|

Report from

Europe

European furniture production falls to a new low

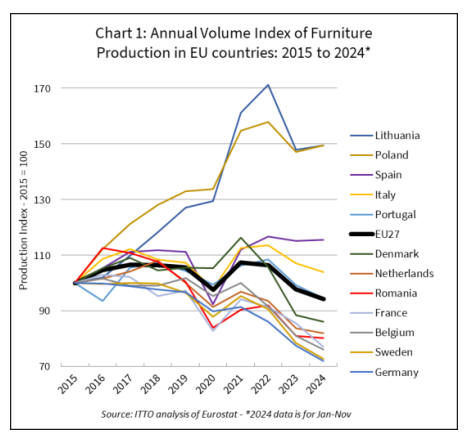

2024 was a challenging one for the European furniture

sector. According to Eurostat data the value of furniture

production in the EU27 fell 3-4%. This followed an 8%

decline the previous year. Production in the EU last year

was lower than in 2020 at the height of the pandemic

(Chart 1).

Over past two years Europe has faced increased

uncertainty, sluggish economic performance and a marked

slowdown in the construction industry. As a result,

European consumer demand for furniture has come under

considerable strain.

Despite falling inflation European furniture consumption

has continued to suffer from the erosion of household

purchasing power, the propensity for consumers to save

and the erosion of real financial wealth. Consumers are

also now more inclined to spend the disposable income

that they do have on travel and eating out, activities

precluded during the pandemic, rather than on furniture

products which they invested in heavily during 2021 and

2022 in the wake of the COVID lockdowns.

The costs of producing furniture in Europe also remained

high in 2024. High energy prices, costs of capital and

rising labour costs could not be passed onto customers,

greatly reducing profitability.

Export market competitiveness was impaired and market

prospects, particularly in the US, China and the Middle

East, were cooling and not buoyant enough to support

European production.

While the overall European trend has been sharply

downwards, furniture sector performance has varied

between European countries in recent times. Eurostat data

shows that while overall EU27 furniture production in

2024 was below the level prevailing in 2019, production in

Lithuania, Poland, Spain and Italy remains above the pre-

pandemic level. Production in the first three of those

countries increased last year.

However, production in many other countries is now well

below the pre-pandemic level and continued to decline last

year, including in Germany, Sweden, Belgium, France,

Romania, Netherlands and Denmark (Chart 2).

European furniture exports remain flat - imports rising

The latest Eurostat and UK trade data shows that European

exports of wooden furniture to countries outside the

region, after falling rapidly in 2022, remained flat

throughout 2023 and 2024. However, European imports of

wooden furniture from other parts of the world began to

increase in the second half of 2023, a trend which

continued throughout 2024.

In fact, imports from outside the region last year were

close to those at the height of the boom in 2021 and 2022.

Internal European trade in wooden furniture, which was

slowing in 2023 and the opening months of 2024, also

began to rise in the second half of last year (Chart 2).

China drives rise in European furniture imports in 2024

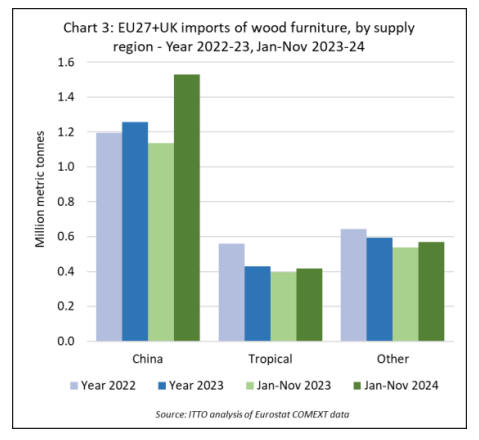

Closer analysis of the data reveals that the recent growth

in wooden furniture imports into the EU27+UK has been

driven almost entirely by China. Imports into Europe from

China increased by 5% to 1.26 million tonnes in 2023 and

were up by more than 35% to 1.53 million tonnes in the

January to November period last year.

In contrast imports from tropical countries fell by 23% to

430,000 tonnes in 2023 and were up only 6% in the

January to November period last year. Imports from all

other countries (mainly non-EU European countries and

Turkey) decreased 8% to 590,000 tonnes in 2023 and

increased by 6% to 570,000 tonnes in the January to

November period last year (Chart 3).

Wooden furniture imports from China have increased both

into the UK, the largest single wooden furniture importing

country in Europe, and into the EU. UK imports from

China increased 13% to 417,000 tonnes in 2023 and were

up another 16% to 445,000 tonnes in the January to

November period last year. EU imports from China were

up only 3% in 2023 to 833,000 tonnes but increased 44%

to 1,090,000 tonnes in the January to November period

last year.

Imports of wooden furniture from China increased very

sharply into all the main EU markets last year including

France (+35% to 236,000 tonnes), the Netherlands (+65%

to 202,000 tonnes), Germany (+34% to 192,000 tonnes),

Spain (+46% to 82,000 tonnes), Belgium (+65% to 71,000

tonnes), Italy (+28% to 59,000 tonnes), and Poland (+40%

to 57,000 tonnes).

The rise in Chinese wooden furniture imports into

European countries in 2023 and 2024 is partly explained

by the fact that it followed a big decline in 2022 when

Chinese exports were seriously impacted by rigorous

lockdowns during the pandemic. And while high

production costs are impeding the international

competitiveness of European furniture products, the

competitiveness of Chinese products is benefiting from

continual improvements in technical performance,

manufacturing efficiency, quality management, and from

increasing investment in advertising and marketing.

The accelerating pace of imports from China during 2024,

at a time when underlying European consumption was

slow, may also be related to EUDR as European importers

were building stock before enforcement of that law was

expected to begin on 30 December 2024.

The EU has now delayed the date of EUDR application

until 30 December 2025 but that decision was only

confirmed at the very end of last year. The full impact of

EUDR on EU imports of composite products like furniture

remains to be seen but is likely to be very significant given

the challenges of meeting the far-reaching traceability

requirements.

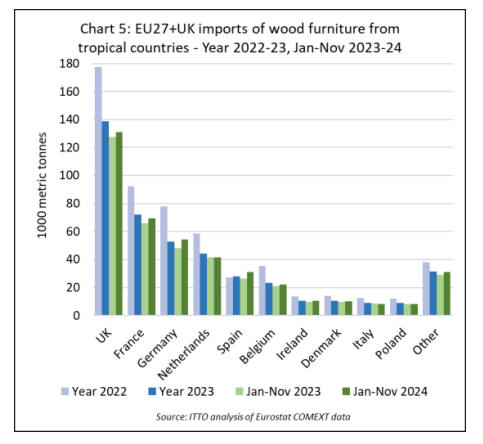

European imports of tropical wooden furniture recover

lost ground

Following a steep decline in 2023, European imports of

wooden furniture from the largest tropical supplying

countries recovered some lost ground in 2024 (Chart 4). In

the January to November period last year, EU27+UK

imports from Vietnam were 148,000 tonnes, up 9%

compared to the same period in 2023.

Imports increased 21% to 80,000 tonnes from Malaysia

and were up 11% to 75,000 tonnes from India. However,

during the same period imports were down from Indonesia

(-8% to 63,000 tonnes), Brazil (-5% to 43,000 tonnes),

Thailand (-28% to 4,000 tonnes) and Singapore (-30% to

2000 tonnes).

Considering European destinations for tropical wooden

furniture, after most recorded a large downturn in 2023,

there was slow recovery in all the main markets in the

January to November period last year.

For example the UK (+3% to 131,100 tonnes), France

(+5% to 69,500 tonnes), Germany (+13% to 54,400

tonnes), Netherlands (+0.1% to 41,600 tonnes), Spain

(+17% to 30,900 tonnes), Belgium (+5% to 22,100

tonnes), Denmark (+4% to 10,200 tonnes), and Poland

(+1% to 8,200 tonnes).

However, Italy recorded a 2% decline in imports of

tropical wooden furniture to 8,300 tonnes during the

eleven-month period (Chart 5).

Slowdown in internal EU furniture market dampens

global trade

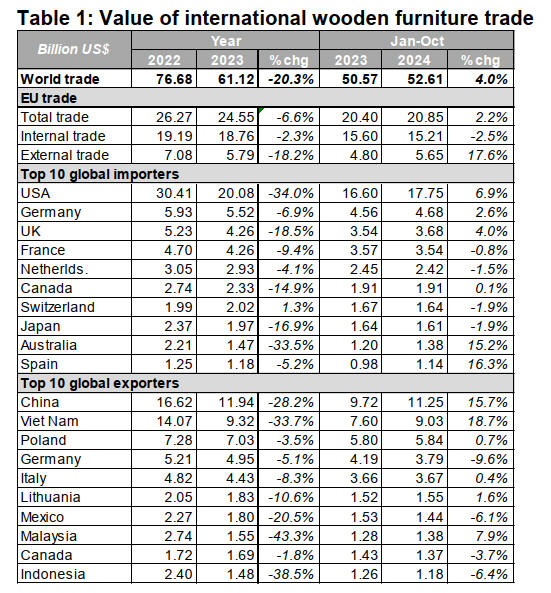

Despite recent challenging market conditions, Europe

continues to hold a crucial position in the global furniture

industry, acting as a pivotal hub for production,

consumption and world trade. Valued at around US$115

billion the European market accounts for more than one-

quarter of the global world furniture market.

A key feature of the European furniture sector is that it is

characterised by an exceptionally high level of business-

to-business trade concentration and integration. Unlike in

the U.S. where a large share of furniture production has

been relocated to China, Southeast Asia and Mexico, 80%

of current demand in Europe continues to be met by

European manufacturers. Considering just wooden

furniture, around 40% (US$ 24.55 billion) of the total

value of world trade in 2023 (US$ 61.12 billion) involved

EU countries where there is a robust intra-regional trade

network (Table 1).

Source: ITTO analysis of www.stix.global,

Based on imports into 46 leading economies

Analysis of wooden furniture trade data shows that the

sluggish pace of EU internal trade in 2024 had a

dampening effect on global trade. In the first ten months of

2024, world trade in wooden furniture was valued at US$

52.6 billion, 4% more than the previous year. However, if

internal EU trade is excluded, the rise in the total value of

global trade was closer to 7% last year.

In the first ten months of 2024, the value of wooden

furniture imports into the EU from outside region

increased by 18% to US$ 5.65 billion.

Imports of wooden furniture products into four other

major global markets also rebounded strongly during this

period: the U.S. (+7% to US$ 17.75 billion), the UK (+4%

to US$ 4.68 billion), Australia (+15.2% to US$ 1.38

billion), and South Korea (+11% to US$ 850 million).

These positive trends were offset by a 2.5% fall in the

value of the EU internal wooden furniture trade to US$

15.21 billion, alongside a 2% fall in Japan’s imports to

US$ 1.61 billion, and a 2% fall in Swiss imports to US$

1.64 billion.

China and Vietnam, and to a lesser extent Malaysia, were

the principal beneficiaries of the overall recovery in global

wooden furniture trade in the first ten months of last year.

The value of China’s exports increased by nearly 16% to

US$ 11.25 billion, while exports from Vietnam increased

by nearly 19% to US$ 9.03 billion. Exports from Malaysia

increased by 8% to US$ 1.38 billion during the period.

|