil (down 56%) and Cameroon (down 48%).

Mahogany imports were especially strong, up 61% for the

month and 38% above a year ago. Imports of Sapelli and

Ipe were especially weak in January with Sapelli dropping

55% to a 2-year low and Ipe imports falling to their lowest

level in at least 10 years.

Canadian imports of sawn tropical hardwood soared in

January, climbing 64% above December totals. Imports

for the month were 30% higher than in January last year.

A nearly seven-fold increase in imports from the

Democratic Republic of the Congo fueled the rise, along

with a 79% jump in imports from top-trader Cameroon.

See: https://apps.fas.usda.gov/gats/default.aspx

and

https://ised-isde.canada.ca/site/trade-data-online/en

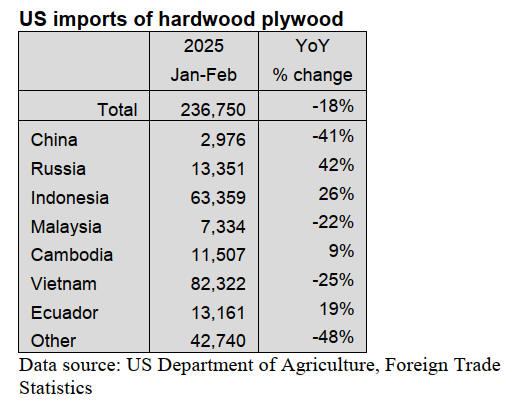

Hardwood plywood imports weaken

US imports of hardwood plywood fell in volume by 10%

in January. At 236,750 cubic metres, hardwood plywood

imports were down 18% from January 2024 totals. Imports

by dollar value were down 11% versus the previous

month.

The volume of imports from Vietnam, the top trading

partner last year, rose 31% in January while imports from

Indonesia and Malaysia both fell more than 30%. Imports

from China also slumped, falling 29% from the previous

month and down 41% from the previous January.

Veneer imports retreat in January

US imports of tropical hardwood veneer plunged 34% in

January, falling sharply after nearly doubling in

December. Imports from India, Ghana, and Cote d’Ivoire

all fell by more than 50% while imports from top-supplier

Cameroon fell by 40%. Strong gains in imports from

China and Italy helped to mitigate the harm. The total

imports of US$1.9 million were also 34% below that of

January 2024.

See: https://apps.fas.usda.gov/gats/default.aspx

Imports of flooring start 2025 hot

US imports of hardwood flooring were strong in January

rebounding somewhat from an anemic December and a

12% decline in imports for 2024. January imports leapt

36% from the previous month to more than US$6 million,

which was 20% higher than the previous January.

Imports from China nearly doubled while imports from

Brazil rose 75%. Imports from Indonesia fell 11% from

the previous month but were still 25% higher than in

January 2024.

US imports of assembled flooring panels, which grew by

32% in 2024, continued their upward trajectory in January

rising 12% from the previous month. Imports from

Vietnam and Indonesia made sizeable gains, advancing

69% and 65%, respectively.

Imports from Thailand slipped 6%. At US$33.5 million,

imports for the month were 40% higher than imports from

January 2024.

See: https://apps.fas.usda.gov/gats/default.aspx

US returns to traditional moulding suppliers

US imports of hardwood moulding rose 1% in January as

long-established supply countries showed significant

gains. Imports from Brazil soared 96%, imports from

China climbed 87% and imports from Malaysia jumped

53%.

Imports from these traditional trading partners rose in

2024, but at rates lower than the 29% increase in overall

growth for the year.

Meanwhile, imports from Canada slipped 5% for the

month while imports from the rest of the world fell 13%.

Total imports for January were 47% higher than imports

for January 2024.

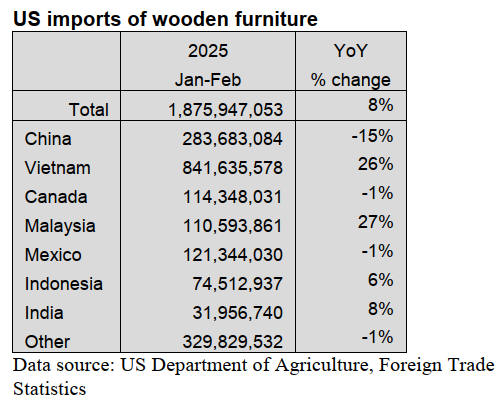

Wooden furniture imports continue rising

US imports of wooden furniture rose for the third

consecutive month, gaining 3% in January. At nearly

US$1.88 billion, imports were 8% higher than last January

as imports rose steadily from most trading partner

countries.

Imports from Malaysia jumped 12% in January to a level

27% higher than in January 2024. Imports from top-trader

Vietnam also continued their growth—up 2% over the

previous month and 26% from January 2024. Imports from

India lagged, falling 23% from the previous month—yet

still 8% higher than a year ago.

See: https://usatrade.census.gov/index.php?do=login

Furniture orders showed slight rise in December

New residential furniture orders rose 1% in December

compared to the same period in 2023 according to the

February issue of Furniture Insights,reversing the previous

month's decline. Approximately two-thirds of furniture

dealers surveyed reported increased orders in December

compared to the year prior.

However, compared to November 2024, December new

orders dropped 15%, although that could include some

seasonality due to the December holiday break, according

to Mark Laferriere, assurance partner at Smith Leonard the

accounting and consulting firm that produces the monthly

report. New orders were also down for the year to date, by

1%.

December shipments were down 2% compared to 2023

figures and also down 7% versus November 2024. For the

year 2024 shipments were down 6% compared to 2023.

On a seasonally adjusted basis, sales at furniture and home

furnishings stores were down 1.7% in January compared

to the previous month but up 3.7% from January 2024,

according to the January Furniture Insights.

See: https://www.woodworkingnetwork.com/furniture/furniture-

orders-show-slight-rise-december-year-over-year

and

https://www.smith-leonard.com/2025/03/03/february-2025-

furniture-insights/

Executive Orders on timber

On 1 March the US President issued executive orders

intended to boost domestic timber production and to

launch an investigation into the national security

implications of US imports of wood products.

The first executive order aims at dramatically increasing

domestic timber production by reducing federal

regulations and expediting approval processes. The order

directs multiple federal agencies to take immediate action

to boost the supply of lumber, paper and bioenergy

products citing national economic security and wildfire

prevention as key priorities.

The Order mandates the Departments of the Interior and

Agriculture to issue new guidance within 30 days to

accelerate timber harvesting on federal lands managed by

the Bureau of Land Management (BLM) and the US

Forest Service (USFS). This includes streamlining forest

management projects under the Endangered Species Act

and proposing legislative measures to further ease

restrictions.

Within 90 days, officials must present a four-year target

for annual timber sales. Additionally, within 180 days the

administration will explore categorical exclusions under

the National Environmental Policy Act to fast-track timber

production and wildfire risk reduction. These directives

represent a sharp shift in federal land management policy,

prioritising economic development over environmental

protections.

In a second executive order the Commerce Secretary was

instructed to lead an investigation into the national

security implications of the nation’s current imports of

timber and manufactured wood products. This will include

looking into demand for wood products in the US,

assessing whether domestic production can meet domestic

demand and the significance of major foreign exporters in

meeting US demand along with any predatory trade

practices that affect the country’s competitiveness in the

industry.

See:https://www.whitehouse.gov/presidential-

actions/2025/03/immediate-expansion-of-american-timber-

production/

and

https://www.whitehouse.gov/presidential-

actions/2025/03/addressing-the-threat-to-national-security-from-

imports-of-timber-lumber/

|