Japan

Wood Products Prices

Dollar Exchange Rates of 15th

Mar

2025

Japan Yen 148.64

Reports From Japan

Pace of wage growth yet to

keep up with inflation

Many major Japanese companies have agreed to meet the

wage demands of labour unions which have long been

calling for substantial increases to address surging

consumer prices.

The government has been monitoring the annual wage

negotiations to see if the strong push for salary increases

will extend to small and medium-sized companies which

employ around 70% of the country's workforce. Wage

talks for small and mid-size companies are ongoing and it

remains to be seen whether the trend of wage increases by

major firms will spread to smaller firms.

Wages remained flat in Japan for decades following the

bursting of the asset-inflated bubble economy in the early

1990s and ensuing deflation. But in response to inflation

the spring wage talks in 2023 saw the highest pay

increases in 30 years. Nevertheless, the pace of pay growth

has yet to keep up with persistent inflation, with real

wages falling year-on-year for the third consecutive year

in 2024.

Many large corporations have the resources to boost

wages, supported by strong earnings for the current fiscal

year. The combined net profits of major companies are

expected to reach yen 52.65 trillion for fiscal 2024

marking a record for the fourth straight year according to

data from SMBC Nikko Securities Inc.

See: https://japantoday.com/category/business/japan-major-

firms-offer-large-pay-hikes-amid-inflation-labor-crunch

Only non-manufacturing sector held up business

sentiment index

The most recent business sentiment index (BSI) among

Japan's large enterprises across all industries stood at plus

2.0, marking the fourth consecutive quarter of positive

sentiment according to data from Japan's Cabinet Office

and Ministry of Finance. The increase was driven by the

non-manufacturing sector which benefited from improved

cost recovery.

The BSI for the non-manufacturing sector remained

positive for the 10th straight quarter at plus 4.1 supported

by rising customer numbers in the service industry and

increased demand for software development and

advertising revenue in the information and

communications sector.

The manufacturing sector, however, saw a decline with its

BSI at minus 2.4, the first negative figure in three quarters.

Rising raw material costs and increased consumer cost-

consciousness contributed to a sharp drop in the food

manufacturing industry. Capital investment across all

industries, including large and small businesses, is

projected to rise 5.9% in fiscal 2025 with manufacturing

leading the growth.

See:

https://english.news.cn/20250313/7571107a2ad74a9a88eedd392f

1ec52c/c.html

Japan to face US tariffs

The Minister of Trade recently visited the US to try and

convince the new administration to exempt Japan from the

US tariff campaign. The Minister commented "we

explained Japan’s position on the impact on local

industries and with regards to the development of the

business environment,d expansion of investment and

employment in both Japan and the US.”

See:

https://www.japantimes.co.jp/business/2025/03/11/economy/japa

n-trade-minister-us-tariff-exemption

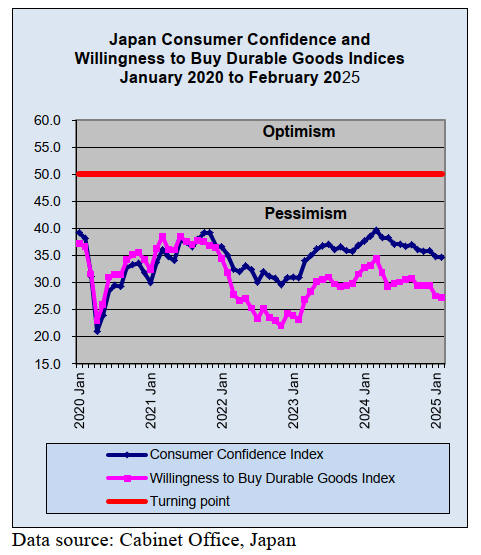

Consumer confidence index continues down

The Cabinet Office reported the seasonally adjusted

Consumer Confidence Index was 35.0 in February which

was below last month's 35.2 and missed expectations. The

income growth indicator was down to 39.7 while the

overall livelihood index lost 0.3 points to 31.9 but the

employment index increased month on month to 41.1.

The index on “willingness to buy durable goods” stood at

27.2, decreasing by 0.3 points from January. The percent

of respondents who expect prices to increase over the next

year was 93%, unchanged from the previous month.

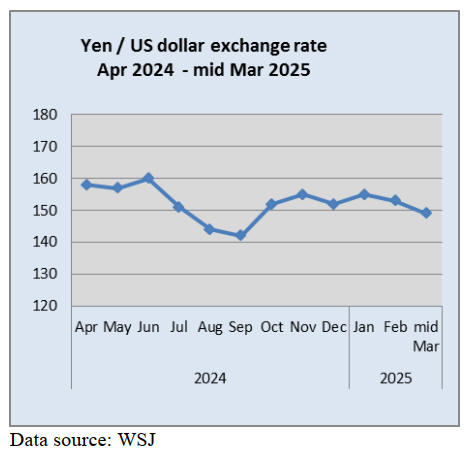

Uncertain US economic outlook to impact yen/dollar

rate

The yen briefly reached 147 against the dollar in early

March, the strongest level since early October last year

boosted by yen buying and dollar selling in anticipation of

the Bank of Japan (BoJ) raising interest rates again but

analysts expect the Japanese currency to eventually

weaken in light of the uncertain US economic outlook.

The latest yen rally was sparked by comments from the

US President that countries such as Japan and China were

holding down their currencies to support export

competiveness.

The BoJ is unwinding the monetary easing policy in place

between 2013-2023 to break Japan free from decades of

deflation. During this time the BoJ deployed a massive

asset-buying programme in 2013 and then negative

interest rates in 2016.

See: https://asia.nikkei.com/Business/Markets/Currencies/Yen-

selling-pressure-persists-despite-Trump-warning-

shot?utm_campaign=GL_JP_update&utm_medium=email&utm

_source=NA_newsletter&utm_content=article_link

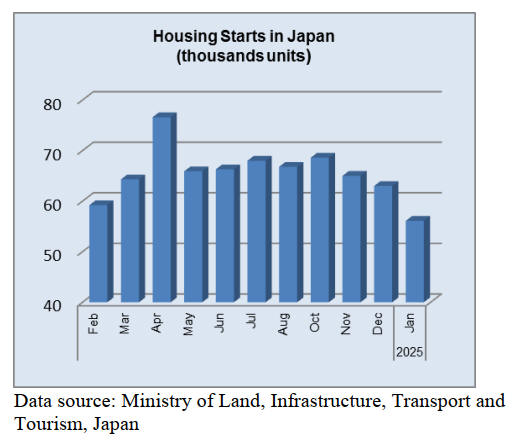

New home prices trend higher

The average price of new houses in Tokyo increased 2.4%

month on month in February to a record yen 78.59 million

(US$534,000) driven by demand for homes within an easy

commute to the heart of the city.

However, a recent survey found prices for new

condominiums in Tokyo fell in 2024 after a substantial

increase in 2023. According to the Real Estate Economic

Institute the average price of a new apartment in the

Japanese capital and surrounding areas slipped 3.5% to

yen 78 million (US$498,000), the first drop in six years.

See:

https://www.japantimes.co.jp/business/2025/01/23/economy/toky

o-apartment-prices-drop/

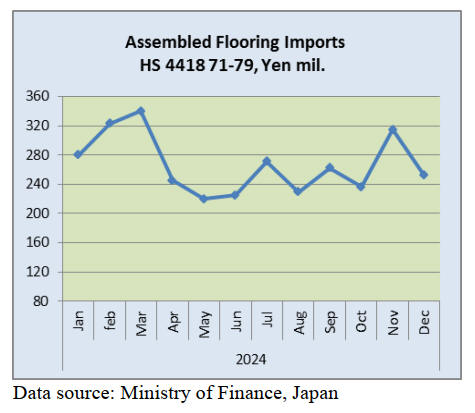

Import update

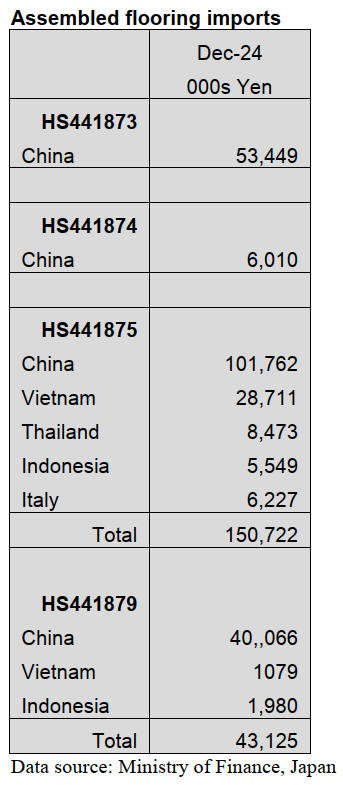

Assembled wooden flooring imports

The main category of assembled flooring imports in

December was HS441875, accounting for 59% of the total

value of assembled flooring imports compared to the 69%

share reported in November. Of HS441875 imports, 68%

was provided by shippers in China and 19% by shippers in

Vietnam. The three other sources of assembled flooring

(HS441875) in December were Thailand and Italy.

The second largest category in terms of value in December

was HS441873 all of which was shipped from China. In

December HS441873 accounted for 21% of all HS441873

arrivals. The third largest category in value terms was

HS441879 (17%).

After surging in November the value of imports of

assembled wooden flooring (HS441871-79) in December

dropped 20% compared to November and dropped 10%

compared to December 2023.

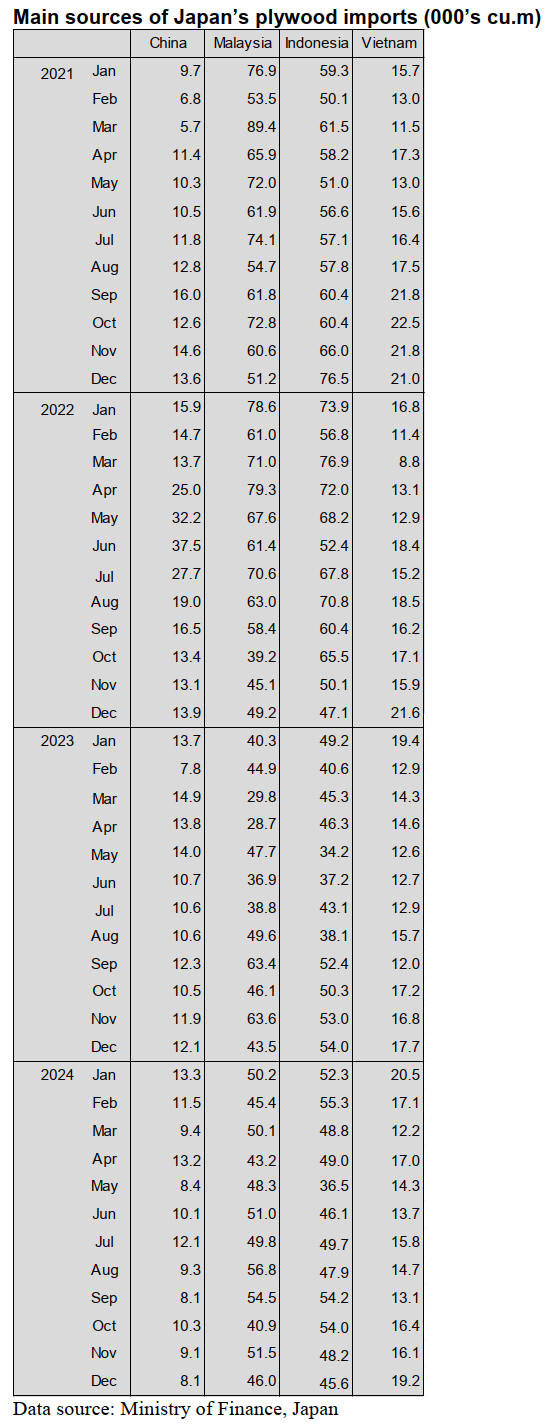

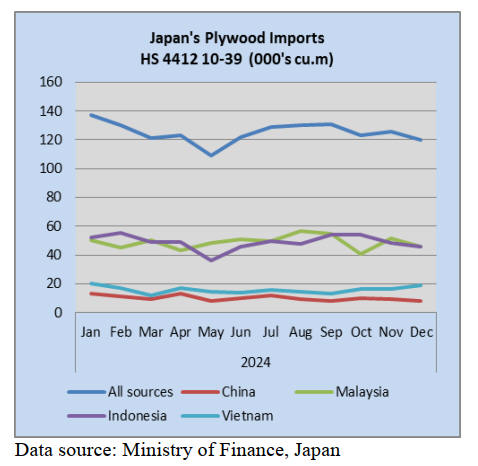

Plywood imports

December was a quiet month for arrivals of plywood

(HS441210-39). Malaysia and Indonesia were, as usual,

the top suppliers but in December arrivals from Malaysia

were down and arrivals from Indonesia were at around the

same volume as in November. Month on month, arrivals

from China were down while arrivals from Vietnam rose.

The volume of December plywood imports (441210-39)

was 118.9 cu.m (124,90 cu.m in November).

Malaysia and Indonesia held a significant share of Japan’s

plywood imports and in December 2024 accounted for

over 75% of the total volume of plywood imports. The

other two major suppliers of plywood to Japan in

December 2024 were Vietnam and China. Arrivals from

Vietnam in December totalled 19,163 cu.m up from the

16,075 cu.m, in November. Arrivals of plywood from

China in December totalled 8,117 cu.m down from the

9,077 cu.m. in November.

As in previous months, of the various categories of

plywood imported in December, HS441231 was the

largest (85% of total imports) followed by HS441233

(3%). Malaysia and Indonesia accounted for most of the

HS441231 arrivals in December.

Small volumes of HS441239 arrived in Japan during

December from a wide range of suppliers including

Sweden, Finland, Chile, the Philippines, Taiwan P.o.C and

New Zealand.

Trade news from the Japan Lumber Reports (JLR)

The Japan Lumber Reports (JLR), a subscription trade

journal published every two weeks in English, is

generously allowing the ITTO Tropical Timber Market

Report to reproduce news on the Japanese market

precisely as it appears in the JLR.

For the JLR report please see:

https://jfpj.jp/japan_lumber_reports/

North American logs

The movement of North American logs is not lively due to

low demand. However, the orders this year are better than

last year. Since there had been a heavy snow in February,

2025, the schedule for processing lumber would be

delayed. The price of small sized Douglas fir lumber is a

little bit high because a Douglas fir lumber manufacturer

stopped changing the price.

Moreover, the price of KD cypress lumber started to rise

due to a shortage of cypress logs. The price of European

timber is also high. Douglas fir lumber manufacturers in

Japan would raise the price because the yen is weak and

the price of logs in North America is high. Precutting

plants were very careful to purchase logs because they

watch order incoming for new fiscal year.

South Sea logs and products

Movement of South Sea and Chinese lumber has been

sluggish. There are not a lot of inquiries because it is

almost the end of the fiscal year and constructions for

houses and shopping malls are going on. Some companies

purchase a small amount of lumber for decks for the new

business year in April.

It is difficult to say the market is lively. The companies are

very careful to purchase laminated boards even though the

distribution stock is in a shortage because they are not sure

how demand changes in the future. Economy in China is

bad and so as the sales of lumber. Additionally, demand in

Japan is low so Chinese sellers keep the price in level.

Demand and supply for South Sea log has been balanced.

There are enough South Sea logs for lumber and plywood

manufacturers. Demand for blocks for steel and

shipbuilding manufacturers is firm.

In South Asia, the log price has been high and the weather

is stable so it is able to cut down the trees smoothly.

Plywood supply in 2024. Total plywood supply in 2024

was 4,617,000 cbms, 2. 3 % more than 2023. Domestic

plywood falls slightly and imported plywood recovers

slightly from the previous year.

Total plywood supply in 2023 was 4,514,000 cbms so the

result in 2024 rises by 100,000 cbms. However, the results

in 2023 and 2024 are under 5,000,000 units. The result in

2020 was 5,213,000 cbms even though there had been an

influence of the COVID-19.

The new housing starts in 2024 were 792,000 units, 3.4 %

less than 2023 and total floor areas are 5.2 % less than the

previous year. One of the reasons for a decrease is that

one-story house was popular than two-story house. Then,

domestic plywood manufacturers kept controlling

production.

Production of domestic structural softwood plywood is 0.1

% up and shipment is 0.7 % down from last year. The

average shipment in per month at the first half of 2024 is

178,000 cbms and at the second half of 2024 is 194,000

cbms.

The price of 12 mm 3 x 6 structural softwood plywood

kept falling. It was 1,450 yen, delivered per sheet at the

beginning of the year and it declined to around 950 yen,

delivered per sheet, in December, 2024. Distributors and

other manufacturers requested the domestic plywood

manufacturers to lower the price.

The bearish market influenced clients to prefer spot

purchasing. As a result, the movement became sluggish.

However, the inquiries for plywood started to increase

since last autumn and shipment exceeded production

during October to December, 2024. The inventory

declined and the plywood price reached the bottom.

Imported plywood is 2,000,000 cbms, 6.2 % more than

2023. Indonesian and Malaysian plywood increase from

last year. In 2023, inventory in Japan was saturated and it

had to be controlled. Japanese buyers could not purchase a

lot of imported plywood due to sudden changes in

exchange rates.

Trading companies, wholesalers and Japanese importers

were still careful to purchase a certain amount of imported

plywood in 2024. The market condition in Japan was not

lively and the yen was over 160 yen against the US dollar.

There is an increase in Vietnamese plywood. The volume

was the highest ever.

|