|

1.

CENTRAL AND WEST AFRICA

Regional sentiment

Across Gabon, Cameroon and Congo producers say

harvesting is moderate to low, constrained by weak export

demand. Repairs to roads and railways, critical for timber

transport, progress slowly. Power and fuel shortages

continue to challenge industrial operations, particularly in

Gabon’s veneer mills.

The sharp decline in Chinese demand remains the largest

factor affecting production, it is only purchases by

Vietnam and the Philippines that maintain the flow of

orders. In contrast, demand in the Middle East has shown

some slight improvement for certain hardwood species

such as Iroko, Sapelli and other redwoods. Overall,

mid‐February sees the timber sector still in a cautious

mode awaiting more robust international demand and

stability in power/infrastructure to fully resume

production.

Regional up-date

Gabon

Forestry officials in Gabon are moving forward with GPS

marking on sawnwood bundles but there is scepticism

about how effectively this can be enforced in practice. The

requirement to mark every bundle of sawn timber with

GPS data underscores the government’s emphasis on

traceability, even if the current level of on‐the‐ground

enforcement is uncertain. The push toward FSC

certification by the end of the year is adding extra pressure

on operators already dealing with weak demand.

Some veneer and plywood mills in the Nkok Special

Economic Zone are working at reduced capacity, often just

one shift, due to the slow overseas demand and power

disruptions.

Okoume peeler logs are reportedly trading around

70,000 FCFA/cu.m delivered. Good CS‐grade logs can sell

at up to 85,000 FCFA/cu.m. Sawlog prices in the local

market have increased to around 55,000 FCFA/cu.m (up

from 50,000 FCFA).

Ongoing repairs to key routes (such as Ndjole/Bifoun)

remain slow with only one lane open on some stretches.

Companies report that moving timber to Owendo Port can

take 2–3 days due to poor road conditions.

Cameroon

Logging operations have resumed but at reduced levels

due to slow international demand, particularly in China.

The dry season (now until June) should allow for easier

road maintenance but market sentiment remains cautious.

Trucking is reported “back to normal” as key routes have

been repaired, especially the road to Sangmelima, vital for

south‐Congo forest‐sawmill operators heading to the Kribi

Port.

It is reported that Douala Port currently sees fewer logs

arriving from North Congo and the Central African

Republic. Operations at the port are said to be better under

the port’s new management.

Republic of Congo

Production in the north is said to have returned to a

“normal” following the end of seasonal rains yet overall

output remains modest because of weak demand in Asian

and European markets. Chinese buyers have drastically

reduced orders pushing mills in the region to seek

alternative markets. Industries in the Congo suffer

frequent fuel shortages and reduced power supply in urban

areas is a challenge for businesses.

March trade mission to Cameroon

ATIBT will lead a trade mission to Cameroon. This

initiative has been arranged as part of the ASP-Green Pact

with the aim of promoting development of a sustainable,

climate resilient economic model in Cameroon. Support is

provided by the EU as part of the Cameroonian Forest

Governance Improvement Programme (PAMFOR).

ITTO has been advised that registration is still open.

See: https://www.atibt.org/en/news/13586/invitation-to-a-

professional-trip-to-cameroon-commit-to-a-green-economy-with-

the-asp-pacte-vert-project

2.

GHANA

New CEO for Forestry Commission

Stakeholders in the timber industry have applauded the

President appointment of Dr. Hugh C.A. Brown as the

new Chief Executive of Ghana’s Forestry Commission

(FC). Prior to his new appointment Dr. Brown, a

professional forester, served as the Executive Director of

the Forest Services Division of the Commission. The

industry acknowledged Dr. Brown's expertise and

experience in forestry management and anticipate he will

steer the timber industry and the Forestry Commission in

the right direction.

According to timber merchants from Ghana’s timber

producing areas in the Ashanti, Western, Western North

and Ahafo Regions, they are optimistic the new Chief

Executive’s leadership will not only boost the industry but

also contribute to the country's economic growth.

See: https://www.myjoyonline.com/timber-industry-hails-

president-mahamas-appointment-of-new-forestry-commission-

ceo/

and

https://www.peacefmonline.com/article/388379-timber-industry-

hails-president-mahamas-appointment-of-forestry-commission-

ceo

Ghana’s wood product exports decline again

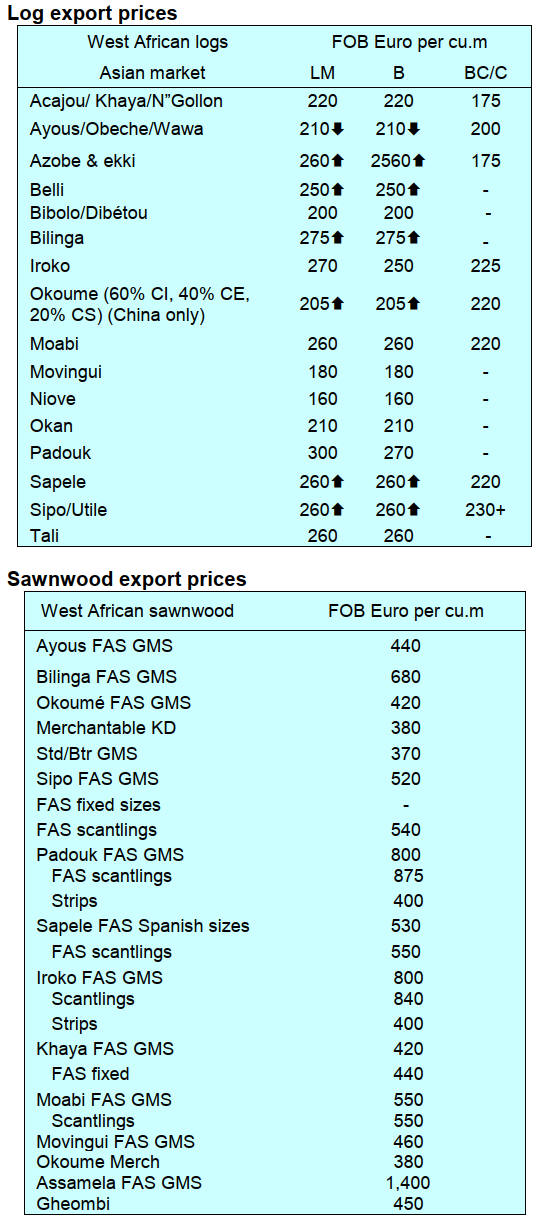

Ghana earned Euro10.22 million from the export of

21,091 cu.m of wood products in December 2024, a

significant decline of nearly 7% in value and 8% in

volume compared to December 2023.

2024 exports earned US$123.47 million from a volume of

272,829 cu.m. of wood and wood products, a drop in

volume (7%) and in value (8%) when compared to same

period 2023.

Air dried sawnwood accounted for 51% of the export

value in 2024 while figures for kiln dried sawnwood were

19%, sliced veneer 6%, billets, plywood (to the regional

market) and mouldings 5% and rotary veneer 4%. These

altogether accounted for 95% (Eur 116.79 million) of total

revenue earned from timber exports.

The major markets for timber from Ghana were India,

Egypt, Vietnam, United States of America, Belgium,

Germany, Senegal, Italy, Burkina Faso and Togo. Others

included United Kingdom, Saudi Arabia and Estonia.

Wawa, ofram, makore, edinam, sapele, denya, ceiba, teak

and gmelina featured prominently in the export of

sawnwood, rotary veneer, sliced veneers billet and

plywood.

Analysis of the 3-year data for 2022, 2023 and 2024

showed a declining export trend in both volumes and

values. One of the main reasons cited for the downtrend

was inadequate raw material.

Air-dried sawnwood accounted for close to 60% of the

total export volume in each of the three years reported and

together with kiln dried accounted for over 70% while

about sixteen other products accounted for the remaining

30% of the total export volume.

Chiefs and traditional authorities involved in fighting

illegal mining

The Minister of Lands and Natural Resources, Emmanuel

Armah-Kofi Buah, has announced his Ministry’s key

objectives among which he has the vision of the roll-out of

a multi-pronged measure to deal with illegal mining

(galamsey) activities in the country.

Speaking at his first meeting with staff and management of

the Ministry in Accra, the Minister enumerated fresh

measures that would aid in his programme to halt illegal

mining activities, restore forest reserves and create a

mining sector that will not damage water bodies.

The Minister did not rule out the strengthening

intelligence-led swoops that had been deployed over the

years to tackle the problem. He added that there would

also be comprehensive and coordinated interventions

involving Chiefs, Metropolitan, Municipal and District

Assemblies (MMDAs), security agencies, civil society

organisations and others to help deal with the root cause of

illegal practices.

According to the Minister, the government’s focus is to

reform the forestry, mining and land sectors and make sure

that Ghanaians have a pathway to legal mining. He tasked

the Forestry Commission to focus on protecting the forest

reserves and to heal degraded forest resources. He

promised reforms at the Lands Commission to make their

services accessible to the people.

He implored on Chiefs and traditional authourities to lead

the fight against galamsey as they will actively be engaged

in the pre- and post-licensing mining periods to keep them

abreast of activities in their jurisdictions.

Meanwhile the Lands Minister, has inaugurated an 18-

member committee to develop a blueprint within two

weeks for the reform of the mining sub-sector.

New Bank of Ghana Governor

The President has nominated Dr. Johnson Asiamah as the

new Governor of the Bank of Ghana (BoG), following the

impending retirement of the current Governor, Dr. Ernest

Addison, who formally requested to proceed on leave

ahead of his retirement. Dr. Asiamah is an economist and

former Deputy Governor of the BoG (2016-2017) with

over 23 years of experience in monetary policy

formulation, financial stability regulation and economic

management.

The First and Second Deputy Governors of the BoG Dr.

Maxwell Opoku-Afar and Mrs. Elsie Addo Awadzi have

also decided to leave ahead of the expiration of their

tenure.

Meanwhile, an International Monetary Fund (IMF) team is

already in the country to hold a series of engagements with

government about the economy. The discussions will

focus on the economy and the 2025 Budget. Ghana has

received about US$1.9 billion to support the economy

since 2023.

See: https://thebftonline.com/2025/01/31/dr-johnson-asiamah-

nominated-as-bog-governor/

and

https://www.myjoyonline.com/imf-begins-talks-with-

government-on-economy-2025-budget-from-today/

3. MALAYSIA

Expanding wood products certification scheme

The Sarawak Timber Association (STA), in its latest

STAReview, reports on the Malaysian Timber Industry

Board (MTIB) engaging the Institute of Tropical Forestry

and Forest Product of Universiti Putra Malaysia to

recommend improved data generation to expand MTIB’s

Wood Product Certification Scheme.

This is part of the Government's efforts to explore

opportunities to expand the certification scheme to include

products that meet the demand in the global market.

In this connection, a roundtable session with stakeholders

was held to exchange ideas and discuss issues related to

requirements, impacts, challenges, opportunities and

relevance of certification in advancing the country's

Sustainable Development Goals.

Discussions included offering incentives to companies that

demonstrate strong commitment to improving product

quality, implementing cost-sharing measures to ease the

financial burden on businesses, ensuring government

recognition of certified products, enhancing market access

for certified product and strengthening collaboration and

synergy among various Government agencies.

See: https://sta.org.my/images/STAReviewDec2024.pdf

The STAReview also reported that the Malaysian Timber

Certification Council (MTCC) organised an inception

workshop for the ‘Promoting Sustainable Wood Use for

the Domestic Market in Malaysia’. The workshop was

attended by policymakers, research institutions, timber

associations and industry players to discuss and provide

inputs on the project inception report.

In his opening remarks, Akmal Saarani, Director (Chain of

Custody) at MTCC announced that this project, funded by

the International Tropical Timber Organization, is an

initiative aimed at enhancing and diversifying domestic

consumption while promoting local markets for

sustainable wood and wood products in Malaysia.

With MTCC appointed by the Ministry of Plantation and

Commodities as the executing agency, this 18-month

project has the ambitious goal of increasing domestic

consumption, improving supply chains and reinforcing

government policies related to the use of sustainable wood

products.

See: https://sta.org.my/images/STAReviewDec2024.pdf

and

https://www.instagram.com/p/DDv0h4OTdwD/?img_index=1

Sabah Timber Industries Association supports

plantation plan

Sabah Timber Industries Association (STIA) reaffirmed its

commitment to support the State Government’s forest

plantation target of planting 400,000 hectares as outlined

in the Forest Plantation Development Action Plan. Its

President, Tan Peng Juan, said this initiative aims to

reduce reliance on natural forest species.

The Forest Plantation Development Action Plan (2022–

2036) is a strategic initiative by the Sabah Forestry

Department aimed at transforming forest plantation

development in Sabah. It was launched in March 2022.

The 15-year plan provides guidance in accordance with

sustainable forest management principles as outlined in the

Sabah Maju Jaya Development Plan (2021–2025) and the

Sabah Forest Policy.

The Sabah timber industry recorded a steady increase in

exports from January to November 2024, with an average

rise of 11% in volume and 6% in value compared to the

same period in 2023.

Japan remained the largest importer accounting for 22% of

the total export value followed by the United States (11%)

and Taiwan P.o.C (9%). Exports to European countries

were negligible contributing only around 2% to total

earnings.

See: https://www.dailyexpress.com.my/news/251404/undefined/

and

https://www.dailyexpress.com.my/news/251406/undefined/

Malaysian International Furniture Fair

The Malaysian International Furniture Fair (MIFF) will

take place on 1-4 March 2025 in the World Trade Centre

Kuala Lumpur (WTCKL) and Malaysia International

Trade & Exhibition Centre (MITEC) in Kuala Lumpur.

The organisers say over 650 furniture manufacturers and

exporters will be exhibiting from Australia, Cambodia,

China, India, Indonesia, Hong Kong, Japan, South Korea,

Taiwan, Thailand, Vietnam, UAE and USA.

See: https://miff.com.my/register-

now/?cid=edm230125NewExh

4.

INDONESIA

Export Benchmark Price (HPE) of Wood for

February

2025

Processed wood (prices per cu.m)

Processed wood products which are leveled on all four

sides so that the surface becomes even and smooth with

the provisions of a cross-sectional area of 1,000 sq.mm to

4,000 sq.mm (ex 4407.11.00 to ex 4407.99.90)

Processed wood products which are leveled on all four

sides so that the surface becomes even and smooth of

Merbau wood with the provisions of a cross-sectional area

of 4000 mm2 to 10000 mm2 (ex 4407.11.00 to ex

4407.99.90) = 1,500 US Dollars/cu.m

See: https://jdih.kemendag.go.id/peraturan/keputusan-menteri-

perdagangan-republik-indonesia-nomor-122-tahun-2025-tentang-

harga-patokan-ekspor-dan-harga-referensi-atas-produk-

pertanian-dan-kehutanan-yang-dikenakan-bea-keluar

Forestry targets 400,000 job creation

The Minister of Forestry, Raja Juli Antoni, said the

government is targeting an investment of IDR19.9 trillion

in the forestry sector which is expected to create 400,000

jobs. This was reported during a meeting with

Commission IV of the Indonesian House of

Representatives. The Minister stated that the theme for the

Ministry of Forestry's development in 2025 is to enhance

forest production and promote downstream activities to

ensure equitable economic development across regions.

The forestry development theme for 2025 aims to achieve

several objectives. The first is to enhance economic

growth by increasing the contribution to GDP and increase

exports by 3-5%t; second, equitable regional development

through increasing the capacity of forest farming groups

by 7-8% and third;, reducing deforestation by 3-4%.

See: https://www.antaranews.com/berita/4605338/menhut-bidik-

investasi-kehutanan-rp1919-triliun-dan-400-ribu-pekerja

18 Companies lose their concession rights

The Minister of Forestry announced the government has

revoked forest management licenses for 18 companies that

collectively controlled 526,144 hectares of land. The

decision was made after it was observed these companies

failed to manage the forests sustainably for the economic

benefit of surrounding communities.

See: https://jakartaglobe.id/business/govt-revokes-concessions-

of-18-companies-controlling-over-half-a-million-hectares-of-

forest-land

and

https://news.detik.com/berita/d-7761324/menhut-cabut-izin-

pemanfaatan-hutan-18-perusahaan

Furniture and craft industry urged - be aware global

challenges

Indonesia's furniture and craft industry is facing significant

challenges due to the global situation, particularly the high

tariff policies by the USA said Fajarini Puntodewi,

Director General of National Export Development at the

Ministry of Trade. He warned that Indonesian products

may struggle to enter the US market adding "our primary

export destinations are the United States, which holds a

market share of 53% and the European Union, accounting

for over 15%.

Within the EU, significant markets include the

Netherlands, Germany, Belgium, France and Spain, we

also export to Asian countries such as Japan, said Fajarini.

The domestic industry must improve as global demand for

furniture and crafts remains promising. The positive

growth trend is projected at 15%. Specifically for furniture

products the global market size reached US$770 billion in

2024 and is expected to reach US$925.46 billion by 2029.

See: https://www.cnbcindonesia.com/news/20250207192419-4-

609001/kemendag-tiba-tiba-minta-industri-mebel-kerajinan-ri-

waspada-ada-apa

New regulation on depositing export earnings a

challenge says association

The Indonesian Furniture and Craft Industry Association

(Himki) stated that the mandatory policy requiring the

depositing of 100% of foreign exchange proceeds from

export within one year could negatively impact the

national furniture and craft industry which is export-

oriented, labour-intensive and closely integrated with the

global supply chain.

Export proceeds are essential for business capital,

including for the purchase of high-tech production

machines which also require access to foreign exchange

because they have to be imported.

Business stakeholders are currently concerned about the

requirement to deposit export earnings in domestic

accounts as this could restrict their access to foreign

currency. Additionally, fluctuations in exchange rates

could negatively impact exporters when converting

currencies.

There are also risks to cash flow and the long-term

sustainability of the business according to the Association

as company's liquidity could be affected, particularly for

small SME exporters who rely heavily on the flexibility of

deposits for their operational and expansion needs.

The Association has requested the government carefully

consider this policy to ensure it does not impede exporters

in the creative industry sector who require significant

support from the government. He hopes a scheme will be

established allowing companies to withdraw foreign

currency in specific amounts without time limits provided

it is used for productive purposes.

See:https://www.msn.com/id-id/berita/other/industri-mebel-

waswas-kebijakan-wajib-parkir-dhe-1-tahun-bikin-modal-

seret/ar-AA1yshsV?ocid=BingNewsVerp

Promotion in the Middle East and Africa, APHI Visits

ITPC Dubai

Secretary General of the Indonesian Forestry

Entrepreneurs Association (APHI), Purwadi Soeprihanto,

visited the Indonesia Trade Promotion Center (ITPC)

Dubai, United Arab Emirates to strengthen the promotion

of wood products to the Middle East and African markets.

In a statement he said “Dubai is a potential hub for the

Middle East and Africa markets."

Importers met represented two market categories in Dubai,

namely the niche market for high-end hotels, apartments

and residences represented by Fakih Group and Tarrab

Group and the retail market represented by Rahmani

Group.

See: https://forestinsights.id/promosi-produk-kayu-di-timur-

tengah-dan-afrika-aphi-kunjungi-itpc-dubai/#

Agroforestry to achieve food self-sufficiency

The Indonesian government has opted to promote and

adopt the agroforestry approach to cultivate gogo-type

(dry) paddy on 1.1 million hectares across the country to

achieve self-sufficiency in food. Speaking in Indramayu,

West Java, Forestry Minister, Raja Juli Antoni, stated that

his Ministry is collaborating with the Ministry of

Agriculture to execute this initiative.

The Minister then stated that his Ministry also identified

an additional 1.4 million hectares of land suitable for corn

cultivation. Meanwhile, Agriculture Minister, Andi Amran

Sulaiman, commended the Forestry Ministry for endorsing

agroforestry to ramp up food production.He emphasised

that synergy between the forestry and agriculture sectors is

key for Indonesia to solidify its food security.

See: https://forestinsights.id/dukung-ketahanan-pangan-

kemenhut-kementan-garap-agroforestry-perhutanan-sosial/#

Indonesia introduced multi-business Sustainable

Forest Management

At the ‘Forest Governance, Markets and Climate (FGMC)

Stakeholder Forum 2025’ in London, Indonesia unveiled

its Multi-Business Forestry Scheme to promote sustainable

forest management. Agus Justianto explained that in

Indonesia traditional forest management faces the

challenges of deforestation, loss of biodiversity and

tenurial conflicts and that a transformation of forest

management policies is needed.

Agus explained the transformation of forest management

in Indonesia involves first reorienting forest management

with a sustainable forest management approach and

community involvement. Indonesia, said Agus, is

currently transforming its forest management policy by

implementing Multi-Business Forestry (MUK) which is

oriented towards forest landscape management.

By implementing MUK, forestry concessions can carry

out various business activities in the form of utilising

wood and non-wood forest products, environmental

service and utilising areas to optimise the potential of

forest products," said Agus. Through MUK, community

involvement in forest management will also be more open.

This is because forestry concessions (Forest Utilization

Business Permits/PBPH) can implement agroforestry to

develop non-forestry commodities while still paying

attention to forest sustainability.

See: https://forestinsights.id/di-fgmc-stakeholder-forum-

indonesia-ekspos-skema-multi-usaha-kehutanan-untuk-

pengelolaan-hutan-lestari/#

5.

MYANMAR

Export sawnwood specification amended

In August 2022, when the classification of primary wood-

based products was announced, the sectional area of sawn

timber with a size of 24 square inches and a maximum

width of 4 inches was classified as semi-finished and

eligible for export. Recently, the specification for the

sectional area was increased to 36 square inches.

However, it is understood that timber exceeding 24 square

inches is subject to a Special Goods Tax of 5%. Since

Myanmar's wood-processing sector is predominantly

based on primary processing, increasing the limit may

result in higher production yields.

Wood based industries

In 2015-16, there were approximately 333 wood-based

industries in Myanmar, 12 of which were foreign ventures.

Following the sanctions imposed on Myanmar Timber

Enterprise (MTE) after 2021 and the resulting near

collapse of exports to major markets, it is now believed

that fewer than ten export-oriented factories remain.

In addition, Myanmar's state owned woodbased industries

were under the control of Myanmar Timber Enterprise.

Until 2014, MTE operated 65 sawmills and 18 woodbased

industries, and it reserved certain logs for use in these

mills.

In 2014-15 MTE began selling more logs to the private

sectorwith the exception of small quantities reserved for

few sawmills that were required to produce for state

projects and needs. Most MTE sawmills and woodbased

industries are now leased to the private sector.

Trade surplus forecast

Myanmar estimates that there will be a trade surplus in the

2024-2025 fiscal year as a result of the prospect of exports

surpassing import, according to 2024-2025 Fiscal Year’s

Financial Policy Paper released by the Budget Department

under the Ministry of Planning and Finance.

The paper stated that the export value is anticipated at

US$16.7 billion, the import value is US$16.3 billion, and

the trade surplus is US$400 million. The Minister of

Commerce and Industry, Htun Ohn, said that 60% of the

export target had been achieved between April and

November in the 2024-2025 fiscal year.

Myanmar mainly exports rice, pulses, seafood and

clothing while importing capital goods, industrial raw

materials and consumer good. In the last fiscal year the

country earned about US$14.614 billion from exports.

The export drive will face a major hurdle as many young

workers have left the country to avoid conscription into

the armed forces and this is severely impacting

Myanmar’s garment industry. Garment factories are

reporting a 20% drop in production as recruiting new

workers and finding skilled labor becomes increasingly

difficult.

See- https://eng.mizzima.com/2024/12/22/17572

and

See- https://www.irrawaddy.com/business/economy/myanmars-

garment-industry-unravelling-amid-chronic-labor-shortage.html

Emergency rule extended

The State Administration Council has extended the four-

year emergency rule delaying plans for long-promised

general elections. The National Defence and Security

Council extended a state of emergency for another six

months until 31 July according to a government statement

The emergency rule has now been extended for six times.

The regional media has reported China is playing a key

role in brokering peace talks between the administration

and ethnic armed groups the latest being a ceasefire

agreement with the Myanmar National Democratic

Alliance Army.

See-

https://www.businesstimes.com.sg/international/asean/myanmar

-generals-extend-emergency-rule-again-delaying-polls

In related news, the Jakarta Post published a long article

saying ASEAN must move beyond empty diplomacy and

hold Myanmar’s military accountable.

See- https://www.thejakartapost.com/opinion/2025/02/12/time-

to-end-aseans-accommodative-approach-in-myanmar.html

Formation of development commissions amid

deepening economic crisis

The administration has announced three new development

commissions as the country grapples with severe

infrastructure and economic challenges. The Electricity

and Energy Development Commission, chaired by Deputy

Prime Minister General Tin Aung San, aims to address the

nation’s critical power shortages.

The power crisis has triggered factory closures across

industrial zones prompting the formation of the Industrial

Development Commission. This commission is led by

Deputy Prime Minister and Union Minister for Transport

and Communications, General Mya Tun Oo.

Additionally, the administration established the

Agriculture and Livestock Development Commission

chaired by General Nyo Saw, a member of the military

council. These commissions emerge as Myanmar’s

economy faces significant challenges.

See- https://eng.mizzima.com/2024/12/21/17551

6.

INDIA

Sawnwood price continues

to climb

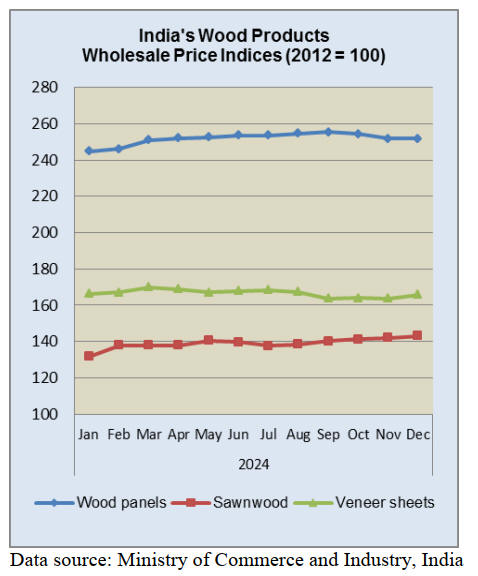

The annual rate of inflation based on the India Wholesale

Price Index (WPI) was 2.37% in December 2024. The

positive rate of inflation in December 2024 was primarily

due to increase in prices of food articles, manufactured

food products, other manufacturing, manufacture of

textiles and non-food articles.

The index for the manufacturing sector in December 2024

was the same as that in November. Out of the 22 groups

for manufactured products 11 saw an increase in prices, 9

a decrease and 2 groups, including wood panels, saw no

change in prices.

Some of the important groups that showed month on

month price increases were sawnwood, wood veneers,

textiles, fabricated metal products except machinery &

equipment), other non-metallic mineral products, motor

vehicles, chemicals and chemical products.

Some of the groups that saw declining prices were basic

metals, food products and furniture.

See: https://eaindustry.nic.in/pdf_files/cmonthly.pdf

Tax cuts to drive consumption

In announcing the annual budget Finance Minister,

Nirmala Sitharaman, indicated the government will cut

personal income tax rates to spur middle-class spending

and accelerate growth. India's economy is projected to

expand by 6.4% in the current financial year, the weakest

pace in four years currently, consumers facing with high

food price inflation.

Interest rate cut, first in five years

The private sector has welcomed the Reserve Bank of

India’s decision to lower interest rate for the first time in

nearly five years saying this will complement the

consumption-boosting measures announced in the budget

to support fading growth in the hope that inflation will

ease to 4.4% in the first quarter and be a steady 4.2%

through 2025-26.

https://www.thehindu.com/business/Economy/rbi-

monetary-policy-committee-meeting-

friday/article69190903.ece#cxrecs_s

Panel prices to be raised

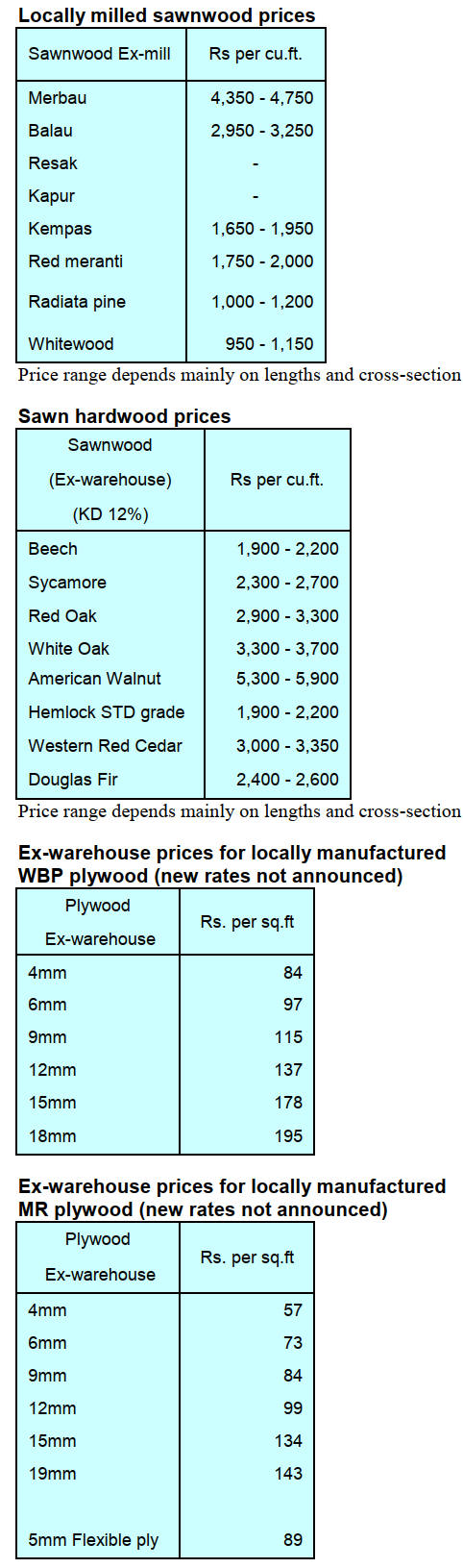

The Kandla Timber Association (KTA) has announced

that due to rising raw material costs, inflation and rising

log prices producers have been compelled to increase

plywood prices by 5 % and flush door and blockboard

prices have been raised by Rs3/sq. ft.

The decision to increase the prices was taken jointly by

members of the Kandla Timber Association (KTA) and

members of Haryana Plywood Manufacturers Association

(HPMA). Both are leading associations in the Indian wood

panel industry and say that due to significant increases in

the cost of raw materials, including timber, resin and rising

labour cost the decision has been made by all the members

to implement a price increase on plywood products.

The rise in timber prices, combined with escalating resin

and labour costs, has made this change necessary to

maintain the quality and consistent supply of the product.

The Associations say “while we understand that price

increases can be challenging this decision has been made

collectively to ensure the continued sustainability of the

industry.

In related news, members of the All India Plywood

Manufacturers Association (AIPMA) has decided to

increase the rate of Shuttering Plywood (12mm) by

Rs3/sq. ft. the price of other thicknesses will be increased

prorata.

The decision to increase prices was unanimously taken

after rigorous discussions among plywood manufacturers.

It was been noted that increased raw material prices and

the high moisture content of logs aggravate the situation.

Both decisions are applicable with immediate effect and

no order will be accepted by any member at old rates. It is

very likely that prices will be reviewed again at the next

meeting following the continued increase in the log prices.

7.

VIETNAM

Wood and wood product (W&WP)

trade highlights

title

Vietnam’s W&WP exports to the US in December 2024

reached US$887.4 million, up 7% compared to November

2024 and up 19% compared to December 2023.

Vietnam’s imports of raw wood (logs and sawnwood) in

December 2024 amounted to 506,900 cu.m, worth

US$162.7 million, up 8% in volume and 8% in value

compared to November 2024. Compared to December

2023 imports increased by 37% in volume and 34% in

value. In 2024 imports weret 5.59 million cu.m, worth

US$1.81 billion, up 26% in volume and 20% in value

compared to 2023.

Vietnam's pine imports in December 2024 totalled 70,100

cu.m, worth US$15.0 million, down 17% in volume and

21% in value compared to November 2024. Compared to

December 2023 imports increased by 53% in volume and

43% in value. In 2024 imports of pine totalled 975,600

cu.m, worth US$218.2 million, up 38% in volume and

41% in value compared to 2023.

Vietnam’s NTFP exports in December 2024 increased for

the second consecutive month reaching US$80.29 million,

up 19% compared to November 2024 and up 13% over the

same period in 2023. In 2024 NTFP exports were valued

at US$803.08 million, up 10% compared to 2023.

Spectacular export performance in 2024

The wood products industry experienced a spectacular

export performance in 2024 following a sharp 16% decline

during 2023 said Ngo Sy Hoai, Vice Chairman and

Secretary General of the Viet Nam Timber and Forest

Product Association (VIFOREST).

Despite the success challenges are ahead as both the EU

and US markets increasingly demand stricter traceability

of wood origin. Alongside enforcing green growth and

digital transformation criteria Ngo said that VIFOREST

will prioritise enhancing trade defense capabilities for

businesses in an effort to drive the industry forward.

VIFOREST will work with the Trade Remedies Authority

and Vietnamese trade offices overseas to issue timely

warnings and help businesses avoid trade defense cases.

Tran Quang Bao, Director General of the Department of

Forestry under the Ministry of Agriculture and Rural

Development, will promote Vietnam’s Timber Legality

Assurance System (VNTLAS), strengthen links across the

supply chain from forest growers to processing and export

enterprises and support businesses in engaging in

international trade fairs to secure contracts and promote

Vietnamese wood products.

In addition to building high-tech processing zones,

expanding export market share, proactively promoting

trade in wood and wood products in major markets,

developing sales through e-commerce channels.

The wood industry needs to pay more attention and invest

in raw material sources. Specifically, it is necessary to

develop more large timber plantations, sustainably

managed forests and certified forests.

See: https://en.baochinhphu.vn/wood-industry-eyes-us18-billion-

export-turnover-in-2025-11125011315534835.htm

Wood production and sustainable forest management

Wood production in Vietnam in 2024 was estimated to

have reached 23.3 million cubic metres, up from 20.8

million cubic metres in 2023. This growth reflects the

country’s continuous investment in forestry and expanding

plantation areas.

A significant portion of the timber harvested in Vietnam

comes from plantation forests, which account for over

80% of the total output. The shift towards plantation

forestry has been a deliberate strategy aimed at reducing

pressure on natural forests while meeting the rising

demand for raw materials. The government’s afforestation

programmes and incentives for private sector participation

have contributed to this outcome.

One of the most prominent trends in Vietnam’s wood

industry is the focus on sustainable forest management and

the use of certified wood. As global consumers

increasingly demand environmentally responsible

products, Vietnamese manufacturers are adopting

international standards such as the Forest Stewardship

Council (FSC) certification. By 2024, over 1 million

hectares of forests in Vietnam will be FSC-certified,

reflecting the country’s commitment to sustainable

practices.

Another trend is the rising adoption of technology in wood

processing and manufacturing. Many companies are

investing in advanced machinery and automation to

improve efficiency, reduce waste and meet the stringent

quality requirements in export markets. Additionally, the

shift towards high-value-added products, such as custom-

designed furniture, has gained momentum as

manufacturers seek to enhance their competitiveness.

Wooden furniture continues to dominate Vietnam’s wood

product exports, accounting for over 60% of total exports.

This growth has been driven by high demand in key

markets such as the United States, China, Japan, and South

Korea. The United States remains the largest market,

driven by high demand for furniture and home goods.

China plays a key role as both a market and a processing

hub for Vietnamese wood products. Japan and South

Korea continue to grow as significant markets. Demand in

European Union has expanded driven by the EU-Vietnam

Free Trade Agreement (EVFTA), which has reduced

tariffs on Vietnamese wood products.

Challenges and prospects for the wood industries

Despite its impressive growth Vietnam’s wood industry

faces several challenges. One major issue is the increasing

scrutiny of the legality of timber sources.

With stringent international regulations, such as the EU’s

Deforestation Regulation, Vietnamese exporters must

ensure that their products comply with these requirements.

Non-compliance could lead to trade restrictions and loss of

market access.

Another challenge is the rising cost of raw materials and

labour. As Vietnam’s economy grows wages have been

increasing putting pressure on profit margins. Moreover,

the reliance on imported wood materials exposes the

industry to fluctuations in global supply and prices.

Climate change is also a looming threat with unpredictable

weather patterns affecting timber yields and quality.

Addressing these issues requires investments in climate-

resilient forestry practices and technologies.

Looking ahead, the prospects for Vietnam’s wood industry

remain positive. The global demand for wooden furniture

and sustainable products is expected to grow, offering

ample opportunities for Vietnamese manufacturers.

Government support in the form of favorable policies,

trade agreements and financial incentives will further

bolster the sector.

Moreover, the increasing urbanisation and middle-class

growth in Asia, particularly in China and India, present

untapped markets for Vietnamese wood products. By

diversifying their market base and focusing on innovation,

Vietnamese companies can reduce reliance on traditional

markets and ensure long-term sustainability.

In 2025 Vietnam’s wood products market will continue to

thrive, driven by steady timber output, robust export

performance and adoption of sustainable practices. While

challenges such as regulatory compliance and rising costs

persist the industry’s resilience and adaptability offers a

promising outlook. By embracing innovation and

sustainability, Vietnam is well-positioned to maintain its

status as a global leader in the wood products industry.

See: https://b-company.jp/vietnam-wood-industry-in-2024-and-

prospects-for-sustainable-development/

Fund for forestry development programme

The Ministry of Finance is currently seeking public

feedback on a draft Circular amending and supplementing

certain articles of Circular No. 21 which regulates the

management and use of operational funds for the

implementation of the sustainable Forestry Development

Programme.

The draft adds regulations on funding for activities related

to forest protection, forest development, improving forest

productivity and quality and sustainable forest

management (added as Article 3a) as follows:

Funding will be for activities that protect special-use

forests, support livelihood development, improve the lives

of people in buffer zones of special-use forests, protect

forests and support the protection of natural production

forests during forest closures.

It also covers activities such as promoting natural

regeneration, supporting the development of sustainable

forest management plans, obtaining sustainable forest

management certification and supporting scattered tree

planting and contracted forest protection.

The content and level of funding will follow Decree No.

58/2024/NĐ-CP dated May 24, 2024, on certain

investment policies in forestry and the guidance from the

Ministry of Agriculture and Rural Development (MARD)

outlined in the Circular regulating certain forestry

activities under the Sustainable Forestry Development

Program and the National Target Program for Socio-

Economic Development in Ethnic Minority and

Mountainous Areas for 2021-2030.

See: https://vietnamagriculture.nongnghiep.vn/new-proposal-on-

fund-using-for-sustainable-forestry-development-program-

d402295.html

8. BRAZIL

Periodic halt to native timber harvesting

The ban on harvesting in the natural forests in Mato

Grosso State runs from 1 February to 1 April during the

rainy period to protect the soil when it is more susceptible

to degradation due to the use of heavy machinery.

This restriction was established by Resolution No.

406/2009 of CONAMA (National Environmental Council)

and regulated in the state by Resolution No. 10/2017 of

SEMA-MT (State Environmental Secretariat of Mato

Grosso) which mandates that competent environmental

authorities define the periods of restricted logging,

skidding and log transportation.

However, the transportation of logs from log yards is

allowed, provided that the logs were registered in the

System for Forest Products Trade and Transport (Sisflora)

before the prohibition period.

Currently, approximately 6% of Mato Grosso’s territory is

under Sustainable Forest Management Plans (SFMP ) with

a target of reaching 6 million hectares by 2030.

The adoption of SFMP helps promote sustainable forest

use, environmental conservation and socioeconomic

development and prevents degradation and deforestation.

See: https://forestnews.com.br/comeca-periodo-proibitivo-da-

colheita-de-madeira-nativa-em-mato-grosso/

Pará advances with concessions for forest restoration

The State of Pará in the Amazon region is developing a

State Concession Programme for Forest Restoration as

part of the Native Vegetation Recovery Plan (PRVN).

During a recent meeting at the Secretariat of Environment

and Sustainability (SEMAS) a map of new areas that may

be granted to the private sector was presented along with

the integration of this initiative into other public policies

and the definition of additional technical aspects of the

project.

The foundation of the programme is based on the

concession notice issued during COP 29 of the UNFCCC

last year which aims to restore over 10,000 hectares

located in the Triunfo do Xingu Environmental Protection

Area (APA) in Altamira municipality, known as the

Triunfo do Xingu Restoration Unit (URTX).

According to SEMAS one of the main goals is to

designate over 100,000 hectares of public land to the

Restoration Unit Concession Programme by 2026.

One of the key features of the URTX project is the

Integrated Action Plan which seeks to improve the quality

of life for local communities through investments in

security, education, logistics, healthcare, infrastructure,

public services and environmental and land regularisation.

See: https://forestnews.com.br/para-prepara-programa-de-

concessoes-para-restauracao-florestal/

Cooperation on environmental governance in the

Amazon

The Ministry of Foreign Affairs (MRE) has published a

technical cooperation agreement with Germany for the

implementation of the ‘Technical Cooperation Project on

Land Governance and Environmental Control in the

Amazon’. It is reported the German government will

invest EUR2.5 million to the project with execution led by

the Ministry of Agrarian Development and Family

Agriculture (MDA). The Brazilian Cooperation Agency of

the Ministry of Foreign Affairs (ABC/MRE) will

coordinate and oversee activities.

Germany is a strategic partner of Brazil in technical

cooperation programmes. According to ABC/MRE,

priority areas include projects focused on tropical forests,

energy efficiency and renewable energy.

Under this agreement on land governance and

environmental management in the Amazon the Brazilian

government will provide non-financial counterpart support

including the assignment of MDA personnel at both

operational and managerial levels as well as physical

facilities and equipment.

The agreement also includes tax exemptions and exclusive

immunities and protections for the German technical staff

involved.

The agreement is valid for six years, extendable for an

additional two years but it will be annulled if an Execution

Commitment Term is not formalised by November 30,

2028.

After Norway, which has contributed BRL3.4 billion to

the Amazon Fund since 2009, Germany is the second-

largest donor with a contribution of BRL387.859 million.

The third-largest contributor is the United Kingdom with

nearly BRL284 million.

See: https://agenciacenarium.com.br/acordo-com-alemanha-

preve-r-155-milhoes-para-governanca-na-amazonia/

ABIMCI highlights obstacles to exporting

In January the Brazilian Association of Mechanically

Processed Timber Industry (ABIMCI) released the 2024

export summary to its member companies. The document

compiles official data from the Foreign Trade Secretariat

of the Ministry of Development, Industry, Trade and

Services (Secex/MDIC) including consolidated export

figures, historical series for each segment and key

destinations.

The summary aims to provide its members with essential

information to help them plan and develop their strategies

for 2025 further strengthening their position in global

trade.

ABIMCI notes satisfying demand in 2024 was challenging

due to significant factors such as logistical and port

bottlenecks, strikes by government agency employees

involved in export processes and the threat of dockers´

strikes in the United States, which affected the global trade

scenario last year.

The complex landscape of the logistics and port crisis

presents multiple variables, for which unfortunately, there

are no short-term solutions. Infrastructure improvements

to enhance service efficiency require planning and

medium to long-term investments.

These challenges are expected to continue throughout

2025 along with tariff and non-tariff trade barriers that

continue to impact the sector, uncertainties regarding the

new US administration and adaptation to the EUDR.

See:

https://abilink.abimci.com.br/ev/PTZmt/BM6/8ce5/w8KE9Kx7y

k/BQyw/

For the export summary see: Resumos-das-exportacoes-Ano-

2024.pdf

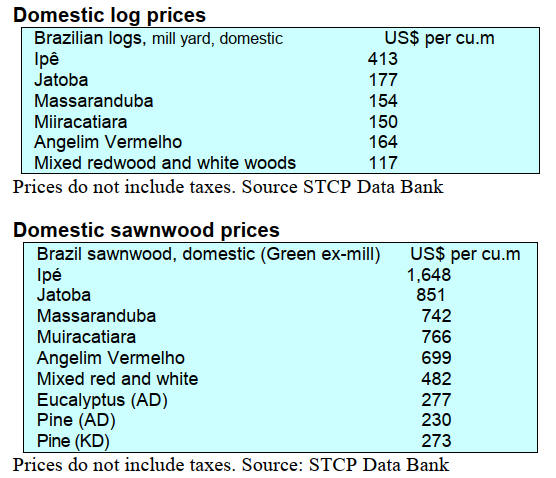

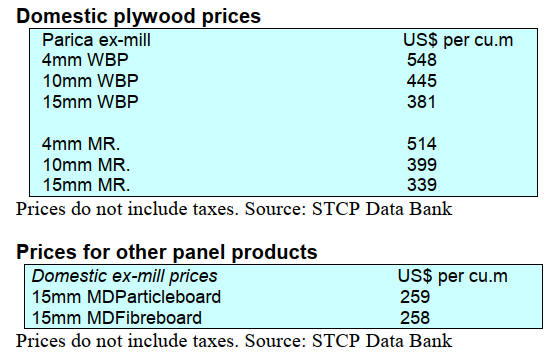

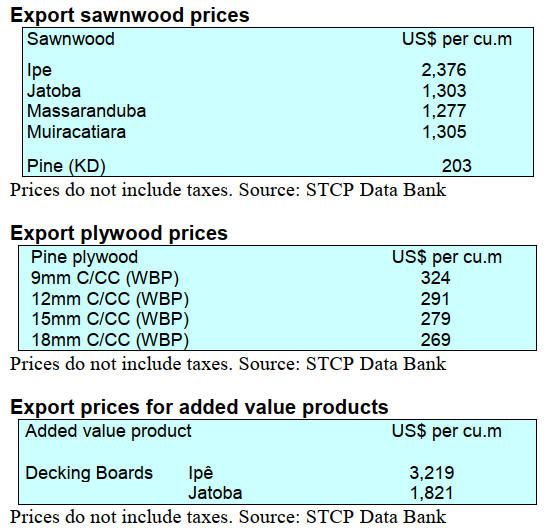

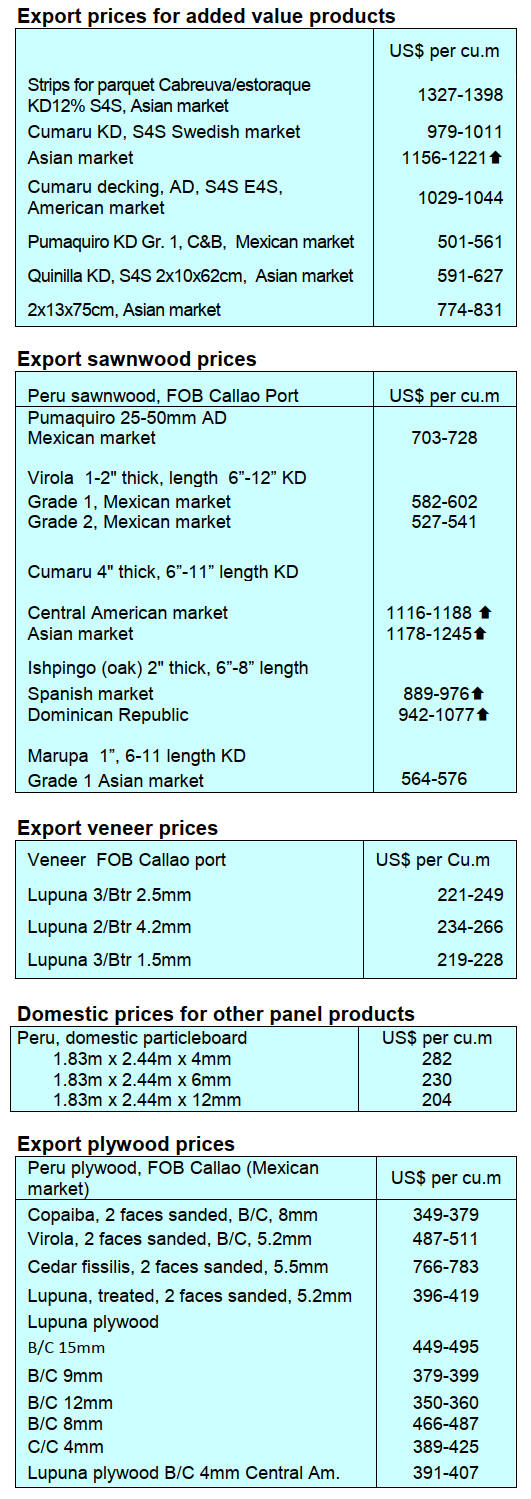

Export prices

Average FOB prices Belém/PA, Paranaguá/PR,

Navegantes/SC and Itajaí/SC Ports.

9. PERU

Profiled wood exports

increase

According to information provided by the Services and

Extractive Industries Management of the Exporters

Association (ADEX), shipments of “profiled wood, except

ipé, molded wood, planks and friezes for parquet”,

amounted to US$16.9 million in 2024, increasing by

almost 10% compared to 2023 (US$15.3 million).

European countries imported the highest value with 43%

shipped to France earning US$7.2 million, a year on year

decrease of 4%. According to figures from ADEX's Data

Trade Business Intelligence System, the other 3 main

importers were Denmark (US$2.1 million, up 42% year on

year) and Belgium (US$1.7 million but down year on year

by 23%).

The US imported US$973,000, China with US$911,000,

Mexico US$821,000, Germany US$711,000, New

Zealand US$331,000, South Korea US$318,000 and South

Africa US$241,000.

The information from ADEX highlighted that a large

part

of the shipments were made from Lima Port (44%).

The tariff heading that groups semi-manufactured profiled

wood products was the most important in the wood sector,

with shihuahuaco decking as the outstanding product. The

inclusion of shihuahuaco (Dipteryx spp.) in Appendix II of

CITES impacted the trade at the end of last year

generating an increase in demand in the US and France.

In addition, European countries brought forward their

orders in order to ensure the timely supply of this highly

valued resource.

SERFOR and OSINFOR extend cooperation

In order to strengthen the forestry and wildlife sector of

the country the National Forestry and Wildlife Service

(SERFOR) and the Agency for the Supervision of Forestry

and Wildlife Resources (OSINFOR0 renewed their

Interinstitutional Cooperation Agreement to continue

promoting a legal and competitive forestry and wildlife

sector.

The agreement was renewed and will run to 2030. The

heads of both entities emphasised that, thanks to this

strategic alliance, the expectations of users can be met and

coordinated work can be generated with local and regional

governments, since the aim is to decentralise management

in the sector.

Activities were supported by German Cooperation GIZ

and other international agencies such as JICA, SECO

SUIZA IICA, CIFOR- ICRAF and the Executive Board of

the Ministry of Economy and Finance.

See: https://www.gob.pe/institucion/osinfor/noticias/1103602-

serfor-y-osinfor-suscriben-adenda-de-convenio-para-seguir-

impulsando-el-sector-forestal-y-de-fauna-silvestre-legal

Industrialists to attend Interzum Guangzhou

In March Asia's influential fair Interzum Guangzhou for

the furniture, woodworking machinery and interior

decoration sectors will be held together with the China

International Furniture Fair. A group of Peruvian wood

businessmen will also be present thanks to the Peruvian

consulting firm Tropical Forest Peru, organiser of their

attendance.

Peruvian wooden furniture imports grow

Peruvian wooden furniture imports experienced

remarkable growth in 2024 reaching a total of US$57.62

million, an increase of 48% compared to 2023 (US$ 38.04

million).

Brazil was the main supplier with an increase of 53% in

exports to Peru reaching US$36.65 million. China

followed with an increase of 32% adding another US$8.4

million. In addition, Spain US$2.03 million and Chile

US$1.81 million.

|