US Dollar Exchange Rates of

15th

Mar

2025

China Yuan 7.24

Report from China

Suspension of US log imports

It has been reported by the General Administration of

Customs that China has suspended imports of log from the

United States. Chinese Customs has recently detected

quarantine pests including bark beetles and long-horned

beetles in logs imported from the United States.

The suspension aims to prevent the introduction of

harmful species and protect China's agricultural and

forestry production.

See:

http://www.customs.gov.cn/customs/302249/302266/302267/638

9608/index.html

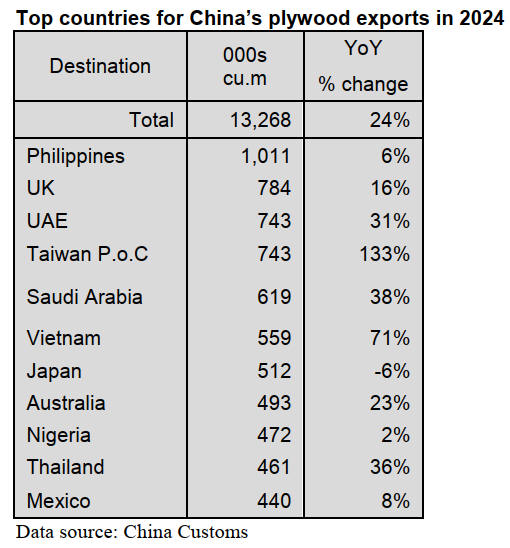

Rise in plywood exports

China exported plywood to more than 200 countries and

markets and the share of the top 10 destinations in 2024

accounted for just 48% of the national total. According to

the data from China Customs, China’s plywood exports

totalled 13.27 million cubic metres valued at US$5.271

billion in 2024, up 24% in volume and 9% in value year

on year.

Most of the major destinations for China's plywood

exports saw significant growth in 2024, especially Taiwan

P.o.C where the export volume increased by more than

130%. In addition, China’s plywood exports to Vietnam,

Saudi Arabia, Thailand and the UAE rose 71%, 38%, 36%

and 31% respectively year on year.

The average CIF price for China’s plywood exports fell

11% to US$397 per cubic metre in 2024 from US$447 per

cubic metre in 2023. China’s plywood exports to Japan in

2024 fell 6% to 512,000 cubic metres in 2024.

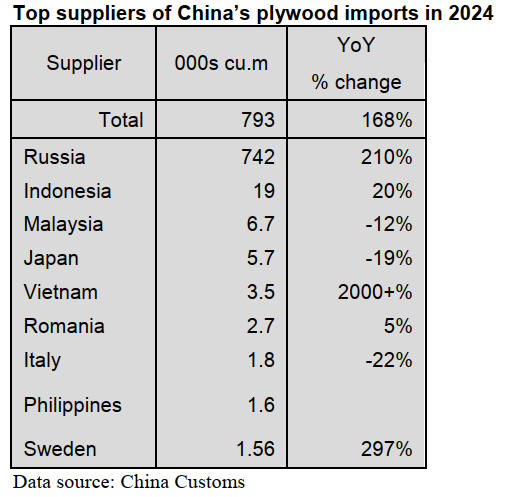

Surge in plywood imports

According to data from China Customs, plywood imports

in 2024 totalled 793,000 cubic metres valued at US$222

million, surging nearly 170% in volume and 8% in value

over 2023. Russia was the largest supplier of China’s

plywood imports in 2024. China’s plywood imports from

Russia surged 210% to 742,000 cubic metres, accounting

for 94% of the national total.

Chinese enterprises have built factories in Russia to

manufacture plywood and export to China by the China-

Europe railway. This is why Chinese imports of Russian

plywood continued to rise in 2024. Russian birch plywood

is becoming more and more popular among Chinese

consumers resulting in large increase in China’s plywood

imports from Russia in recent years.

China’s plywood imports from Vietnam and Sweden also

surged in 2024. In contrast, China’s plywood imports from

Malaysia, Japan and Italy in 2024 fell 12%, 19% and 22%

year on year.

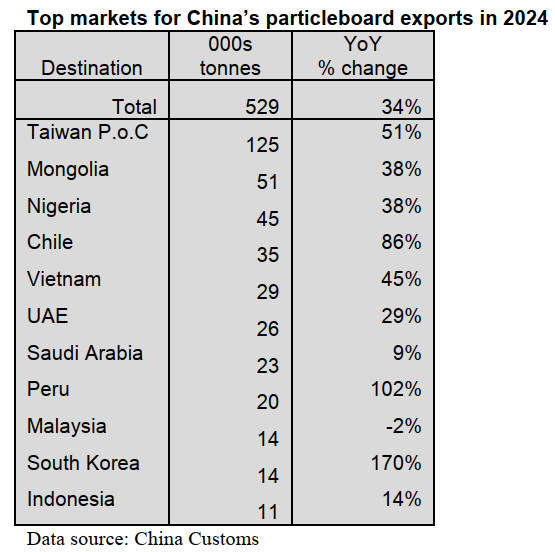

Rise in particleboard exports

According to China Customs, particleboard exports in

2024 totalled 529,000 tonnes valued at US$296 million,

up 34% in volume and 9% in value on 2023 levels.

China’s particleboard exports to Malaysia alone fell 2%

but for other top destinations China’s particleboard exports

rose.

Taiwan P.o.C was the largest market for China’s

particleboard exports in 2024 and exports rose 51% to

125,000 tonnes compared to 2023. Particleboard exports to

Peru and South Korea surged 102% and 170% over 2023.

China has exported particleboard to Asia, Africa and Latin

America with the rapid development of the Belt and Road

Initiative countries.

Demand for low cost particleboard in Asia, Africa and

Latin America has increased which has supported exports

of particleboard to these countries in recent years.

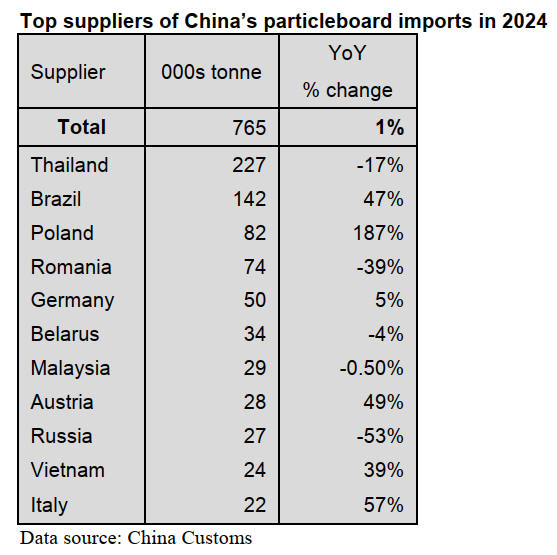

Slight rise in particleboard imports

According to China Customs particleboard imports

totalled 765,000 tonnes valued at US$347 million in 2024,

up 1% in volume and 4% in value, year on year.

Nearly 70% of China’s particleboard was imported from

four countries, Thailand, Brazil, Poland and Romania in

2024.

Thailand was the largest supplier of particleboard imports

in 2024. China’s particleboard imports from Thailand fell

17% and this is the main reason for China’s particleboard

imports did not increase much in 2024.

China’s particleboard imports from Poland surged in 2024.

It has been reported that the China-Europe freight train has

become a strong bond for China-Europe trade cooperation.

Poland is also the country with the most significant growth

in the volume of freight traffic along the Belt and Road

Initiative countries. In the first three quarters of 2024,

228,000 TEU of commodities arrived in Poland on China-

Europe freight trains, an increase of 154% over the same

period of 2023.

China’s particleboard imports from Brazil, Austria,

Vietnam and Italy rose 47%, 49%, 39% and 57%

respectively in 2024.

In contrast, China’s particleboard imports from Romania

and Russia fell 39% and 53% largely in 2024.

Thailand exceeded Romania to become the largest supplier

of China’s particleboard imports in 2024 and the volume

of particleboard imports from Thailand rose to 227,000

tonnes valued at US$66 million, up in value by 55% over

2023.

China’s particleboard imports from Brazil, Austria,

Vietnam and Italy rose 47%, 49%, 39% and 57%

respectively in 2024. In contrast, China’s particleboard

imports from Romania and Russia fell 39% and 53%

largely in 2024.

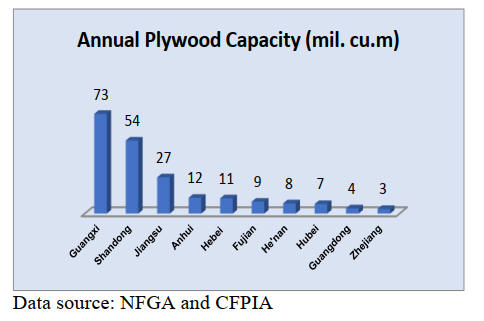

Plywood production capacity in 2024

According to the statistics from the Academy of Industry

Development and Planning under the National Forestry

and Grassland Administration (NFGA) and the China

Forestry Products Industry Association (CFPIA), the

number of plywood enterprises has declined but in terms

of production capacity there was an increase.

There were more than 6,020 plywood manufacturing

enterprises in 2024, down 19% year on year. The total

annual production capacity was 221 million cubic metres

in 2024, up 8% on 2023 level.

At the beginning of 2024 around 1,500 plywood mills

were under construction nationwide with a total extra

annual production capacity of about 29 million cubic

metres. It is expected that the total annual production

capacity of plywood in China will drop to 200 million

cubic metres by the end of 2025.

At present, the overall capacity of China's plywood

industries is greater than consumer demand. The

production capacity of plywood for furniture making and

home decoration accounts for about 36% of the total

production capacity.

Plywood for concrete formwork accounts for about 27%

of the total production and the oversupply of production

capacity is still prominent. The production capacity of

plywood for packaging further declined and the market

share is about 18% of total production capacity.

Blockboard accounts for about 11% of the total production

capacity and the balance is used for wood composite floor

substrate, container base, veneer laminated wood.

China's plywood industry continues to adjust the product

structure to adapt to changes in market demand.

See:

http://www.cnfpia.org/sf_A23CBF49946940E4A5E9FDED0E55

F5E4_297_9E5BA0FB363.html

|