|

Report from

North America

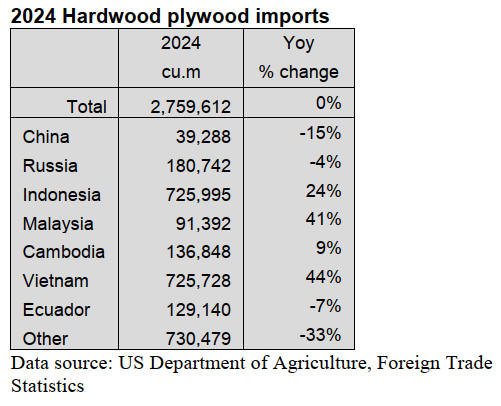

Hardwood plywood imports unchanged in 2024

The amount of hardwood plywood imported into the US in

2024 was nearly identical to that brought in in 2023,

although the value of the wood rose substantially.

At 2,759,612 cubic metres, the volume of hardwood

plywood imported was less than 1% greater than in 2023.

Imports from top trading partners Indonesia and Vietnam

both surged in 2024 as both gained market share. Imports

from Indonesia rose 41% while imports from Vietnam

rose 44%.

While total volume remained steady in 2024 the dollar

value of imports rose a healthy 13% in 2024 to more than

US$1.7 billion. In December, import volume rose 3%

from the previous month to 262,273 cubic metres, which

was 5% lower than that in the previous December.

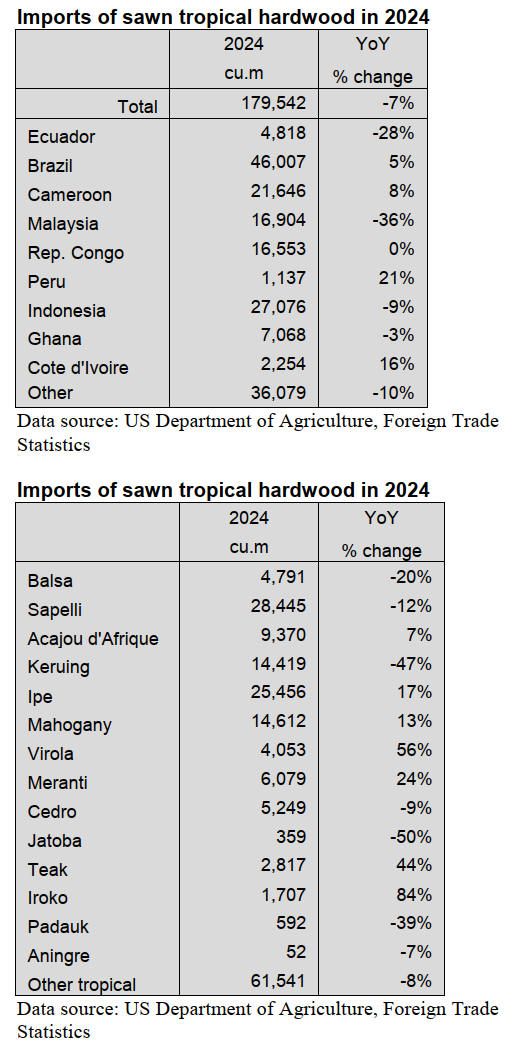

Imports of sawn tropical hardwood fell in 2024

US imports of sawn tropical hardwood fell 7% in 2024

compared with the previous year. The 179,542 cubic

metres of wood imported was significantly less than the

193,567 imported in 2023.

Imports from two top US trade partners, Indonesia and

Malaysia fell 9% and 36%, respectively, for the year while

imports from Brazil, the number1 trading partner in both

2023 and 2024, rose 5%.

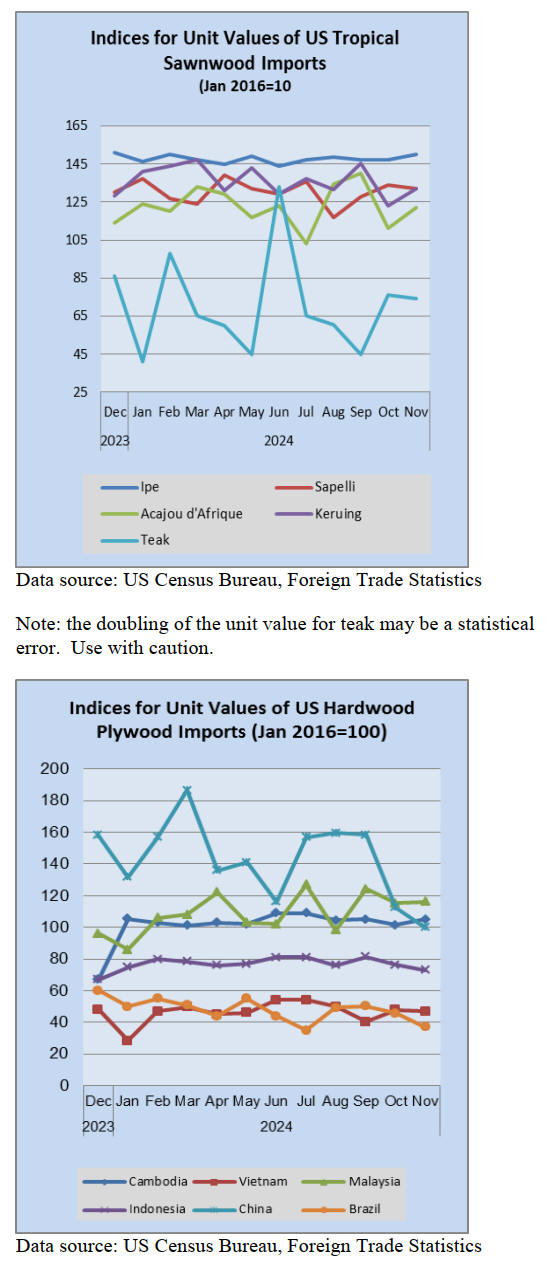

Imports of Sapelli, the most imported sawn tropical

hardwood, fell 12% in 2024 while imports of Keruing

plunged by 47%. Imports of Ipe, which grew 17% in 2024,

surpassed Keruing as the second-most imported tropical

hardwood by volume.

At 12,421 cubic metres, December imports were down

27% from the previous month and 7% lower than that of

December 2023.

Canadian imports of sawn tropical hardwood rose

significantly in 2024, outpacing the previous year by 28%.

Imports from top trader, Cameroon, rose 46% in 2024

while imports from Brazil rose 54%.

Among the smaller trades imports from Bolivia grew by

73% last year while imports from Indonesia fell 61%.

Imports of Sapelli, the most traded wood, grew 28% for

the year.

Although the total yearly gains were impressive,

December was one of the worst months of the year, with

imports falling 18% from the previous month to a level

41% below that of December 2023.

Veneer imports rebounded in December

After a sharp downturn in November, US imports of

tropical hardwood veneer recovered smartly in December

by nearly doubling the previous month’s total. Still,

imports ended 2024 down 17% from the previous year.

Imports from Italy were especially weak in 2024, falling

77% from 2023 while imports from Cameroon, the top

trading partner for veneers, were off by 11% in 2024.

Imports from Cote d’Ivoire were the exception in 2024,

gaining 18% for the year, while imports from all other

major trading countries fell by at least 10%. While imports

of tropical hardwood veneer rose 99% in December from

the previous month, they still fell short of December 2023

imports by 6%.

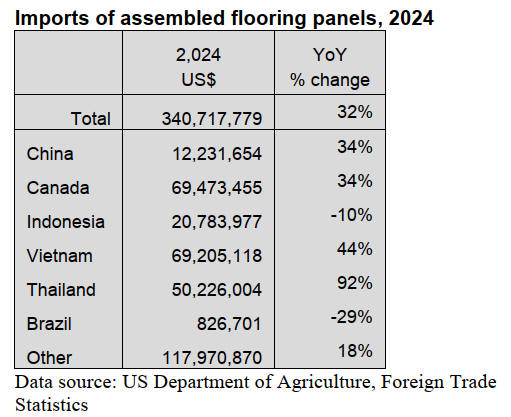

Imports of assembled flooring panels surged in 2024

US imports of assembled flooring panels climbed by 32%

in 2024 with imports from top trading partners seeing even

larger gains. Imports from the top trading partner Canada

rose 34% while imports from Vietnam surged 44% and

Thailand vaulted 92%.

Imports from Indonesia (down 10%) and Brazil (down

29%) were among those losing share. Total imports of

assembled flooring panels topped US$340.7 million in

2024. For December, imports fell by 3% but were 7% up

from the previous December.

US imports of hardwood flooring were not nearly as

strong in 2024, as imports fell by 12% for the year.

Imports from Indonesia tumbled 34% while imports from

Malaysia slid 29%. Imports from Brazil gained 84% in

2024 to move ahead of Indonesia as the lead trade partner

for the year.

Flooring imports for 2024 were just over US$71million

after surpassing US$80 million in 2023. In December,

imports fell 39% from the previous month and were 22%

below that of the previous December.

Moulding imports leapt in 2024

US imports of hardwood moulding jumped 29% in 2024

as newer trade partners made the most impressive gains.

Imports from traditionally top supplying nations made

modest headway in 2024 including a 15% rise in imports

from Canada and a 7% rise in imports from Malaysia.

However, nearly all the boost in imports can be attributed

to trading countries that were not significant in the market

five year ago for example countries such as Vietnam,

Cambodia and Lithuania.

US imports of hardwood moulding exceeded US$163

million in 2024. In December, imports were 40% higher

than in December 2023 after rising 6% from the previous

month.

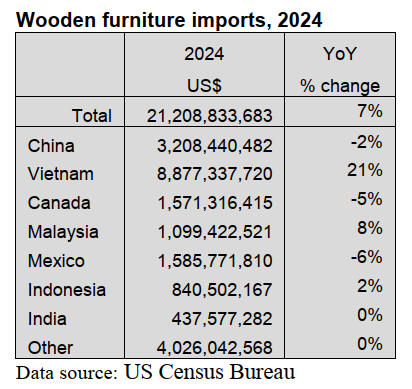

Wooden furniture imports exceeded US$21 billion in

2024

US imports of wooden furniture rose by 7% in 2024 as

imports from Vietnam showed solid growth. After falling

below US$20 billion in 2023, imports surpassed US$21.2

billion in 2024 but well short of the record US$25 billion

of 2022 but a respectable gain, nonetheless.

The rise was fueled by a 21% jump in imports from

Vietnam, a supplier that accounted for more than a third of

all 2024 imports. Imports fell for the year from other top

suppliers Canada (down 5%) and Mexico (down 6%),

while imports from most other trade partners were mostly

flat for the year. Imports from December were up 1% from

the previous month and up 5% from the previous

December.

Residential furniture - tariff uncertainties cloud 2025

outlook

New US residential furniture orders fell 9% in November

compared to the same period in 2023 according to the

January issue of Furniture Insights. This decline follows a

relatively flat October and marks a return to the downward

trend observed from May through September.

Approximately 40% of the survey participants reported

increased orders in November compared to a year ago.

However, new orders were up 5% compared to October

2024 figures although down slightly for the year-to-date,

noted Mark Laferriere, assurance partner at Smith

Leonard, the accounting and consulting firm that produces

the monthly report.

November shipments were down 1% compared to 2023

figures, and flat with October 2024. Year to date through

November 2024, shipments were down 7% compared to

2023. Backlogs were down 10% compared to November

2023, but up 1% from October 2024 "as current new

orders outpaced shipments during the last month."

On a seasonally adjusted basis, sales at furniture and home

furnishings stores were up 2.3% in December compared to

the previous month and up 8.4% from December 2023.

However, sales were down 2.2% for the year-to-date

December 2024, compared to the same period for 2023 on

an unadjusted basis, according to the January Furniture

Insights.

Future market projections are difficult, Laferriere said,

without knowing the extent of the impact tariffs will have

on the furniture industry, housing and the overall

economy. Domestic manufacturers, especially those with

"hybrid operations," will be impacted through their

outsourcing of materials and components.

"While likely greatly oversimplifying a very complex

situation, an additional 10% tariff on Chinese goods would

seem manageable given the inflationary pressures the

industry has dealt with in the last few years, coupled with

the long product pipeline allowing time for companies to

make necessary adjustments," Laferriere noted.

"What seems more immediately concerning is the

potential impact of tariffs on Canadian lumber utilised by

the US housing industry as well as Canadian energy and

the impact that could have on inflation in general, and

specifically, consumer spending, interest rates, and

ultimately housing activity that drives the furniture

industry.”

See:

https://www.woodworkingnetwork.com/furniture/residential-

furniture-orders-slump-november-cautious-optimism-2025

Homebuilders ask for tariff exemptions on building

materials

Citing the potential cost impact on US housing the

National Association of Homebuilders (NAHB) sent a

letter to the President requesting tariff exemptions on

building materials from Canada and Mexico.

See: https://www.nahb.org/-/media/NAHB/advocacy/docs/letter-

to-president-potential-tariffs-

013125.pdf?rev=4f33c6137e9846b1866e4692241d2a1d

The President announced an across-the-board tariff of 25%

on Canadian and Mexican goods coming into the United

States, including tariffs on building materials that could

increase construction costs and harm housing affordability.

As of 3 February tariffs on both countries have been

delayed for one month as negotiations continue.

The 25% tariff on softwood sawnwood products from

Canada would be in addition to an effective 14.5% duty

rate already in place, meaning that the overall effective

Canadian lumber tariffs will rise to nearly 40%.

The NAHB states that proposed new tariffs on China,

Canada and Mexico are projected to raise the cost of

imported construction materials by US$3 billion to US$4

billion, depending on the specific rates. For some

materials, where imports are critical to supply, prices

could see dramatic increases, adding layered costs that

could substantially impact builders’ ability to deliver new

projects.

The NAHB estimates that US$184 billion worth of goods

were used in the construction of both new multifamily and

single-family housing in 2023.

About US$13 billion of those goods were imported from

outside the US, meaning approximately 7% of all goods

used in new residential construction originate from a

foreign nation.

See: https://www.nahb.org/advocacy/top-priorities/material-

costs/how-tariffs-impact-home-building

|