Japan

Wood Products Prices

Dollar Exchange Rates of 25th

Feb

2025

Japan Yen 150.65

Reports From Japan

Recovery in business

spending

The economy expanded an annualised 2.8% in the 2024

October-December quarter according to Cabinet Office

data backed by a recovery in business spending. The

positive figures will likely support the Bank of Japan's

plan to keep raising interest rates and normalise monetary

policy.

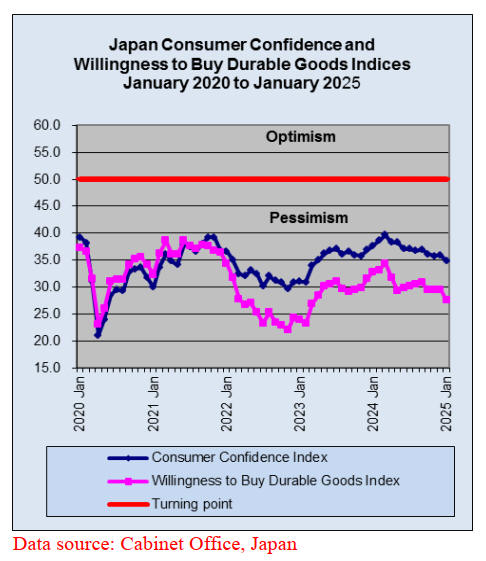

While the latest wage and household spending indicators

showed encouraging signs analysts are anticipating price

pressures will delay a full recovery in personal

consumption in the short-term.

In mid-February the government maintained its view that

the Japanese economy is recovering moderately but noted

that consumer spending has yet to fully pick up. There was

also a mention that US tariff threats, if implemented,

would slow export growth.

Exports were supported by strong shipments to Asia,

driven by solid demand for production machinery in China

and chip-manufacturing equipment in some other Asian

countries. The report also said "full attention should be

given to U.S. economic policies as a series of higher tariffs

are planned on imports”.

See: https://www.asahi.com/ajw/articles/15628672

and

https://mainichi.jp/english/articles/20250219/p2g/00m/0bu

/039000c

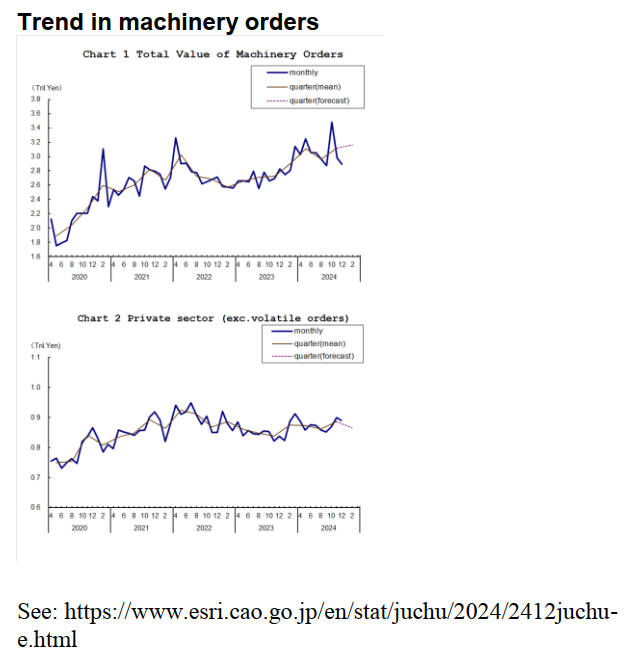

Trend in machinery orders reverses direction

The Cabinet Office has reported the total value of

machinery sales, excluding those for ships and by electric

power companies, declined by 1.2% month-on-month in

December 2024, the worst reading in four months. The

latest reading also reversed the 3.4% growth in November

and defied market expectations for a slight 0.1% gain.

Orders from the manufacturing sector dropped 10% while

non-manufacturing orders rose 5%. The biggest falls were

seen in industries such as mining, quarrying, real estate,

chemical products, information and communication

electronics and pulp, paper and paper products.

On an annual basis, private-sector machinery orders

increased 4.3% in December, slowing from a 10% surge in

November.

In the period January-March 2025 the value of private

sector machinery orders is forecast to fall.

Japanese companies try to tackle labour shortages

The Ministry of Health, Labour and Welfare has reported

the number of foreign workers in Japan has risen to a new

high of 2.3 million, the highest since 2008 when data was

first compiled.

By nationality, Vietnam had the largest number of workers

in Japan, at around 570,000 or 25% of the total, followed

by China and the Philippines with 400,000 and 240,000,

respectively. The largest year-on-year increases were with

workers arriving from Myanmar (up 61% year on year),

Indonesia (up 40%) and Sri Lanka (up 34%).

See: https://www.nippon.com/en/japan-data/h02312/

Inflation rising at the fastest pace in 19 months

Government data shows core consumer inflation was

recorded at 3.2% in January, rising at the fastest pace in 19

months, adding to expectations that the Bank of Japan

(BoJ) will raise interest rates once again.

The year-on-year increase in the core consumer price

index (CPI), which excludes fresh food prices, slightly

exceeded a median market forecast for a gain of 3.1% and

followed December’s rise of 3.0%.

A separate index stripping out costs of both fresh food and

fuel, which is closely watched by the BoJ as a better gauge

of demand-driven inflation, rose 2.5% in January from a

year earlier the data showed.

See: https://japannews.yomiuri.co.jp/news-

services/reuters/20250221-239822/

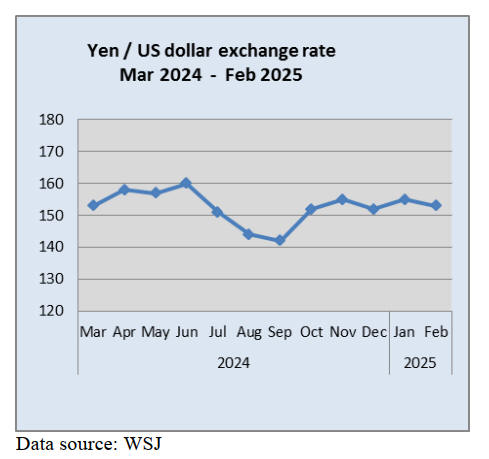

Stronger yen encourages moves to another

interest

rate increase

The yen strengthened slightly against the US dollar at the

end of February as Japanese consumer spending news

spured anticipation that the Bank of Japan (BoJ) will be

encouraged to increase interest rates at its next meeting.

The gains in yen strength gathered momentum when

Japan’s wage growth jumped by the most in nearly three

decades and accelerated even further when a pro-rate hike

BoJ board member said that rates need to go higher.

See:

https://www.japantimes.co.jp/business/2025/02/07/markets/yen-

weekly-surge/

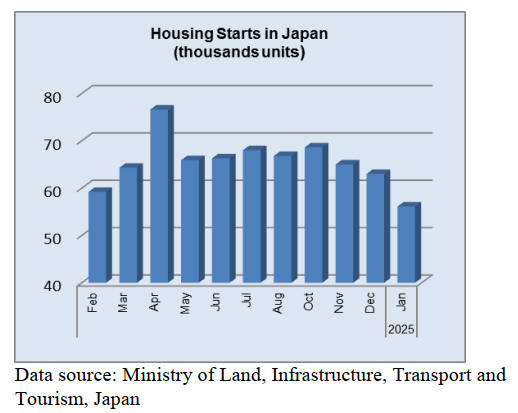

Drop in housing starts

In 2024, approximately 722,000 housing starts were

initiated in Japan. This represented a decline of 12%

compared to the previous year. 2024 was the second time

since 1995 that the number of new dwellings fell below

800,000.

Poll shows Japanese are satisfied with housing costs

While much of the developed world is frustrated by the

rising cost of housing there are a few exceptions.

According to Gallup's Annual World Poll, which surveyed

more than 37,000 people across 38 OECD countries most

people in Japan are satisfied with housing costs.

Japan's low birthrate and restrictive immigration policies

mean its population has been shrinking for decades which

left about 10 million homes vacant across the country.

Unlike many other industrialised countries Japan's national

government controls its land-use laws through zoning

regulations and other rules that determine what gets built

where are relatively simple, consistent and not subject to

much community pushback.

Japan is particularly vulnerable to earthquakes which

mean new homes employ the latest technologies. While

American homes tend to appreciate over time and are seen

as key investments, Japanese homes tend to depreciate as

they age and become non-compliant with building codes.

See: https://www.businessinsider.com/countries-with-affordable-

housing-can-teach-us-lower-costs-japan-2024-9

Extreme snow fall in Northern Japan

Residents in northern Japan have suffered record snow

fall, occasionally reaching the eaves of the roof. Many

cities have seen record snowfall this month bringing

construction work to a standstill.

See: https://japantoday.com/category/national/northern-japan-

snowed-under-after-two-week-whiteout

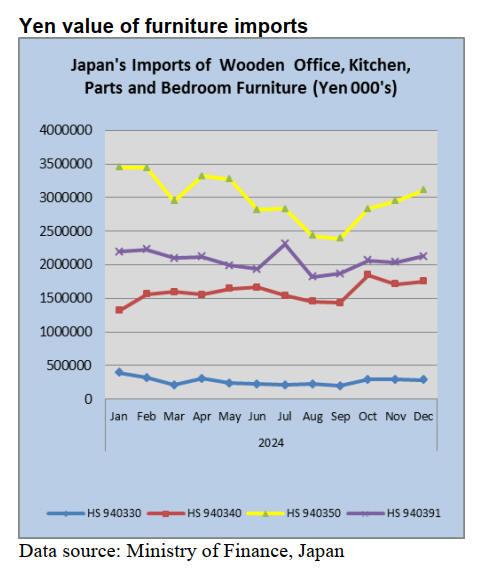

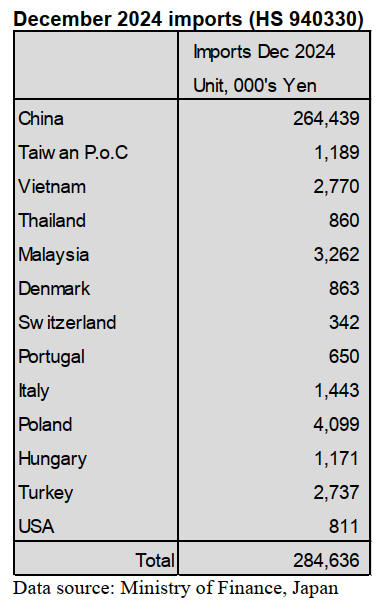

December 2024 wooden office furniture imports (HS

940330)

In December 2024 China accounted for a huge 93% of

Japan’s imports of wooden office furniture (HS 940330)

thus increasing it share of imports from the around 80% in

November 2024.

The only other shippers of note in December Poland (1.5%

and a month on month increase) and Malaysia also at 1.5%

share of imports which was sharply down from the 9%

share in November.

Year on year, the value of Japan’s imports of wooden

office furniture in December rose around 8% but month on

month there was almost no change in the value of imports.

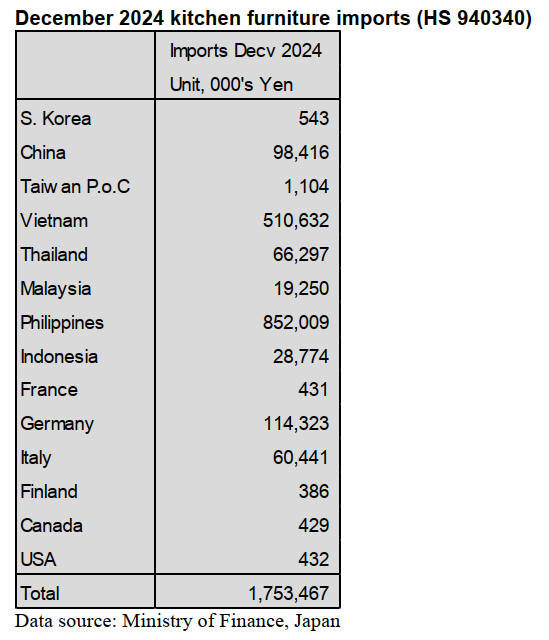

In December 2024 the combined value of shipments of

wooden kitchen furniture (HS940340) from the

Philippines and Vietnam accounted for around 80% of

Japan’s December imports. While the value of December

imports from the Philippines was at the same level as in

November there was an almost 17% rise in the value of

imports from Vietnam.

The third and fourth suppliers in December were Germany

and China, each capturing a 6-7% share of the value of

December imports.

The year on year value of Japan’s wooden kitchen

furniture imports rose 20% in December building on the

month gains that were observed every month since

September.

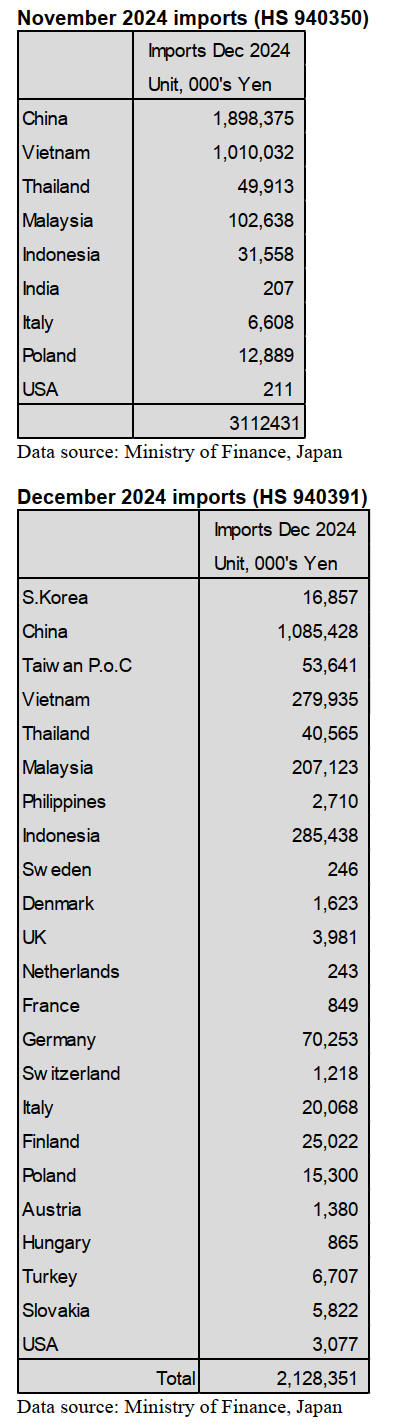

December 2024 wooden bedroom furniture imports

(HS 940350)

The top two shippers of wooden bedroom furniture (HS

940350) to Japan in December were China (61% share, the

same as in November) and Vietnam (33%), a sharp rise

compared to the value of November. Malaysia and

Thailand were the other shippers of note with Malaysia,

seeing a 3% share of December imports and Thailand a

2% share.

Compared to November there was a 5% increase in the

value of imports in December and a 13% rise compared to

the value reported for December 2023. In the third quarter

of 2024 there was a sustained monthly increase in the

value of wooden bedroom furniture some of which can be

explained by the weakening yen US dollar exchange rate.

December 2024 wooden furniture parts imports (HS

940391)

Shippers in China, Indonesia, Vietnam and Malaysia

accounted for almost 90% of Japan’s wooden furniture

parts (HS 940391) in December.

Of the total value of imports 51% was delivered from

China, almost the same value as in November; 13% from

Indonesia, a decline month on month; 13% from Vietnam,

a rise month on month and 10% from Malaysia also a

month on month increase.

Compared to the value of December 2023 imports there

was a 12% decline in the value of December 2024 imports

and compared to November there was little change. In

December 2024 fourteen shippers in Europe accounted for

around 7% of the value of arrivals.

Trade news from the Japan Lumber Reports (JLR)

The Japan Lumber Reports (JLR), a subscription trade

journal published every two weeks in English, is

generously allowing the ITTO Tropical Timber Market

Report to reproduce news on the Japanese market

precisely as it appears in the JLR.

For the JLR report please see:

https://jfpj.jp/japan_lumber_reports/

Wood export in 2024

Log export in 2024 is 1,819,493 cbms, 14.0 % more than

2023. Lumber export is 153,009 cbms, 12.5 % more than

last year. The reasons are that demand for timber in Japan

is low and the yen is weak. Log export increases for

straight two years and lumber increases for the first time in

three years. Wood export is 53.7 billion yen, 6.5 % more

than last year. This result exceeds the result of 2022, when

it was the highest wood export ever, by 2.0 %.

Logs have been exported to China mainly and the volume

is 1,636,493 cbms, 15.6 % increased from the previous

year. This is two straight years rising. The increase is 46.3

% and this is nearly 520,000 cbms.

The yen started 146 yen against the dollar at the beginning

of 2024 and depreciated to 160 yen in July, 2024. Bank of

Japan raised the rate of interest and the yen appreciated

against the dollar once. Then, yen was 140 yen against the

dollar in September, 2024 but the yen depreciated again. It

was 153 yen against the dollar at the end of 2024.

The price of log for China had been under US$110, C&F

per cbm after the Chinese New Year last year. Then, the

price stayed US$115 – 120, C&F per cbm.

The freight was US$50,000, around 2,500 cbms at the

beginning of last year and then it rose to nearly US$60,000

in autumn. Even though high freight continued, Japanese

exporters had a stable profit through the year, because the

log price was as high as around 11,000 yen, delivered per

cbm.

Logs for South Korea are 113,070 cbms, 12.3 % more than

last year and this is for the first time in two years to

increase. Logs for Taiwan are 65,823 cbms, 9.4 % less

than the previous year. This is decreasing for three years in

a row.

Lumber for China is 65,211 cbms, 15.4 % more than the

previous year and for the U.S. is 42,005 cbms, 30.6 %

more than the previous year. Demand for fences recovered

slightly in the U.S. because the inventory adjustment was

completed.

|