Japan

Wood Products Prices

Dollar Exchange Rates of 10th

Feb

2025

Japan Yen 152.50

Reports From Japan

Tourism boost for

hospitality accommodation

In 2024 the weak yen fueled a tourism boom with more

than 36 million people visiting the country according to

the National Tourism Organization. Spending by foreign

visitors surged to 8.14 trillion yen (US$51.78 bil.), a 50%

plus rise from the previous year.

While the influx of visitors has delivered a boost to

Japan’s economy after decades of stagnation the surge in

arrivals has also prompted pushback among locals.

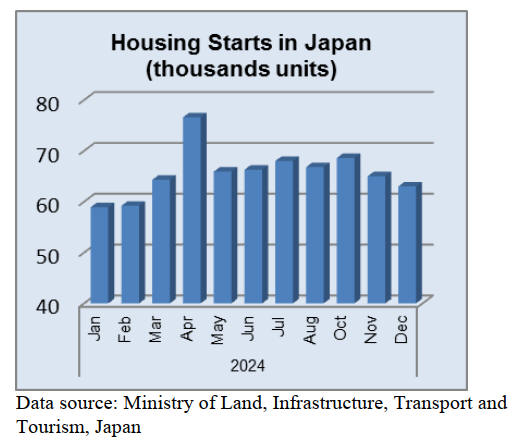

There is a growing demand for hospitality

accommodation, creating opportunities for the wood

products sector, however, rising construction costs and a

shortage of builders are holding back the supply of new

properties leading to more renovation and rebranding of

existing properties.

Pre-pandemic there was considerable investment in hotels

but during the pandemic many were converted into other

uses. Now there is a shortage, especially in the few top

tourist destinations according to analysts at TTG Asia who

recommend potential investors should work with local

governments to promote second and third tier cities

because they are important for the long-term sustainable

growth of tourism.

See:https://www.aljazeera.com/economy/2025/1/15/japans-

tourist-arrivals-hit-all-time-high-as-weak-currency-draws-masses

and

https://www.ttgasia.com/2024/10/23/bright-future-for-japans-

hotel-market/

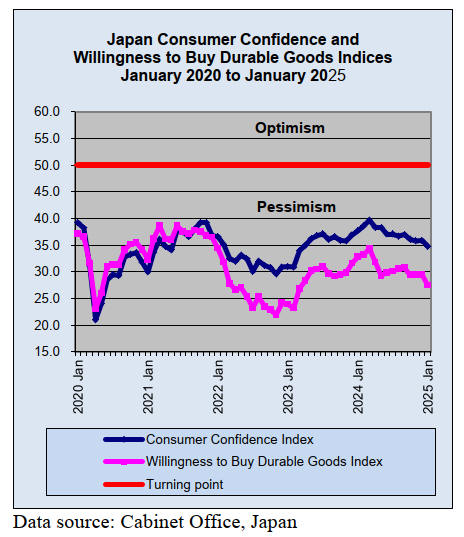

Pay increases failing to keep pace with rising prices

Ministry of Health, Labor and Welfare data shows real

wages fell in 2024 marking the third consecutive year of

decline as pay increases failed to keep pace with rising

prices. Nominal wages or the average total monthly

earnings per worker including base and overtime pay

increased 2.9% to 348,182 yen last year, expanding for the

fourth straight year but consumer prices outpaced wage

growth with a 3.2%.

The Chief Economist at Mizuho Research and

Technologies considers inflation might be tougher to tame

than expected, putting real wage growth at risk and

possibly becoming a drag on the all-important household

consumption. Although the Bank of Japan forecasts a

slowdown in food price growth and overall inflation from

the second half of 2025 this may not happen.

Japan struggled with deflation for decades and kept

interest rates at or near zero for years to get prices rising

again. They are now increasing and are becoming an issue

for workers who are finding their wages barely growing or

actually declining month to month on a real basis, says

Mizuho Research.

See: https://japantoday.com/category/business/update2-japan-

real-wages-drop-for-3rd-straight-yr-in-2024-as-inflation-bites

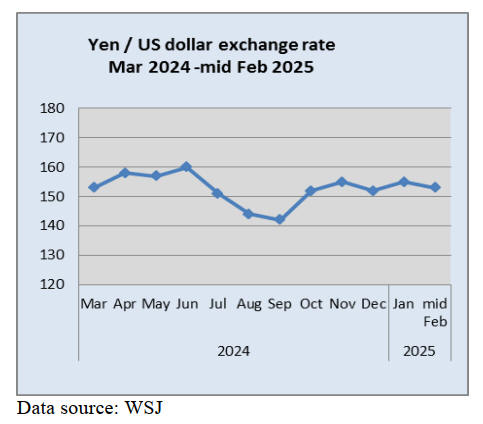

Weak yen increasingly burdensome

After Bank of Japan (BOJ) raised short-term interest rates

to 0.5% last month, expectations grew that the Bank may

raise rates faster and higher which could drive the yen to

rise against the US dollar.

However, in early February the dollar rose to a one-week

high against the yen as a rapidly rising consumer prices in

the US raised expectations that interest rates will not be

lowered any time soon.

Declines in the yen's "real strength" are standing out amid

its ongoing depreciation and years of deflation. In a

monthly index released by the Bank for International

Settlements (BIS) showing the effective value of the

currencies of 64 countries and regions around the world,

the yen has continued to see the biggest declines. As Japan

relies heavily on imports for essential goods like food and

energy.

See:

https://mainichi.jp/english/articles/20240625/p2a/00m/0bu/02400

0c

Owners of new buildings to be required to

calculate

lifetime CO2 emissions

The government is considering a plan to require home

owners and builders to calculate the amount of carbon

dioxide that will be emitted when constructing, managing

or demolishing buildings. The government hopes to

submit a bill to the Diet session in 2026. According to the

International Energy Agency the buildings sector

accounted for nearly 40% of global CO2 emissions in

2022.

Owners of new buildings over a specified size will be

required to calculate the project’s lifetime CO2 emissions

as part of a life cycle assessment. CO2 emissions would be

calculated at all stages of a structure’s lifecycle from

procurement and the manufacturing of materials to

construction, use, repair, maintenance and demolition.

See: https://japannews.yomiuri.co.jp/politics/politics-

government/20250106-231678/

and

https://www.iea.org/data-and-statistics/charts/global-co2-

emissions-from-buildings-including-embodied-emissions-from-

new-construction-2022

A first in housing subsidies

Takashi Ishizuka reports that a city neighboring Tokyo

will be the first in Japan to offer housing subsidies, not

just to newlyweds but also to residents preparing for

marriage.

The Ichikawa Municipal authority introduced the initiative

in February to support young couples, promote settlement

in the city and address declining birth rates. The

programme, which supplements a national initiative for

newlywed support, will also provide assistance to couples

in the premarital stage, a first in Japan. The programme

covers two groups, couples renting a home together before

marriage and newlyweds renting after marriage.

See:

https://mainichi.jp/english/articles/20250207/p2a/00m/0na/00800

0c

Affluent foreigners choosing Japan for luxury homes

Affluent foreigners seeking home options are increasingly

choosing Japan. The new arrivals in cities such as Tokyo

and Osaka are upending the luxury housing market.

Chinese already make up the largest group of foreigners in

Japan. Until recently, the previous generation of Chinese

immigrants tended to be students, interns and labourers.

The investment migration consultancy Henley & Partners

predicted that China would rank top in terms of the

outflow of high-net-worth individuals (those with

investable assets of US$1 million or more).

Many Chinese are arriving in Japan under the business

manager visa which requires at least yen 5 million in

investments or the highly skilled foreign professional visa.

See:

https://www.japantimes.co.jp/news/2023/11/28/japan/society/chi

nese-immigrants-new-

wave/?utm_medium=email&utm_source=pianoex&utm_campai

gn=379845623701

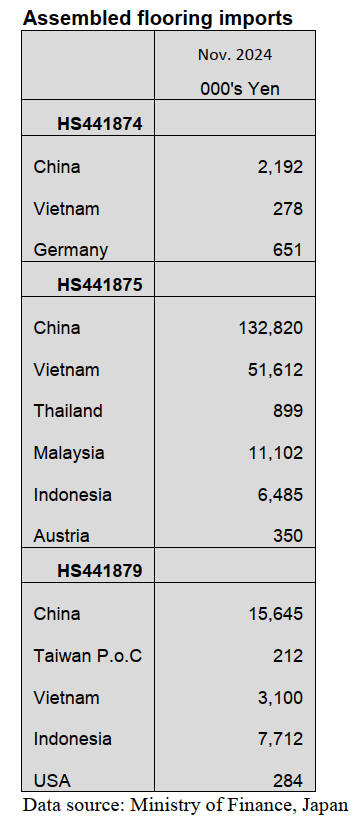

Import update

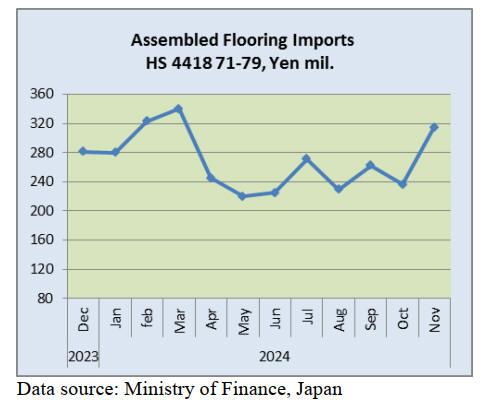

Assembled wooden flooring imports

The value of imports of assembled wooden flooring

(HS441871-79) surged in November rising just over 30%

from a month earlier. In the second half of 2024 the yen

strengthened against the US dollar making imports

cheaper than in the first half of the year.

The main category of assembled flooring imports was

HS441875 accounting for 64% of the total value of

assembled flooring imports compared to the 74% share

reported in October. Of HS441875 imports 65% was

provided by shippers in China and 26% by shippers in

Vietnam. The two other main sources of assembled

flooring (HS441875) in November were Malaysia and

Indonesia.

The second largest category in terms of value in

November was HS441879, 8% (13% in October), the

second monthly decline. The third category of imports was

HS441873 all of which was shipped from China.

Year on year, the value of assembled wooden flooring

(HS441871-79) in November was up around 25%.

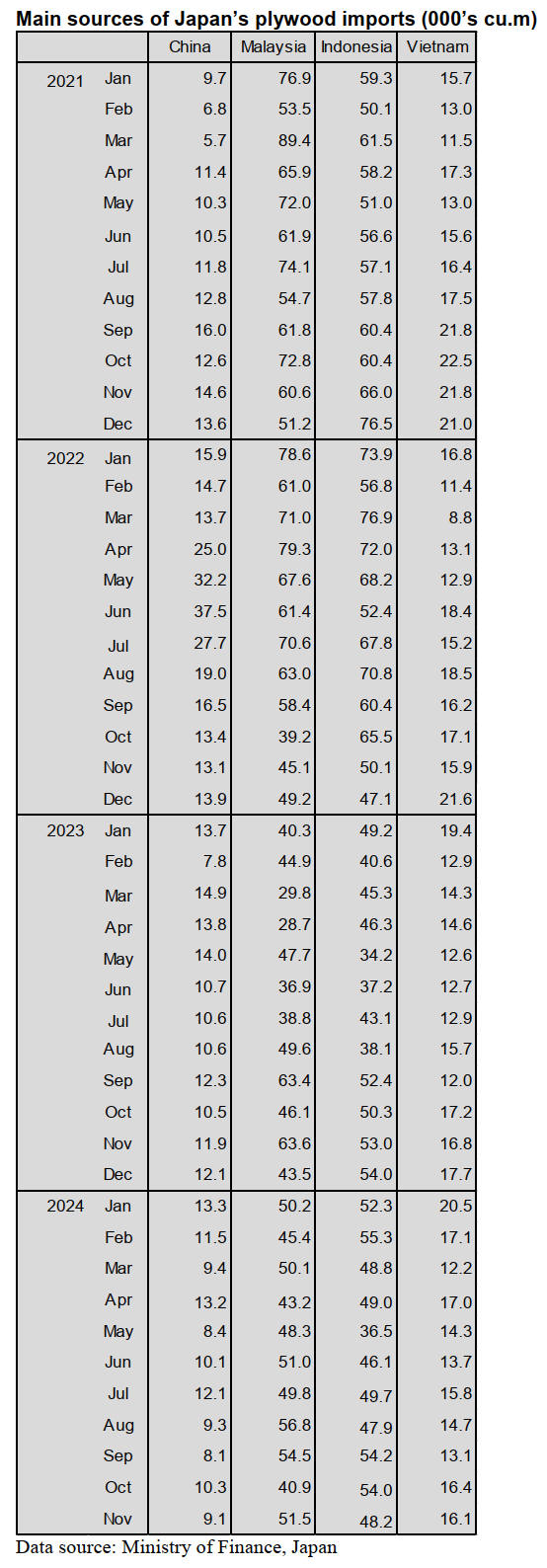

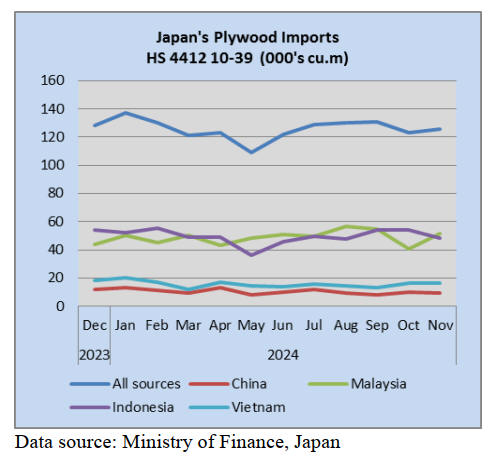

Plywood imports

The volume of November plywood imports (441210-39)

was 126,0020 cu.m (122,810 cu.m in October). This was

around the same level as in November 2023.

Malaysia and Indonesia hold a significant share of Japan’s

plywood imports and in November 2024 accounted for

almost 80% of the total volume of plywood imports. The

other two major suppliers of plywood to Japan in

November 2024 were Vietnam and China.

Arrivals from Vietnam in November totaled 16,075

cu.m,

almost the same volumes as imported in October. Arrivals

of plywood from China amounted to 9,077 cu.m.

Year on year, all but one of the top four suppliers saw a

decline in November import volumes. Month on month,

shipments from Vietnam were maintained but shipments

from Malaysia increased. As in previous months, of the

various categories of plywood imported in November

HS441231 was the largest (87% of total imports) followed

by HS441234 (6%), HS441233 (5%) and HS441239 (2%).

Malaysia and Indonesia accounted for most of the

HS441231 arrivals. Shipments from Vietnam and China

were spread across the categories tracked except in the

case of HS441273 for which China was the only shipper.

Trade news from the Japan Lumber Reports (JLR)

The Japan Lumber Reports (JLR), a subscription trade

journal published every two weeks in English, is

generously allowing the ITTO Tropical Timber Market

Report to reproduce news on the Japanese market

precisely as it appears in the JLR.

For the JLR report please see:

https://jfpj.jp/japan_lumber_reports/

Projection of import wood products

The Japan Lumber Importers Association disclosed

projection of imported wood products for 2024 and the

first half of 2025.

Volume of logs will decrease by 13 % in 2024 but volume

of lumber will increase by 17.2 % in 2024. Volume of

lumber in the first half of 2025 will be 12.5 % less than the

same period last year.

Volume of North American lumber in 2024 is 15.8 % less

than the previous year because a major Douglas fir lumber

manufacturer, Chugoku Lumber Co., Ltd., reduced

production. Chugoku Lumber stopped producing lumber

due to the fire occurred at one of its plants, Kahima plant

inAugust, 2023. Additionally, some other lumber

manufacturers reduced production and the price of

softwood structural plywood dropped.

Also, the sales of softwood structural plywood were not

good so plywood manufacturers stopped using Douglas fir

logs.

Consumers started to purchase domestic logs instead of

NZ logs but radiata pine logs for lumber are popular in

Susaki city, Kochi Prefecture. Volume of South Sea logs

was minimum. There were no Russian logs due to

prohibited exports from Russia.

Imported wood products in 2024 increased except South

Sea products. Volume of glulam is 15.6 % up and of

Russian products is 14.2 % up because the volume of these

products was very low in 2023. European products and

glulam increased because Japanese importers did not order

a lot due to the weak yen and over-stocking in 2023.

Moreover, it was unable to pass the Suez Canal due to

conflicts in the Middle East. Also, there were many

containers from China.

As a result, demand and supply of lumber were

unbalanced because of containers from Europe and China

arrived at once. As for Russian lumber, taruki is still very

popular and the price is high so there are a lot of imported

taruki. North American lumber had been purchased to fill

the inventories but demand for 2 x 4 was stable. A

projection for supplying of imported lumber at the first

half of 2025 will decline by 12.5 % and of imported logs

will rise by 3 %. All kinds of lumber will decline except

NZ and Chilean lumber.

European lumber has been declining since last October

and the inventories will be controlled. Also, the

inventories of North American lumber will be controlled

but it depends on the tariff on wood products between

Canada and the U.S. Lumber manufacturers in Europe and

North America would reduce operations due to high-

priced logs, low-priced lumber and the tariff problem

between Canada and the U.S

Plywood Domestic plywood manufacturers still raise the

price of domestic softwood plywood in February, 2025.

They will raise the price of 12 mm 3 x6 to 1,000 – 1,050

yen, delivered per sheet, from 950 – 980 yen, delivered per

sheet.Some of them plan to raisethe price in March, 2025.

Inquiries to softwood plywood are firm. It is hard to say

that demand for houses is lively but consumers started to

purchase plywood because their inventory became less and

less.

Imported plywood, which was purchased when the yen

was 150 yen against the dollar, has been delivered to

Japan. 12 mm 3 x 6 painted plywood for concrete form

costs 1,850 yen,delivered per sheet.

Form plywood is 1,550 yen, delivered per sheet. Structural

plywood is 1,550 yen. 2.5mm plywood is 750 yen,

delivered per sheet.4mm plywood is 930 yen, delivered

per sheet.5.5 mm plywood is 1,100 yen, delivered per

sheet.

The futures price of some plywood is more than the

price

in Japan so consumers hesitate to purchase plywood.

Malaysian or Indonesian plywood manufacturers expect to

raise the price due to high-priced logs and production

costs. However, Japanese buyers are reluctant to purchase

due to the weak yen.

The price in South Asia is leveled off. 12 mm 3 x 6

painted plywood for concrete form is $580 – 600, C&F per

cbm. Form plywood is US$490–510, C&F per cbm.

Structural plywood is US$500 – 520, C&F per cbm. 2.4

mm 3 x 6 is US$970, C&F per cbm. 3.7 mm plywood is

US$880, C&F per cbm. 5.2 mm plywood is US$850, C&F

per cbm.

Domestic logs and lumber side and it is difficult to cut

down trees.In northern part of Kanto region, 3 m cedar log

is 18,500 yen, delivered per cbm. It is 15,000 yen,

delivered per cbm in Kyushu region.3m medium diameter

cedar log is 17,000 yen, delivered per cbm in the northern

part of Kanto region and is 13,000 – 14,000 yen in Tohoku

region.

In Kyushu region, it is 14,500 yen, delivered per cbm. In

Shikoku region, it is 18,000 – 19,000 yen, delivered per

cbm due to snowfall.

4 m cypress log for sills costs 26,000 yen in Chugoku

region and this is 4,000 yen more than last time. It is

24,500 yen and it is 500 yen up in the northern part of

Kanto region. It is 25,000 yen in Kyushu region and it is

1,000 yen up from last time. Compared to last year, the

price of cedar log in Tohoku and Kyushu regions is 1,000

yen down but the price in the northern part of Kanto

region is 2,500 yen up. Cypress log is 1,000 – 2,000 yen

down in Tokai region and Western Japan.

However, it is 3,000 yen up in Chugoku region and is

2,500 yen up in the northern part of Kanto region. It is

2,000 yen up in Kyushu region.

Domestic lumber is in short. The price of 120 mm square

or Green lumber has been rising since last November.

However, movement of domestic lumber is not lively.

|