|

1.

CENTRAL AND WEST AFRICA

Aiming to diversify markets

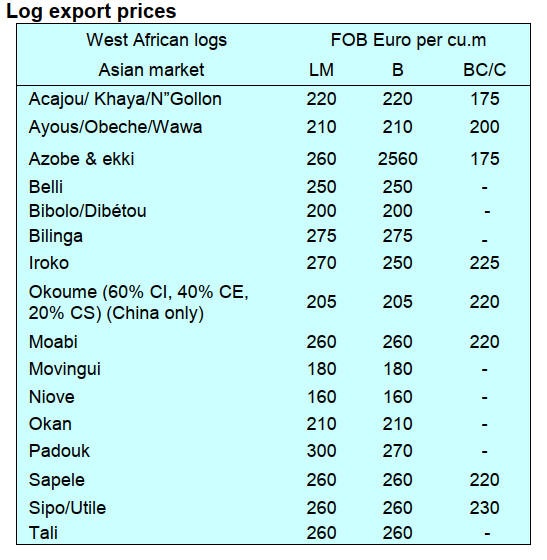

Producers report a modest increase in the price of kiln-

dried Okoume destined for China. In contrast, Azobe

prices face downward pressure. Millers report low

recovery rates on large sections of Azobé (20×20 cm, for

instance). Some mills hope to shift to smaller Azobé sizes

to improve yield and are targeting the seasonal garden

market in Europe. Another challenge for exporters is the

high local transportation costs.

Demand is said to be firm for large Azobé ‘mats’ and

dragline sheets in the Netherlands but some mills in the

region are closed citing the slump in Chinese orders for

Okoume and redwoods. EU demand for Okan and Dabema

is reportedly weak.

As challenges mount in the EU market many producers are

looking to new destinations such as Vietnam or even

South America in order to diversify.

Regional update

Gabon

Frequent rains in up-country areas are keeping operations

at low levels. The GSEZ log yard reportedly has around

30,000 cu.m of Okoume logs for utilisation by enterprises

in the Zone.

It is reported that sawing-grade Okoume log prices have

risen to around 50,000 FCFA per cubic metre delivered,

plus around 20,000 FCFA per cubic metre in

transportation costs. Many mills, especially in Nkok,

continue to operate single shifts because of cautious

interest from Indian and Chinese buyers.

China’s purchases of timber remain low. The Philippines

continues to source Okoume, while Vietnam shows steady

interest in Tali and has begun purchasing Padouk. Demand

in Middle East markets has seen some improvement with

enquiries for Okoume, Iroko and Dabema.

Although orders from India, the Philippines and Vietnam

provide some relief the lack of demand in China continues

to restrain market growth. Steadier electricity supply is

helping mills operate more predictably but high transport

costs, weather-related road issues and regulatory

complexities still weigh on production volumes and profit

margins.

The government of Gabon has adopted a bill establishing

the general framework for investment in the country.

See: https://www.lenouveaugabon.com/fr/economie/0703-20524-

le-gabon-veut-proposer-des-avantages-fiscaux-et-douaniers-

pour-attirer-plus-d-investisseurs

In the coming months, several Gabonese craftsmen could

benefit from the support of Chinese experts in the use of

bamboo and rattan according to Pascal Ogowe Siffon,

Gabon Minister of Tourism and Crafts and Zhou Ping,

Chinese Ambassador to Gabon.

As the world's leading producer and user of bamboo and

rattan China has indicated it will support Gabon's

application for membership in the International Bamboo

and Rattan Organization (INBAR).

See: https://www.gabonreview.com/valorisation-du-bambou-et-

du-rotin-la-chine-prete-a-aider-le-gabon/

Cameroon

Political activities are picking up ahead of presidential

elections scheduled for the end of the year. Although

details remain sparse, local industry players anticipate

possible policy or administrative changes tied to the

political campaign. Beyond that, market conditions are

largely unchanged with mills continuing to operate under

existing regulatory pressures and subdued export demand.

No significant changes have been reported since the

previous update with harvesting, milling, transportation

and port operations continuing under broadly similar

conditions. Container availability remains sufficient and

no new disruptions have been announced. Demand from

China remains subdued while the Middle East maintains

moderate interest in species such as Iroko, Sapelli and

redwoods.

A recent development with the potential to influence

logistics was the Cameroon Economic Forum, held on 26-

27 February under the theme “Reviving Cameroon’s

Economy in a Rapidly Changing Global Landscape: What

Are the Key Solutions?”

Organised by the Cameroon Business Group (GECAM)

and presided over by Prime Minister, Joseph Dion Ngute,

the forum brought together public decision-makers,

international experts, and private companies to address the

country’s path to economic recovery.

Discussions emphasised three strategic pillars for logistics:

boosting trade flows with tailored solutions, accelerating

digitalisation and developing sustainable, eco-friendly

infrastructure. From a timber perspective improved

logistics may eventually help address transport and

infrastructural bottlenecks that continue to hamper milling

and export activities.

Republic of Congo

While the country’s oil exports remain solid timber

revenues are in decline leading to reports of layoffs in the

forest sector. The income from oil and mining has not

fully offset declining revenue from timber exports.

Harvesting in the Republic of Congo remains at reduced

levels due to diminished Chinese interest, prompting

sawmills to focus more on European demand. This shift

may risk oversupply in certain CITES-listed timbers.

The Philippines continues to buy Okoume, while Vietnam

shows stable demand for Tali and Padouk. Power supplies

in Brazzaville have stabilised, alleviating earlier electricity

disruptions that hampered mill operations.

The impact of the conflict in DRC is of concern. Although

the most recent fighting is concentrated in the eastern

DRC the conflict’s ramifications affect the broader Congo

Basin timber sector. While not verified it has been

reported that armed groups in the DRC are profiting from

illegal logging and charcoal production in protected areas

such as Virunga and Kahuzi-Biega National Parks.

These developments in the DRC pose potential

compliance risks for cross-border traders and could

eventually disrupt shared logistics corridors. Producers are

aware that given the recent developments in the DRC they

must be pay attention to log source documentation,

particularly critical to maintain access to European and

other international markets.

See: https://news.mongabay.com/2025/03/the-environmental-

toll-of-the-m23-conflict-in-eastern-drc-analysis/

Experts sought

As part of the development of projects in the Republic of

the Congo ATIBT is putting together a pool of experts and

consulting firms.

See: https://www.atibt.org/en/news/13611/identification-of-a-

pool-of-experts-and-consulting-and-technical-firms-for-

temporary-assignments-in-the-republic-of-the-congo

2.

GHANA

2025 Budget – businesses enjoy tax reliefs -

awaiting

VAT reforms

The Government, through the 2025 Budget presentation

by the Finance Minister, Dr. Cassiel Ato Forson,

announced plans to abolish some taxes considered

unfavourable for business growth and the livelihood of

Ghanaians.

The Minister mentioned some taxes/levies would be

abolished prior to Parliamentary approval of the budget

such as the 1% Electronic Transfer Levy (E-Levy) on

Mobile Money, the Emission Levy on industries and

vehicles and the VAT on motor vehicle insurance policies

all of which are inline with the party manifesto.

According to the Minister these are measures principally

to help ease the pressure on the business sector including

manufacturing industries and Small Medium Enterprises.

Prior to the budget trade bodies such as the Association of

Ghana Industries (AGI), the Ghana Union of Trades’

Association (GUTA) and the Ghana National Chamber of

Commerce and Industries (GNCCI) underscored the need

for economic stability in the 2025 budget, stressing its

critical role in sustaining businesses and improving

livelihoods.

The Ghana Ports and Harbours Authority (GPHA) had

also called for the elimination of the Value Added Tax

(VAT) on transit goods which was seen as undermining

competitiveness.

With VAT at 22%, which businesses led by the AGI

consider hurt business operations, Dr. Forson assured that

the government will undertake comprehensive VAT

reforms this year with the aim to review the current

structure.

The Minister indicated the parameters for the VAT

reforms are likely to include abolishing the COVID-19

Levy; reversing the decoupling of GETFund (Ghana

Education Trust Fund) and NHIL from the VAT and

reducing the effective VAT rate for businesses. Other

measures include reversing the VAT flat rate regime,

upwardly adjusting the VAT registration threshold to

exempt micro and small businesses from the collection of

VAT and improving compliance through public education

and awareness.

The Minister was confident that by prioritising the

elements mentioned in the budget statement an

environment where businesses can thrive and be

competitive can be created which will drive economic

recovery. The AGI is yet to make any public

announcement on the budget and if the plan contains

strategies that will strengthen the local currency and lower

interest rates, as these measures that will positively impact

on the business community.

See: https://citinewsroom.com/2025/03/2025-budget-must-

ensure-economic-stability-guta/

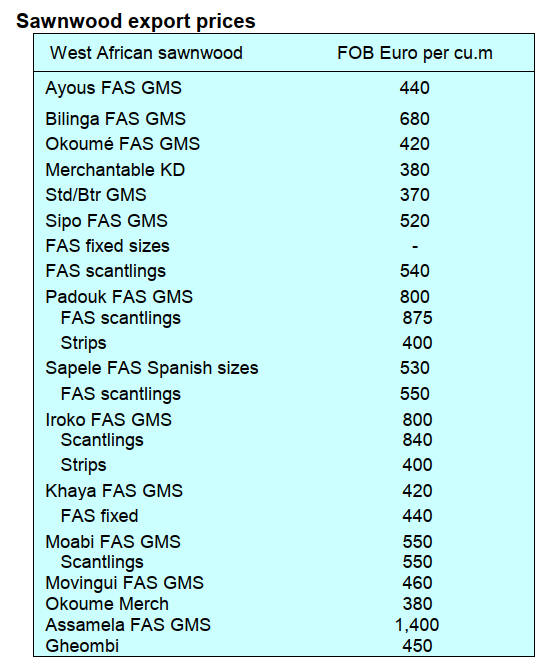

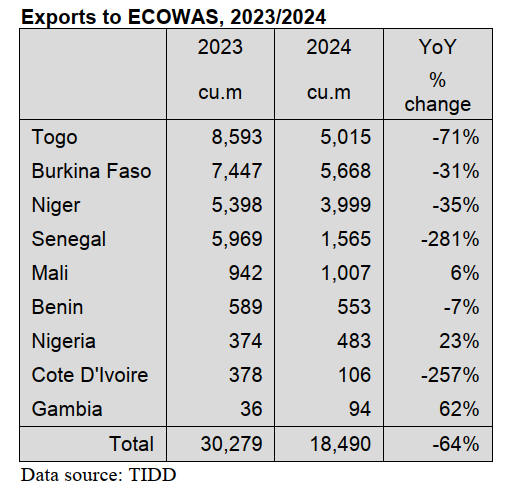

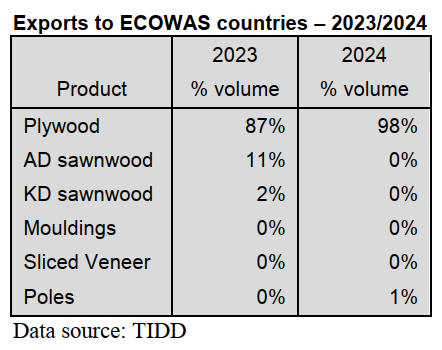

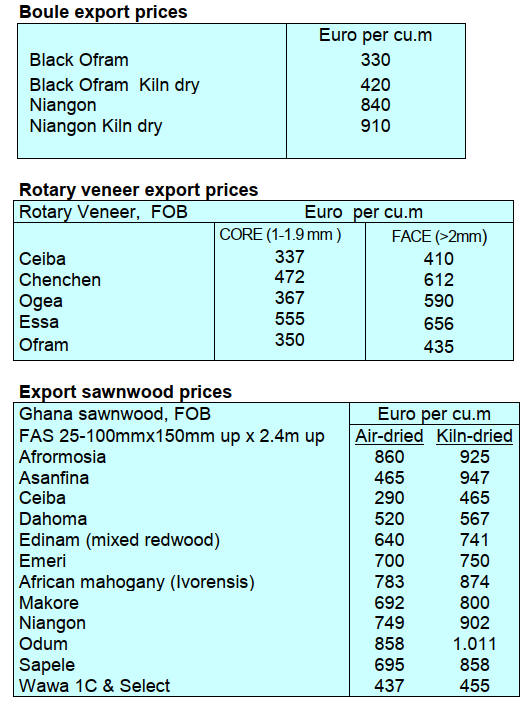

Exports to ECOWAS dipped in 2024

According to the Timber Industry Development Division

(TIDD) data, Ghana’s export of wood and wood products

to the African market in 2024 accounted for 9% (25,477

cu.m) of total exports while, for the same period in 2023,

the volume was 36,245 cu.m.

The major destinations for Ghana’s wood product exports

to Africa included Egypt, Morocco and South Africa with

the ECOWAS sub-region alone accounting for 73%

(18,490 cu.m) of the total export volume in 2024. This

volume was below that slipped in 2023.

While Burkina Faso, Togo, Niger and Senegal were the

major markets within ECOWAS their contribution to the

overall export earnings dipped to 16,247cu.m in 2024

from 27,407cu.m in 2023.

Wood products exported included kiln dried sawnwood,

sliced veneer, poles and the main export item, plywood.

The data shows that all ECOWAS countries imported

plywood during the period. ECOWAS countries, except

Niger and Nigeria, recorded higher average unit prices for

wood products in 2024 as against 2023. The leading

plywood importing countries were Togo, Burkina Faso

and Niger.

Stakeholders engaged on emissions reduction/benefit

sharing plan

The Climate Change Directorate (CCD) of the Forestry

Commission (FC) organised a National Stakeholder

Engagement and Validation Workshop on the draft Benefit

Sharing Plan (BSP) designed for The REDD+

Environmental Excellence Standard (TREES) programme

areas. The two-day event highlighted actions contributing

to emission reductions and benefit allocations achieved

through programme progress.

In her welcome address, Miss Roselyn Fosuah Adjei,

Director, CCD, briefed participants on the proposed

agenda and challenged them to be candid with their

contributions to help boost livelihoods in local

communities and address issues of deforestation and forest

degradation.

The Reducing Emissions from Deforestation and Forest

Degradation and the role of sustainable forest management

along with conservation and enhancement of forest carbon

stocks are UN-backed frameworks aimed at combating

climate change. It sets requirements for accounting,

monitoring, reporting, verification, risk mitigation and

transparency where governments receive incentives to

reduce emissions through its market-based framework,

TREES. The CCD under the FC, serves as the National

REDD+ Secretariat, overseeing programmes and

collaborating with like-minded organisations.

See: https://fcghana.org/fc-holds-stakeholder-engagement-on-

the-draft-bsp-for-the-trees-programme-area/

Ghana remains strategic investment hub

The International Finance Corporation (IFC) remains

optimistic about Ghana’s economic prospects and

reaffirmed its commitment to supporting private-sector

growth.

Dahlia Khalifa, IFC’s Regional Director for Central Africa

and Anglophone West Africa, highlighted Ghana’s

resilience and economic potential in an interview with the

Business and Financial Times.

The IFC has injected more than US$2 billion into the

Ghanaian economy over the past decade with US$450

million disbursed in 2023 alone, a figure expected to be

higher in 2024.

Khalifa noted that the IFC is channeling its investments

into sectors with high employment potential including

agribusiness, light manufacturing and renewable energy,

adding that Ghana’s fundamentals remain strong despite

economic turbulence, positioning the country for sustained

growth.

See:

https://www.ghanaweb.live/GhanaHomePage/business/Ghana-

remains-strategic-investment-hub-despite-challenges-IFC-

2015128#google_vignette

3. MALAYSIA

Timber industry, the third largest contributor to

commodity exports

The Malaysian International Furniture Fair (4-7 March

2025) set the stage for a dynamic furniture buying season

in Asia. At the opening of the Fair Datuk Seri Johari

Abdul Ghani, Minister of Plantation and Commodities

said Malaysia’s wooden furniture exports earned a total of

RM9.9 bil. in 2024 an 8.4% increase from 2023 with

wooden furniture exports accounting for almost half of the

total. “This achievement positions the timber industry as

the third largest contributor of our commodity exports,” he

said.

Johari said MIFF played a pivotal role in shaping and

elevating Malaysia’s furniture industry adding that the

platform enables businesses to showcase craftsmanship,

foster new partnerships and explore the latest trends in

design and manufacturing. “MIFF has rightfully earned its

place among the world’s top ten furniture trade shows and

proudly stands as Southeast Asia’s largest and longest-

running furniture fair,” he said.

See:

https://www.thestar.com.my/news/nation/2025/03/01/malaysia03

9s-export-of-wood-furniture-grew-84-to-rm99bil-last-

year#goog_rewarded

Strengthening efforts on forest conservation

Nik Nazmi Nik Ahmad, Minister of Natural Resources and

Environmental Sustainability, is reported as saying

Malaysia is strengthening efforts on forest conservation

through innovative financing strategies.

He said the Ministry has been exploring mechanisms such

as green bonds, sukuk (Sharia-compliant financial

certificates), carbon taxes and sustainable investments to

ensure that conservation efforts are adequately funded.

“To address the funding gap, Malaysia introduced the

Forest Conservation Certificate (FCC) in May 2024

through the Malaysia Forest Fund, an initiative designed to

facilitate private sector investment in forest conservation

projects.

Former Perak State Park Director, Shah Redza Hussein, is

the Chief Executive Officer of the Malaysia Forest Fund

(MFF), a federal government agency working to channel

financing towards forest conservation, protection and

management in the country.

See: https://thesun.my/malaysia-news/malaysia-strengthens-

forest-conservation-with-innovative-financing-nik-nazmi-

NG13738137

and

https://www.eco-business.com/news/malaysia-forest-fund-

appoints-shah-redza-hussein-as-ceo/

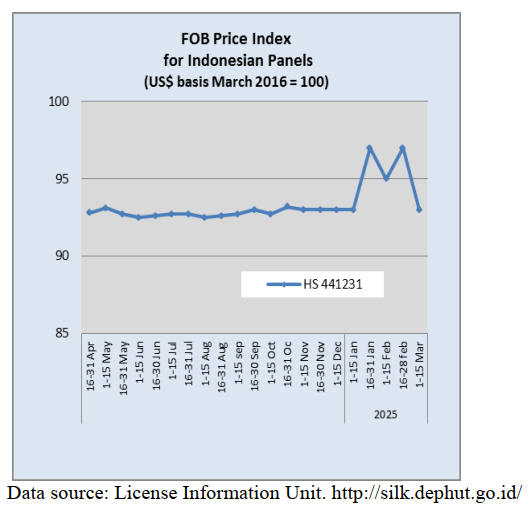

Unfavourable market conditions – mills closing

One of the big six timber companies in Sarawak closed its

loss-making plywood manufacturing business on 1

January this year.

According to the company, the timber business has, in

recent times, contributed little to the group because of the

weak market demand and strict operational requirements

related to timber certification. The other challenge is

competition in the Japanese market from plywood

manufactured locally from domestic softwoods.

The Malaysian media has reported another of the big

groups in Sarawak reported losses from timber related

business in 2024. The media has also reported a third

member of the big six timber companies in Malaysia has

voluntarily withdrawal its MTTC timber certification in

the Gerenai Forest management Unit.

MTCC Communications and Marketing Director,

Muhammad Hasif Azizan, said the reasons cited for the

withdrawal were unfavourable market conditions and an

inability to sustain forest operations.

See: https://www.thestar.com.my/business/business-

news/2025/03/10/wtk-exits-loss-making-plywood-

manufacturing-ops

and

http://theborneopost.pressreader.com/article/282153592025030

and

http://theborneopost.pressreader.com/article/281608131175979

Environment compliance audit course

The Borneo Post has reported the Natural Resources and

Environment Board (NREB) has appointed an official

training provider for the Environmental Compliance Audit

(ECA) Training Course. This course equips potential

auditors with the necessary knowledge and skills to

conduct ECA effectively.

Successful completion of the course is one of the key

competencies required to qualify as an NREB Registered

Environmental Auditor.

To enhance environmental compliance and risk

assessment in project development the NREB introduced

the Natural Resources and Environment (Audit) Rules

2008 which were gazetted in 2008 and came into force in

2013. The Rules aim to improve regulatory adherence,

mitigate environmental risks and promote self-regulation

among project proponents.

See:

http://theborneopost.pressreader.com/article/281663965748503

4.

INDONESIA

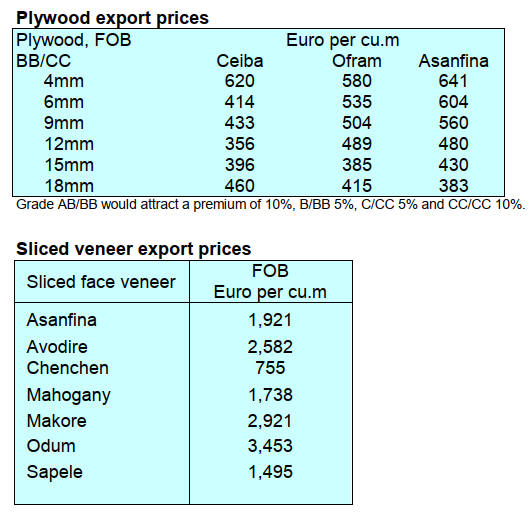

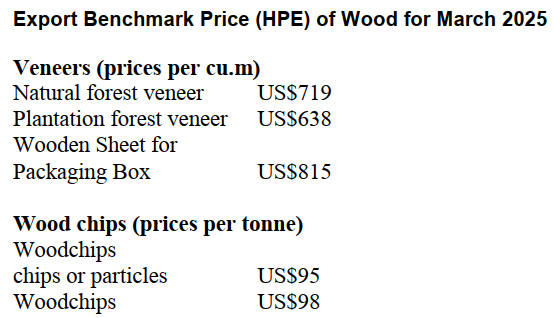

Processed wood (prices per cu.m)

Processed wood products which are leveled on all four

sides so that the surface becomes even and smooth with

the provisions of a cross-sectional area of 1,000 sq.mm to

4,000 sq.mm (ex 4407.11.00 to ex 4407.99.90)

Processed wood products which are leveled on all four

sides so that the surface becomes even and smooth of

Merbau wood with the provisions of a cross-sectional area

of 4000 mm2 to 10000 mm2 (ex 4407.11.00 to ex

4407.99.90) = US$1,500/cu.m

See: https://jdih.kemendag.go.id/peraturan/keputusan-menteri-

perdagangan-republik-indonesia-nomor-219-tahun-2025-tentang-

harga-patokan-ekspor-dan-harga-referensi-atas-produk-

pertanian-dan-kehutanan-yang-dikenakan-bea-keluar

Furniture sector performance

At the opening of the 2025 Indonesia International

Furniture Expo (IFEX) the Deputy Minister of Industry,

Faisol Riza, stated the national furniture and craft industry

continues to record growth amidst global uncertainty

adding "we appreciate the Indonesian Furniture and Craft

Industry Association (HIMKI) as an Association of the

furniture and craft industry which continues to synergise

with the government and other associations in making

efforts that have proven to have a positive effect on the

Indonesian furniture industry, so that the market can

continue to grow."

The Deputy Minister added that industry players can take

advantage of growth in the domestic market to expand and

become more competitive.

To support the furniture sector the Ministry of Industry has

developed various strategies that focus on facilitating the

availability of raw materials by coordinating with related

ministries and institutions to improve the supply chain of

raw materials for the furniture industry through the

facilitation of the Furniture Industry Raw Material

Logistics Center.

See: https://emitennews.com/news/industri-furnitur-catat-

pertumbuhan-207-persen-di-2024

Furniture makers face challenges when exporting

Abdul Sobur, General Chairperson of the Indonesian

Furniture and Craft Industry Association (HIMKI), has

raised concerns that the government budget savings are

challenging the potential expansion of exports and leading

to reduced spending on industrial products.

He stated that Association members rely on government

support for international exhibition programmes to

enhance international and domestic market share. Against

this background Sobur is reported as saying "we hope the

government, the ministry of industry and the ministry of

trade will support participation in the exhibition in Dubai

as Indonesia needs to target emerging markets.

According to Sobur, international exhibitions are vital for

the furniture industry, particularly for those companies

that lack financial resources. Meanwhile, financially stable

furniture manufacturers are expanding into non-traditional

markets such as China, the Middle East and India.

Sobur also mentioned that the impact of government

budget cuts could negatively affect domestic sales

performance because of a cut in government spending on

desks and chairs for schools as well as furniture for

government offices.

In related news, the HIMKI is preparing for the possible

implementation of import tariffs in the US. HIMKI

General Chair, Abdul Sobur, emphasised that Indonesia

must diversify its export markets by targeting non-

traditional regions.

Sobur said “historically, we have relied too heavily on the

American market which accounts for over 50% of our

exports and Europe which makes up 35%. Sobur

underscored the need for the local industry to remain

vigilant regarding US trade policies as the US represents

one of the largest markets for the furniture industry.

However, he acknowledged that expanding exports to non-

traditional markets presents various challenges. To

facilitate this expansion, Sobur suggested the government

could play a supporting role, particularly by promoting

bilateral agreements through free trade agreements (FTAs)

with countries that are potential export destinations.

See: https://www.msn.com/id-id/ekonomi/ekonomi/prabowo-

hemat-anggaran-pengusaha-mebel-kesulitan-ekspor/ar-

AA1Am2qD?ocid=BingNewsVerp

and

https://voi.id/en/economy/465963

and

https://www.msn.com/id-id/berita/other/kebijakan-tarif-as-bikin-

industri-mebel-ketar-ketir/ar-AA1AnHsN?ocid=BingNewsVerp

Promoting high-quality furniture in Vietnam

The Consulate General of the Republic of Indonesia

(KJRI) in Ho Chi Minh City supports Indonesian furniture

companies in their efforts to enter the Vietnamese market.

Several Indonesian furniture companies participated in the

VIFA Expo 2025, held in Ho Chi Minh City from March 5

to 8.

The Indonesian products showcased at the VIFA Expo

2025 included indoor furniture made from engineered

wood panels, sofas and mattresses. The strength of

Indonesian furniture products lies in their quality and

design which are recognised by buyers as having high

value according to the KJRI.

See: https://www.idxchannel.com/news/indonesia-promosikan-

produk-furnitur-unggulan-ke-pasar-vietnam

Forest Law revision centres on green energy,

indigenous peoples' rights

Revision of the Forestry Law has been included in the

2025 Priority National Legislation Programme and the

main agenda for discussion in Commission IV of the

House of Representatives with focus on strengthening

green energy campaigns and indigenous peoples’ rights.

This revision highlights aspects that focus on the

development of sustainable biomass energy in order to

achieve the target of national energy self-sufficiency.

Several crucial points in this revision include the

allocation of production forests for biomass energy,

licensing regulations for green energy investment, fiscal

incentives for green technology and strengthening

indigenous peoples' rights through energy partnership

schemes.

Member of the House’s Commission IV, which oversees

agriculture, environment, forestry and maritime affairs,

Rokhmin Dahuri, emphasised that in order for the forestry

sector to contribute to sustainable economic growth, there

are five key aspects that must be addressed.

"We must strengthen forestry spatial planning through the

Forest Use Agreement (TGHK), implement an appropriate

silviculture system and strengthen the forestry industry

supply chain from upstream to downstream.

He added, indigenous peoples must have rights in forest

management, and governance must also be improved so

that policies are more integrated," These comments were

made in a discussion on "Policy Direction of the Forestry

Bill and Its Correlation to Energy Self-Sufficiency" held

by the Indonesian Parliamentary Center.

See:https://indonesiabusinesspost.com/3744/capitol-influence-

and-lobbying/forestry-law-revision-centers-on-green-energy-

indigenous-peoples-rights

Promoting technological integration for sustainable

forest production

At a recent event, Krisna Septiningrum, Director of Forest

Products and Plantation Industry, Ministry of Industry,

said "the key to the competitive advantage of the wood

processing industry is a sustainable supply of wood raw

materials and modernisation of machinery and

technology".

On the same occasion, Indroyono Soesilo, Chairman of the

Indonesian Forestry Community Communication Forum

(FKMPI) encouraged the integration of technology for

sustainable forest production and supply chain efficiency

to continue to spur export performance.

Indroyono highlighted the importance of plantation forests

in supplying raw materials for the wood industry and the

challenges faced, including tenure issues. To increase

global competitiveness the FKMPI encourages

diversification of wood-based products, expansion of

export markets to the Middle East and Africa, and

increased investment through partnerships with the UK,

Germany, Japan, South Korea and the European Union.

See: https://forestinsights.id/fkmpi-dorong-integrasi-teknologi-

untuk-produksi-kehutanan-berkelanjutan/#

Building capacity in satellite data interpretation

The Food and Agriculture Organization (FAO) has trained

local experts in remote sensing techniques critical for

monitoring the world’s forest and mangrove ecosystems.

Fifty national representatives convened in Lombok for a

workshop which was organised with financial support

from the European Union.

By establishing a network of satellite image interpreters in

Indonesia the workshop contributes directly to FAO’s

Remote Sensing Survey (RSS) which in turn provides data

for the Global Forest Resources Assessment (FRA) the

largest examination of forest resources across the globe.

"Through this workshop national remote sensing experts

were empowered with knowledge to generate high-quality

estimates in order to contribute to the transparency and

accessibility of essential data on forests," said Adolfo

Kindgard, FAO Forestry Officer.

See: https://indonesia.un.org/en/290405-fao-builds-

indonesia%E2%80%99s-capacity-satellite-data-interpretation-

assess-forest-area

5.

MYANMAR

Private plantations

Some say it is time to assess whether the outcomes of

initiating private plantations in 2005-06, imposing the log

export ban in 2014 and implementing the one-year

nationwide logging moratorium in 2016-17, along with the

ten-year moratorium in the Bago Region (until 2026-27)-

have delivered expectations.

The log export ban and logging moratorium were one-time

policy decisions with success dependent on external

factors beyond ongoing efforts, while private plantation

development remains the only initiative still progressing.

Products from private plantation forests are increasingly

seen as vital, especially as timber from natural forests is

largely excluded from international markets due to

sanctions. To ensure long-term market sustainability,

strengthening forest certification and timber legality

assurance systems are essential. Even if initial efforts rely

on national standards without immediate international

recognition, they lay the foundation for future acceptance.

See:

https://www.itto.int/direct/topics/topics_pdf_download/topics_id

=6691&no=1&disp=inline

Easing of procedures for furniture and flooring exports

requested

U Aung Kyaw Moe, Vice President of the Myanmar

Wood-Based Furniture Manufacturers Association has

indicated a proposal was submitted to the Forestry

Department to allow the export of locally produced

finished wooden furniture and flooring with streamlined

and simplified documentation.

Myanmar exports finished wooden furniture and finished

wood flooring to India, Singapore and Japan every year.

Currently, furniture is exported to India while flooring

called Myanmar Flooring is also exported to Singapore

and Japan.

Russian investment in Dawei SEZ

Myanmar and Russia signed an investment cooperation

agreement for the Dawei Special Economic Zone (SEZ)

which includes a port and an oil refinery. The

announcement coincided with the fifth meeting of the

Russia-Myanmar Intergovernmental Commission on

Trade and Economic Cooperation. The meeting

covered nine agreements on economic infrastructure,

banking, education, communication, technology and

humanitarian cooperation.

Russian Minister of Economic Development Maxim

Reshetnikov and Myanmar's Union Minister for

Investment and Foreign Economic Relations, Dr. Kan

Zaw, led the discussions. The Dawei SEZ, spanning 196

square kilometres on the Andaman coast is envisioned as a

hub for high-tech industries, transportation, IT and export

processing according to the Russian Ministry of Economic

Development.

See:- https://elevenmyanmar.com/news/russia-and-myanmar-

sign-investment-agreement-for-dawei-special-economic-zone-

including-port-and

FAFT briefed on National Strategy for Anti-Money

Laundering Law.

The Financial Action Task Force (FATF) has again

Flagged North Korea, Iran and Myanmar as High-Risk

Jurisdictions placing them at the most critical level on its

blacklist.

The Myanmar Central Bank Governor attended the latest

FATF session to outline the country’s efforts in combating

money laundering and implementing its National Strategy

for Anti-Money Laundering Law.

See: https://www.fatf-gafi.org/en/publications/High-risk-and-

other-monitored-jurisdictions/Call-for-action-february-2025.html

6.

INDIA

Pause in sawnwood price

increases

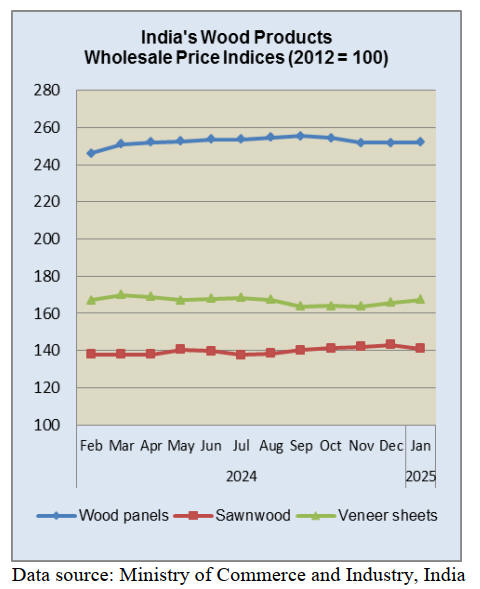

The annual rate of inflation based on the all India

Wholesale Price Index (WPI) was 2.31% in January 2025.

The positive rate of inflation in January was primarily due

to increases in prices of manufactured food products, food

articles, other manufacturing, non-food articles and

manufacture of textiles.

The index for the manufacturing sector increased to 143.2

in January 2025 from 143.0 in December 2024. Out of the

22 NIC two-digit groups for manufactured products, 15

groups witnessed an increase in prices, 5 groups witnessed

a decrease in prices and 2 groups witnessed no change in

prices.

Some of the important groups that showed month on

month price increases were other manufacturing,

manufacture of food products, machinery and equipment;

chemicals and chemical products, pharmaceuticals along

with medicinal chemical and botanical products.

Some of the groups that witnessed a decrease in price were

manufacture of basic metals, fabricated metal products

(except machinery and equipment) wearing apparel,

beverages and transport equipment. Of the wood products

tracked the price index for wood panels rose in January as

did the index for veneers. The Index for sawnwood

dropped in January after a sharp rise in December 2024.

See: https://eaindustry.nic.in/pdf_files/cmonthly.pdf

Quality Control Order entered into force

The correspondents reports the Indian Quality Control

Order has entered into force and imported wood-based

products are now restricted as the overseas suppliers

require a license issued by an Indian government body to

ship wood based panels to India.

Time will tell if this decision benefits the end-user or the

prices rise. The trade is awaiting clarification from the

government on how the new standards will apply and

whether there are exemptions.

Local company championing eucalyptus planting

A MDF company is encouraging farmers to grow

eucalyptus in order to promote sustainability and resource

renewal. The company says eucalyptus as a renewable

crop known for its rapid growth making it an ideal

resource for engineered boards. With growth rates 6 - 12

feet annually eucalyptus provides a sustainable alternative

to traditional hardwoods.

As part of its commitment to sustainability the company

actively supports reforestation. In 2024 the company

distributed 5.5 million eucalyptus saplings to support

reforestation with an ambitious goal to distribute 20

million saplings this year.

See: https://plyinsight.com/action-tesa-championing-a-nature-

friendly-revolution-to-enhance-wood-reserves-2/

Expanding bamboo production for industrial use

The Tripura State government (North East India) has a

five-year plan to expand bamboo forests for industrial use

to 45,000 hectares. At present 70% of the country’s

bamboo incense sticks are from Tripura and the State

government is keen to expand production.

Leading the initiative is Mission Director, Subhash

Chandra Das, who said “Tripura produces bamboo on

461.32 hectares exclusively for industrial use and we plan

to increase that by 45,000 hectares in five years.” The

objective of this plan is to supply bamboo for commercial

and industrial purposes.

There are challenges in the bamboo production sector,

especially transportation. “Transportation of bamboo from

dense forests or hilly areas has emerged as a major

challenge,” Das said. Mr. Das added that the project is

mobilising farmers to create bamboo plantations to ensure

sustainable incomes.

See: https://www.ptinews.com/story/national/from-461-to-45k-

hectares-tripura-s-bold-bamboo-expansion-drive-for-industrial-

use/2318625

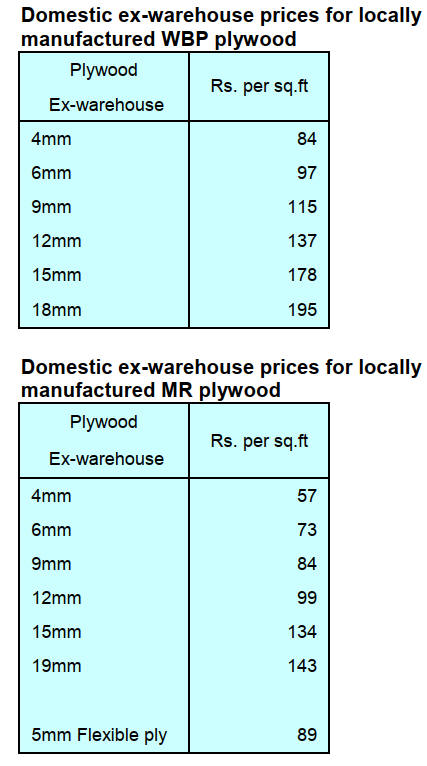

Plywood

The recently announced price increases have not been

introduced as domestic demand is weak.

7.

VIETNAM

Wood and Wood product (W&WP) trade

highlights

According to Vietnam Customs W&WP exports in

February 2025 earned US$1.03 billion, down 28%

compared to January 2025 but up 34% compared to

February 2024. Of the total, WP exports fetched US$665.7

million, down 32% compared to January 2025, but up 39%

compared to February 2024.

In the first 2 months of 2025 W&WP exports totalled

US$2.45 billion, up 9% over the same period in 2024 of

which WP exports alone contributed US$1.65 billion, up

9% over the same period in 2024.

Vietnam's W&WP imports in February 2025 reached

US$220 million, up 11.4% compared to January 2025 and

up 79.9% compared to February 2024. In the first 2

months of 2025, W&WP imports totaled US$418 million,

up 22.0% over the same period in 2024.

WP exports to the UK in February 2025 were valued at

US$19.8 million, up 78% compared to February 2024. In

the first 2 months of 2025 W&WP exports to the UK

earned US$45.4 million, up 39% over the same period in

2024.

While W&WP exports to major markets were on a

downward trend in the first month of 2025 exports to the

UK has been growing positively

In February 2025 kitchen furniture exports brought in

about US$85 million, up 67% compared to February 2024.

In the first 2 months of 2025 kitchen furniture exports

earned US$198 million, up 11% over the same period in

2024.

Vietnam's ash imports in February 2025 totalled 38,500

cu.m worth US$9.6 million, up 8% in volume and 10% in

value compared to January. In the first 2 months of 2025,

imports of ash totalled 70,600 cu.m, worth US$17.5

million, up 14% in volume and 11% in value over the

same period in 2024.

Vietnam's W&WP exports to South Korea in February

2025 were valued at US$45.6 million, up 8% compared to

February 2024. In the first 2 months of 2025 W&WP

exports to South Korea earned US$119 million, up 6%

over the same period in 2024.

In February 2025, Vietnam’s bedroom furniture exports

earned US$134 million, an increase of 66% compared to

February 2024. In the first 2 months of 2025 bedroom

furniture exports contributed US$319 million, up 15.4%

over the same period in 2024.

Vietnam's pine wood imports in February 2025 were

63,300 cu.m, worth US$12.9 million, up 9% in volume

and 11% in value compared to January 2025. Compared to

February 2024 imports increased by 31% in volume and

23% in value.

In the first 2 months of 2025, pine wood imports

were

reported at 114,800 cu.m, worth US$23.1 million, up 8%

in volume and down 2% in value over the same period in

2024.

Vietnam’s imports of log and sawnwood from the EU in

January 2025 amounted to 53,945 cu.m, with a value of

US$17.32 million, down 8% in volume and down 6% in

value compared to December 2024 but up 7% in volume

and 12% in value compared to January 2024.

Vietnam’s exporters brace for tariff hike

Vietnamese exporters are seeking strategic solutions to

mitigate the impact of potential US tariffs on lumber and

forest products.

The US Department of Commerce has launched an

investigation into sawnwood imports with potential tariffs

of up to 25% on wood and forestry products set to take

effect in April. The prospect of these tax changes has

raised alarm among Vietnamese wood industry players as

they could have a profound impact.

Mr. Ngo Sy Hoai, Vice President and General Secretary of

the Vietnam Timber and Forest Products Association

(VIFORES), emphasised that the proposed tariffs would

create serious challenges for businesses in both countries.

In response, VIFORES and key businesses in the sector

are closely monitoring developments and preparing for

potential countermeasures.

The Association is ready to answer any inquiries from US

authorities and to participate in hearings if requested.

Their goal is to demonstrate that the trade relationship

between Vietnam and the US in the wood sector is

mutually beneficial rather than adversarial.

“Vietnam is among the top surplus exporters of wood

products to the US, primarily in furniture. Given the

significance of the US market, companies involved in the

supply chain are understandably concerned. We hope that

the relevant authorities from both countries can find

common ground to ensure mutual benefit,” said Mr. Hoai.

Mr. Do Ngoc Hung, Vietnam’s Trade Counselor in the US

noted that, while American tariff policies on imports could

create new export opportunities for Vietnam, they also

introduce risks that require close monitoring.

He emphasised the need for Vietnam to closely track US

trade policies and tariff measures, adjust strategies

accordingly and strengthen coordination with Vietnam’s

Ministry of Industry and Trade as well as the country’s

trade office in the US to stay informed and develop

counter-measures.

Furthermore, businesses should carefully review their

production and export plans as countries subjected to US

tariffs may implement protective trade measures

increasing competition for Vietnam’s export market.

According to Vietnam’s General Department of Customs

in 2024, the US remained Vietnam’s largest wood product

export market with exports reaching US$8.17 billion.

Vietnam’s total wood product and wooden furniture

exports in 2024 exceeded US$16.28 billion, a 21%

increase compared to 2023. In January 2025 alone, wood

and forest product exports reached US$1.42 billion,

placing them among the top seven export commodities

generating over US$1 billion. The sector accounted for

68% of the country’s total exports.

See: https://antidumping.vn/vietnams-wood-exporters-brace-for-

potential-tariff-hike-n28520.html

Speaking at the Vietnam Furniture Industry Outlook 2025,

Đỗ Ngọc Hưng, trade counselor and Head of the Vietnam

Trade Office in the US said “if the US increases tariffs it

will have a negative impact on Vietnam’s wood industry."

The Vietnamese wood industry has set a growth target of

10-15% in 2025 and under normal trade conditions this is

a rather modest target. However, given the current global

trade situation it is difficult to say if the industry will be

able to realise this goal, said Đỗ Ngọc Hưng.”

Ngô Chơn Trí, Chief Operating Officer of one of the

leading enterprises in the home goods and furniture e-

commerce market said the US tariff increase on goods

from certain countries offers an advantage for Vietnamese

businesses. But for that they must strengthen their

capabilities and build a sustainable supply chain.

He added “with a strong commitment to delivering high

quality and reasonable prices, we see tremendous

opportunities in the US market. We are confident in the

strength of Vietnamese manufacturers. By working closely

with local producers and e-commerce platforms, we will

continue to bring high-quality, reasonably priced products

to US consumers.”

See: https://vietnamnews.vn/economy/1693453/viet-nam-wood-

industry-braces-for-us-import-tariff-policy-changes.html

Adapt export strategies - Minister

According to the Minister of Industry and Trade, Nguyen

Hong Dien, Vietnam’s export sector is at a crossroads

facing both significant opportunities and considerable

challenges and the nation must prepare strategically to

enhance competitiveness in light of the shifting global

trade landscape, he noted.

In an era of rising geopolitical instability, Minister Dien

said that competition in the global exporting market is set

to intensify, particularly with players such as China,

Indonesia and Thailand.

Developed nations have been applying stricter standards

and regulations concerning supply chains, raw materials,

labour, and environmental practices, further complicating

international trade and now the US plans to impose

sweeping tariffs which has triggered the stockpiling of

goods to avoid tax hikes which has driven up freight costs.

Despite these pressures the Minister said Vietnam may

find itself positioned to capitalize on global supply chain

shifts, he said, explaining that the country could attract

more investment into high-value sectors. However, the

rising logistics costs and higher standards from importing

markets might challenge the nation’s competitiveness.

In spite of such big challenges, a possible trade war

entailing tariffs is expected to smooth the path for Vietnam

to boost its production and exports.

In response to the global trade uncertainties the Ministry

of Industry and Trade plans to continue prioritising

investment in key export sectors, including high-tech

manufacturing.

A key aspect of Vietnam’s strategy lies in bolstering the

digital transformation of its enterprises, especially small

and medium-sized businesses which will help them reduce

costs, increase labour productivity and meet increasingly

stringent international quality standards. The ministry is

committed to facilitating this transformation by offering

training, consultations on rules of origin, and connecting

businesses with reputable international suppliers to

optimise production costs and enhance competitiveness.

8. BRAZIL

New biodiversity conservation targets

The National Biodiversity Commission (CONABIO) has

established 23 national biodiversity targets for the 2025–

2030 period as part of the National Biodiversity Strategy

and Action Plan (NBSAP). The targets address

deforestation reduction, ecosystem restoration,

conservation and management, the promotion of

sustainable use and trade. They also focus on curbing

species extinctions and genetic variability loss, reducing

invasive exotic species and minimising pollution.

The initiative also outlines complementary funding

sources beyond public resources, such as private sector

incentives to strengthen ecosystem protection and the

leadership of traditional communities.

Other key topics highlighted in Brazil’s biodiversity

targets, which are also expected to be central to

discussions in Rome, include the elimination of harmful

subsidies, capacity building, technical-scientific

cooperation and technology transfer for the conservation,

management and sustainable use of socio-biodiversity.

See: https://forestnews.com.br/conabio-lanca-novas-metas-de-

conservacao-da-biodiversidade-para-2030/

Plan for planted forests in Minas Gerais

The State of Minas Gerais has launched a Plan for the

Sustainable Development of Planted Forests, a strategic

initiative aimed at strengthening the forestry sector in the

State coordinated by the Superintendence for Forestry

Promotion in the Agriculture, Livestock and Supply

secretariat (SEAPA).

The Plan addresses key topics such as planted forest

legislation, the Green Seal, Rural Environmental Registry

and the restructuring of the sector's production chains.

The initiative seeks to attract investments, expand markets

and boost jobs and income generation with a special focus

on small and medium-sized producers.

Additionally, it aims to facilitate access to information on

financing options for agro-industries that use raw materials

from planted forests, the Crop-Livestock-Forest

Integration System (ILPF- Sistema de Integração Lavoura-

Pecuária-Floresta), as well as training and guidance on

techniques for planting, management and

commercialisation of forest products.

The plan was developed in partnership with various

sectoral entities including the Environmental Management

Center and the Working Group on Planted Forests.

Other organisations involved in the process included the

Minas Gerais Forest Industry Association (AMIF), the

Federation of Agriculture and Livestock of Minas Gerais

(FAEMG), the State Forestry Institute (IEF), the Institute

for Integrated Development of Minas Gerais

(InvestMinas) and several state secretariats, such as

Economic Development (SEDE), Finance (SEF),

Environment and Sustainable Development (SEMAD) and

Planning and Management (SEPLAG).

The implementation of the plan will be led by the Forestry

Promotion Superintendence with support from the Sectoral

Chamber of Forestry linked to the State Council for

Agricultural Policy (CEPA). The initiative is expected to

promote sustainable rural development by encouraging the

integration of crops, livestock and forests, while

strengthening public policies focused on the forest

economy.

See: https://www.remade.com.br/noticias/20545/minas-gerais-

lanca-plano-estadual-para-florestas-plantadas

Investment fund support for forest restoration

Brazil will receive a total of US$247 million in

investments to promote forest restoration and nature-based

solutions under the Nature, People and Climate (NPC)

Programme of the Climate Investment Funds (CIF).

The plan, approved in February this year, allocates US$47

million from CIF, US$100 million from the Climate Fund

(via BNDES) and US$100 million from the World Bank to

finance restoration of the Amazon and Cerrado biomes.

The CIF's NPC programme supports the development of

nature-based solutions to address climate change by

promoting ecosystem restoration and strengthening the

resilience of rural populations. With a total budget of

US$400 million, the programme recognises the

interdependence between land use, the climate crisis and

community livelihoods and encourages countries to

implement projects that integrate mitigation and

adaptation strategies.

Development of the plan was led by the Brazilian Forest

Service (SFB), as the technical focal point of the NPC

Brazil, with the participation of the Ministry of

Environment and Climate Change (MMA), BNDES, the

World Bank and the Inter-American Development Bank

(IDB).

The objective is the transformation of degraded areas of

the Tocantins-Araguaia Basin, known as “the

Deforestation Arc”, into a new Restoration Arc with plans

to restore 54,000 hectares of forest with a potential to

capture up to 7.75 million tonnes of CO₂ emissions and

generating 21,000 new jobs. BNDES will coordinate the

implementation focusing on the private sector and

promoting sustainable production chains.

NPC Brazil is the first Investment Plan approved under the

CIF’s Strategic Climate Fund (SCF) with a 100% focus on

the private sector. It uses a blended finance to leverage

investments in environmental restoration and encourage

company participation in environmental recovery

initiatives. Additionally, for the first time, CIF will

allocate resources for investments in the Brazilian

Amazon, aligning with the National Native Vegetation

Recovery Plan (Planaveg).

With the approval of the Investment Plan, Brazil now has

18 months to develop the implementation plan and details

of the projects to be carried out.

See: https://www.maisfloresta.com.br/brasil-contara-com-us-

247-milhoes-para-restauracao-florestal-e-solucoes-baseadas-na-

natureza/

Transport issues at Ports - industry in search of

solutions

The Brazilian forestry and timber sectors are facing

serious logistical challenges primarily due to issues at

ports andwith maritime transport operations. Timber

industries and other sectors have been struggling with

route cancellations, shipment delays and excessive queues

which directly impact export competitiveness.

According to the National Confederation of Industry

(CNI), these disruptions have caused significant financial

losses, particularly due to the lack of predictability and the

extra charges because of extended terminal delays.

The problems with exporting products in containers from

Brazil have, according to ABIMCI, worsened since the

second half of last year. Exporters plan dispatch on the

basis of vessel arrival schedules but recently schedules are

being changed at the last minute leaving companies with a

challenge to reorganise their logistics.

Additionally, delays and omissions in vessel schedules

often lead to ships by-passing ports where cargo is

waiting. This issue results in financial losses and often

leads to extra time related charges for containers according

to the CNI.

The Brazilian Association of Mechanically Processed

Timber Industry (ABIMCI), representing the timber

sector, has been actively seeking solutions to improve the

efficiency of port operations. ABIMCI has participated in

meetings with CNI and the National Waterway Transport

Agency (ANTAQ) to highlight the negative impacts of

delays and unjustified fines. They have also pushed for

greater flexibility and transparency in government and port

authority actions.

ABIMCI has called for better accountability in addressing

shipment issues and proposed the establishment of a

“situation room” for ongoing discussions on short-term

improvements to streamline operation processes.

Meanwhile, long-term structural measures, such as

terminal expansions and deepening dredging projects, are

being planned.

See:

https://imprensa.portaldaindustria.com.br/posicionamentos/probl

emas-no-escoamento-de-cargas-pelos-portos-mobiliza-industria-

em-busca-de-solucoes/ and Abimci News - Edição Fevereiro

2025

9. PERU

Furniture exports

increased in 2024

According to information provided by the Services and

Extractive Industries Department of the Association of

Exporters (ADEX), shipments of furniture and furniture

parts in 2024 were valued at US$4.7 million FOB, a

positive 14.5% increase compared to 2023.The main

market for these items was the United States which

accounted for a 53% but this was down 3.5% compared to

2023.

Other markets were Chile 10% share, Colombia 9%.

The

top five export markets included Italy and Guatemala at

7% and 5% share respectively.

Plantations to be established in seven regions

Through forestry incentives over the next three years

5,000 hectares of new plantations will be established in

seven regions across the country at an estimated cost of

around US$10 million.

At the launch of the ‘Forest Incentives Programme (PIF)

2025’ the National Forestry and Wildlife Service (Serfor)

invited rural and native communities, forest producer

organisations and SMEs from the regions of Áncash,

Cajamarca, Huánuco, Junín, Madre de Dios, Pasco and

San Martín to participate in this first call for proposals for

the PIF 2025.

This new call is expected to benefit 50 organisations with

co-financing to establish 100 hectares of plantations each

over a period of three years.

See: https://www.gob.pe/institucion/serfor/noticias/1116696-

gobierno-con-programa-de-bosques-productivos-sostenibles-se-

instalara-5-mil-hectareas-de-nuevas-plantaciones-en-7-regiones

OSINFOR strengthens training for sustainable forest

oversight and management

A ‘Refresher Course for Third-Party Supervisors’ was

successfully concluded in the last week of February. This

training programme brought together 30 professionals

registered with the Forest and Wildlife Resources

Oversight Agency (OSINFOR). Participants updated their

knowledge in forest management and the use of

technological platforms. The course consisted of two

stages, one virtual and one in-person.

A supervision simulation was developed including the pre-

field and field phases. The course took place in a forest

concession in Ucayali where supervisors tested

methodologies to collect on-site information using drones

for subsequent processing and analysis.

See: https://www.gob.pe/institucion/osinfor/noticias/1116869-el-

osinfor-fortalece-la-formacion-de-supervisores-para-la-

fiscalizacion-y-gestion-sostenible-de-los-bosques

|